Market

Dogizen ICO hits $4m as Standard Chartered predicts BTC at $500k

Key takeaways

- Standard Chartered predicts that Bitcoin’s price could hit $500k before Trump leaves office.

- Dogizen’s ICO has surpassed $4m and is now in its sixth stage.

BTC to hit $500k in 2028: Standard Chartered

Bitcoin is trading close to $100,000 following its excellent performance last year. However, Standard Chartered’s Geoffrey Kendrick expects it to reach the $500,000 mark by the end of 2028, driven by improved investor access and a decline in long-term volatility.

According to the analyst, the current choppy market conditions might not hamper Bitcoin’s long-term outlook. Kendrick added that access to the crypto market is improving under Donald Trump, which could inject fresh capital into Bitcoin.

What is Dogizen?

With Bitcoin expected to hit $500k in four years, altcoins could go on an even bigger run during that period. One altcoin that is building a strong community and use case is Dogizen.

Dogizen sets the record as the first Telegram ICO. This unique project allows investors to partake in the ICO via the Dogizen Telegram mini app. It is a tap-to-earn project that directly competes with Catizen, the popular cat-themed game on the Telegram app.

According to their whitepaper, Dogizen will keep friends connected and together through Telegram. In the game,m players can collect Treatz (Dogizen coins), connect with friends through refurrals, fetch flights, and retrieve passport stamps as they explore new destinations. The team is currently working on map expansions and new mini-games.

Dogizen ICO nears completion

According to the Dogizen website, the ICO ends in roughly 28 hours, after which the token will list on centralised and decentralised exchanges. As the first Telegram ICO, Dogizen is working to provide exclusive perks for players and seamless deployment for developers.

Its native $Treatz token will power various activities within the ecosystem. Users can spend their coins in multiple game worlds. Furthermore, with a large audience on an active game (over 1 million active players), Dogizen has already started delivering on its roadmap and is taking things to the next level.

By building a strong community, Dogizen ensures its presale is a success. It will also leverage its community to ensure further roadmap progression is successful. In the second phase, Dogizen will unveil its launchpad, expand the Dogizen gaming arcade, and introduce the developer SDK.

Dogizen’s ICO hits $4m

The Dogizen ICO is currently in its sixth stage and is set to end soon. The project has raised over $4 million from investors. According to the website, investors can purchase the $Treatz token using various cryptocurrencies, including Ether, USDC, USDT, BNB, and SOL. Dogizen also has a card option for those who wish to pay using fiat currencies.

In the current stage, $Treatz is going for $0.000089 and is set to increase to $0.000094 in the next stage. Dogizen lets investors purchase the $Treatz token via the Dogizen Telegram mini-app. Simply access the Dogizen mini-app on Telegram, navigate to the buy menu, enter the amount, confirm the purchase, and complete the transaction.

Is it too late to buy the $Treatz token?

No, it is not. The Dogizen ICO is still ongoing and represents an excellent opportunity for investors to invest early in the project. As the first Telegram ICO, Dogizen is working to expand beyond its current tap-to-earn feature. The developers are working to introduce the Dogizen launchpad, expand the gaming arcade, and launch the developer SDK.

Dogizen is a dog-themed memecoin that will offer various utilities to users. Its native $Treatz token could surge higher once it lists on exchanges and is used to power activities within the Dogizen ecosystem.

Market

Asia’s First XRP Investment Fund is Here, Backed by Ripple

HashKey Capital has launched the HashKey XRP Tracker Fund, the first fund in Asia focused exclusively on tracking the performance of XRP.

The fund is now open to professional investors. Ripple is backing the initiative as an early investor.

Institutional Interest in XRP Investment Continues to Grow

According to HashKey, XRP offers a faster and more cost-effective alternative to traditional cross-border payment systems. The new tracker fund aligns with HashKey Capital’s goal of connecting conventional finance with digital asset markets.

The fund allows investors to subscribe using either cash or in-kind contributions. Investors can redeem or subscribe to shares on a monthly basis.

CF Benchmarks, known for its role in global ETF markets, will provide the fund’s benchmark.

“XRP stands out as one of the most innovative cryptocurrencies in today’s market, attracting global enterprises who use it to transact, tokenize, and store value. With the first XRP Tracker Fund available in the region, we simplify access to XRP, catering to the demand for investment opportunities in the very best digital assets,” said Vivien Wong, Partner at HashKey Capital.

Most recently, Ripple acquired prime brokerage platform Hidden Road for $1.25 billion. It was one of the largest acquisition deals in the crypto and blockchain space.

Earlier today, Hidden Road secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA).

Meanwhile, XRP continues to gain traction with institutional investors. Standard Chartered recently forecast that XRP could surpass Ethereum by 2028, citing increased demand for efficient cross-border payment solutions and growing disruption in global trade.

“XRP is uniquely positioned at the heart of one of the fastest-growing uses for digital assets – facilitation of cross-border and cross-currency payments. In this way, XRPL is similar to the main use case for stablecoins such as Tether. This stablecoin use has grown 50% annually over the past two years, and we expect stablecoin transactions to increase 10x over the next four years. We think this bodes well for XRPL’s throughput growth, given the similar use cases for stablecoins and XRPL,” Geoff Kendrick, Standard Chartered’s Head of Digital Assets Research, told BeInCrypto.

Interest in XRP ETFs is also increasing. Teucrium Investment Advisors recently received NYSE Arca approval for the Teucrium 2x Long Daily XRP ETF (XXRP), the first leveraged XRP ETF in the United States.

Also, attention is now turning to spot XRP ETFs. Grayscale and 21Shares are both awaiting decisions from the SEC on their XRP-based products.

The SEC has up to 240 days to review the Grayscale XRP Trust and the 21Shares Core XRP Trust, with final deadlines set for October 18 and 19, 2025.

XRP’s price has declined by nearly 20% over the past month, but institutional confidence remains high.

Ripple recently confirmed progress in resolving its long-standing legal battle with the SEC. A joint motion to pause court proceedings was approved, giving both parties 60 more days to finalize a settlement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

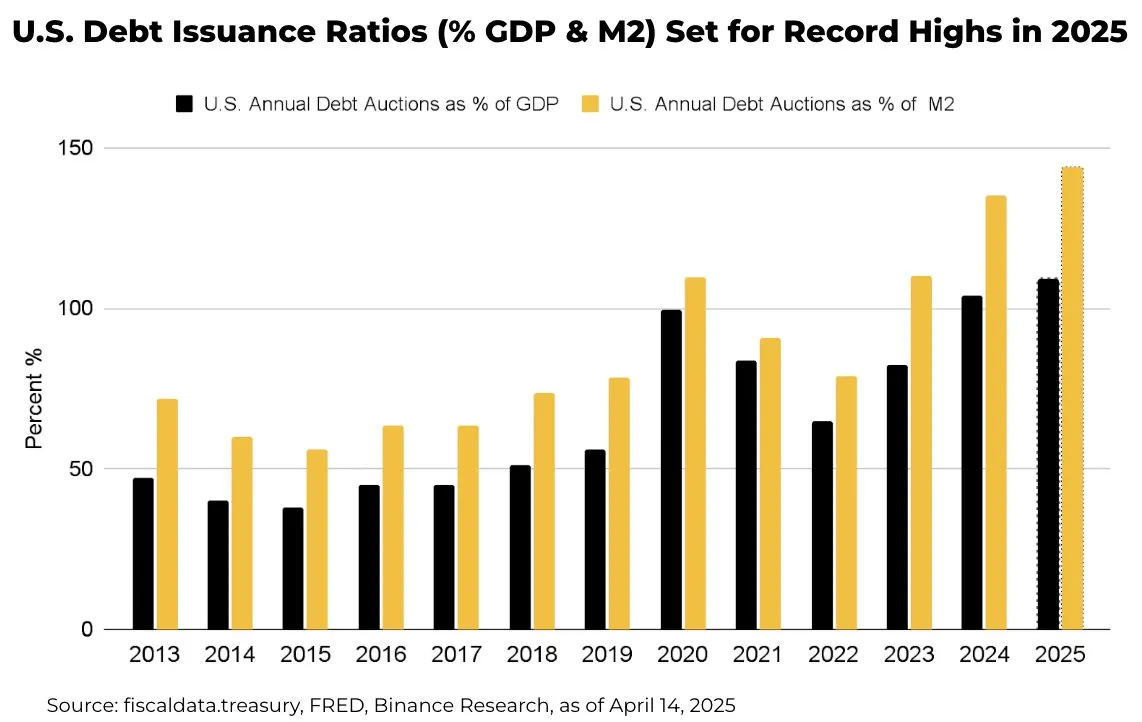

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market?

Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity cost of holding non‑yielding assets like Bitcoin and Ethereum, potentially drawing capital away from crypto.

US Bonds Might Add to the Crypto Market’s Volatility

The whole narrative potentially boils down to foreign demand for US bonds. Overseas investors hold roughly one‑third of US debt.

Any reduction in appetite—whether due to tariffs or portfolio rebalances—could force the Treasury to offer even steeper yields. Rising yields tend to tighten global liquidity, making risk assets like cryptocurrencies less attractive.

When yields climb, equities and crypto can face selling pressure. For example, during the 2022 bond sell‑off, Bitcoin fell more than 50% alongside Treasury yields spiking. A repeat scenario could test crypto’s appeal.

Meanwhile, the US dollar’s strength could compound headwinds. As yields rise, the dollar typically gains. A stronger dollar makes Bitcoin’s USD‑denominated price more expensive for overseas buyers, dampening demand.

Yet crypto offers unique attributes. In periods of extreme monetary expansion, such as post‑pandemic, investors turned to Bitcoin as an inflation hedge.

Even if higher yields curb speculative flows, crypto’s finite supply and decentralized nature may sustain a baseline of buyer interest.

Technically, Bitcoin’s correlation to yields may weaken if Treasury issuance triggers broader macro volatility. When bond markets are hit by trade or fiscal policy shocks, traders may turn to digital assets to diversify since they don’t move in step.

However, that thesis hinges on continued institutional adoption and favorable regulation.

Crypto’s liquidity profile also matters. Large bond sales often drain bank reserves—tightening funding markets.

In theory, tighter liquidity could boost demand for DeFi protocols offering higher yields than traditional money markets.

Overall, record US debt supply points to higher yields and a stronger dollar—volatility for crypto as a risk asset.

Yet crypto’s inflation‑hedge narrative and evolving technical role in diversified portfolios could temper volatility. Market participants should watch foreign demand trends and liquidity conditions as key indicators for crypto’s next moves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Are Ethereum Whales Threatening ETH Price Stability?

Ethereum (ETH) continues to struggle below the $2,000 mark, a level it hasn’t reclaimed since March 28, as bearish momentum lingers across both technical and on-chain indicators. Despite attempts to stabilize, recent data reveals rising concentration of ETH among whale wallets, alongside persistent weakness in trend indicators like EMA lines.

At the same time, retail and mid-sized holders are gradually losing share, further skewing ownership toward large players. This combination of declining retail participation and heavy whale dominance may leave ETH increasingly vulnerable to sharp corrections if sentiment turns.

ETH Whale Holdings Hit 9-Year High, Raising Centralization Concerns

The amount of ETH held by whale addresses—wallets controlling more than 1% of the total circulating supply—has reached its highest level since 2015, sitting at 46%.

This marks a significant shift in Ethereum’s ownership data, as whales surpassed the holdings of retail investors back on March 10 and have continued to grow their share since. In comparison, investor-level addresses, which hold between 0.1% and 1% of supply, and retail wallets, which hold less than 0.1%, have both seen declines in their share of ETH.

The jump from 43% to 46% in just a few months reflects a sharp accumulation trend among the largest holders, suggesting a growing concentration of ETH in fewer hands.

Whales typically represent institutional investors, funds, or early adopters, and their behavior can significantly impact price due to the volume they control. Investor-level addresses often reflect high-net-worth individuals or smaller institutions, while retail addresses include everyday traders and holders.

While some might see the rise in whale holdings as a vote of confidence, it also increases the risk of sudden volatility if large holders begin offloading.

With retail and investor participation shrinking, the market may become more fragile and vulnerable to sharp, unexpected price movements driven by a few dominant players.

Whales Holding 1,000 to 100,000 ETH Now Control $59 Billion

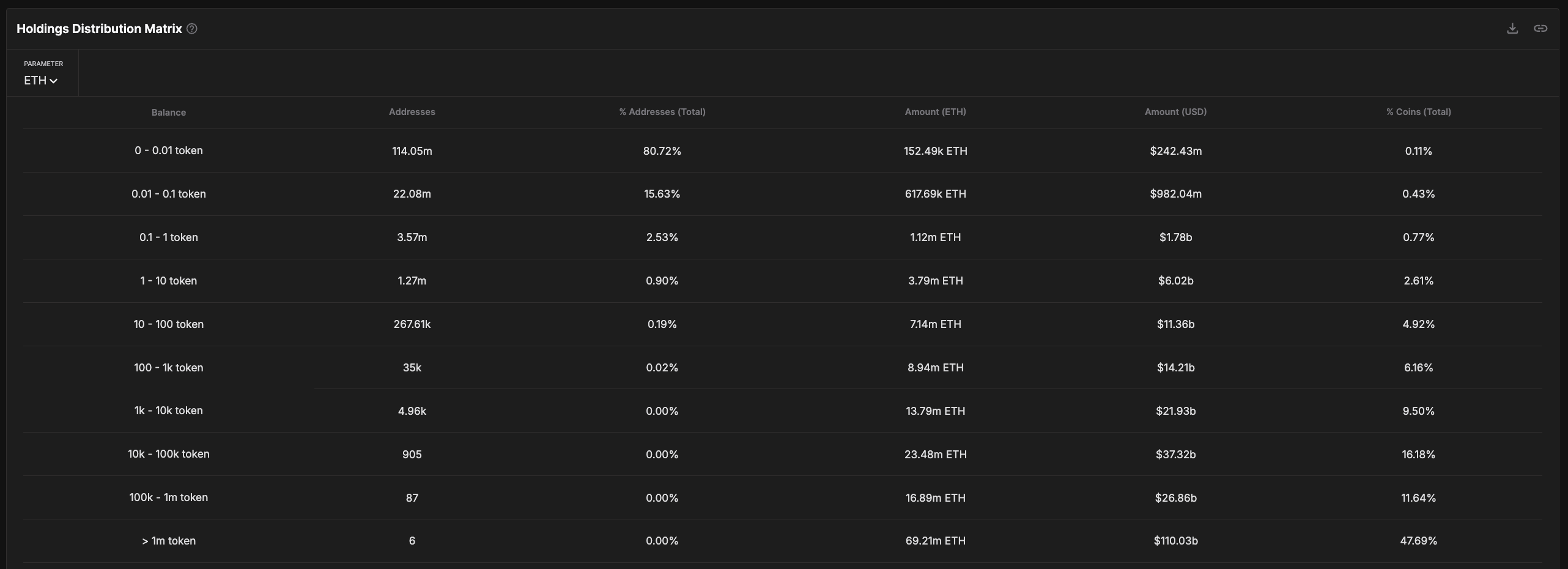

Analyzing the ETH Holdings Distribution Matrix reveals concerning signs of deepening concentration.

When excluding addresses with over 100,000 ETH—typically linked to centralized exchanges—whale addresses holding between 1,000 and 100,000 ETH now control roughly $59 billion in ETH, representing around 25.5% of the circulating supply.

This group has steadily accumulated more of the network’s supply, reinforcing a power shift toward large entities operating outside of exchanges but still commanding immense influence over the market. Recently, Galaxy Digital moved $100 million in Ethereum, raising questions about whether it was a strategic shift or a sell-off signal.

While some might interpret this trend as strategic positioning by confident holders, it also exposes Ethereum to significant downside risk.

With over a quarter of supply concentrated in the hands of these whales, any coordinated or panic-driven selling could trigger sharp price drops, especially in an environment with weakening retail participation.

Rather than a sign of long-term stability, this level of concentration may make the ETH market increasingly fragile and prone to volatility if these holders start to rotate their capital to other assets.

Bearish EMA Structure Keeps ETH Under Pressure

Ethereum’s EMA lines continue to flash bearish signals, with short-term averages still positioned below the long-term ones—indicating downward momentum remains in play.

If a new correction happens, Ethereum could first test support at $1,535. A breakdown below that level opens the door to deeper declines toward $1,412 or even $1,385.

Should these supports also fail to hold, Ethereum would edge dangerously close to the $1,000 mark, a level some analysts have flagged as a potential downside target in the event of an extended market correction.

Still, a bullish reversal is not entirely out of the question. If buying pressure returns and Ethereum reclaims short-term momentum, it could test the resistance level at $1,669.

A breakout above that would be a significant technical signal, potentially pushing Ethereum price toward $1,749 and even $1,954.

However, with EMAs still tilted to the downside, the burden remains on bulls to prove that momentum has shifted decisively in their favor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoCrypto Casino Founder Charged With Fraud in New York

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

-

Market20 hours ago

Market20 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Market19 hours ago

Market19 hours agoBinance Leads One-Third of the CEX Market in Q1 2025

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Altcoin17 hours ago

Altcoin17 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market14 hours ago

Market14 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance