Market

Grayscale Altcoins, Tesla’s Bitcoin, and More

This week in the crypto market, Bitcoin’s price surpassed $68,000, and the market capitalization returned to over $2.28 trillion.

BeInCrypto noted special investor interest in events such as Grayscale’s review of 35 altcoins for potential investment products and investors’ expectations of an altcoin season ahead of the US elections.

Additionally, Miles Deutscher has suggested several altcoins, claiming they might have a strong growth potential. The community is also paying attention to Craig Wright’s legal plans and Tesla’s Bitcoin movements.

Grayscale Unveils 35 Potential Altcoins

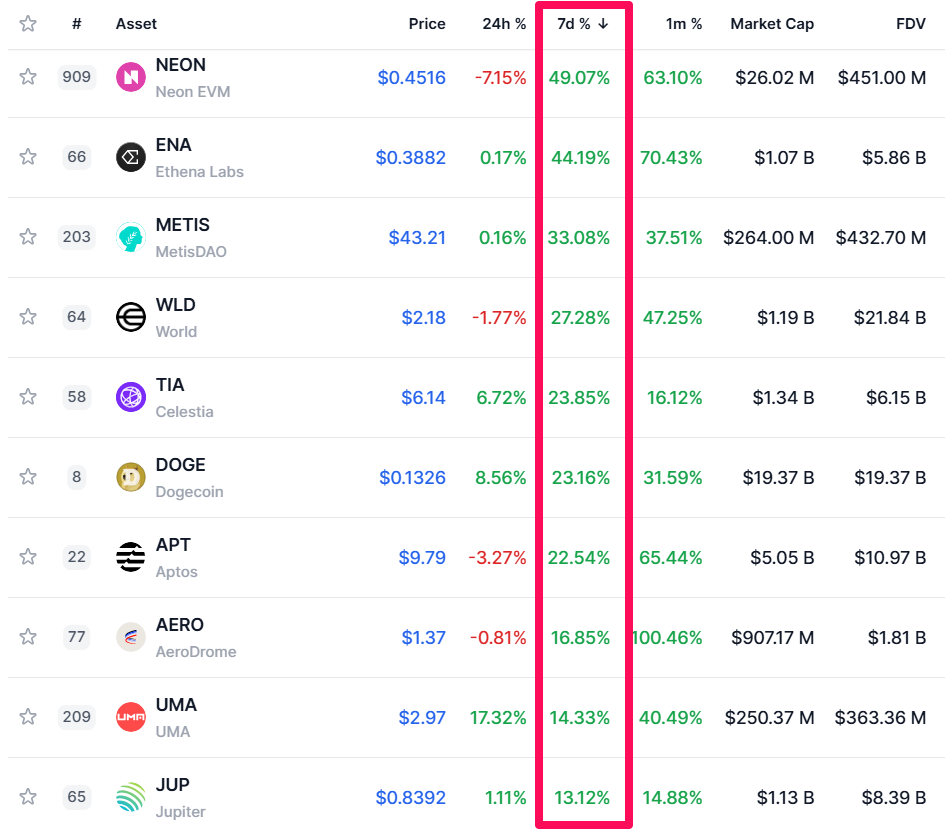

Earlier this week, Grayscale announced a list of 35 altcoins under consideration for future investment products. Following the announcement, many of these altcoins experienced significant price increases over the week. The top 10 altcoins on the list saw gains ranging from 13% to 49%.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Thirty of the 35 altcoins enjoyed a green week, with only Kaspa (KAS) and Helium (HNT) facing notable declines of -4% and -7.4%, respectively.

“Assets Under Consideration lists digital assets not currently included in a Grayscale investment product but identified by our team as possible candidates for inclusion in a future product,” Grayscale explained.

Additionally, Grayscale filed with the SEC to convert its Digital Large Cap Fund into an ETF, following the success of transforming Bitcoin Trust and Ethereum Trust into spot ETFs.

Miles Deutscher Highlights 4 Altcoins

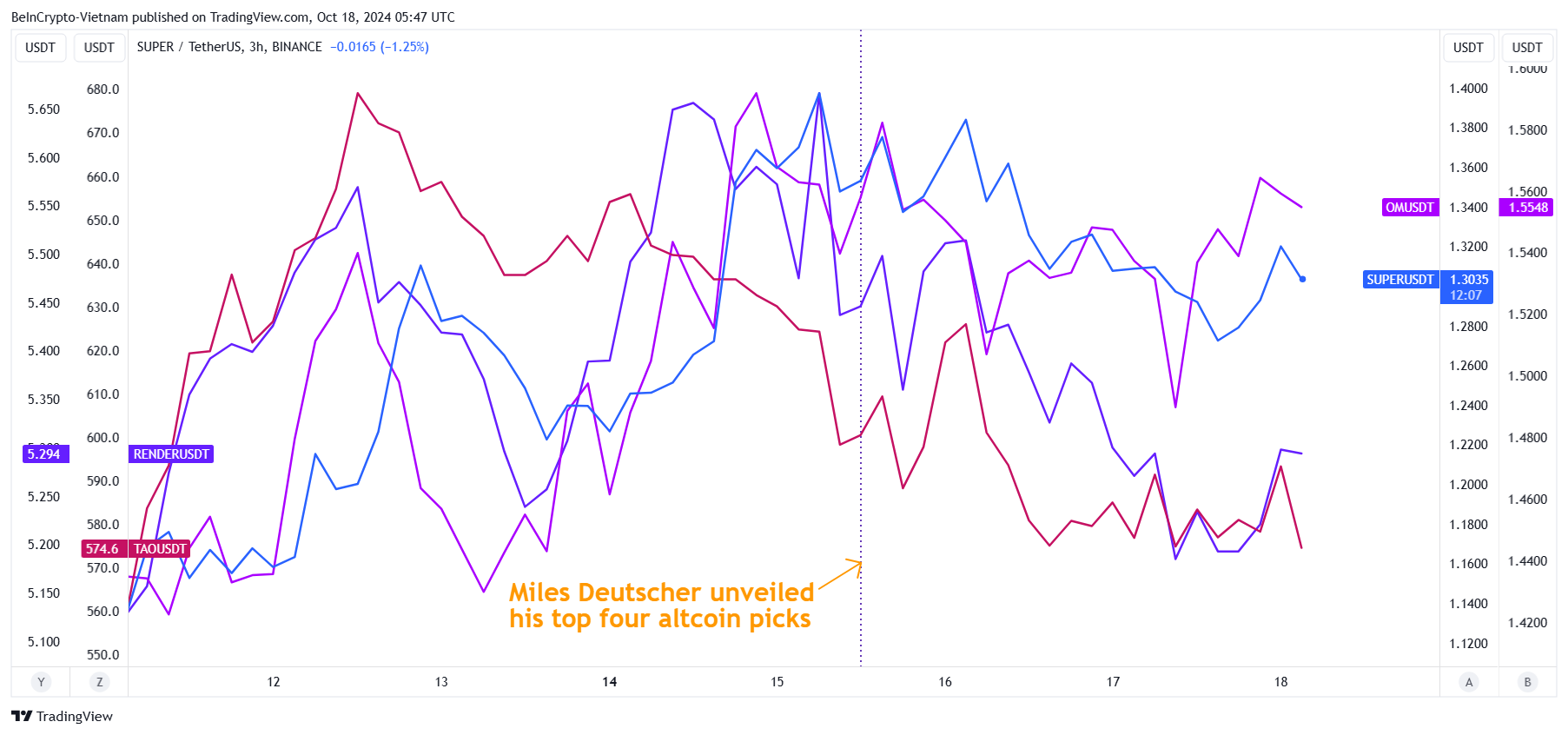

Investor Miles Deutscher introduced four altcoins that he believes could deliver 10x returns. These altcoins focus on GameFi, artificial intelligence (AI), Decentralized Physical Infrastructure Network (DePIN), and real-world assets (RWA) sectors, including:

- SuperVerse (SUPER)

- Bittensor (TAO)

- Mantra (OM)

- Render (RNDR)

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Since his announcement, the prices of these altcoins have slightly declined, which occurred as Bitcoin Dominance reached a three-year high. Deutscher also commented on meme coins, suggesting they are at a crossroads and may face a short-term correction.

Craig Wright Plans to Sue Bitcoin Core

On October 11, a tracker from the UK High Court revealed that Craig Wright is taking legal action against Bitcoin Core and Square.

Wright, representing himself in the case as a “direct claimant,” is seeking £911 billion ( ~$1.18 trillion) from Bitcoin Core and Square, alleging they misrepresented Bitcoin (BTC) as the true version of the digital asset created by Satoshi Nakamoto.

Additionally, Wright threatened to sue MicroStrategy CEO Michael Saylor for allegedly misrepresenting Bitcoin. The Australian computer scientist is also filing three other legal appeals in the UK, two against the Crypto Open Patent Alliance (COPA) and one targeting Peter McCormack.

Read more: Satoshi Nakamoto – Who is the Founder of Bitcoin?

Altcoin Season Ahead of US Presidential Election?

Throughout the week, several crypto industry experts expressed optimism for altcoin’s price ahead of the US presidential election. Ki Young Ju, CEO of CryptoQuant, suggested that a Trump victory could spur regulatory changes that would trigger an altcoin season.

“If Trump wins, expect regulatory changes, including fee switches enabling token burns for revenue-generating projects,” Ki Young Ju said.

Technical analysts Michaël van de Poppe and CRG also predicted that the altcoin season could begin next month. Echoing these views, Crypto Rover forecasted an impending altcoin season by monitoring Bitcoin Dominance’s movements. Bitcoin Dominance (BTC.D) represents Bitcoin’s share of total market capitalization. Its adjustments often signal an altcoin rally.

Read more: Bitcoin Dominance Chart: What Is It and Why Is It Important?

Tesla Moves Bitcoin Worth Up to $760 Million

This week, Elon Musk’s Tesla unexpectedly moved nearly all of the Bitcoin it had held for the past three years to new wallet addresses. Initially, investors feared Tesla might be preparing to sell the BTC through OTC, but those concerns quickly dissipated as Bitcoin’s price remained unaffected.

“No proof it’s an OTC deal yet. Even if it was, that means someone else bought it so it’s not entirely bearish. Who knows,” Sir Doge of the Coin said.

Read more: Who Owns the Most Bitcoin in 2024?

Many now believe the move was a simple reallocation. In 2021, Musk had stated that Bitcoin payments made to Tesla would be held as Bitcoin, not converted into fiat.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP remains one of the most popular coins in the market, with a cult-like community that has supported it for years. With the bullish sentiment surrounding it, the altcoin has performed quite well and continues to inspire support. The most recent developments for XRP have been the ETF filings that suggest it might be the next altcoin to get an SEC nod after Ethereum. The number of filings also puts it well ahead of investor favorites such as Solana and Dogecoin in the running for the next ETF approval.

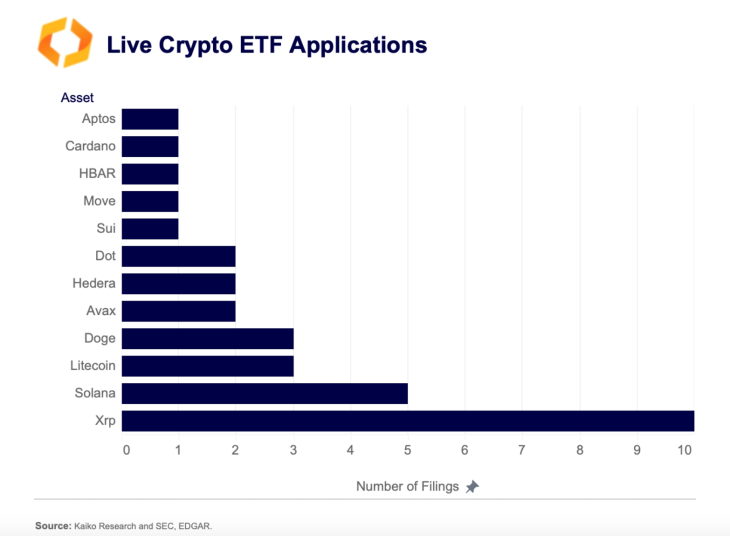

XRP ETF Filings Climb To 10

XRP ETF filings have been coming out of the market over the past year, especially with the approvals of Ethereum Spot ETFs. These ETFs are expected to give institutional investors an official vehicle to get proper exposure to the market. As Bitcoin and Ethereum ETFs have been done and dusted, issuers have looked to other large cap altcoins to bring into the market.

Related Reading

The next favorites on the list have been XRP, in addition to heavy hitters such as Solana, Dogecoin, and Litecoin. However, in the race, XRP has clearly differentiated itself in terms of interest, boasting twice as many filings as any other altcoin.

According to data from Kaito Research, there are currently 10 XRP ETF filings pending approval or rejection from the SEC. In contrast, there are five Solana ETF filings, 3 Litecoin filing, and 3 Dogecoin filings. This shows clearly that interest in XRP as the next altcoin to gain ETF approval is the highest.

Additionally, the SEC has acknowledged the XRP ETF filings from industry leaders such as Grayscale. There are also filings from ProShares, Franklin Templeton, Bitwise, 21Shares, among others. However, BlackRock has not made a move to file for an XRP ETF despite leading the Bitcoin and Ethereum ETF campaigns.

Nevertheless, the filings for XRP ETFs remain a big deal for the altcoinm and their approval could trigger another wave of price hikes.

ETFs And The SEC Battle Conclusion

For many, the major hindrance to an SEC approval of an XRP ETF was the ongoing battle between the crypto firm and the regulator, which began in 2020. However, in March 2025, Ripple CEO Brad Garlinghouse announced that the case was officially over.

Related Reading

With this development, expectations that the regulator will look favorably upon an XRP ETF are high. If the ETFs are approved, even with a fraction of the Bitcoin ETF volumes, the XRP price is expected to explode in response, with some analysts predicting that the altcoin’s price could rise to the double-digits.

Featured image from Dall.E, chart from TradingView.com

Market

Expanding Blockspace and Enhancing Privacy

Ethereum Layer-2 (L2) network Base, incubated by Coinbase, has unveiled its product roadmap for the second quarter (Q2) 2025.

It indicates a bold slate of performance upgrades, enhanced privacy features, and broader support for developers.

Base Q2 Roadmap: Speed, Privacy, and Builder Adoption

In a detailed post on X (Twitter), Base’s development team outlined key objectives for the quarter. The roadmap reaffirms Base’s commitment to building in the open. It also lays the groundwork for scaling its role as a core pillar of the on-chain economy.

The plan to achieve 200ms effective block times on the mainnet is among the most eye-catching. The move could dramatically increase throughput and improve user experience.

Additionally, Base aims to scale blockspace from 30 to 50 Mgas/s and reach “Stage 1 decentralization.” Notably, they are key milestones in both performance and network security.

Privacy is also a central focus. Base is working to implement privacy-preserving on-chain account verification. This initiative reflects the growing importance of identity and privacy in a blockchain environment where transparency and pseudonymity often clash.

Beyond scaling and privacy, the roadmap details efforts to enhance its developer toolkit, notably expanding usage of the Base MCP (Modular Crypto Platform) tooling. This includes increasing weekly active apps built on OnchainKit and MiniKit and launching new Base Appchains on the mainnet.

The Base MCP tooling is part of a broader push to enable developers to go from “Idea to App, App to Business,” as described by the team. However, it is worth noting that MCP protocols have come under scrutiny recently due to a critical security flaw, raising concerns about their current implementations.

BeInCrypto recently reported on vulnerabilities that, if left unpatched, could expose user data or funds. This suggests that Base’s teams must prioritize security alongside growth.

“This risk comes from using a ‘poisoned’ MCP. Hackers could trick Base-MCP into sending your crypto to them instead of where you intended. If this happens, you might not notice,” Superoo7, head of Data and AI at Chromia, highlighted.

Base’s community-centric ethos is evident in its continued support for builder programs like Base Batches, Buildathons, and the Builder Rewards initiative. The team emphasized that these initiatives will support developers technically and economically, creating viable paths to earning a living by building on-chain.

Coinbase CEO Brian Armstrong also weighed in, endorsing the roadmap with a simple but affirming statement. This highlights Coinbase’s continued backing of the Layer-2 solution, which has become a standout in the ecosystem.

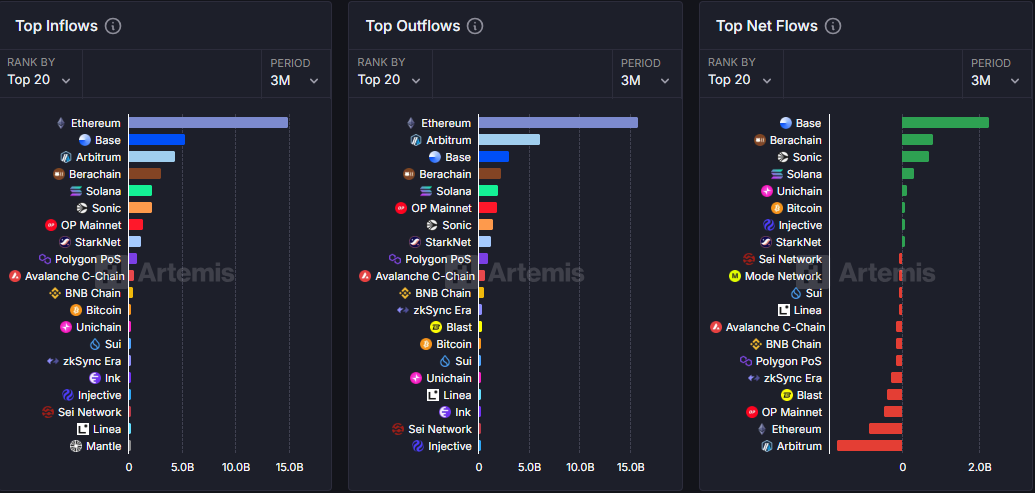

Base Blockchain Leads Net Flows Across DeFi Bridges

Base has emerged as a top performer in 2025, leading the market in net flow over the past three months. On total inflow metrics, data on Artemis Terminal shows it is second, after Ethereum (ETH). This traction reflects growing user confidence and adoption across DeFi, gaming, and NFT verticals.

Still, the network has not been immune to controversy. Only hours ago, Base faced backlash after a meme coin, allegedly promoted by insiders, triggered a trading frenzy and abrupt collapse. As BeInCrypto reported, this raised accusations of a pump-and-dump scheme.

While Base distanced itself from the coin in question, the incident raises concerns about transparency and ethical boundaries on the platform.

“This wasn’t a meme coin. This wasn’t a token launch. Base didn’t drop a coin to pump bags or flip the market. This was a content coin — and that distinction matters,” Base developer Charis posted on X.

As Base moves into Q2, it stands at a crossroads. On the one hand, it is armed with performance upgrades and developer momentum. On the other hand, it faces heightened scrutiny.

If successful, its roadmap could further cement Base’s place as a foundation of the next-generation internet. However, the pressure to balance innovation, security, and trust has never increased.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Range-Bound—But a Move Higher May Be Brewing?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

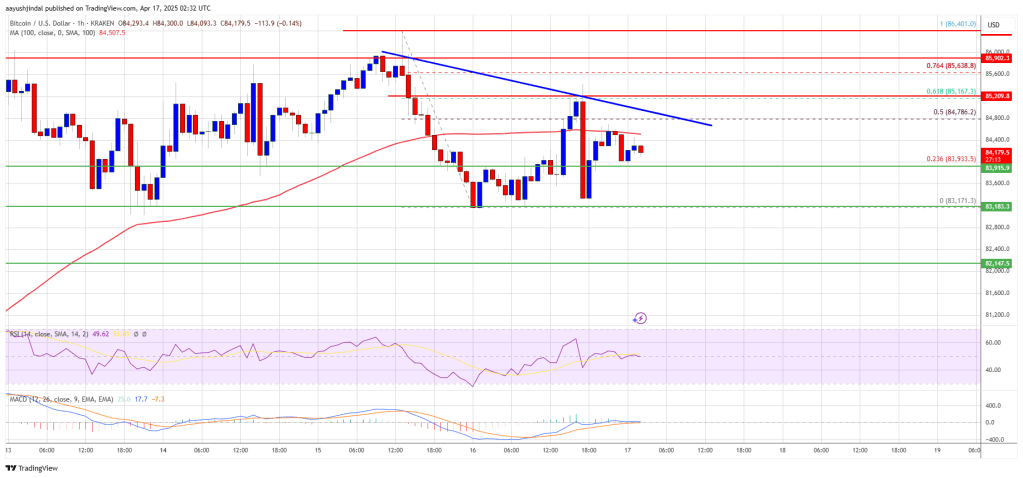

Bitcoin price started a fresh decline below the $85,500 zone. BTC is now consolidating and might attempt to clear the $85,200 resistance zone.

- Bitcoin started a fresh decline below the $85,500 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $84,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,000 zone.

Bitcoin Price Eyes Fresh Increase

Bitcoin price struggled near the $86,500 zone and started a fresh decline. BTC declined below the $85,500 and $85,000 levels to enter a short-term bearish zone.

The price tested the $83,200 support. A low was formed at $83,171 and the price recently corrected some losses. There was a move above the $83,800 level. The price surpassed the 50% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $84,750 level. There is also a connecting bearish trend line forming with resistance at $84,800 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $85,150 level or the 61.8% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low. The next key resistance could be $85,500.

A close above the $85,500 resistance might send the price further higher. In the stated case, the price could rise and test the $85,800 resistance level. Any more gains might send the price toward the $86,400 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,000 resistance zone, it could start another decline. Immediate support on the downside is near the $83,900 level. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $83,200, followed by $82,200.

Major Resistance Levels – $84,750 and $85,150.

-

Altcoin19 hours ago

Altcoin19 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market21 hours ago

Market21 hours agoHow It’s Impacting the Network

-

Market19 hours ago

Market19 hours agoPi Network Drops10% as Outflows Surge, Death Cross Looms

-

Market17 hours ago

Market17 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Market14 hours ago

Market14 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Market20 hours ago

Market20 hours agoRaydium’s New Token Launchpad Competes with Pump.fun

-

Market18 hours ago

Market18 hours agoRipple and the SEC Receive 60-Day Pause to Reach Settlement