Market

Crypto Airdrops to Watch: SupraOracles, Aptos, Scroll, Eclipse

The crypto market continues to show strength, with Bitcoin eyeing the $70,000 psychological level. Amidst the broader market optimism, well-informed investors are now eyeing crypto airdrops as a potentially lucrative avenue.

For investors and crypto enthusiasts, these airdrops offer the chance to acquire new tokens and join the vibrant crypto communities. Airdrops aim to distribute free tokens while attracting new followers and expanding user bases. This week, there are four significant airdrops to watch.

SupraOracles: Countdown to Blast off

SupraOracles is airdropping free SUPRA tokens after the Snapshot on October 21. The fundraiser raised $26.52 million, and participants included Coinbase Ventures, HashKey Capital, Animoca Brands, and HTX Ventures.

Users who completed simple airdrop tasks, including participating in the airdrop campaign and completing tasks, can now see the eligible tokens. The users can also select a token claim plan to confirm the token claim method, with participants that fail to choose expected to be enrolled into a 30-month vesting plan automatically.

Read more: What are Crypto Airdrops?

Additionally, SupraOracles has unleashed another activity named Supra Starcade, with 250 million SUPRA tokens allocated. It comes amid a bigger prize pool and more user transactions. Participants will have to guess the prices of different tokens, and all activities will take place in the test network.

Following an October 19 snapshot, new developments have emerged in the Scroll airdrop. The project recently raised $80 million in a fundraiser led by Polychain Capital, with participation from Variant, IOSG, and Bain Capital Crypto. This brings the Scroll airdrop closer to fruition.

The momentum comes after the listing of Scroll’s SCR token on Binance’s launch pool, setting the stage for formal community rewards. The SCR token will debut on major cryptocurrency exchanges on Tuesday, October 22, alongside the launch of the claim portal, allowing farmers to redeem the airdrop.

The airdrop will likely be based on marks accumulated by various Ethereum addresses. On-chain footprint criteria will also be used to filter out Sybil attackers and bots. As reported by BeInCrypto, 1 billion SCR tokens will be available, with 15% allocated to the airdrop, split into two phases of 7% and 8%.

Despite this, community sentiment around the airdrop appears sour. Concerns have arisen about the team’s ability to offer substantial rewards to over 2 million active addresses. Additionally, speculation suggests that some insiders may have unfairly accumulated large amounts of marks.

“Scroll team is so greedy! After allocating %23 to themselves, they also chose to sybil the airdrop by allocating team addresses 1m+ marks each,” said Anon Vee, a crypto investor and trader on X.

Eclipse: Blockchain Infrastructure Token Watchlist

Eclipse, the first Ethereum Layer-2 solution powered by Solana Virtual Machine (SVM), has raised $65 million from investors including Polychain Capital and Delphi Ventures. Tribe Capital, Hack VC, and Placeholder Ventures also co-led contributions.

Although the reward date remains uncertain, Eclipse is among the potential airdrops expected this week. To participate, users will need to mint NFTs as the project’s mainnet or official bridge becomes operational.

“To honor this milestone, claim “Path of Discovery”, a commemorative NFT designed by Nio on Scope. Mint is open for 7 days,” Eclipse wrote.

Notably, participants must add the Eclipse network to their wallets before minting the NFTs, with the bridge allowing a minimum of 0.002 ETH per transaction.

Aptos: Production Ready Blockchain

In the pursuit of new projects, airdrop farmers could forget about existing giants like Aptos. Based on the project’s tokenomics, 51% of tokens are allocated for community rewards. The airdrop also comes as a celebration of the second anniversary of the launch of the mainnet.

Against these backdrops, Aptos has raised $350 million in a fundraiser co-led by Binance Labs, Andreessen Horowitz (a16z), DragonFly Capital, FTX Ventures, and Jump Crypto. Other participants include Coinbase Ventures, Circle, and Multicoin Capital.

With this, it also passes as a potential airdrop with participation involving NFT minting. Aptos released a limited edition NFT to celebrate the second anniversary of the launch of the mainnet.

“Cheers to Two Years! If you’re here, you’re early to celebrate the 2nd Anniversary of Aptos Mainnet, we’ve released a commemorative AptosTwo NFT—available for a limited time. Mint yours today and tell all your friends you were first,” Aptos shared.

