Market

Find Out 3 Major Token Unlocks of Next Week

Token unlock involves releasing tokens that were previously blocked under fundraising terms. Projects carefully schedule these releases to avoid market pressure and prevent a drop in token prices.

However, factors like lack of liquidity or early investor profit-taking can significantly impact an asset’s dynamics. Here are three major token unlocks to watch next week.

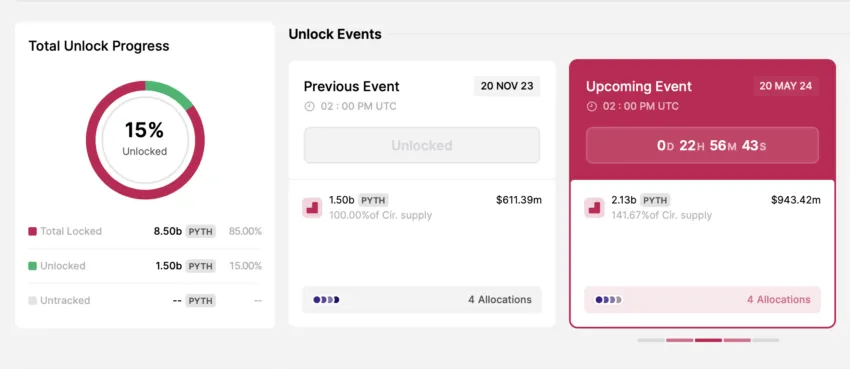

Pyth Network (PYTH)

- Unlock date: May 20

- Number of tokens unlocked: 2.13 billion PYTH

- Current circulating supply: 1.5 billion PYTH

Pyth Network is a decentralized oracle that supplies real-time financial market data to blockchain applications. It gathers high-quality pricing information from various sources, including trading firms and exchanges. The project aims to improve the accuracy and reliability of data used in smart contracts and decentralized finance (DeFi) platforms.

The PYTH token has a maximum supply of 10 billion. On May 20, the project will unlock 2.13 billion tokens, which exceeds the current circulating supply. Approximately 800 million PYTH will go to private sale participants and publishers, with the remainder allocated for protocol development and ecosystem growth.

Crypto community members have polarized opinions on how the unlock will affect PYTH price. Some believe the altcoin is headed for a significant collapse, while others are confident that tokenomics design will allow it to hold its ground.

“Pyth unlock worth $910M is on 20th May. 141.67% of current supply is being unlocked. AEVO dumped 25% after the unlock. Most of PYTH holders have staked so they can’t sell their bags. Regardless i am looking for shorting setups,” one crypto trader noted.

Read more: What Is a Blockchain Oracle? An Introductory Guide

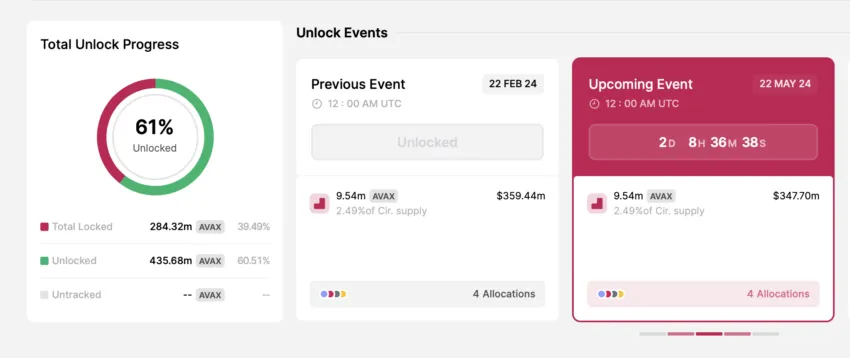

Avalanche (AVAX)

- Unlock date: May 22

- Number of tokens unlocked: 9.54 million AVAX

- Current circulating supply: 382.77 million AVAX

Avalanche is a decentralized blockchain platform that delivers high performance and scalability, enabling developers to create and deploy decentralized applications (dApps) and custom blockchain networks. The native token of the Avalanche network is AVAX, used for paying transaction fees, staking, and participating in the platform’s governance.

