Market

How Bitcoin Price Rally to $68,000 Could Bring $136 Billion Profits

As market sentiment continues to shift towards the bullish end, Bitcoin (BTC) price also appears to be towing the same path. With an 8.50% increase in the last seven days, the cryptocurrency is eyeing levels that could bring in substantial profits for its holders.

Beyond that, this on-chain analysis explains how this potential price surge could precede a new all-time high before the next quarter winds down.

Bitcoin Gives Bull Run Alert

According to crypto asset management firm 10x Research, Bitcoin is preparing for an explosive move. However, in its weekly report dated September 22, 10x Research stated that BTC needs to retest two key levels before the prediction can be validated.

“The two key levels to watch for Bitcoin are the previous cycle high of $68,330 and the 21-week moving average. Dropping below the moving average could signal the end of the current cycle, while breaking above it— especially if the previous cycle high comes into play — could indicate an extension,” Thielen wrote in the report.

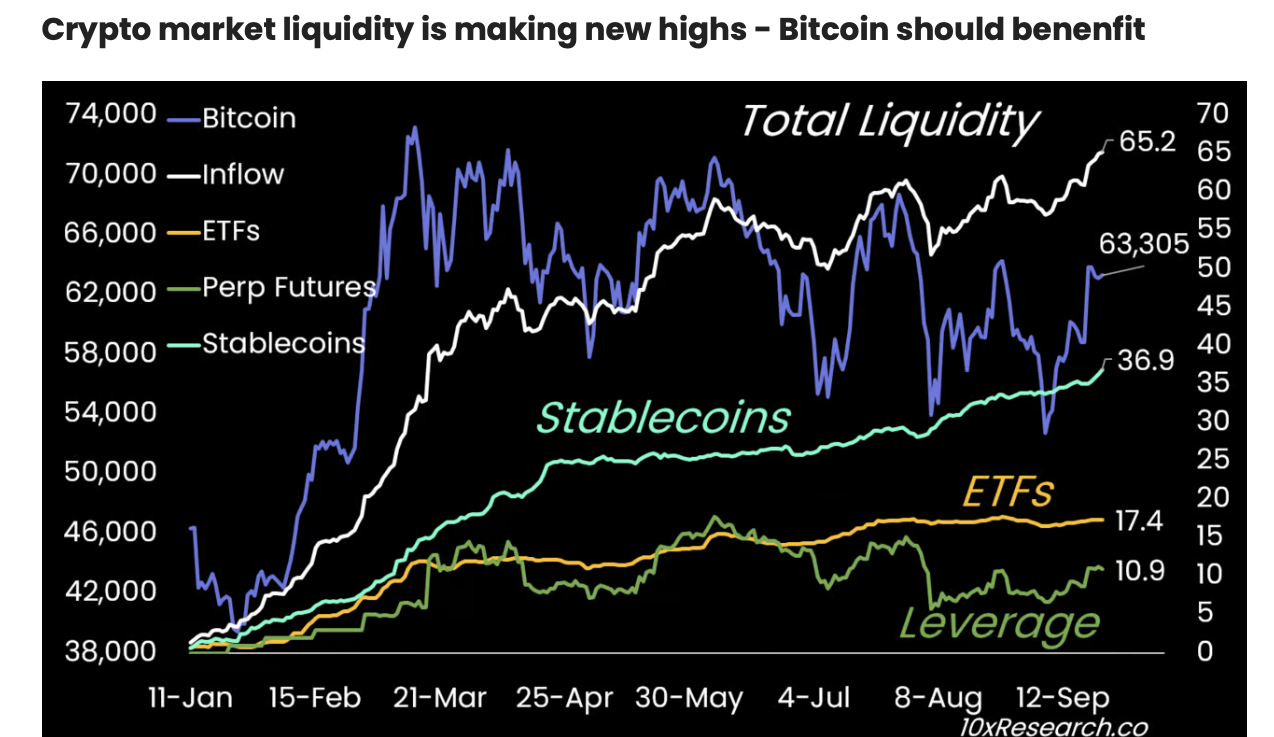

Interestingly, this forecast is in line with BeInnCrypto’s prediction last week that Bitcoin price is set for a new all-time high. Backing up the thesis, the firm notes that the broader crypto market liquidity is hitting new highs. As such, BTC could gain from the influx.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

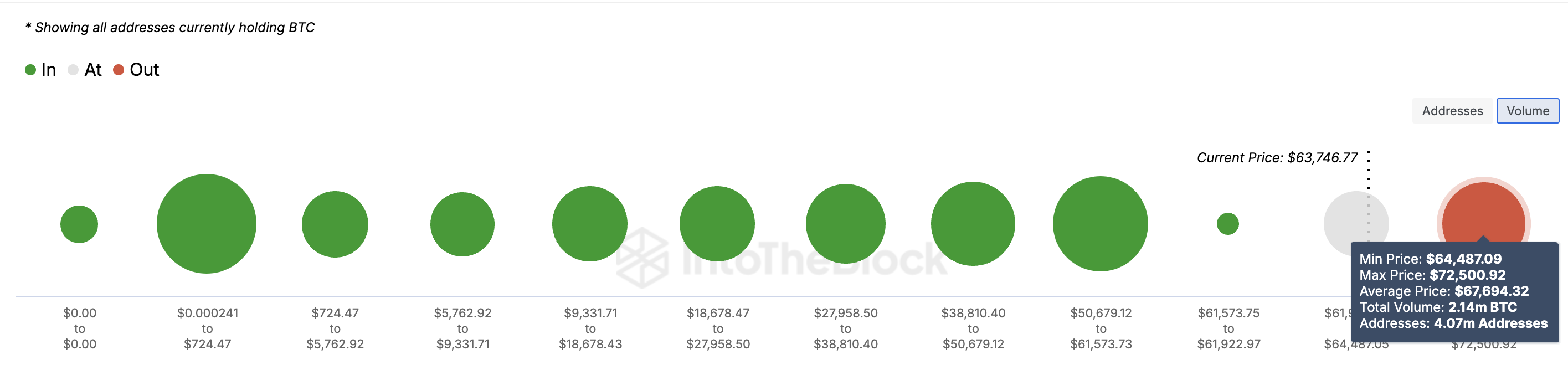

Based on IntoTheBlock’s data, Bitcoin’s potential run to $68,000 could unleash profits not seen in a long time. Using the Global In/Out of Money (GIOM), BeInCrypto observes that over 4 million addresses holding 2.14 million BTC at an average price of $67,694 are in losses.

With Bitcoin’s bullish outlook, the coin could be set to extend gain for these holders. Thus, a rally to $68,000 could translate to $145 billion in gains and make almost every Bitcoin holder profitable.

BTC Price Prediction: $76,000 Nearby

On the weekly chart, Bitcoin’s recent price surge has formed a bullish flag pattern. A steep rise forms the “flagpole,” followed by a brief consolidation between two parallel trendlines, signaling the potential continuation of the uptrend.

Currently, Bitcoin is trading at $63,447. The bullish outlook strengthens with the support level holding at $55,016. For the rally to continue, Bitcoin needs to break through the $64,196 resistance. If successful, the next target could be above its all-time high, potentially reaching $76,035.

Read more: How To Trade Bitcoin Futures and Options Like a Pro in 2024

However, if Bitcoin faces rejection at this resistance, a downward move could follow. In such a case, the bullish prediction may be invalidated, and the price could retreat back to $55,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price Breaks Ascending Triangle To Target Another 20% Crash

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The PEPE price has taken a sudden bearish turn after breaking out of an Ascending Triangle pattern. In light of this breakout, a crypto analyst has predicted that PEPE could face a massive 20% price crash if it fails to hold above a critical resistance level.

Bears Threaten 20% Crash In PEPE Price

PEPE’s price action has swiftly reversed from bullish to bearish, marked by a negative Change of Character (CHoCH) following its breakout from an Ascending Triangle pattern. Notably, PEPE’s CHoCH is highlighted where the price broke below previous support, indicating a significant structural shift to the bearish zone as buyers lose momentum.

Related Reading

According to pseudonymous TradingView analyst ‘MyCryptoParadise’, bears could seize control of PEPE’s price as it approaches a crucial resistance zone at $0.000008. The analyst has suggested that if the meme coin fails to break above the resistance, it could result in a 20% crash to lower support levels.

The first minor support level at $0.0000065 is highlighted in the green line on the analyst’s price chart. Should bearish momentum persist, PEPE could drop further, trapping late buyers and extending its correction phase. The analyst has pinpointed a much deeper support zone at $0.0000055, serving as a crucial defense against a stronger price breakdown.

A major factor supporting PEPE’s projected price crash is the alignment of its key resistance level with several bearish elements. The TradingView analyst’s price chart shows that PEPE’s $0.000008 resistance coincides with a 200 Exponential Moving Average (EMA), which acts as a dynamic resistance. The 200 EMA is often a reliable indicator of long-term trend shifts, and its overlap with the resistance adds strength to the bearish outlook.

The resistance also coincides with a Fair Value Gap (FVG), a region where liquidity has been left untested, suggesting that price could be drawn back to fill this gap. Lastly, PEPE’s critical resistance level intersects with a Fibonacci Golden Zone, a key retracement level where price reversals often occur, further signaling the potential for a downturn.

Potential Breakout Scenario

While ‘MyCryptoParadise’ projects a 20% correction for the PEPE price, which is currently trading at $0.00000698, he also shared a possible bullish scenario in which the meme coin surprises traders with an upward breakout. The TradingView analyst has projected that if PEPE manages to close a candle above the $0.000008 resistance, his bearish thesis could be completely invalidated.

Related Reading

In this case, the market should anticipate a continuation of the uptrend, with the next price target potentially reaching $0.0000085 and beyond. However, for bulls to break through this resistance level, strong volume and momentum are required. Given that Pepe’s price is still in the red, this bullish scenario seems like a less likely scenario for now.

Featured image from Adobe Stock, chart from Tradingview.com

Market

Ethereum Holders Buy Heavily as Price Nears October 2023 Levels

Ethereum has experienced a challenging month and a half, with its price nearing a 17-month low at $1,802 at the time of writing. Despite this ongoing downtrend, which nearly sent ETH into a bear market, key investors have remained optimistic.

As Ethereum approaches these significant levels, many market participants believe that a price rebound could be on the horizon.

Ethereum Investors Capitalize On Low Prices

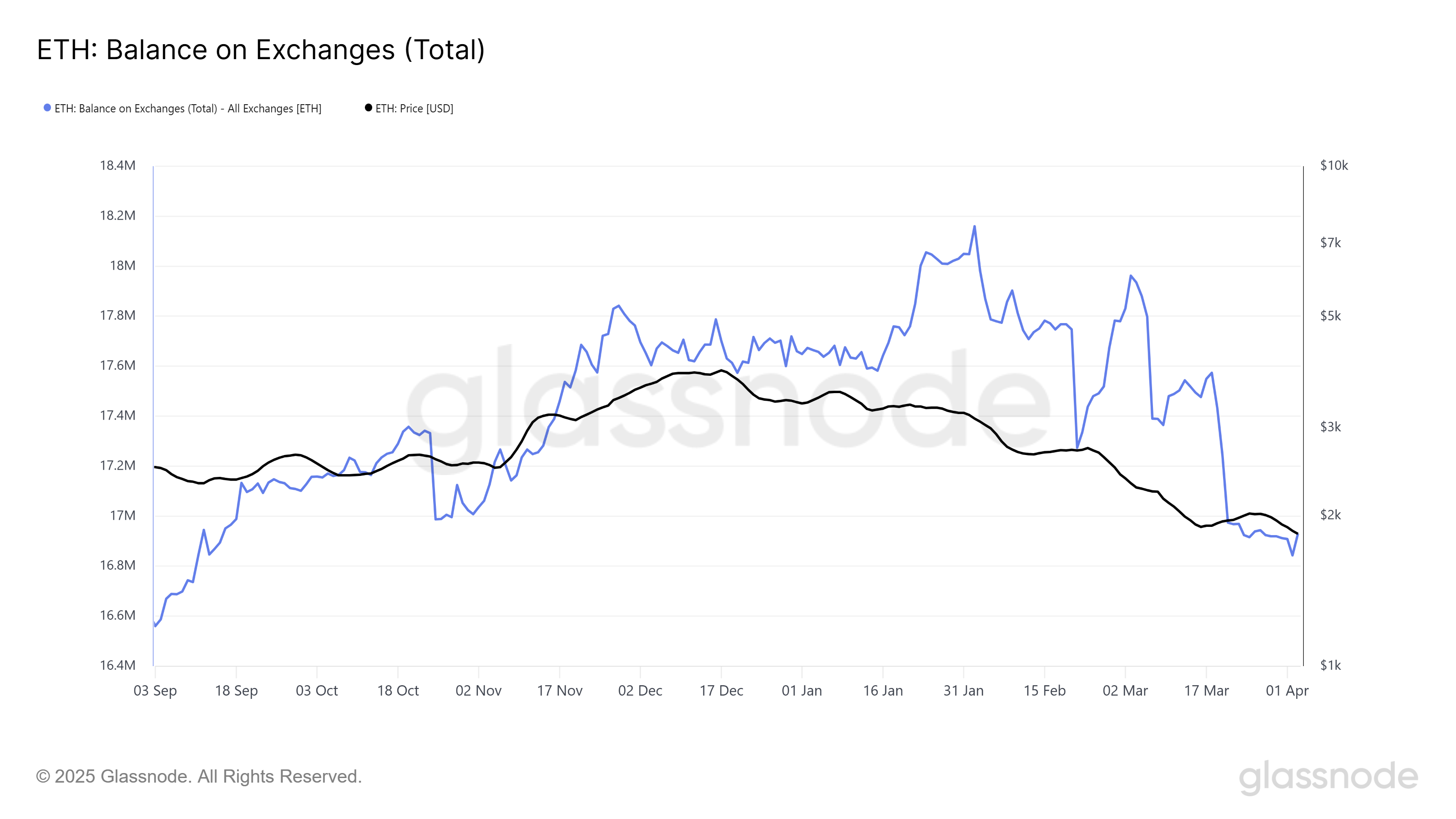

Ethereum’s supply on exchanges has dropped to a six-month low, indicating that investors are increasingly holding their assets off the market. This drop in exchange supply is often seen as a bullish sign because it suggests that long-term holders (LTHs) are accumulating more ETH at these low price levels, anticipating future price appreciation.

These investors are not willing to sell, demonstrating strong conviction in Ethereum’s long-term value. The decrease in exchange balances also indicates less short-term trading activity. This suggests that many investors are waiting for the price to rebound before making any moves.

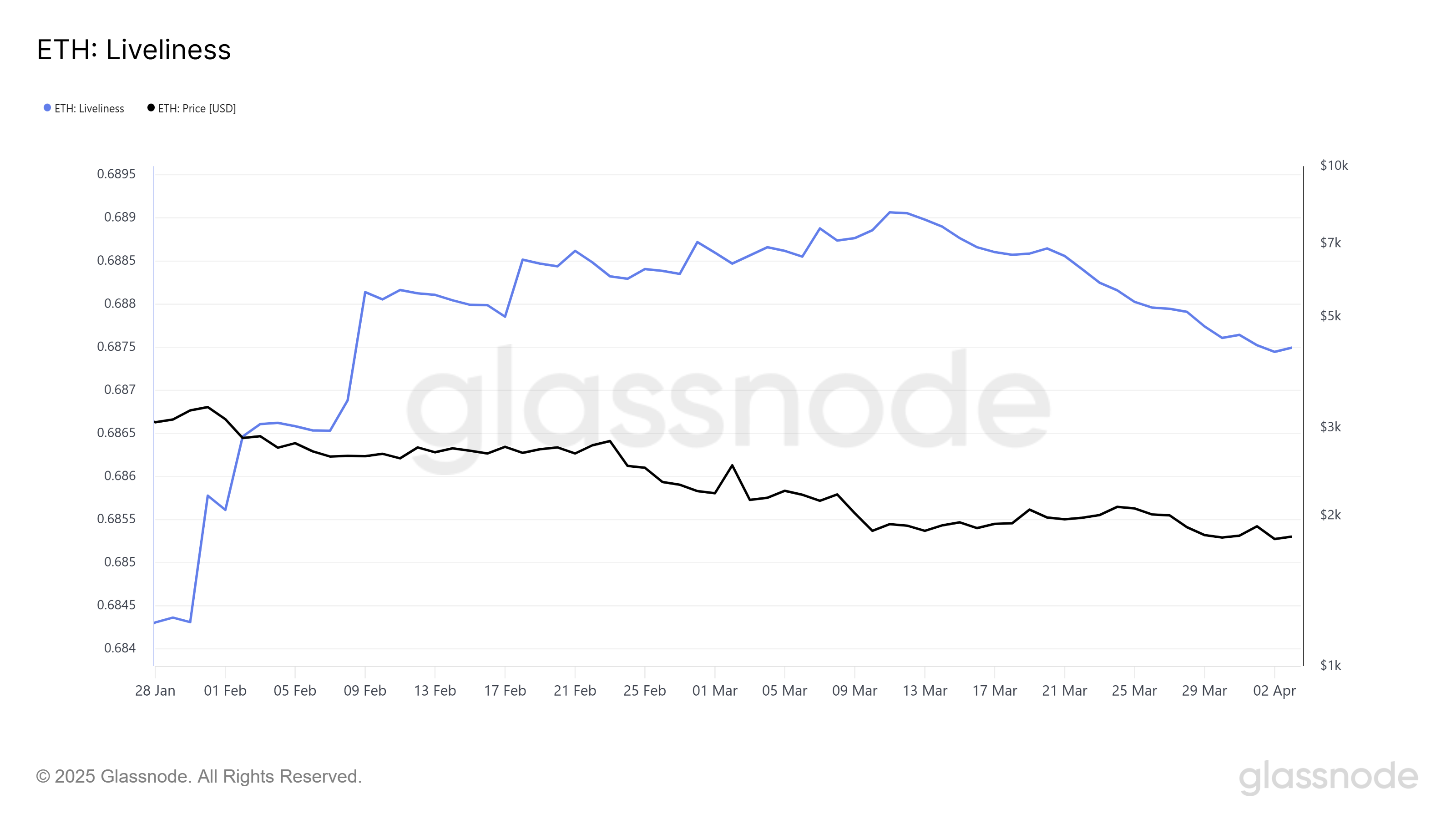

Over the past month, Ethereum’s Liveliness indicator has declined, signaling that the selling pressure is weakening. Liveliness measures the activity of long-term holders, and a decline generally points to accumulation rather than selling.

This drop reflects the growing sentiment among Ethereum’s long-term investors, who are increasing their holdings and expecting the price to recover in the future. The decline in Liveliness suggests that many are confident in Ethereum’s fundamentals and are less concerned about short-term fluctuations.

This accumulation phase suggests that Ethereum’s market sentiment may be shifting. The confidence of LTHs—who hold significant influence over the asset’s price—could lead to a strong upward momentum once the market conditions improve.

ETH Price Needs A Nudge

Ethereum is currently trading at $1,802, just below the resistance level of $1,862. The price has been stuck under this barrier for six weeks, continuing the downtrend that has defined much of the recent price action. However, if Ethereum can break above $1,862, it could signal the end of the downtrend and the start of a price recovery.

Given the current market sentiment and accumulation by key holders, it is possible that Ethereum will continue to gain upward momentum. If Ethereum successfully breaks through the $1,862 resistance, it could move toward the $2,000 mark, regaining some of the losses from the previous weeks.

On the other hand, should the bearish sentiment intensify, Ethereum’s price may dip further toward its 17-month low of $1,745. Failure to secure support at this level could lead to even greater losses. This could extend the recent downtrend and leave many investors exposed to a prolonged bearish market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PENDLE Token Outperforms BTC and ETH with a 10% Rally

PENDLE has surged by 10% in the past 24 hours, making it the market’s top gainer during this period. The altcoin has even outperformed major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

With buying activity still underway, the PENDLE token is poised to extend its uptrend in the short term.

PENDLE Soars 43% After March Lows

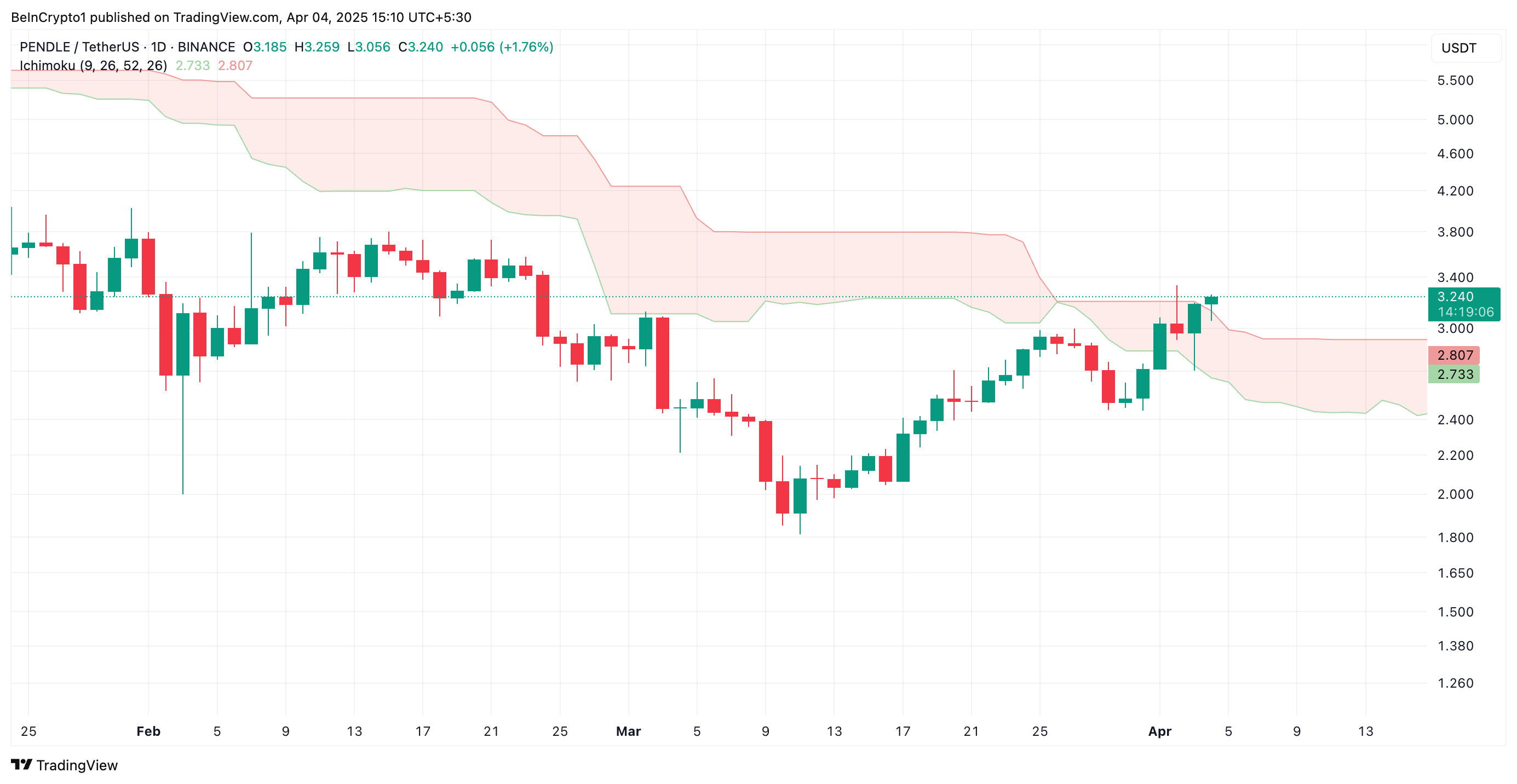

PENDLE cratered to a seven-month low of $1.81 on March 11. As sellers got exhausted, the token’s buyers regained dominance and drove a rally. Trading at $3.24 at press time, PENDLE’s value has since climbed 43%.

The double-digit surge in the altcoin’s price has pushed it above the Leading Spans A and B of its Ichimoku Cloud indicator. They now form dynamic support levels below PENDLE’s price at $2.73 and $2.80, respectively.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset trades above the leading spans A and B of this indicator, its price is in a strong bullish trend. The area above the Cloud is considered a “bullish zone,” indicating that market sentiment is positive, with PENDLE buyers in control.

This pattern suggests that the token’s price could continue to rise, with the Cloud acting as a support level if prices pull back.

In addition, PENDLE currently trades above its Super Trend indicator, confirming the likelihood of extended gains.

The Super Trend indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

If an asset’s price is above this line, it signals bullish momentum in the market. In this scenario, this line represents a support level that will prevent the price from any significant dips. For PENDLE, this is formed at $2.34.

PENDLE Holds Above Key Trendline

Since its rally began on March 11, PENDLE has traded above an ascending trendline. This pattern forms when a series of higher lows connect, indicating that the price of an asset is consistently rising over time.

It represents a bullish trend, showing that PENDLE demand exceeds supply, with buyers pushing prices higher.

This trendline acts as a support level. With the token’s price bouncing off the trendline, it signals that the asset is in an uptrend and likely to continue. In this scenario, PENDLE could rally to $3.60.

However, if selloffs commence, the PENDLE token could lose some of its recent gains and fall to $3.06.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Faces ‘Hyperinflation Hellscape’—Analyst Reveals Key On-Chain Insights

-

Market19 hours ago

Market19 hours agoWhat to Expect After March’s Struggles

-

Market18 hours ago

Market18 hours agoBitcoin Price Still In Trouble—Why Recovery Remains Elusive

-

Market17 hours ago

Market17 hours agoEthereum Price Losing Ground—Is a Drop to $1,550 Inevitable?

-

Market23 hours ago

Market23 hours agoCrypto Market Mirrors Nasdaq and S&P 500 Amid Recession Fears

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

-

Bitcoin22 hours ago

Bitcoin22 hours agoWhy ETF Issuers are Buying Bitcoin Despite Recession Fears

-

Market21 hours ago

Market21 hours agoStellar (XLM) Falls 5% as Bearish Signals Strengthen