Market

Former CFTC Chair Flags Risks in Trump’s Crypto Ventures

In an exclusive interview with BeInCrypto, former US CFTC Commissioner Timothy Massad explains how President Trump’s crypto ventures and political power have significantly overlapped in his first two months at the White House.

Shortly before assuming office for the second time, US President Donald Trump dove head-first into a flurry of crypto experiments. From endorsing World Liberty Financial (WLFI) to launching his meme coin, Trump is raising serious concerns over conflicts of interest. Tim Massad, the 12th CFTC Chairman, who served under Barack Obama, shares his thoughts.

A Historic President For Many Reasons

Before assuming his first term in office in 2016, President Trump broke with modern precedent by departing from established conflict-of-interest norms. A real estate mogul with a trademark for a last name, Trump would be entering the Oval Office as the leader of a multi-billion dollar empire.

While former presidents like Jimmy Carter and George W. Bush took measures to separate themselves from their businesses by placing their assets in a blind trust, the sitting President took a different approach.

Instead, Trump handed day-to-day management decisions over to his sons but did not divest in his ownership stake.

Though he received much backlash during his first term over conflict of interest concerns, Trump refused to relinquish ownership of the Trump Organization before assuming office for the second time.

However, the ‘conflict of interest’ has reached a new level this time, compared to 2016. Today, his ventures extend far beyond real estate. Trump has now secured a significant footing in the crypto industry.

Given Trump’s favorable stance toward digital asset policy development, players inside and outside the industry have begun to wonder whether his decisions are based on the sector’s best interests or are designed to benefit his own ventures.

How Deep is Trump’s Involvement in World Liberty Financial?

Though Trump does not have a direct role in WLFI, he appears on the whitepaper’s list of supporting teams as “Chief Crypto Advocate.” His three sons, Eric, Donald Jr., and Barron, are also on the list.

Reports further unveiled that the Trump family holds a 75% stake in the platform’s net revenue and a 60% stake in the holding company. At the same time, Trump and his associates own 22.5 billion of the company’s tokens.

For former CFTC Commissioner Tim Massad, despite Trump’s informal role in WLF’s governance, his stake in the platform’s performance raises serious conflicts of interest.

“I think it’s unprecedented and plainly wrong for a President of the United States to engage in commercial ventures or have his family and associates engage in commercial ventures that can be directly influenced by the policies he adopts as President or the statements he makes about those policies,” Massad told BeInCrypto.

Meanwhile, the tokens themselves are non-transferrable, limiting financial flexibility. Though the project aims to provide token holders access to a range of DeFi-related products and services, it has yet to launch them. In the meantime, token holders will have to wait until the time comes to use their tokens.

“I have yet to see any real business case or utility that’s of value to people who invest. So I think it all just has a character of taking advantage of people,” Massad added.

The industry has also grown weary over how WLF and other Trump-endorsed projects could be used to gain the President’s favor.

Industry Leaders Voice Concerns Over World Liberty Financial’s Legitimacy

Shortly before Trump launched World Liberty Financial, many prominent figures in the crypto sector warned that the project could cause Trump further legal troubles. Meanwhile, Alex Miller, CEO of Web3 platform Hiro, described the project as an “obvious pump scheme.”

Meanwhile, Alex Miller, CEO of Web3 platform Hiro, described the project as an “obvious pump scheme.”

Other industry leaders, such as Mark Cuban, Max Keiser, and Anthony Scaramucci, also criticized Trump’s decision to proceed with WLF’s token sales. Trump’s involvement in the project heightened fears that crypto’s fragile public image and controversial reputation would be smeared further.

Massad agreed with this last point, adding that crypto policy development is alive and well today more than ever. The ongoing development of stablecoin regulations, open talks of a national crypto strategic reserve, and a Senate-driven digital asset working group are only some of the current institutional initiatives.

“He, the Trump Organization and his family members should not be engaging in commercial ventures that pose such blatant conflicts of interest, given the fact that crypto regulation and things like a potential Bitcoin reserve are important policy issues today. A US president shouldn’t be engaging in these things at all, in my view,” Massad said.

Since the project’s launch six months ago, several examples validating these concerns have emerged. The most notable one has focused on Tron founder Justin Sun.

Justin Sun’s Controversial Investment in WLFI

TRON founder Justin Sun became World Liberty Financial’s largest investor in November after buying $30 million worth of WLF tokens.

