Market

CZ’s Dog Broccoli Sparks Viral Meme Coin Race

Changpeng “CZ” Zhao, former CEO of Binance, revealed the name of his dog, Broccoli, today. A race has begun for BROCCOLI meme coins while he remains an impartial observer.

CZ is directly engaging with the meme coin space after recently criticizing it, but he doesn’t stand to profit from it. The BROCCOLI tokens are more of a social experiment for him, with unpredictable results.

CZ and Broccoli Enter the Meme Space

Changpeng “CZ” Zhao, former CEO of Binance, is predicting a good year for crypto. Since his release from prison, he rejoined a Binance spinoff and has been an active participant in the community.

However, the meme coin craze has caused the Binance founder some consternation. He unintentionally pumped a test token ‘TST’ in an educational video, and things escalated from there.

CZ subsequently criticized the meme coin industry, claiming that Binance’s listing protocols were flawed. The other co-founder, Yi He, defended the company’s practices, and CZ’s name is getting traction in the meme space.

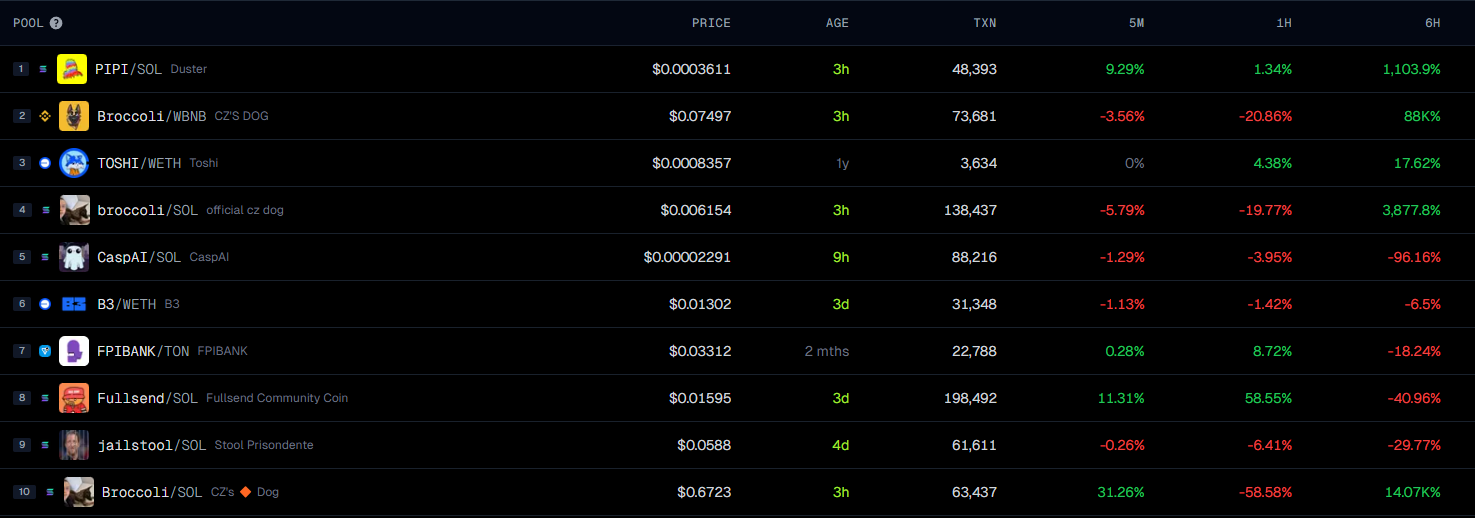

Yesterday, a token based on his dog briefly reached a $14 billion market cap before crashing. CZ responded by revealing the dog’s name – Broccoli.

“I am just posting my dog’s picture and name. I am NOT issuing a meme coin myself. It’s up to the community to do that (or not). I will likely interact with a few of the more popular meme coins on BNB Chain (BSC). The BNB Foundation may provide rewards for the top memes on the BNB Chain, giving LP support or other rewards,” CZ claimed.

CZ posted Broccoli’s identity as a social experiment; if people wish to create tokens for his dog, they should at least use the dog’s real picture. Subsequently, a few BROCCOLI tokens have emerged, some seeing dramatic spikes.

CZ, however, will strictly serve as an impartial viewer for the time being.

In some ways, CZ and the BROCCOLI tokens are reminiscent of another meme-related social media event. Last month, entrepreneur Mark Cuban proposed launching a meme coin, but only to mock the industry.

CZ’s actions here are less outwardly critical but nonetheless seem like a lighthearted way to poke fun at this aggressive market.

So far, it doesn’t seem like his opinions of meme coins have actually changed much. However, the BROCCOLI tokens are an amusing spectacle, and CZ claimed he will probably interact with the most successful projects.

Even if this does change one man’s personal opinion, it isn’t likely to have a lasting impact on the broad market. Right now, it’s all in good fun.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Bitcoin ETFs End Dry Spell with Fresh Capital

After seven straight days of outflows, institutional investors seem to have rekindled their love for Bitcoin ETFs. Since April 2, US-listed spot Bitcoin ETFs have posted net inflows for the first time, drawing $1.47 million in fresh capital on Monday.

While this figure is modest, it marks a notable shift in sentiment and the first sign of renewed institutional appetite for Bitcoin exposure through regulated funds.

Bitcoin ETFs End 7-Day Drought With Modest Inflows

Last week, Bitcoin investment funds recorded $713.30 million in net outflows as the broader cryptocurrency market struggled to stay afloat amid the growing impact of Donald Trump’s escalating trade war rhetoric.

But the tide may be starting to turn.

On Monday, U.S.-listed spot BTC ETFs recorded $1.47 million in net inflows, marking the first capital flow into these funds since April 2. While the amount is modest, it breaks a nearly two-week drought and could signal a gradual shift in institutional sentiment toward BTC.

The largest daily net inflow came from BlackRock’s IBIT, attracting $36.72 million. This brings its total cumulative net inflows to $39.60 billion.

On the other hand, Fidelity’s FBTC recorded the largest net outflow on Monday, shedding $35.25 million in a single day.

BTC Derivatives Market Heats Up Despite Cautious Options Flow

On the derivatives side, BTC’s futures open interest has edged higher over the past 24 hours, signaling increased derivatives activity.

At press time, this sits at $56 billion, rising by 2% in the past day. Notably, during the same period, BTC’s period has climbed by 1.22%.

BTC’s futures open interest refers to the total number of outstanding futures contracts that have yet to be settled. When it rises during a price uptick like this, it suggests that new money is entering the market to support the upward move, potentially reinforcing bullish momentum.

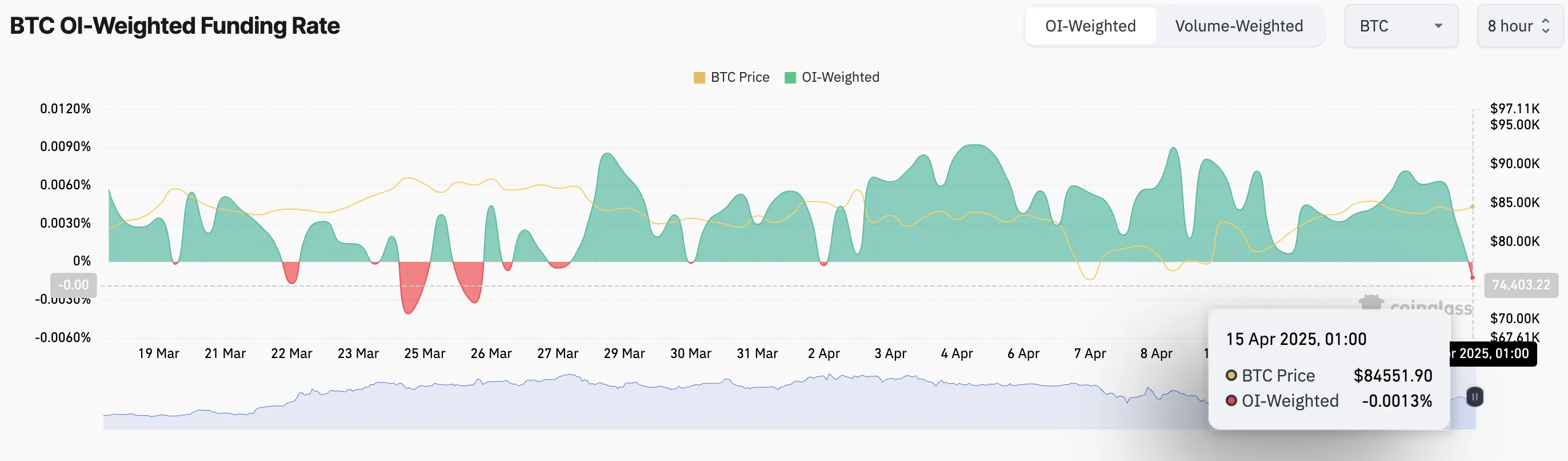

However, there’s a catch. While open interest in BTC futures has increased, the nature of these new positions appears to be bearish. This is evident in the coin’s funding rate, which has now flipped negative for the first time since April 2.

This means that more BTC traders are paying to hold short positions than longs, suggesting that a growing number of market participants are betting on a potential pullback despite the modest inflows into spot ETFs.

Moreover, the mood remains cautious on the options side. Today, there are more put contracts than calls, signaling that some traders may be hedging their bets or anticipating further downside, even as other indicators turn bullish.

Still, for BTC ETFs, any inflow after two weeks of silence feels like a win. With the broader market sentiment toward the coin turning increasingly bullish, it remains to be seen if this trend could persist for the remainder of the week.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s Tariffs Spark Search for Jerome Powell’s Successor

The Trump administration is gearing up for significant economic shifts, with its proposed tariffs said to be setting the stage for a potential overhaul of the Federal Reserve’s (Fed) leadership.

Like Gary Gensler’s ouster at the SEC (Securities and Exchange Commission), reports indicate that Fed chair Jerome Powell may face a similar fate with discussions starting long before his term ends.

Jerome Powell’s Exit Planned As Trump Tariffs Spell Economic Hardship

Treasury Secretary Scott Bessent announced the Trump administration’s plans to interview candidates to replace Fed Chair Jerome Powell.

Notably, Powell’s term as Fed chair ends in May 2026, over a year out. With almost 13 months left, experts suggest the administration’s move may be a strategic response to the economic turbulence expected from Trump’s aggressive tariff policies in 2025.

The sentiment is that the Trump administration may pave the way for a new Fed Chair to steer the economy through 2026 with interest rate cuts and stimulus measures.

“The interest rates affect credit cards, they’ll affect auto loans, the bottom 50% of Americans over the past two years have gotten crushed by these high interest rates. We’re set on bringing interest rates down,” Bessent claimed in a televised interview.

Trump’s tariff proposals, including a 125% tax on Chinese imports, are projected to impact the US economy substantially. According to a Tax Foundation study published on April 11, 2025, these tariffs could reduce US GDP by 1.3% in the long run.

The study also estimates tariffs will amount to an average tax increase of $1,300 per US household in 2025. This adds pressure on consumers already grappling with inflationary concerns.

Combined with foreign retaliation affecting $330 billion of US exports, the overall GDP reduction could reach 1.0%. This highlights the economic challenges the administration anticipates in the coming year.

Trump Administration Prepares For 2026 Economic Recovery

This report comes a month after Bessent presented Fed Chair Jerome Powell as a significant obstacle. He alluded that Powell impeded the Trump administration’s determination to lower interest rates.

Indeed, the Federal Open Market Committee (FOMC), led by Powell, has rejected interest rate cuts. They maintain this stance until they are comfortable with inflation cooling.

The Fed also made significant downward revisions to its 2025 economic projections. They painted a picture of weaker growth and persistent inflation.

According to economists, the Trump Administration is bracing for “economic weakness” in 2025 due to the tariffs. However, it sees 2026 as a year of recovery through monetary policy adjustments.

“This sets up perfectly for 2026 to be the year of interest rate cuts and economic stimulus, with the newly appointed Fed Chair,” The Kobeissi Letter said.

Therefore, the timing of Powell’s replacement aligns with these economic projections. A new Fed Chair, potentially more aligned with Trump’s economic agenda, could facilitate interest rate cuts and stimulus to counteract the tariff-induced slowdown.

Jerome Powell has served as Fed Chair since 2018. He has maneuvered a complex economic environment, which included high inflation and the post-pandemic recovery.

His second term, confirmed in May 2022, has been characterized by efforts to balance the Fed’s dual mandate of stable prices and full employment. However, this has been met with criticism, including from President Trump, for not being accommodative enough.

“The Fed would be much better off cutting rates as US tariffs start to transition (ease) their way into the economy. Do the right thing,” Trump shared on Truth Social.

The early search for his successor indicates the administration’s desire for a Fed Chair who might be more amenable to its policy goals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Altcoin23 hours ago

Altcoin23 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market21 hours ago

Market21 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market24 hours ago

Market24 hours agoBitcoin Price Rises Steadily—But Can the Rally Hold This Time??

-

Market23 hours ago

Market23 hours agoUser Data from Major Crypto Exchanges Leaked to Dark Web

-

Bitcoin20 hours ago

Bitcoin20 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear