Market

Full Service Suite for Developers

In a recent integration, Base provided its developers and users with access to all Chainlink services, including Data Streams and VRF infrastructure.

This collaboration unites a builder-friendly ecosystem with industry-standard decentralized computing infrastructure, enhancing both platforms’ capabilities.

Chainlink Services on Base

The integration allows developers on Base to create user experiences rivaling those of centralized exchanges (CEXs). Chainlink contributes ultra-fast, user-friendly DeFi products with high throughput, while Base Layer-2 (L2) brings unmatched on-chain execution speed and security through its Ethereum connection.

Although Coinbase incubates the Base blockchain, it is secured by the Ethereum network, providing the stability and scalability needed to support decentralized applications (dApps).

With Chainlink’s full suite of products available on Base, developers can leverage CCIP, functions, price feeds, data streams, and VRF. According to Tom Vieira, Head of Product at Base, this will enable the building of on-chain apps.

Read More: What is Base Chain? Everything You Need to Know

The development enhances capabilities for both developers and users. It marks a significant milestone in the evolution of the decentralized finance (DeFi) market and the progress of blockchain technology. By equipping developers with essential tools to build dynamic, secure, and high-performance applications, it also ensures that users enjoy a seamless and efficient on-chain experience.

“Base’s builder-friendly environment is a natural fit for Chainlink products, and we’re excited to see the entire Chainlink platform now available on Base. Chainlink Data Streams’ low-latency market data will enable developers to build the next generation of DeFi products. VRF will now enable smart contracts on Base to access random number generation securely,” said Thodoris Karakostas, Head of Blockchain Partnerships at Chainlink Labs.

Base TVL Grows 19.7% in August

As BeInCrypto reported, Base founder Jesse Pollak is also planning to build a “dream wallet. These developments highlight the continued acceleration of the L2 flywheel, with assets steadily flowing into the blockchain.

Base has seen a 19.7% surge in total value locked (TVL) since August 5, climbing from $1.229 billion to $1.472 billion by August 16. This sharp increase indicates rising user participation and growing interest in the platform.

Despite its recent gains, Base faces key challenges, including concerns about decentralization due to its current setup. Coinbase is currently the sole sequencer for the network, giving the exchange full control over transaction validation. This centralized model contradicts crypto’s principles, leading to mistrust and limiting the number of projects built on the platform.

In addition to centralization issues, Base L2 has experienced withdrawal delays due to its reliance on Optimistic Rollups. Developed in partnership with Optimism, Base inherits the chain’s anti-fraud system, which allows users to challenge transactions by submitting fraud proofs, contributing to these delays.

Read more: 7 Best Base Chain Meme Coins to Watch in 2024

Security concerns also arise from Optimism’s vulnerabilities, affecting meme coins and exposing users to potential losses, which have negatively impacted Base’s total value locked (TVL).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Shifts $1B in XRP Amid Growing Bearish Pressure

XRP is under pressure, down nearly 6% in the past 24 hours and teetering just above the $2 mark as bearish momentum builds. A $1.02 billion unlock from Ripple’s escrow has sparked fresh concerns about oversupply, with tokens moved to operational wallets possibly poised for distribution.

At the same time, network activity has collapsed 87% since mid-March and technical indicators like DMI and EMA lines suggest growing downside risk. With weakening trend strength and fading demand, XRP may struggle to hold key support levels unless a catalyst revives bullish sentiment.

Ripple Wallet Activity Sparks Fears

Onchain data shows that Ripple has unlocked 500 million XRP—worth around $1.02 billion—from its escrow account.

The tokens were moved from the “Ripple (27)” escrow address to two operational wallets, “Ripple (12)” and “Ripple (13),” potentially positioning them for distribution or sale.

While the escrow account still holds another 500 million XRP, the movement of such a large amount into accessible wallets often raises concerns about increased market supply. If Ripple sells a portion of these tokens, it could create short-term selling pressure on XRP’s price.

From a technical standpoint, XRP’s DMI chart is flashing bearish signals. The ADX, which measures trend strength, has sharply declined to 26.68 from 42.45 just two days ago, suggesting the recent trend is weakening.

Meanwhile, the +DI has dropped to 12.91, down from 22 yesterday—indicating a decline in bullish momentum. At the same time, the -DI has surged to 27.43 from 15.64, pointing to rising bearish pressure.

This shift in directional strength, combined with the large token unlock, suggests XRP may face further downside unless demand quickly absorbs the incoming supply.

XRP Network Activity Collapses 87%

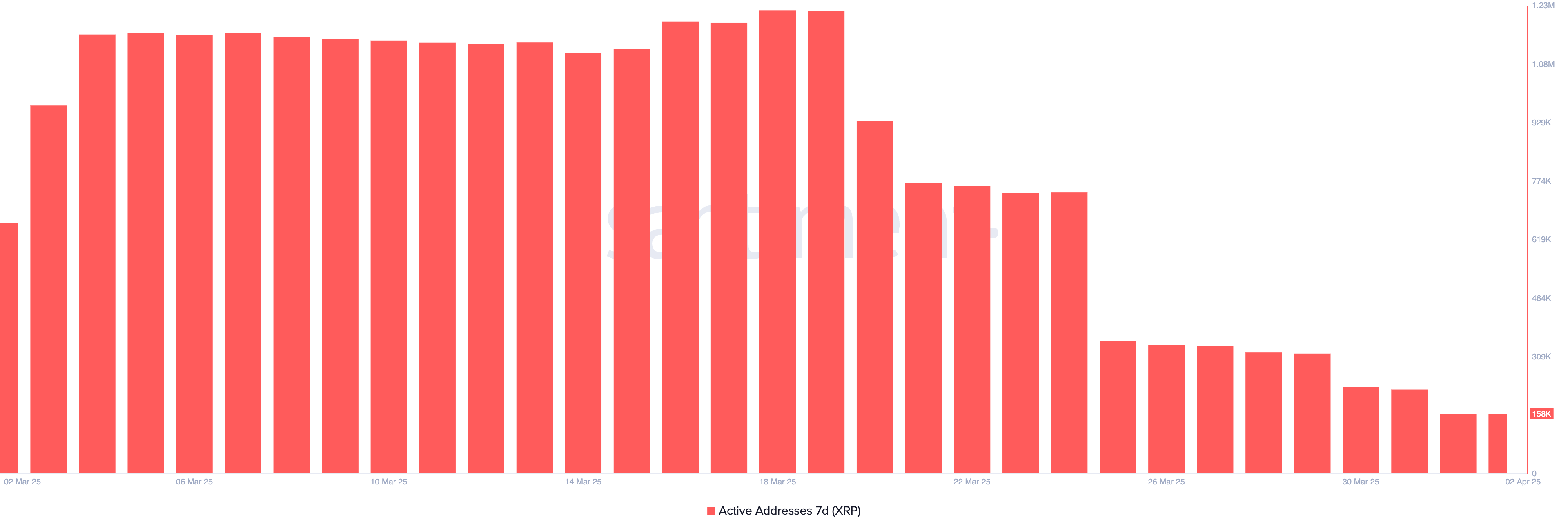

XRP’s network activity surged to record highs in March, with 7-day active addresses reaching an all-time peak of 1.22 million on March 18.

However, that momentum quickly faded, with the number now plummeting to just 158,000—an 87% drop in less than three weeks.

This dramatic reversal suggests that the recent spike in engagement may have been short-lived or event-driven rather than indicative of sustained adoption or growing user demand.

Tracking 7-day active addresses is a key on-chain metric, offering insight into how frequently a token’s network is being used. High activity can signal strong user interest and utility, often aligning with price support or rallies.

On the other hand, sharp declines in active addresses—like what XRP is now experiencing—can signal waning demand, decreasing network usage, and potential selling pressure.

With such a steep drop in activity, XRP’s price may struggle to find an upside unless new catalysts reignite user engagement.

XRP Faces Strong Downtrend, But Eyes Rebound If Key Levels Break

XRP’s EMA structure clearly reflects a strong ongoing downtrend, with short-term moving averages positioned well below the long-term ones and a wide gap between them—signaling persistent bearish momentum.

Unless bulls step in soon, XRP price may be on track to test support around $1.90, a key level that has held in the past.

A break below it could expose the asset to further downside toward $1.77.

However, if XRP manages to reverse the current trend and regain upward momentum, it could climb to challenge resistance at $2.06.

A successful breakout above that level might pave the way for a continued rally toward $2.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

The crypto market watches with bated breath as XRP teeters at $1.97, a battleground where bullish conviction clashes with bearish determination. After a retreat from recent highs, the digital asset now faces a critical test.

The current standoff mirrors the broader tug-of-war in crypto markets, where sentiment shifts rapidly and key price levels dictate the next major move. For XRP, $1.97 isn’t just another number; it’s a line in the sand. A decisive hold here could reignite upward momentum, while a breakdown may embolden the bears.

Market Sentiment: Fear, Greed, Or Indecision?

According to Grumlin Mystery, a well-known crypto analyst, XRP is likely to experience a further downside in the near future, potentially dropping to $1.96. In his March 30th post on X, he highlighted that a decrease in liquidity within the crypto market is playing a crucial role in weakening XRP’s price stability, driven by the impact of US tariffs and the implementation of Trump’s policy changes.

Grumlin pointed out that restrictive trade policies and economic uncertainty have led to a slowdown in capital flow into riskier assets like cryptocurrencies. With reduced liquidity, market participants have less buying power, making it easier for bears to push prices lower. He warned that if these economic conditions persist, XRP could struggle to find strong support, and a drop below $1.96 could trigger further declines.

This drying up of liquidity has allowed sellers to gain the upper hand, exerting downward pressure on prices. As a result, XRP’s ability to hold support at $1.96 remains uncertain, and unless market conditions improve, a deeper correction could be on the horizon.

Grumlin Mystery further elaborated that a sharp change in Trump’s rhetoric regarding tariffs remains highly unpredictable, making it difficult to gauge its full impact on the financial markets, including cryptocurrencies. While many initially believed that Trump’s stance would be a major positive catalyst for the crypto market, the reality appears to be more complex.

The analyst emphasized that market uncertainty is increasing as traders struggle to anticipate the next move in U.S. economic policy. If Trump maintains or intensifies his tariff approach, it could further tighten liquidity conditions, making it even harder for XRP to sustain bullish momentum.

Possible Scenarios For XRP

If buyers successfully defend the $1.96 level, XRP could see renewed upside momentum. A bounce from this support zone might trigger a rally toward $2.64, where the next resistance lies. A breakout above this level raises the potential to $2.92 or even $3.4, confirming a bullish recovery. Increased trading volume and improving market sentiment would be key indicators of this scenario playing out.

Sellers’ failure to maintain control and XRP’s failure to hold above $1.96 may cause a sharper decline. In this case, the next critical support levels to watch would be $1.70 and $1.34. Breaking below these levels could expose the asset to more losses to $0.93 or lower.

Market

Binance Managed 94% of All Crypto Airdrops and Staking Rewards

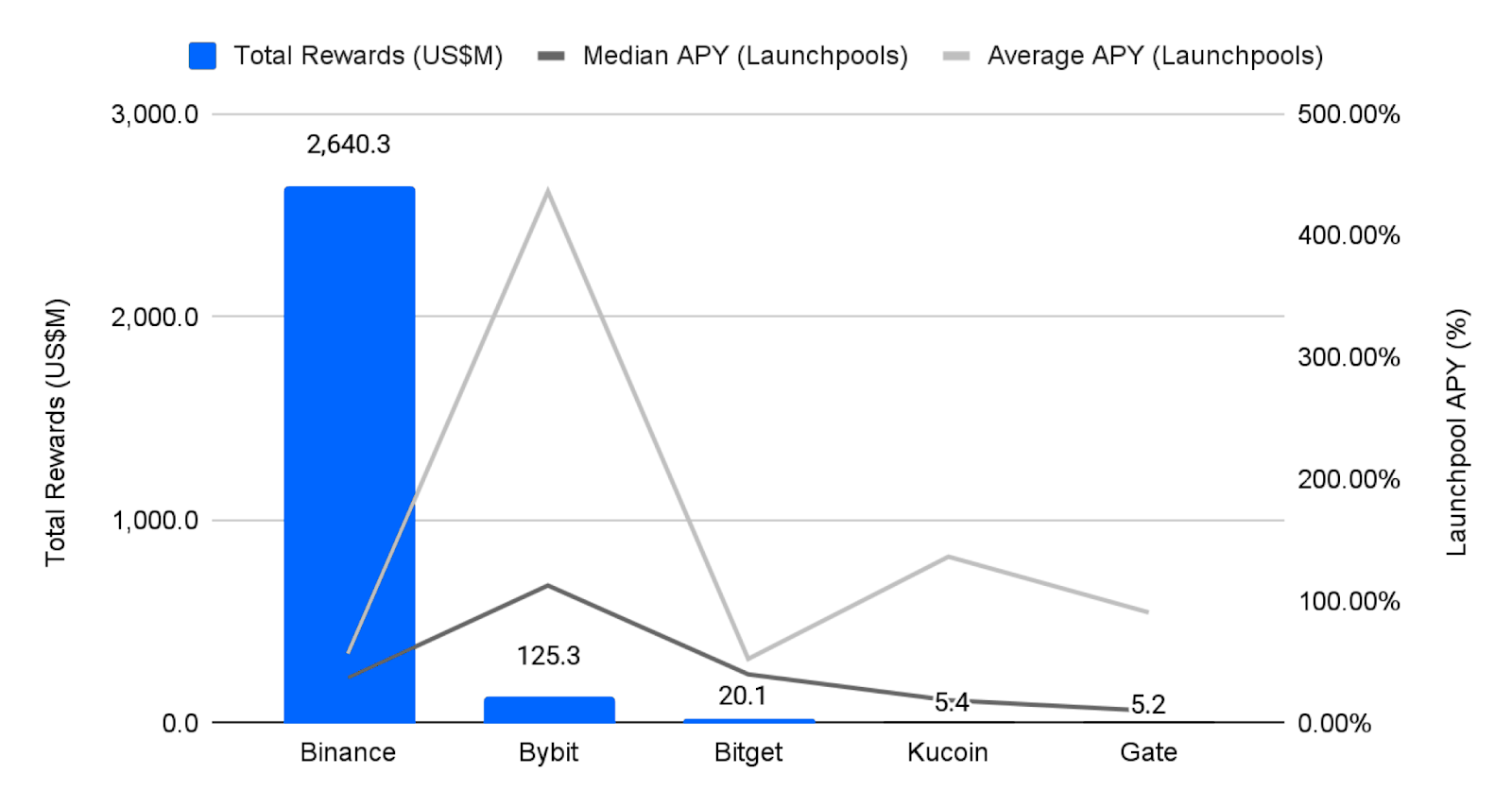

A new report shows that Binance almost has a monopoly in the CEX market in terms of crypto airdrop distribution and staking rewards. In 2024, the exchange received $2.6 billion of a total of $2.7 billion in rewards, amounting to 94% of the entire market segment.

In an exclusive press release shared with BeInCrypto, Binance also revealed that it’s making substantial changes to its airdrop services to improve user experience and make participation easier.

Binance Leads the Market in Crypto Airdrops

Binance, the world’s largest crypto exchange, has become the go-to platform for airdrops and staking rewards. It launched the HODLer airdrop program less than a year ago, providing many new projects with a comprehensive platform to reward early adopters.

In the past year, the exchange has become synonymous with the latest airdrops, as most users are accessing their rewards through the platform.

Based on this impressive performance in the airdrop sector, Binance has substantially upgraded a few of its services. The platform has revamped its Launchpool and BNB Earn pages, making it easier for users to both track and participate in airdrops.

“With these upgrades, we’re making it easier than ever for users to unlock the full potential of BNB and participate in high-quality token launches. The redesigned Binance Launchpool and BNB pages reflect our commitment to user education, simplicity, and maximizing rewards,” said Jeff Li, VP of Product at Binance.

The updated BNB page will give Binance users key benefits, such as real-time information on airdrops across its platforms, including Launchpool, Megadrop, and HODLer Airdrops.

Users will also see features like trading fee discounts, VIP perks, and a historical rewards section. These improvements are designed to help the firm maintain its significant dominance while continuing to focus on integrity.

Hopefully, these improvements will allow the firm to maintain its significant dominance while maintaining its usual integrity. Last month, Binance Research identified some systemic problems with airdrops in general, and the exchange seems particularly concerned with its reputation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin22 hours ago

Altcoin22 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin23 hours ago

Altcoin23 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Market15 hours ago

Market15 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market14 hours ago

Market14 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market18 hours ago

Market18 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed