Market

Glassnode Highlights Bitcoin’s “Atypical” Market Cycle

According to blockchain analytics firm Glassnode, Bitcoin’s latest market cycle is exhibiting “atypical” characteristics. The firm highlights that Bitcoin (BTC) has matured into a global asset with deep liquidity, allowing investors to trade at all hours, even when traditional markets are closed.

This accessibility has positioned Bitcoin uniquely in the financial arena, especially during macroeconomic uncertainty.

Bitcoin’s Increasing Global Influence

According to Glassnode, Bitcoin has become a store of value and a medium of exchange. It cites a net capital inflow exceeding $850 billion and a daily economic volume of nearly $9 billion.

Further, nation-states such as Bhutan and El Salvador have integrated Bitcoin into their financial strategies, while discussions in the US government continue to explore Bitcoin’s role as a potential strategic reserve asset.

The report also acknowledges Bitcoin’s market capitalization of $2 trillion, ranking as the world’s seventh-largest asset, surpassing silver, Saudi Aramco, and Meta. However, the pioneer crypto’s reaction to global events, such as President Donald Trump’s tariffs, is a key highlight.

Over the weekend, Bitcoin and other digital assets sharply declined in response to the Trump administration’s new tariffs on Mexico, Canada, and China. With traditional markets closed, Bitcoin experienced significant volatility.

Bitcoin fell from $104,000 to below $93,000, while both Ethereum and Solana lost over 20% at the time.

According to Glassnode, this reaction reflects Bitcoin’s role as a 24/7 global asset that investors turn to in response to macroeconomic developments. This aligns with Robert Kiyosaki’s outlook that the recent correction was a prime wealth-building moment amid global economic uncertainty.

Institutional Investors Driving Market Trends

Moreover, Bitwise CIO Matt Hougan, suggested that President Trump’s recent executive order could further influence Bitcoin’s market cycle. The order affecting financial regulations and digital assets may introduce new dynamics to Bitcoin’s institutional adoption.

“It [the executive order] created a pathway for the largest Wall Street banks and investors to move aggressively into the space. However, the full mainstreaming of crypto—the one contemplated by Trump’s executive order, where banks custody crypto alongside other assets, stablecoins are integrated broadly into the global payments ecosystem, and the largest institutions establish positions in crypto—I’m convinced will bring trillions,” Hougan wrote.

Indeed, the week following the digital asset stockpile executive order, crypto inflows soared to $1.9 billion. This added to a series of weeks with positive flows into digital asset investment products for January.

Glassnode notes a shift in Bitcoin’s investor base, with institutional investors playing an increasingly significant role. The introduction of US spot Bitcoin ETFs (exchange-traded funds) has facilitated regulated access to the asset, leading to over $40 billion in net inflows. It has also contributed to combined assets under management (AUM) exceeding $120 billion in just one year.

“If we dive into the IBIT investor cap table (as noted by analyst TXMC), we can see clear signs of heightened demand from institutional investors. This provides further evidence that Bitcoin is attracting an increasingly sophisticated investor base,” an expert in the report read.

BTC is More Resilient and Less Volatile, Glassnode Says

Further, the report references the collapse of FTX in late 2022. Since then, Bitcoin dominance has been on an uptrend, rising from 38% to 59%. This indicates a preference among investors for Bitcoin over altcoins.

Against this backdrop, the report acknowledges analysts’ view of Bitcoin’s clear monetary hedge narrative, noting that wider accessibility through ETFs contributes to this trend.

“Comparing market capitalizations from the 2022 lows: Bitcoin grew from $363 billion to $1.93 trillion (5.3x increase). Meanwhile, altcoins (excluding Ethereum and stablecoins), increased from $190 billion to $892 billion (4.7x increase),” the report alluded.

Despite this divergence, Bitcoin and altcoins remain correlated. A reversal in Bitcoin dominance could signal a capital rotation back into the altcoin sector, kickstarting the colloquial “alt season.”

As BeInCrypto reported, on-chain data also reveals that Bitcoin’s current cycle has been more stable than previous ones. Realized losses during market pullbacks have remained relatively minor, and volatility has been lower than in past bull markets.

Analysts attribute this to a more knowledgeable investor base, particularly among retail holders. They accumulate during corrections rather than panic selling at the top. Nevertheless, the presence of institutional investors, regulatory developments, and increased liquidity have all contributed to a more structured and mature Bitcoin market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

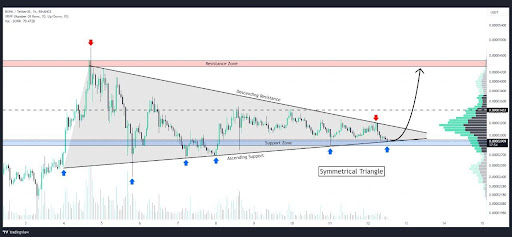

BONK Symmetrical Triangle Squeeze: Is A Mega Breakout Imminent?

Bonk (BONK), one of the more energetic players in the meme coin space, is showing signs of a potentially explosive move as it coils tighter within a symmetrical triangle pattern. This classic chart formation, characterized by converging trendlines of lower highs and higher lows, often acts as a pressure booster for price action — the longer the squeeze, the more powerful the breakout tends to be.

The symmetrical triangle squeeze is a technical signal that often precedes sharp breakouts, and in BONK’s case, it couldn’t come at a more pivotal moment. With the broader meme coin market showing signs of strength and sentiment slowly shifting, a decisive move from this setup could define the next chapter for BONK. A breakout above the upper trendline might ignite fresh bullish momentum and open the door to new highs, while a break below support could trigger a sell-off toward lower key levels.

Bonk’s Recent Price Action: The Setup For A Big Move

According to a recent post by Whales_Crypto_Trading on X (formerly Twitter), Bonk is currently forming a symmetrical triangle pattern on the 1-hour chart. The price has just rebounded from the lower support trendline of the triangle, suggesting that buyers are stepping in to defend the structure and potentially build momentum for an upward breakout.

What makes this pattern particularly noteworthy is the potential upside. Whales_Crypto_Trading highlighted a profit target range of 70–80%, should BONK successfully break above the upper resistance trendline. With volatility tightening and volume starting to show signs of recovery, such a breakout could offer a substantial short-term trading opportunity.

However, traders are advised to keep a close eye on volume confirmation and key breakout levels to avoid possible fakeouts, as symmetrical triangles can break in either direction.

Will The Meme Coin Explode Or Fizzle Out?

Bonk’s symmetrical triangle pattern has reached a critical stage, raising speculations about whether the meme coin will break free with force or lose steam under pressure. The recent bounce off the support trendline suggests bullish interest is still alive, and if momentum continues to build, BONK could be gearing up for a powerful breakout, potentially delivering gains in the 70–80% range as projected by traders.

However, it’s important to remain cautious. Symmetrical triangles are neutral by nature, meaning a breakdown is still on the table if buyers fail to push through resistance. The next few candles on the 1-hour chart could provide key confirmation of BONK’s direction.

In the end, BONK is approaching a defining moment. Whether it explodes into a bullish run or fizzles out into another rejection will largely depend on volume, sentiment, and the strength of the breakout. Traders should stay alert, as a big move may be closer than it seems.

Market

BANK Token Surges 150% After Binance Futures Listing

Lorenzo Protocol’s native token, BANK, has recorded a 150% price surge within six hours of its official launch.

The token’s rapid climb follows its listing on multiple platforms, including Binance’s Alpha Market and the launch of a BANKUSDT perpetual contract on Binance Futures with up to 50x leverage.

What is the New BANK Token on Binance Futures?

The Token Generation Event (TGE) for BANK took place today, April 18, via Binance Wallet, in partnership with PancakeSwap. Lorenzo Protocol raised $200,000 through the sale of 42 million BANK tokens—2% of the total supply—priced at $0.0048 each.

The token is now trading on PancakeSwap, Bitget, and CoinEx. Following its debut, BANK reached a market cap of approximately $22 million.

BANK is the governance and utility token for Lorenzo Protocol, a DeFi platform focused on enhancing Bitcoin liquidity.

The protocol allows users to earn yield on BTC without giving up custody. It uses financial primitives like Liquid Principal Tokens (LPTs) and Yield-Accruing Tokens (YATs).

According to its claims, BANK holders can stake their tokens to receive veBANK, which provides governance rights and a share of future emissions.

Also, Lorenzo Protocol is built on a Cosmos-based Ethermint appchain. It enables BTC restaking and interoperability with Bitcoin’s Layer 1. The design supports on-chain issuance and settlement of BTC-backed assets.

The listing of the BANK/USDT perpetual contract on Binance Futures adds further momentum to the token. Binance Futures is a derivatives platform that allows users to trade perpetual contracts with high leverage.

Binance has historically preferred new tokens on the BNB chain for early futures trading. BANK’s sharp price increase and rapid market integration highlight strong early interest in Lorenzo Protocol’s approach to BTC-based DeFi infrastructure.

Currently, it’s far-fetched to project whether the exchange will list this newly launched token. However, Binance’s new community voting on token listing has offered positive hopes for small market cap projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Asia’s First XRP Investment Fund is Here, Backed by Ripple

HashKey Capital has launched the HashKey XRP Tracker Fund, the first fund in Asia focused exclusively on tracking the performance of XRP.

The fund is now open to professional investors. Ripple is backing the initiative as an early investor.

Institutional Interest in XRP Investment Continues to Grow

According to HashKey, XRP offers a faster and more cost-effective alternative to traditional cross-border payment systems. The new tracker fund aligns with HashKey Capital’s goal of connecting conventional finance with digital asset markets.

The fund allows investors to subscribe using either cash or in-kind contributions. Investors can redeem or subscribe to shares on a monthly basis.

CF Benchmarks, known for its role in global ETF markets, will provide the fund’s benchmark.

“XRP stands out as one of the most innovative cryptocurrencies in today’s market, attracting global enterprises who use it to transact, tokenize, and store value. With the first XRP Tracker Fund available in the region, we simplify access to XRP, catering to the demand for investment opportunities in the very best digital assets,” said Vivien Wong, Partner at HashKey Capital.

Most recently, Ripple acquired prime brokerage platform Hidden Road for $1.25 billion. It was one of the largest acquisition deals in the crypto and blockchain space.

Earlier today, Hidden Road secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA).

Meanwhile, XRP continues to gain traction with institutional investors. Standard Chartered recently forecast that XRP could surpass Ethereum by 2028, citing increased demand for efficient cross-border payment solutions and growing disruption in global trade.

“XRP is uniquely positioned at the heart of one of the fastest-growing uses for digital assets – facilitation of cross-border and cross-currency payments. In this way, XRPL is similar to the main use case for stablecoins such as Tether. This stablecoin use has grown 50% annually over the past two years, and we expect stablecoin transactions to increase 10x over the next four years. We think this bodes well for XRPL’s throughput growth, given the similar use cases for stablecoins and XRPL,” Geoff Kendrick, Standard Chartered’s Head of Digital Assets Research, told BeInCrypto.

Interest in XRP ETFs is also increasing. Teucrium Investment Advisors recently received NYSE Arca approval for the Teucrium 2x Long Daily XRP ETF (XXRP), the first leveraged XRP ETF in the United States.

Also, attention is now turning to spot XRP ETFs. Grayscale and 21Shares are both awaiting decisions from the SEC on their XRP-based products.

The SEC has up to 240 days to review the Grayscale XRP Trust and the 21Shares Core XRP Trust, with final deadlines set for October 18 and 19, 2025.

XRP’s price has declined by nearly 20% over the past month, but institutional confidence remains high.

Ripple recently confirmed progress in resolving its long-standing legal battle with the SEC. A joint motion to pause court proceedings was approved, giving both parties 60 more days to finalize a settlement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market21 hours ago

Market21 hours agoBinance Leads One-Third of the CEX Market in Q1 2025

-

Altcoin20 hours ago

Altcoin20 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Altcoin19 hours ago

Altcoin19 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

-

Market16 hours ago

Market16 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance