Market

Focus on Value, Not Speculation

Ethereum (ETH) core developer Peter Szilagyi is disappointed with the crypto industry, advocating for actual value in a sector that can be so much more.

The crypto industry has come a long way since its inception, from the creation of Bitcoin to the development of various blockchain projects and applications. There are still challenges, but the industry keeps growing and changing, guided by goals of decentralization, transparency, and financial empowerment.

How Crypto Started and How It’s Going

The ethos behind crypto was to provide a decentralized and secure alternative to traditional currency and financial systems. The potential for blockchain technology to disrupt various industries and empower individuals with financial sovereignty was the main goal.

In the early years, the focus was on building the infrastructure for cryptocurrencies and exploring their potential use cases. Bitcoin gained popularity as a digital currency and store of value, while Ethereum introduced smart contracts, enabling developers to build decentralized applications (dApps) on its blockchain.

The industry has seen quick growth, with new projects and tokens entering the market, fueled by the initial coin offering (ICO) boom of 2017. However, the ICO craze also brought about challenges, as many projects turned out to be scams or failed to deliver on their promises.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

This led to concerns about investor protection and regulatory oversight. The industry now faces scrutiny from governments and financial regulators worldwide. As the industry evolved, the focus shifted towards addressing scalability issues, improving security, and user experience.

Projects like decentralized finance (DeFi) emerged, offering a wide range of financial services without the need for traditional intermediaries. Stablecoins provided a stable means of value transfer within the volatile crypto market, while privacy coins enhanced transaction anonymity.

Despite these advancements, Peter Szilagyi is disappointed that the speculative aspects of crypto take precedence over what could be its true value.

“Yes, it takes time to ‘build a new monetary system’. For sure… but how about we make a few useful things along the way? Everyone is so focused on becoming the next V that nobody wants to build useful stuff, everyone’s in it for value extraction,” Szilagyi lamented.

Ethereum’s Peter Szilagyi on Crypto: “A Damn Casino”

“Crypto is a damn casino,” he says, referring to how traders cheer when the price soars and lives wrecked when prices crash. In his opinion, the industry is about so much more. This criticism concerns the speculative nature of the market, characterized by extreme price volatility and a focus on short-term gains.

“Bitcoin at least tries (and fails) to be a safe haven asset, the rest are all selling shovels with no gold rush in sight… My feeling is that the speculative aspects outrank the true values way too heavily and we seem to like it because it makes money. I fail to see any value creation thus far… Mind you, making it big by luck and moving your funds into some non-crypto venture is not a success story for crypto. It at best is a success story for a philanthropic lucky person, but more likely a simple diversification of said person,” Szilagyi added.

With this, he observes that digital assets as a system could collapse if everyone’s focus is on “value extraction” instead of building useful stuff. The Ethereum executive calls for the industry to create something genuinely useful that people want to use.

Nevertheless, Erik Voorhees challenges Szilagyi’s casino outlook, highlighting some of the valuable projects in the industry with actual use cases. Among them are stablecoins, DeFi lending, DEXs, privacy coins, wallet apps, financial intelligence systems like Dune or Messari, and high-throughput blockchains. Voorhees is the founder of Swiss digital asset trading company ShapeShift and Venice, a permissionless alternative to popular AI apps.

But Szilagyi writes off DEXs, privacy coins, and wallets. DeFi data developer Geninsus.sol on X agrees.

“When I talk about crypto to non-crypto people, I always say we have 99% of useless things and 1% of potentially useful things. The most bullish use case for me is the possibility to lend/exchange money from peer-to-peer without any central organization taking a split and all automated,” the developer said.

Szilagyi’s critique of the industry reflects concerns about the prevalence of trading and speculation over genuine value creation. This debate mirrors the ongoing tension between speculation and utility within the crypto space and raises good rhetoric:

“How does the crypto industry impact 99.999% of the world population who doesn’t have money to gamble?”

Read more: 4 Best Crypto Learn and Earn Platforms in 2024

The future of the crypto industry will likely be shaped by efforts to balance innovation, regulation, and user adoption. Building sustainable projects with tangible benefits for users will be crucial for long-term success.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Falls To Record New Low Amid Weak Inflows

Pi Network (PI) has experienced a significant downtrend recently, with price declines that have left many holders facing losses.

The altcoin has failed to break free from this negative momentum, and the market conditions continue to worsen. As a result, investors are losing confidence, and the price may continue to drop further.

Pi Network Continues To Suffer

The Chaikin Money Flow (CMF) continues to show bearish signs, remaining well below the zero line. This indicates that the network is suffering from outflows, meaning that investors are moving their funds out of Pi Network. Despite a bullish start, Pi failed to sustain interest, leading many holders to sell off their positions.

The outflow trend is concerning for investors, as the lack of positive momentum suggests a prolonged downtrend. The market sentiment remains bearish, with sellers outweighing buyers. As the CMF stays in the negative zone, it signals that Pi Network’s price could struggle to find stability in the short term.

The Ichimoku Cloud, a widely used technical indicator, is hovering well above the candlesticks, signaling that the bearish trend is gaining strength. This indicates that there is little upward momentum in the market, and Pi Network is likely to face more downward pressure.

Additionally, broader market conditions are still negative, which suggests that Pi Network may fail to recover in the immediate future. With bearish technical indicators and a lack of support from investors, the outlook for Pi Network remains grim for now.

PI Price Hits A New Low

Pi Network is currently priced at $0.61, having formed a new all-time low of $0.60 after dropping by nearly 14% over the last 24 hours. The altcoin continues to struggle under the weight of negative sentiment and is not showing signs of reversal in the near term.

Based on the ongoing outflows and bearish technical indicators, Pi Network will likely continue its decline. It could fall further to $0.50, potentially forming new all-time lows. The current market conditions suggest that recovery is unlikely without a significant shift in sentiment.

However, if Pi Network can bounce off the $0.60 level, it might regain some support and climb back to $0.87. This would help recover some of the recent losses and potentially give the altcoin another chance at a bullish move. But, without a strong catalyst, it may struggle to break through the resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TRUMP Token Hits Record Low Due To Liberation Day Tariffs

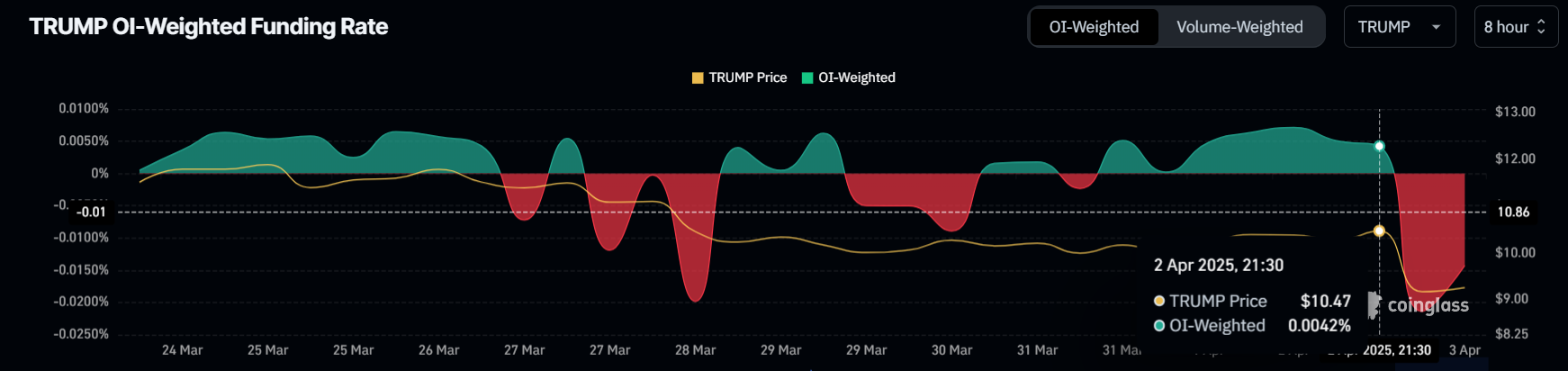

TRUMP token has faced a significant downturn, failing to recover after a recent decline. The altcoin’s price has been further pressured by the announcement of US President Donald Trump’s Liberation Day Tariffs.

As a result, bearish sentiment has grown, leading traders to capitalize on the negative market conditions.

Trump’s Announcement Took A Toll

The funding rate for TRUMP turned negative over the last 24 hours, signaling increased bearish activity. Traders are shifting to short contracts, betting that the price will decline further. This shift in sentiment follows the announcement of the tariffs, which, despite being a policy move, had a negative impact on TRUMP’s price.

This negative market reaction highlights traders’ skepticism about the future prospects of TRUMP. While the tariff announcement was meant to stimulate market reactions, it instead spurred fear, driving a wave of sell-offs.

Looking at the broader momentum, technical indicators such as the Relative Strength Index (RSI) reveal that TRUMP is far from recovering its recent losses. The RSI remains firmly in the bearish zone, well below the neutral 50.0 mark. With no signs of reversal or bullish momentum, the token is likely to continue facing declines in the short term.

The oversold conditions are not yet reached either, indicating there is still room for further declines. With the RSI not showing any substantial recovery signals, the current downtrend could persist until market sentiment shifts or a new catalyst sparks renewed interest in the token.

TRUMP Price Suffers

TRUMP’s price hit a new all-time low of $8.97 before recovering slightly to $9.29. Over the last 24 hours, the token has seen a 10% decline. This drop has added to its month-long 45% slide, as the token lost crucial support levels, including $12.57 and $10.29.

The ongoing bearish trend suggests that TRUMP could continue to slide, with the next key support around $8.00. If the broader market conditions remain weak and the bearish sentiment continues to dominate, the price could dip further, reaching new lows before any potential recovery.

However, if TRUMP manages to reclaim $10.29 as support, it could mark the beginning of a recovery attempt. Successfully breaching $12.57 could invalidate the current bearish outlook and signal a potential rally, but this would require a significant shift in investor sentiment and market conditions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin’s Future After Trump Tariffs

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding its ground while Wall Street stumbles, why Trump’s tariffs may push the Fed into money-printing mode, and what that could mean for crypto’s next chapter. From Ethereum’s test of resilience to rising odds of a US recession, here’s everything you need to know to stay ahead.

Bitcoin Enters Its Risk-Dynamic Era Amid Tariffs and Turmoil

Bitcoin’s reaction to recent macro shocks—particularly Trump’s sweeping tariffs—has been noticeably calm compared to traditional markets, and that’s turning heads. While Wall Street stumbles harder than expected, crypto has held relatively steady.

Nexo Dispatch Editor Stella Zlatarev told BeInCrypto that this isn’t just resilience—it’s evidence that Bitcoin may be entering a new phase of market maturity.

“A 2–3% drop in crypto is a rounding error compared to past cycles,” she said, emphasizing that this stability amid chaos suggests Bitcoin is no longer just a speculative punt. “Bitcoin’s ability to weather macro turbulence without the wild swings of previous years suggests institutional investors are treating it less as a speculative punt and more as a strategic asset,” Zlatarev said.

Analysts also stressed that Bitcoin’s behavior doesn’t align with traditional asset categories.

“It’s not gold, and it’s not the yen. Instead, Bitcoin is emerging as a risk-dynamic asset – one that doesn’t crumble like high-growth stocks but also doesn’t attract the same flight-to-safety flows as traditional safe havens,” Zlatarev told BeInCrypto.

This concept of a “risk-dynamic” asset positions Bitcoin in a unique role: something that thrives in uncertainty but doesn’t collapse when the market turns.

Zlatarev from Nexo also noted that how Ethereum and other blue-chip altcoins respond next will be key.

“If ETH mirrors BTC’s performance, it strengthens the case that top-tier crypto assets are evolving into a more predictable asset class. If ETH wobbles, it reinforces that, for now, Bitcoin is in a league of its own.”

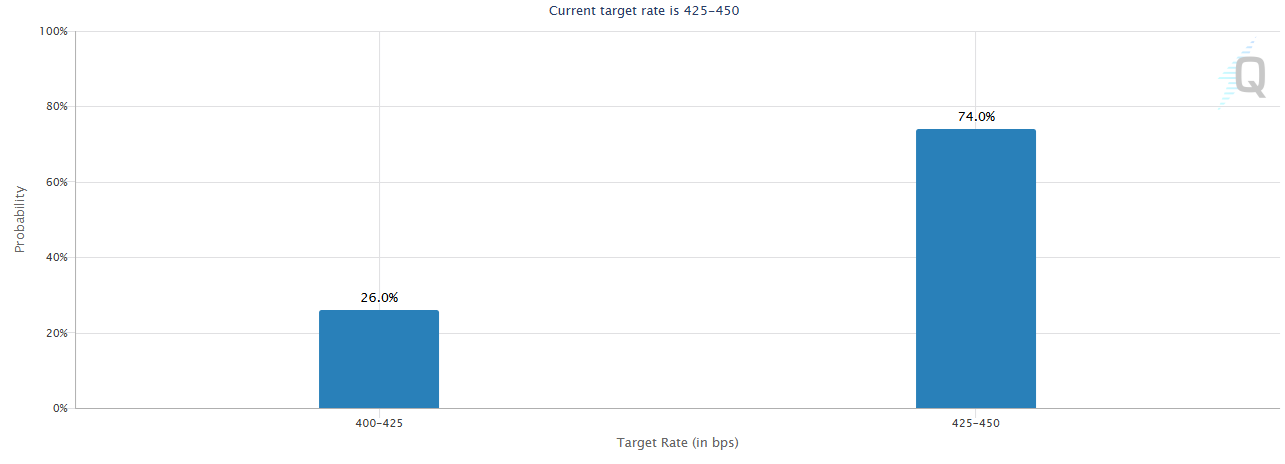

Meanwhile, the macro backdrop is shifting fast. Trump’s new “Liberation Day” tariffs have spooked global trade partners and have also sent ripple effects through prediction markets. Polymarket now gives almost 50% odds of a US recession this year—a major shift following the announcement.

Also, CME FedWatch tool shows interest rate traders have boosted the probability the US Federal Reserve will make four rate cuts this year. Eventually, this could relief the current macroeconomic pressure on Bitcoin.

Former BitMex CEO Arthur Hayes mentioned that Trump’s current tariff strategy could complicate the US bond market. In other words, pressure is building for the Fed to intervene—possibly by turning on the liquidity spigot once again.

All of this puts Bitcoin in a new spotlight. Its steadiness is no longer being dismissed as a coincidence. It may be the first sign that crypto, or at least its most mature players, is stepping out of the shadows of speculation and into the spotlight of strategic finance.

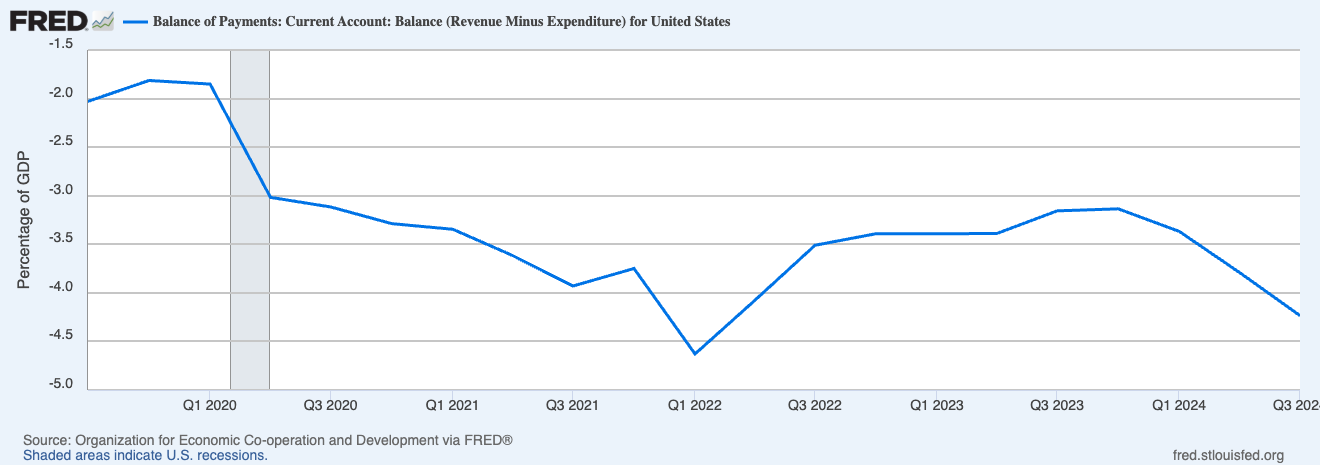

Chart of the Day

By reducing foreign demand for US Treasuries, Trump’s tariffs may force the Fed to inject more liquidity—potentially weakening the dollar and boosting Bitcoin as an alternative store of value.

Byte-Sized Alpha

– Trump’s “Liberation Day” enforces 10%+ tariffs on all imports, hitting China, the EU, and Israel, triggering market drops and recession fears.

– According to Standard Chartered, Bitcoin may hit $500,000 by Trump’s term end, AVAX could 10x by 2029, and Ethereum’s 2025 target drops to $4,000.

– The STABLE Act of 2025 advances with bipartisan support, aiming to tighten stablecoin rules as competition and regulatory pressure intensify.

– Bitcoin ETFs see $221 million in April inflows led by ARKB, but BTC derivatives cool with falling futures interest and bearish options sentiment.

– DXY hits a 2024 low after “Liberation Day” tariffs, fueling short-term Bitcoin surge hopes amid global tensions and policy uncertainty.

– Bitcoin struggles below $85,000 amid weak sentiment, but long-term holders stay firm, keeping capitulation fears at bay.

– Polymarket sees almost 50% chance of US recession as Trump’s tariffs spark market fears and trade tensions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Altcoin22 hours ago

Altcoin22 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Ethereum21 hours ago

Ethereum21 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Ethereum23 hours ago

Ethereum23 hours agoWhales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead?

-

Altcoin19 hours ago

Altcoin19 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin20 hours ago

Altcoin20 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market12 hours ago

Market12 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin12 hours ago

Altcoin12 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds