Market

Cardano (ADA) Stalls as Volume Hits $1 Billion in 24 Hours

Cardano (ADA) has remained relatively stagnant, with its price barely moving from the levels seen seven days ago. Despite this lack of price action, trading volume has surged nearly 28% in the last 24 hours, climbing to $1 billion.

This increase in activity comes while ADA continues to consolidate, with technical indicators signaling indecision in the market. As momentum builds, traders are watching closely for signs of a breakout from this tight range.

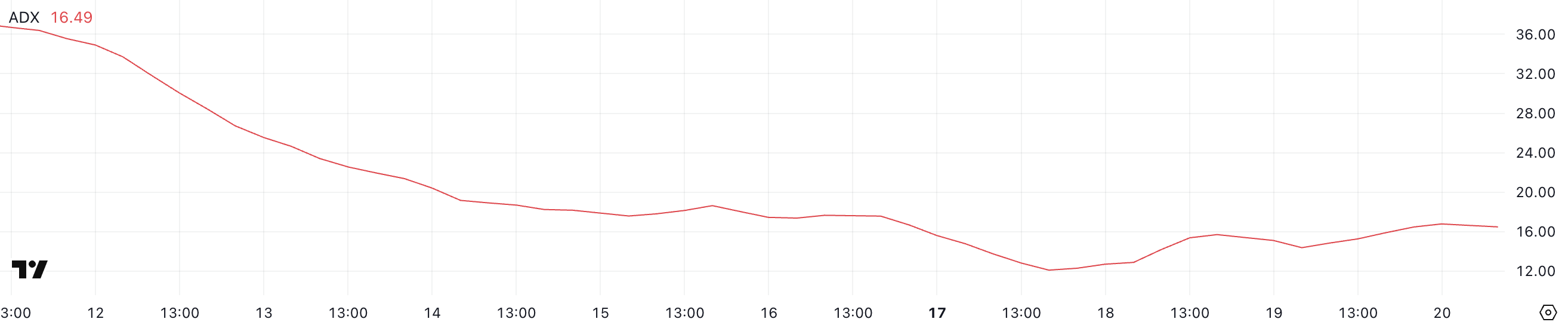

Cardano ADX Shows The Lack Of A Clear Direction

Cardano’s trend strength has remained relatively unchanged, with its ADX currently at 16.49 – roughly the same level it has maintained since yesterday.

This flat movement in the ADX suggests that there hasn’t been a significant shift in momentum, and the market lacks a clear directional trend.

ADA’s price is currently caught in a consolidation phase, with neither buyers nor sellers able to establish dominance, which is reflected in the stagnant ADX reading.

The ADX (Average Directional Index) is a technical indicator used to measure the strength of a trend without indicating its direction.

An ADX below 20 typically signals a weak or non-existent trend, while readings between 20 and 40 point to a developing or moderate trend, and values above 40 indicate a strong trend.

With ADA’s ADX holding below the 20 mark, it suggests that the current market environment remains indecisive, likely leading to continued sideways movement.

For now, this consolidation phase could persist until a stronger directional move emerges, either through renewed buying momentum or an increase in selling pressure.

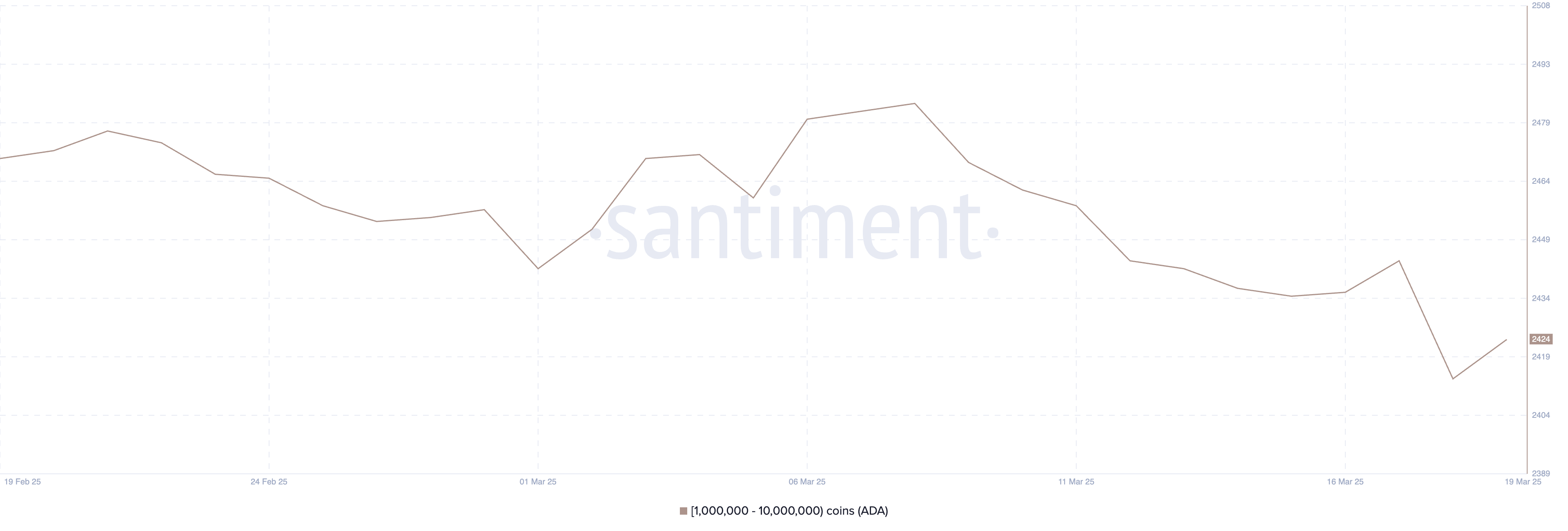

Cardano Whales Dip to July 2024 Lows

The number of Cardano whales experienced a sharp decline between March 8 and March 18. These are wallets holding between 1 million and 10 million ADA.

According to Santiment data, the number of ADA whales fell from 2,484 to just 2,414, marking the lowest level since July 2024.

On March 19, there was a slight recovery, with the number of whales rising to 2,424.

While this minor rebound shows some renewed accumulation, the overall count remains well below the levels seen in previous weeks, highlighting reduced participation from larger holders during this period.

Tracking ADA whales is crucial because these large addresses often play a significant role in influencing price action. Whales can create liquidity shifts and often act as a signal for institutional or high-net-worth investor sentiment.

The current lower whale count suggests that confidence among these key players might still be cautious.

Even with the recent uptick, whale numbers remaining below their earlier highs could point to subdued buying pressure, potentially limiting ADA’s ability to break out of its current consolidation phase in the near term.

Cardano Is Trading Between a Critical Range

Cardano EMA lines signal a consolidation phase. The short-term moving averages remain below the long-term ones but are currently very close together, indicating a lack of strong momentum in either direction.

This setup suggests indecision in the market, but it also leaves room for a potential breakout. If Cardano price manages to build bullish momentum and establish an uptrend, it could first target the $0.77 resistance.

A successful breakout above this level could pave the way for a rally toward $1.02, and if buying pressure continues, ADA might even push as high as $1.17.

On the flip side, if a downtrend develops, ADA could fall back to test the key support level at $0.64.

Losing this support would be a bearish signal and could trigger a deeper decline toward $0.58.

The current positioning of the EMA lines shows that while there’s no clear trend dominance, both bullish and bearish scenarios remain possible depending on how the price reacts to these critical levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethena Labs Leaves EU Market Over MiCA Compliance

Ethena Labs is officially closing its German branch and EU operations after a previous MiCA application rejection. For the past month, the firm has been preparing to withdraw from this market.

Although the exit was anticipated, ENA reacted notably, with the altcoin falling over 7% after today’s announcement.

