Market

Dogecoin (DOGE) Attempts a Comeback: Can It Clear Resistance?

Dogecoin started a recovery wave above the $0.240 zone against the US Dollar. DOGE is now consolidating and might face hurdles near $0.270.

- DOGE price started a recovery wave above the $0.2350 and $0.2420 levels.

- The price is trading below the $0.2780 level and the 100-hourly simple moving average.

- There is a major bearish trend line forming with resistance at $0.260 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could start another increase if it clears the $0.260 and $0.270 resistance levels.

Dogecoin Price Faces Resistance

Dogecoin price started a fresh decline from the $0.3450 resistance zone, like Bitcoin and Ethereum. DOGE dipped below the $0.300 and $0.250 support levels. It even spiked below $0.220.

The price declined over 25% and tested the $0.20 zone. A low was formed at $0.20 and the price is now rising. There was a move above the 50% Fib retracement level of the downward wave from the $0.3415 swing high to the $0.20 low.

However, the bears are active near the $0.280 zone. Dogecoin price is now trading below the $0.270 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.260 level.

There is also a major bearish trend line forming with resistance at $0.260 on the hourly chart of the DOGE/USD pair. The first major resistance for the bulls could be near the $0.270 level. The next major resistance is near the $0.2850 level or the 61.8% Fib retracement level of the downward wave from the $0.3415 swing high to the $0.20 low.

A close above the $0.2850 resistance might send the price toward the $0.300 resistance. Any more gains might send the price toward the $0.320 level. The next major stop for the bulls might be $0.3420.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.270 level, it could start another decline. Initial support on the downside is near the $0.2420 level. The next major support is near the $0.2250 level.

The main support sits at $0.220. If there is a downside break below the $0.220 support, the price could decline further. In the stated case, the price might decline toward the $0.2020 level or even $0.200 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.2420 and $0.2250.

Major Resistance Levels – $0.2700 and $0.2850.

Market

Canada’s New PM Carney Is a Bitcoin Skeptic—What It Means

Mark Carney, the former governor of both the Bank of England and the Bank of Canada, is poised to become Canada’s next prime minister. However, he has long been skeptical and strongly critical of Bitcoin (BTC).

On March 9, Carney secured an overwhelming victory with 85.9% of the vote. He is expected to assume office in the coming days.

Mark Carney’s Views on Bitcoin

Carney will become Canada’s next Prime Minister, replacing Justin Trudeau, who resigned in January 2025 after nearly a decade in power.

Although Carney has never held a seat in Parliament, his experience managing economic crises and international reputation have garnered significant support within the Liberal Party.

However, Carney’s rise to Canada’s new Prime Minister position does not appear to be a positive signal for the crypto market. For years, he has expressed deep skepticism and sharp criticism of Bitcoin (BTC) and other decentralized cryptocurrencies. He formed his stance during his tenure as Governor of the Bank of England and has reiterated it in the years since.

“Canada’s new Prime Minister Mark Carney, a known critic of Bitcoin, previously labeled it [BTC] as having serious deficiencies,” said X user EdGeraldX.

Specifically, in a 2018 speech on the Future of Money, Carney assessed that Bitcoin has “serious deficiencies” due to its fixed supply cap, which leads to price instability.

“The fixed supply of Bitcoin has sparked a global speculative frenzy, encouraging the proliferation of new cryptocurrencies,” he stated.

He likened Bitcoin to a “criminal act of monetary amnesia,” arguing that recreating a digital gold standard was a historical mistake. Carney believes Bitcoin and other cryptocurrencies are “poor short-term stores of value,” failing to meet the basic criteria of money, such as stability and usability in transactions.

In 2018, he warned that Bitcoin threatened financial stability if left unregulated, calling for strict oversight to curb illegal activities like money laundering and terrorism financing.

Carney Prefers CBDCs Instead

In contrast, Carney enthusiastically advocates for Central Bank Digital Currencies (CBDCs) while opposing Bitcoin. This view is somewhat similar to that of Indian regulators. He argues that CBDCs could expand banking access for individuals and businesses while enabling central banks to combat terrorism and economic crime.

“Carney calls Bitcoin’s fixed supply a crime, supports CBDCs, and now controls policy for a $1.9 trillion economy,” shared an X user.

Carney’s views on Bitcoin and cryptocurrencies align with and are arguably more rigid than those of his predecessor. In September 2022, Trudeau hit out at Pierre Poilievre, a pro-crypto politician chosen to lead Canada’s Conservative Party.

Carney assumes office as Canada faces a trade war sparked by US President Donald Trump’s tariff policies. The US has officially imposed a 25% tariff on Canada after suspending it in early February.

Carney’s anti-Bitcoin stance may lead to stricter regulations to control cryptocurrencies. He might focus on anti-money laundering measures and investor protection, similar to the approach he advocated at the Bank of England. This could affect the ETFs operating in Canada like the BlackRock’s Bitcoin ETF or 3iQ’s Solana ETF.

Additionally, Canada may soon develop a digital Canadian dollar, potentially diminishing the role of Bitcoin and altcoins in the economy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP’s Supply in Profit Shrinks as Bearish Sentiment Rises

XRP has maintained a downtrend since reaching an all-time high of $3.40 on January 16. It currently trades at $2.18, noting a 35% price drop over the past two months.

The double-digit dip has led to a decrease in the amount of XRP tokens held in profit. On-chain data shows that the bearish sentiment against the altcoin is climbing, hinting at an extended decline.

XRP Sees Drop in New Demand, Signaling Market Interest Slowdown

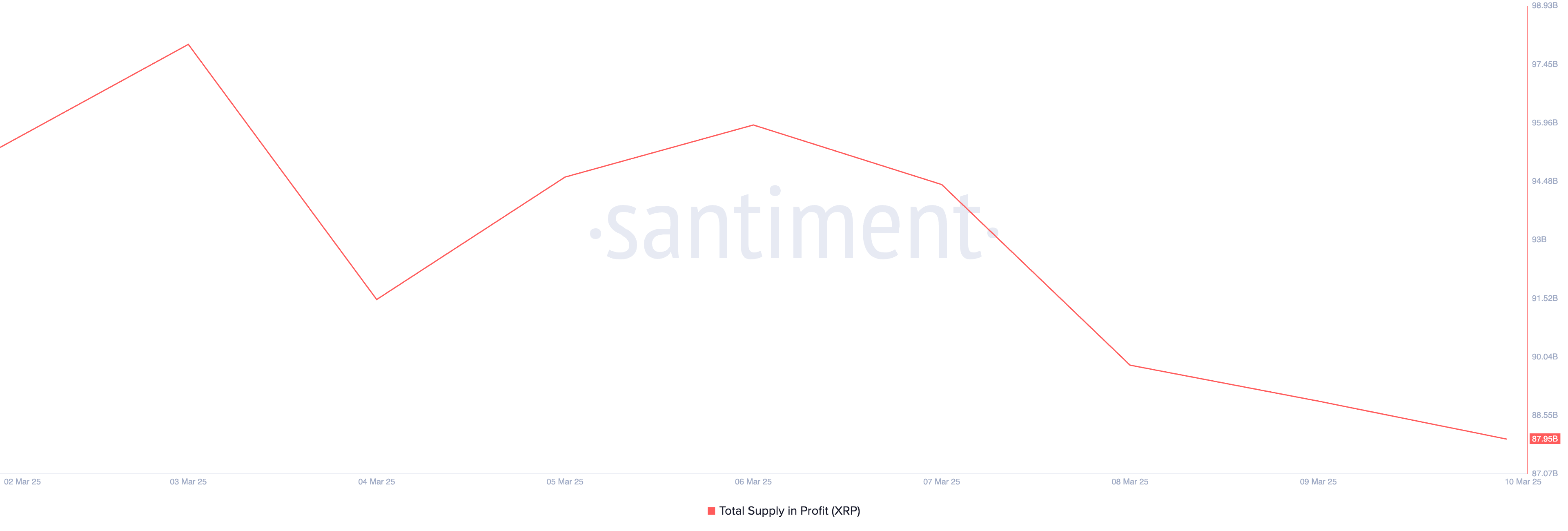

As XRP’s price falls, its total supply in profit has also reduced. According to Santiment, this has shrunk by 6.39 billion over the past week to fall to its year-to-date low.

As of this writing, 87.95 billion tokens out of a total supply of 99.98 billion are held at a profit. This signals that some investors are now holding XRP at a loss, reflecting increased selling pressure and weakening market sentiment.

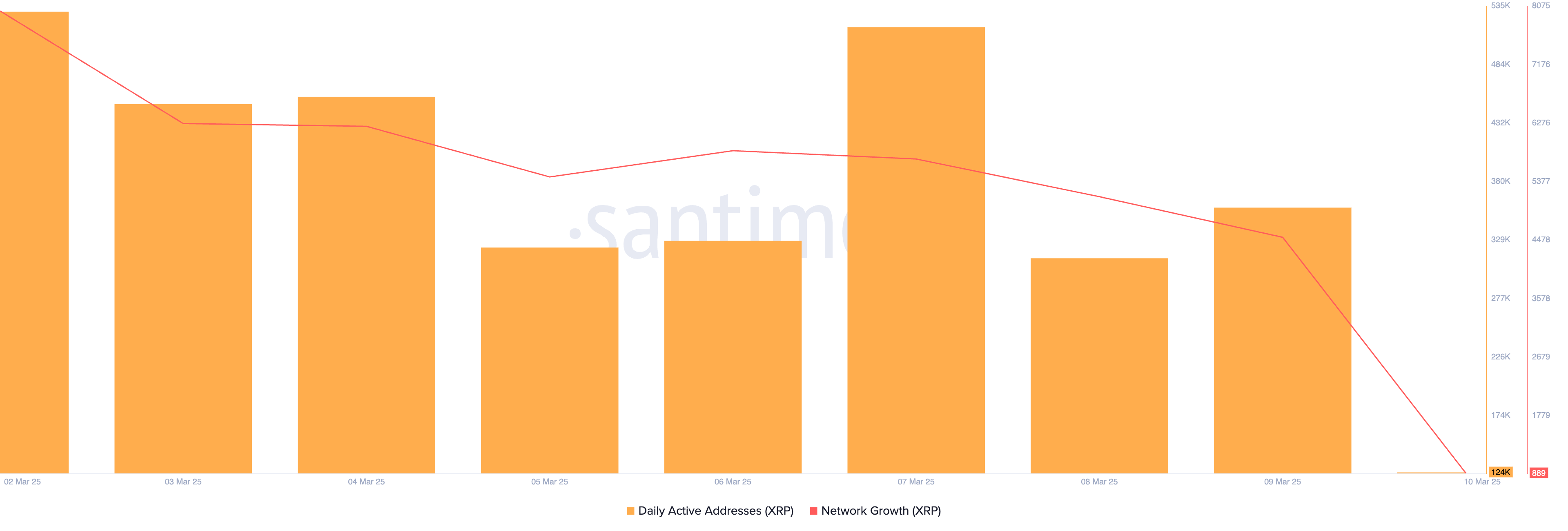

Moreover, on-chain data also shows a slump in new demand, with daily fresh purchases of XRP seeing a notable drop this month. Per Santiment, only 4,516 new wallet addresses were created on Sunday to trade XRP.

This represented the lowest daily count of new XRP demand since the beginning of the year.

When an asset sees a drop in new demand, it means fewer investors are buying it. As observed with XRP, this has reduced trading activity and weakened price support in its spot market. It signals waning market interest in the altcoin and can contribute to further price declines if selling pressure remains high.

XRP Faces Selling Pressure: Will Bulls Break the Downtrend?

On the daily chart, XRP has traded below a descending trend line since reaching its all-time high, reflecting the downward trend.

This bearish pattern is formed when an asset’s price consistently creates lower highs over time. It suggests that sellers are in control, and unless the price breaks above the trend line, further declines are likely.

XRP trades at $2.17 at press time, significantly below this descending trendline. With a growing bearish bias, the token’s price might fall further from this trendline. In that scenario, XRP’s value could drop below $2 to $1.47.

However, if buying pressure gains momentum, XRP could break above its descending trendline and climb to $2.93.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

$620 Million Liquidations Shake the Market

The crypto market has kicked off the week with a sharp downturn, as a wave of liquidations wiped out $620.5 million in the past 24 hours.

The sell-off was fueled by a steep decline in Bitcoin’s (BTC) price, which plunged to as low as $80,000 over the weekend. The sudden drop triggered widespread margin calls, forcing traders out of leveraged positions and amplifying volatility across the market.

Crypto Market Hit by $620 Million Liquidation Wave

According to data from Coinglass, the past 24 hours saw a massive shakeout in the crypto market, with 225,381 traders liquidated.

Long positions took the hardest hit, accounting for $529.4 million in losses. Meanwhile, short positions saw $91.1 million in liquidations.

Bitcoin led the liquidation spree, with $239.5 million in positions wiped out. $205.6 million came from long traders caught off guard by the market downturn, triggering forced sell-offs. The largest single liquidation order occurred on Binance, where a BTC/USDT position worth $32.0 million was wiped out.

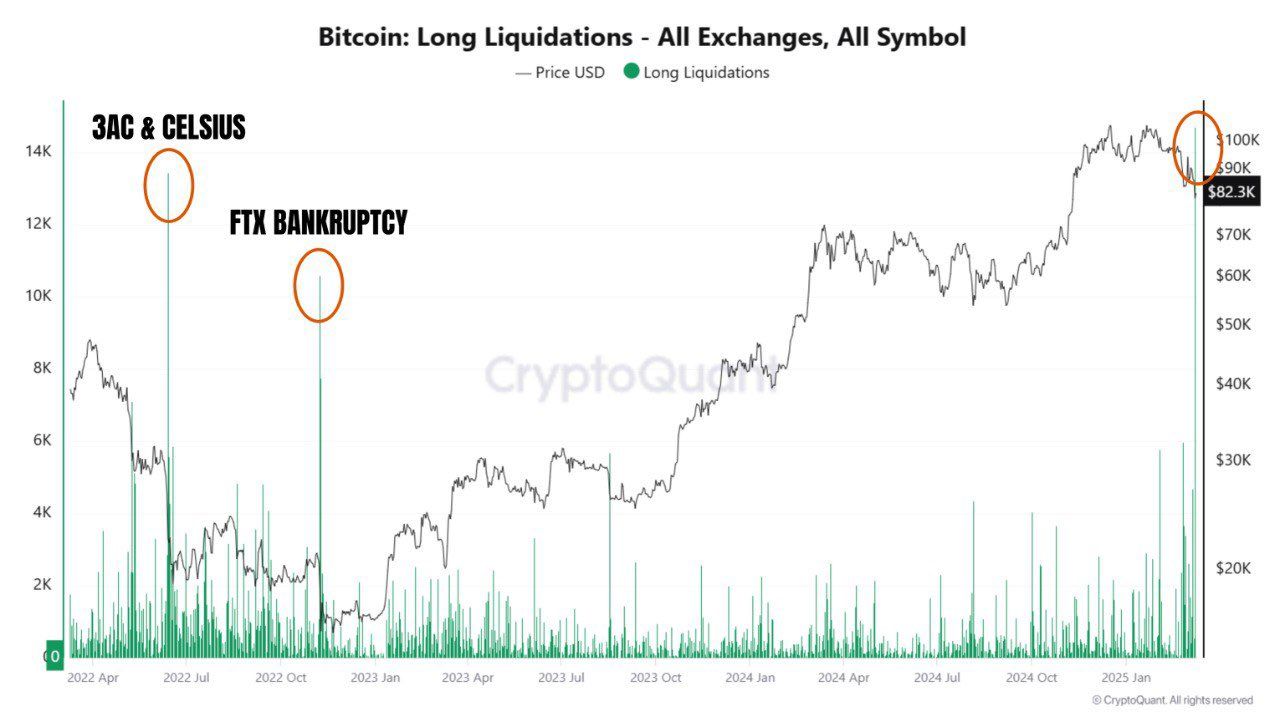

Analyst Ash Crypto highlighted the severity of the recent market turmoil in the latest X (formerly Twitter) post.

“Bitcoin long liquidations in all exchanges exceeds 3AC, Celsius and FTX collapse,” the post read.

Data from CryptoQuant shows that Bitcoin’s long liquidations surged to 14,714 yesterday. For comparison, 13,453 BTC were liquidated during the Celsius crash, 1,807 BTC during the FTX collapse, and 1,311 BTC in the Three Arrows Capital (3AC) meltdown.

The wave of liquidations comes as Bitcoin struggles in the market, facing renewed downward pressure. Contrary to expectations, President Donald Trump’s Strategic Bitcoin Reserve executive order triggered a sharp decline in Bitcoin’s value.

Furthermore, the downturn intensified as recession fears escalated, adding further uncertainty to the market.

“An ugly start to the week. Looks like BTC will retest $78,000,” Arthur Hayes, former BitMEX CEO wrote.

He predicted that if $78,000 fails to hold, $75,000 will be the next critical support level. Hayes also pointed out a large amount of open interest (OI) in Bitcoin options between $70,000 and $75,000. Thus, if BTC enters that range, it could lead to heightened volatility.

For now, BTC continues to hold above $80,000. At the time of writing, it was trading at $82,629, down 3.9% in the past 24 hours.

Market Plunge Forces Crypto Whales Into Liquidation Chaos

The broad impact of Bitcoin’s price drop was felt across the sector. The total crypto market cap suffered a $148 billion drop. Ethereum (ETH) was the second most affected asset, with $108.5 million in liquidations. As per BeInCrypto data, ETH was down 5.3% over the past day, trading at $2,062 at press time.

The downturn has placed whales under increasing pressure, with some now facing the risk of massive liquidations. According to Lookonchain data, a whale holding 65,675 ETH (worth $135.8 million) on Maker is on the verge of liquidation.

The whale’s health rate has dropped to 1.05, with a liquidation price set at $1,931, raising concerns about potential forced sell-offs if ETH continues to decline.

Additionally, an on-chain analyst revealed that World Liberty Financial’s (WLFI) investment portfolio has suffered heavy losses. The firm had initially invested $336 million across nine tokens. Yet, the portfolio’s value has plunged to $226 million, marking a $110 million loss.

Ethereum makes up 65% of the entire portfolio, making it the most affected asset. The average purchase price of ETH was $3,240, but with ETH now trading around $2,000, the DeFi project has suffered a 37% loss, amounting to $80.8 million.

Despite the turmoil, OnchainLens reported that a whale has increased long positions across multiple assets, including Solana (SOL), Ethereum, dogwifhat (WIF), and Bitcoin.

The positions have turned against the trader, who is now sitting on an unrealized loss of $14.3 million. The whale still has an open order worth $8.4 million for these tokens, further increasing risk exposure. Moreover, the whale supplied 19,413 ETH to fund these trades and borrowed $16.2 million USDC to go long on HyperLiquid.

However, not all whales are losing money in this market shakeout. Data from Lookonchain highlighted that another whale has successfully shorted BTC multiple times during recent price drops. The trader has accumulated an unrealized profit of over $7.5 million.

“He has now set additional short positions at $92,449 – $92,636 and placed limit orders to take profit between $70,475 – $74,192,” the post further added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours ago1inch Hacker Returns $5 Million Stolen Funds After Bug Bounty

-

Market15 hours ago

Market15 hours agoShiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

-

Altcoin24 hours ago

Altcoin24 hours agoExpert Predicts XRP Price Can Reach $280, Here’s When

-

Bitcoin23 hours ago

Bitcoin23 hours agoUS Bitcoin ETFs Record $800 Million Net Outflow In Past Week — Details

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin: Analyzing Divergence In Investor Behavior – Who’s Buying And Selling BTC?

-

Market20 hours ago

Market20 hours agoFintech Leaders Push for US Federal Regulatory Sandbox

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Liquidation Heatmap Signals Potential Bitcoin Price Swings – What’s Next

-

Market17 hours ago

Market17 hours agoSafeMoon (SFM) Selling Pressure Threatens Previous Gains