Market

Celebrity Meme Coins: Hype or Long-Term Opportunity?

Celebrity meme coins have recently surged in popularity, with figures like Elon Musk, Donald and Melania Trump, and Javier Milei driving significant traffic to this speculative trading area. Once limited to artists and influencers, the meme coin craze has attracted the attention of political leaders.

In an interview with BeInCrypto, industry leaders from BingX, Titan, Bitget, and Trust Wallet discussed the general appeal of meme coins, their associated risks, underlying advantages, and future prospects in the broader crypto sector.

Celebrity Endorsements of Meme Coins

Meme coins generate significant excitement in the cryptocurrency market, attracting investor interest. The accessibility of meme coins to crypto and non-crypto users, combined with their simple launch process, has led to a rise in celebrity-backed tokens.

“At their best, meme coins capture a unique cultural vibe and spark contagious community virality. Celebrities amplify this effect by adding an instant dose of mainstream appeal and social media buzz, effectively lighting a viral fuse,” said Eowyn Chen, CEO of Trust Wallet.

When regulatory obstacles hinder crypto project promotion, meme coins have emerged as a practical marketing alternative for developers. Renowned experts like crypto analyst Miles Deutscher have also spoken about the particular allure meme coins initially had on smaller retail investors.

Deutscher argued that the rise of platforms like Pump.fun can be interpreted as a reaction to former SEC Chair Gary Gensler’s aggressive crackdown on the crypto industry. According to him, Pump.fun was created in direct response to the increasing difficulty of launching fair projects.

To a certain extent, Chen agrees with this analysis.

“On one hand, strict regulations have forced many projects that might have launched as ‘serious’ utility tokens to reinvent themselves as meme coins. These tokens offer wild, unpredictable price swings that attract speculators—so much so that exchanges rush to list them. On the other hand, meme coins tap into a cultural vibe that’s both rebellious and humorous,” she said.

Chen also provided a historical and sociological explanation for the rising trend of meme coins.

Generational Trends and the Rise of Meme Coins

In the 1990s, playwright William Strauss and historian Neil Howe coined the term known as the Strauss-Howe hypothesis. According to this theory, the progression of human society is closely linked to generational change, exhibiting patterns that repeat over approximately 80 to 100 years.

These cycles feature four generations vying for power, leading to an inflection point that forces substantial social and political restructuring. Inspired by this theory, author G. Michael Hopf later developed a quote that represents these four cycles:

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times,” the quote reads.

According to Chen, we are currently in the last phase, where weak men create hard times, and we use meme coins to mock them.

“According to Strauss–Howe generational theory, we’re in the ‘Fourth Turning,’ a time when people expect the future to be bleak—think economic doldrums, looming wars, and a general ‘what’s the point?’ attitude. When life feels like a constant lottery, why not bet on a coin that’s as unpredictable as your dorm roommate’s cooking? Meme coins, with their irreverent, joker-style humour, let people laugh at the establishment while secretly hoping for a visionary revival. They’re not just investments; they’re a way to vent frustration, embrace risk, and even find a bit of community spirit—all with a wink and a nod,” she explained.

Though these meme coins may offer a reprieve from a bleak future, the question remains whether they represent a viable long-term investment or simply a fad.

The Meme Coin Allure Among Public Figures

Several public figures have spotted the attractive prospects of meme coins. Their accessibility and ease of use have drawn high-profile names to launch their own tokens.

“The surge in meme coin popularity coincides with the rise of decentralized platforms and social media-inspired applications, which make it easy for anyone with a wallet to launch a token. Celebrities recognized this as an opportunity to monetize their following and strengthen engagement with fans,” Vivien Lin, Chief Product Officer at BingX, told BeInCrypto.

Given that younger generations tend to use meme coins the most, celebrities can use these types of token launches to engage the majority of their fan bases.

“Now, throw some celebrity sparkle into the mix. When a public figure launches a memecoin, they might think in simple terms: this can connect with younger, digital native, grassroots public to signal that it’s cool. And of course, the tokens seem to be able to grow with unimaginable speed and value, that boost a lot of financial motivations behind as well,” said Chen.

In fact, the current wave of celebrity meme coins isn’t particularly unique. It mirrors past crypto waves that used different strategies to produce similar outcomes.

“This wave of celebrity meme coins bears similarities to earlier NFT trends, where celebrities launched collections promising exclusive experiences for fans. Both trends demonstrate how celebrities leverage technology to strengthen fan engagement and create new forms of connection,” Lin added.

Yet, a notable difference exists between meme coins launched by influencers or pop artists and those launched by political leaders, especially when they are a country’s incumbent president.

Meme Coins as Trackers of Public Sentiment

When pop star Iggy Azalea launched her MOTHER token, its highest point reached $136.6 million. Meanwhile, Haliey Welch’s HAWK token reached a maximum of $500 million.

However, when political figures, such as the US presidential couple and Argentine President Javier Milei, launched their meme coins, their highest peak in market capitalization reached billions of dollars.

“These coins were unique events, and replicating them would be nearly impossible. The success of TRUMP was partially driven by the buzz surrounding Trump’s reelection and global recognition. It’s incredibly rare to see a token achieve a market cap exceeding $3 billion within a month of trading,” Lin said.

The trading activity of meme coins launched by political figures can be useful in reflecting broader public sentiment and alignment with the figures themselves.

“While this kind of rapid surge is exceptional, it highlights how crypto markets can quickly reflect trends, with investors essentially casting ‘votes’ through their transactions. This makes crypto a valuable tool for identifying emerging social and financial sentiment,” Lin explained.

To that point, Chris Chung, Founder of Solana swap platform Titan, added:

“The main driver of the current popularity of celebrity meme coins is the hype surrounding the US election. People wanted to get involved in the political action and the TRUMP and MELANIA meme coins offered them an easy and quick way to do so.”

However, despite initial price surges, if a solid roadmap doesn’t accompany the token launches, prospects of long-term viability seem abysmal.

A Short-Lived Success

The rise of meme coins associated with celebrities is fueled by their influence, market speculation, and cultural trends. The initial excitement generated by these coins attracts investors, and this cycle repeats as new celebrity-backed tokens emerge, appealing to both early investors and trend followers.

But time and time again, the success of celebrity token launches proved to be short-lived.

“Celebrities, aware of the short-term nature of trends in today’s creator economy, recognize the demand and capitalize on the opportunity, endorsing these tokens. However, the long-term success of these coins remains uncertain, as they heavily depend on ongoing public interest and market speculation,” Alvin Kan, Chief Operating Officer at Bitget Wallet, told BeInCrypto.

The viability of any meme coin, whether endorsed or not by a celebrity, is straightforward, according to him.

“There is little evidence that these coins can sustain their price or popularity over time. Typically, after a quick appreciation, the price falls, as seen with recent launches. For these coins to evolve into more stable investments, they would need to develop stronger community engagement and broader utility. Without such developments, celebrity-backed memes coins are more likely to remain speculative and short-term in nature,” Kan said.

According to Chung, plenty of examples exist to back this explanation up.

“I think it’s the same with any memecoin. You get a short term run-up, but unless it shows some benefits or strong following, it will die off. The memes that survive have a team behind them with a strong narrative. DOGE is still here because it has had continued support and endorsement from Elon Musk. WIF is still here because it’s a bit of a status symbol if you’re an OG on Solana, like DOGE and SHIBA are on other networks. But PNUT, for example, fell off the radar because no one continued building the narrative behind it. It was just short-term hype,” he said.

In fact, analyzing what other meme coin projects did right can serve as indicators of what celebrity projects did wrong.

Lessons from Successful Projects

Dogecoin originated as a joke in late 2013, intended by creators Billy Markus and Jackson Palmer as a lighthearted alternative to serious cryptocurrencies. Inspired by the ‘Doge’ meme, it quickly gained popularity. According to the official website, Dogecoin surpassed Bitcoin’s transaction volume within two weeks.

After Markus and Palmer departed in 2014, a core development team assumed responsibility for maintaining and advancing the cryptocurrency. Despite its origins as a humorous endeavor, Dogecoin cultivated a substantial and dedicated community.

The success of the Shiba Inu coin mirrors that of Dogecoin. Its prominence is largely credited to its integration with internet meme culture. Viral moments, including celebrity tweets, influencer endorsements, and extensive social media campaigns, significantly boosted its popularity.

“DOGE and SHIB spent years developing communities, publishing whitepapers, and contributing to philanthropic efforts like dog rescue programs, Olympic sponsorships, and clean water initiatives once they realized their token was accumulating more market share,” Lin explained.

Celebrity meme coins that learned to integrate real-world utility into their products early on also benefitted from long-term success.

“Iggy Azalea’s MOTHER token has maintained engagement through hosting events, giveaways, and partnerships for token holders,” Lin added.

However, this was not the case for most celebrity meme coins.

“In contrast, celebrity meme coins get an instant spark from top–down endorsements—they create quick buzz and viral hype, but often lack the deep, sustained community support needed for long-term success. In short, while celebrity-backed tokens capture immediate attention, lasting value comes from genuine, grassroots engagement,” Chen explained.

Given this reality, celebrity meme coins offer investors more risks than rewards today.

Associated Risks

The main risks associated with celebrity meme coins include pump-and-dump schemes and rug pulls.

“Investing in celebrity-backed meme coins comes with a set of risks that mirror those found in the broader meme coin space, though they can sometimes be amplified by the extra hype. For example, pump-and-dump schemes remain a major hazard—when a celebrity endorsement causes prices to surge on the strength of social media buzz, the rally can quickly evaporate once the initial excitement subsides,” Chen told BeInCrypto.

When Javier Milei launched LIBRA earlier this month, insider traders were the first to purchase the token when prices were still low. Within an hour of its launch, LIBRA had reached a market capitalization of over $4 billion.

Taking advantage of the soaring prices, insiders sold off most of the token’s supply, causing the price to plummet. Meanwhile, smaller investors lost over $250 million. The episode serves as a key example of how these types of schemes most impact inexperienced investors.

“Celebrity-backed meme coins follow a similar pattern of influencer-driven hype seen in past cryptocurrency trends. However, the key difference lies in the target audience: previous waves of meme coins were often promoted by crypto-native figures, such as Elon Musk or well-known developers. Today’s celebrity meme coins aim to attract a broader audience that is more familiar with the celebrity endorsing the coin than with the cryptocurrency space itself,” Kan explained.

Furthermore, celebrity involvement significantly increases the stakes, as their influence drives substantial traffic, amplifying the potential for catastrophic consequences.

Legal and Ethical Concerns

When celebrities are involved in fraudulent schemes connected to meme coins, the backlash tends to be higher. After the LIBRA boom and bust, Milei received over 100 legal complaints in Argentina, while opposition leaders threatened to impeach him.

Haliey Welch’s Hawk Tuah meme coin launch ended in similar circumstances. After reaching a market capitalization of half a billion dollars, the token crashed within 20 minutes.

“The ethics of celebrity-backed financial endorsements are under intense scrutiny. Investors often don’t know the true intentions of the teams behind these tokens. In the case of Haliey Welch’s Hawk Tuah token, allegations of fraud and deceptive practices led to the project’s swift collapse. Since Welch’s fan base was largely non-crypto native, many investors felt misled,” Lin commented.

In response, several legal actions were taken against Welch.

“Consider the consequences of the entire Hawk Tuah girl debacle. Investors have filed a lawsuit against her and there have even been reports of her being investigated by Interpol,” Chung said.

As a response, industry experts anticipate that regulatory bodies will increase their oversight of meme coins.

Regulatory Scrutiny and Investor Protection

Several celebrity meme coin launches ending in havoc set important precedents for how regulators and the industry will address these issues.

“As memecoins and celebrity endorsements gain more attention, regulatory bodies are likely to tighten their scrutiny. Regulators may begin to categorize these endorsements as market manipulation or fraudulent activities, especially in light of ongoing investigations into cryptocurrency and celebrity promotions. This could result in stricter guidelines regarding disclosure and anti-fraud measures. While the regulatory landscape is still evolving, it is possible that the popularity of celebrity-backed meme coins will diminish if stricter regulations are imposed,” Kan told BeInCrypto.

There are also steps individual investors can take to minimize risks.

“Education is key. Before exploring any token—celebrity-backed or otherwise—users should research its origins, tokenomics, and community involvement. If a token is heavily tied to a single person’s influence without clear utility or decentralization, it could be a red flag. It’s also important to recognize that meme coins, especially celebrity-driven ones, are highly speculative, and people should never invest more than they can afford to lose,” Chen said.

Chang agreed with this last point and added:

“Information diversification is an important part of this – being more plugged into Crypto Twitter can help investors keep on top of the news and narratives.”

Meanwhile, portfolio diversification is essential to reduce overexposure to meme coin investments.

“Diversifying investments and avoiding putting more money into these coins than one can afford to lose can help mitigate risk. Monitoring the market and staying informed about potential shifts in price and hype can also prevent significant losses,” Kan said.

Yet, the onus for long-term viability should fall on meme coin projects to establish robust foundations rather than expecting investors to mitigate risk solely.

The Future of Celebrity Meme Coins

Industry experts unanimously agree that community and utility are the key determinants for the future success of celebrity meme coins. They are bound to fail without them, and smaller investors will bear the biggest brunt.

“Celebrity memecoins will really be like any other memecoins. If a celebrity can form enough of a following and keep the narrative around the memecoin going, the token will survive. If not, it will die like the vast majority of memecoins,” Chung said.

This will determine the project’s success or failure.

“As more negative stories accumulate around the collapse of celebrity-backed coins, the ethical and regulatory challenges may discourage further celebrity involvement. The future of these coins will likely depend on whether they can evolve to offer more sustainable communities and utility, or if they will remain tied to short-term hype,” Kan concluded.

In the end, only time will reveal the fate of celebrity meme coins.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Report Alleges Massive Meme Coin Sniping on Pump.fun

According to a new report from Pine Analytics, token deployers on Pump.fun systematically funded sniper wallets to buy their own meme coins. This impacted over 15,000 token launches on the platform.

These sniper wallets operated primarily during US trading hours, executing standardized, profitable strategies. Unrelated bot activity obscures their behavior, making it extremely difficult to isolate these wallets—and they can readily adapt to new countermeasures.

Snipers Roam Free on Pump.fun Meme Coins

Pump.fun has remained one of the most popular meme coin launchpads on Solana despite persistent controversies and other criticism.

However, Pine Analytics’ new report has uncovered a new controversy, discovering systematic market manipulation on the platform. These snipes include as much as 1.75% of all launch activity on Pump.fun.

“Our analysis reveals that this tactic is not rare or fringe — over the past month alone, more than 15,000 SOL in realized profit was extracted through this method, across 15,000+ launches involving 4,600+ sniper wallets and 10,400+ deployers. These wallets demonstrate unusually high success rates (87% of snipes were profitable), clean exits, and structured operational patterns,” it claimed.

Solana meme coin deployers on Pump.fun follow a consistent pattern. They fund one or more sniper wallets and grant them advance notice of upcoming token launches.

Those wallets purchase tokens in the very first block and then liquidate almost immediately—85% within five minutes and 90% in just one or two swap events.

Pump.fun meme coin developers exploit this tactic to create the appearance of immediate demand for their tokens. Retail investors, unaware of the prior sell‑off, often purchase these tokens after the snipe, giving developers an unfair advantage. This constitutes market manipulation and erodes trust in the platform.

Pine Analytics had to carefully calibrate its methods to identify genuine snipers. Apparently, 50% of meme coin launches on Pump.fun involve sniping, but most of this is probably bots using the “spray and pray” method.

However, by filtering out snipers with no direct links to developer wallets, the firm missed projects that covered their tracks through proxies and burners.

In other words, the meme coin community does not have adequate defenses against systematic abuse on Pump.fun. There are a few possible ways that the platform could flag repeat offenders and sketchy projects, but adaptive countermeasures could defeat them. This problem demands persistent and proactive action.

Unfortunately, it may be difficult to enact such policies. Meme coin sniping is so systematic that Pump.fun could only fight it with real commitment.

Analysts think that building an on-chain culture that rewards transparency over extraction is the best long-term solution. A shift like that would be truly seismic, and the meme coin sector might not survive it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Leads Blockchain Metrics as SOL Momentum Builds

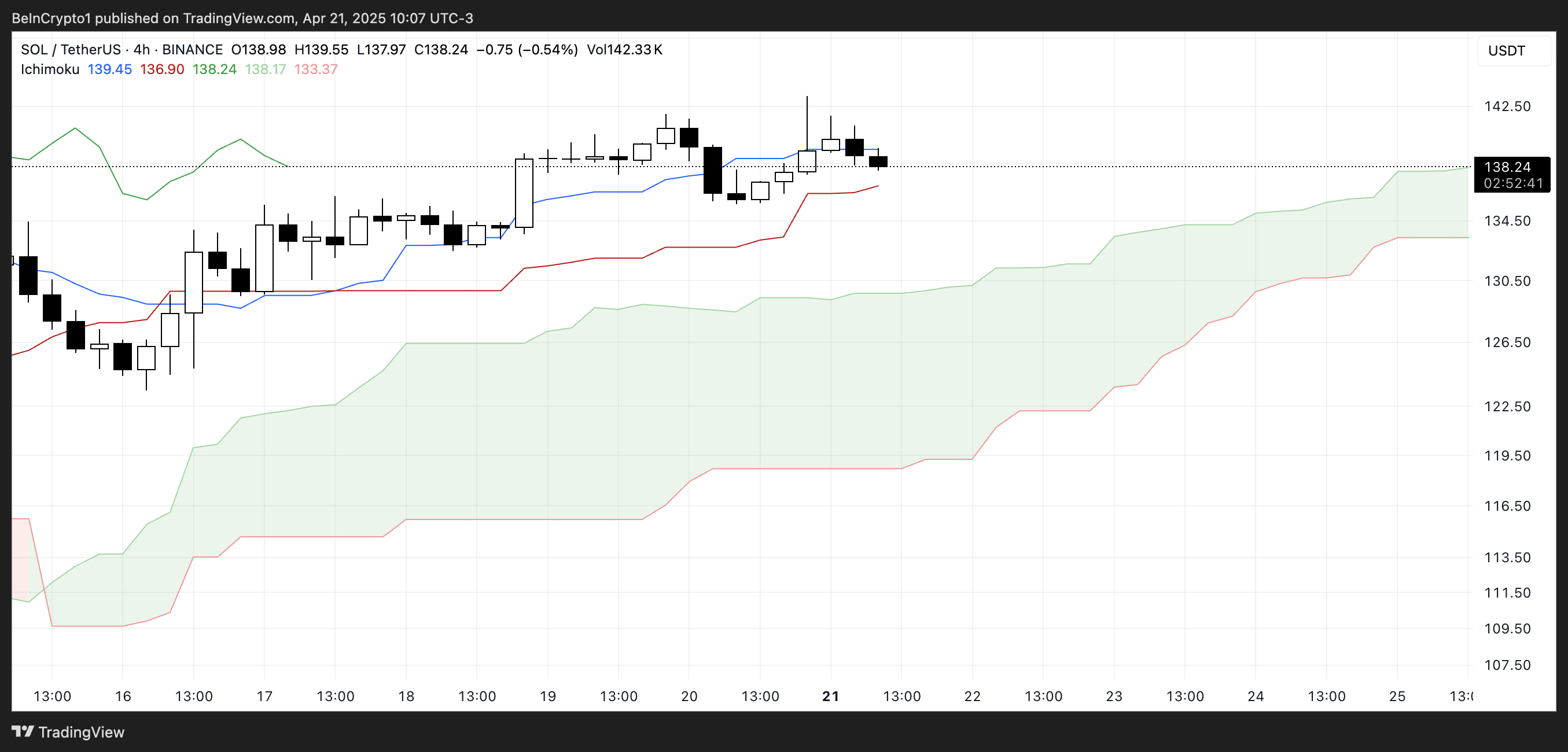

Solana (SOL) continues to show strength across multiple fronts, maintaining a bullish structure on its Ichimoku Cloud chart while gaining momentum in key market metrics. The BBTrend indicator has turned higher again, signaling renewed buying pressure after a brief cooldown.

On-chain activity remains strong, with Solana leading all blockchains in DEX volume and dominating fee generation thanks to the explosive growth of meme coins and launchpad activity. With SOL now trading above a key resistance level, the path is open for further upside—though a loss of momentum could still trigger a retest of lower supports.

Solana Maintains Bullish Structure, but Momentum Faces Key Test

On Solana’s Ichimoku Cloud chart, the price is currently above the Kijun-sen (red base line) but has dipped below the Tenkan-sen (blue conversion line), signaling weakening short-term momentum.

The flattening Tenkan-sen and price behavior suggest possible consolidation or the early stages of a pullback. Still, with the price holding above the Kijun-sen, medium-term support remains intact.

The overall Ichimoku structure remains bullish, with a thick, rising cloud and leading span A well above span B—indicating strong underlying support.

If Solana finds support at the Kijun-sen and climbs back above the Tenkan-sen, the uptrend could regain strength; otherwise, a test of the cloud’s upper boundary may follow.

Meanwhile, Solana’s BBTrend is currently at 6, extending nearly ten days in positive territory after peaking at 17.5 on April 14. The recent increase from 4.26 to 6 suggests renewed bullish momentum following a brief cooldown.

BBTrend, or Bollinger Band Trend, tracks the strength of price movement based on Bollinger Band expansion.

Positive values like the current one point to an active uptrend, and if the BBTrend continues to rise, it could signal stronger momentum and potential for another upward move.

Solana Dominates DEX Volume and Fee Generation as Meme Coins Drive Ecosystem Growth

Solana has once again claimed the top spot among all chains in DEX volume, recording $15.15 billion over the past seven days. The combined total of Ethereum, BNB, Base, and Arbitrum reached $22.7 billion.

In the last 24 hours alone, Solana saw $1.67 billion in volume, largely fueled by its booming meme coin ecosystem and the ongoing launchpad battle between PumpFun and Raydium. Adding to this good momentum, Solana recently surpassed Ethereum in Staking Market Cap.

When it comes to application fees, Solana’s momentum is just as clear. Four of the top ten fee-generating apps over the past week—PumpFun, Jupiter, Jito, and Meteora—are Solana-focused.

Pump leads the pack with nearly $18 million in fees alone.

Solana Breaks Key Resistance as Uptrend Targets Higher Levels, but Risks Remain

Solana has finally broken above its key resistance at $136, flipping it into a new support level that was successfully tested just yesterday.

Its EMA lines remain aligned in a bullish setup, suggesting the uptrend is still intact.

If this momentum continues, SOL price could aim for the next resistance zones at $147 and $152—levels that, if breached, open the door to a potential move toward $179.

The current structure favors buyers, with higher lows and strong support reinforcing the trend.

However, if momentum fades, a retest of the $136 support is likely.

A breakdown below that level could shift sentiment, exposing Solana to deeper pullbacks toward $124 and even $112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Firms Donated $85 million in Trump’s Inauguration

According to a new report, 15 firms and individuals from the crypto industry donated more than $100,000 to President Trump’s Inauguration, totaling over $85 million.

Almost all of these companies apparently received direct or indirect benefits from Trump’s administration. This includes dropped legal proceedings, lucrative business partnerships, participation in Trump’s Crypto Summit, and more.

Crypto Industry Went All-In on Trump’s Inauguration

Since promising to bring friendlier regulations on the campaign trail, Donald Trump attracted a reputation as the Crypto President.

Trump’s Inauguration festivities included a “Crypto Ball,” and several prominent firms made donations for these events. Today, a report has compiled all crypto-related contributions of over $100,000, revealing some interesting facts.

Since taking office, President Trump and his family have been allegedly involved in prominent crypto controversies, and these donations may be linked to several of them.

For example, eight of the donors, Coinbase, Crypto.com, Uniswap, Yuga Labs, Kraken, Ripple, Robinhood, and Consensys, had SEC investigations or lawsuits against them closed since Trump’s term began.

The commission might have dropped its probe against these companies anyway due to its changing stance on crypto enforcement. However, being in the President’s good books likely helped the process.

Further Alleged Benefits for Donors

In other words, nearly half the firms that made donations to Trump’s Inauguration have seen their legal problems cleared up quickly. This isn’t the only regulation-related benefit they allegedly received.

Circle, for example, recently made an IPO after openly stating that Trump’s Presidency made it possible. Galaxy Digital received SEC approval for a major reorganization, a key step for a NASDAQ listing.

Other donors, such as Crypto.com and ONDO, got more direct financial partnerships with businesses associated with the Trump family.

Previously, Ripple’s CEO, Brad Garlinghouse, anticipated a crypto bull market under Trump. Also, XRP, Solana, and Cardano were all unexpectedly included in the US Crypto Reserve announcement.

All three of these companies made major donations to Trump’s Inauguration.

It seems that most of the firms involved got at least some sort of noticeable benefit from these donations. Donors like Multicoin and Paradigm received invitations to Trump’s Crypto Summit, while much more prominent groups like the Ethereum Foundation got snubbed.

Meanwhile, various industry KOLs and community members have already alleged major corruption in Trump’s crypto connections.

While some allegations might lack substantial proof, the crypto space has changed dramatically under the new administration, for both good and bad.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.