Market

Ethereum Realized Cap Soars to All-Time High, ETH Bears Beware

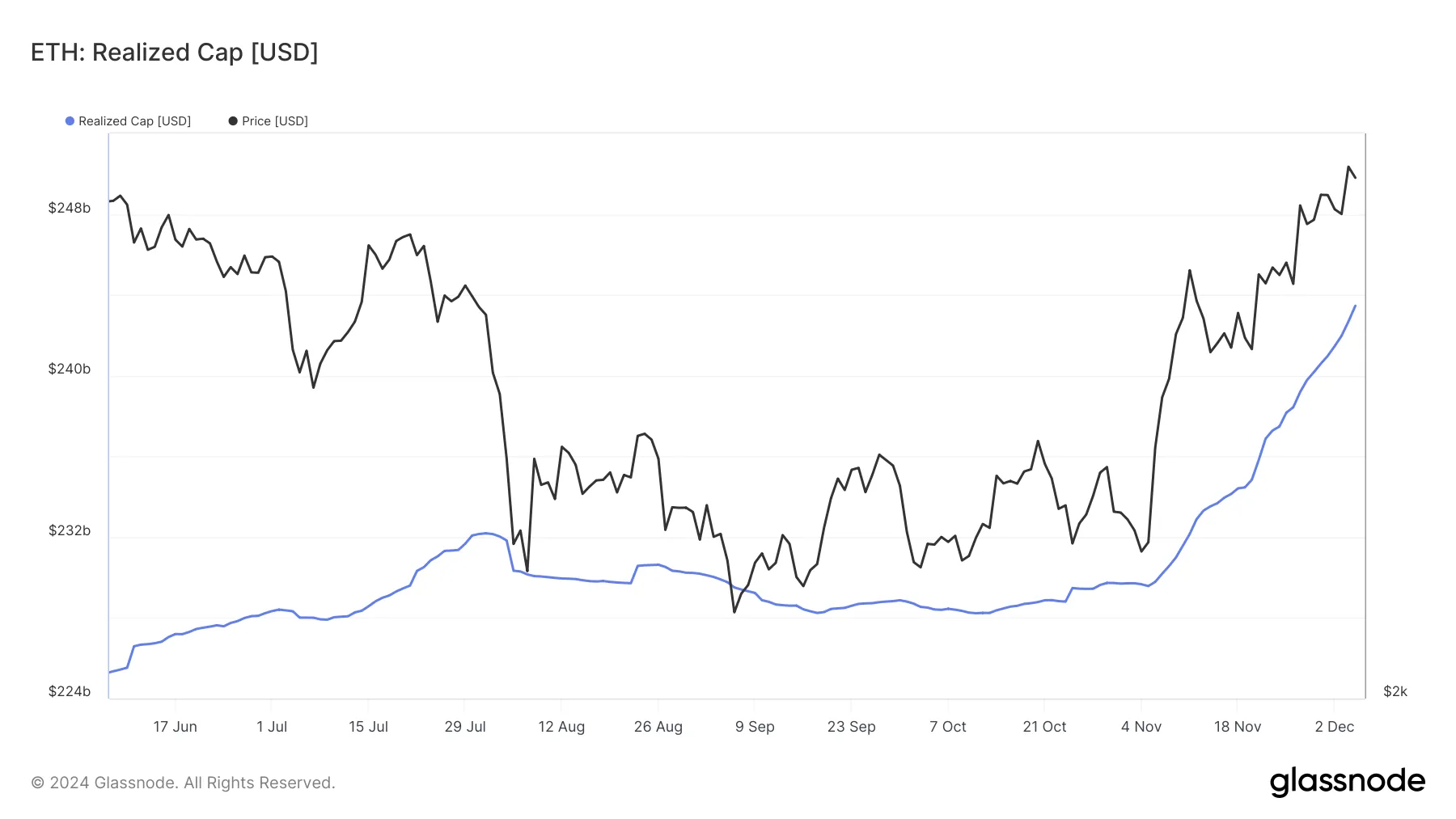

Ethereum Realized Cap, which faced a notable downturn between August and November, has hit a new all-time high of $243.45 billion, according to Glassnode data. This development comes amid ETH’s price rally to $3,800.

Based on historical data, the rise in Realized Cap is a sign of a bullish trend. Hence, this milestone could spell trouble for traders who are bearish about Ethereum’s price action.

Ethereum Remains Undervalued Amid Latest Milestone

Ethereum’s Realized Cap — a key on-chain indicator — has shown a notable increase, hinting at a potential for significant price appreciation. The metric, which considers the price at which each coin last moved, helps identify market tops and bottoms.

An increase in Realized Cap indicates that coins last moved at lower prices and are being spent, suggesting that ETH is being repriced higher. On the other hand, a decrease in Realized Cap reflects spending at higher prices, signaling the potential for a decline.

Therefore, Ethereum’s rising Realized Cap suggests growing confidence among holders and a repricing of ETH’s value. Further, if this trend remains the same, it will align with historical patterns that precede significant price surges.

Besides this metric above, Ethereum’s Market Value to Realized Value (MVRV) Long/Short Difference also aligns with the thesis. As the name implies, the MVRV Long/Short Difference shows if long-term holders have more unrealized profits at the current value or if short-term holders do.

When the metric is negative, it means that short-term holders have the upper hand. In most cases, this is bearish for the price. However, according to Santiment, Ethereum’s MVRV Long/Short Difference has climbed to the positive zone at 5.67%, indicating that the trend is bullish and the cryptocurrency is undervalued.

The last time the cryptocurrency followed such a trend, ETH bears bore the brunt as the price rallied toward $4,100. Thus, if this movement continues, then Ethereum’s value could be higher in the short term.

ETH Price Prediction: $4,200 Looms

An evaluation of the daily ETH/USD chart shows that the cryptocurrency is following a similar trend, which saw it reach a yearly high in June. During that period, Ethereum’s price initially dropped from $2,770 to $2,200 before it climbed above $4,000 months later.

Between October and the first week of November, ETH decreased from $2,700 to $2,300 before its recent rebound. The Relative Strength Index (RSI), which measures momentum, follows the same pattern.

If this trend continues, then ETH could rise to $4,200 in the short term. Should bulls sustain the move, then the crypto could climb as high as $4,500.

However, if the Ethereum Realized Cap drops and buying pressure subsides, this trend might change, and the price could slip below $3,500.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MANEKI Leads With 333% Rally

The crypto market is going nowhere at the moment, stabilizing instead of rallying or crashing. However, this is not stopping meme coins from noting extravagant rallies as displayed by MANEKI.

BeInCrypto has analyzed two other meme coins that, while not experiencing explosive growth, are still generating enough market movement to make them important assets to watch.

MAGIC•INTERNET•MONEY (Bitcoin) (MIM)

- Launch Date – February 2025

- Total Circulating Supply – 21 Billion MIM

- Maximum Supply – 21 Billion MIM

- Fully Diluted Valuation (FDV) – $65.54 Million

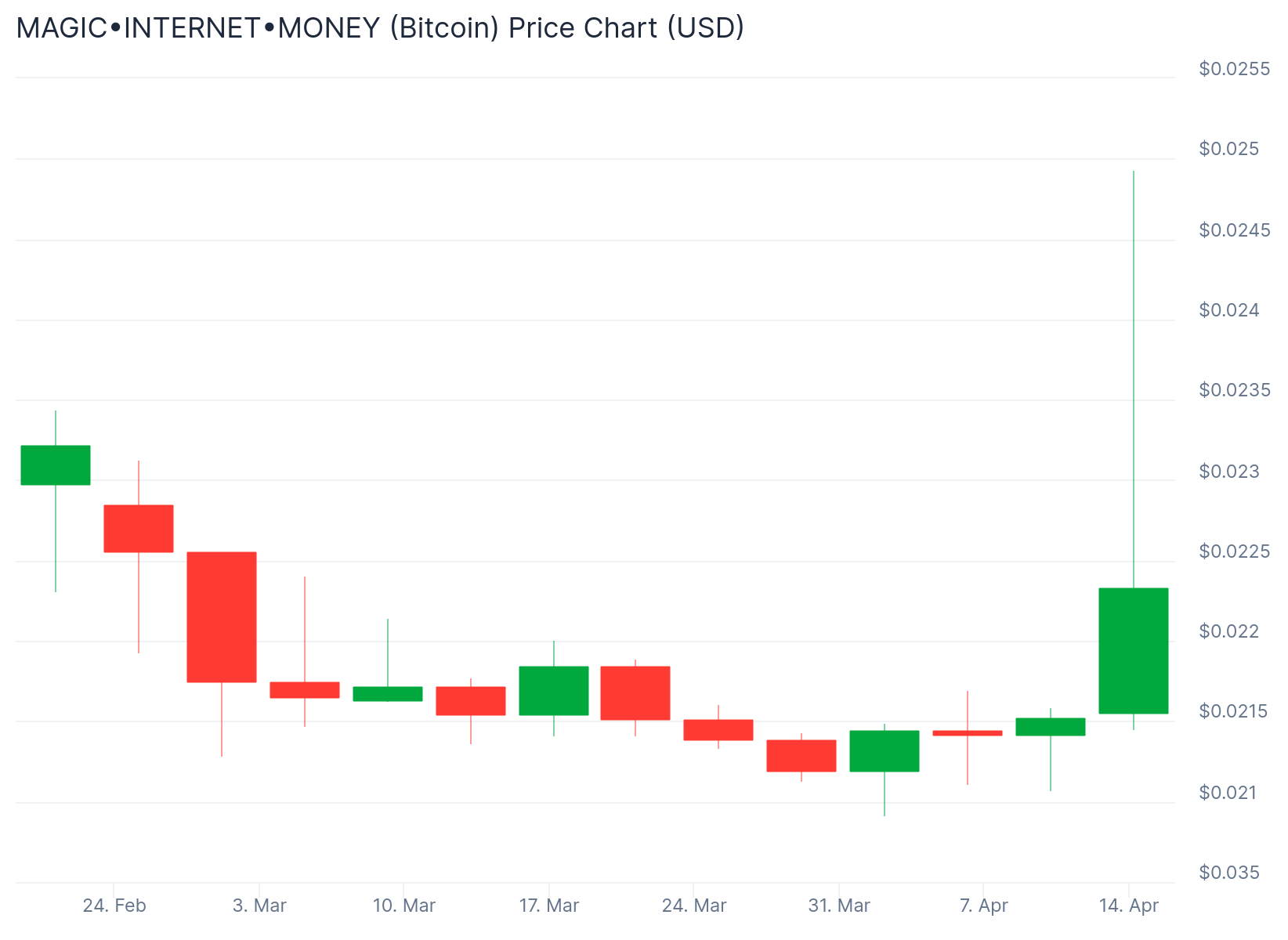

MIM experienced an eventful week with sharp rallies early on, followed by slight declines in the past few days. Currently trading at $0.003026, this meme coin has garnered attention due to its performance as a Bitcoin-based token.

Despite recent declines, MIM has surged by 64% over the past week. The token’s unique positioning as a meme coin on Bitcoin adds to its intrigue, especially as meme coins expand into different blockchain ecosystems. This trend indicates growing investor interest and speculation in such assets.

MIM remains primed for further gains, potentially reaching $0.004000 or higher. However, if investors decide to sell, the price could fall back to $0.00200, reflecting the volatility of meme coins. Traders should carefully monitor market sentiment and any signs of selling pressure.

Shiba Inu (SHIB)

- Launch Date – August 2020

- Total Circulating Supply – 589.2 Trillion SHIB

- Maximum Supply – 589.5 Trillion SHIB

- Fully Diluted Valuation (FDV) – $7.01 Billion

Shiba Inu’s price is currently at $0.00001189, continuing its downtrend since the start of the year. While the meme coin shows signs of potential recovery, the reduced burn rate has contributed to limiting upward momentum. A continuation of this trend could hinder any substantial gains for SHIB.

The burn rate for Shiba Inu has dropped significantly, falling by 98% over the last 24 hours. A high burn rate usually helps reduce inflation and supports price growth. The current decline in burn rate presents challenges, as it reduces demand and further limits SHIB’s ability to recover in the short term.

SHIB is holding above the support level of $0.00001141 and may continue to consolidate around this price point. However, if it breaches the $0.00001252 resistance, it could invalidate the bearish-neutral outlook.

Small Cap Corner : MANEKI (MANEKI)

- Launch Date – April 2024

- Total Circulating Supply – 8.85 Billion MANEKI

- Maximum Supply – 8.88 Billion MANEKI

- Fully Diluted Valuation (FDV) – $38.45 Million

MANEKI has emerged as one of the top-performing tokens this month, gaining 33% over the past week. In the last 24 hours alone, the meme coin surged by more than 30%, showing strong potential for further upward movement. The growth in the cat-themed token market is fueling this momentum.

Despite being a small-cap token, MANEKI has caught the attention of investors. The growing interest in cat-themed tokens has added to its appeal. Currently trading at $0.0043, the coin is on the verge of breaching the $0.0047 resistance. A successful breakthrough could push the price to $0.0055.

However, if the price fails to breach $0.0047, the coin could fall back to $0.0036. Losing this support would invalidate the bullish thesis, causing a drop to $0.0022. Investors need to monitor the price closely to determine the next potential move for MANEKI.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Poised for $90,000 Surge

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts have to say about Bitcoin’s (BTC) price outlook. Key investment strategies are driving the next directional bias for the pioneer crypto.

Is a $90,000 Breakout Imminent for Bitcoin?

Crypto markets continue to reel from Trump-infused volatility, which weighs heavily on investor sentiment. Traders and investors are bracing for macroeconomic headwinds that continue to temper modest gains.

Among them is Trump’s tariff chaos, which provoked China’s retaliatory stance. Adding another layer of complexity to the US crypto news, Federal Reserve (Fed) chair Jerome Powell ruled out a near-term rate cut, citing economic uncertainty and risks from trade policy.

Reports also indicate that China is liquidating seized cryptocurrencies through private firms to support local government finances amid economic struggles.

The macro context also includes Jerome Powell’s hawkish Federal Reserve (Fed) stance, which ruled out a near-term rate cut.

Amidst this uncertainty, investors may delay allocating capital to high-volatility assets until the macroeconomic outlook stabilizes.

This likely explains Bitcoin’s stunted outlook, oscillating between the $80,000 and $90,000 psychological levels.

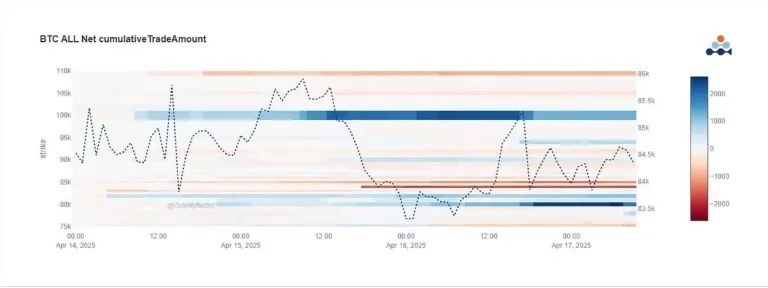

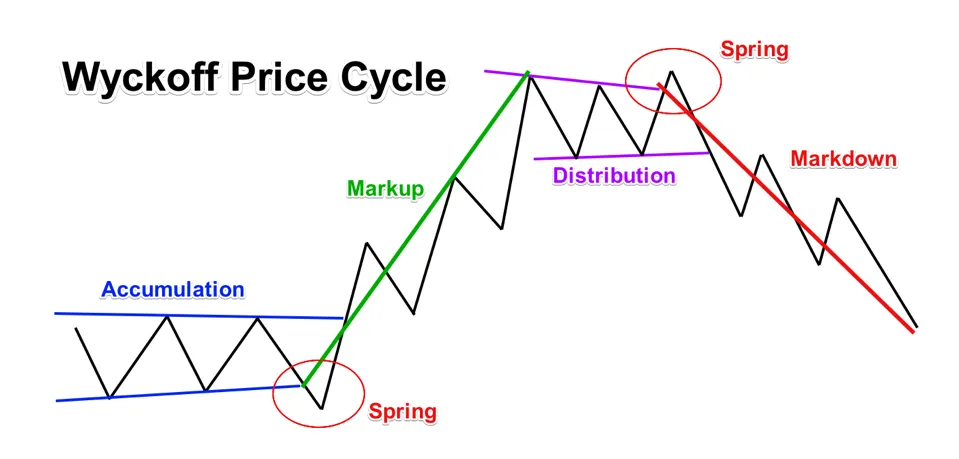

However, despite the concerns, analysts are still optimistic, citing key investment or trading strategies. BeInCrypto contacted Blockhead Research Network (BRN) analyst Valentin Fournier, who alluded to the Wyckoff price cycle.

“Our base case remains an accumulation phase, with occasional dips likely before Bitcoin can make a clean break above the $89,000–$90,000 resistance,” Fournier told BeInCrypto.

The Wyckoff Price Cycle, developed by Richard Wyckoff, is a technical analysis framework to identify market trends and trading opportunities. It consists of four phases:

- Accumulation: Where smart money buys at low prices, often marked by a “spring” (a false breakdown).

- Markup: A bullish phase with rising prices.

- Distribution: Where smart money sells at highs, also featuring a “spring” (false breakout).

- Markdown: A bearish phase with declining prices.

Fournier added that because Bitcoin dominance continues to rise, this suggests altcoins could continue underperforming in the short term.

He also noted that, in contrast to Bitcoin’s strength, trade tensions have affected traditional markets more.

“This is highlighted by Nvidia’s decline following new export restrictions on chips to China,” he said.

What Does Options Data Say?

If the accumulation phase thesis is true, it aligns with a recent analysis by Deribit’s Tony Stewart, highlighting trader sentiment favoring the upside.

The bullish cohort is buying $90,000 to $100,000 Calls, suggesting bets on a price rise for Bitcoin. However, others are bearish, buying $80,000 Puts and selling $100,000+ Calls, indicating they expect a decline or hedging.

Likewise, funding strategies reveal bullish traders are rolling up positions from $84,000 to $90,000 Calls and selling lower Puts ($75,000) to finance their bets. This indicates confidence in a near-term rally.

Chart of the Day

Traders analyze these repeating phases’ price action, volume, and market structure. Based on that, they can spot reversals and time entries or exits while understanding institutional behavior.

Byte-Sized Alpha

- Bitcoin whales withdrew over $280 million from exchanges in one day, signaling a bullish move toward cold storage amid market volatility.

- Gary Gensler warns that many altcoins lack solid fundamentals, and their value is driven more by sentiment, making them unsustainable.

- CEO Richard Teng confirms that Binance advises global governments on crypto policy and helps countries establish crypto reserves.

- Coinbase forecasts short-term crypto volatility through mid-May 2025, citing economic pressures and trade policy uncertainties.

- Ethereum’s dominance has dropped to 7.3%, hitting a 5-year low, which analysts view as a rare long-term buying opportunity.

- A16z urges the SEC to modernize crypto custody rules, advocating for RIAs to self-custody digital assets under clear safeguards.

- Bitcoin struggles below $85,000, and open interest remains stagnant below $36 billion, indicating indecision among traders. Positive funding rates hint at renewed optimism.

- Base reveals ambitious Q2 roadmap only hours after a meme coin, allegedly promoted by insiders, triggered a trading frenzy and abrupt collapse.

Crypto Equities Pre-Market Overview

| Company | At Close April 16 | Pre-Market Overview |

| Strategy (MSTR) | $311.66 | $315.50 (+1.31%) |

| Coinbase Global (COIN) | $172.21 | $174.10 (+1.10%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.58 | $15.15 (-2.69%) |

| MARA Holdings (MARA) | $12.32 | $12.40 (+0.65%) |

| Riot Platforms (RIOT) | $6.36 | $6.41 (+0.79%) |

| Core Scientific (CORZ) | $6.59 | $6.68 (+1.37) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

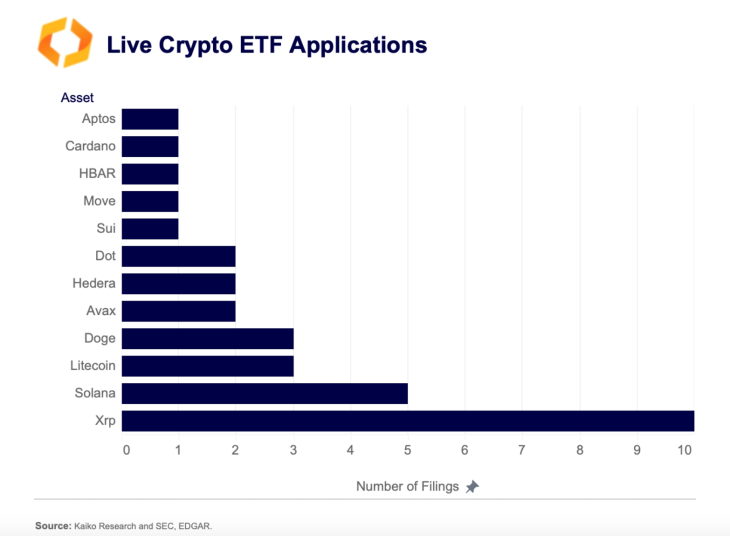

XRP remains one of the most popular coins in the market, with a cult-like community that has supported it for years. With the bullish sentiment surrounding it, the altcoin has performed quite well and continues to inspire support. The most recent developments for XRP have been the ETF filings that suggest it might be the next altcoin to get an SEC nod after Ethereum. The number of filings also puts it well ahead of investor favorites such as Solana and Dogecoin in the running for the next ETF approval.

XRP ETF Filings Climb To 10

XRP ETF filings have been coming out of the market over the past year, especially with the approvals of Ethereum Spot ETFs. These ETFs are expected to give institutional investors an official vehicle to get proper exposure to the market. As Bitcoin and Ethereum ETFs have been done and dusted, issuers have looked to other large cap altcoins to bring into the market.

Related Reading

The next favorites on the list have been XRP, in addition to heavy hitters such as Solana, Dogecoin, and Litecoin. However, in the race, XRP has clearly differentiated itself in terms of interest, boasting twice as many filings as any other altcoin.

According to data from Kaito Research, there are currently 10 XRP ETF filings pending approval or rejection from the SEC. In contrast, there are five Solana ETF filings, 3 Litecoin filing, and 3 Dogecoin filings. This shows clearly that interest in XRP as the next altcoin to gain ETF approval is the highest.

Additionally, the SEC has acknowledged the XRP ETF filings from industry leaders such as Grayscale. There are also filings from ProShares, Franklin Templeton, Bitwise, 21Shares, among others. However, BlackRock has not made a move to file for an XRP ETF despite leading the Bitcoin and Ethereum ETF campaigns.

Nevertheless, the filings for XRP ETFs remain a big deal for the altcoinm and their approval could trigger another wave of price hikes.

ETFs And The SEC Battle Conclusion

For many, the major hindrance to an SEC approval of an XRP ETF was the ongoing battle between the crypto firm and the regulator, which began in 2020. However, in March 2025, Ripple CEO Brad Garlinghouse announced that the case was officially over.

Related Reading

With this development, expectations that the regulator will look favorably upon an XRP ETF are high. If the ETFs are approved, even with a fraction of the Bitcoin ETF volumes, the XRP price is expected to explode in response, with some analysts predicting that the altcoin’s price could rise to the double-digits.

Featured image from Dall.E, chart from TradingView.com

-

Market23 hours ago

Market23 hours agoHow It’s Impacting the Network

-

Altcoin21 hours ago

Altcoin21 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market15 hours ago

Market15 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Market22 hours ago

Market22 hours agoRaydium’s New Token Launchpad Competes with Pump.fun

-

Market21 hours ago

Market21 hours agoPi Network Drops10% as Outflows Surge, Death Cross Looms

-

Market18 hours ago

Market18 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Ethereum18 hours ago

Ethereum18 hours agoOver 1.9M Ethereum Positioned Between $1,457 And $1,598 – Can Bulls Hold Support?