On May 22, over 9 million AVAX tokens will be unlocked and distributed among strategic partners, the Avalanche Foundation, the team, and airdrop participants.

Read more: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

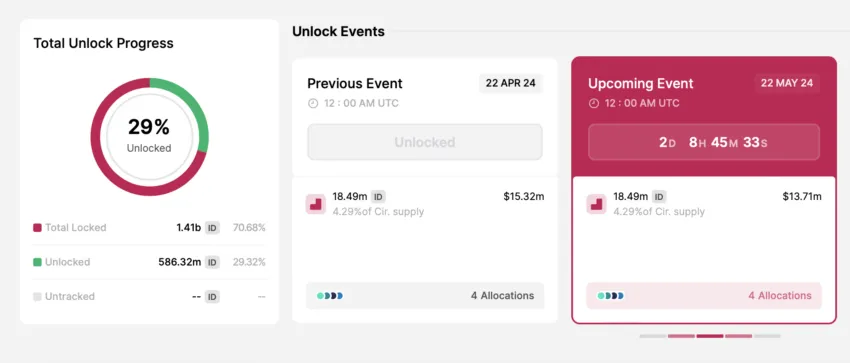

Space ID (ID)

- Unlock date: May 22

- Number of tokens unlocked: 18.49 million ID

- Current circulating supply: 430.5 million ID

Space ID is a decentralized identity protocol that helps users securely manage their online identities across various blockchain platforms. It enables users to create a single digital identity for use in multiple decentralized applications (dApps). The ID is the utility token of the Space ID ecosystem, designed to incentivize user participation and support the security and growth of the network.

On May 22, the project will add 18 million ID to the circulating supply. According to TokenUnlocks, most of these tokens will go to the Space ID Foundation, the ecosystem fund, and airdrop participants.

Read more: Which Are the Best Altcoins To Invest in May 2024?

Although token unlocks are often considered bearish, a well-planned schedule can enhance a project’s long-term viability. Aligned with milestones and development progress, unlocks will motivate team members, boost community engagement, and promote ecosystem growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Technical Analyst Warns Ripple’s XRP Price Could drop 50%

Veteran market analyst Peter Brandt has issued a gloomy year-end forecast for XRP, suggesting the asset may struggle to maintain its momentum despite recent gains.

On April 18, Brandt shared his updated analysis on X (formerly Twitter), projecting two possible scenarios for XRP’s market capitalization by year’s end.

Cautionary Outlook for XRP Despite Recent Surge

The first scenario places XRP’s market cap around $116.67 billion, while the second offers a more bearish outlook of just above $60 billion.

Essentially, both figures imply a decline from XRP’s current valuation of roughly $2.09 per token at a market capitalization of $121 billion.

Brandt’s analysis is based on a technical pattern he previously identified on XRP’s price chart.

According to him, the formation resembles a classic head-and-shoulders setup—a pattern that often signals a trend reversal. If this plays out, XRP could fall as low as $1.07.

He added then that a move below $1.90 would confirm the pattern and likely trigger a steep correction of more than 50%. However, a break above $3 could invalidate the bearish outlook.

“XRP is forming a textbook H&S pattern. So, we are now range bound. Above 3.000 I would not want to be short. Below 1.9 I would not want to own it,” Brandt explained.

This cautious forecast follows a remarkable surge in XRP’s price since late 2024.

Following Donald Trump’s return to the White House, the token rallied over 300%, reaching a high of $3.28 before pulling back to its current level.

This price performance has led many investors to believe that the Trump administration’s friendlier stance toward digital assets could help the asset continue its rally.

One major catalyst was the Securities and Exchange Commission’s (SEC) decision to drop several lawsuits against crypto companies, including Ripple.

That shift reduced regulatory uncertainty and sparked renewed interest in XRP, culminating in the launch of exchange-traded funds (ETFs) focused on the product.

Adding to the momentum, Ripple launched its own stablecoin, RLUSD, aiming to tap into a growing segment of the digital asset market.

Still, Brandt’s warning suggests that XRP’s recent rally may not be sustainable if bearish pressure intensifies.

Ripple Not Rushing Into IPO Despite Industry Trend

Amid renewed attention on XRP’s performance, Ripple CEO Brad Garlinghouse has addressed growing speculation about the company going public.

In a recent video shared on X, Garlinghouse made it clear that Ripple does not plan to file for an IPO in 2025.

He emphasized that the company is not actively seeking external funding because it remains financially stable and is prioritizing product development and business expansion.

“Will we IPO in 2025? I think that’s a definitive no…We’ve said there’s no imminent plans to go public,” Garlinghouse stated.

While the company isn’t moving forward with an IPO this year, Garlinghouse didn’t completely close the door.

He noted that Ripple is evaluating whether going public would benefit the business in the long run. However, such a move isn’t a current priority.

“You have to ask yourself, okay, how does Ripple benefit from being a public company? And is it a high priority for us?” he said.

Moreover, Garlinghouse also hinted that the regulatory landscape—especially under new leadership at the SEC—could influence Ripple’s future decisions.

His comments come as several crypto firms, including Kraken and Ciecle, reportedly prepare for IPOs. For now, though, Ripple appears comfortable staying private until conditions become more favorable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SUI Ranks 5th in DEX Volume, But Rally Lacks Strength

SUI blockchain has been gaining traction in recent weeks, and its market cap is now approaching $7 billion. Fueled by meme coin activity and rising DeFi engagement, the network has seen a notable jump in DEX volume and technical momentum.

While indicators like RSI and EMA lines show early signs of a potential trend shift, overall strength remains mixed. SUI sits at a key crossroads—supported by short-term excitement but still needing stronger confirmation to challenge top-tier chains.

SUI Surges to 5th in DEX Volume, But Still Trails Top Chains

SUI’s recent surge in DEX activity has grabbed attention, largely fueled by growing interest in meme coins and speculative trading on its ecosystem. Over the past seven days, SUI’s DEX volume hit $2.1 billion, marking a 4.49% increase and continuing its steady upward trend.

This momentum has helped SUI outperform other ecosystems, most notably surpassing Arbitrum in the past 24 hours to become the fifth-largest chain by DEX volume.

However, despite the short-term gains, SUI still trails well behind top-tier networks like Base, BNB Chain, Ethereum, and Solana in total DEX activity.

These established ecosystems continue to dominate in terms of liquidity, user base, and overall transaction volume.

While SUI’s rise is notable, especially given its relatively new position in the DeFi ecosystem, it will need to sustain this growth and diversify beyond meme coin hype to truly challenge the leading players.

For now, it remains an exciting underdog with momentum—but not yet a major contender.

SUI Momentum Rebuilds, But Trend Remains Weak

SUI’s RSI is now at 51.86, up from 35.22 just three days ago. This suggests buying pressure has returned after a short-term dip, helping stabilize price action.

The Relative Strength Index (RSI) measures momentum on a scale from 0 to 100. Readings above 70 are considered overbought, while those below 30 indicate oversold conditions.

Sitting near the midpoint, SUI’s RSI points to neutral momentum. It hasn’t crossed above 70 in almost a month, showing that bullish strength has remained limited.

Meanwhile, SUI’s DMI (Directional Movement Index) shows that its ADX is down to 9 from 14.79 just two days ago. The ADX measures trend strength, and anything below 20 signals a weak or nonexistent trend.

The +DI is at 15.83 while the -DI is at 13.15, meaning buyers have a slight edge—but the low ADX suggests that edge isn’t strong. There’s no clear trend dominating the market right now.

Together, the RSI and DMI suggest that SUI is in a consolidation phase. Buyers are showing some activity, but not enough to build a strong, sustained trend—at least for now.