The move was highly controversial. Despite Trump’s endorsement, WLFI struggled to meet its $30 million fundraising target during its first public sale. The token’s availability was restricted, excluding general trading and limiting purchases to non-US and accredited US investors.

Sun’s investment turned WLFI’s luck around. Soon after that, he also became one of the project’s advisors. Then, on the day of Trump’s inauguration, Sun invested an additional $45 million in the project, bringing the total sum to $75 million.

This investment brought varying degrees of scrutiny. While some questioned his quick transition from investor to advisor, others pointed to Sun’s past as a potential motive for his contributions.

In March 2023, the SEC filed fraud charges and other securities law violations against Sun and his companies. This regulatory baggage has led some industry leaders to question the wisdom of his association with World Liberty Financial.

Meanwhile, Tron’s price soared following Sun’s latest WLF investment. Tron, which had been experiencing lagging prices up until that point, was able to jumpstart its trading activities.

However, these conflicts of interest are not just limited to Sun’s investment.

Potential Binance Stake and Further Conflicts

Less than two weeks ago, reports surfaced that the Trump family had held talks to acquire a financial stake in Binance’s US division. Though Binance’s founder, Changpeng Zhao, discredited these reports, flirting with the theory comes easily.

Zhao could also benefit from an agreement. In 2023, he pleaded guilty to federal charges for failing to implement adequate anti-money-laundering measures at Binance.

Following his plea, Zhao resigned as Binance’s CEO. Motive-driven speculations point toward the possibility of a potential presidential pardon.

For Massad, maneuvers like these are natural when a president directly involves himself in crypto ventures.

“I think there is a huge risk of conflicts of interest and corruption by virtue of the President and people associated with him selling crypto assets—whether that’s through World Liberty Financial or the meme coins. It creates the potential for ongoing conflicts, because people who might want to curry favor with the administration could buy the coins,” Massad told BeInCrypto.

All the while, Trump benefits his crypto ventures every time he makes a pro-crypto announcement.

Is Trump Manipulating the Crypto Market?

A week into March, Trump signed an executive order to establish a Crypto Strategic Reserve and a US Digital Asset Stockpile. In his original announcement, Trump said the reserve would include Bitcoin, Ethereum, and altcoins like XRP, ADA, and SOL.

The crypto market responded immediately, with all five cryptocurrencies posting strong gains. Yet, Trump’s announcement quickly raised concerns over potential market manipulation.

With Bitcoin, Ethereum, and XRP in its treasury, WLF’s holdings grew in value as those assets appreciated. This growth could have boosted investor confidence, leading to higher demand for WLF tokens.

The crypto market’s overall surge and attention to Trump-related projects also generated greater investor interest in WLF, contributing to its price appreciation.

Meanwhile, Trump’s meme coin surged following the President’s reserve announcement. While TRUMP’s price stood at $13.55, with a trading volume of almost $1.2 billion on March 2, those numbers surged to $17.46 and $3.6 billion, respectively, following the news a day later.

On March 4, TRUMP’s price and trading volume plummeted below the numbers they registered only two days earlier.

“I think the meme coins have looked like a classic pump-and-dump scheme or money grab. I don’t think the issue should be, why not let people invest in these things if they want to? Of course they should have the right to invest in whatever they want. The issue is the propriety of the President of the United States selling things that capitalize on his being the President,” said Massad.

Even Ethereum Co-Founder Vitalik Buterin touched on the damaging effects of political meme coins in a social media post published five days after TRUMP’s launch.

“Now is the time to talk about the fact that large-scale political coins cross a further line: they are not just sources of fun, whose harm is at most contained to mistakes made by voluntary participants, they are vehicles for unlimited political bribery, including from foreign nation states,” Buterin said.

Given Trump’s active participation in the crypto industry over the past several months, a vital question remains: Why hasn’t Trump been held accountable over these apparent conflicts of interest?

The answer remains short and bitter: He can’t be.

Can Trump Be Held Accountable?

The potential conflicts of interest arising from Donald Trump’s involvement in the cryptocurrency industry have drawn the attention of various political figures, particularly those focused on government ethics and oversight.

US Senator Elizabeth Warren has been the most vocal opponent of Trump’s dealings in the crypto industry.

A day before the White House Digital Assets Summit, Warren sent an extensive letter to Trump’s crypto czar, David Sacks.

“I write today to request information about how you, as President Trump’s ‘Crypto Czar,’ have addressed your conflicts of interest, and how you will prevent the President and other private individuals from directly profiting off of the Trump Administration’s efforts to selectively pump the value of certain crypto assets, drop crypto asset-related enforcement actions, and deregulate the crypto asset industry. These actions have the potential to benefit billionaire investors, Trump Administration insiders, and speculators at the expense of middle-class families,” Elizabeth Warren wrote.

However, not much else can be done beyond letters that demand responses and clarifications from the Trump administration.

The Legal Loophole

US Presidents are largely exempted from conflict of interest provisions. This exemption has been based on legal interpretations that argue these laws could impede the President’s ability to fulfill their constitutional duties.

“The problem is, the POTUS is not subject to the conflict-of-interest laws that apply to most other executive branch officeholders. There is the Foreign Emoluments Clause in the Constitution, which prohibits accepting gifts from foreign countries. There’s also a domestic clause that prohibits accepting gifts from the government. But beyond that, he’s not subject to the usual conflict-of-interest standards. So, it’s unfortunate that we don’t have those standards applicable to a president. I think, had any other president done these things, there would be far more outrage,” Massad told BeInCrypto.

Given the legal circumstances, public scrutiny and political pressure are the best ways to hold a president accountable for potential conflicts of interest.

Yet, despite the legal exemptions for sitting presidents, the ethical implications of Trump’s crypto dealings remain undeniable.

As the lines between political power and personal profit continue to blur, the necessity for clear ethical standards, even without legal mandates, becomes increasingly urgent.

Failing to do so might erode public trust in the crypto industry, generating potentially irreversible consequences.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

XRP price started a fresh increase above the $2.20 resistance. The price is now correcting gains and might find bids near the $2.050 zone.

- XRP price started a downside correction from the $2.250 resistance zone.

- The price is now trading below $2.120 and the 100-hourly Simple Moving Average.

- There was a break below a connecting bullish trend line with support at $2.140 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if there is a close below the $2.050 support zone.

XRP Price Dips Again

XRP price started a fresh increase above the $1.980 resistance, like Bitcoin and Ethereum. The price climbed above the $2.020 and $2.050 resistance levels.

A high was formed at $2.244 and the price recently started a downside correction. There was a move below the $2.120 support zone. Besides, there was a break below a connecting bullish trend line with support at $2.140 on the hourly chart of the XRP/USD pair.

The price even spiked below the 50% Fib retracement level of the upward move from the $1.920 swing low to the $2.244 high. The price is now trading below $2.120 and the 100-hourly Simple Moving Average.

On the upside, the price might face resistance near the $2.120 level. The first major resistance is near the $2.180 level. The next resistance is $2.20. A clear move above the $2.20 resistance might send the price toward the $2.250 resistance. Any more gains might send the price toward the $2.320 resistance or even $2.350 in the near term. The next major hurdle for the bulls might be $2.50.

Another Decline?

If XRP fails to clear the $2.120 resistance zone, it could start another decline. Initial support on the downside is near the $2.050 level and the 61.8% Fib retracement level of the upward move from the $1.920 swing low to the $2.244 high. The next major support is near the $2.00 level.

If there is a downside break and a close below the $2.00 level, the price might continue to decline toward the $1.920 support. The next major support sits near the $1.840 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.050 and $2.00.

Major Resistance Levels – $2.120 and $2.180.

Market

Ethereum Leads Q1 2025 DApp Fees With $1.02 Billion

In Q1 2025, Ethereum solidified its leading position in the decentralized application (DApp) platform sector, generating $1.021 billion in fee revenue.

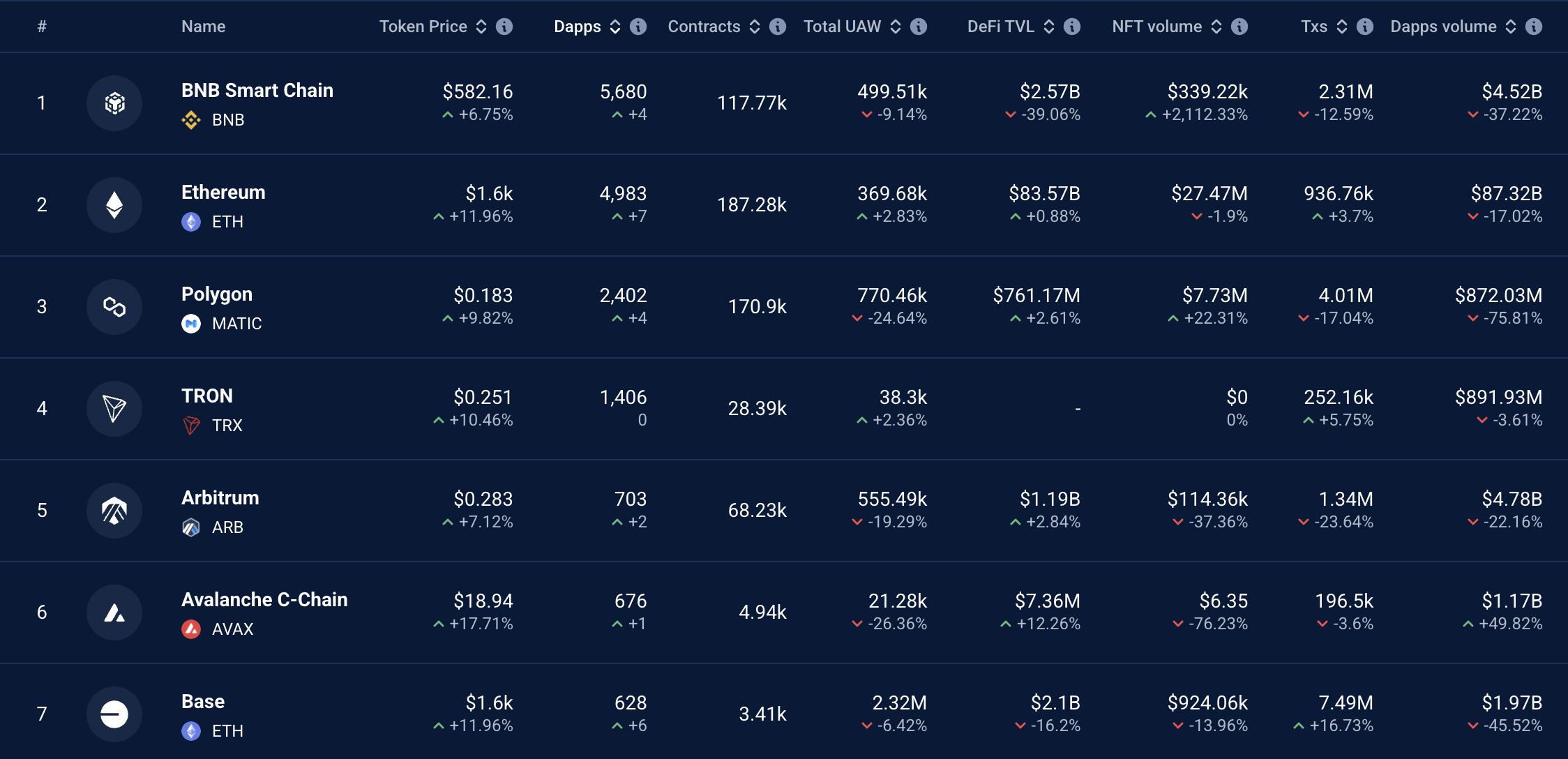

Other networks such as Base (Coinbase’s Layer-2), BNB Chain, Arbitrum, and Avalanche C-Chain also recorded significant revenue but lagged far behind Ethereum.

Fee Revenue Landscape Among Blockchains

According to Token Terminal, Ethereum maintained its top position among DApp platforms, with DApp fee revenue reaching $1.021 billion in Q1 2025. This figure highlights Ethereum’s dominance and strong growth within the DApp ecosystem.

Base, a Coinbase Layer-2 network, ranked second with $193 million in DApp fee revenue, showing notable growth but still trailing Ethereum. BNB Chain followed in third with $170 million, Arbitrum with $73.8 million, and Avalanche C-Chain in fifth with $27.68 million.

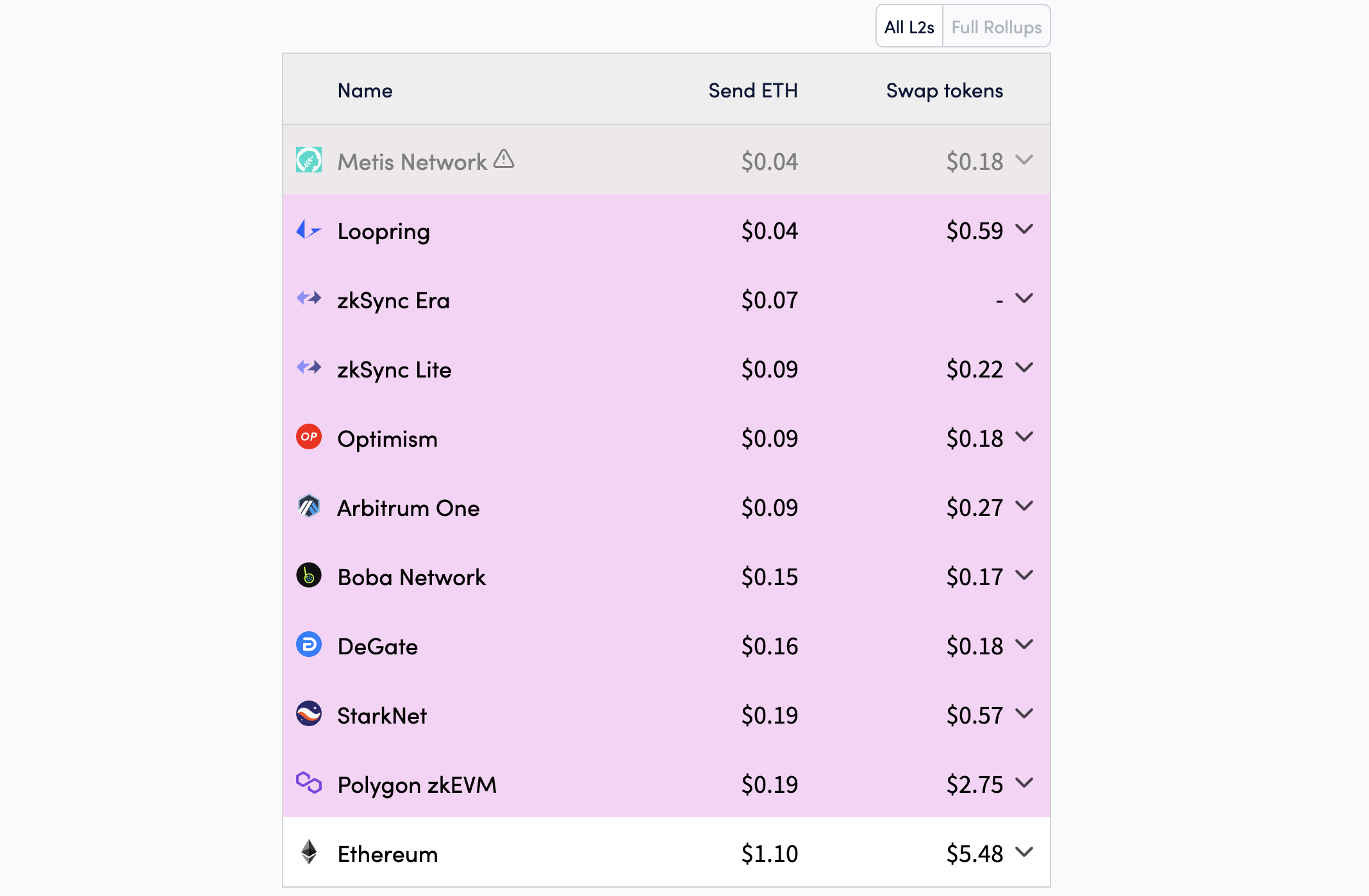

DApp fee revenue is a key metric for measuring a blockchain’s activity and user value. On Ethereum, popular DApps include DeFi protocols like Uniswap and Aave, NFT platforms like OpenSea, blockchain games, and social applications. The growth in Ethereum’s DApp fee revenue indicates sustained high demand for these applications despite competition from other networks and often high transaction costs (gas fees) on the mainnet.

Why Ethereum Leads

Several factors explain Ethereum’s continued leadership in DApp fee revenue. Firstly, Ethereum was the first blockchain to support smart contracts, laying the foundation for its DApp ecosystem. According to DappRadar data, Ethereum remains the blockchain with the largest DApps, hosting over 4,983 active DApps, below the BNB Chain.

Second, Ethereum’s high security and reliability make it the preferred choice for developers and users. Despite high mainnet transaction costs, Ethereum has improved performance through upgrades like Dencun (implemented in 2024), which reduced costs on Layer-2 networks and enhanced scalability.

Third, Ethereum’s DeFi ecosystem remains a primary driver of fee revenue. According to DefiLlama, the Total Value Locked (TVL) in Ethereum’s DeFi protocols reached $46 billion, representing 51% of the total TVL in the DeFi market.

While Ethereum leads, other networks are also showing significant growth. According to Token Terminal, Base, Coinbase’s Layer-2, generated $193 million in DApp fee revenue, a 45% increase from Q4 2024.

BNB Chain, with $170 million, remains a strong competitor due to low costs and a diverse DApp ecosystem, including platforms like PancakeSwap. Arbitrum, another Ethereum Layer-2, recorded $73.8 million, driven by the expansion of DeFi and blockchain gaming DApps. With $27.68 million, Avalanche C-Chain excels in finance and NFTs but cannot match Ethereum’s scale.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price on The Brink? Signs Point to Renewed Decline

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

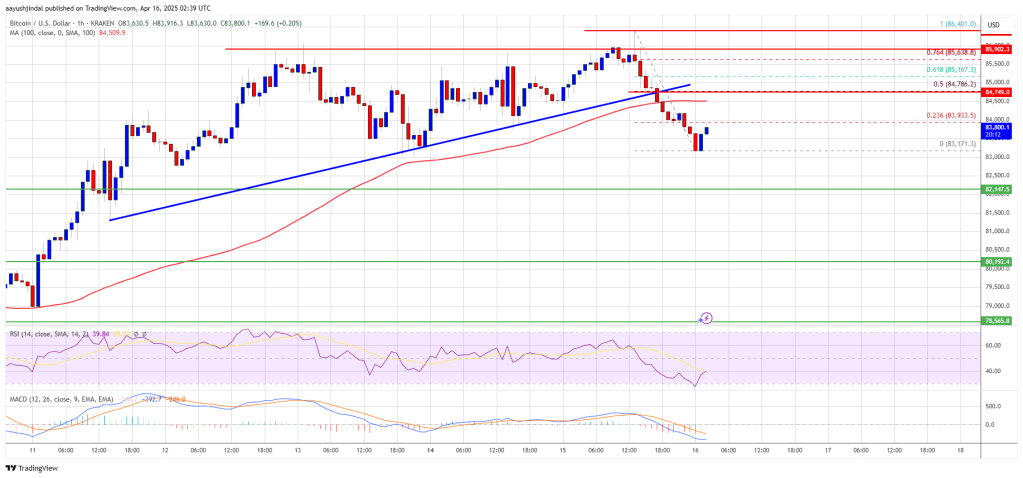

Bitcoin price started a fresh decline from the $86,500 zone. BTC is now consolidating and might continue to decline below the $83,200 support.

- Bitcoin started a fresh decline from the $86,500 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There was a break below a connecting bullish trend line with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $84,500 zone.

Bitcoin Price Faces Rejection

Bitcoin price started a fresh increase above the $83,500 zone. BTC formed a base and gained pace for a move above the $84,000 and $85,500 resistance levels.

The bulls pumped the price above the $86,000 resistance. A high was formed at $86,401 and the price recently corrected some gains. There was a move below the $85,000 support. Besides, there was a break below a connecting bullish trend line with support at $84,500 on the hourly chart of the BTC/USD pair.

The price tested the $83,200 support. Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $84,000 level and the 23.6% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

The first key resistance is near the $84,500 level. The next key resistance could be $84,750 and the 50% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

A close above the $84,750 resistance might send the price further higher. In the stated case, the price could rise and test the $85,500 resistance level. Any more gains might send the price toward the $86,400 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,000 resistance zone, it could start another decline. Immediate support on the downside is near the $83,500 level. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $83,200, followed by $82,200.

Major Resistance Levels – $84,750 and $85,500.

-

Market20 hours ago

Market20 hours agoCan Pi Network Avoid a Similar Fate?

-

Market23 hours ago

Market23 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Ethereum24 hours ago

Ethereum24 hours agoSEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

-

Market22 hours ago

Market22 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market19 hours ago

Market19 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Altcoin15 hours ago

Altcoin15 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance