Market

DePIN Set to Surpass Centralized Networks in Next 15 Years

The telecommunications industry faces several challenges, including the need for continuous infrastructure upgrades, rising service costs, and limited coverage in rural areas. As a result, many customers are exploring alternative options that ensure accessible and reliable connectivity.

Decentralized Physical Infrastructure Networks (DePINs) have emerged to remedy the issues posed by traditional telecommunications companies. BeInCrypto spoke with industry experts from Huddle01, Impossible Cloud Network, and Aethir to understand how DePINs lower the access barriers to connectivity by employing blockchain technology.

The Rise of DePIN Networks

Traditional telecommunications industries have relied on large infrastructure to provide internet access nationwide. Because of their large-scale nature, these projects require significant capital.

As a result, governments and large companies have traditionally been in charge of managing such resources.

DePINs were designed to change this approach by allowing for the decentralization of these networks. They leverage distributed ledgers and token incentives to build and maintain a decentralized and far-reaching infrastructure.

Providers receive tokens as rewards for continuing to provide services in the real world. The entire process is automated through smart contracts, allowing hardware interconnectivity, executing complex transactions, and managing rewards.

“DePINs fundamentally rethink how communication networks operate by leveraging decentralization and community participation. They use a network of distributed nodes contributed by the participants so the service can scale dynamically as more participants join. DePINs are also highly economical because they utilize underutilized resources like bandwidth and storage from everyday users,” explained Ayush Ranjan, Co-Founder & CEO at Huddle01.

Market sentiment and overall adoption seem to agree with DePINs’ utility.

A Promising Future for Decentralized Telecommunications

According to a Messari report, DePIN revenue reached over $500 million in 2024, a 100x increase from 2022.

Per the report, the number of active DePIN projects nearly doubled last year. DePIN tokens now represent 5% of the total cryptocurrency market cap, and over 13 million devices worldwide contribute to DePIN operations daily.

Experts across the industry expect this growth to continue.

“Because of this model, DePIN has the potential to outgrow centralized networks like Google, Microsoft and Facebook by 100s, if not 1000x in the next 15 years. It might not be as flashy and exciting as memecoin trading, but it completely changes the game,” predicted Kai Wawrzinek, CEO and Co-Founder of Impossible Cloud Network (ICN), a decentralized multi-service cloud platform.

Today, the DePIN industry boasts a market capitalization of nearly $23.3 billion and over $2 billion in trading volumes. According to CoinGecko data, Bittensor, Render, Filecoin, Theta Network, and The Graph are among the projects leading the current ranking.

The increase in decentralized telecommunications options reflects a greater need for fairer and more inclusive approaches to internet connectivity.

Driven by the ever-increasing demand for connectivity, the telecom industry faces heightened pressure to innovate. However, current network models, often characterized by vertical integration, struggle to meet this demand.

“Traditional centralized telecom models are expensive, slow to expand, and don’t consistently offer equal access. Within this traditional model, a few major companies control the infrastructure, which allows them to keep pricing high and often limits competition. Additionally, expanding coverage requires significant investment and time, ultimately leaving some areas underserved,” said Kyle Okatomo, Chief Technology Officer at Aethir, a decentralized GPU cloud infrastructure project.

This centralized model tends to monopolize service provision and inherently generates more inequality for areas with smaller populations or limited infrastructure.

“Centralized telecom providers tend to prioritize profitable urban areas, leaving rural and remote regions underserved. This became especially apparent during the pandemic when remote schooling peaked, and students in rural areas struggled with connectivity,” Ranjan told BeInCrypto.

Their concentrated power makes telecom providers more susceptible to targeted security attacks.

“Centralization often means data is stored in one place. This creates a huge single point of failure risk and often leads to breaches– just think of the AT&T hack last year that resulted in leaked data for 73 million customers,” added Wawrzinek.

Given these limitations, many telecommunications companies face increased competition from DePIN projects.

Empowering Communities Through DePINs

For Wawrzinek, the mission behind every DePIN project focusing on telecommunications improvement is simple:

“DePIN is about taking control away from one centralized entity and distributing it among the community– literally giving power back to the people,” he said.

The decentralized infrastructure provided by DePINs offers a clear Web3 use case, utilizing various technologies to connect service providers with end users. This decentralization helps make services more cost-effective and faster.

“DePINs expand internet access by decentralizing and democratizing critical infrastructure, moving beyond the limitations of discrete traditional centralized models. Said plainly, centralized networks are discrete, whereas decentralized networks can easily and quickly expand via community-based ownership and contribution. This creates a more flexible, cost-effective, and widely accessible alternative,” Okatomo told BeInCrypto.

By empowering communities to set up their own hotspots or internet service providers (ISPs), DePINs facilitate the creation of small local networks that others can access. Users pay for bandwidth, and providers receive payments directly.

In its latest report, Messari highlighted how DePIN projects like Helium Mobile, DAWN, and WiFi Map use tokenized models to simplify and improve internet connectivity.

“Helium allows users to run nodes to provide decentralized wireless access and earn tokens in return, DAWN on Solana turns users into localized ISPs, and WiFi Map rewards global WiFi sharing,” Wawrzinek explained.

These models encourage active participation from service providers and consumers, as everyone collaborates to ensure the infrastructure functions effectively.

“By contributing, they essentially own a part of the network. Unlike traditional systems where ownership typically requires payment, DePINs operate on a model where ownership is earned through contributions, with earning becoming a byproduct of participation,” Ranjan added.

Coordinated efforts with policymakers will be required to support the continued growth of the DePIN sector.

Addressing Regulation in the DePIN Sector

As DePIN projects continue to develop, they have begun to draw institutional recognition for their potential. Last November, the Harvard Business School decided to teach Helium Mobile’s DePIN strategy as part of its strategy curriculum.

While DePIN networks gain more acceptance, the issue of regulation within the sector is becoming increasingly important.

“Clear regulations that encourage investment and security can help foster growth within the DePIN ecosystem. They should also ensure that network flexibility remains intact while addressing concerns from both enterprises and consumers. Additionally, promoting collaboration across sectors along with independent, controlled testing helps regulators develop informed policies while proactively managing risk to build trust and stability within the community,” Okatomo told BeInCrypto.

Some industry experts in the United States emphasized the importance of avoiding one-sided discussions and adopting an open-minded approach to foster effective communication between regulators and DePIN leaders.

Three days before leaving office, former US Securities and Exchange Commission (SEC) Chair Gary Gensler sued Nova Labs, the developers behind the Helium Network.

The lawsuit claims Nova Labs defrauded its customers while breaching federal securities and regulations. The allegations focus on the company’s hotspot devices, which they have sold since 2019.

“Regulation is important for DePIN, but it needs to be thoughtfully implemented. For example, the SEC’s recent lawsuit against Helium is just not productive. Regulators need to understand DePIN business models and not just demonize anything to do with crypto. We do need clear regulations around tokenomics, data privacy, infrastructure deployment…we don’t need year-long lawsuits that make all innovation grind to a standstill. I’m all for an open dialogue between DePIN and regulators– and, in fact, I don’t believe we can grow without it. But, until now, it’s been a one-sided conversation, and that needs to change,” Wawrzinek told BeInCrypto.

In addition to improving dialogue with regulators, DePIN experts also plan to focus on other areas for improvement.

Overcoming Challenges in DePIN Adoption and Expansion

Leaders in the DePIN industry underscore the need for improved educational resources to responsibly educate society on DePIN use cases and drive broader adoption.

“The technical aspects of DePIN can be daunting for new users, which can make onboarding confusing,” said Ranjan.

To that point, Wawrzinek added:

“A bigger challenge is, perhaps, to do with the overall understanding and perception of web3 and crypto. There’s still a certain level of mistrust and a lack of education, but also many web2 companies –our clients included– don’t really want to get involved with crypto directly.”

The fact that limited regulations currently exist surrounding DePIN can also affect their stability.

“DePINs operate in a decentralized environment, often leading to unclear or nonexistent regulations. This lack of oversight can have major consequences for the security and stability of DePIN networks, especially in heavily regulated industries like electricity and telecommunications,” Ranjan told BeInCrypto.

He also pointed to scalability and efficiency as two aspects that must be closely monitored alongside DePIN expansion.

“As DePIN networks grow, the volume of transactions increases, potentially overwhelming current blockchain infrastructures and leading to performance issues,” he said.

Some projects like Huddle01 have explored and deployed Layer-3 blockchain solutions to enhance scalability.

Addressing these limitations while leveraging DePINs’ advantages could drive widespread adoption and create strong competition for established telecommunications giants.

DePIN Beyond Telecommunications

DePINs’ prospects seem very bright, and the presence of these networks extends far beyond the telecommunications industry. Several established projects tackle other issues related to energy grids, supply chain logistics, and identity solutions.

Some have started to employ artificial intelligence to improve operational efficiency, while use cases have extended to game developers, marketing agencies, and retailers.

“DePIN has the potential to replace existing systems and make them far better. It’s not just the internet –DePIN has wide applications across GPU computing, AI, gaming, you name it. There is still work to be done– especially when it comes to interoperability, without which DePIN projects are just operating in silos. But, if we do this right, we get a decentralized ecosystem where the individuals benefit –not the corporate giants– and it’s the corporations that will need to adapt. I really look forward to seeing that future,” Wawrzinek concluded.

If DePINs can overcome their current hurdles, they could usher in a new era of decentralized innovation with benefits that extend far beyond telecommunications.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Sui Meme Coins Surge With Rising DEX Volumes

Sui meme coins, not typically seen at the forefront of the sector, are surging in volume recently. Their market cap is far smaller than Solana meme coins, but it’s also growing fast.

LOFI, a meme coin deployed on the blockchain, surged by over 186% in a week. If fresh DEX trading volumes start flowing into these assets, Sui could be the next emerging ecosystem for meme coins.

Are Sui Meme Coins About to Explode?

Meme coins based on Solana have been getting a lot of attention lately, with surging trade volumes and token prices. This has fueled speculation that Solana’s poised to lead a new meme coin boom, especially as the sector is exposed to new risks.

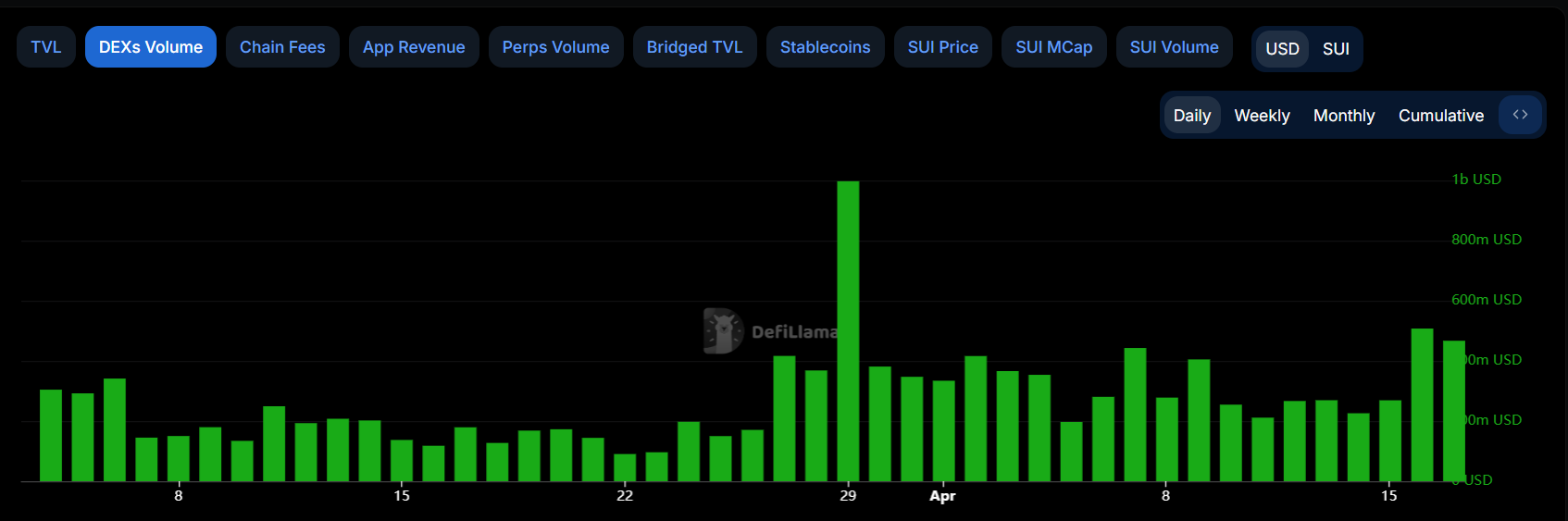

However, Sui meme coins are gaining some unexpected traction, and DEX volumes are noticeably soaring.

Sui is a high-performance Layer-1 blockchain that shares many similarities with Solana but several key differences.

Its design focuses on scalability, using parallel transaction processing and an object-centric transaction model to achieve this aim. Sui’s ecosystem is much less mature than Solana’s, but this could present opportunities for meme coins.

Sui’s developers are constantly working on upgrades to encourage new projects, some of which are explicitly geared towards meme coins. Solana’s 6.3 billion meme coin market cap grew by 2.4% in the previous 24 hours, while Sui’s increased by 4.6%.

LOFI grew 184.5% in the last week, highlighting its dedicated community.

LOFI’s impressive rise stands out, but several other projects on the layer-1 network have also attracted speculative interest. Meme coins thrive on community hype, and the blockchain’s DEX volumes are soaring.

If this high performance and committed enthusiasm connect with fresh investors, it could present an explosive opportunity.

For now, Sui’s meme coin ecosystem has a ways to go, with a total market cap of $123 million. However, this sector moves fast, and the Sui ecosystem could be poised to make some major growth soon, if meme coin enthusiasts continue to trade.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 AI Coins To Watch: RENDER, IP, and CLANKER

AI coins continue to draw attention as April nears its end, with Render (RENDER), Story Protocol (IP), and CLANKER standing out. RENDER has led the pack, surging nearly 17% this week and reclaiming a $2 billion market cap.

In contrast, Story (IP) is down 6.5%, the worst performer among the top 10 AI tokens, while CLANKER dropped over 7% in the last 24 hours. With momentum shifting across the sector, all three tokens are positioned at key technical levels that could define their next move.

RENDER

Render Network provides decentralized GPU computing power for creators, developers, and artificial intelligence applications. Its infrastructure supports rendering for 3D graphics, visual effects, and artificial intelligence model training.

RENDER, the network’s native token, has surged nearly 17% over the past week, pushing its market cap back above $2 billion. It was the top performer among the ten largest AI coins in the market.

If the bullish momentum holds, RENDER could test resistance levels at $4.065 and $4.21, and a breakout could open the path to $4.63.

However, if the trend reverses, key support lies at $3.82 and $3.68—losing these could trigger a deeper decline toward $3.47 or even $3.14 in a stronger correction.

Story (IP)

Story Protocol is a decentralized infrastructure designed to manage and monetize intellectual property (IP) on-chain, with a strong focus on artificial intelligence.

It allows creators to register stories, characters, and other digital assets, enabling collaborative development, licensing, and programmable royalties—all while integrating AI into the creation and distribution process.

Despite its explosive 477% rally between February 16 and 26, Story’s native token, IP, is down 6.5% over the last seven days—the largest drop among the top 10 AI coins.

If the current correction continues, IP could test support at $3.82, and a break below that may push the price under $3. However, if bullish momentum returns, IP could retest resistance at $4.49 and then aim for $5.04.

A strong rebound could eventually lift the token back toward the $6.61 zone, reclaiming some of its earlier hype.

tokenbot (CLANKER)

Tokenbot is a coin launchpad built on the Base chain. Its native token, CLANKE, has been down over 7% in the last 24 hours.

Notably, Base has climbed to the fourth spot in weekly DEX volume, reaching $4.7 billion—just behind BNB, Ethereum, and Solana—although its volume is down 7.73% in the last week.

Interest remains around Base’s recent push into “Content Coins,” with the community watching closely to see how the narrative evolves.

If CLANKER’s current downtrend deepens, it could test support at $27.97 and potentially fall to $22.84, dropping below $25 for the first time since April 6.

On the upside, a recovery could lead to a test of the $36 resistance, followed by $40. If sentiment around Base tokens strengthens, CLANKER could rally toward $47 as momentum builds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Struggles Under $0.17 Despite Strong Support

Hedera (HBAR) is up more than 5% in the last 24 hours, showing signs of short-term relief after a rough start to April.

Despite the bounce, technical indicators still point to a weak overall trend, with bearish EMA alignment and a flat ADX reading. Momentum remains uncertain, but bulls have managed to defend key support levels so far.

Hedera Shows Early Signs of Bullish Shift, But Trend Still Weak

Hedera’s DMI indicator shows its ADX at 19.8—slightly up from 18.49 two days ago but down from a recent high of 21.94 earlier today.

The ADX (Average Directional Index) measures the strength of a trend, regardless of its direction. Values below 20 typically indicate a weak or consolidating market, while readings above 25 suggest a strong trend is developing.

HBAR’s current ADX near 20 suggests momentum is still relatively soft, with no clear directional strength in place.

Looking at the directional indicators, the +DI (Directional Indicator) has risen from 13.42 to 14.2, showing a slight increase in bullish pressure. Meanwhile, the -DI has declined from 19.89 to 17.15, indicating weakening bearish momentum.

This narrowing gap between +DI and -DI may signal a potential shift in favor of the bulls, but with ADX still under 25, the trend remains unconfirmed.

If +DI continues to climb and crosses above -DI, Hedera could attempt a short-term reversal—but for now, the market remains in a cautious, sideways phase.

HBAR Enters Cloud Zone as Trend Momentum Stalls

The Ichimoku Cloud chart for HBAR reflects a mostly neutral to slightly bearish trend.

The price is currently trading below the Kijun-sen (red line) and very close to the Tenkan-sen (blue line), indicating weak short-term momentum and a lack of clear direction.

Both lines are flat, which often signals consolidation and market indecision.

Looking ahead, the Kumo (cloud) is relatively thick and bearish, with the Senkou Span A below the Senkou Span B. However, price action has entered the cloud zone, suggesting possible trend exhaustion or transition.

The Chikou Span (lagging green line) is overlapping with recent price candles, reinforcing the sideways outlook.

Unless HBAR breaks cleanly above the cloud and reclaims the Kijun-sen, the market is likely to remain in a holding pattern.

Hedera Holds Key Supports, But Bearishness Still Lingers

Hedera’s EMA lines are currently showing a bearish structure, with short-term averages positioned below the long-term ones—typically a sign of ongoing downward momentum.

Despite this, HBAR price has recently tested and held support at both $0.156 and $0.153, signaling that buyers are still defending key levels. If the trend reverses from here, HBAR could begin a recovery move, first targeting resistance at $0.168.

A break above that level could open the path to $0.178, and if bullish momentum strengthens further, a move toward $0.201 could follow.

On the flip side, if selling pressure resumes, Hedera could retest the same support zones at $0.156 and $0.153.

Losing these levels would weaken the technical structure significantly and could trigger a deeper drop.

In that case, the next major support comes all the way down near $0.124, which would represent a substantial decline and reinforce the current bearish trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoXRP Dips To $1.97 – A Golden Opportunity Before The Next Rally?

-

Market22 hours ago

Market22 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market16 hours ago

Market16 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Market21 hours ago

Market21 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Ethereum20 hours ago

Ethereum20 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Market20 hours ago

Market20 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?

-

Altcoin19 hours ago

Altcoin19 hours agoCrypto Whales Bag $20M In AAVE & UNI, Are DeFi Tokens Eyeing Price Rally?

-

Market24 hours ago

Market24 hours agoXRP Slides Into Bearish Zone Amid Weak Trading Signals