EMA Setup Still Bearish, But SUI Bulls Show Signs of Life

SUI’s EMA lines are still showing a bearish setup, with short-term averages sitting below the long-term ones. However, the gap between them has narrowed, and a potential golden cross may be forming.

A golden cross occurs when a short-term EMA crosses above a long-term one, often seen as a bullish signal. If this plays out, SUI could gain momentum and push toward the $2.28 resistance level.

Breaking above that could open the path toward $2.41 and $2.54. If bullish momentum builds further, SUI blockchain could even test the $2.83 level—its highest since early March.

But if the market fails to hold current levels and selling pressure returns, a correction could begin. In that case, it might fall back to test the $2.02 support.

Losing that support could bring deeper downside, potentially pushing SUI toward $1.71. For now, price action is at a critical point, with both breakout and breakdown scenarios on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

5 Crucial Red Flags Investors Missed

The collapse of the MANTRA (OM) token has left investors reeling, with many facing significant losses. As analysts comb through the causes of the collapse, many questions remain.

BeInCrypto consulted industry experts to identify five critical red flags behind MANTRA’s downfall and reveal strategies investors can adopt to steer clear of similar pitfalls in the future.

MANTRA (OM) Crash: What Investors Missed and How to Avoid Future Losses

On April 13, BeInCrypto broke the news of OM’s 90% crash. The collapse raised several concerns, with investors accusing the team of orchestrating a pump-and-dump scheme. Experts believe that there were many early signs of trouble.

Yet, many overlooked the risks associated with the project.

1. MANTRA Red Flag: OM Tokenomics

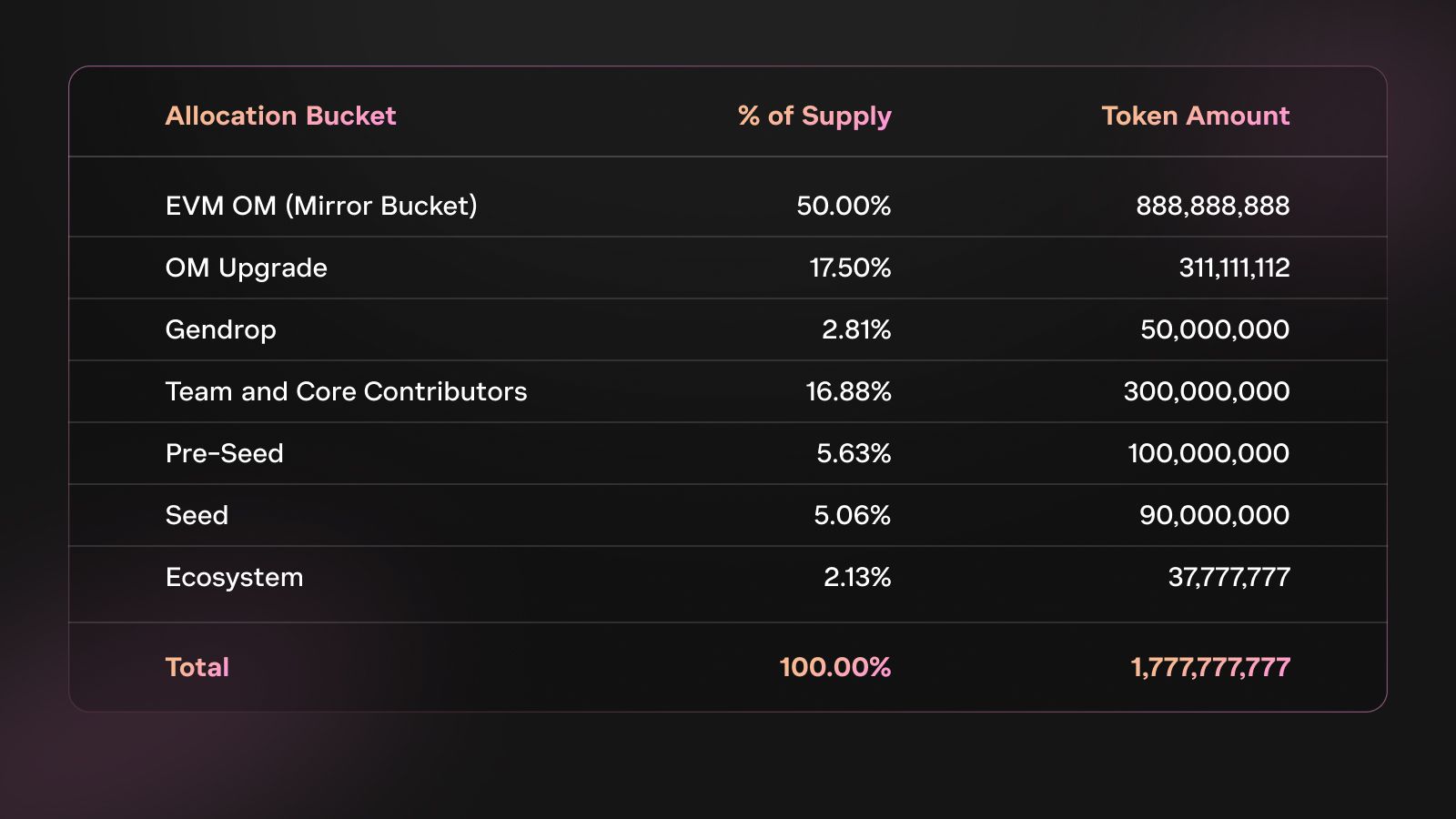

In 2024, the team changed OM’s tokenomics after a community vote in October. The token migrated from an ERC20 token to the native L1 staking coin for the MANTRA Chain.

In addition, the project adopted an inflationary tokenomic model with an uncapped supply, replacing the previous hard cap. As part of this transition, the total token supply was also increased to 1.7 billion.

However, the move wasn’t without drawbacks. According to Jean Rausis, co-founder of SMARDEX, tokenomics was a point of concern in the OM collapse.

“The project doubled its token supply to 1.77 billion in 2024 and shifted to an inflationary model, which diluted its original holders. Complex vesting favored insiders, while low circulating supply and massive FDV fueled hype and price manipulation,” Jean Rausis told BeInCrypto.

Moreover, the team’s control over the OM supply also raised centralization concerns. Experts believe this was also a factor that could have led to the alleged price manipulation.

“About 90% of OM tokens were held by the team, indicating a high level of centralization that could potentially lead to manipulation. The team also maintained control over governance, which undermined the project’s decentralized nature,” said Phil Fogel, co-founder of Cork.

Strategies to Protect Yourself

Phil Fogel acknowledged that a concentrated token supply isn’t always a red flag. However, it’s crucial for investors to know who holds large amounts, their lock-up terms, and whether their involvement aligns with the project’s decentralization goals.

Moreover, Ming Wu, the founder of RabbitX, also argued that analyzing this data is essential to uncover any potential risks that could undermine the project in the long term.

“Tools like bubble maps can help identify potential risks related to token distribution,” Wu advised.

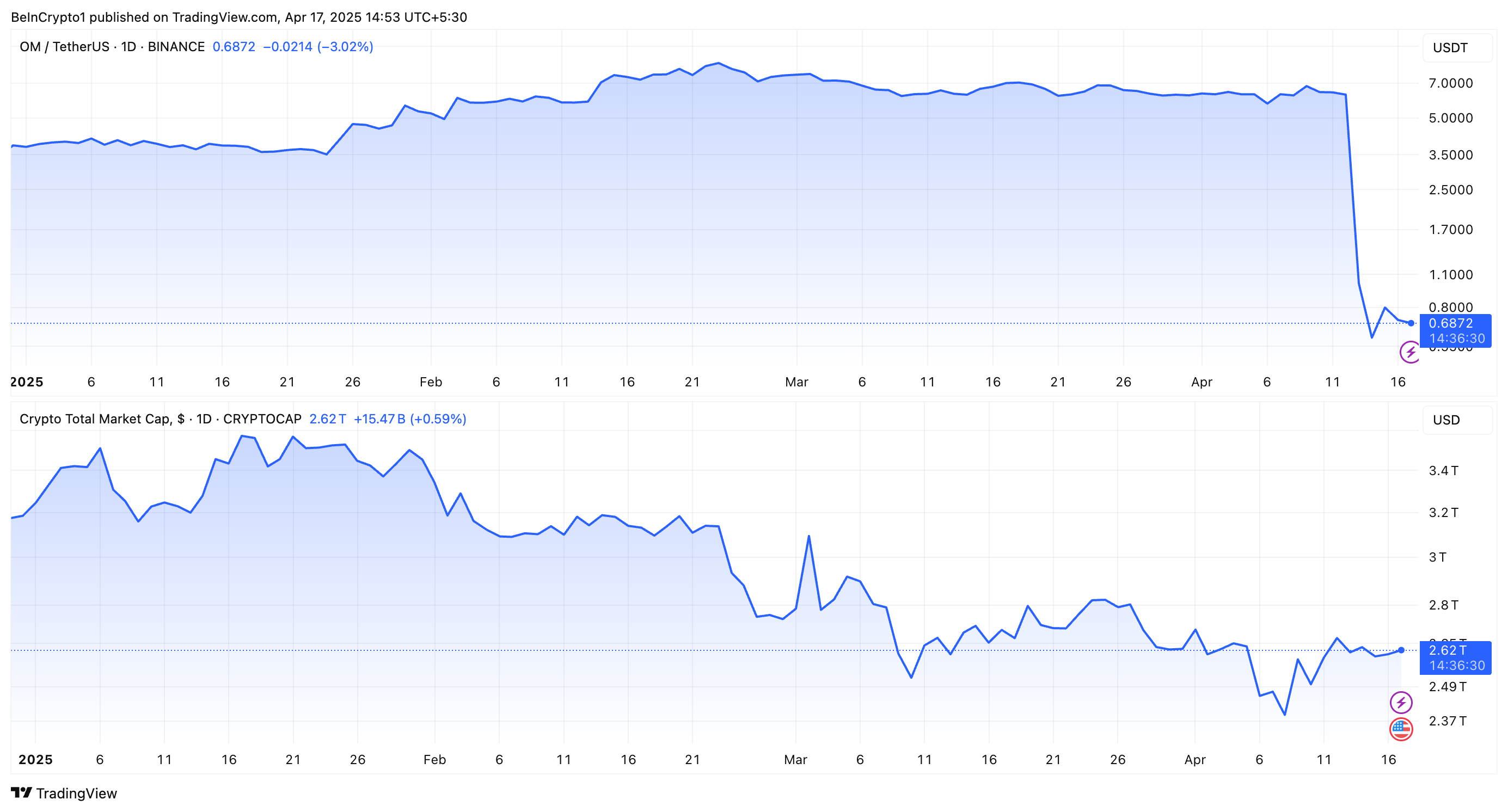

2. OM Price Action

2025 has been marked as the year of significant market volatility. The broader macroeconomic pressures have weighed heavily on the market, with the majority of the coins experiencing steep losses. Yet, OM’s price action was relatively stable until the latest crash.

“The biggest red flag was simply the price action. The whole market was going down, and nobody cared about MANTRA, and yet its token price somehow kept pumping in unnatural patterns – pump, flat, pump, flat again,” Jean Rausis disclosed.

He added that this was a clear sign of a potential issue or problem with the project. Nevertheless, he noted that identifying the differentiating price action would require some technical analysis know-how. Thus, investors lacking the knowledge would have easily missed it.

Despite this, Rausis highlighted that even the untrained eye could find other signs that something was off, ultimately leading to the crash.

Strategies to Protect Yourself

While investors remained optimistic about OM’s resilience amid a market downturn, this ended up costing them millions. Eric He, LBank’s Community Angel Officer, and Risk Control Adviser emphasized the importance of proactive risk management to avoid OM-style collapses.

“First, diversification is key—spreading capital across projects limits single-token exposure. Stop-loss triggers (e.g., 10-20% below buy price) can automate damage control in volatile conditions,” Eric shared with BeInCrypto.

Ming Wu had a similar perspective, emphasizing the importance of avoiding over-allocation to a single token. The executive explained that a diversified investment strategy helps mitigate risk and enhances overall portfolio stability.

“Investors can use perpetual futures as a risk management tool to hedge against potential price declines in their holdings,” Wu remarked.

Meanwhile, Phil Fogel advised focusing on a token’s liquidity. Key factors include the float size, price sensitivity to sell orders, and who can significantly impact the market.

3. Project Fundamentals

Experts also highlighted major discrepancies in MANTRA’s TVL. Eric He pointed out a significant gap between the token’s fully diluted valuation (FDV) and the TVL. OM’s FDV reached $9.5 billion, while its TVL was only $13 million, indicating a potential overvaluation.

“A $9.5 billion valuation against $13 million TVL, screamed instability,” Forest Bai, co-founder of Foresight Ventures, stated.

Notably, several issues were also raised regarding the airdrop. Jean Rausis called the airdrop a “mess.” He cited many issues, including delays, frequent changes to eligibility rules, and the disqualification of half the participants. Meanwhile, suspected bots were not removed.

“The airdrop disproportionately favored insiders while excluding genuine supporters, reflecting a lack of fairness,” Phil Fogel reiterated.

The criticism expanded further as Fogel pointed out the team’s alleged associations with questionable entities and ties to questionable initial coin offerings (ICOs), raising doubts about the project’s credibility. Eric He also suggested that MANTRA was allegedly tied to gambling platforms in the past.

Strategies to Protect Yourself

Forest Bai underscored the importance of verifying the project team’s credentials, reviewing the project roadmap, and monitoring on-chain activity to ensure transparency. He also advised investors to assess community engagement and regulatory compliance to gauge the project’s long-term viability.

Ming Wu also stressed distinguishing between real growth and artificially inflated metrics.

“It’s important to differentiate real growth from activity that’s artificially inflated through incentives or airdrops, unsustainable tactics like ‘selling a dollar for 90 cents’ may generate short-term metrics but don’t reflect actual engagement,” Wu informed BeInCrypto.

Finally, Wu recommended researching the background of the project’s team members to uncover any history of fraudulent activity or involvement in questionable ventures. This would ensure that investors are well-informed before committing to any project.

4. Whale Movements

As BeInCrypto reported earlier, before the crash, a whale wallet reportedly associated with the MANTRA team deposited 3.9 million OM tokens into the OKX exchange. Experts highlighted that this wasn’t an isolated incident.

“Large OM transfers (43.6 million tokens, ~$227 million) to exchanges days prior were a major warning of potential sell-offs,” Forest Bai conveyed to BeInCrypto.

Ming Wu also explained that investors should pay close attention to such large transfers, which often act as warning signals. Moreover, analysts at CryptoQuant also outlined what investors should look out for.

“OM transfers into exchanges amounted to as much as $35 million in just an hour. This represented an alert sign as: Transfers into exchanges are below $8 million in a typical hour (excluding transfers into Binance, which are typically large given the size of the exchange). Transfers into exchanges represented more than a third of the total OM transferred, which indicates a high transfer volume into exchanges,” CryptoQuant informed BeInCrypto.

Strategies to Protect Yourself

CryptoQuant stated that investors need to monitor the flows of any token into exchanges, as it could indicate increasing price volatility in the near future.

Meanwhile, Risk Control Adviser Eric He outlined four strategies to stay up-to-date when it comes to large transfers.

- Chain Sleuthing: Tools like Arkham and Nansen allow investors to track large transfers and monitor wallet activity.

- Set Alerts: Platforms like Etherscan and Glassnode notify investors of unusual market movements.

- Track Exchange Flows: Users need to track large flows into centralized exchanges.

- Check Lockups: Dune Analytics helps investors determine if team tokens are being released earlier than expected.

He also recommended focusing on the market structure.

“OM’s crash proved market depth is non-negotiable: Kaiko data showed 1% order book depth collapsed 74% before the fall. Always check liquidity metrics on platforms like Kaiko; if 1% depth is below $500,000, that’s a red flag,” Eric revealed to BeInCrypto.

Additionally, Phil Fogel underlined the importance of monitoring platforms like X (formerly Twitter) for any rumors or discussions about possible dumps. He stressed the need to analyze liquidity to assess whether a token can handle sell pressure without causing a significant price drop.

5. Centralized Exchange Involvement

After the crash, MANTRA CEO JP Mullin was quick to blame centralized exchanges (CEXs). He said the crash was triggered by “reckless forced closures” during low-liquidity hours, alleging negligence or intentional positioning. Yet Binance pointed to cross-exchange liquidations.

Interestingly, experts were slightly divided on how CEXs contributed to OM’s crash. Forest Bai claimed that CEX liquidations during low-liquidity hours worsened the crash by triggering cascading sell-offs. Eric He corroborated this sentiment.

“CEX liquidations played a major role in the OM crash, acting as an accelerant. With thin liquidity—1% depth falling from $600,000 to $147,000—forced closures triggered cascading liquidations. Over $74.7 million was wiped in 24 hours,” he mentioned.

Yet, Ming Wu called Mullin’s explanation “just an excuse.”

“Analyzing the open interest in the OM derivatives market reveals that it was less than 0.1% of OM’s market capitalization. However, what’s particularly interesting is that during the market collapse, open interest in OM derivatives actually increased by 90%,” Wu expressed to BeInCrypto.

According to the executive, this challenges the idea that liquidations or forced closures caused the price drop. Instead, it indicates that traders and investors increased their short positions as the price fell.

Strategies to Protect Yourself

While the involvement of CEXs remains debatable, the experts did address the key point of investor protection.

“Investors can limit leverage to avoid forced liquidations, choose platforms with transparent risk policies, monitor open interest for liquidation risks, and hold tokens in self-custody wallets to reduce CEX exposure,” Forest Bai recommended.

Eric He also advised that investors should mitigate risks by adjusting leverage dynamically based on volatility. If tools like ATR or Bollinger Bands signal turbulence, exposure should be reduced.

He also recommended avoiding trading during low-liquidity periods, such as midnight UTC, when slippage risks are highest.

The MANTRA (OM) collapse is a powerful reminder of the importance of due diligence and risk management in cryptocurrency investments. Investors can minimize the risk of falling into similar traps by carefully assessing tokenomics, monitoring on-chain data, and diversifying investments.

With expert insights, these strategies will help guide investors toward smarter, more secure decisions in the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoTRUMP Meme Coin Ignores $307M Unlock, Bearish Trend Holds

-

Altcoin18 hours ago

Altcoin18 hours agoLorenzo Protocol (BANK) Price Rallies 150% After This Binance Announcement

-

Market17 hours ago

Market17 hours agoDespite an 18% Drop, XRP’s Exchange Supply Hits Lows—Bullish Setup Ahead?

-

Market14 hours ago

Market14 hours agoXRP Consolidation About To Reach A Bottom, Wave 5 Says $5.85 Is Coming

-

Altcoin7 hours ago

Altcoin7 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market21 hours ago

Market21 hours agoBase Launches Strong, But Content Coins Draw Doubt

-

Altcoin23 hours ago

Altcoin23 hours agoIs Solana Forming a Death Cross Against Bitcoin?

-

Altcoin11 hours ago

Altcoin11 hours agoXRP ETF Approval Could Spark a ‘Perfect Storm’ for Ripple Coin: Expert