Market

Growing number of Solana and Cardano investors are investing heavily in this utility token under $0.08

A growing number of smart money crypto investors are shifting their focus from Solana (SOL) and Cardano (ADA) to an emerging utility token priced under $0.08. The Rexas Finance token offers a unique value proposition with strong use cases in decentralized finance (DeFi) and real-world asset tokenization, making it an attractive alternative to more volatile projects.

Its cutting-edge technology and growing adoption rates could be setting the stage for substantial long-term gains. With the potential for exponential growth, these savvy investors see this low-cost token as a high-reward opportunity to capitalize on before it fully breaks out.

Utility Token Rexas Finance under $0.08

Buying a piece of real estate or gold needs significant capital, and the process is often slow and complicated. But Rexas Finance changes this by enabling these assets to be indicated as tokens on the blockchain. This shows that users can easily buy, sell, and trade fractions of the assets, opening up investment opportunities to a wide range of audiences.

Key features of Rexas Finance

Rexas Token Builder simplifies the process of tokenizing assets by eliminating the need for complex coding, enabling users to launch tokens in minutes. In addition, Rexas Launchpad provides a decentralized, secure project for token funding over many blockchain networks.

For artists and creators, Rexas GenAI also offers an AI-based tool for creating unique digital artworks, ideal for venturing into the NFT space.

Rexas DeFi further enables the platform by allowing seamless cryptocurrency swaps across various networks, while Rexas Estate allows users to co-own real-world properties and earn passive income in stablecoins.

Finally, Rexas Treasury is a multi-chain yield optimizer that enables users to earn compound interest on their crypto deposits.

Rexas Finance began the presale of the native token RXS on September 8, 2024. The total supply of RXS tokens is 1 billion. The Rexas Finance project has already raised over $2.85M, with the third stage of its presale over. This presale event is important for the platform as it allows early investors to engage in what might turn into a revolutionary solution for RWA tokenization.

Rexas Finance’s $1M Giveaway is live, offering a huge chance for early adopters to join the project’s growth. With a current token price of $0.06 and a projected listing price of $0.20, the potential for an increase indicates a good opportunity for investors.

About Rexas Finance (RXS)

Rexas Finance is the users’ gateway to the future of asset management. Rexas allows users to own or tokenize virtually any real-world asset, from real estate and art to commodities and intellectual property world-wide. With Rexas, users gain access to a world where asset liquidity and investment choices are boundless.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

BANK Token Surges 150% After Binance Futures Listing

Lorenzo Protocol’s native token, BANK, has recorded a 150% price surge within six hours of its official launch.

The token’s rapid climb follows its listing on multiple platforms, including Binance’s Alpha Market and the launch of a BANKUSDT perpetual contract on Binance Futures with up to 50x leverage.

What is the New BANK Token on Binance Futures?

The Token Generation Event (TGE) for BANK took place today, April 18, via Binance Wallet, in partnership with PancakeSwap. Lorenzo Protocol raised $200,000 through the sale of 42 million BANK tokens—2% of the total supply—priced at $0.0048 each.

The token is now trading on PancakeSwap, Bitget, and CoinEx. Following its debut, BANK reached a market cap of approximately $22 million.

BANK is the governance and utility token for Lorenzo Protocol, a DeFi platform focused on enhancing Bitcoin liquidity.

The protocol allows users to earn yield on BTC without giving up custody. It uses financial primitives like Liquid Principal Tokens (LPTs) and Yield-Accruing Tokens (YATs).

According to its claims, BANK holders can stake their tokens to receive veBANK, which provides governance rights and a share of future emissions.

Also, Lorenzo Protocol is built on a Cosmos-based Ethermint appchain. It enables BTC restaking and interoperability with Bitcoin’s Layer 1. The design supports on-chain issuance and settlement of BTC-backed assets.

The listing of the BANK/USDT perpetual contract on Binance Futures adds further momentum to the token. Binance Futures is a derivatives platform that allows users to trade perpetual contracts with high leverage.

Binance has historically preferred new tokens on the BNB chain for early futures trading. BANK’s sharp price increase and rapid market integration highlight strong early interest in Lorenzo Protocol’s approach to BTC-based DeFi infrastructure.

Currently, it’s far-fetched to project whether the exchange will list this newly launched token. However, Binance’s new community voting on token listing has offered positive hopes for small market cap projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Asia’s First XRP Investment Fund is Here, Backed by Ripple

HashKey Capital has launched the HashKey XRP Tracker Fund, the first fund in Asia focused exclusively on tracking the performance of XRP.

The fund is now open to professional investors. Ripple is backing the initiative as an early investor.

Institutional Interest in XRP Investment Continues to Grow

According to HashKey, XRP offers a faster and more cost-effective alternative to traditional cross-border payment systems. The new tracker fund aligns with HashKey Capital’s goal of connecting conventional finance with digital asset markets.

The fund allows investors to subscribe using either cash or in-kind contributions. Investors can redeem or subscribe to shares on a monthly basis.

CF Benchmarks, known for its role in global ETF markets, will provide the fund’s benchmark.

“XRP stands out as one of the most innovative cryptocurrencies in today’s market, attracting global enterprises who use it to transact, tokenize, and store value. With the first XRP Tracker Fund available in the region, we simplify access to XRP, catering to the demand for investment opportunities in the very best digital assets,” said Vivien Wong, Partner at HashKey Capital.

Most recently, Ripple acquired prime brokerage platform Hidden Road for $1.25 billion. It was one of the largest acquisition deals in the crypto and blockchain space.

Earlier today, Hidden Road secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA).

Meanwhile, XRP continues to gain traction with institutional investors. Standard Chartered recently forecast that XRP could surpass Ethereum by 2028, citing increased demand for efficient cross-border payment solutions and growing disruption in global trade.

“XRP is uniquely positioned at the heart of one of the fastest-growing uses for digital assets – facilitation of cross-border and cross-currency payments. In this way, XRPL is similar to the main use case for stablecoins such as Tether. This stablecoin use has grown 50% annually over the past two years, and we expect stablecoin transactions to increase 10x over the next four years. We think this bodes well for XRPL’s throughput growth, given the similar use cases for stablecoins and XRPL,” Geoff Kendrick, Standard Chartered’s Head of Digital Assets Research, told BeInCrypto.

Interest in XRP ETFs is also increasing. Teucrium Investment Advisors recently received NYSE Arca approval for the Teucrium 2x Long Daily XRP ETF (XXRP), the first leveraged XRP ETF in the United States.

Also, attention is now turning to spot XRP ETFs. Grayscale and 21Shares are both awaiting decisions from the SEC on their XRP-based products.

The SEC has up to 240 days to review the Grayscale XRP Trust and the 21Shares Core XRP Trust, with final deadlines set for October 18 and 19, 2025.

XRP’s price has declined by nearly 20% over the past month, but institutional confidence remains high.

Ripple recently confirmed progress in resolving its long-standing legal battle with the SEC. A joint motion to pause court proceedings was approved, giving both parties 60 more days to finalize a settlement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

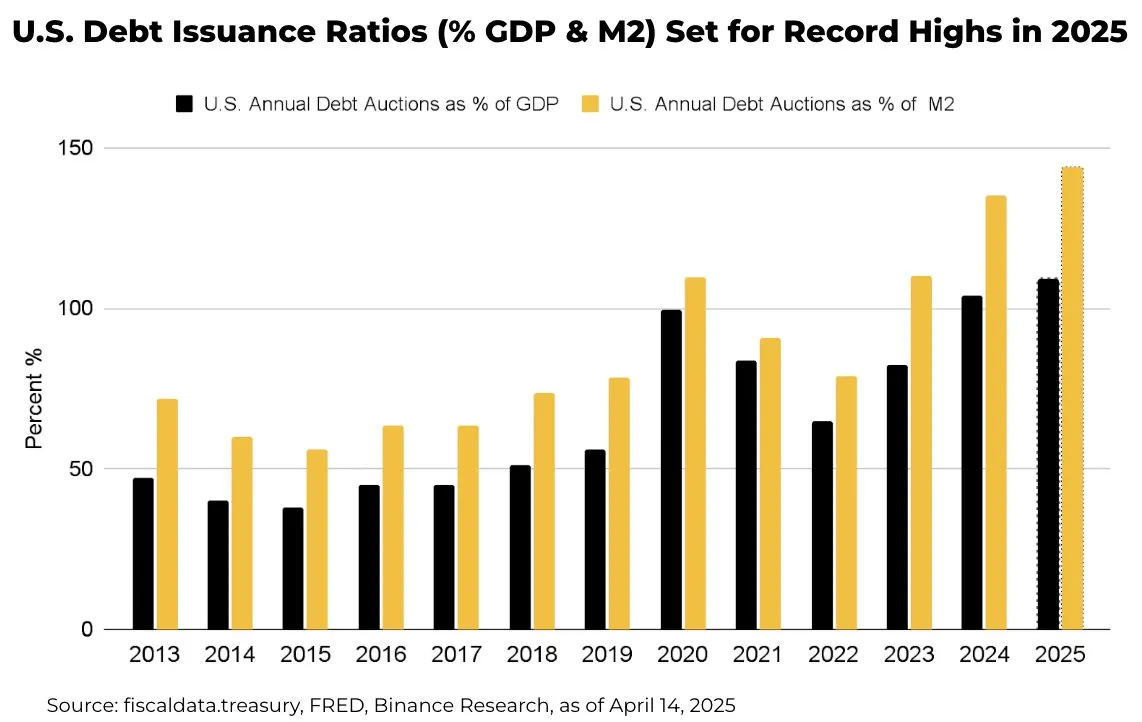

How $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market?

Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity cost of holding non‑yielding assets like Bitcoin and Ethereum, potentially drawing capital away from crypto.

US Bonds Might Add to the Crypto Market’s Volatility

The whole narrative potentially boils down to foreign demand for US bonds. Overseas investors hold roughly one‑third of US debt.

Any reduction in appetite—whether due to tariffs or portfolio rebalances—could force the Treasury to offer even steeper yields. Rising yields tend to tighten global liquidity, making risk assets like cryptocurrencies less attractive.

When yields climb, equities and crypto can face selling pressure. For example, during the 2022 bond sell‑off, Bitcoin fell more than 50% alongside Treasury yields spiking. A repeat scenario could test crypto’s appeal.

Meanwhile, the US dollar’s strength could compound headwinds. As yields rise, the dollar typically gains. A stronger dollar makes Bitcoin’s USD‑denominated price more expensive for overseas buyers, dampening demand.

Yet crypto offers unique attributes. In periods of extreme monetary expansion, such as post‑pandemic, investors turned to Bitcoin as an inflation hedge.

Even if higher yields curb speculative flows, crypto’s finite supply and decentralized nature may sustain a baseline of buyer interest.

Technically, Bitcoin’s correlation to yields may weaken if Treasury issuance triggers broader macro volatility. When bond markets are hit by trade or fiscal policy shocks, traders may turn to digital assets to diversify since they don’t move in step.

However, that thesis hinges on continued institutional adoption and favorable regulation.

Crypto’s liquidity profile also matters. Large bond sales often drain bank reserves—tightening funding markets.

In theory, tighter liquidity could boost demand for DeFi protocols offering higher yields than traditional money markets.

Overall, record US debt supply points to higher yields and a stronger dollar—volatility for crypto as a risk asset.

Yet crypto’s inflation‑hedge narrative and evolving technical role in diversified portfolios could temper volatility. Market participants should watch foreign demand trends and liquidity conditions as key indicators for crypto’s next moves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Market24 hours ago

Market24 hours agoCrypto Casino Founder Charged With Fraud in New York

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

-

Market20 hours ago

Market20 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Market19 hours ago

Market19 hours agoBinance Leads One-Third of the CEX Market in Q1 2025

-

Altcoin17 hours ago

Altcoin17 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market14 hours ago

Market14 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance