Market

Gate.io Joins Forces with Oracle Red Bull Racing in F1

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

In a world where extreme speed meets cutting-edge technology, only true game changers can maintain their lead. Recently, Gate.io officially announced its sponsorship of Oracle Red Bull Racing in F1, sparking widespread market attention and discussion.

Whether it’s the eight-time championship-winning Red Bull Racing team in F1, or Gate.io, a Web3 pioneer driving industry transformation through innovation, both share the same relentless pursuit of excellence – pushing limits and continuously evolving to dominate their respective arenas.

As the 2025 F1 season approaches, Gate.io and Oracle Red Bull Racing will join forces to drive innovation through technology, define the future through speed, and create a legacy worthy of game changers.

Technology-Driven Excellence: The Relentless Pursuit of Game Changers

In both the crypto market and F1, speed, precision, and innovation determine victory. The partnership between Gate.io and Oracle Red Bull Racing is more than just a branding collaboration—it is the convergence of two industry leaders who share a deep-rooted competitive spirit.

- Leading with Speed: While Oracle Red Bull Racing team in F1 pushes the boundaries of aerodynamics, Gate.io builds its competitive edge through trading speed. In 2024, Gate.io launched 873 new tokens, including 437 first-listings worldwide, continuously accelerating industry innovation and helping users capture market opportunities.

- Winning with Precision: Just as Oracle Red Bull Racing fine-tunes its race strategy through data analytics, Gate.io optimizes every trade with intelligent order matching and advanced algorithms, ensuring transactions are executed at the best possible price, giving users an edge in volatile markets.

- Global Influence: With over 500 million F1 fans worldwide, and Gate.io’s user base surpassing 21 million and growing, this partnership strengthens the global presence of both game changers, extending their reach into new markets.

Branding Momentum Transition: A Strategic Expansion for the Future

Gate.io’s sponsorship of Oracle Red Bull Racing is more than just a branding opportunity—it’s a strategic global expansion plan.

- Targeted Engagement: This partnership is not just about exposure; it’s about reaching the right audience. F1’s global fanbase includes high-net-worth individuals, tech enthusiasts, and finance professionals—key demographics for the crypto industry. Through this collaboration, Gate.io aims to bridge the gap between traditional investors and the future of digital finance.

- Alliance of Champions: Just as Oracle Red Bull Racing dominates F1, Gate.io is a pioneer in crypto space. As one of the longest-standing exchanges, Gate.io continues to lead through technological innovation, security, and market leadership. This partnership is more than just brand exposure—it’s a union of two elite forces.

- Brand Influence: Gate.io’s branding will be featured on Oracle Red Bull Racing’s rear wing, nose, headrests, wheel covers, and even on the helmet of four-time World Champion, Max Verstappen. This symbolizes Gate.io’s strength as an industry leader and reinforces its commitment to innovation and excellence on a global stage.

In the race for market leadership, Gate.io is accelerating with precision and vision, steering toward a broader and more influential future.

Digital Acceleration: Breaking Barriers to Stay Ahead

Like the F1 circuit, the digital asset industry is a battlefield where every second defines the future. In this post-CEX era, Gate.io is not just witnessing the evolution of industry. It is actively driving it forward, redefining industry standards through technological breakthroughs and strategic brand expansion.

- Industry Leader: In January 2025, Gate.io’s total reserves surpassed $10.328 billion, ranking fourth globally. The exchange continues to enhance security frameworks and risk management systems, ensuring a stable and trustworthy trading environment.

- Brand Accelerator: By integrating blockchain technology with mainstream culture, Gate.io is reshaping public perceptions of crypto. In February 2025, Gate.io sponsored the Token of Love Music Festival, bridging the gap between blockchain technology and global pop culture, drawing Web3 enthusiasts worldwide and broadcasting the creativity and vitality of the crypto industry to the global audience.

- Value Creator: Gate.io recently completed its Q4 2024 GT token burn, bringing the total burned supply to 177 million GT, reinforcing its commitment to the long-term value of its platform token. With GT surging over 300% in 2024, Gate.io once again proved its strategic foresight in the market.

- Meme Ecosystem Pioneer: Through its Pilot Section and MemeBox, Gate.io is actively fostering the explosive growth of the Meme ecosystem, helping users capitalize on emerging market trends in real-time.

In F1, only those who relentlessly optimize their technology and strategy can stay ahead. In crypto, only those who continuously innovate can remain dominant across market cycles. Gate.io understands this fundamental truth—and with over 12 years of technical expertise, it has solidified its position as a long-term leader.

Game Changers Never Stop

The F1 race never slows down, and neither does Gate.io’s evolution.As Oracle Red Bull Racing’s cars cut through the air, breaking limits to cross the finish line, and as Gate.io accelerates through market fluctuations to achieve new milestones, both are driven by the same belief: “Only game changers can shape the future.”

Disclaimer: This content does not constitute an offer, solicitation, or recommendation. You should always seek independent professional advice before making investment decisions. Gate.io may restrict or prohibit certain services in specific jurisdictions. For more details, please read the User Agreement.

Disclaimer

This article contains a press release provided by an external source and may not necessarily reflect the views or opinions of BeInCrypto. In compliance with the Trust Project guidelines, BeInCrypto remains committed to transparent and unbiased reporting. Readers are advised to verify information independently and consult with a professional before making decisions based on this press release content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Price Eyes Breakout, But $600 Remains A Stubborn Ceiling

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Bitcoin and Global M2 Money Supply: A Misleading Connection?

A financial analyst has publicly criticized the use of global M2 money supply data to predict Bitcoin (BTC) price movements, calling such analyses mathematically unsound and misleading.

The criticism comes amid a surge in the global M2 money supply to an all-time high. Several analysts are forecasting similar trends for BTC.

Is Global M2 Money Data a Reliable Predictor for Bitcoin Price Movements?

The analyst, known as TXMCtrades, shared his thoughts on X (formerly Twitter). He specifically pointed to a chart by macro investor Raoul Pal that compared Bitcoin’s price to global M2.

TXMCtrades argued that charting global M2 daily or weekly is fundamentally flawed due to the inconsistent update frequencies of the underlying data. According to him, doing so distorts the information by amplifying short-term fluctuations instead of providing an accurate, long-term trend.

“People, you can’t create a daily or weekly time series of “Global M2” when the United States is only updating M2 on a weekly basis and all others are monthly!” the post read.

He explained that many countries have yet to update their figures beyond February, creating significant gaps in the dataset. TXMCtrades contended that this inconsistency results in a metric that largely reflects foreign exchange (FX) fluctuations rather than actual money supply dynamics.

“You’re looking at an M2 weighted inverse dollar exchange rate 95% of the time. Be better at math!” he added.

He also highlighted broader concerns about the misuse of global M2. The analyst stressed that China, which constitutes 46% of global M2, is the only major economy with a broad money supply above its post-COVID peak in dollar terms.

“They are currently trying to ease out of an ongoing multi-year debt deflation and doing a pretty shit job of it. Their M2 goes straight up,” TXMCtrades remarked.

Meanwhile, US M2 remains below its 2022 peak. In addition, the analyst emphasized that it is growing at its slowest pace since Bitcoin’s inception, excluding the 2022-2024 period. This suggests that the US is not experiencing rapid money supply growth, which could impact inflation or other economic trends.

This disparity, TXMCtrades argues, further undermines the reliability of global M2 as a predictor of Bitcoin price movements. The analyst also disputed the use of “random offsets” to align global M2 with Bitcoin price movements, a method employed by several analysts.

For instance, Raoul Pal has suggested a 12-week lag between global M2 and Bitcoin’s price. Meanwhile, Colin Talks Crypto proposes a 15.4-week lag. Meanwhile, Mr. Wall Street estimates the lag to be between 10.7 and 15 weeks. Some have even extended the M2 correlation to predict altcoin prices, such as Solana (SOL).

“SOL has been following Global M2 Money Supply (+100 days) its last two legs up. If this continues, SOL is set to pump massively within the next 2 weeks,” analyst Curb posted.

Nonetheless, the analyst stated that offsets are often arbitrary and don’t reflect the actual dynamics of money supply or asset prices.

“Money is money, it doesn’t have a wait time,” he claimed.

The analyst suggested that such models are overfitted to recent historical data and lack a strong foundation for forecasting. Lastly, TXMCtrades called for greater rigor in financial analysis. He urged analysts to “stop proliferating scammy analysis” and adopt more mathematically sound approaches to understanding cryptocurrency price dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Struggles to Rebound—Key Hurdles In The Way

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

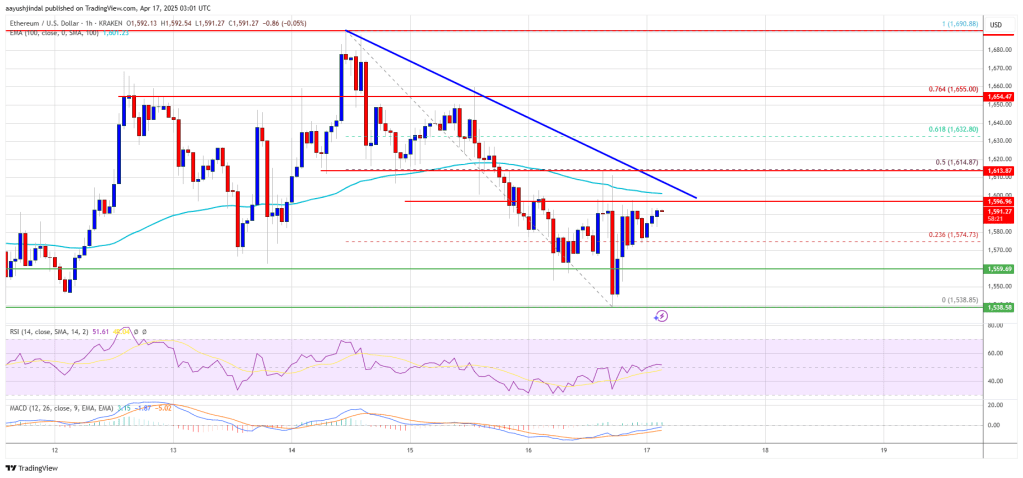

Ethereum price started a fresh decline below the $1,650 zone. ETH is now consolidating and might decline further below the $1,550 support zone.

- Ethereum started a fresh decline below the $1,650 and $1,620 levels.

- The price is trading below $1,600 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,600 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,655 resistance zone.

Ethereum Price Faces Resistance

Ethereum price struggled to continue higher above $1,700 and started a fresh decline, like Bitcoin. ETH declined below the $1,620 and $1,600 support levels. It even spiked below $1,550.

A low was formed at $1,538 and the price is now correcting some losses. There was a move above the $1,565 level. The price climbed above the 23.6% Fib retracement level of the downward move from the $1,690 swing high to the $1,538 low.

Ethereum price is now trading below $1,600 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,600 level. There is also a new connecting bearish trend line forming with resistance at $1,600 on the hourly chart of ETH/USD.

The next key resistance is near the $1,615 level or the 50% Fib retracement level of the downward move from the $1,690 swing high to the $1,538 low. The first major resistance is near the $1,650 level. A clear move above the $1,650 resistance might send the price toward the $1,690 resistance.

An upside break above the $1,690 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,600 resistance, it could start another decline. Initial support on the downside is near the $1,560 level. The first major support sits near the $1,535 zone.

A clear move below the $1,535 support might push the price toward the $1,500 support. Any more losses might send the price toward the $1,420 support level in the near term. The next key support sits at $1,400.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,535

Major Resistance Level – $1,650

-

Bitcoin24 hours ago

Bitcoin24 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Altcoin17 hours ago

Altcoin17 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

-

Altcoin24 hours ago

Altcoin24 hours agoExpert Reveals Current Status Of 9 Ripple ETFs

-

Market22 hours ago

Market22 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Market20 hours ago

Market20 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market24 hours ago

Market24 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?

-

Market17 hours ago

Market17 hours agoThis Crypto Security Flaw Could Expose Seed Phrases