Market

Can Solana Meme Coin BULLY Price Continue to Rise After ATH?

Dolos The Bully (BULLY), a meme coin built on the Solana blockchain, has hit a new all-time high today. This milestone comes after BULLY’s price increased by over 700% within the last seven days.

With its market cap above $200 million, the meme coin holders may be wondering if the price can go higher. This analysis looks at the possibility.

Dolos The Bully Soars, Shows Bullish Potential

At press time, BULLY is trading at $0.23, marking a significant rise in its value. Over the last 24 hours, the meme coin surged by 72%, contributing to an impressive 700% increase over the past week. This meteoric rally indicates heightened interest and bullish momentum around BULLY in recent days.

For context, Dolos The Bully was created as a meme coin related to an AI language model built on the Llama 3.1 architecture. The token also embodies a persona that blends the cunning and trickery of Greek mythology with the sharp, fast-paced dynamics of crypto Twitter culture, similar to tokens like Goatseus Maximums (GOAT).

However, BULLY’s rapid gains often come with volatility. As such, the meme coin holders may need to monitor it closely for potential corrections.

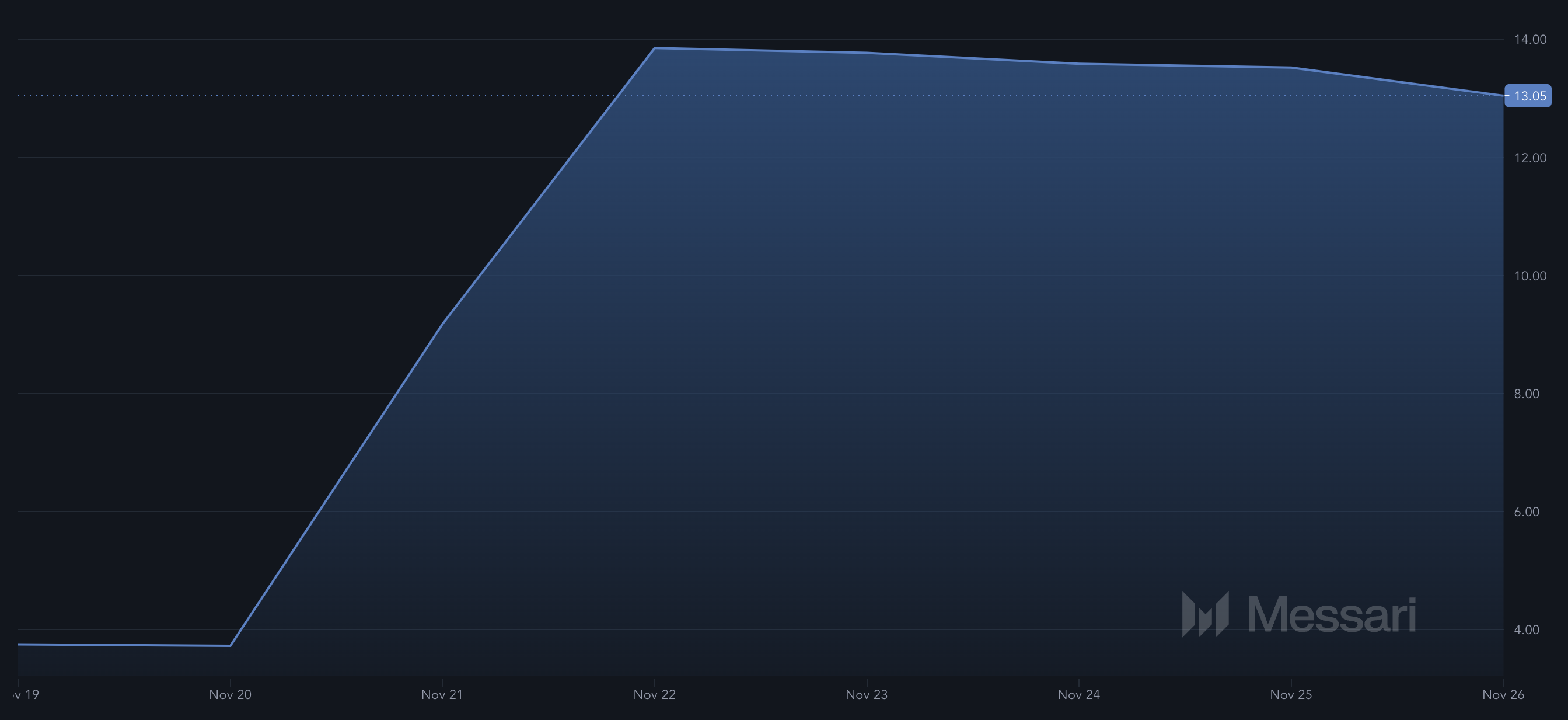

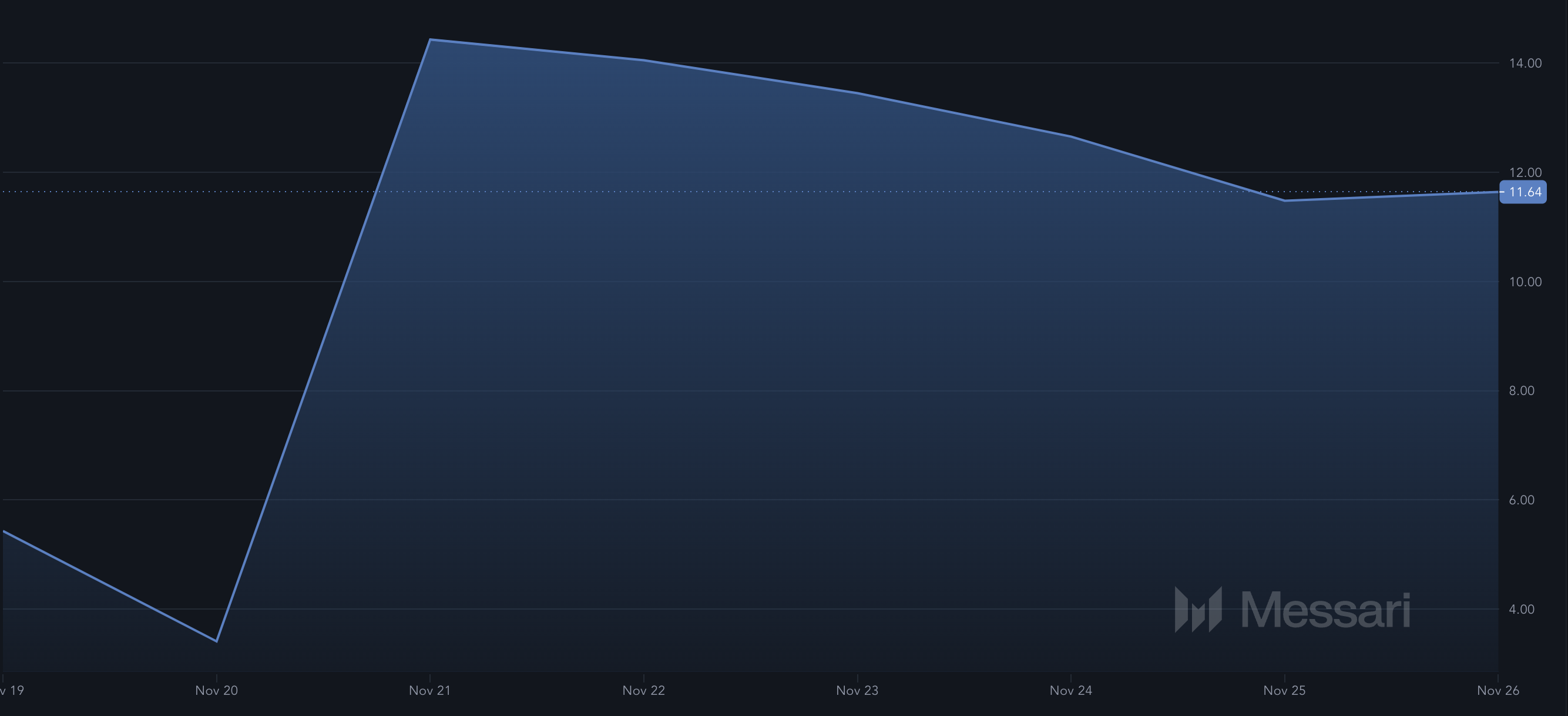

According to Messari, the volatility around BULLY has been rising since November 20. This suggests that massive buying pressure or selling pressure could lead to a quick rally or downturn.

Besides that, BULLY’s Sharpe Ratio has recently jumped, further supporting its upward price trajectory. This metric assesses an asset’s performance by factoring in the risk taken.

A positive Sharpe Ratio indicates that the reward from holding or trading the cryptocurrency outweighs the risk, suggesting favorable investment potential. Conversely, a negative Sharpe Ratio warns that the asset might not yield satisfactory returns relative to the risks involved.

For BULLY, the current positive Sharpe Ratio implies that the meme coin is likely to continue its price increase, provided the metric remains positive. This aligns with the recent 72% daily and 700% weekly surge, reflecting growing market confidence in the token.

BULLY Price Prediction: Higher Highs Next?

On the 4-hour chart, BULLY’s price has risen above the 20-day Exponential Moving Average (EMA). The EMA assesses if a cryptocurrency’s price is moving in an upward direction or in a downtrend.

When the indicator rises, the trend is bullish. But when it trends downwards, it is bearish. Since the Solana meme coin is above the 20 EMA (blue), it means that the price is likely to increase. If that remains the case, then the token’s value might climb toward $0.30.

However, if selling pressure rises, that might not be the case. In that scenario, BULLY could drop below $0.16.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Jumps 4% as Bullish Signals Emerge

Cardano (ADA) is up 4% on Monday, trying to hit $0.65, showing signs of renewed bullish momentum. Technical indicators are beginning to align in favor of buyers, with the BBTrend turning positive for the first time in days and the DMI signaling strengthening upward pressure.

ADA is also nearing a potential golden cross formation on its EMA lines, which could further support a breakout if resistance levels are cleared. With momentum building and key levels in sight, Cardano is entering a critical zone that could define its short-term direction.

Cardano Shows Early Signs of Recovery as BBTrend Turns Positive

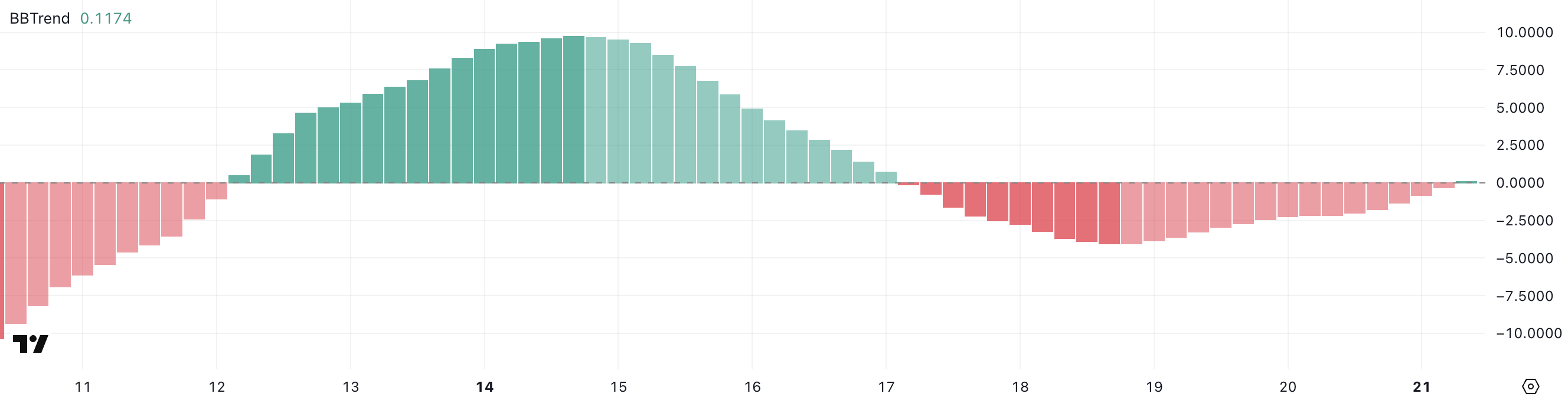

Cardano BBTrend has just flipped back into positive territory at 0.11, following four straight days in the negative zone. This shift, though subtle, may be the first sign of momentum stabilizing after recent weakness.

BBTrend, or Bollinger Band Trend, is a technical indicator that gauges the strength and direction of a trend based on how wide or narrow the Bollinger Bands are.

When the bands begin to expand and BBTrend moves into positive values, it often suggests growing volatility in favor of an emerging bullish trend. On the other hand, prolonged negative readings typically signal fading momentum and a lack of directional strength.

While a BBTrend of 0.11 is still low and not yet signaling a strong uptrend, the fact that it turned positive marks a potential inflection point.

It suggests that selling pressure may be fading and the price could be entering a recovery phase if buying activity increases. This early uptick in BBTrend often precedes a broader move.

Traders will likely be watching closely to see if this positive shift is sustained in the coming sessions, as continued gains in BBTrend could indicate the beginning of a more defined upward move for ADA.

Cardano Buyers Regain Control as Uptrend Shows Early Strength

Cardano Directional Movement Index (DMI) is showing a notable shift in momentum, with its Average Directional Index (ADX) climbing to 17.79, up from 13.77 yesterday.

The ADX measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values below 20 suggest a weak or non-existent trend, while readings above 25 typically confirm that a trend is gaining strength.

ADA’s ADX is still below the 20 threshold but rising steadily—indicating that momentum is building and a stronger directional move could soon take shape.

Looking deeper, the +DI (positive directional indicator) has jumped to 26.38 from 16.30 just a day ago, signaling increased buying pressure. Although it has slightly pulled back from an earlier peak at 29.57, it remains firmly above the -DI (negative directional indicator), which has dropped significantly from 22.72 to 13.73.

This widening gap between the +DI and -DI suggests a clear shift in favor of bulls, with buyers regaining control after a brief period of selling pressure.

If the ADX continues to rise alongside a dominant +DI, it could confirm a strengthening uptrend for Cardano.

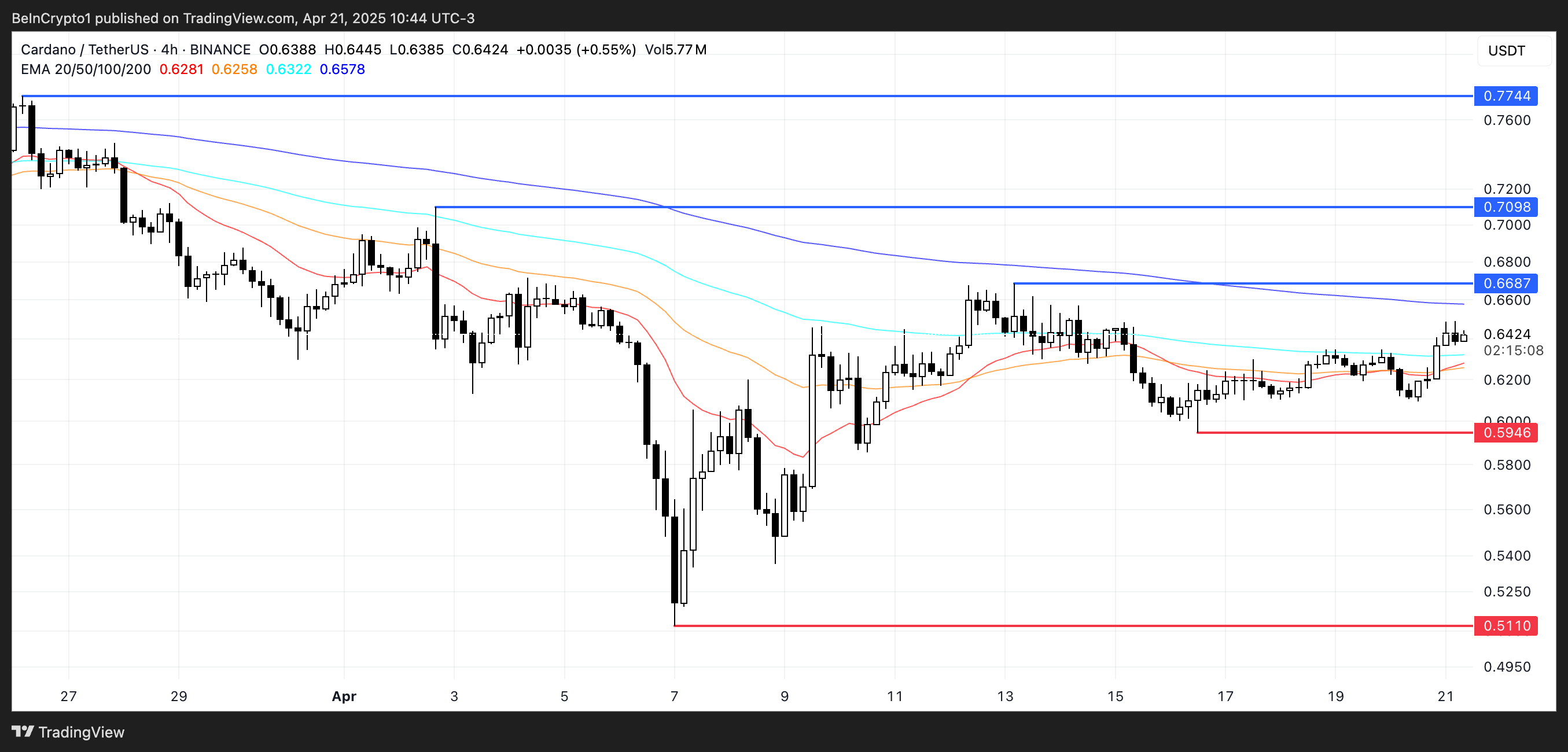

Cardano Nears Golden Cross as Bulls Eye Breakout—but Key Support Still in Play

Cardano price is approaching a potentially bullish technical development, as its EMA lines suggest a golden cross may form in the coming sessions.

A golden cross occurs when the short-term moving average crosses above the long-term moving average, often signaling the start of a stronger uptrend.

If this crossover is confirmed and ADA manages to break above the resistance at $0.668, the next upside targets sit at $0.709 and $0.77—levels not seen since late March.

However, if ADA fails to maintain its upward trajectory and the momentum fades, downside risks remain in play.

A drop back toward the $0.594 support would be the first sign of weakness, and a breakdown below that level could expose the asset to deeper losses, with $0.511 as the next key support zone.

Price action around the $0.668 resistance will likely be the deciding factor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETFs Dominate Market Despite 72 Altcoin Proposals

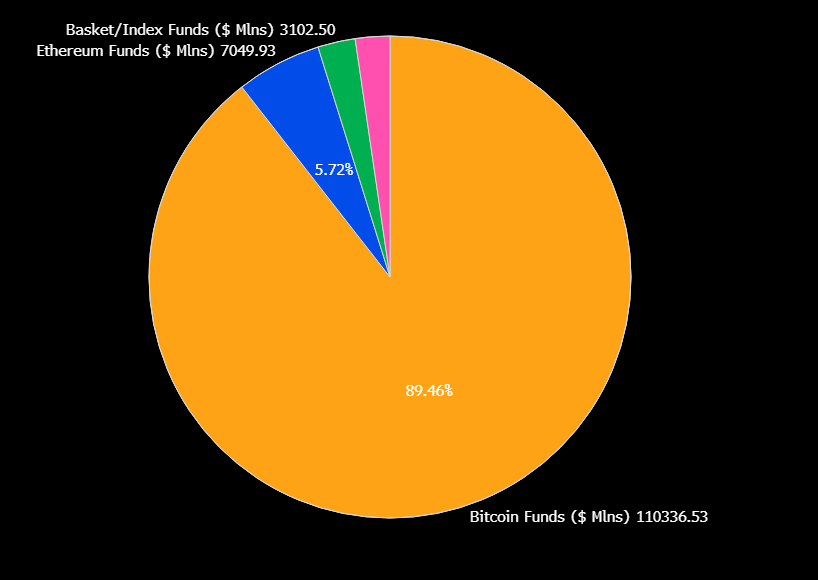

As the SEC is signaling its willingness to approve new altcoin ETFs, 72 active proposals are awaiting a nod. Despite the growing interest from asset managers to launch more altcoin-based products in the institutional market, Bitcoin ETFs currently command 90% of crypto fund assets worldwide.

New listings can attract inflows and liquidity in these tokens, as demonstrated by Ethereum’s approval of ETF options. Still, given the current market interest, it’s highly unlikely that any crypto found will replicate Bitcoin’s runaway success in the ETF market

Bitcoin Dominates the ETF Market

Bitcoin ETFs dramatically changed the global digital assets market over the past month, and they are performing quite well at the moment. In the US, total net assets have reached $94.5 billion, despite continuous outflows in the past few months.

Their impressive early success opened a new market for crypto-related assets, and issuers have been flooding the SEC with new applications since.

This flood has been so intense that there are currently 72 active proposals for the SEC’s consideration:

“There are now 72 crypto-related ETFs sitting with the SEC awaiting approval to list or list options. Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x MELANIA and everything in between. Gonna be a wild year,” claimed ETF analyst Eric Balchunas.

The US regulatory environment has become much friendlier toward crypto, and the SEC is signaling its willingness to approve new products. Many ETF issuers are attempting to seize the opportunity to create a product as successful as Bitcoin.

However, Bitcoin has a sizable head start, and it’s difficult to imagine any newcomer disrupting its 90% market share.

To put that into perspective, BlackRock’s Bitcoin ETF was declared “the greatest launch in ETF history.” Any new altcoin product would need a significant value-add to encroach upon Bitcoin’s position.

Recent products like Ethereum ETF options have attracted fresh liquidity. Yet, Bitcoin’s dominance in the institutional market remains unchanged.

Of these 72 proposals, only 23 refer to altcoins other than Solana, XRP, or Litecoin, and many more concern new derivatives on existing ETFs.

Some analysts claim that these products, taken together, couldn’t displace more than 5-10% of Bitcoin’s ETF market dominance. If an event significantly disrupted Bitcoin, it would also impact the rest of crypto.

Still, that doesn’t mean that the altcoins ETFs are a futile endeavor. These products have continually created new inflows and interest in their underlying assets, especially with issuers acquiring token stockpiles.

However, it’s important to be realistic. While XRP and Solana ETF approvals could drive new bullish cycles for the altcoin market, Bitcoin will likely dominate the ETF market by a large margin — given its widespread recognition as a ‘store of value’.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Lists RSR, Atkins Association Fuels Bullishness

Coinbase is listing Reserve Rights (RSR), a dual‑token stablecoin platform aimed at creating a collateral‑backed, self‑regulating stablecoin ecosystem. Following the announcement, Binance’s ‘smart money’ traders are increasing long positions on the altcoin.

Incoming SEC Chair Paul Atkins was an early advisor for RSR, but he doesn’t maintain any active connection to the project. Nonetheless, RSR speculators may be anticipating some benefits from this old association.

Coinbase Lists RSR To New Enthusiasm

RSR has been active since 2019, aiming to upend the stablecoin ecosystem. It’s an ERC‑20 utility and governance token that underpins the Reserve Protocol, a dual‑token system designed to back and stabilize the Reserve stablecoin (RSV) at a $1 USD peg. RSR, a non-stablecoin, provides governance and backstop insurance to its counterpart.

The asset’s valuation peaked in 2021 but has been quiet since then until regaining prominence in 2024. Today’s Coinbase listing announcement saw RSR jump nearly 10%.

Coinbase first announced that it would list RSR a little under three weeks ago. Coinbase listings usually cause the underlying tokens to spike, and this has been no exception.

However, an intriguing side effect has also taken place. As the asset prepares its debut on Coinbase, top traders on Binance are showing a strong bullish positioning.

On Binance, the top‑trader long/short ratio measures the share of total open positions held as longs by the top 20% of accounts by margin balance. A 65.48% long ratio means these “smart money” participants are overwhelmingly betting prices will rise.

Meanwhile, beyond Coinbase listing, RSR is getting attention due to its link with incoming SEC Chair Paul Atkins. Although Atkins disclosed his crypto investments and has no current link with RSR, he joined the Reserve Rights Foundation as an advisor in its early stages.

Since Atkins succeeded in his confirmation hearing, RSR posted an impressive 22% rally. Technically, he hasn’t been seated as Chair yet, but traders are evidently expecting bullish developments.

Atkins has promised to bring crypto-friendly reform, and this connection could disproportionately impact his former associates.

That isn’t to say that anyone has alleged that Atkins will engage in corruption to unfairly boost RSR. However, since becoming President, members of Trump’s family have been involved in several controversial crypto deals. This precedent may be encouraging traders to believe in the importance of political connections.

For now, market narratives are very important in this industry. As Atkins officially begins his career as the SEC’s new Chair, RSR may continue to receive indirect benefits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin17 hours ago

Bitcoin17 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Bitcoin23 hours ago

Bitcoin23 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Market19 hours ago

Market19 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Market17 hours ago

Market17 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Altcoin14 hours ago

Altcoin14 hours agoExpert Reveals Why BlackRock Hasn’t Pushed for an XRP ETF

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Says Solana Price To $2,000 Is Within Reach, Here’s How

-

Market16 hours ago

Market16 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V

-

Altcoin9 hours ago

Altcoin9 hours agoWill Cardano Price Break Out Soon? Triangle Pattern Hints at 27% ADA Surge