Market

How to Start Trading on dYdX Chain: A Beginners Guide

Trading platforms offer a variety of options for users, but few specialize in decentralized perpetual futures. dYdX stands out in this niche, providing users with an innovative platform for perpetual trading, characterized with high transaction speed, low fees and numerous possibilities for DYDX token holders. It is also perfectly suitable for newbie traders, simplifying the DeFi experience and making the transition from centralized exchanges seamless.

The recent developments in dYdX’s offerings make it an ideal choice for those looking to explore decentralized finance (DeFi) with ease. This guide is designed to help beginners navigate dYdX and its features, providing the essential steps needed to start trading.

What is dYdX?

dYdX is a decentralized perpetual exchange. Launched in 2018, it has established itself as a leader in decentralized perpetual trading through its combination of cutting-edge technology and affordability. The platform’s growth is supported by prominent venture capital firms and investors, including Andreessen Horowitz, Paradigm, and Polychain, among others.

In 2023, dYdX announced its migration from the Ethereum blockchain to the Cosmos ecosystem with the dYdX Chain. This transition marked a significant milestone for the platform, allowing for increased scalability, full decentralization, distribution of 100% of protocol fees to Stakers and higher throughput. The migration also enabled dYdX to implement a fully decentralized order book system and matching engine providing more control and precision for traders.

dYdX Chain is fully decentralized, so users can easily onboard using a variety of wallets or socials thanks to the Privy integration and aren’t required to complete Know Your Customer (KYC) checks. All you need is a funded crypto wallet or social account and you can start trading in a matter of minutes.

dYdX has established itself as a leading platform for perpetual trading of crypto assets. The platform’s average daily transaction volume consistently exceeds $1 billion, reaffirming its position as a significant player in the trading landscape. It has outpaced many decentralized trading platforms and competes with prominent centralized exchanges, demonstrating dYdX’s growing influence in the market.

How to Trade on dYdX?

Step 1: Getting Started

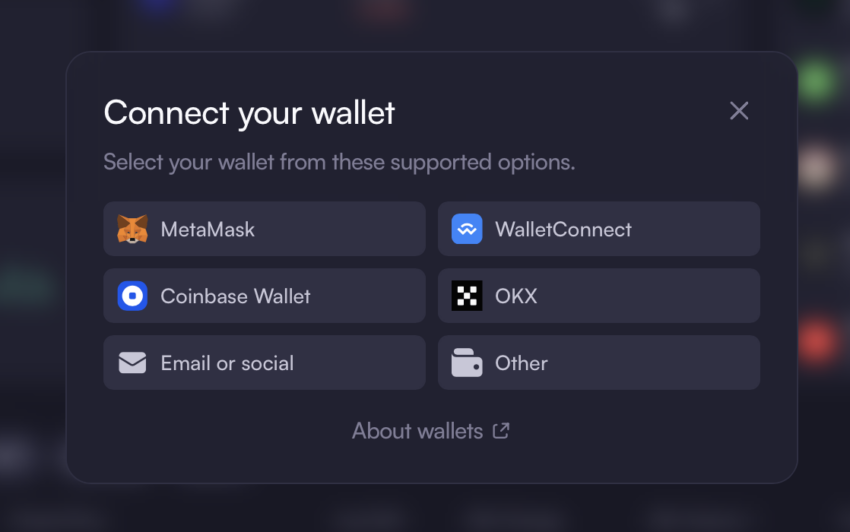

Before you begin trading on dYdX Chain, you need a compatible cryptocurrency wallet, e-mail or socials (X or Discord). Here’s how to set up a wallet:

- Choose a Wallet: Popular options include MetaMask, Trust Wallet, and Ledger. Make sure your chosen wallet is compatible with dYdX on the dydx.trade interface. A hardware wallet like Ledger offers added security by keeping your private keys offline.

You can also set up a new wallet using Privy and log in using your existing email or social accounts. It doesn’t require memorizing a seedphrase — just choose a preferred log in method and click Authorize.

