Market

How Is DePin Token Helium’s (HNT) Price up by 65% in a Week

DePin token Helium’s (HNT) price has grown considerably in the last few days while the rest of the market struggled to recover.

While following Bitcoin’s example is usually considered to be the more beneficial option, HNT chose the other path and came out on top.

Helium Continues Its Gains

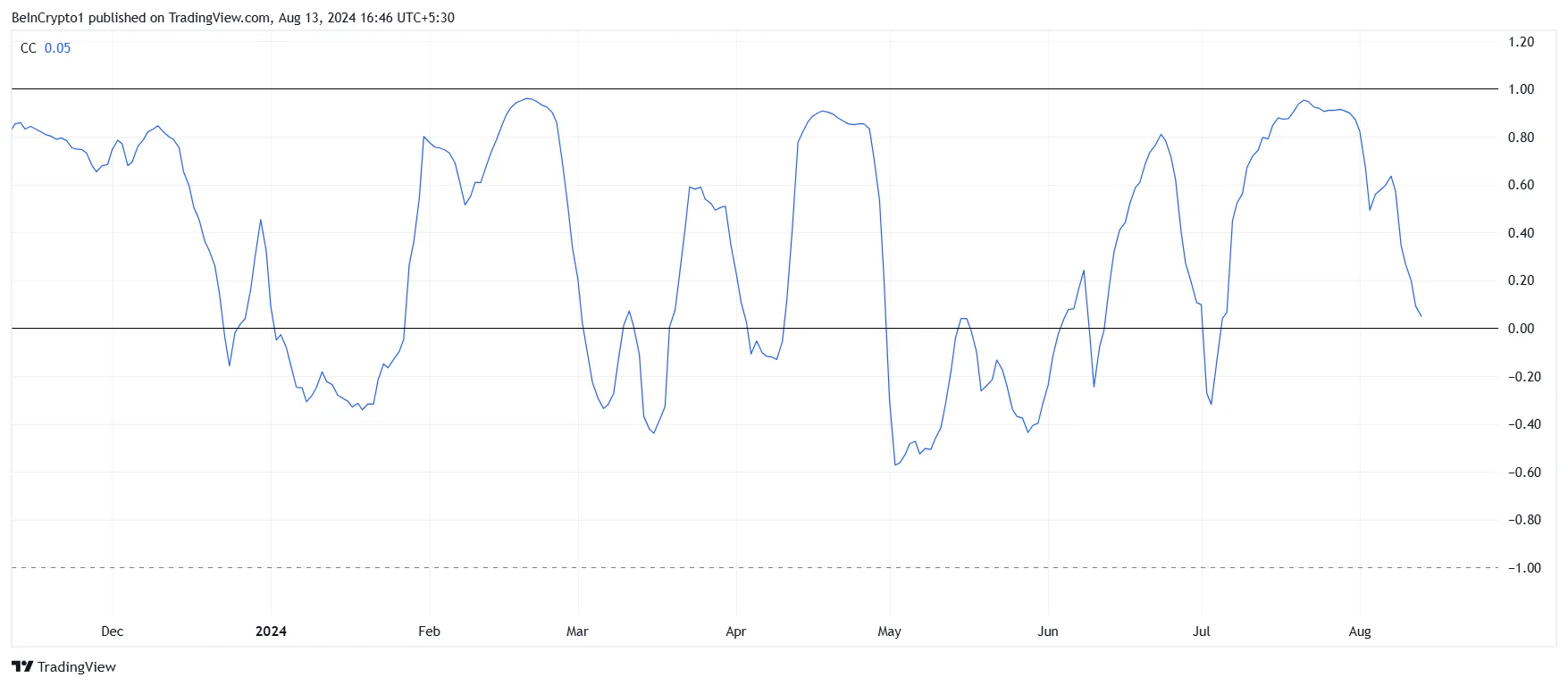

Helium’s price crossed the $7 mark over the last 24 hours for the first time in a little over four months. The reason behind this growth has been the altcoin’s decision to step away from the king of cryptocurrencies, Bitcoin.

Since the beginning of August, HNT’s correlation with Bitcoin has deteriorated, currently standing at 0.05. This weakening correlation has been notable as Bitcoin has been experiencing bearish conditions over the past few days.

Read More: Helium Staking for Beginners: Earn Passive Income With HNT

Despite Bitcoin’s recent downturn, the DePin token has managed to rally, which is likely influenced by this declining correlation. The separation from Bitcoin’s performance has been providing HNT with an opportunity to move independently.

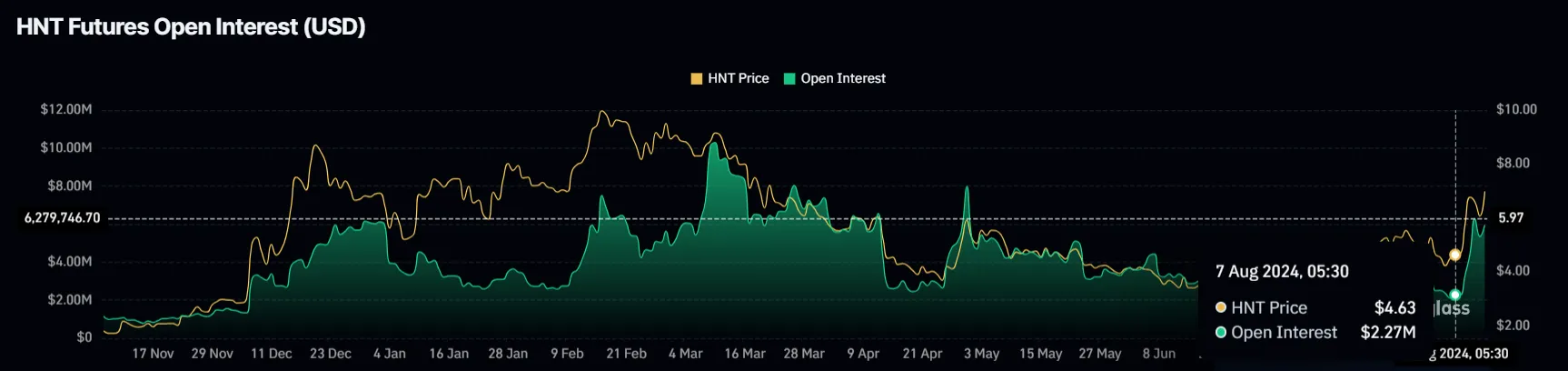

Additionally, the rise in HNT’s price could be sustained by increased investor interest, as indicated by a significant increase in Open Interest. Over the past week, Open Interest has surged from $2.26 million to $5.95 million.

This more than doubled the open interest rate, reflecting growing investor confidence and participation. If this momentum persists, HNT’s bullish trend might continue.

HNT Price Prediction: Up Next, $8

Helium’s price benefit from separating from Bitcoin’s price action could be noted in a further rally. The altcoin is currently at $6.47, attempting to secure $6.33 as a support floor. This would enable HNT to note further rise.

Looking at Helium’s past performance at price, HNT could face consolidation upon rallying. This is because $8 is a key barrier that would require stronger bullish momentum to break through.

Read More: Helium (HNT) Price Prediction 2024/2025/2030

However, the price could take a hit if HNT holders move to book profits and sell their holdings. As a result, the DePin token could lose its support at $6.33, sending it to the psychological support of $5 and invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin & Ethereum Options Expiry: Can Prices Stay Stable?

The crypto market is set to see $2.58 billion in Bitcoin and Ethereum options expire today, a development that could trigger short-term price volatility and impact traders’ profitability.

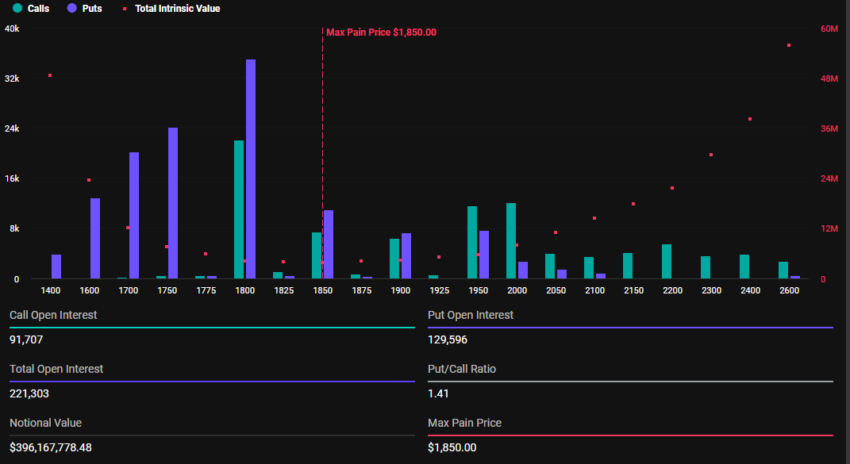

Of this total, Bitcoin (BTC) options account for $2.18 billion, while Ethereum (ETH) options represent $396.16 million.

Bitcoin and Ethereum Holders Brace For Volatility

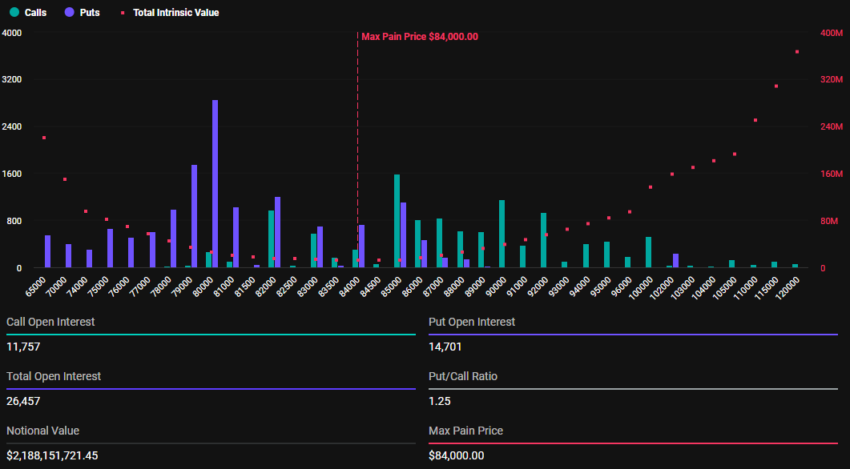

According to data on Deribit, 26,457 Bitcoin options will expire today, significantly lower than the first quarter (Q1) closer, where 139,260 BTC contracts went bust last week. The options contracts due for expiry today have a put-to-call ratio 1.25 and a maximum pain point of $84,000.

The put-to-call ratio indicates a higher volume of puts (sales) relative to calls (purchases), indicating a bearish sentiment. More traders or investors are betting on or protecting against a potential market drop.

On the other hand, 221,303 Ethereum options will also expire today, down from 1,068,519 on the last Friday of March. With a put-to-call ratio of 1.41 and a max pain point of $1,850, the expirations could influence ETH’s short-term price movement.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC was trading at $82,895 as of this writing, whereas ETH was exchanging hands for $1,790.

This suggests that prices might rise as smart money aims to move them toward the “max pain” level. Based on the Max Pain theory, options prices tend to gravitate toward strike prices where the highest number of contracts, both calls and puts, expire worthless.

Nevertheless, price pressure on BTC and ETH will likely ease after 08:00 UTC on Friday when Deribit settles the contracts. However, the sheer scale of these expirations could still fuel heightened volatility in the crypto markets.

“Where do you see the market going next? Deribit posed.

Elsewhere, analysts at Greeks.live explain the current market sentiment, highlighting a bearish outlook. This adds credence to why more traders are betting on or protecting against a potential market drop.

Bearish Sentiment Grips Markets

In a post on X (Twitter), Greeks.live reported a predominantly bearish sentiment in the options market. This follows US President Donald Trump’s tariff announcement.

BeInCrypto reported that the new tariffs constituted a 10% blanket rate and 25% on autos. While this fell short of market expectations, it was still perceived as a negative development, sparking widespread concern among traders.

According to the analysts, options flow reflected this pessimism, with heavy put buying dominating trades.

“Trump’s tariffs are viewed as severe trade disruption… The market’s initial positive reaction with a price spike to $88 was seen as gambling/short covering, followed by a sharp reversal as reality set in about economic impacts. Options flow remains heavily bearish, with traders noting significant put buying, including “700 79k puts for end of April,” wrote Greeks.live analysts.

Traders snapping up 700 $79,000 puts for the end of April signals expectations of a sustained downturn. According to the analysts, the consensus among traders points to continued volatility, with a potential “bad close” below $83,000 today, Friday, April 4. Such an action would erase the earlier pump entirely.

Meanwhile, many traders are adopting bearish strategies, favoring short calls or put calendars. Shorting calls is reportedly deemed the most effective approach in the current climate.

Therefore, while the market’s initial reaction to Trump’s tariffs was a mix of hope and reality, the reversal reflects the broader economic fallout from Trump’s policies. As traders brace for choppy conditions, the bearish outlook in options trading paints a cautious picture for the days ahead.

Global supply chain disruptions and economic uncertainty remain at the forefront of market concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Battle Heats Up—Can Bulls Turn the Tide?

XRP price started a fresh decline below the $2.050 zone. The price is now consolidating and might face hurdles near the $2.10 level.

- XRP price started a fresh decline below the $2.120 and $2.050 levels.

- The price is now trading below $2.10 and the 100-hourly Simple Moving Average.

- There is a short-term declining channel forming with resistance at $2.0680 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if it fails to clear the $2.10 resistance zone.

XRP Price Attempts Recovery

XRP price extended losses below the $2.050 support level, like Bitcoin and Ethereum. The price declined below the $2.00 and $1.980 support levels. A low was formed at $1.960 and the price is attempting a recovery wave.

There was a move above the $2.00 and $2.020 levels. The price surpassed the 23.6% Fib retracement level of the downward move from the $2.235 swing high to the $1.960 low. However, the bears are active below the $2.10 resistance zone.

The price is now trading below $2.10 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $2.070 level. There is also a short-term declining channel forming with resistance at $2.0680 on the hourly chart of the XRP/USD pair.

The first major resistance is near the $2.10 level. It is near the 50% Fib retracement level of the downward move from the $2.235 swing high to the $1.960 low. The next resistance is $2.120.

A clear move above the $2.120 resistance might send the price toward the $2.180 resistance. Any more gains might send the price toward the $2.2350 resistance or even $2.40 in the near term. The next major hurdle for the bulls might be $2.50.

Another Decline?

If XRP fails to clear the $2.10 resistance zone, it could start another decline. Initial support on the downside is near the $2.00 level. The next major support is near the $1.960 level.

If there is a downside break and a close below the $1.960 level, the price might continue to decline toward the $1.920 support. The next major support sits near the $1.90 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $2.00 and $1.960.

Major Resistance Levels – $2.10 and $2.120.

Market

Ethereum Price Losing Ground—Is a Drop to $1,550 Inevitable?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price attempted a recovery wave above the $1,820 level but failed. ETH is now consolidating losses and might face resistance near the $1,840 zone.

- Ethereum failed to stay above the $1,850 and $1,840 levels.

- The price is trading below $1,840 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $1,810 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,820 and $1,840 resistance levels to start a decent increase.

Ethereum Price Dips Further

Ethereum price failed to stay above the $1,800 support zone and extended losses, like Bitcoin. ETH traded as low as $1,751 and recently corrected some gains. There was a move above the $1,780 and $1,800 resistance levels.

The bulls even pushed the price above the 23.6% Fib retracement level of the downward move from the $1,955 swing high to the $1,751 low. However, the bears are active near the $1,820 zone. The price is now consolidating and facing many hurdles.

Ethereum price is now trading below $1,820 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,810 level. There is also a short-term bearish trend line forming with resistance at $1,810 on the hourly chart of ETH/USD.

The next key resistance is near the $1,840 level or the 50% Fib retracement level of the downward move from the $1,955 swing high to the $1,751 low at $1,850. The first major resistance is near the $1,880 level.

A clear move above the $1,880 resistance might send the price toward the $1,920 resistance. An upside break above the $1,920 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,850 resistance, it could start another decline. Initial support on the downside is near the $1,765 level. The first major support sits near the $1,750 zone.

A clear move below the $1,750 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,620.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,750

Major Resistance Level – $1,850

-

Market21 hours ago

Market21 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Issues Key Announcement On StakeStone TGE; Here’s All

-

Altcoin21 hours ago

Altcoin21 hours agoMovimiento millonario de Solana, SOLX es la mejor opción

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Bitcoin20 hours ago

Bitcoin20 hours agoBlackRock Approved by FCA to Operate as UK Crypto Asset Firm

-

Bitcoin23 hours ago

Bitcoin23 hours agoUS Dollar Index Drops – What Does It Mean for Bitcoin?

-

Market20 hours ago

Market20 hours agoHBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

-

Altcoin20 hours ago

Altcoin20 hours agoJohn Squire Says XRP Could Spark A Wave of Early Retirements