Market

Cardano (ADA) Struggles to Sustain Gains—Is the Uptrend in Trouble?

Cardano price started a fresh rally above the $0.70 zone. ADA is now correcting gains and struggling to start another increase above $0.780.

- ADA price started a fresh rally above the $0.70 and $0.720 levels.

- The price is trading above $0.720 and the 100-hourly simple moving average.

- There is a key bullish trend line forming with support at $0.750 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another decline if it trades below the $0.7150 support zone.

Cardano Price Climbs Above $0.70

After forming a base above the $0.650 level, Cardano started a fresh rally beating Bitcoin and Ethereum. ADA was able to clear the $0.70 and $0.720 resistance levels.

It even surged above the $0.80 level. A high was formed at $0.8204 and the price is now correcting gains. There was a move below the $0.80 level. The price dipped below the 23.6% Fib retracement level of the upward move from the $0.6512 swing low to the $0.8204 high.

However, the bulls are now active near the $0.7550 zone. There is also a key bullish trend line forming with support at $0.750 on the hourly chart of the ADA/USD pair.

Cardano price is now trading above $0.7550 and the 100-hourly simple moving average. On the upside, the price might face resistance near the $0.780 zone. The first resistance is near $0.800. The next key resistance might be $0.820.

If there is a close above the $0.820 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.9150 region. Any more gains might call for a move toward $1.00 in the near term.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.80 resistance level, it could start another decline. Immediate support on the downside is near the $0.750 level and the trend line.

The next major support is near the $0.7150 level or the 61.8% Fib retracement level of the upward move from the $0.6512 swing low to the $0.8204 high. A downside break below the $0.7150 level could open the doors for a test of $0.650. The next major support is near the $0.6250 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.7500 and $0.7150.

Major Resistance Levels – $0.8000 and $0.8200.

Market

Solana (SOL) Price Rises 13% But Fails to Break $136 Resistance

Solana (SOL) has climbed 13% over the past seven days, showcasing strong short-term performance. While momentum indicators like the RSI and EMA lines remain supportive, recent price action suggests that bullish strength may be stalling just below a key breakout point.

At the same time, the sharp drop in BBTrend indicates weakening trend strength and fading volatility, often a sign of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s next move will likely depend on whether buyers can regain control or if a broader pullback begins to unfold.

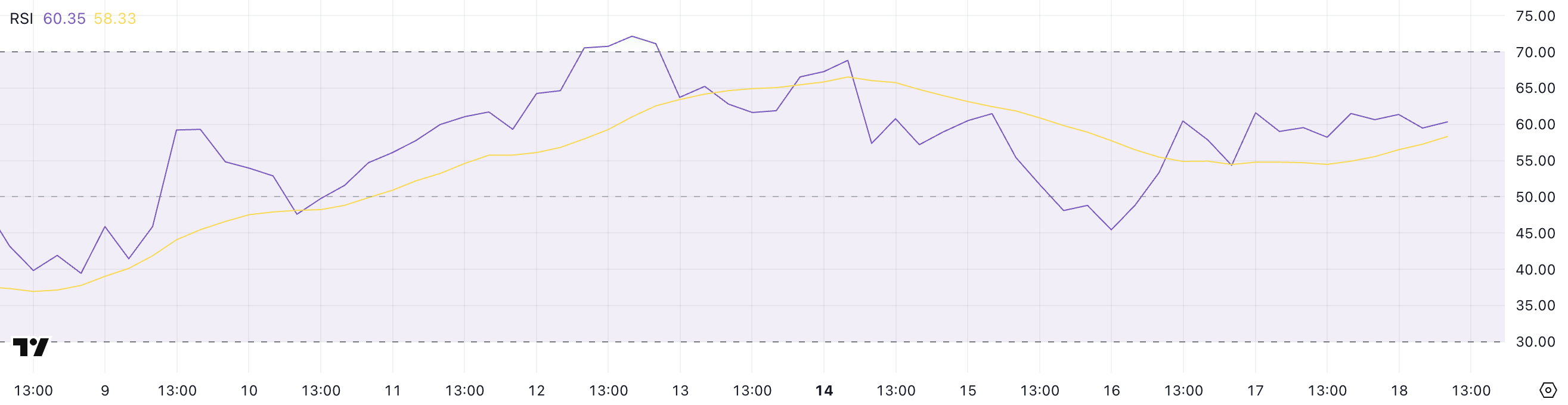

SOL RSI Rises Sharply, but Pause in Momentum Signals Caution

Solana’s Relative Strength Index (RSI) is currently at 60.35, marking a noticeable rise from 45 just two days ago.

This jump signals growing bullish momentum, although the RSI has remained stable since yesterday, suggesting that upward pressure may be easing for now.

The increase reflects renewed buying interest in recent sessions, pushing SOL closer to overbought territory but not quite there yet. This leveling off could indicate that the market is taking a breather before deciding its next move.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements, ranging from 0 to 100. Values above 70 typically indicate that an asset is overbought and may be due for a pullback, while readings below 30 suggest oversold conditions, potentially signaling a buying opportunity.

With Solana’s RSI at 60.35, the asset is approaching bullish territory but hasn’t yet entered an extreme zone.

This positioning suggests that while recent momentum is positive, SOL could face some short-term consolidation or resistance before continuing higher—unless strong buying interest resumes and pushes the RSI closer to overbought levels.

SOL Trend Strength Weakens as BBTrend Falls Below 6

Solana’s BBTrend indicator is currently at 5.69, a significant drop from the 17.5 reading observed just four days ago.

This sharp decline suggests that volatility around SOL’s price has cooled notably, and the strength of the prior trend is weakening.

While BBTrend doesn’t signal direction on its own, the drop indicates that the strong movement, likely bullish, has lost momentum, and SOL may be entering a phase of consolidation or uncertainty.

BBTrend, short for Bollinger Band Trend, measures the strength of a price trend based on the expansion or contraction of Bollinger Bands.

Higher values suggest a strong, directional move (either up or down), while lower values point to weaker trends and reduced volatility. With BBTrend now at 5.69, Solana is in a much less volatile environment, which often precedes a breakout or a reversal.

For now, this reading signals that the recent momentum is fading. Unless volatility picks up again, SOL’s price may remain range-bound in the short term.

Golden Cross Looms for SOL, But $136 Barrier Still Holding Strong

Solana’s EMA lines continue to reflect a bullish structure, with the short-term average trending above the long-term one—suggesting that positive momentum remains intact.

A potential golden cross is also forming, which, if confirmed, would further reinforce the bullish outlook.

However, despite this favorable setup, Solana price has struggled to break through the $136 resistance level over the past few days, indicating that buyers may be losing steam at this key threshold.

Tracy Jin, COO of MEXC told BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with strong volume, it could open the path toward the next targets at $147 and potentially higher. But if the current momentum fades and the price reverses, a test of support at $124 becomes likely.

About Solana next moves, Jin told BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown below that could accelerate losses toward $112, and in the event of a deeper correction, SOL could even revisit the $95 region.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Roadmap Frustrates Users Over Missing Timeline

Pi Network released its Mainnet Migration Roadmap today. The roadmap lays out a three‑phase plan to move tens of millions of Pioneers who are still waiting to be moved to the open network. It also introduces new rewards, such as referral bonuses.

However, unlike most project roadmaps, Pi network didn’t provide any estimated date or timeline. This lack of clarification has frustrated early adopters who still await key rewards and clarity on rollout pacing.

Pi Network’s Three‑Phase Migration Plan

According to the roadmap, Pi Network will first complete initial migrations for Pioneers already in the queue. This batch covers verified base mining rewards, Security Circle contributions, lockup commitments, utility‑app usage rewards, and confirmed Node rewards for some operators.

After clearing the first wave, the team will tackle second migrations, adding all referral mining bonuses linked to KYC‑verified team members. Pi says these referral rewards will follow once the current queue finishes.

Finally, the network will move into ongoing periodic migrations—potentially monthly or quarterly—to process any remaining bonuses and rewards.

The cadence “is to be determined,” the roadmap notes.

Community Concerns and Critical Gaps

A thorough observation reveals several gaps and potential concerns in the roadmap.

For one, the plan never discloses how many Pioneers remain in the queue or the network’s daily migration capacity. Without those figures, users can’t predict when their own migration will occur.

Node operators report that some “confirmed Node rewards” have landed, but criteria for qualification remain opaque. Early node runners worry they may miss out without clear benchmarks.

Many Pioneers say they have tapped their claim buttons daily since migration opened yet still lack basic mining rewards. They question whether those base rewards and deferred referral bonuses will ever arrive in phase two.

Also, the roadmap admits the UI’s “Transferable Balance” underestimates actual migrated amounts to save resources. Users fear this pessimistic display could erode trust if their true balances remain hidden.

“I thought we were mining all of these PI coins this whole time? I thought the security circles were the Consensus Mechanism. It kinda seems to me like there isn’t a blockchain, and never was one. What kind of “Blockchain protocol” would “Require” all tokens to be minted at genesis?” one community member wrote.

Crucially, Pi offers no audit or error‑resolution process for users who spot mismatches in their historical mining data.

Given six years of complex records, occasional disputes seem inevitable, but the roadmap remains silent on redress.

All migrations hinge on KYC completion, yet the team omits any scaling targets or timelines for identity verification. A bottleneck here could stall every subsequent phase.

The schedule also ignores how major token unlock events—such as the roughly 108.9 million PI tokens due to release this month—will align with migration waves.

Finally, some Pioneers challenge the project’s foundational narrative. They note that Pi’s statement “all tokens were minted at genesis” contradicts six years of “mining.”

This raises doubts about whether Pi ever operated on a true blockchain protocol.

In the past month, PI price has dipped by over 45%. To sustain momentum and community trust, the team must now supply concrete timelines, transparent criteria, and clear audit paths for its Mainnet migration.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Altcoin23 hours ago

Altcoin23 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market20 hours ago

Market20 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Market18 hours ago

Market18 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Market22 hours ago

Market22 hours agoSui Meme Coins Surge With Rising DEX Volumes

-

Altcoin21 hours ago

Altcoin21 hours agoAnalysts Predict XRP Price to Hit $6 as Wave 2 Correction Nears End