Market

Cardano (ADA) at a Crossroads: Could Bears Take Control Again?

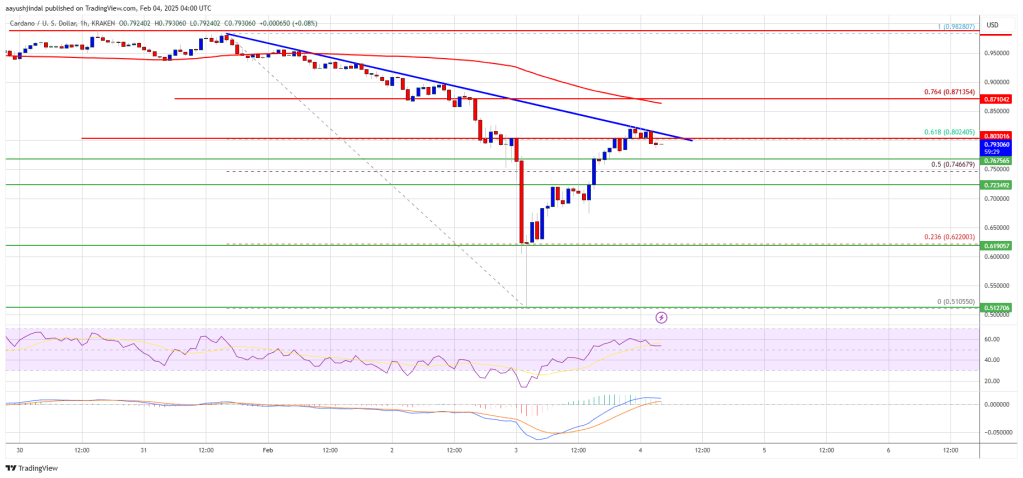

Cardano price started a fresh decline below the $0.9250 zone. ADA is now correcting losses and struggling to clear the $0.80 resistance.

- ADA price started a fresh decline from the $0.9250 zone.

- The price is trading below $0.850 and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $0.8050 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another decline if it trades below the $0.7650 support zone.

Cardano Price Faces Resistance

After struggling to stay above the $0.950 level, Cardano started a fresh decline like Bitcoin and Ethereum. ADA declined below the $0.90 and $0.850 support levels.

There was a clear move below the $0.60 support zone. A low was formed at $0.5105 and the price recently started a decent upward move. The price cleared the $0.60 and $0.70 resistance levels. The bulls pumped the price above the 50% Fib retracement level of the downward move from the $0.9828 swing high to the $0.5105 low.

However, the bears are now active near the $0.80 zone. There is also a key bearish trend line forming with resistance at $0.8050 on the hourly chart of the ADA/USD pair.

Cardano price is now trading below $0.80 and the 100-hourly simple moving average. On the upside, the price might face resistance near the $0.80 zone and the 61.8% Fib retracement level of the downward move from the $0.9828 swing high to the $0.5105 low.

The first resistance is near $0.820. The next key resistance might be $0.850. If there is a close above the $0.850 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.9250 region. Any more gains might call for a move toward $1.00 in the near term.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.80 resistance level, it could start another decline. Immediate support on the downside is near the $0.7650 level.

The next major support is near the $0.7230 level. A downside break below the $0.7230 level could open the doors for a test of $0.6880. The next major support is near the $0.6250 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now above the 50 level.

Major Support Levels – $0.7650 and $0.7230.

Major Resistance Levels – $0.8000 and $0.8200.

Market

Circle Introduces On-Chain Refund Protocol to Strengthen USDC Payments

Circle, the issuer behind the USDC stablecoin, has officially introduced the Refund Protocol—an advanced smart contract framework developed by Circle Research.

This innovation marks a turning point for decentralized stablecoin payments by directly embedding on-chain dispute resolution mechanisms into the blockchain, ensuring digital commerce transparency, security, and trust.

Role of Refund Protocol in the Circle Ecosystem

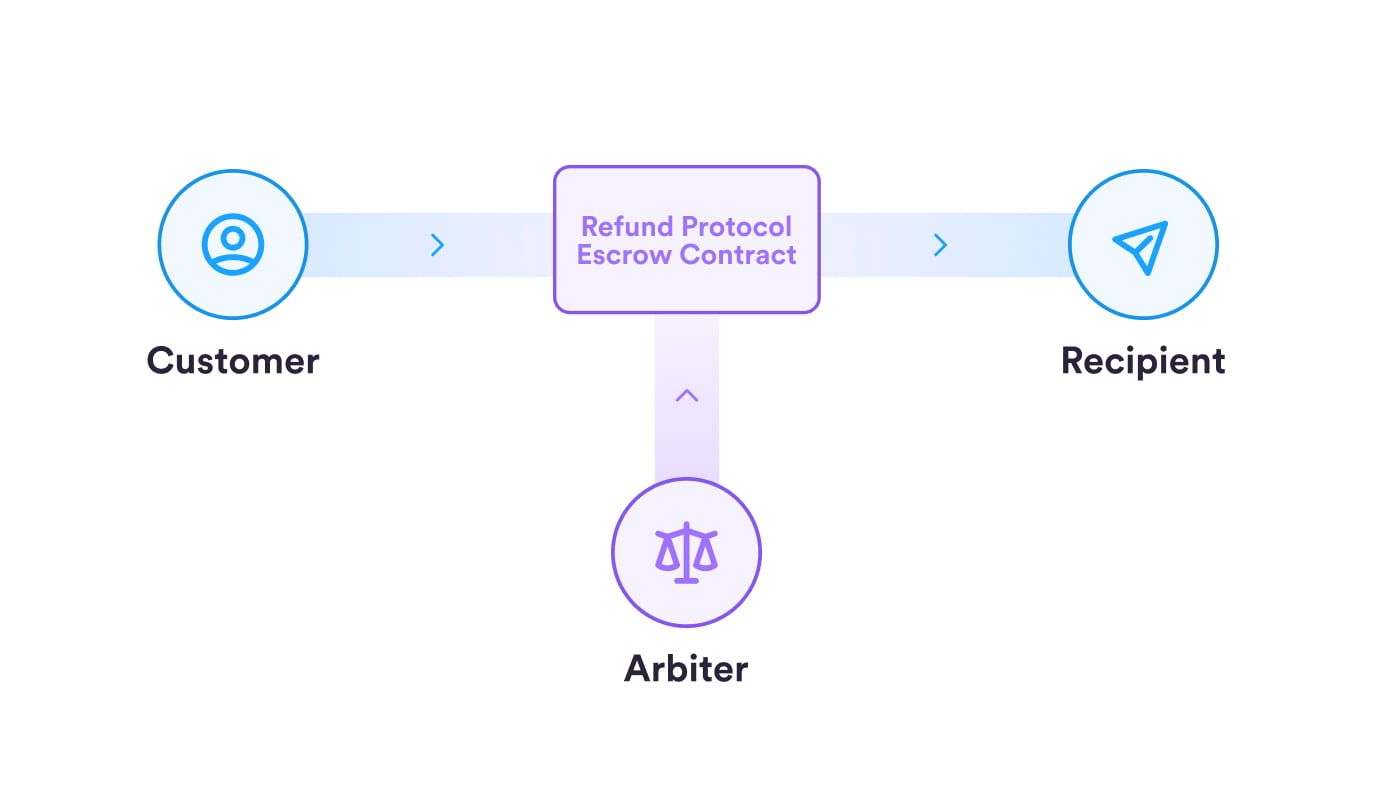

Traditional stablecoin payment models often lack on-chain refund or dispute resolution mechanisms. Typically, the sender’s stablecoins are held in escrow for a period before being released to the recipient.

An external party, known as an arbiter, oversees this escrow account. However, resolution usually happens off-chain when disputes arise, leading to two major concerns: centralized control by the arbiter and lack of transparency in the dispute process.

To solve this, Circle has designed the Refund Protocol to enhance the overall stablecoin payment experience, especially for USDC. The protocol acts as a smart contract, enabling non-custodial escrow and on-chain dispute resolution.

“Today, Circle’s R&D team released a new Refund Protocol for stablecoin payments. This builds on our earlier open source releases for confidential payments as well as reversible payments. Progress in mainstreaming stablecoin payments,” said Circle CEO Jeremy Allaire.

Rather than controlling the escrow account, the Refund Protocol can only do two things: release funds to the recipient or refund them to the customer. This removes reliance on third-party intermediaries, increases transparency, and boosts efficiency and user trust.

Refund Protocol to Help USDC Gain Market Share?

According to data from DefiLlama, USDT from Tether currently dominates the stablecoin market with over 61% market share. Although USDC holds the second position, its market capitalization is still less than half that of USDT.

The launch of Refund Protocol provides Circle with a strategic edge. By offering developers and businesses an easy way to integrate USDC payments into e-commerce platforms, NFT marketplaces, and DeFi applications, the protocol strengthens USDC’s position as a flexible and reliable medium of exchange.

Additionally, Refund Protocol gives Circle an advantage by providing a decentralized, low-cost, and transparent solution. This will help USDC stand out in real-world applications.

Refund Protocol may face regulatory hurdles despite its innovation, especially in jurisdictions with strict blockchain laws. The legal recognition of on-chain dispute resolution remains uncertain in many regions, potentially posing one of the biggest obstacles to widespread adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Under Pressure—Bearish Setup Could Trigger Sell-Off

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Is XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

Ripple’s recently acquired Hidden Road has secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA). This marks a significant milestone in expanding its prime brokerage services for institutional investors.

Market watchers see it as a deliberate strategy by Ripple to build infrastructure and position itself for future growth. That being said, traders are expecting that XRP’s value will rise later.

Ripple Expands Institutional Presence with Hidden Road’s FINRA License

According to the latest press release, Hidden Road Partners CIV US LLC was granted approval. The license now enables the firm to provide a broader suite of regulatory-compliant services, including clearing, financing, and prime brokerage for fixed-income assets to institutions.

Noel Kimmel, President of Hidden Road, highlighted that the license was a pivotal development for the company. According to him, it enhances Hidden Road’s ability to operate in traditional financial (TradFi) markets.

“As a FINRA member, we will be able to bring our best-in-class, technology-driven fixed income service offering to an expanded universe of institutional clients. Our business has tremendous momentum, and we look forward to continuing to provide superior execution and support to our clients amidst today’s exceptionally dynamic market environment,” Kimmel said.

The FINRA approval follows Ripple’s $1.25 billion acquisition of Hidden Road. Announced on April 8, 2025, this was one of the largest deals in the digital assets sector.

The move positions Ripple as the first cryptocurrency company to own a global, multi-asset prime broker. Experts believe the acquisition and subsequent license are part of a broader strategy Ripple is employing.

“Hidden Road just secured a broker-dealer license right after Ripple’s acquisition. This isn’t a coincidence, it’s a statement. XRP is not playing checkers. It’s playing regulatory chess,” an analyst wrote on X (formerly Twitter).

Is Ripple Behind XRP’s Low Price? Analyst Thinks So

In fact, analysts also claim that XRP’s neutral reaction to recent milestones isn’t a sign of weakness but rather a strategic move. In a recent analysis, crypto analyst Levi argued that the current price of XRP, hovering around $2, is not coincidental, but rather a result of Ripple’s deliberate approach.

He suggested that the low price is designed to allow Ripple to operate under the radar while making key strategic moves, such as the Hidden Road acquisition.

“Hidden Road isn’t a flex. It’s infrastructure. It’s the final puzzle piece — giving Ripple a fully integrated, lightning-fast, global value settlement system,” he stated.

The analyst emphasized that while the public focused on Ripple’s legal battles with the SEC, the company quietly built its global value settlement system behind the scenes.

“XRP at $2 isn’t undervalued — it’s deliberately suppressed. When the switch flips, the revaluation won’t be gradual — it’ll be instant,” Levi noted.

In his view, those who have invested early will be positioned to benefit as the market shifts. Meanwhile, XRP, after hitting an all-time high earlier this year, has continued to decline.

At press time, the altcoin was trading at $2.0. According to BeInCrypto data, this represented a decline of 1.0% over the past day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoHow Rising Solana Network Inflows Could Drive SOL Price to $150?

-

Bitcoin22 hours ago

Bitcoin22 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Market22 hours ago

Market22 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Altcoin14 hours ago

Altcoin14 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Market23 hours ago

Market23 hours agoXRP’s $2.00 Pivot Point—A Launchpad or Breakdown Zone?

-

Market14 hours ago

Market14 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin22 hours ago

Altcoin22 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Market20 hours ago

Market20 hours agoExpanding Blockspace and Enhancing Privacy