Market

Could this new under-$1 cryptocurrency see 100x gains to become the next Solana or Polygon?

Just a few years ago, it would have been difficult to foresee the meteoric rise of projects like Solana (SOL) and Polygon (MATIC). Early investors in these platforms reaped significant profits, thanks to their rapid growth potential and innovative technology. Now, another contender, Rexus Finance (RXS), is stepping into the spotlight, with some analysts highlighting it as a promising altcoin priced at under $1.

Rexas Finance (RXS): The Next Solana or Polygon?

Rexus Finance (RXS), like Solana and Polygon in their early stages, is a project with the potential to tackle some of the most pressing issues in decentralized finance (DeFi), including scalability, efficiency, and cost. Its focus on real world assets puts it front and center in some huge global industries, including real estate and commodities.

Successful Presale Reflects Strong Investor Interest

One of the early indicators of Rexus Finance’s potential is the strong performance of its token presale. Stage 1 of the RXS presale sold out in less than 72 hours, drawing significant interest from both institutional and retail investors. Currently in Stage 2, RXS tokens are now priced at $0.04 each.

The rapid sellout of Stage 1 suggests growing market confidence in Rexus Finance’s vision. Some of the analysts that saw early success with projects like Solana and Polygon are now showing interest in RXS, seeing a similar growth opportunity. For new investors, Rexus Finance presents a unique prospect, with the possibility of substantial upside according to several analyst predictions.

Disrupting DeFi with Advanced Technology

Rexus Finance aims to address key challenges in the DeFi sector, such as high fees, long transaction times, and network congestion. Its scalable infrastructure allows for thousands of transactions per second, making it well-suited for dApps and smart contracts. Additionally, Rexus Finance’s cross-network functionality enhances its competitiveness by allowing decentralized applications to interoperate seamlessly.

This bridge technology, which connects various decentralized applications, could provide Rexus Finance with a critical edge in the future DeFi ecosystem. Its robust infrastructure and ability to integrate different blockchain networks make it a compelling platform for developers and users alike.

A Clear Roadmap for Future Growth

The Rexus Finance team has laid out an ambitious roadmap focused on expansion and innovation. Following the presale, the next key milestone will be the public listing of the RXS token. This will enable full utilization of the token for transactions and development on the platform.

As RXS becomes more widely available, demand is expected to increase as developers deploy smart contracts and build dApps on the network. This increased usage could drive up the utility and, potentially, the value of the RXS token over time, according to some market forecasts.

Could Rexus Finance Be the Next 100x Altcoin?

While the cryptocurrency market is notorious for its unpredictability, some projects have managed to achieve remarkable growth, as seen with Solana and Polygon. Rexus Finance stands out due to its combination of innovative technology and strong investor interest, which could make it a significant player in the market. Several analysts suggest that Rexus Finance has the potential to deliver substantial returns, possibly even 100x growth in the long term, though this still remains speculative at this early stage.

Rexus Finance’s advantages—scalability, transaction speed, low fees, and solid infrastructure—are similar to the factors that fueled the success of its predecessors. With a token price currently well under the $1 level, it presents an attractive entry point for those looking to invest in early-stage blockchain projects.

Conclusion: A Promising Future for Rexus Finance

Rexus Finance (RXS) has demonstrated its potential to make a significant impact in the DeFi space – and its presale is demonstrating that many investors agree with its upside potential.

While predicting future success in the volatile crypto market is always challenging, Rexus Finance’s innovative approach and early market traction suggest that it could become a key player in the industry. Its fast, scalable blockchain and strong presale performance suggest that the project is attracting attention from both developers and investors.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Cardano (ADA) Jumps 4% as Bullish Signals Emerge

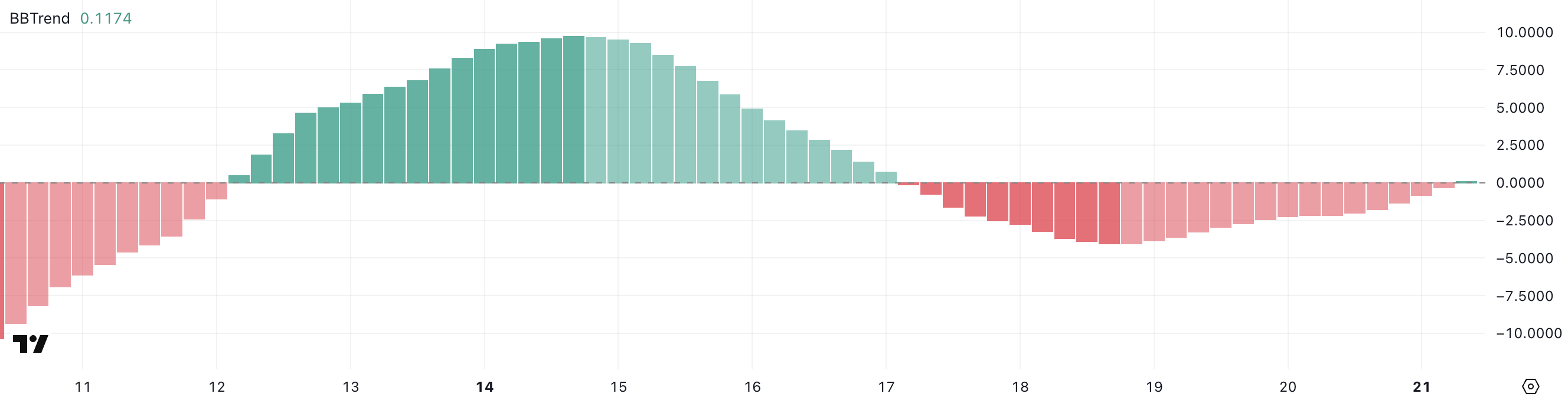

Cardano (ADA) is up 4% on Monday, trying to hit $0.65, showing signs of renewed bullish momentum. Technical indicators are beginning to align in favor of buyers, with the BBTrend turning positive for the first time in days and the DMI signaling strengthening upward pressure.

ADA is also nearing a potential golden cross formation on its EMA lines, which could further support a breakout if resistance levels are cleared. With momentum building and key levels in sight, Cardano is entering a critical zone that could define its short-term direction.

Cardano Shows Early Signs of Recovery as BBTrend Turns Positive

Cardano BBTrend has just flipped back into positive territory at 0.11, following four straight days in the negative zone. This shift, though subtle, may be the first sign of momentum stabilizing after recent weakness.

BBTrend, or Bollinger Band Trend, is a technical indicator that gauges the strength and direction of a trend based on how wide or narrow the Bollinger Bands are.

When the bands begin to expand and BBTrend moves into positive values, it often suggests growing volatility in favor of an emerging bullish trend. On the other hand, prolonged negative readings typically signal fading momentum and a lack of directional strength.

While a BBTrend of 0.11 is still low and not yet signaling a strong uptrend, the fact that it turned positive marks a potential inflection point.

It suggests that selling pressure may be fading and the price could be entering a recovery phase if buying activity increases. This early uptick in BBTrend often precedes a broader move.

Traders will likely be watching closely to see if this positive shift is sustained in the coming sessions, as continued gains in BBTrend could indicate the beginning of a more defined upward move for ADA.

Cardano Buyers Regain Control as Uptrend Shows Early Strength

Cardano Directional Movement Index (DMI) is showing a notable shift in momentum, with its Average Directional Index (ADX) climbing to 17.79, up from 13.77 yesterday.

The ADX measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values below 20 suggest a weak or non-existent trend, while readings above 25 typically confirm that a trend is gaining strength.

ADA’s ADX is still below the 20 threshold but rising steadily—indicating that momentum is building and a stronger directional move could soon take shape.

Looking deeper, the +DI (positive directional indicator) has jumped to 26.38 from 16.30 just a day ago, signaling increased buying pressure. Although it has slightly pulled back from an earlier peak at 29.57, it remains firmly above the -DI (negative directional indicator), which has dropped significantly from 22.72 to 13.73.

This widening gap between the +DI and -DI suggests a clear shift in favor of bulls, with buyers regaining control after a brief period of selling pressure.

If the ADX continues to rise alongside a dominant +DI, it could confirm a strengthening uptrend for Cardano.

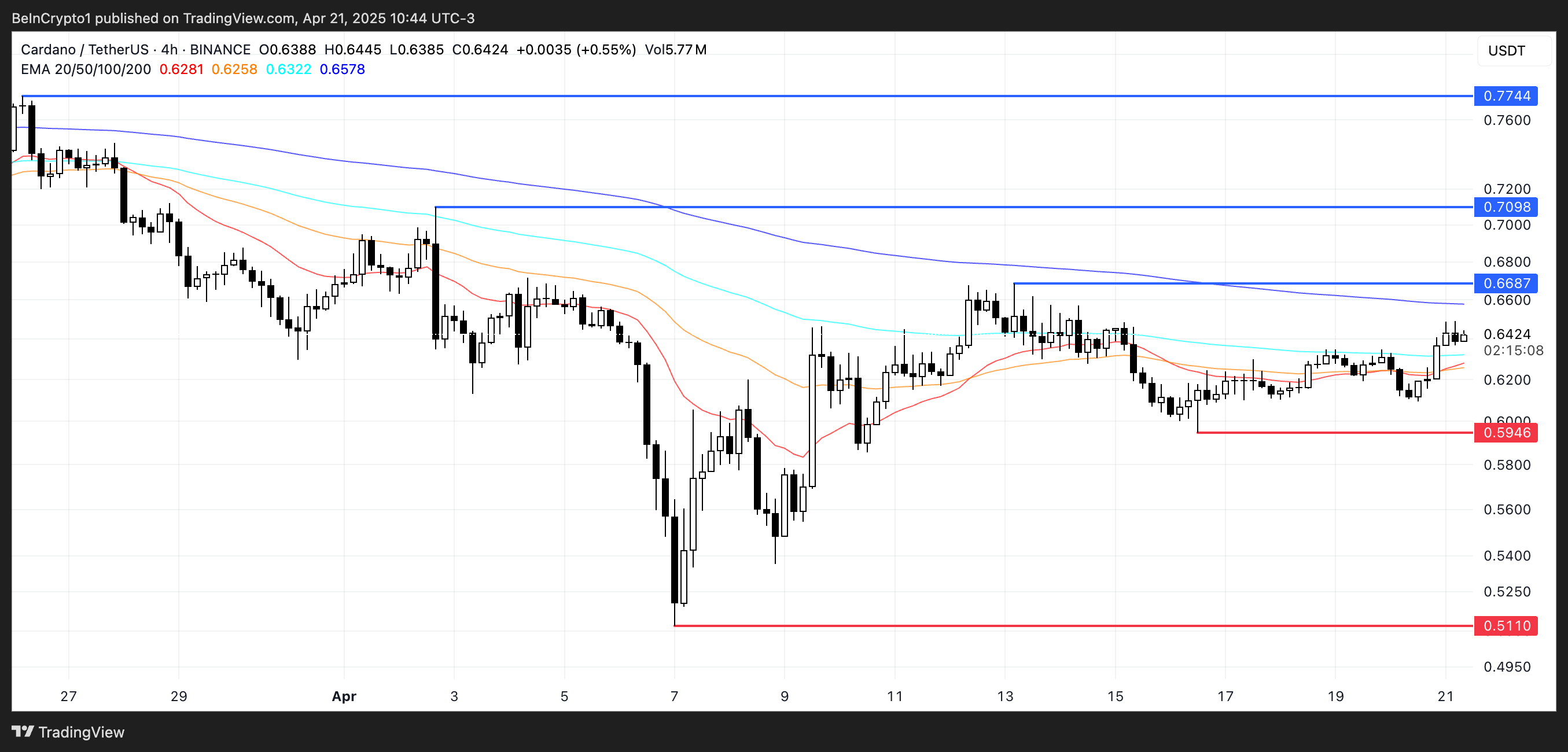

Cardano Nears Golden Cross as Bulls Eye Breakout—but Key Support Still in Play

Cardano price is approaching a potentially bullish technical development, as its EMA lines suggest a golden cross may form in the coming sessions.

A golden cross occurs when the short-term moving average crosses above the long-term moving average, often signaling the start of a stronger uptrend.

If this crossover is confirmed and ADA manages to break above the resistance at $0.668, the next upside targets sit at $0.709 and $0.77—levels not seen since late March.

However, if ADA fails to maintain its upward trajectory and the momentum fades, downside risks remain in play.

A drop back toward the $0.594 support would be the first sign of weakness, and a breakdown below that level could expose the asset to deeper losses, with $0.511 as the next key support zone.

Price action around the $0.668 resistance will likely be the deciding factor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETFs Dominate Market Despite 72 Altcoin Proposals

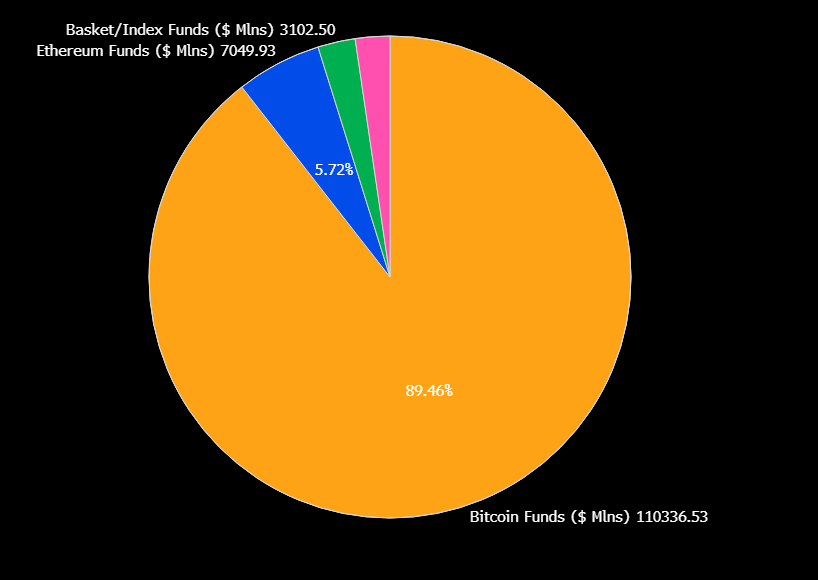

As the SEC is signaling its willingness to approve new altcoin ETFs, 72 active proposals are awaiting a nod. Despite the growing interest from asset managers to launch more altcoin-based products in the institutional market, Bitcoin ETFs currently command 90% of crypto fund assets worldwide.

New listings can attract inflows and liquidity in these tokens, as demonstrated by Ethereum’s approval of ETF options. Still, given the current market interest, it’s highly unlikely that any crypto found will replicate Bitcoin’s runaway success in the ETF market

Bitcoin Dominates the ETF Market

Bitcoin ETFs dramatically changed the global digital assets market over the past month, and they are performing quite well at the moment. In the US, total net assets have reached $94.5 billion, despite continuous outflows in the past few months.

Their impressive early success opened a new market for crypto-related assets, and issuers have been flooding the SEC with new applications since.

This flood has been so intense that there are currently 72 active proposals for the SEC’s consideration:

“There are now 72 crypto-related ETFs sitting with the SEC awaiting approval to list or list options. Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x MELANIA and everything in between. Gonna be a wild year,” claimed ETF analyst Eric Balchunas.

The US regulatory environment has become much friendlier toward crypto, and the SEC is signaling its willingness to approve new products. Many ETF issuers are attempting to seize the opportunity to create a product as successful as Bitcoin.

However, Bitcoin has a sizable head start, and it’s difficult to imagine any newcomer disrupting its 90% market share.

To put that into perspective, BlackRock’s Bitcoin ETF was declared “the greatest launch in ETF history.” Any new altcoin product would need a significant value-add to encroach upon Bitcoin’s position.

Recent products like Ethereum ETF options have attracted fresh liquidity. Yet, Bitcoin’s dominance in the institutional market remains unchanged.

Of these 72 proposals, only 23 refer to altcoins other than Solana, XRP, or Litecoin, and many more concern new derivatives on existing ETFs.

Some analysts claim that these products, taken together, couldn’t displace more than 5-10% of Bitcoin’s ETF market dominance. If an event significantly disrupted Bitcoin, it would also impact the rest of crypto.

Still, that doesn’t mean that the altcoins ETFs are a futile endeavor. These products have continually created new inflows and interest in their underlying assets, especially with issuers acquiring token stockpiles.

However, it’s important to be realistic. While XRP and Solana ETF approvals could drive new bullish cycles for the altcoin market, Bitcoin will likely dominate the ETF market by a large margin — given its widespread recognition as a ‘store of value’.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Lists RSR, Atkins Association Fuels Bullishness

Coinbase is listing Reserve Rights (RSR), a dual‑token stablecoin platform aimed at creating a collateral‑backed, self‑regulating stablecoin ecosystem. Following the announcement, Binance’s ‘smart money’ traders are increasing long positions on the altcoin.

Incoming SEC Chair Paul Atkins was an early advisor for RSR, but he doesn’t maintain any active connection to the project. Nonetheless, RSR speculators may be anticipating some benefits from this old association.

Coinbase Lists RSR To New Enthusiasm

RSR has been active since 2019, aiming to upend the stablecoin ecosystem. It’s an ERC‑20 utility and governance token that underpins the Reserve Protocol, a dual‑token system designed to back and stabilize the Reserve stablecoin (RSV) at a $1 USD peg. RSR, a non-stablecoin, provides governance and backstop insurance to its counterpart.

The asset’s valuation peaked in 2021 but has been quiet since then until regaining prominence in 2024. Today’s Coinbase listing announcement saw RSR jump nearly 10%.

Coinbase first announced that it would list RSR a little under three weeks ago. Coinbase listings usually cause the underlying tokens to spike, and this has been no exception.

However, an intriguing side effect has also taken place. As the asset prepares its debut on Coinbase, top traders on Binance are showing a strong bullish positioning.

On Binance, the top‑trader long/short ratio measures the share of total open positions held as longs by the top 20% of accounts by margin balance. A 65.48% long ratio means these “smart money” participants are overwhelmingly betting prices will rise.

Meanwhile, beyond Coinbase listing, RSR is getting attention due to its link with incoming SEC Chair Paul Atkins. Although Atkins disclosed his crypto investments and has no current link with RSR, he joined the Reserve Rights Foundation as an advisor in its early stages.

Since Atkins succeeded in his confirmation hearing, RSR posted an impressive 22% rally. Technically, he hasn’t been seated as Chair yet, but traders are evidently expecting bullish developments.

Atkins has promised to bring crypto-friendly reform, and this connection could disproportionately impact his former associates.

That isn’t to say that anyone has alleged that Atkins will engage in corruption to unfairly boost RSR. However, since becoming President, members of Trump’s family have been involved in several controversial crypto deals. This precedent may be encouraging traders to believe in the importance of political connections.

For now, market narratives are very important in this industry. As Atkins officially begins his career as the SEC’s new Chair, RSR may continue to receive indirect benefits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin17 hours ago

Bitcoin17 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Market20 hours ago

Market20 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Bitcoin23 hours ago

Bitcoin23 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Says Solana Price To $2,000 Is Within Reach, Here’s How

-

Market18 hours ago

Market18 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Altcoin15 hours ago

Altcoin15 hours agoExpert Reveals Why BlackRock Hasn’t Pushed for an XRP ETF

-

Market17 hours ago

Market17 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V

-

Market13 hours ago

Market13 hours agoSolana Staking Cap Surpasses Ethereum, But Is This Sustainable?