Market

FOMC Minutes, Airdrop, and More

This week, some major news has captured the attention of crypto investors and enthusiasts alike.

The release of the Federal Open Market Committee (FOMC) meeting minutes, Etherfi’s airdrop Season 3 launch, and several other significant developments are expected to influence the decentralized finance (DeFi) sector and the broader crypto industry.

FOMC Meeting Minutes and Other Macro Data Releases

This week, the crypto market braces for several macroeconomic data releases, notably the FOMC meeting minutes and the non-farm payroll figures for June. Analysts expect 180,000 new jobs in June, keeping the unemployment rate at 4%, the highest since February 2022. May saw a gain of 272,000 jobs, initially boosting confidence about the economy despite signs of a slowdown.

Investor concerns about US economic momentum may grow with below-expectation numbers. June’s data revealed continuing unemployment claims at 1.84 million, a peak since November 2021, highlighting difficulties for job seekers. The focus will also be on the average hourly earnings growth, expected to decrease to a post-pandemic low of 3.9% year-on-year in June.

Analysts believe these insights will significantly impact Bitcoin (BTC) and the broader crypto market. According to crypto analyst CrypNuevo, Bitcoin has shown preliminary signs of potential market movements.

They observed two crucial liquidity areas of interest. The first is between $62,500 and $63,500, marking the primary short-term liquidity zone. The second area is around $67,100, regarded as a significant mid-term zone.

CrypNuevo also noted a notable issue in the opposite direction involving a long wick. They believe it will likely get filled to balance the open interest gaps.

“So I finally came up with this projection: Not necessarily for the week ahead, the time frame is more like 2-3 weeks. Impulsive moves up to liquidate high-leverage short positions and then drop back down to fill the 50% of the wick. Forming a potential accumulation range,” CrypNuevo wrote.

Zero1 Labs, a decentralized AI solution, has announced a major activation for the Zero1 community. This initiative, involving over 25 prominent communities, aims to further decentralize its native token, DEAI.

The new Community Program seeks to foster greater engagement within crypto communities and expand Zero1 Labs into the largest AI crypto community. It delivers exclusive rewards to new supporters by forming strategic alliances with top community projects.

Collaborating with well-known communities, Zero1 Labs offers users a chance to claim a share of a $2 million DEAI prize pool. The protocol aims to reward both existing supporters and attract new participants eager to explore decentralized technology and AI.

Participants can earn rewards by engaging with the community and writing unique content about Zero1 Labs. They can enhance their chances of receiving more rewards by completing various social tasks, such as following on X, joining the Discord community, and discussing DEAI on X. Each action accumulates points, increasing the likelihood of earning rewards.

The Community Program will officially kick off on July 3, 2024. To ensure fair participation, snapshots of specific communities will be taken the day before the announcement. This snapshot will determine eligibility, giving participants limited time to engage in social activities and maximize rewards.

NATIX Token Launch and Listings

NATIX Network will launch its token, NATIX, on July 2. On the same day, major crypto exchanges, including KuCoin and Gate.io, will list the NATIX token on their respective platforms.

This launch is anticipated to provide significant opportunities for traders and investors as it becomes available on prominent exchanges. NATIX is an AI-powered dynamic map supercharged by the decentralized physical infrastructure (DePIN) and driver community.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Etherfi Announces ETHFI Airdrop Season 3

Etherfi, a protocol offering liquid restaking services on the Ethereum network, has recently announced details concerning its Season 2 ETHFI airdrop. The schedule is as follows: the checker tool to verify eligibility for the airdrop will become available on July 5, with the official claiming of airdrops set for July 8.

Additionally, there is exciting news for the upcoming Season 3. Etherfi has committed to distributing 25 million ETHFI tokens. The allocation of these tokens will be based on each community member’s level of participation and engagement.

Season 3 kicked off on July 1 and is expected to run until the beginning of September. Following the end of the season, the airdrop distribution will take place.

SUI and Other Major Token Unlocks

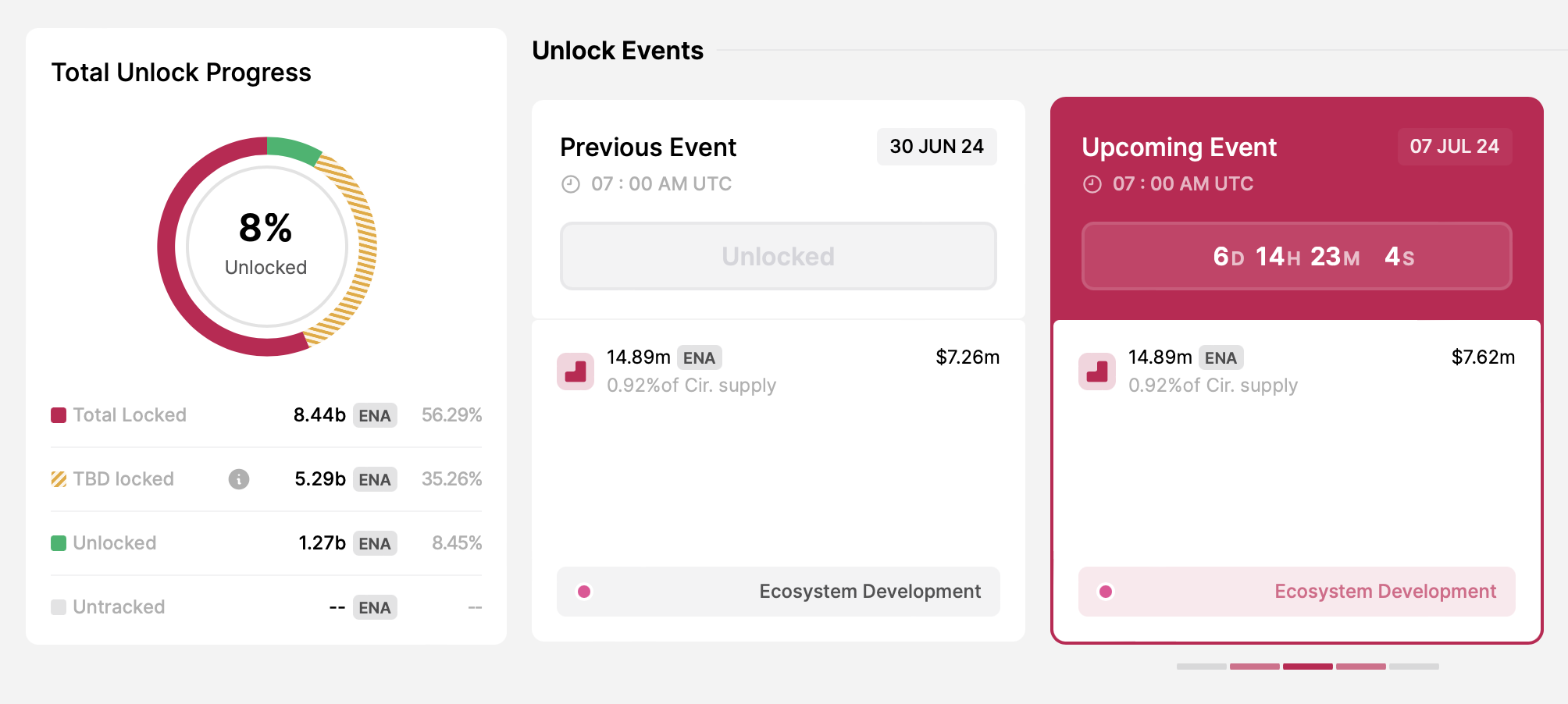

Ethena (ENA), the synthetic currency protocol on Ethereum, will unlock 14.89 million of its native token, ENA, dedicated to ecosystem development. According to Token Unlocks data, these tokens represent 0.92% of ENA’s circulating supply and are worth approximately $7.62 million at the time of writing.

In addition to ENA, DYDX and SUI have also held token unlocks today at midnight UTC. Read this article for further detailed information on major crypto token unlocks this week.

zkSync Introduces Elastic Chain in 3.0 Roadmap

zkSync, an Ethereum layer-2 (L2) network, has introduced a new “Elastic Chain” feature in its latest zkSync 3.0 roadmap. The v24 upgrade transforms zkSync into an Elastic chain from a single ZK chain. This Elastic Chain comprises multiple chains within the zkSync ecosystem, offering users the experience of using a single chain.

Matter Labs, the team behind zkSync, describes the Elastic Chain as an infinitely extensible network of ZK chains. These include rollups, validiums, and volitions. They are secured by mathematical proofs and seamlessly interoperable with a uniform, intuitive user experience.

In a June 29 announcement, the zkSync team promised to share more details on how these ZK chains seamlessly work together this week. This new feature could further enhance the network’s capabilities and user experience.

Read more: What Is zkSync?

Parcl’s Upcoming PRCL Staking Program

Parcl, a real-world asset (RWA) tokenization protocol on the layer-1 blockchain Solana, will present its upcoming PRCL staking program this week. Staking will effectively unlock all participation in the Parcl ecosystem, including governance, existing and future protocol incentives, and Parcl Labs Data API access.

Epochs are a fundamental principle of time for staking, with one epoch equaling seven days. The first epoch will be announced shortly.

This week’s news in the crypto space highlights significant milestones and potential market shifts. Investors and enthusiasts closely watch these events, anticipating their impacts on the market dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Wormhole (W) Jumps 10%—But Is a Pullback Coming?

Wormhole (W) surged nearly 12% on Thursday after the project unveiled its official product roadmap. The project’s one-year anniversary has sparked speculative interviews.

However, technical data shows buyers and sellers locked in a fierce battle, as momentum indicators suggest a weakening trend. The DMI, Ichimoku Cloud, and EMA structures all reflect market indecision, with no clear direction confirmed just yet.

Wormhole DMI Chart Shows Market Indecision

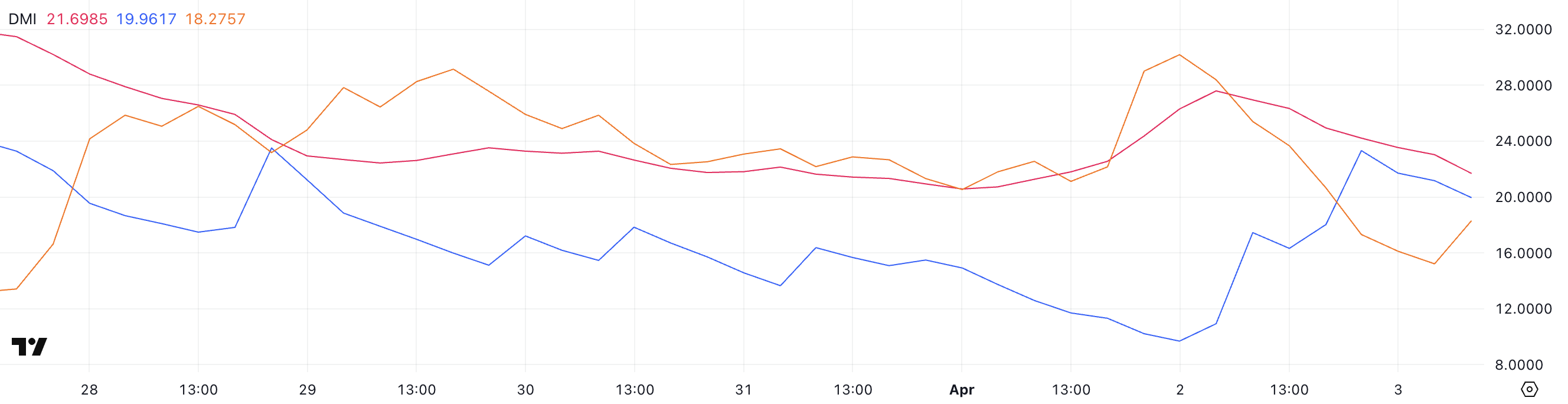

Wormhole’s DMI chart shows its ADX (Average Directional Index) has dropped to 21.69 from 27.59 just a day earlier, signaling that the recent trend may be losing strength.

The ADX is a key indicator used to measure the strength—not the direction—of a trend. Generally, values below 20 suggest a weak or non-existent trend, while values above 25 indicate a strong trend.

With ADX now hovering near the threshold, it suggests that the bullish momentum seen in recent days could be fading.

Looking deeper, the +DI (Positive Directional Indicator) has fallen to 19.96 after peaking near 24 earlier, though it had surged from 9.68 the previous day.

Meanwhile, the -DI (Negative Directional Indicator) climbed to 18.27 after dropping to 15.21 earlier, following a sharp decline from 30.18 yesterday. This narrowing gap between +DI and -DI—combined with a weakening ADX—suggests uncertainty and potential indecision in price action.

With a $137.64 million token unlock on the horizon, this shift could hint at a cooling bullish impulse and the risk of renewed selling pressure if supply outweighs demand.

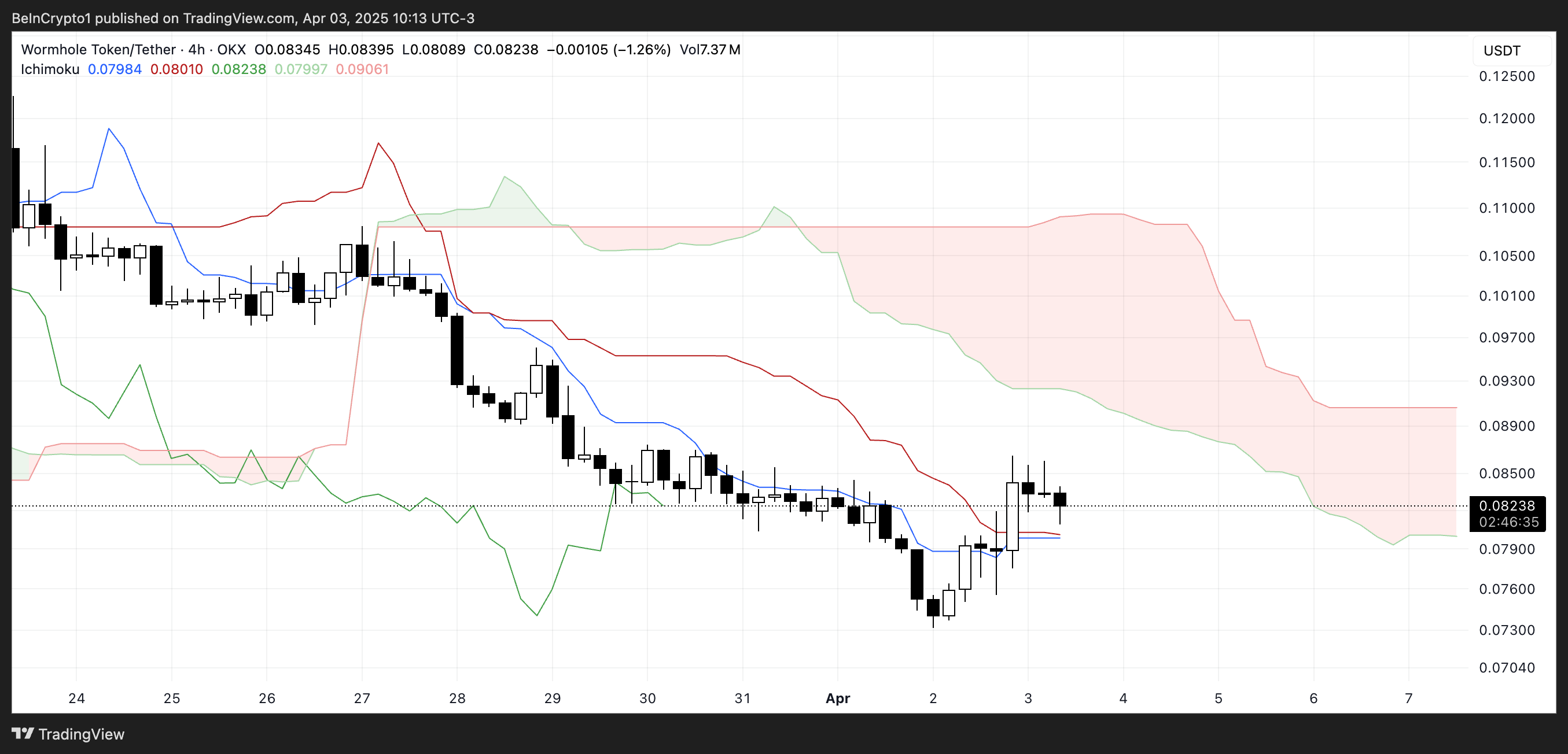

Ichimoku Cloud Shows Mixed Signals

Wormhole’s Ichimoku Cloud chart shows a mixed outlook. Price action is attempting to break through resistance but still faces notable headwinds.

The Tenkan-sen (blue line) has recently flattened and is closely aligned with the Kijun-sen (red line), signaling indecision or a potential pause in momentum.

Typically, when these lines are flat and close together, it indicates consolidation rather than a clear trend continuation or reversal.

Meanwhile, the Kumo (cloud) remains thick and red ahead, reflecting strong overhead resistance and a bearish long-term bias.

The price is hovering near the lower edge of the cloud but has yet to make a decisive move above it—suggesting that bullish momentum is tentative at best.

For a confirmed trend reversal, a clean break above the cloud with bullish crossovers would be needed. Until then, the chart points to a market still trying to find direction, especially ahead of a major token unlock event that could further impact sentiment and price action.

Will Wormhole Reclaim $0.10 In April?

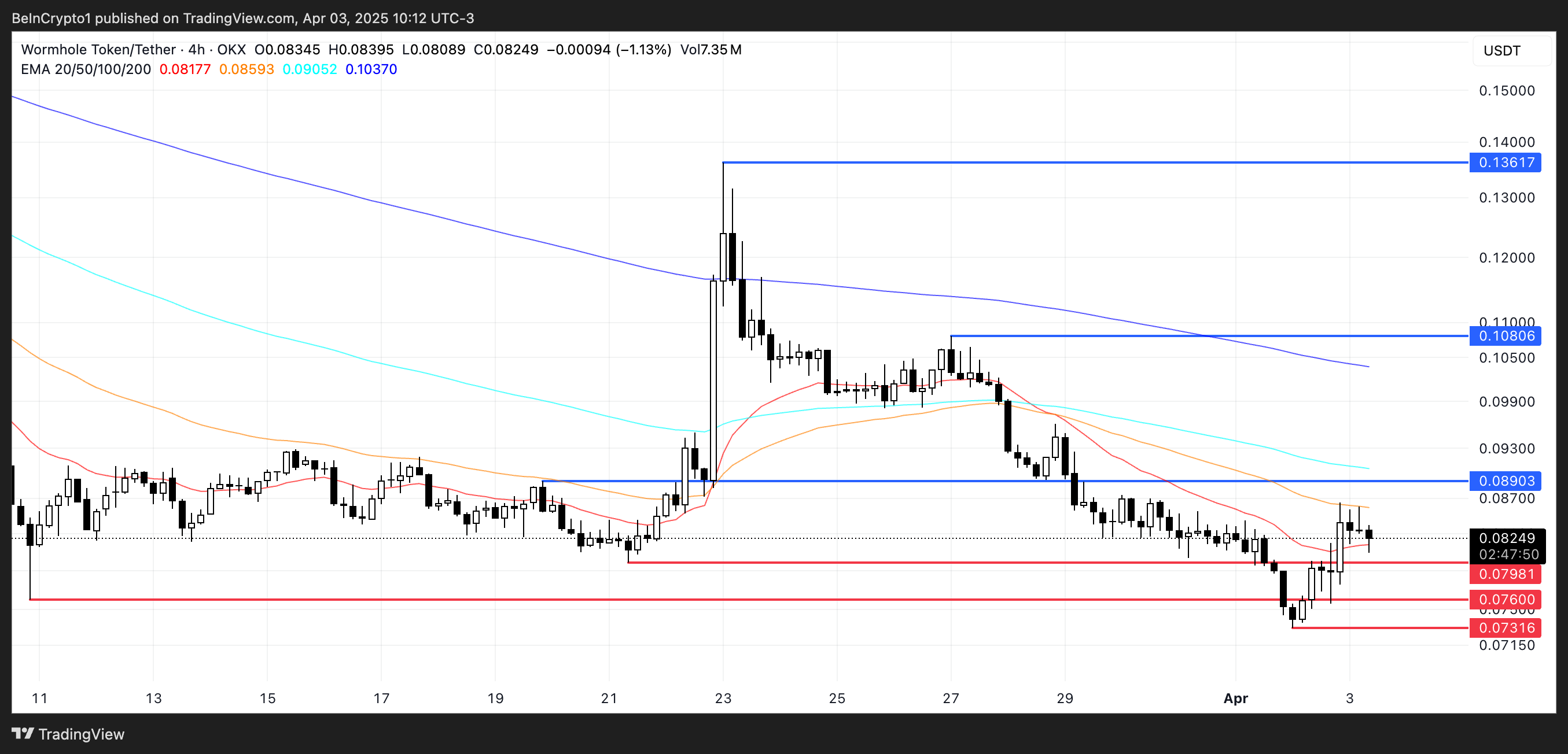

Wormhole, which builds solutions around interoperable bridges, continues to see its EMA setup reflect a bearish structure. Short-term moving averages are still positioned below the longer-term ones, an indication that downward pressure remains dominant.

However, one of the short-term EMAs has started to curve upward, hinting at a possible shift in momentum as buyers begin to step in. This early uptick could signal the beginning of a trend reversal, though confirmation is still pending.

If bullish momentum gains traction, Wormhole may attempt to break the nearby resistance at $0.089. A successful breakout could open the door for a move toward higher resistance levels at $0.108 and even $0.136.

Conversely, failure to clear $0.089 could reinforce bearish control, pushing the price back to test support at $0.079.

A break below that level could expose W to further downside toward $0.076, $0.073, and potentially below $0.07—marking uncharted territory for the token.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Shifts $1B in XRP Amid Growing Bearish Pressure

XRP is under pressure, down nearly 6% in the past 24 hours and teetering just above the $2 mark as bearish momentum builds. A $1.02 billion unlock from Ripple’s escrow has sparked fresh concerns about oversupply, with tokens moved to operational wallets possibly poised for distribution.

At the same time, network activity has collapsed 87% since mid-March and technical indicators like DMI and EMA lines suggest growing downside risk. With weakening trend strength and fading demand, XRP may struggle to hold key support levels unless a catalyst revives bullish sentiment.

Ripple Wallet Activity Sparks Fears

Onchain data shows that Ripple has unlocked 500 million XRP—worth around $1.02 billion—from its escrow account.

The tokens were moved from the “Ripple (27)” escrow address to two operational wallets, “Ripple (12)” and “Ripple (13),” potentially positioning them for distribution or sale.

While the escrow account still holds another 500 million XRP, the movement of such a large amount into accessible wallets often raises concerns about increased market supply. If Ripple sells a portion of these tokens, it could create short-term selling pressure on XRP’s price.

From a technical standpoint, XRP’s DMI chart is flashing bearish signals. The ADX, which measures trend strength, has sharply declined to 26.68 from 42.45 just two days ago, suggesting the recent trend is weakening.

Meanwhile, the +DI has dropped to 12.91, down from 22 yesterday—indicating a decline in bullish momentum. At the same time, the -DI has surged to 27.43 from 15.64, pointing to rising bearish pressure.

This shift in directional strength, combined with the large token unlock, suggests XRP may face further downside unless demand quickly absorbs the incoming supply.

XRP Network Activity Collapses 87%

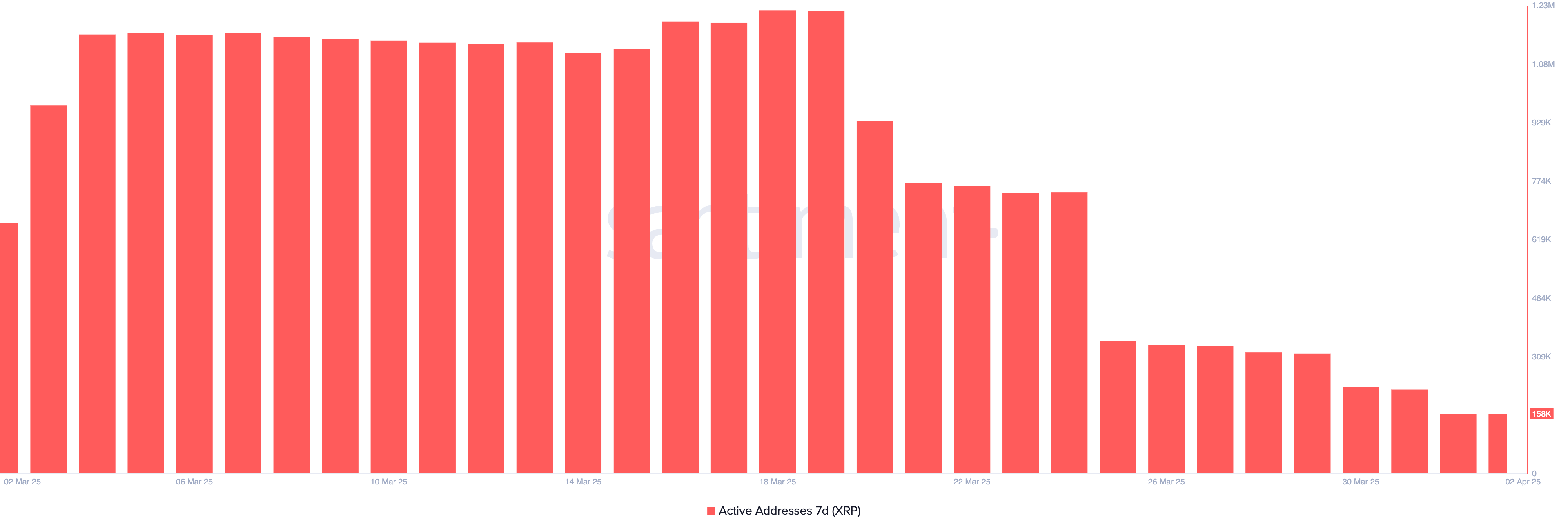

XRP’s network activity surged to record highs in March, with 7-day active addresses reaching an all-time peak of 1.22 million on March 18.

However, that momentum quickly faded, with the number now plummeting to just 158,000—an 87% drop in less than three weeks.

This dramatic reversal suggests that the recent spike in engagement may have been short-lived or event-driven rather than indicative of sustained adoption or growing user demand.

Tracking 7-day active addresses is a key on-chain metric, offering insight into how frequently a token’s network is being used. High activity can signal strong user interest and utility, often aligning with price support or rallies.

On the other hand, sharp declines in active addresses—like what XRP is now experiencing—can signal waning demand, decreasing network usage, and potential selling pressure.

With such a steep drop in activity, XRP’s price may struggle to find an upside unless new catalysts reignite user engagement.

XRP Faces Strong Downtrend, But Eyes Rebound If Key Levels Break

XRP’s EMA structure clearly reflects a strong ongoing downtrend, with short-term moving averages positioned well below the long-term ones and a wide gap between them—signaling persistent bearish momentum.

Unless bulls step in soon, XRP price may be on track to test support around $1.90, a key level that has held in the past.

A break below it could expose the asset to further downside toward $1.77.

However, if XRP manages to reverse the current trend and regain upward momentum, it could climb to challenge resistance at $2.06.

A successful breakout above that level might pave the way for a continued rally toward $2.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

The crypto market watches with bated breath as XRP teeters at $1.97, a battleground where bullish conviction clashes with bearish determination. After a retreat from recent highs, the digital asset now faces a critical test.

The current standoff mirrors the broader tug-of-war in crypto markets, where sentiment shifts rapidly and key price levels dictate the next major move. For XRP, $1.97 isn’t just another number; it’s a line in the sand. A decisive hold here could reignite upward momentum, while a breakdown may embolden the bears.

Market Sentiment: Fear, Greed, Or Indecision?

According to Grumlin Mystery, a well-known crypto analyst, XRP is likely to experience a further downside in the near future, potentially dropping to $1.96. In his March 30th post on X, he highlighted that a decrease in liquidity within the crypto market is playing a crucial role in weakening XRP’s price stability, driven by the impact of US tariffs and the implementation of Trump’s policy changes.

Grumlin pointed out that restrictive trade policies and economic uncertainty have led to a slowdown in capital flow into riskier assets like cryptocurrencies. With reduced liquidity, market participants have less buying power, making it easier for bears to push prices lower. He warned that if these economic conditions persist, XRP could struggle to find strong support, and a drop below $1.96 could trigger further declines.

This drying up of liquidity has allowed sellers to gain the upper hand, exerting downward pressure on prices. As a result, XRP’s ability to hold support at $1.96 remains uncertain, and unless market conditions improve, a deeper correction could be on the horizon.

Grumlin Mystery further elaborated that a sharp change in Trump’s rhetoric regarding tariffs remains highly unpredictable, making it difficult to gauge its full impact on the financial markets, including cryptocurrencies. While many initially believed that Trump’s stance would be a major positive catalyst for the crypto market, the reality appears to be more complex.

The analyst emphasized that market uncertainty is increasing as traders struggle to anticipate the next move in U.S. economic policy. If Trump maintains or intensifies his tariff approach, it could further tighten liquidity conditions, making it even harder for XRP to sustain bullish momentum.

Possible Scenarios For XRP

If buyers successfully defend the $1.96 level, XRP could see renewed upside momentum. A bounce from this support zone might trigger a rally toward $2.64, where the next resistance lies. A breakout above this level raises the potential to $2.92 or even $3.4, confirming a bullish recovery. Increased trading volume and improving market sentiment would be key indicators of this scenario playing out.

Sellers’ failure to maintain control and XRP’s failure to hold above $1.96 may cause a sharper decline. In this case, the next critical support levels to watch would be $1.70 and $1.34. Breaking below these levels could expose the asset to more losses to $0.93 or lower.

-

Altcoin23 hours ago

Altcoin23 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin24 hours ago

Altcoin24 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market16 hours ago

Market16 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market15 hours ago

Market15 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Ethereum10 hours ago

Ethereum10 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Market14 hours ago

Market14 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K