- Install and Configure: Download and install the wallet app or browser extension, and set up your account by following the prompts. Make sure to securely store your recovery seed phrase. Never share this phrase with anyone, as it gives full access to your wallet.

- Fund Your Wallet: Transfer some cryptocurrency, such as USDC, into your wallet. This is necessary for trading on dYdX Chain. Depending on your chosen wallet, you may need to purchase cryptocurrency from an exchange or transfer it from another wallet.

Step 2: Connect to dYdX

With your wallet ready and funded, it’s time to connect to dYdX Chain:

- Visit dydx.trade — the front end user interface for dYdX Chain.

- Connect Your Wallet or socials: Click the “Connect Wallet” button and select your wallet type. Follow the prompts to complete the connection. Ensure your wallet extension or app is open and ready for interaction.

- Authorize: You’ll be asked to authorize transactions through your wallet interface. Make sure to review the details before confirming. This step ensures you understand and approve the connections and transactions taking place.

dYdX Chain is available for iOS: the same dYdX Chain trading experience you know and love — now directly in your pocket!

Download dYdX for iOS here.

Step 3: Explore the Platform

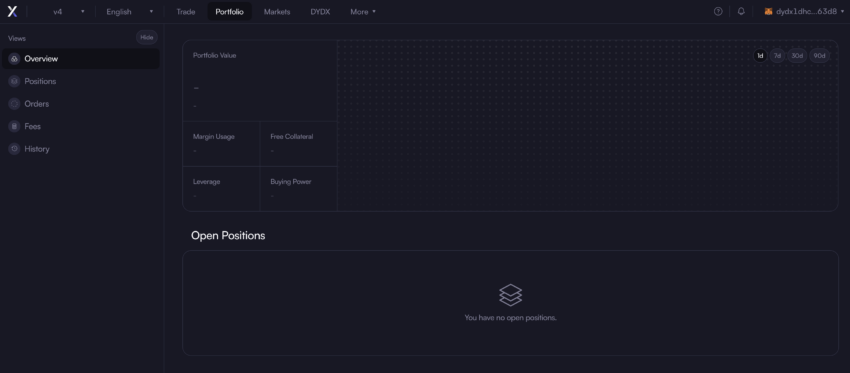

Once connected, you can explore dYdX Chain’s interface:

- Dashboard: The dashboard provides an overview of your account, including balances, open positions, and trade history. This section also offers shortcuts to key functionalities, making it easier to manage your portfolio.

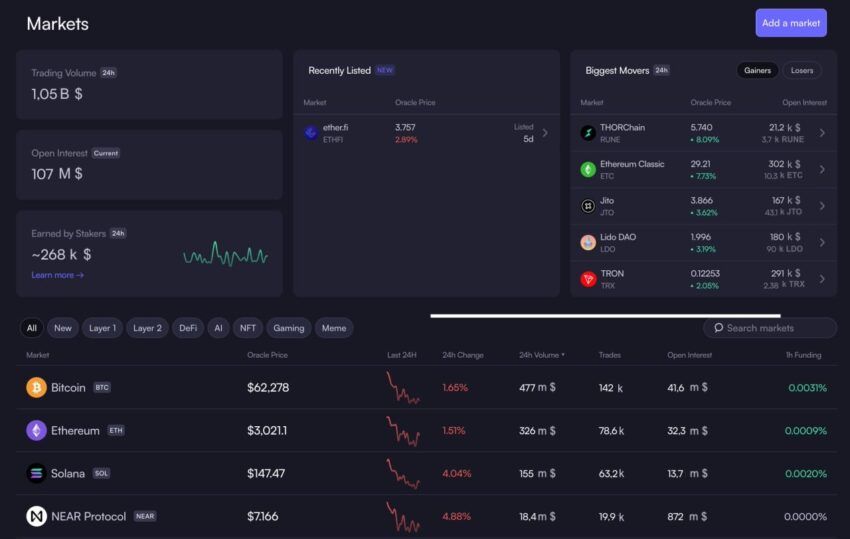

- Markets: Navigate to the Markets section to view available trading pairs, recently listed markets, 24h USDC distribution, biggest movers, current prices and 24h trading volumes. You can also view price trends, helping you make informed decisions.

- Order Book: dYdX Chain’s orderbook and matching engine is fully decentralized and purpose built for the optimal trading experience. It shows active buy and sell orders, giving you insights into market trends. This information can guide your trading strategy, especially when placing limit orders.

Step 4: Start Trading

Now that you’re familiar with the interface, you’re ready to place trades:

- Select a Market: Choose a trading pair from the Markets section. dYdX Chain offers over 63+ pairs, allowing you to diversify your portfolio or focus on specific assets. You can switch between the selected market and all available pairs using the All Markets button in the top left menu.

- Order Type: Decide on an order type, such as a market order (instant execution at current prices) or limit order (executed at a specified price). Limit orders are useful for specifying exact entry or exit points for your trades. For a detailed overview you can view this comparison table.

- Enter Trade Details: Specify the amount and price for your trade. Double-check these details before finalizing to avoid mistakes.

- Set The Leverage: Deciding what leverage to use is a crucial aspect of perpetual trading. Leverage refers to the funds borrowed from the platform to amplify a trade, acting as a multiplier on gains or losses. dYdX Chain offers up to 20x leverage trading. The liquidation price is calculated automatically before you enter the trade, helping effectively manage the risk.

- Understand dYdX Trading Fees: Fees vary based on the type of trade and your trading volume in the last 30 days. Fee is between 0,025% and 0,05% for taker orders. Generally, the fees are lower than that on centralized exchanges. Up to 90% of your trading fees are distributed instantly back into your dYdX Chain address. Additionally there is an incentive program currently live that subject to governance will distributed 5M USD in DYDX to eligible traders.

- Review and Confirm: Double-check all details before executing your trade.

- Manage Your Positions: Monitor open positions from the dashboard and manage them by closing or modifying as needed. Keeping track of your positions helps you adapt to market changes and protect your investments.

Step 5: Get The Most Of dYdX Trading Rewards and Launch Incentives

Trading rewards incentivize users to trade on the protocol. dYdX rewards users for every successful trade based on the amount of fees paid. The system automatically distributes trading rewards directly to the trader’s account per block. Prior to each trade, the UI will also show the expected amount of rewards a trade of that size will receive.

The dYdX Chain also runs a Launch Incentives Program, tailored to expand and transition the current dYdX user base to the new protocol. The governance proposal set aside $20M of DYDX from dYdX Chain Community Treasury to be distributed as rewards for trading and market making activity. You can find an extensive blog post describing the program details here.

Step 6: Stay Informed

Trading on dYdX Chain requires staying updated:

- Community: Join the dYdX community on social media or participate in forums to stay informed about updates and opportunities. Engaging with the community can also provide valuable insights and support.

- Learning Resources: Explore educational materials provided by dYdX Academy and other DeFi resources to enhance your trading skills. Continuous learning can help you refine your strategies and navigate the platform more effectively.

- Security: Always keep security in mind, enabling two-factor authentication (2FA) and avoiding sharing sensitive information. Regularly review your security settings to protect your assets.

Although perpetual trading is inherently risky and not recommended for beginners, dYdX Chain offers an excellent starting point for those interested in trading perpetual futures. The platform boasts high liquidity, support for a wide range of assets, and low fees due to its advanced technology. These features make dYdX Chain a serious competitor to prominent centralized exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PI Token Price Faces Bearish Pressure, Risking a Drop to $0.40

PI has been on a steady downtrend since February 26, shedding 72% of its value as bearish sentiment continues to weigh on the token.

Bearish pressure continues to mount on the PI token, suggesting that it may be poised to enter a new phase of decline.

PI Network Risks Fresh Decline

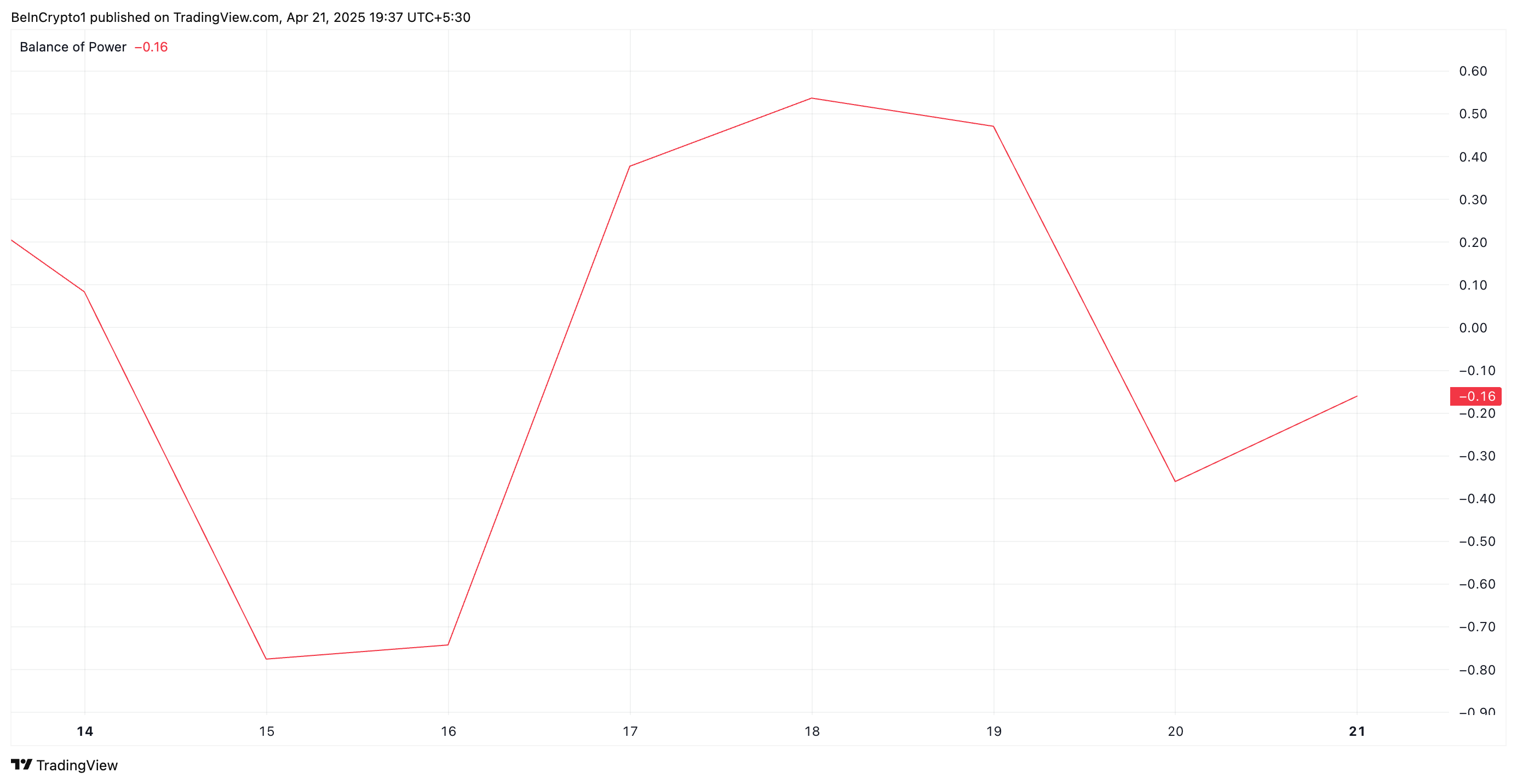

An assessment of the PI/USD one-day chart reveals that token holders remain steadfast in their distribution. At press time, PI’s Balance of Power (BoP) is negative, reflecting the selling pressure in the market.

The BoP indicator measures the strength of buying versus selling pressure by comparing the close price to the trading range within a given period. When BOP is negative like this, it indicates that sellers are dominating the market, suggesting downward pressure on the asset’s price.

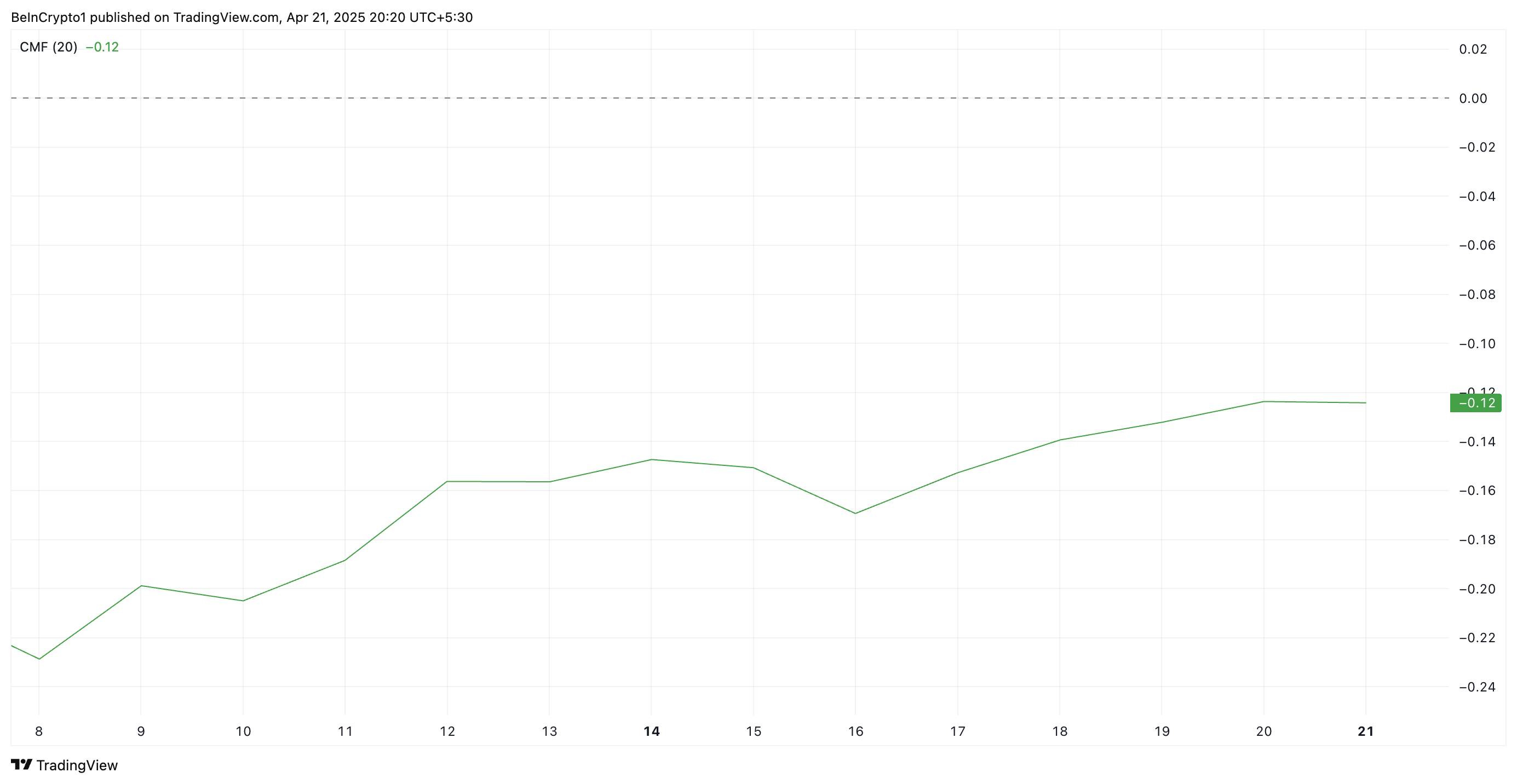

Further, the setup of PI’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, this is below the central line at -0.12.

The CMF indicator measures an asset’s buying and selling pressure. A negative CMF reading suggests that the asset is experiencing more selling pressure than buying pressure. This means PI traders are distributing rather than accumulating. This signals bearish sentiment and confirms the downward momentum in the token’s price.

Sellers Tighten Grip on PI, But Recovery to $1.01 Still on the Table

At press time, PI trades at $0.63, below the dynamic support formed above it at $0.93 by its Super Trend indicator.

The Super Trend indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price trades below the Super Trend line like this, it signals a bearish trend and hints at potential decline. If PI’s decline strengthens, it could revisit its all-time low of $0.40.

However, if demand returns to the PI market, its price could break above the resistance at $0.86 and surge to $1.01.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle, BitGo, and Others Eye Bank Charters in US

With support from Trump’s White House and easing regulations, firms like Circle and BitGo are pursuing becoming full-fledged financial institutions.

Reports indicate a new wave of crypto companies knocking on the once-closed doors of the American banking system. This time, someone is listening.

Crypto Firms Seek Bank Charters as Wall Street’s Doors Reopen

After years of being sidelined, crypto companies are coming back, this time through the front door of the US banking system.

Citing sources familiar with the matter, the Wall Street Journal revealed that several major players, including Circle and BitGo, are preparing to apply for bank charters or financial licenses.

Traditional banks are also responding to the shift. US Bancorp is re-launching its crypto custody program via NYDIG, while Bank of America (BofA) said it would issue its stablecoin once the legal framework is in place.

Even global giants are watching closely. A consortium including Deutsche Bank and Standard Chartered is evaluating how to expand crypto operations into the US.

While details remain scarce, the interest signals that crypto is no longer just a niche but a competitive frontier.

These firms reportedly aim to operate with the same legitimacy and access as traditional lenders. This includes holding deposits, issuing loans, and launching stablecoins under regulatory supervision.

The timing is not random. A sharp pivot in federal policy, driven by President Trump’s pledge to make the US a Bitcoin superpower, has reopened regulatory pathways once shut after the FTX collapse.

In parallel, Congress is advancing stablecoin legislation requiring issuers to secure federal or state licenses.

The push for bank status comes amid a broader effort to legitimize crypto within US finance. Earlier this year, regulators rolled back key restrictions. Among them, the SEC’s controversial SAB 121, which had blocked banks from holding crypto on behalf of clients.

Meanwhile, Federal Reserve (Fed) Chair Jerome Powell affirmed that banks could serve crypto customers provided proper risk management strategies exist.

In another regulatory green light, the Office of the Comptroller of the Currency (OCC) clarified that banks can offer stablecoin and custody services. However, this is provided they comply with established banking rules.

These signals have emboldened crypto firms previously kept at arm’s length. Anchorage Digital, the only US crypto-native firm with a federal bank charter, says the regulatory lift is massive but worth it.

“It hasn’t been easy… the whole gamut of regulatory and compliance obligations that banks have can be intertwined with the crypto industry,” Anchorage CEO Nathan McCauley reportedly admitted.

McCauley cited tens of millions in compliance costs. Nevertheless, Anchorage has since collaborated with BlackRock, Cantor Fitzgerald, and Copper for high-profile custody and lending programs.

BitGo, which will reportedly custody reserves for Trump-linked stablecoin USD1, is nearing a bank charter application.

Circle, the issuer of USDC, is also pursuing licenses while fending off competition, just like Tether. This is a traditional finance (TradFi) venture into stablecoins.

The firm delayed its IPO this month, citing market turmoil and financial uncertainty. However, insiders say regulatory clarity remains a top priority.

Firms like Coinbase and Paxos are exploring similar routes, considering industrial banks or trust charters to expand their financial offerings legally.

At the policy level, venture firm a16z has called on the SEC to modernize crypto custody rules for investment firms, reflecting the industry’s hunger for clarity and parity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Springs Back From $531 With Unshaken Bullish Conviction

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

-

Market23 hours ago

Market23 hours agoTokens Big Players Are Buying

-

Market22 hours ago

Market22 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Bitcoin10 hours ago

Bitcoin10 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Predicts Pi Network To Reach $5 As Whales Move 41M Pi Coins Off Exchanges

-

Market20 hours ago

Market20 hours agoWill XRP Break Support and Drop Below $2?

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

-

Bitcoin17 hours ago

Bitcoin17 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Market13 hours ago

Market13 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance