Market

DOGE Price Up, but Others Falter

This week, most meme coins took a breather compared to October’s eventful trends, with Dogecoin (DOGE) leading the pack. However, other meme coins didn’t fare that well.

AI-themed Goatseus Maximus (GOAT) and hippo-inspired Moo Deng (MOODENG) both experienced double-digit declines, diverging from Dogecoin’s uptrend. Here’s a breakdown of what happened and what might be next for these coins.

Dogecoin (DOGE)

On October 26, Dogecoin’s price was $0.13. But this week, the meme coin’s value climbed by 20% and currently trades at $0.16. Dogecoin’s rally can be attributed to multiple factors, including rising demand and large investor accumulation. However, Elon Musk’s post on X (formerly Twitter) on Monday gave the upswing an extra boost.

In the post, Musk, who has been supporting DOGE for some years, shared a picture of him and a “muscular” Dogecoin. As soon as that happened, Dogecoin’s price rallied from $0.14 to $0.16 within a few hours.

While the coin eventually reached $0.17, the recent Bitcoin (BTC) retracement helped pull the price back. From a technical standpoint, Dogecoin has formed a bullish flag on the 4-hour chart.

A bullish flag pattern suggests that an asset’s price may continue to rise in the near term. This pattern forms after a strong upward movement, followed by a slight consolidation, and signals the potential for further gains if the upward trend resumes.

Read more: Best Crypto Exchanges With the Lowest Trading Fees

As seen above, DOGE is on the brink of breaking out from the consolidation phase (flag). Once validated, the meme coin’s price might climb to $0.18. In a highly bullish scenario, Dogecoin might climb to $0.20.

On the other hand, a breakdown below the flag could invalidate this thesis. In that scenario, DOGE could decline to $0.14.

Goatseus Maximus (GOAT)

Unlike Dogecoin, Goatseus Maximus saw a double-digit decline this week despite trending for several weeks. This drop could be tied to waning demand as the AI-themed meme coin narrative cools off. Earlier, during the peak of this trend, GOAT’s price surged, nearing a $1 billion market cap. The price at that time also got close to $1.

But as of this writing, GOAT has fallen nearly 30% since Monday. A look at the 4-hour timeframe, the Moving Average Convergence Divergence (MACD), which measures momentum, has fallen to the negative region.

This fall indicates that momentum around GOAT is bearish. As such, the price might continue to fall. Should that remain the case, then the meme coin’s value might sink to $0.34.

A rebound, however, could occur if buying pressure increases again. In that scenario, the MACD reading might turn positive, and GOAT’s price might rise toward $0.90.

Moo Deng (MOODENG)

Moo Deng also faced a significant dip this week, with its price down by 20% over the last seven days.

This drop might stem from a shifting focus in the meme coin market as traders move liquidity away from MOODENG toward other trending coins. As a result, MOODENG’s price has fallen below its 20 and 50-period Exponential Moving Averages (EMA).

When prices remain below these EMAs, it typically signals a bearish trend, contrasting with the bullish sentiment seen when prices hold above these levels. Should this remain the same, then the meme coin’s price might continue to decline.

Read more: 11 Top Solana Meme Coins to Watch in November 2024

If that happens, MOODENG might drop from $0.18 to $0.16. On the flip side, if demand for the meme coin rises, then this thesis might not come to pass. Instead, the token could beat the $0.20 resistance and climb to $0.24.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Approaches Resistance—Will It Smash Through?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave above the $1,850 level. ETH is now consolidating and facing key hurdles near the $1,920 level.

- Ethereum started a recovery wave above $1,820 and $1,850 levels.

- The price is trading above $1,860 and the 100-hourly Simple Moving Average.

- There is a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,900 and $1,920 resistance levels to start a decent increase.

Ethereum Price Starts Recovery

Ethereum price managed to stay above the $1,750 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,820 and $1,850 resistance levels.

The bulls even pushed the price above the $1,880 resistance zone. There was a move above the 50% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low. However, the bears are active near the $1,920 zone.

Ethereum price is now trading above $1,850 and the 100-hourly Simple Moving Average. There is also a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,900 level. The next key resistance is near the $1,920 level and the 61.8% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low.

The first major resistance is near the $1,970 level. A clear move above the $1,970 resistance might send the price toward the $2,020 resistance. An upside break above the $2,020 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,920 resistance, it could start another decline. Initial support on the downside is near the $1,860 level and the trend line. The first major support sits near the $1,845 zone.

A clear move below the $1,845 support might push the price toward the $1,800 support. Any more losses might send the price toward the $1,765 support level in the near term. The next key support sits at $1,710.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,860

Major Resistance Level – $1,920

Market

Bitcoin Price Bounces Back—Can It Finally Break Resistance?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $83,500 zone. BTC is now consolidating and might struggle to settle above the $85,500 zone.

- Bitcoin started a decent recovery wave above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $83,500 zone.

Bitcoin Price Starts Recovery

Bitcoin price managed to stay above the $82,000 support zone. BTC formed a base and recently started a decent recovery wave above the $82,500 resistance zone.

The bulls were able to push the price above the $83,500 and $84,200 resistance levels. The price even climbed above the $85,000 resistance. A high was formed at $85,487 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,550 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,200 level. The first key resistance is near the $85,500 level. The next key resistance could be $85,850. A close above the $85,850 resistance might send the price further higher. In the stated case, the price could rise and test the $86,650 resistance level. Any more gains might send the price toward the $88,000 level or even $88,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $84,500 level and the trend line. The first major support is near the $83,500 level and the 50% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

The next support is now near the $82,850 zone. Any more losses might send the price toward the $82,000 support in the near term. The main support sits at $80,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,500.

Major Resistance Levels – $85,200 and $85,500.

Market

Analyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

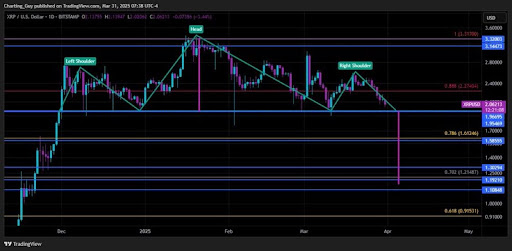

Recent XRP price action has sparked a new prediction from a crypto analyst, as a potential Head and Shoulders pattern emerges on the chart. The analyst warns that this technical formation could trigger a significant price correction for XRP, describing this downturn as the worst-case scenario.

Analyst Predicts XRP Price Crash To $1.15

The ‘Charting Guy,’ a pseudonymous crypto analyst on X (formerly Twitter), has unveiled a potential Head and Shoulder pattern formation on the XRP price chart. The analyst has shared insights into the implications of this technical pattern, projecting a potential crash in the XRP price.

Related Reading

As a well-known bearish reversal pattern, the formation of a Head and Shoulder in the XRP price chart suggests a potential shift from an uptrend to a downtrend. Typically, a Head and Shoulder pattern consists of three peaks: the Left Shoulder, Head, and Right Shoulder. However, the Charting Guy has confirmed that XRP’s current pattern formation consists of two right shoulders and one head. Due to this irregularity, the analyst has expressed doubt about the possibility of the pattern playing out.

If the Head and Shoulder pattern eventually takes shape, it could lead to a significant drop in the XRP price, potentially bringing it down to as low as $1.15. This price level aligns with a key Fibonacci Golden Pocket retracement zone between 0.618 – 0.786.

Notably, the analyst has described this projected price crash as the worst-case scenario for XRP. While he believes a bearish move is possible, the analyst is confident that XRP’s broader market structure is bullish.

Moreover, the Charting Guy argues that if XRP does decline to $1.15, it would likely serve as a healthy retracement in an overall bullish trend. He noted that XRP’s price has been holding the $2 level on daily closes, meaning its price action remains strong above support levels. This also indicates the possibility of an uptrend resumption that could yield higher highs and higher lows for XRP.

Key Support And Resistance Levels To Watch

The Charting Guy’s analysis of XRP’s potential Head and Shoulder pattern formation highlights several critical price levels to watch. Since XRP has consistently closed daily candles above $2, the analyst has determined this level as short-term support.

Related Reading

XRP has also been wicking during recent pullbacks in a crucial range between $1.7 and $1.9. As a result, the crypto analyst has revealed that he will be watching this area closely for a potential price bounce.

The Golden Pocket retracement zone, which represents the worst-case scenario for the XRP price, is between $1.15 and $1.30. If XRP experiences a deeper price correction, lower support levels have been marked from $1.19 to $0.91.

For its resistance levels, the Charting Guy has pinpointed $2.27 as a key price point. Additionally, $3.14 – $3.32 has been identified as an upper resistance range where XRP could rally if bullish momentum resumes.

Featured image from Medium, chart from Tradingview.com

-

Ethereum23 hours ago

Ethereum23 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Altcoin23 hours ago

Altcoin23 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market20 hours ago

Market20 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Market23 hours ago

Market23 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Market22 hours ago

Market22 hours agoXRP Bulls Fight Back—Is a Major Move Coming?

-

Market21 hours ago

Market21 hours agoIs CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

-

Bitcoin18 hours ago

Bitcoin18 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Bitcoin17 hours ago

Bitcoin17 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!