Market

How ADGM Plans to Make the UAE the Crypto Capital of the World

The Abu Dhabi Global Market (ADGM) has been making continuous strategic efforts to position the UAE as the crypto and blockchain capital of the world. The region’s regulatory clarity, streamlined process, and strategic position as a global financial hub have contributed to its success.

BeInCrypto spoke with Dmitry Fedotov, the Head of DLT Foundations at ADGM, to understand how its blockchain-friendly regulations have driven crypto giants to open offices in Abu Dhabi.

ADGM Poised to Accelerate Blockchain Adoption

Over the past few years, the UAE has emerged as a global leader in blockchain and Web3 adoption, creating a favorable environment for innovation and growth. The ADGM, a financial-free zone on Al Maryah Island in Abu Dhabi, has gained particular recognition for its blockchain-friendly regulatory framework.

The ADGM was established in 2013 by a Federal Decree. It functions as the city’s financial center and responds to an independent legal and regulatory framework. Its approach to Web3 innovation has attracted major players in the industry.

“ADGM positions itself as a global leader by taking such innovative steps, inspiring other jurisdictions to adopt forward-thinking solutions that redefine governance and engagement in emerging technologies,” Fedotov told BeInCrypto.

The UAE at large is experiencing a surge in crypto adoption as more businesses and users have adopted digital assets for transactions and investments.

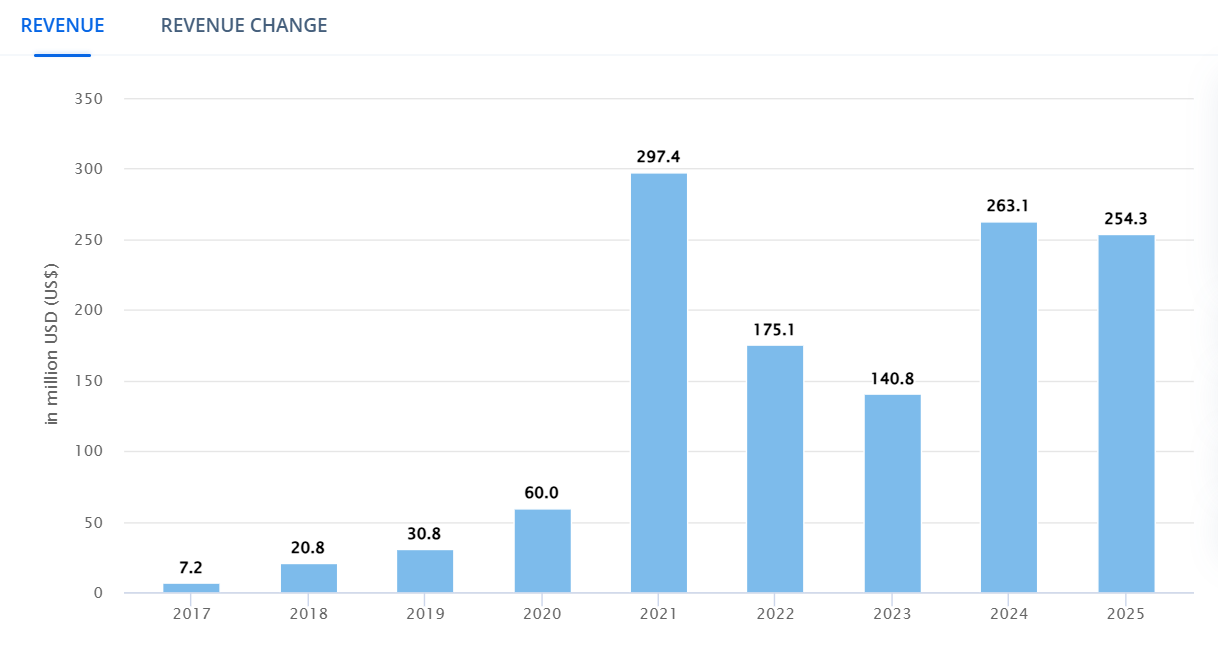

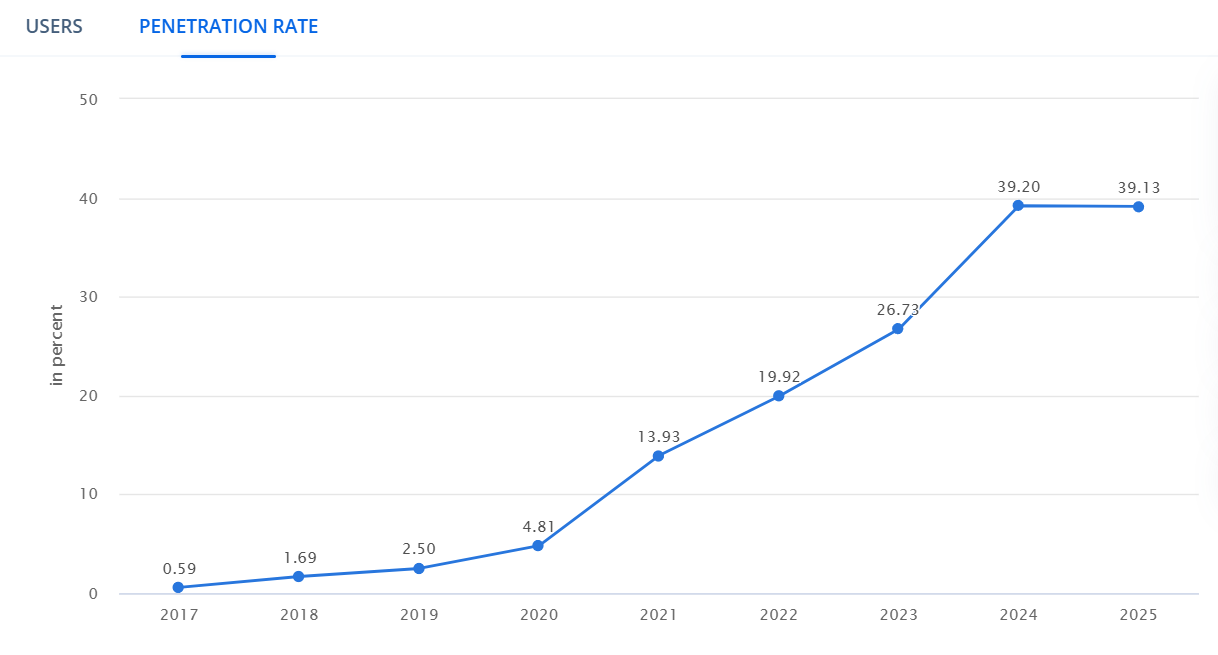

According to Statista, the number of users participating in the country’s crypto market will reach 3.78m users by 2025. Consequently, revenue rates are expected to remain high this year.

Meanwhile, the Aptos Foundation, a leading global blockchain entity, announced last month the opening of its new office in the ADGM.

The strategic move aims to drive regional partnerships, accelerate blockchain adoption, and expand the Aptos ecosystem. It also reinforces the UAE’s status as a hub for blockchain and Web3 innovation.

“Partnerships with industry leaders enhance our ecosystem’s credibility, while streamlined licensing processes make ADGM stand out compared to other financial hubs. These measures create a unique balance of growth opportunities and regulatory clarity,” Fedotov said.

Beyond Aptos, Chainlink Labs, TON, and Polygon Labs established their presence in ADGM to accelerate adoption in the Middle East.

However, for any crypto entity to pursue business endeavors in ADGM, it must first undergo a series of evaluations to determine whether it is eligible for operation.

Regulation of Virtual Asset Activities in ADGM

Over the years, the UAE has established notable regulatory clarity for the crypto industry. Before offering virtual asset services in the region, an entity must first gain an operating license from ADGM’s Financial Services Regulatory Authority (FSRA).

The FSRA defines a virtual asset as “a digital representation of value that can be digitally traded and functions as a medium of exchange, a unit of account, or a store of value, but does not have legal tender status in any jurisdiction.”

Virtual assets do not require a third party to create or interact with them. Because of this, they present a series of unique challenges for regulators worldwide.

In response, the FSRA considers seven key factors in determining whether a virtual asset meets these requirements. The factors include asset maturity, security, traceability and monitoring, exchange connectivity, type of distributed ledger, innovation and efficiency, and practical application.

More specifically, the FSRA evaluates whether there is sufficient client demand for the virtual asset. It also monitors whether controls are in place to manage its volatility and if the asset can withstand or respond to its specific risks and vulnerabilities.

Applicants also need to demonstrate whether the virtual assets help to solve a fundamental problem. Examples include meeting an unmet market need and determining whether they possess real-world, quantifiable functionality.

“This pioneering spirit ensures ADGM remains at the forefront of shaping the future of how regulators approach ever-evolving regulatory needs,” Fedotov said.

Tether’s USDT was one of the first companies to receive approval from Abu Dhabi’s FSRA to operate its stablecoin as an Accepted Virtual Asset on the ADGM. The approval reflects compliance with the region’s regulatory standards, paving the way for USDT’s inclusion in licensed financial services.

However, the Virtual Assets Framework is not the only one the ADGM has implemented to ensure regulatory compliance.

ADGM’s DLT Framework

In 2023, the ADGM established a framework to develop a worldwide standard for blockchain foundations, decentralized autonomous organizations (DAOs), and other Web3 entities.

Known as the Distributed Ledger Technology (DLT) Foundations Framework, this legislation allows the issuance of tokens and enables entities to employ diverse token governance strategies.

“ADGM offers regulatory clarity in a highly respectable jurisdiction based on the direct application of English Common Law with a supportive environment for innovation,” Fedotov said.

Before receiving approval, DLT Foundations must ensure compliance with all applicable laws, requirements, rules, and regulations set forth by the UAE, the Emirate of Abu Dhabi, and the ADGM.

To register a DLT Foundation in ADGM, applicants must provide a written charter signed by all of the founders and additionally sign a declaration of compliance. Applicants must also pay a series of initial registration fees and provide a copy of the whitepaper and tokenomics paper.

DLT Foundations must always have a registered office in the ADGM. They also need to demonstrate that they have substantial resources, experience, and personnel in the UAE.

“Initiatives like the DLT Foundations framework give blockchain-based organisations the opportunity to issue utility tokens and apply smart contracts for decentralised governance models,” Fedotov added.

Last month, ADGM registered TON as a DLT Foundation under its legal framework. This enabled a smoother operation and governance support for the decentralized organization.

TON aims to drive the adoption of its blockchain in the Middle East. ADGM’s comprehensive regulatory framework provides a supportive environment for the blockchain to do so via its DLT Foundation.

Balancing Innovation with Consumer Protection

To maintain its DLT Foundation status, the TON blockchain needs to continuously comply with a series of regulations, particularly developed to safeguard consumer security.

“ADGM’s DLT/blockchain framework aligns closely with global standards, focusing on key areas like combating financial crime, ensuring user protection, and promoting market integrity,” Fedotov told BeInCrypto.

The framework discloses that before granting a registration license, entities must provide evidence that they comply with laws related to anti-money laundering, anti-bribery, sanctions, export controls, consumer and data protection, and cybercrime prevention.

DLT Foundations must also conduct specific security audits on its data protection and security systems at least once per calendar year. Copies of the audits’ results must be sent to the registrar within two weeks of completion.

Like the DLT Foundations Framework, the Virtual Asset Framework requires the same degree of exhaustiveness to ensure user protection.

According to the legislation, “given the increased use of Virtual Assets as a medium for financial transactions, and their connectivity to the mainstream financial system through Virtual Asset and derivative exchanges and intermediaries, there is the increased potential of contagion risks impacting the stability of the financial sector.”

Consequently, the FSRA outlines in the virtual asset framework that applicants must mitigate risks related to anti-money laundering (AML), consumer protection, technology governance, ‘exchange-type’ activities, and custody.

Applicants also need to comply with FSRA’s AML rulebook and place controls regarding virtual asset wallets, private keys, risk management, and systems recovery.

Collaboration with the Financial Action Task Force

The ADGM and the different jurisdictions that comprise the UAE have also collaborated with the Financial Action Task Force (FATF) in developing its regulatory framework. This intergovernmental organization serves as a global anti-money laundering watchdog.

“Through partnerships with leading blockchain security companies, ADGM integrates international best practices. Collaborations with global regulatory bodies, and adoption of recommendations issued by the Financial Action Task Force (FATF), help establish benchmarks for the industry,” Fedotov said.

In February, the FATF announced that the UAE had been removed from its list of jurisdictions subject to enhanced due diligence or increased monitoring.

This action recognizes the UAE’s significant progress in addressing the FATF’s concerns regarding anti-money laundering and counter-terrorism financing measures.

“ADGM achieves this balance through a principle-based approach that establishes robust security and governance standards while granting companies the flexibility to innovate,” Fedotov added.

While ADGM welcomes responsible innovation within the digital asset sector, it is not intended to serve as a haven for entities that do not have a genuine commitment to regulatory compliance.

For instance, in October 2023, ADGM’s FSRA fined licensed money service provider Pyypl $486,000 for inadequate compliance with AML requirements.

Also, beyond an inclusive yet responsible framework, the ADGM has developed other pioneering initiatives that prioritize a forward-thinking approach to innovation.

Initiatives in Cutting-Edge Fields

Part of ADGM’s appeal to Web3 developers is its proactive approach to innovation.

“ADGM’s initiatives reflect its boldness and willingness to lead by being the first to explore uncharted territories,” Fedotov said.

Over the years, ADGM has launched several pilots that reflect this motivation.

“’Mediation in the Metaverse’ is a prime example, showcasing a groundbreaking approach to resolving disputes in virtual environments and highlighting ADGM’s ability to adapt to the rapidly evolving digital landscape,” he added.

In November 2022, the ADGM Arbitration Centre launched the Mediation in the Metaverse initiative. This pilot project leverages Web3 technology to create a virtual environment replicating the physical ADGM Arbitration Centre.

The immersive experience is accessible via desktop or mobile devices and aims to enhance participant engagement and improve the mediation process.

Since then, ADGM has broadened its endeavors.

“We are closely researching advancements in areas such as quantum computing, AI, autonomous transportation, robotics, and space technology to ensure our regulations support innovation in these cutting-edge fields,” Fedotov told BeInCrypto.

These efforts have already begun to materialize, attracting greater participation in ADGM’s crypto market and in the UAE at large.

According to Statista, the country’s penetration rate will reach 39.13 in 2025. This calculation is based on key market indicators, such as GDP, consumer spending, population, internet penetration, smartphone penetration, credit card penetration, and online banking penetration.

Last month, the Hashgraph Group of the Hedera ecosystem announced that it had secured a fund management license from ADGM.

With its newly attained license, the Swiss-based technology and investment firm announced the launch of a $100 million global venture fund. The funding will go toward promising startups and enterprises leveraging artificial intelligence, blockchain/DLT, robotics, and quantum computing.

This forward-thinking approach is not only limited to the ADGM, however. Other cities in the UAE are also taking a similar road.

ADGM Mirrors Broader UAE Approach to Web3 Innovation

Overall, the UAE’s crypto and blockchain developments have been nothing short of surprising. The country is always looking to set a new benchmark for other global markets.

Last week, Dubai announced plans to construct a 17-story Crypto Tower by 2027, reflecting the city’s commitment to supporting the growth of the blockchain and Web3 sectors. This initiative will provide 150,000 square feet of leasable space for blockchain and digital asset firms.

According to local reports, the Crypto Tower itself will integrate blockchain technology, enabling features such as on-chain voting, shared resource management, and smart contract-based operations to automate bureaucratic processes.

The tower will provide nine floors of office space for crypto companies and allocate three floors to incubators, venture capital firms, and investment groups. There will also be one floor dedicated exclusively to AI initiatives.

“This forward-thinking approach ensures ADGM remains a secure, adaptable, and innovation-friendly hub,” said Fedotov.

With its supportive policies and a growing community of blockchain pioneers, ADGM’s vision of becoming a global leader in blockchain innovation seems well within reach.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Bittensor Surpass Bitcoin as a Store of Value? Expert Predicts

Barry Silbert, CEO of Digital Currency Group, has stated that Bittensor (TAO) has the potential to outperform Bitcoin (BTC) as a global store of value.

His comments come amid notable growth in the Bittensor network, with its subnet ecosystem market capitalization and the TAO token’s price on the rise.

Will Bittensor’s Decentralized AI Model Outperform Bitcoin’s Legacy?

In a recent interview with Raoul Pal, Silbert highlighted the growing influence of artificial intelligence (AI) in the crypto sector. According to him, Bittensor is at the forefront of this revolution, representing the “next big era for crypto.”

“You had the Bitcoin and the Ethereum and the NFTs, and you had the layer 2s and DeFi. I think this is the next big investment theme for crypto,” Silbert stated.

He went on to explain that Bittensor shares the same pioneering spirit as early Bitcoin. Still, its purpose extends beyond financial sovereignty.

“The boldest prediction that I could make for Bittensor is it could be a better version of Bitcoin as a global store of value,” he claimed.

He argued that instead of the $10 to $12 billion spent annually to secure the Bitcoin network, that same amount could be redirected toward incentivizing a global network of individuals working to solve major world problems. He envisions this money fostering innovation on a massive scale, with the potential to grow into a multi-billion-dollar ecosystem.

While acknowledging the value of securing the Bitcoin network, Silbert emphasized that Bittensor’s potential lies in its ability to harness this vast financial backing to address real-world challenges.

He noted that Bittensor operates on a similar economic model to Bitcoin, with halving mechanisms and decentralization, positioning it as a powerful contender in the quest for a more impactful and value-driven global network.

Silbert also noted that while plenty of decentralized AI projects have emerged, Bittensor has set itself apart. He referred to it as having reached “escape velocity.” This term is used to convey a project’s rapid growth and increasing market influence.

“99.9% of crypto tokens that are out there have no reason to exist and are worthless,” he added.

Market data reflects the growing enthusiasm for Bittensor. Notably, amid the ongoing volatility, TAO has fared well in comparison to the broader market, rising 32.1% in the last week. At press time, the altcoin was trading at $328, up 7.2% over the past day.

Additionally, TAO is currently the top trending cryptocurrency on CoinGecko, underlining its rising popularity among investors. Google Trends data further proves the growing interest in Bittensor. The search volume peaked at 100 at the time of writing.

Meanwhile, the Bittensor ecosystem is also seeing notable progress. The latest data indicated that the market capitalization of Bittensor’s subnet tokens more than doubled in April 2025.

It increased by 166%, rising from $181 million at the beginning of April to $481 million at press time. As reported by BeInCrypto, this growth follows a tripling of active subnets over the past year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bulls Defend $2.00—Is a Fresh Price Surge Loading?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Vitalik Buterin Proposes to Replace EVM with RISC-V

Ethereum (ETH) co-founder Vitalik Buterin has proposed overhauling the blockchain’s smart contract infrastructure by replacing the Ethereum Virtual Machine (EVM) with RISC-V, a widely adopted open-source instruction set architecture.

This shift aims to address one of Ethereum’s key scaling bottlenecks by dramatically improving the efficiency and simplicity of smart contract execution.

Buterin Proposes Ditching EVM for RISC-V

The proposal was detailed in a post on the Ethereum Magicians forum. In it, Buterin suggested that smart contracts could eventually be compiled to RISC-V rather than EVM bytecode.

According to Buterin, this shift addresses long-term scalability challenges. This particularly includes keeping block production competitive and improving zero-knowledge (ZK) EVM-proof efficiency.

“It aims to greatly improve the efficiency of the Ethereum execution layer, resolving one of the primary scaling bottlenecks, and can also greatly improve the execution layer’s simplicity – in fact, it is perhaps the only way to do so,” he wrote.

Current ZK-EVM implementations spend around half of their proving cycles on EVM execution. By switching to a native RISC-V VM, Ethereum could potentially achieve up to 100x efficiency gains.

Importantly, many fundamental aspects of Ethereum’s architecture would remain unchanged, preserving continuity for developers and users. Core abstractions such as accounts, smart contract storage, ETH balances, and cross-contract calls would function exactly as they do today.

Developers would still write contracts in familiar languages like Solidity or Vyper. These would simply be compiled to RISC-V rather than EVM bytecode. Tooling and workflows would remain largely intact, ensuring a smooth transition.

Crucially, the proposal ensures backward compatibility. Existing EVM contracts will remain fully operational and interoperable with new RISC-V contracts.

Buterin outlines several potential implementation paths forward. The first would support both EVM and RISC-V smart contracts natively. The second suggests wrapping EVM contracts to run via an interpreter written in RISC-V. Thus, it would enable a full transition without breaking compatibility.

The third, more modular approach, builds on the second by formally enshrining interpreters as part of the Ethereum protocol. This would allow the EVM and the future virtual machines to be supported in a standardized way.

Buterin stated that the idea is “equally as ambitious as the beam chain effort.”

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum. But for the execution layer to see similar gains, this kind of radical change may be the only viable path,” Buterin added.

For context, the Ethereum Beam Chain is a redesign of Ethereum’s consensus layer (Beacon Chain). It focuses on faster block times, faster finality, chain snarkification, and quantum resistance. The development will likely begin in 2026.

This proposal fits into Ethereum’s broader vision of modularity, simplicity, and long-term scalability. Previously, BeInCrypto reported on Buterin’s privacy-centric plans for the blockchain.

The proposal focused on integrating privacy-preserving technologies. Moreover, the Pectra upgrade is also nearing, with the launch expected on May 7.

Meanwhile, ETH continues to face market headwinds, trading at March 2023 lows. This year has been quite hard for the altcoin, as it saw a decline of 50.8%. In fact, Ethereum dominance hit a 5-year low last week.

Nonetheless, BeInCrypto data showed a slight recovery over the last 14 days. ETH rose by 6.1%. Over the past day alone, it saw modest gains of 1.7%. At the time of writing, ETH was trading at $1,639.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market16 hours ago

Market16 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market23 hours ago

Market23 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market21 hours ago

Market21 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market22 hours ago

Market22 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Market17 hours ago

Market17 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

-

Market15 hours ago

Market15 hours agoTokens Big Players Are Buying