Market

Coinbase Powers First AI-to-AI Crypto Transaction

On August 30, 2024, Coinbase, the US’ largest publicly traded crypto exchange, managed the first AI-to-AI crypto transaction.

This milestone, announced by Coinbase’s CEO Brian Armstrong, represents a significant leap toward a future where artificial intelligence’s intersection with the crypto industry is becoming more evident.

Coinbase Leverages AI Agents for Transactions in a Decentralized Economy

Coinbase conducted its first AI-to-AI crypto transactions using the Base Sepolia Network. Known for its scalability and low transaction costs, Base Sepolia provided the ideal environment for this event.

Coinbase employed its advanced Multi-Party Computation (MPC) technology to create a secure AI agent wallet. This ensured the transaction remained controlled and tamper-proof.

After creating and funding a wallet using a faucet method, the AI agent could seamlessly transfer crypto assets to another wallet. This wallet could belong to either a human user or another AI agent. It demonstrated the versatility and potential of AI-to-AI transactions in a decentralized ecosystem.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

The concept of AI agents conducting transactions autonomously is revolutionary. Traditionally, AI has been limited to processing information and making decisions based on pre-programmed algorithms. However, with the ability to manage and transfer assets without human oversight, AI agents can now operate within decentralized financial systems.

This development enables AI agents to transact with other AI entities, humans, and merchants. Furthermore, it allows AI agents to acquire resources, pay for services, and perform tasks that require financial transactions. All of these transactions can happen without human intervention.

“This is an important step for AIs to get useful work done. Today, if you give an AI agent a task and come back in a few days or hours, it can’t get useful work done. In part, this is a limitation of the technology itself, and products like devin.ai are getting closer to this. But the other reason is that AIs can’t transact to acquire the resources they need. They don’t have a credit card to use AWS, Github, or Vercel. They don’t have a payment method to book you the plane ticket or hotel for your upcoming trip. They can’t get through paywalls (for instance, to read a scientific article), promote their post on X with a paid ad, or use the growing network of paid APIs to integrate the data they need,” Armstrong elaborated.

AI Agents in the Crypto Economy: Opportunities and Obstacles Ahead

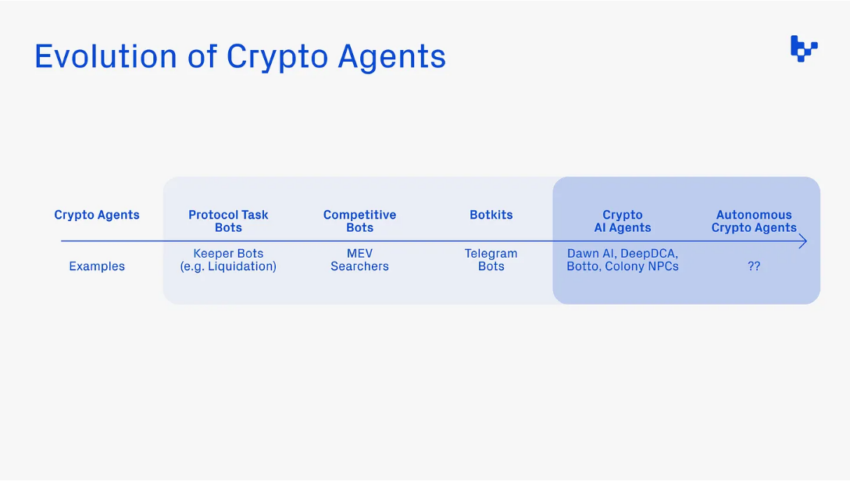

In a December 2023 report, Mason Nystrom, a Junior Partner at Pantera Capital, noted how bots have evolved into “robust AI agents” capable of autonomously handling complex tasks and making well-informed decisions. Nystrom also emphasized that building AI agents on cryptonative rails offers several key advantages. One of the primary benefits is AI agents’ ability to access capital through native payment rails, such as cryptocurrencies.

“Crypto rails present a meaningful improvement for giving AI agents access to capital over having them obtain access to bank accounts or payment processors (e.g. Stripe), or deal with the vast majority of other inefficiencies that exist in our offchain world,” he wrote.

Additionally, AI agents with wallet ownership gain the ability to hold digital assets, such as NFTs or yield-bearing tokens. This grants them digital property rights inherent to crypto assets. Such capability is particularly important for agent-to-agent transactions, where verifiable and deterministic actions are crucial.

“On-chain transactions are deterministic in nature—they either happened or didn’t—which means AI agents will be able to more accurately complete tasks on-chain than off-chain,” he remarked.

Despite AI agents’ promise in the crypto economy, Nystrom also identified significant challenges and limitations. One major limitation is that AI agents need to perform complex logic off-chain to optimize efficiency.

While on-chain transactions are deterministic and verifiable, the computational logic required for decision-making and task execution often needs to be processed off-chain. This condition introduces a layer of complexity and potential vulnerability, as the off-chain components may not have the same level of security and transparency as on-chain transactions.

Additionally, the quality of the tools given directly influences the effectiveness of AI agents. For example, an AI agent tasked with summarizing real-time news events needs access to web scraping tools, while an agent that engages in trading requires a wallet with key signing permissions. This reliance on external tools means that the capabilities of AI agents are inherently limited by the resources and infrastructure available to them.

Moreover, ensuring these tools are secure, reliable, and integrated seamlessly with blockchain technology remains a significant challenge.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

Coinbase’s latest initiative also strengthens the narrative of the intersection between AI and crypto, specifically blockchain. According to a January report from Grayscale Research, the intersection of AI and crypto could offer significant benefits in mitigating societal issues associated with AI. These problems include spreading misinformation and deepfakes.

Galaxy Digital Research adds another dimension to this discussion. It points out that blockchains can serve as a transparent, data-rich environment that AI models require for optimal performance. Although blockchains have limited computational capacity, their transparency and decentralized nature make them ideal for integrating AI in a way that enhances both security and trust.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Bittensor Surpass Bitcoin as a Store of Value? Expert Predicts

Barry Silbert, CEO of Digital Currency Group, has stated that Bittensor (TAO) has the potential to outperform Bitcoin (BTC) as a global store of value.

His comments come amid notable growth in the Bittensor network, with its subnet ecosystem market capitalization and the TAO token’s price on the rise.

Will Bittensor’s Decentralized AI Model Outperform Bitcoin’s Legacy?

In a recent interview with Raoul Pal, Silbert highlighted the growing influence of artificial intelligence (AI) in the crypto sector. According to him, Bittensor is at the forefront of this revolution, representing the “next big era for crypto.”

“You had the Bitcoin and the Ethereum and the NFTs, and you had the layer 2s and DeFi. I think this is the next big investment theme for crypto,” Silbert stated.

He went on to explain that Bittensor shares the same pioneering spirit as early Bitcoin. Still, its purpose extends beyond financial sovereignty.

“The boldest prediction that I could make for Bittensor is it could be a better version of Bitcoin as a global store of value,” he claimed.

He argued that instead of the $10 to $12 billion spent annually to secure the Bitcoin network, that same amount could be redirected toward incentivizing a global network of individuals working to solve major world problems. He envisions this money fostering innovation on a massive scale, with the potential to grow into a multi-billion-dollar ecosystem.

While acknowledging the value of securing the Bitcoin network, Silbert emphasized that Bittensor’s potential lies in its ability to harness this vast financial backing to address real-world challenges.

He noted that Bittensor operates on a similar economic model to Bitcoin, with halving mechanisms and decentralization, positioning it as a powerful contender in the quest for a more impactful and value-driven global network.

Silbert also noted that while plenty of decentralized AI projects have emerged, Bittensor has set itself apart. He referred to it as having reached “escape velocity.” This term is used to convey a project’s rapid growth and increasing market influence.

“99.9% of crypto tokens that are out there have no reason to exist and are worthless,” he added.

Market data reflects the growing enthusiasm for Bittensor. Notably, amid the ongoing volatility, TAO has fared well in comparison to the broader market, rising 32.1% in the last week. At press time, the altcoin was trading at $328, up 7.2% over the past day.

Additionally, TAO is currently the top trending cryptocurrency on CoinGecko, underlining its rising popularity among investors. Google Trends data further proves the growing interest in Bittensor. The search volume peaked at 100 at the time of writing.

Meanwhile, the Bittensor ecosystem is also seeing notable progress. The latest data indicated that the market capitalization of Bittensor’s subnet tokens more than doubled in April 2025.

It increased by 166%, rising from $181 million at the beginning of April to $481 million at press time. As reported by BeInCrypto, this growth follows a tripling of active subnets over the past year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bulls Defend $2.00—Is a Fresh Price Surge Loading?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Vitalik Buterin Proposes to Replace EVM with RISC-V

Ethereum (ETH) co-founder Vitalik Buterin has proposed overhauling the blockchain’s smart contract infrastructure by replacing the Ethereum Virtual Machine (EVM) with RISC-V, a widely adopted open-source instruction set architecture.

This shift aims to address one of Ethereum’s key scaling bottlenecks by dramatically improving the efficiency and simplicity of smart contract execution.

Buterin Proposes Ditching EVM for RISC-V

The proposal was detailed in a post on the Ethereum Magicians forum. In it, Buterin suggested that smart contracts could eventually be compiled to RISC-V rather than EVM bytecode.

According to Buterin, this shift addresses long-term scalability challenges. This particularly includes keeping block production competitive and improving zero-knowledge (ZK) EVM-proof efficiency.

“It aims to greatly improve the efficiency of the Ethereum execution layer, resolving one of the primary scaling bottlenecks, and can also greatly improve the execution layer’s simplicity – in fact, it is perhaps the only way to do so,” he wrote.

Current ZK-EVM implementations spend around half of their proving cycles on EVM execution. By switching to a native RISC-V VM, Ethereum could potentially achieve up to 100x efficiency gains.

Importantly, many fundamental aspects of Ethereum’s architecture would remain unchanged, preserving continuity for developers and users. Core abstractions such as accounts, smart contract storage, ETH balances, and cross-contract calls would function exactly as they do today.

Developers would still write contracts in familiar languages like Solidity or Vyper. These would simply be compiled to RISC-V rather than EVM bytecode. Tooling and workflows would remain largely intact, ensuring a smooth transition.

Crucially, the proposal ensures backward compatibility. Existing EVM contracts will remain fully operational and interoperable with new RISC-V contracts.

Buterin outlines several potential implementation paths forward. The first would support both EVM and RISC-V smart contracts natively. The second suggests wrapping EVM contracts to run via an interpreter written in RISC-V. Thus, it would enable a full transition without breaking compatibility.

The third, more modular approach, builds on the second by formally enshrining interpreters as part of the Ethereum protocol. This would allow the EVM and the future virtual machines to be supported in a standardized way.

Buterin stated that the idea is “equally as ambitious as the beam chain effort.”

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum. But for the execution layer to see similar gains, this kind of radical change may be the only viable path,” Buterin added.

For context, the Ethereum Beam Chain is a redesign of Ethereum’s consensus layer (Beacon Chain). It focuses on faster block times, faster finality, chain snarkification, and quantum resistance. The development will likely begin in 2026.

This proposal fits into Ethereum’s broader vision of modularity, simplicity, and long-term scalability. Previously, BeInCrypto reported on Buterin’s privacy-centric plans for the blockchain.

The proposal focused on integrating privacy-preserving technologies. Moreover, the Pectra upgrade is also nearing, with the launch expected on May 7.

Meanwhile, ETH continues to face market headwinds, trading at March 2023 lows. This year has been quite hard for the altcoin, as it saw a decline of 50.8%. In fact, Ethereum dominance hit a 5-year low last week.

Nonetheless, BeInCrypto data showed a slight recovery over the last 14 days. ETH rose by 6.1%. Over the past day alone, it saw modest gains of 1.7%. At the time of writing, ETH was trading at $1,639.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Market23 hours ago

Market23 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market21 hours ago

Market21 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market22 hours ago

Market22 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Market18 hours ago

Market18 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Enters Historic Buy Zone As Price Dips Below Key Level – Insights

-

Market16 hours ago

Market16 hours agoTokens Big Players Are Buying