Read more: Best Upcoming Airdrops in 2024

While it did not indicate whether there will be an airdrop for this NFT, the mint is free and can give bonuses from Aptos, as well as projects from the Aptos ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

1 Year After Bitcoin Halving: What’s Different This Time?

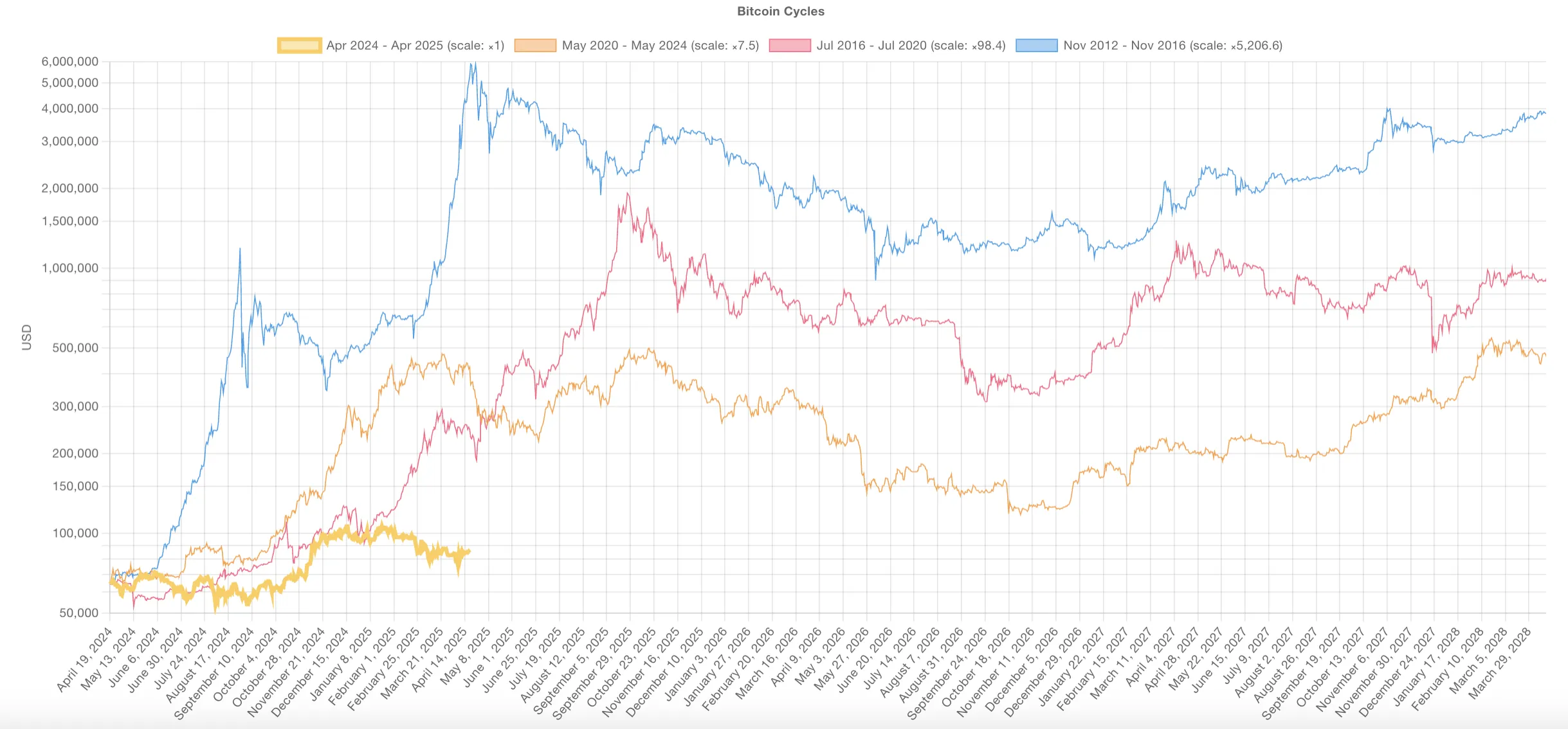

Bitcoin (BTC) is now one year past its most recent halving, and this cycle is shaping up to be unlike any before it. Unlike previous cycles where explosive rallies followed the halving, BTC has seen a far more muted gain, up just 31%, compared to 436% over the same timeframe in the last cycle.

At the same time, long-term holder metrics like the MVRV ratio are signaling a sharp decline in unrealized profits, pointing to a maturing market with compressing upside. Together, these shifts suggest Bitcoin may be entering a new era, defined less by parabolic peaks and more by gradual, institution-driven growth.

A Year After the Bitcoin Halving: A Cycle Unlike Any Other

This Bitcoin cycle is unfolding noticeably differently than previous ones, signaling a potential shift in how the market responds to halving events.

In earlier cycles—most notably from 2012 to 2016 and again from 2016 to 2020—Bitcoin tended to rally aggressively around this stage. The post-halving period was often marked by strong upward momentum and parabolic price action, largely fueled by retail enthusiasm and speculative demand.

The current cycle, however, has taken a different route. Instead of accelerating after the halving, the price surge began earlier, in October and December 2024, followed by consolidation in January 2025 and a correction in late February.

This front-loaded behavior diverges sharply from historical patterns where halvings typically acted as the catalyst for major rallies.

Several factors are contributing to this shift. Bitcoin is no longer just a retail-driven speculative asset—it’s increasingly seen as a maturing financial instrument. The growing involvement of institutional investors, coupled with macroeconomic pressures and structural changes in the market, has led to a more measured and complex response.

Another clear sign of this evolution is the weakening strength of each successive cycle. The explosive gains of the early years have become harder to replicate as Bitcoin’s market cap has grown. For instance, in the 2020–2024 cycle, Bitcoin had climbed 436% one year after the halving.

In contrast, this cycle has seen a much more modest 31% increase over the same timeframe.

This shift could mean Bitcoin is entering a new chapter. One with less wild volatility and more steady, long-term growth. The halving may no longer be the main driver. Other forces are taking over—rates, liquidity, and institutional money.

The game is changing. And so is the way Bitcoin moves.

Nonetheless, it’s important to note that previous cycles also featured periods of consolidation and correction before resuming their uptrend. While this phase may feel slower or less exciting, it could still represent a healthy reset before the next move higher.

That said, the possibility remains that this cycle will continue to diverge from historical patterns. Instead of a dramatic blow-off top, the outcome may be a more prolonged and structurally supported uptrend—less driven by hype, more by fundamentals.

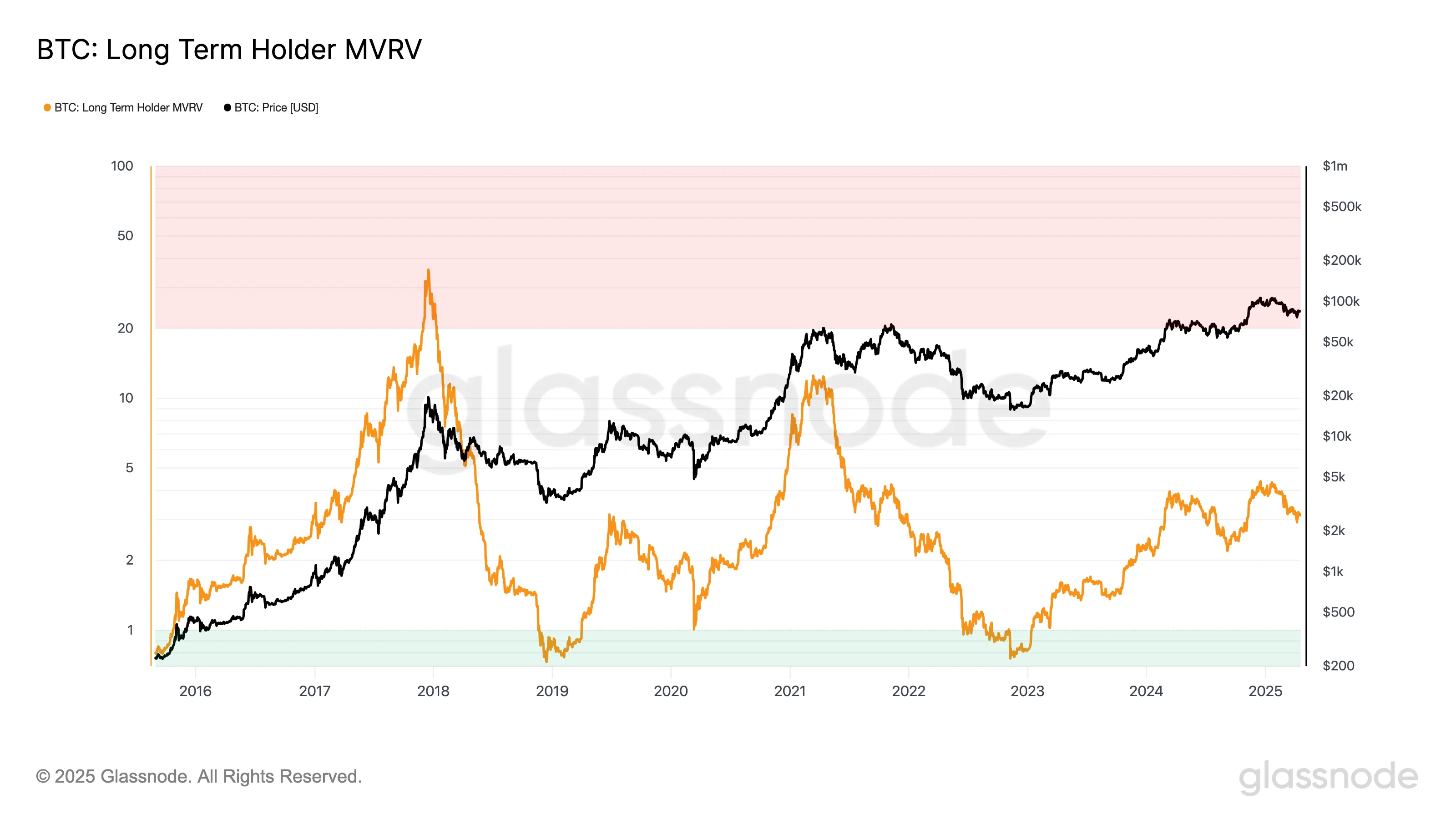

What Long-Term Holder MVRV Reveals About Bitcoin’s Maturing Market

The Long-Term Holder (LTH) MVRV ratio has always been a solid measure of unrealized profits. It shows how much long-term investors are sitting on before they start selling. But over time, this number is falling.

In the 2016–2020 cycle, LTH MVRV peaked at 35.8. That signaled massive paper profits and a clear top forming. By the 2020–2024 cycle, the peak dropped sharply to 12.2. This happened even as Bitcoin price hit fresh all-time highs.

In the current cycle, the highest LTH MVRV so far is just 4.35. That’s a massive drop. It shows long-term holders aren’t seeing the same kind of gains. The trend is clear: each cycle delivers smaller multiples.

Bitcoin’s explosive upside is compressing. The market is maturing.

Now, in the current cycle, the highest LTH MVRV reading so far has been 4.35. This stark drop suggests long-term holders are experiencing much lower multiples on their holdings compared to previous cycles, even with substantial price appreciation. The pattern points to one conclusion: Bitcoin’s upside is compressing.

This isn’t just a fluke. As the market matures, explosive gains are naturally harder to come by. The days of extreme, cycle-driven profit multiples may be fading, replaced by more moderate—but potentially more stable—growth.

A growing market cap means it takes exponentially more capital to move the price significantly.

Still, it’s not definitive proof that this cycle has already topped out. Previous cycles often included extended periods of sideways movement or modest pullbacks before new highs were reached.

With institutions playing a larger role, accumulation phases could stretch longer. Therefore, peak profit-taking may be less abrupt than in earlier cycles.

However, if the trend of declining MVRV peaks continues, it could reinforce the idea that Bitcoin is transitioning away from wild, cyclical surges and toward a more subdued but structured growth pattern.

The sharpest gains may already be behind, especially for those entering late in the cycle.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

VOXEL Climbs 200% After Suspected Bitget Bot Glitch

Voxies (VOXEL), a little-known gaming token, surged by over 200% within 24 hours on April 20 following a suspected malfunction in Bitget’s trading system.

The unexpected glitch led to an explosive spike in activity, pushing the VOXEL/USDT contract’s trading volume to an eye-watering $12.7 billion. According to Coingecko data, this significantly outpaces Bitcoin’s $4.76 billion volume on the same platform.

Bitget Trading Error Reportedly Lets Users Earn Six-Figure Profits

The unprecedented spike drew attention across the crypto space, particularly given that VOXEL is a relatively obscure free-to-play blockchain game token with a market cap under $30 million.

According to on-chain analyst Dylan, the Bitget bot repeatedly executed trades within the narrow $0.125 to $0.138 price range. Savvy traders quickly caught on, using just $100 to scalp profits exceeding six figures.

Reports suggest that the glitch allowed some users to walk away with tens or even hundreds of thousands of USDT in a matter of hours.

In response, Bitget’s spokesperson Xie Jiayin confirmed the platform was aware of the irregular activity and has launched an internal investigation. The company also noted that affected accounts may face temporary restrictions, urging users to contact in-app support for further assistance.

“Every platform, at every stage of development, may encounter challenges and uncertainties, yet these are an inevitable part of the journey. Bitget will provide the event details and resolution within 24 hours,” Jiayin added.

Meanwhile, the incident has sparked criticism from market experts and traders, many of whom question Bitget’s internal safeguards and technical maturity.

Several community members have criticized Bitget’s response to the issue. Some have claimed that the exchange’s decision to forcibly settle VOXEL contracts at discounted rates breached user trust. Bitget’s hybrid custody model is also receiving backlash following the incident.

“The platform’s product design reveals concerning flaws: a hybrid custody risk pool exposes users to systemic risks, and unrestricted position sizes open the door to manipulation. If these issues are not addressed, more altcoins could be weaponized against Bitget—potentially making it the next catastrophic failure in the crypto space,” one analyst stated.

Meanwhile, the timing of the incident is also notable. VOXEL is currently listed on Binance’s “Vote to Delist” program. The campaign aims to improve transparency and give the community a voice in token listings.

Overall, the Bitget incident has amplified concerns about potential market manipulation involving the token and highlighted the broader risks tied to centralized exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Token Launch Frenzy Is Delaying 2025 Altcoin Season

The arrival of an altcoin season is often tied to Bitcoin’s performance. As money flows out of BTC and into altcoins, this triggers a rise in altcoin prices.

However, this cycle is delayed by factors beyond Bitcoin. One such factor is the recent surge in token generation events (TGEs).

Rise in TGEs – A Boon or a Bane?

In the past four and a half months, 45 new tokens have launched, with most failing to provide decent returns. Many tokens launched in 2025 failed to sustain growth post-listing, raising the question of whether this trend is driven by bearish macroeconomic conditions or the lack of fundamental value in these tokens. This is turning altcoins into speculative assets driven by momentum.

Talking to BeInCrypto, Vincent Liu, CIO of Kronos Research, shed light on this question.

“Relentless token launches, especially meme coins, diluted liquidity and fragmented investor attention. Simultaneously, macro headwinds like rising interest rates and a global shift to risk-off sentiment throttled speculative capital. Tokens lacking utility, clear roadmaps, or sustainable ecosystems were quickly repriced in line with growing investor skepticism,” Liu explained.

One of the few successful launches with strong ROI has been Solayer (LAYER). Since its February launch, LAYER has posted an 88% rise and is currently trading just under $2.00.

Altcoin Season Delayed, But Narratives Continue to Grow

The altcoin season index currently stands at 16, indicating Bitcoin’s dominance. Rapid token launches and post-listing failures are contributing to the delay.

However, Liu noted that niche categories like AI-linked tokens continue to show strong demand despite the broader market conditions.

“While a full-fledged altcoin season hasn’t materialized, niche categories like AI-integrated meme coins and emerging tech narratives have shown signs of strength. Many token launches still suffer from inflated valuations and weak fundamentals, diluting capital and stalling broader momentum. Yet AI-linked narratives continue to attract attention not just from crypto natives, but also from traditional finance. Altcoin season isn’t gone, it’s simply evolving,” Liu said.

Despite the delay, the potential for an altcoin season remains. However, 75% of the top 50 altcoins would need to outperform Bitcoin to signal a true shift, which is not the case at the moment.

Are Market Makers Feeding TGE Hype?

Arthur Cheong, founder and CEO of DeFiance Capital, recently raised concerns over TGEs. He highlighted the risk of projects and market makers working together to inflate token prices artificially. This can distort market behavior and undermine investor confidence.

“You don’t know whether the price is a result of organic demand and supply or simply due to projects and market makers colluding to fix the price for other objectives. Absolutely bizarre that CEXs are turning a blind eye to this and altcoin markets are becoming more and more like a lemon market where confidence gets lesser,” Cheong tweeted.

Responding to this, Vincent Liu suggested that there needs to be reforms in the way that token launches are approached.

“…the issue of artificially inflated token prices before launch presents a growing concern. While these short-term surges might attract initial attention, they often undermine long-term investor confidence. To mitigate this, the industry must champion greater transparency around partner agreements, listing criteria, and pre-launch disclosures. Clear communication about a project’s structure, roadmap, and market cap expectations is essential to building a sustainable and trustworthy ecosystem,” Liu said.

Liu believes addressing this problem requires collaboration from market makers, centralized exchanges (CEXs), and investors.

“By conducting thorough research into the fundamentals of new projects, investors can protect themselves from significant losses and identify valuable tokens in the long run,” Liu concluded.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Bitcoin21 hours ago

Bitcoin21 hours agoSwiss Supermarket Chain Welcomes Crypto Payments

-

Market21 hours ago

Market21 hours ago5 Crucial Red Flags Investors Missed

-

Regulation21 hours ago

Regulation21 hours agoJohn Deaton Lays Out 5 To-Do List

-

Market20 hours ago

Market20 hours agoSUI Ranks 5th in DEX Volume, But Rally Lacks Strength

-

Altcoin17 hours ago

Altcoin17 hours agoRipple Expands In Asia With Debut XRP Investment Tool

-

Market23 hours ago

Market23 hours agoHedera Trading Slows 27% Even as Recovery Hints Emerge

-

Bitcoin14 hours ago

Bitcoin14 hours agoAnalyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know