Ethena Labs Failed MiCA Effort

Ethena Labs has been facing continued regulatory difficulties in Europe. In late March, German authorities rejected Ethena’s application for MiCA compliance.

At the time, the firm suggested that this was a minor setback and that it would focus on other markets. Today, it announced that its German branch is winding down altogether.

“We have agreed with BaFin to wind down all activities of Ethena GmbH and will no longer be pursuing the MiCAR authorization in Germany. All whitelisted… users previously interacting with Ethena GmbH have at their request been onboarded with Ethena (BVI) Limited instead. As a result, Ethena GmbH no longer has any direct customers,” it claimed.

The statement further claimed that Ethena GmbH, the German branch, “has not conducted any mint or redeem activity” since the regulators’ MiCA ruling.

Specifically, regulators banned all sales of the USDe stablecoin, putting serious restrictions on the firm. In other words, this outcome is fairly expected. Ethena (BVI) Limited has taken over the German branch’s users.

The network’s governance token, ENA, has seen notable price swings around its MiCA efforts. In Early March, when Ethena Labs was reportedly on track to receive regulatory approval, ENA broke out of multi-month lows and nearly reached $2.5 billion in mark cap.

However, since the rejection, ENA saw continued bearish pressure, which was exacerbated by the macroeconomic conditions across the market. Today’s announcement drove further decline.

MiCA, the European Union’s new stablecoin regulations, have presented difficulties for several firms besides Ethena. For example, Tether’s stablecoins were delisted from EU exchanges when MiCA took effect, prompting serious changes to its business.

Several other issuers have been racing to fill the gap left by these firms by achieving compliance. Most recently, major centralized exchanges such as Crypto.com and OKX have achieved the license, further strengthening their grasp over the EU market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Under Pressure as Volume Drops, Death Cross Nears

Hedera (HBAR) has lost its $7 billion market cap as bearish momentum builds. Trading volume is down 25% in the last 24 hours to $203 million. Key technical indicators are weakening, pointing to growing pressure on the current trend.

The BBTrend has dropped below 10, the RSI is now under 50, and a potential death cross looms on the EMA lines. Unless buying pressure returns soon, HBAR could face deeper corrections in the near term.

Hedera BBTrend Is Still Positive, But Going Down

Hedera’s BBTrend has dropped to 5.84, falling sharply from 11.99 just two days ago. The BBTrend, or Bollinger Band Trend indicator, measures the strength of a trend based on how far the price deviates from its average range.

Readings above 10 typically signal a strong and active trend, while lower values suggest weakening momentum or consolidation.

With BBTrend now sitting below the 10 threshold, it may indicate that Hedera’s recent bullish momentum is losing strength.

The lower reading suggests price volatility is decreasing, which could mean the asset is entering a sideways phase or preparing for a potential pullback.

Unless BBTrend picks up again, HBAR might struggle to sustain upward movement in the short term.

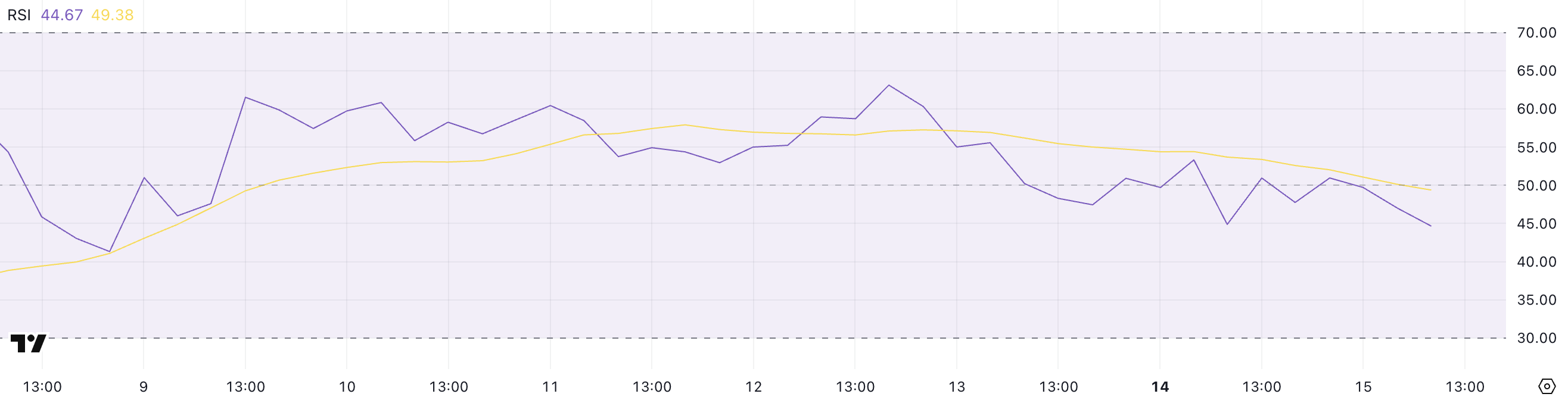

Hedera Is Losing Bullish Momentum

Hedera’s RSI is currently at 44.67, down from 63.12 just three days ago, signaling a notable loss in bullish momentum. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and magnitude of recent price changes.

It ranges from 0 to 100, with values above 70 typically indicating overbought conditions and values below 30 suggesting the asset is oversold.

With RSI now below the neutral 50 mark, it suggests that sellers are gaining more control. An RSI around 44.67 points to weakening demand and could mean that HBAR is entering a consolidation phase or facing mild downward pressure.

If the RSI continues to fall, it could lead to a deeper correction unless buyers step back in.

Will Hedera Fall Below $0.15?

Hedera’s EMA lines are signaling a potential death cross, a bearish formation that could lead to increased downside pressure. If this pattern is confirmed, Hedera price may first test two nearby support levels at $0.156 and $0.153.

These levels have recently acted as short-term cushions, and losing them could trigger a sharper drop.

A breakdown below both supports could open the way toward $0.124, especially if selling momentum accelerates. On the flip side, if HBAR can regain strength and push above the $0.168 resistance, it could shift sentiment back in favor of the bulls.

A breakout there may lead to further gains toward $0.178 and potentially $0.20 if the uptrend builds enough momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Jumps 20% as DEX Volume and Fees Soar

Solana (SOL) is up 20% over the past seven days, supported by strong technical indicators and rising on-chain activity. Its Ichimoku Cloud and BBTrend charts both point to bullish momentum, with trend strength and volatility on the rise.

At the same time, Solana is reclaiming the top spot in DEX volume and dominating protocol fee rankings across major DeFi apps. With a recent golden cross on the EMA lines, SOL now looks set to test key resistance levels if momentum holds.

Solana Indicators Paint A Bullish Picture

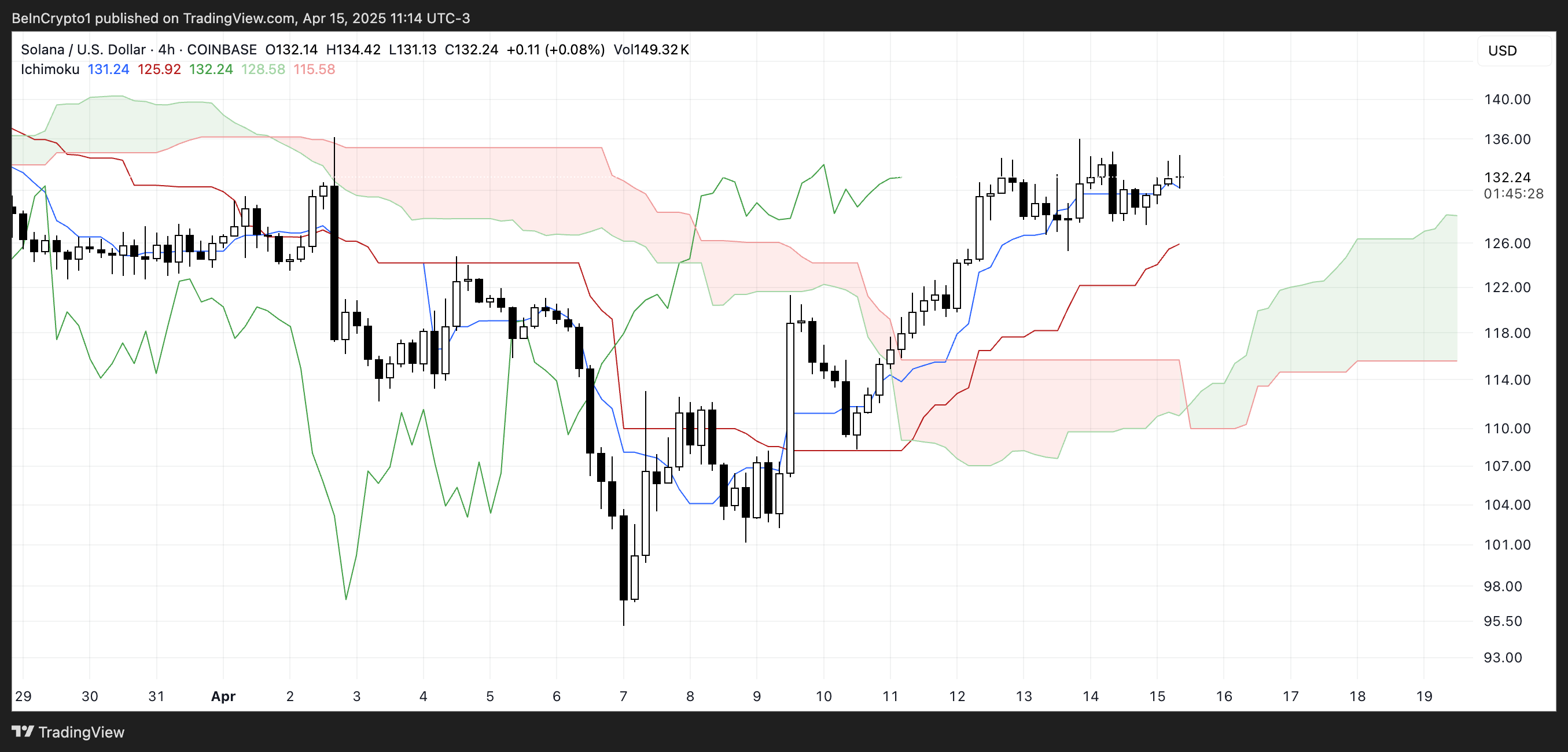

Solana Ichimoku Cloud chart shows a clear bullish structure, with price trading above both the Tenkan-sen and Kijun-sen. This alignment indicates strong short- and medium-term momentum, with buyers maintaining control.

The Kumo ahead is green and steadily expanding, which supports the continuation of the current uptrend. The distance between the price and the cloud also gives the trend some room before any potential weakness sets in.

The Chikou Span is positioned above the cloud and candles, confirming bullish confirmation from past price action. As long as Solana stays above the Kijun-sen and the cloud remains supportive, the trend bias remains upward.

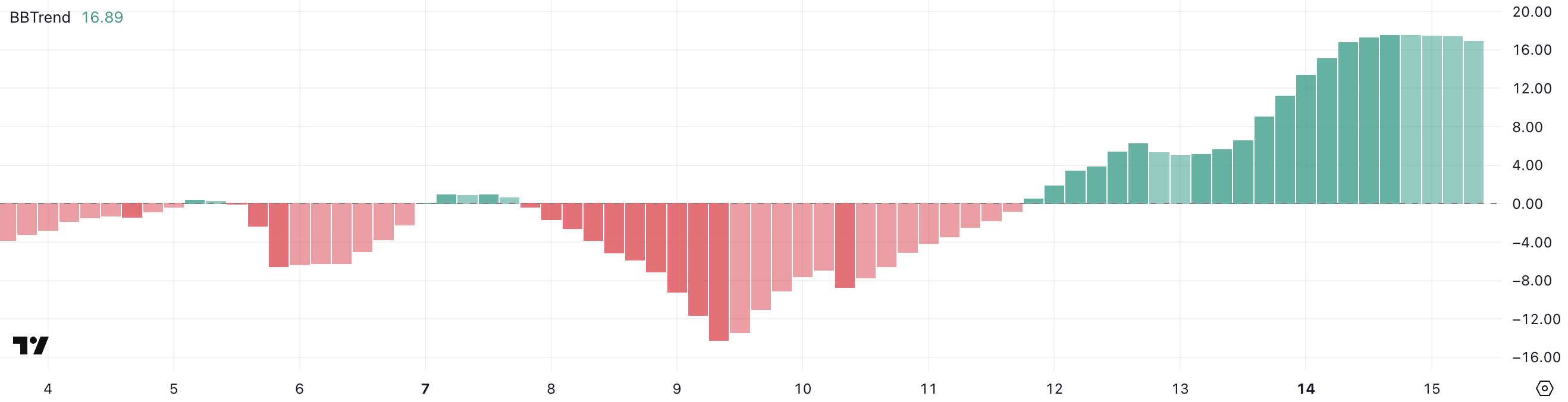

Solana’s BBTrend is currently at 16.89, showing a strong increase from 1.88 two days ago, though slightly down from 17.54 yesterday. This sharp rise indicates that volatility and trend strength have recently expanded significantly.

The BBTrend, or Bollinger Band Trend indicator, measures the strength of a trend based on how far price moves away from its average range. Readings above 10 generally signal a strong trend in motion, while lower values reflect a range-bound or weak market.

With SOL’s BBTrend holding near elevated levels, it suggests the asset is still in a strong trending phase. If it remains high or rises again, it could support further upward movement—but a steady decline might hint at a slowing trend or consolidation ahead.

SOL Volumes and Apps Are On The Rise

Solana is firmly reestablishing its dominance in the decentralized exchange (DEX) space, pulling ahead of Ethereum and BNB in daily volume.

Over the past 24 hours, Solana recorded $2.5 billion in DEX activity, marking a 14% increase over the last seven days. That growth outpaces Base’s 10% and contrasts sharply with the declines seen on Ethereum (-3%) and BNB (-9%).

More impressively, Solana’s seven-day DEX volume has surpassed the combined volume of Base, BNB, and Arbitrum.

Beyond trading volume, Solana is also leading in protocol revenue generation. Among the top eight non-stablecoin protocols ranked by fees, five are directly built on Solana: Pump, Axiom, Jupiter, Jito, and Meteora.

Pump stands out in particular, generating $2.73 million in fees in just the past 24 hours and $15 million across the past week.

Can Solana Break Above $150 In The Next Weeks?

Solana’s EMA lines recently formed a golden cross, a bullish signal that often marks the start of a new uptrend.

This crossover suggests momentum is shifting in favor of buyers, with the potential for Solana price to soon test key resistance levels.

If the current trend holds, Solana could challenge resistance around the $136 zone. A breakout there may open the path toward higher levels such as $147, $160, and even $180 if bullish pressure intensifies.

However, if momentum fades, Solana may face a pullback toward the $124 support zone. A break below that could trigger deeper downside moves, potentially revisiting $112 or even $95 if selling pressure accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Market16 hours ago

Market16 hours agoCan Pi Network Avoid a Similar Fate?

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Urges Pi Network To Learn From The OM Crash Ahead Of Open Mainnet Transition

-

Market19 hours ago

Market19 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Market18 hours ago

Market18 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Market24 hours ago

Market24 hours ago$7 Million Hack Hits Binance-Backed Project

-

Market21 hours ago

Market21 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks