Market

How Bitcoin Benefits in the Long Run

Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, stated that a prolonged tariff war could have a substantial positive impact on Bitcoin over time.

Over the weekend, President Donald Trump imposed tariffs on Canada, Mexico, and China.

Tariff War: Good for Bitcoin?

President Trump has imposed a 25% tariff on imports from Canada and Mexico. Additionally, a 10% tariff on Chinese goods and a 10% tariff on Canadian energy resources are implemented. According to the BBC, Canada and Mexico have also announced plans to impose retaliatory tariffs.

In a recent post on X, Park outlined the Triffin dilemma and President Trump’s personal objectives to explain Bitcoin’s long-term rise.

“Tariffs might be just a temporary tool, but the permanent conclusion is that Bitcoin is not only going higher—but faster,” Park wrote.

Park elaborated that the Triffin dilemma stems from the US dollar’s status as the world’s reserve currency, granting it an “exorbitant privilege.” This privilege results in three structural effects: an overvalued dollar, a persistent trade deficit, and lower borrowing costs for the US government.

While the US benefits from cheaper borrowing, it seeks to correct the imbalances of an overvalued dollar and continuous trade deficits. Therefore, Park suggests that tariffs are being used as a negotiation tactic to push for a new international agreement. This, he argues, is similar to the 1985 Plaza Accord, aimed at weakening the dollar.

Moreover, Park argues that Trump has a personal stake in this strategy. Given his heavy exposure to real estate, his primary objective is to bring down the 10-year Treasury yield.

In a scenario of a weaker dollar and falling US interest rates, risk assets in the US could surge while foreign economies struggle with rising inflation and currency devaluation. Faced with financial instability, Park predicts global investors will turn to alternative assets.

“The asset to own therefore is Bitcoin,” Park noted.

He emphasized that as economic tensions escalate, Bitcoin’s ascent will accelerate.

President Trump’s Tariffs Spark Crypto Market Collapse

Meanwhile, the threat of a trade war sent the crypto market plunging. Over the past few hours, Bitcoin briefly dropped to a minimum of $91,281, while Ethereum fell as low as $2,143. This has resulted in billions being wiped from the market

According to Coinglass, total liquidations exceeded $2.23 billion within the past 24 hours.

“Worst liquidation event in history in a single day,” crypto analyst Miles Deutscher posted on X (formerly Twitter).

Deutscher added that it was worse than the LUNA and FTX collapses, which saw $1.6 billion in liquidations.

Of the total liquidations, $1.88 billion came from long positions and $349.81 million from short positions. In total, 726,788 traders were liquidated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

According to CoinGecko’s quarterly report, the overall crypto market cap fell 18.6% in Q1 2025. Trading volume on centralized exchanges also fell 16% compared to the previous quarter.

This report identified a few positive trends, but most of them contained at least one significant downside. Despite the market euphoria in January, recession fears are taking a very serious toll.

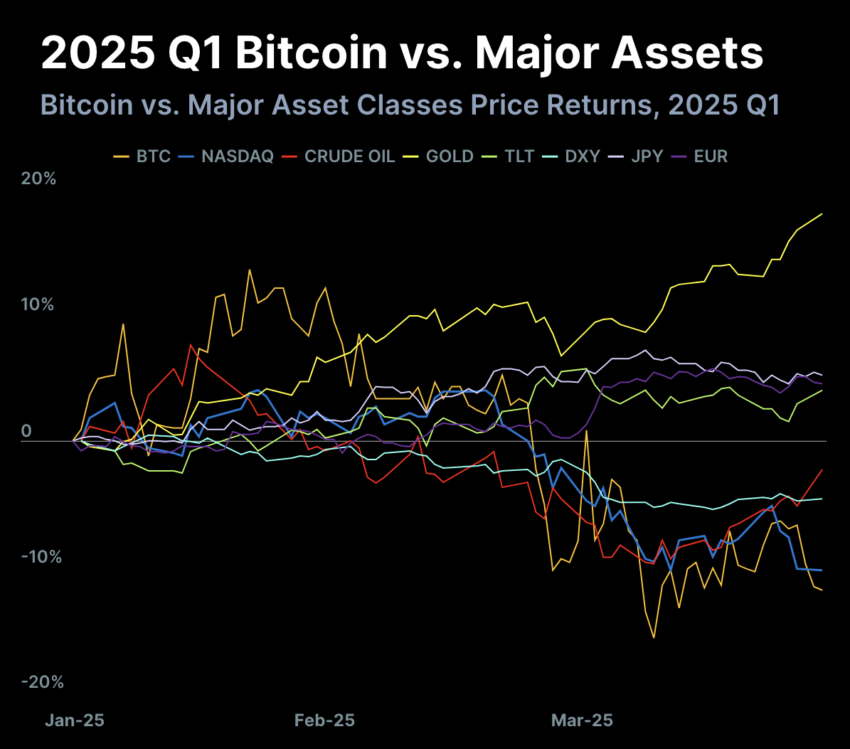

Crypto Suffered Heavy Losses in Q1

The latest CoinGecko report shows just how bearish the first quarter of the year has been. Although the crypto market started January with a major bullish cycle, macroeconomic factors have heavily impacted market sentiment for the past two months.

According to this report, crypto’s total market cap fell 18.6% in Q1 2025, a staggering $633.5 billion. Investor activity fell alongside token prices, as daily trading volumes fell 27.3% quarter-on-quarter from the end of 2024. Spot trading volume on centralized exchanges fell 16.3%, which CoinGecko at least partially attributes to the Bybit hack.

The report mostly focused on concrete numbers, but it pointed to a few specific events that impacted crypto. Markets hit a local high around Trump’s inauguration, thanks to market euphoria over possible friendly policies.

His TRUMP meme coin fueled a brief frenzy in Solana meme coin activity, but this quickly slumped. The LIBRA scandal had a further dampening impact.

Bitcoin increased its dominance in Q1 2025, accounting for 59.1% of crypto’s total market cap. It hasn’t maintained that share of the market since 2021, symbolizing how much more stable it’s been than altcoins.

Nevertheless, BTC also fell 11.8% and was outperformed by gold and US Treasury bonds.

This data point is especially worrying because Trump’s tariffs have wrought havoc on Treasury yields. Even so, the report clearly shows that the rest of crypto suffered even more. Ethereum’s entire 2024 gains vanished in Q1 2025, and multichain DeFi TVL fell 27.5%. C

ountless other areas saw similar results, but they’re too numerous to easily summarize.

That is to say, almost every quantifiable positive development came with at least one major caveat. Solana dominated the DEX trade, but its TVL declined by over one-fifth.

Bitcoin ETFs saw $1 billion in fresh inflows, but total AUM fell by nearly $9 billion due to price drops. The reports reflect that recession fears are gripping the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

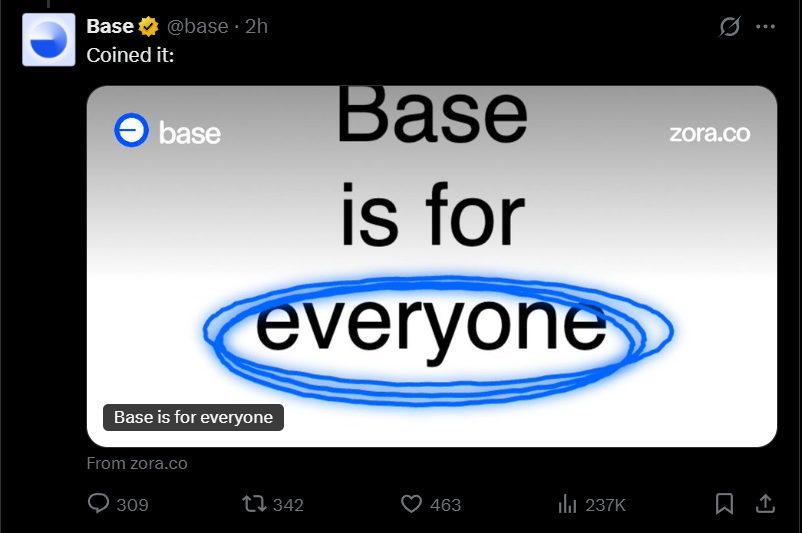

Base Meme Coin Wipes $15 Million After Official Promotion

Coinbase’s Layer 2 network, Base, is facing intense scrutiny after what appears to be a major pump and dump—one that it inadvertently helped fuel. The project’s official Twitter account publicly promoted a meme coin titled “Base is for everyone.”

This triggered a speculative surge, driving the token’s market cap to an estimated $15 to $20 million within hours of launch. The token quickly plummeted near zero in mutes.

Did Base Just Help Fuel a Pump and Dump?

Base’s tweet, which featured promotional imagery and direct links to the meme coin on Zora, created the perception of legitimacy.

Traders piled in, and price charts reflected an explosive rally—followed by an equally sharp collapse.

Within one 4-hour trading window, a green candle representing millions in inflow was immediately reversed by a red candle of equal size, marking a total loss of liquidity and confirming a textbook pump and dump.

The token’s value fell by more than 99%, and trading volumes on Uniswap surged past $13 million during the brief window of activity.

There is massive ongoing outrage against both Coinbase and Base. Crypto influencers have called the incident a failure of due diligence and communications strategy.

Accusations of incompetence and poor risk oversight are spreading fast on social media, while memes mocking the network’s “Base is for everyone” slogan are everywhere.

Base is yet to provide an official response to the incident.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Here’s What Happens If The XRP Price Closes Out This Week Above $2.25

XRP is back trading above, $2, and bullish momentum is gradually creeping back compared to its price action at the end of March and beginning of April. Crypto analyst EGRAG CRYPTO believes this week could highlight a turning point for a full flip into bullish momentum, and how the XRP price closes out the week will be very important.

According to the analyst’s outlook, which was posted on social media platform X, the current XRP candle on the weekly timeframe is hovering just above both $2.10 and the 21-week Exponential Moving Average (EMA). However, he noted that the real confirmation lies with if XRP can manage to close the week with a full-bodied candle above $2.25.

Why Is $2.25 Important For XRP’s Price?

The $2.25 level has now become more than just another short-term resistance. It is what EGRAG considers the final barrier to validating the recovery structure forming after March and April’s sharp retracement. His weekly chart shows XRP climbing out from a significant low after bouncing off the 0.888 Fib extension level and now stabilizing above the yellow 21-week EMA line.

The alignment of XRP’s price above both the $2.10 price level and this moving average adds credibility to the potential of a bullish continuation, but EGRAG makes it clear that a weekly close above $2.25 is the “lock-in” point. From a technical standpoint, this would mark the first full-bodied weekly candle above the 21W EMA since the past four weeks. If achieved, this can be interpreted confirmation that bulls have regained dominance and that a bottom was established on April 7.

Furthermore, it suggests that the April 7 bottom will continue to hold as support going forward. The chart also outlines close price targets at $2.51 and $2.60, with Fibonacci extension levels projecting even higher zones at $2.69 on the way to crossing back above $3.

Failing To Close Above $2.25 Could Reintroduce Unwanted Narratives

EGRAG also issued a cautionary note in case there isn’t a clean breakout. Should XRP fail to close the weekly candle above $2.25, he warned it could trigger a return of bearish narratives, including what he referred to as a possible “tariff issue.” This is referring to the recent tariff back-and-forth between the US and China in the past month, which has unbalanced the investment markets.

A strong rejection could see the XRP price pull back toward the $1.96 Fibonacci level or even lower into the broader support band of around $1.58 to $1.30. The white box region on the chart above would then become the primary battleground for bulls and bears if a close above $2.25 is not secured by the end of the week.

-

Market24 hours ago

Market24 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market22 hours ago

Market22 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market21 hours ago

Market21 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market23 hours ago

Market23 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market19 hours ago

Market19 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin19 hours ago

Altcoin19 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market18 hours ago

Market18 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin17 hours ago

Bitcoin17 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains