Market

Fantom (FTM) Price Faces Pullback After Strong 14% Weekly Gain

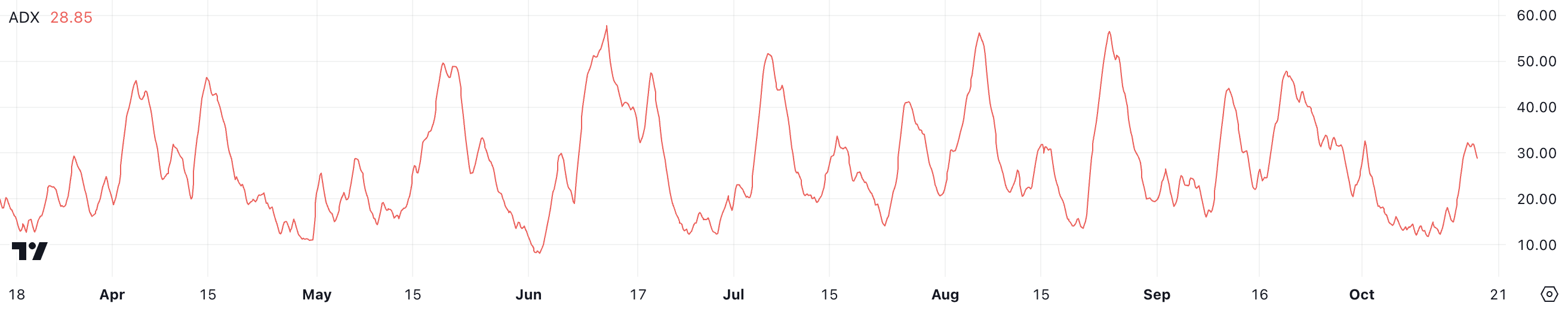

The Fantom (FTM) price has recently shown promising growth, but questions remain about how long this uptrend can last. Despite the initial surge, key indicators are starting to hint at a potential weakening of momentum. ADX values have declined, suggesting that the strong bullish trend may be losing steam.

Additionally, while the recent drop in exchange supply provided a boost, subsequent stability in this metric raises doubts about continued upward pressure. The coming days will be crucial in determining whether FTM can sustain its gains or face a reversal towards lower support levels.

Fantom Price Current Trend May Not Last

FTM’s ADX is currently at 28.85, down from 32 just a day ago. This comes after a rapid surge where the ADX rose from 15 to 32 in just two days, reflecting a strong and swift increase in trend strength.

However, the recent decline indicates that the momentum may be losing some of its force, and traders are paying close attention to see if this trend continues downward.

Read more: Fantom (FTM) Price Prediction 2024/2025/2030

The ADX, or Average Directional Index, measures the strength of a trend, regardless of whether it is bullish or bearish. It ranges from 0 to 100, with values above 20 indicating a trending market and anything above 30 signifying a strong trend. FTM’s price surged by 14% in the past seven days, driven by this strong uptrend.

However, the fact that the ADX has decreased from above the 30 threshold suggests that the current upward momentum might be weakening. If the ADX continues to fall, it could imply that the trend is losing strength, potentially signaling an end to the recent bullish rally.

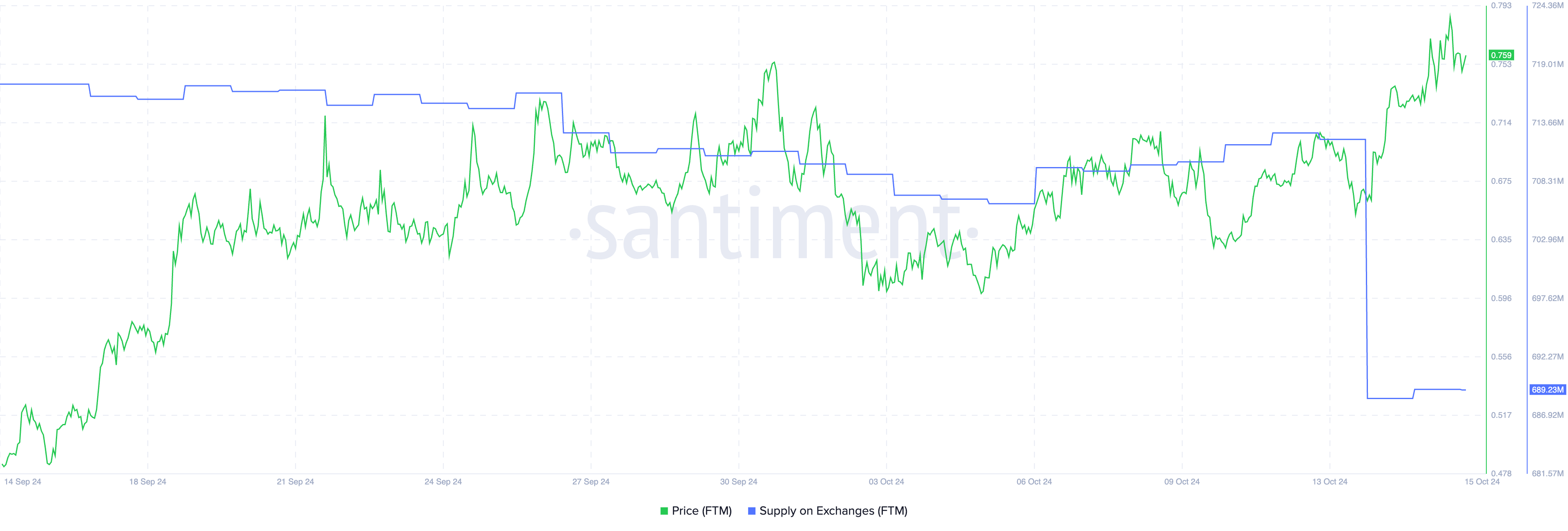

FTM Supply On Exchanges Dropped Heavily Before the Recent Surge

Between October 13 and October 14, FTM’s supply on exchanges dropped from 712 million to 688 million. This coincided with a price increase, with FTM rising from $0.66 on October 13 to $0.78 by October 15.

The reduction in exchange supply suggests that fewer tokens were readily available for selling, aligning with the subsequent price surge.

Typically, when users transfer coins to exchanges, it is considered a bearish signal, as they may be preparing to sell. Conversely, when coins are withdrawn from exchanges, it often signals bullish sentiment, indicating that holders are not planning to sell soon and might be expecting a price increase.

After the initial drop in FTM’s exchange supply, the amount has since stabilized, but it remains crucial to keep monitoring this metric. Changes in supply on exchanges can provide valuable insight into potential shifts in market sentiment.

Fantom Price Prediction: Can It Rise Back To $0.96 In October?

FTM’s EMA (Exponential Moving Averages) lines are currently bullish, with a healthy gap between the short-term and long-term lines. This indicates strong upward momentum, as the price has maintained a clear lead in the recent trend.

When short-term EMAs are positioned well above the long-term ones, it signifies that recent price action is more favorable compared to the longer average, reflecting bullish sentiment in the market.

EMA lines are used to smooth out price data by giving more weight to recent prices. This helps traders identify the direction of a trend and spot changes in momentum earlier.

Read more: 9 Best Fantom (FTM) Wallets in 2024

However, after the recent price surge, FTM’s short-term EMAs have started to curve downwards. If they cross below the long-term EMAs, it will form a “death cross,” a bearish signal that suggests a potential reversal in trend and further downside.

If such a scenario happens, FTM’s price could test support levels at $0.65 and $0.59. On the other hand, if the uptrend regains strength, FTM could continue its rise, challenging resistance at $0.76 — a level it recently failed to surpass. Breaking past that could push FTM back towards $0.85 or even $0.96, its highest price since May.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How a $7 Million Market Was Manipulated on Polymarket

Polymarket, a prediction market platform, is under fire following the most severe manipulation attack in its history.

A prediction market with a betting volume exceeding $7 million produced an erroneous outcome, leaving users with significant losses.

Inside Polymarket’s $7 Million Market Manipulation: What Went Wrong

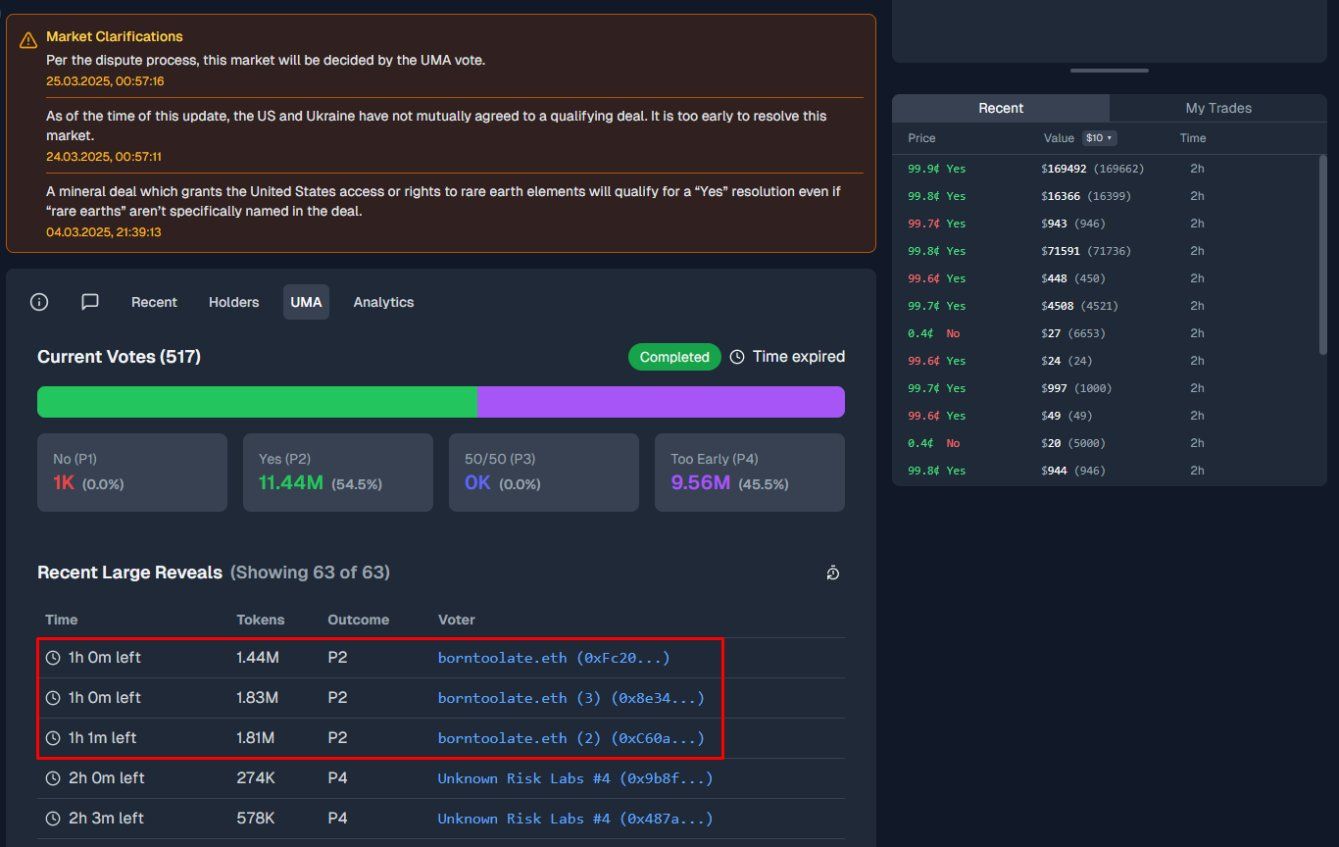

The latest controversy concerns the market: “Ukraine agrees to Trump mineral deal before April?” The market was supposed to run from February 2 to March 31, 2025.

It would resolve as “Yes” if the United States and Ukraine reached an agreement involving Ukrainian rare earth elements by the specified deadline.

Rules on the Polymarket platform explicitly stated that the resolution would be based on “official information from the US and Ukrainian governments.” However, despite no official confirmation, the market was resolved as “Yes,” leading to widespread accusations of manipulation.

“Polymarket has scammed its users once more,” a user wrote on X.

He also noted that, in the past, two markets with identical conditions were classified as “No.” Notably, they had much smaller betting volumes of $91,860 and $360,976. In contrast, the manipulated market boasted a betting volume exceeding $7 million.

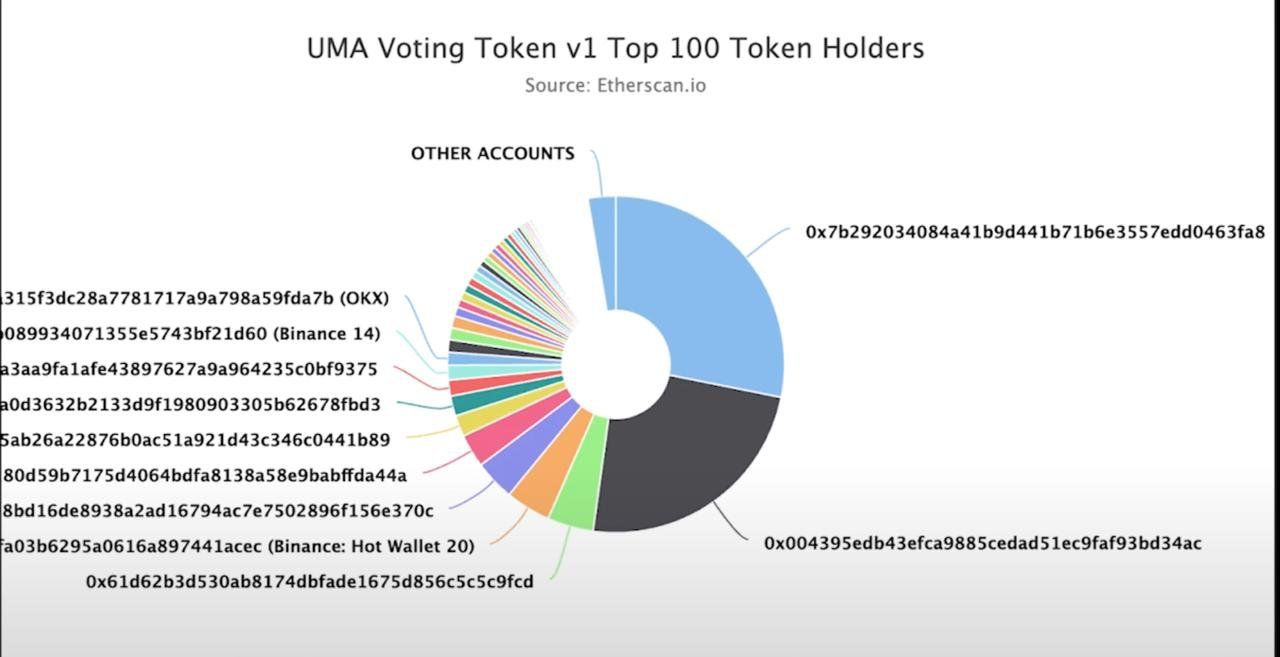

The user claimed that a group of influential users called UMA whales manipulated the outcome. He also revealed that a whale used multiple accounts to cast a large number of votes, totaling 5 million tokens, which accounted for 25% of the total votes.

Thus, the individual effectively concentrated a significant portion of the voting power in their hands, skewing the outcome in favor of the “Yes” option.

Polymarket’s response has done little to assuage user concerns. The team issued an announcement on their official Discord server, acknowledging the situation. However, they stated that they could not issue refunds to affected users because the situation was not a market failure.

“This is an unprecedented situation, and we have been in war rooms all day internally and with the UMA team to make sure this won’t happen again. This is not a part of the future we want to build: we will build up systems, monitoring, and more to make sure this doesn’t repeat itself,” the statement read.

Is Polymarket Rigged? A History of Insider Allegations

Meanwhile, this isn’t the first time Polymarket has been accused of manipulation. A detailed thread by an X user, Folke Hermansen, shed light on several similar instances.

“Polymarket is revealing itself to be revealing itself a totally fraudulent platform. Insiders write rules, place bets, and co-ordinate with verifiers to rig markets and scam their own customers for millions daily,” he posted.

Hermansen disclosed that, in early March, manipulators resolved the “Gold missing from Fort Knox” market as “No,” stealing $3.5 million. Furthermore, in another tariff-related market, he alleged that the dispute button disappeared during the 2-hour window for users to challenge the resolution. This allowed insiders to push the market to a “No” outcome.

Another example he gave was the “Will Trump say China during his crypto summit?” market. Polymarket issued a rule clarification after Trump mentioned China, retroactively declaring it didn’t count and resolving the market to “No.”

Hermansen elaborated that the manipulation of Polymarket markets happens due to a combination of factors related to UMA’s dispute resolution system and the influence of insiders.

He added that UMA resolution votes are highly concentrated, with just two whales controlling over half of the voting power. Furthermore, an individual holds up to 7.5 million of the 20 million staked UMA tokens.

Hermansen stressed that these whales are also active participants in Polymarket, placing large bets on outcomes.

“UMA is, in theory, a neutral third-party blockchain protocol which incentivizes truth-seeking. In reality, it incentivizes crowding towards whatever other people are voting for,” he stated.

According to him, the UMA system incentivizes voters to follow the majority to avoid losing their staked tokens. Thus, large holders’ actions drive voting rather than an independent search for the truth.

Additionally, he detailed that to propose or dispute a market resolution on Polymarket, users must post a bond, which is usually $750 USDC. Insiders with significant holdings can afford to stake large amounts and post bonds. Meanwhile, fear of losing their stake discourages others from challenging them.

As a result, most disputes in UMA end up with near-unanimous resolutions, often 95% or more.

“It’s an open secret that UMA whales can arbitrarily decide how markets resolve,” Hermansen claimed.

He also emphasized that the system’s design anonymizes voting and disputes. Therefore, this makes it difficult to trace who is responsible for incorrect resolutions, further enabling insider manipulation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Network Activity Indicates Bullish Momentum for ADA

Cardano’s price has surged by almost 10% over the past week amid the current broader market recovery. This surge is fueled by Cardano’s increasing network activity and long-term holding trends, indicating growing investor confidence.

With the broader market in recovery mode and on-chain fundamentals strengthening, ADA’s current setup suggests the potential for a sustained upside.

ADA Accumulation Grows as Traders Show Strong Conviction

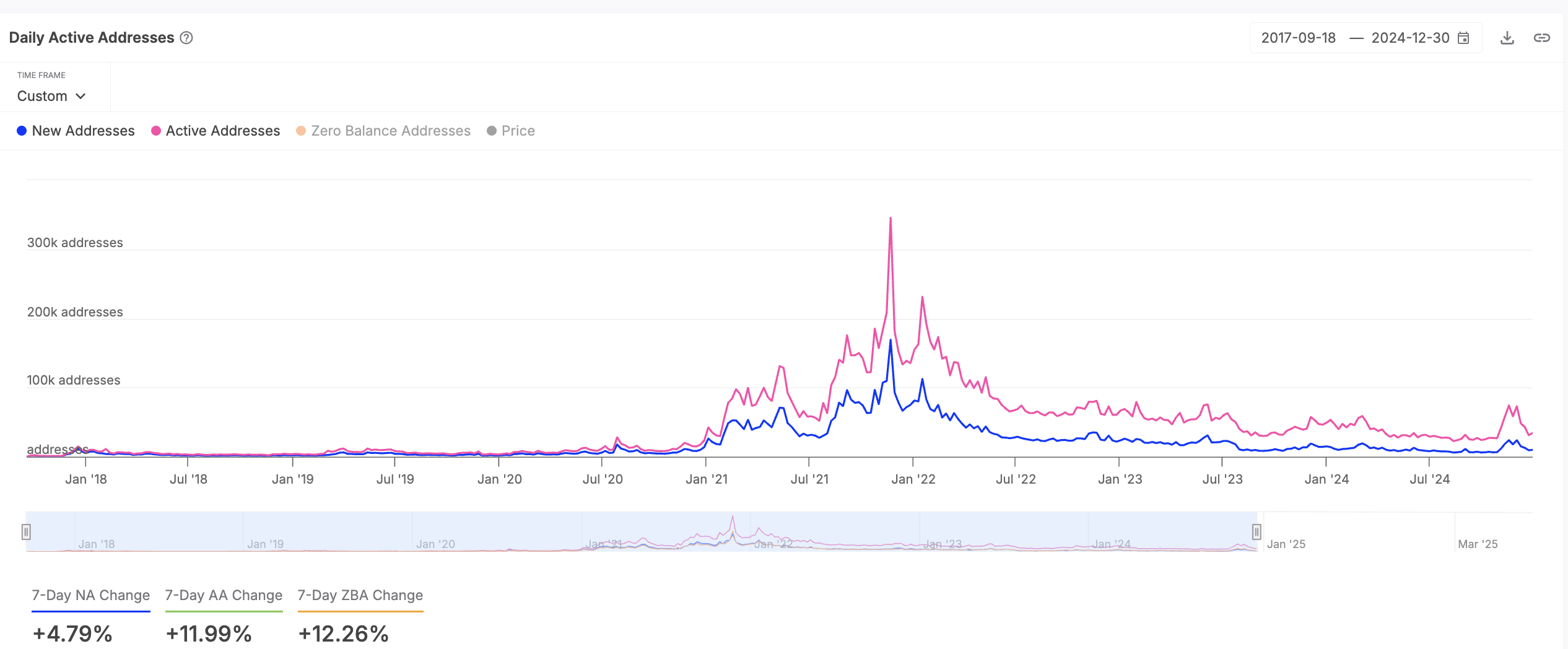

ADA’s demand has soared over the past week, as reflected by the steady surge in the daily count of active addresses on the Cardano network. According to IntoTheBlock, this has risen by 12% over the past seven days, indicating a gradual uptick in the demand for the Layer-1 coin.

This trend is a bullish signal, as it highlights growing investor interest in ADA and could drive its sustained price rally.

Moreover, new demand for the altcoin has also climbed. According to IntoTheBlock, the number of new addresses on the Cardano network has increased by 5% during the review period.

When ADA sees a gradual increase in new demand like this, it indicates the entry of new investors or traders into the market. This leads to higher trading volumes and liquidity, which in turn drives up the coin’s price.

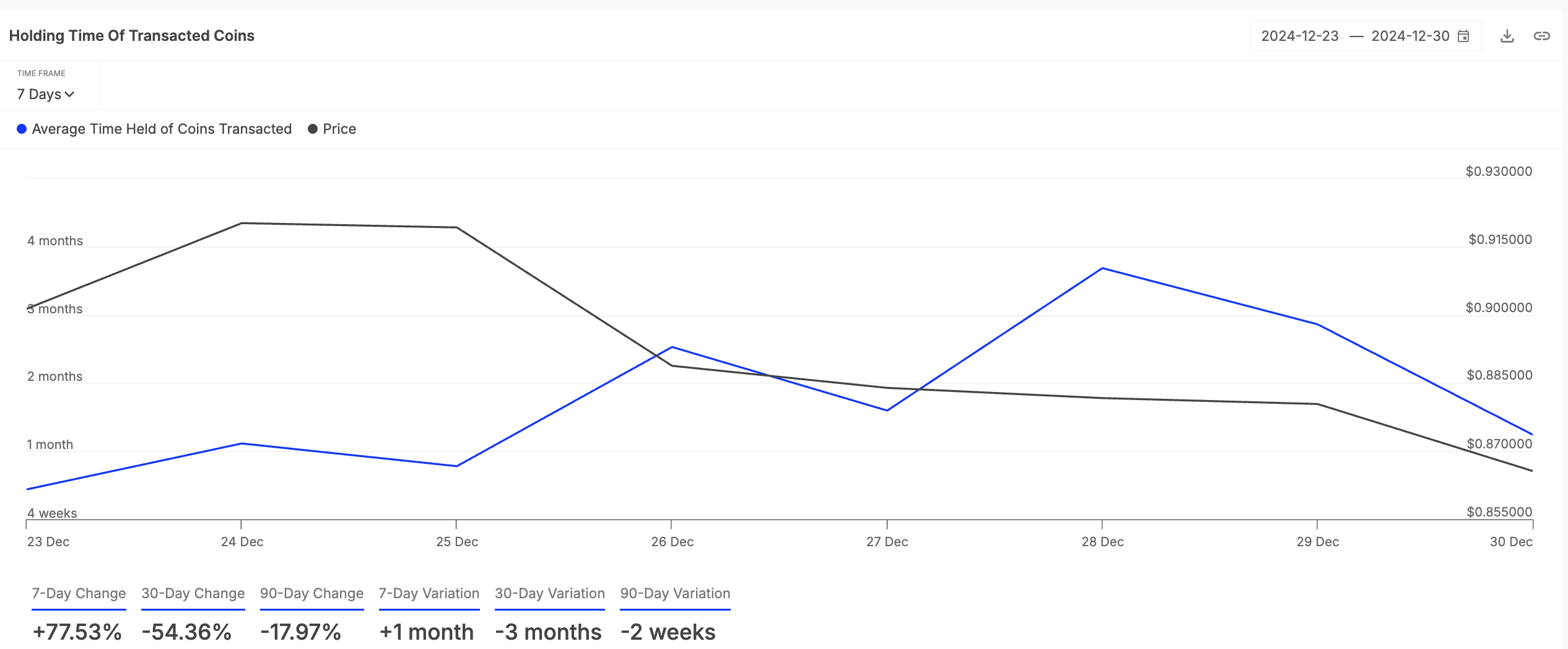

Further, ADA investors have increased their holding time, signaling that the bullish momentum toward the altcoin is growing. According to IntoTheBlock, it has increased by 78% over the past week.

An asset’s holding time measures the average duration its coins/tokens are held before being sold or transferred. This bullish trend marks an ADA accumulation phase, with traders less inclined to sell.

It reflects strong investor conviction, as ADA investors choose to hold on to their coins rather than sell. Also, it could help reduce the selling pressure in the ADA market, driving up its value in the short term.

ADA Bulls Target Higher Gains

ADA trades at $0.76 as of this writing, extending its gains by 4% over the past day. On the daily chart, the coin’s Relative Strength Index (RSI) is in an upward trend at 52.11, confirming the buying activity.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. Conversely, values below 30 indicate that an asset is oversold and due for a rebound.

At 52.11 and climbing, ADA’s RSI readings suggest strengthening bullish momentum as buying pressure builds. If accumulation continues, the coin’s price could reach $0.97.

However, if profit-taking commences, this bullish projection would be invalidated. In that scenario, ADA’s price could dip to $0.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Reshapes Listings with Binance Wallet’s TGEs Approach

Instead of directly listing tokens on the Binance exchange as before, Binance has recently implemented a new method through Binance Wallet.

Accordingly, the exchange has shifted from large-scale initial token offerings to a secondary listing model after hosting Token Generation Events (TGEs) through Binance Wallet.

The Secondary Listing Model

So far this year, five projects have been publicly launched on Binance Wallet. It facilitated the sales of projects, including Particle Network (PARTI), Bedrock (BR), and Bubblemaps (BMT).

It appears that Binance is reducing the direct listing of projects it deems to have potential. Instead, it is adopting a secondary listing model through other components within its ecosystem.

“Binance has pivoted away from doing huge initial launches with big Day-1 selling pressure, while doing more secondary listing shortly after running TGE campaign on Binance Wallet,” a user on X observed.

Binance does not list the tokens immediately after the TGE phase amid the selling pressure. Instead, it allows users to sell first on Binance Wallet, PancakeSwap, or other centralized exchanges (CEXs). This ensures that Binance users who did not participate in the TGE are not affected by price drops.

Finally, Binance can list the token when its valuation is lower, and selling pressure has decreased. Projects with strong capital may have already bought back their tokens at a low price, and at this point, the listing can create a new wave of price increases.

The impressive performance of these projects after TGE triggers a FOMO (Fear of Missing Out) effect, bringing numerous benefits to Binance’s ecosystem. This includes increasing the Total Value Locked (TVL) on the BNB Chain as new assets are issued, attracting new users to the Binance Wallet, and boosting demand for BNB purchases.

X user Ahboyash commented that the token sale on Binance Wallet is part of a 4-stage strategy for new projects. The ultimate goal of this strategy is to list on Binance Futures and eventually aim for a Binance Spot listing.

The user also cited MyShell as an example. The project conducted its TGE Offering on Binance Wallet, then listed on Binance Alpha, and finally achieved a Binance Spot listing.

Impressive Performance of Binance Wallet TGE Projects

Thanks to this secondary listing model, projects conducting TGEs through Binance Wallet have shown strong performance. Data from icoanalytics indicates that all five projects launched via Binance Wallet in 2025 have achieved ROI ranging from 2.3x to 14.7x, outperforming projects on Binance Alpha.

This strategy has effectively reduced users’ risk and optimized the benefits for Binance ecosystem components, including BNB Chain and Wallet. As a result, Binance Wallet’s daily trading volume surged to $90.5 million on March 18. This represented a 24x increase from early March.

However, users on other CEXs may experience losses due to initial selling pressure. Additionally, if a project fails to develop successfully, both Binance and investors could face negative consequences.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoUptrend Resumes After A Healthy Pullback

-

Altcoin21 hours ago

Altcoin21 hours agoCBOE Files 19b-4 For Fidelity’s Solana ETF With US SEC

-

Altcoin23 hours ago

Altcoin23 hours agoBlackRock’s BUIDL Launches On Solana Signaling Rising Institutional Adoption

-

Market23 hours ago

Market23 hours agoCardano Holders Refuse To Liquidate, Support Price Rise to $0.85

-

Market17 hours ago

Market17 hours agoTop 3 PumpFun Meme Coins to Watch Before March Ends

-

Market16 hours ago

Market16 hours agoSEC Will Return $75 Million to Ripple in the XRP Lawsuit

-

Market24 hours ago

Market24 hours agoPumpSwap’s Total Trading Volume Surpasses $1 Billion

-

Altcoin17 hours ago

Altcoin17 hours agoSolana Co-Founder Challenges Layer 2s—Are They Even Needed?