Market

Can Ethereum Recover After Negative First Month for ETH ETFs?

Ethereum (ETH) price faced a notably challenging August following a 30% decline in late July. The introduction of spot Ethereum exchange-traded funds (ETFs) was initially anticipated to spark renewed interest and drive positive price action.

However, institutional investors’ lukewarm reception of ETH ETFs played a significant role in the ongoing slump.

Ethereum Did Not See Much Bullishness

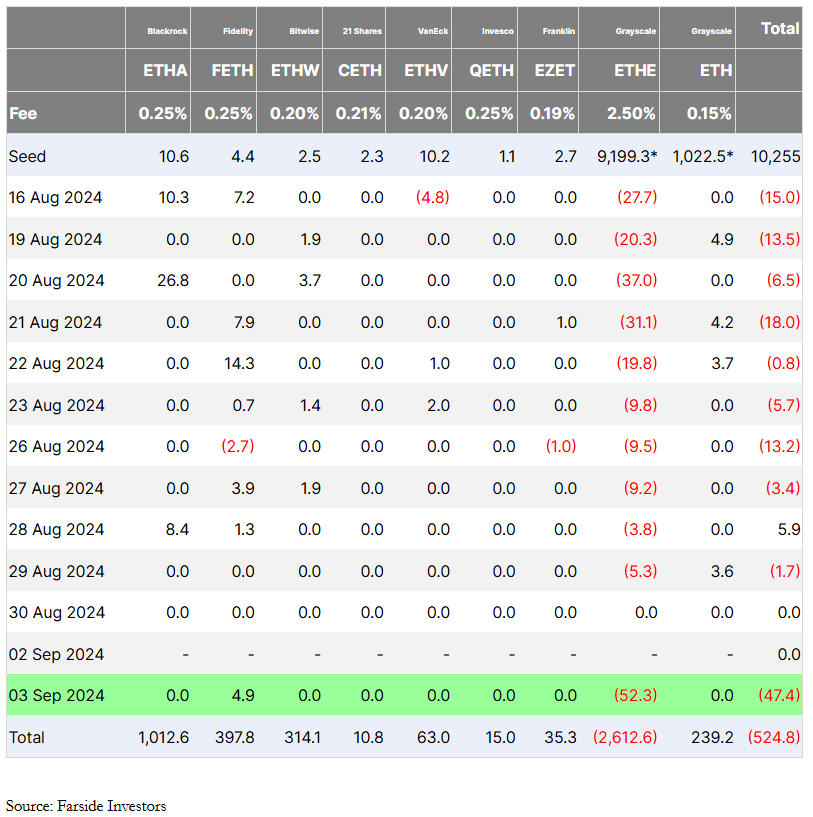

Institutional investors have shown a clear lack of enthusiasm towards Ethereum since the launch of spot ETH ETFs. In their first month, these ETFs recorded outflows of approximately $476 million. The outflows were significantly influenced by the Grayscale Ethereum Trust (ETHE) unlock, which caused a bearish ripple effect across the market.

In stark contrast, spot Bitcoin ETFs garnered inflows exceeding $3.7 billion during the same period. The disparity in investor sentiment between Bitcoin and Ethereum is significant and suggests that Ethereum’s current market perception is overwhelmingly negative. This sluggish performance of spot ETH ETFs could further depress Ethereum’s price.

Read more: How to Invest in Ethereum ETFs?

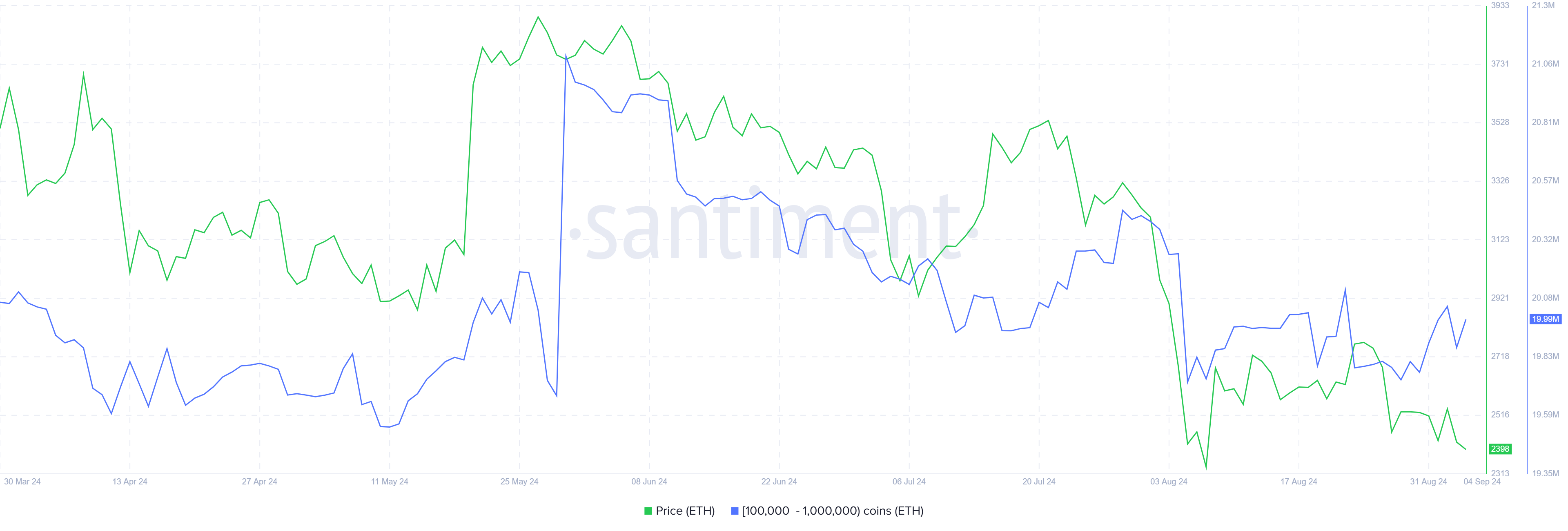

Furthermore, the investors’ sentiment towards Ethereum appears bearish, particularly when considering the actions of large-scale holders, often referred to as crypto whales. Addresses holding between 100,000 to 1 million ETH offloaded around 410,000 ETH in the last week, equating to a little under $1 billion at $981 million in value.

This massive sell-off reflects a broader pessimistic sentiment within the market, further pressuring ETH’s price downward. These whale activities are a strong indicator of the market’s current mood. When such large holders begin to liquidate their positions, it often signals a lack of confidence in near-term recovery.

ETH Price Prediction: Wait Before Recovery

Ethereum’s price has remained below the critical $2,811 resistance level since the 30% drop in late July, with recent consolidation occurring under $2,546. This consolidation suggests that ETH is struggling to gain upward momentum, which is crucial for any potential recovery.

Given the factors discussed, Ethereum may continue to consolidate under $2,546, with the potential to test the $2,344 support level in the coming days. The lack of institutional support and the broader market’s bearish sentiment could result in further downside pressure.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if institutions and crypto whales start to exhibit renewed interest and inflows into ETH ETFs improve, the outlook could shift. In such a scenario, ETH could breach the $2,546 level and move towards $2,681. Successfully flipping this resistance into support would invalidate the short-term bearish outlook, potentially setting the stage for a more sustained recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Onyxcoin (XCN) Shows Reversal Signs After 200% Rally

Onyxcoin (XCN) is down nearly 10% over the past seven days, cooling off after a sharp 200% rally between April 9 and April 11. Momentum indicators suggest that the bullish trend may be losing strength, with both the RSI and ADX showing signs of fading conviction.

While XCN’s EMA lines remain in a bullish formation, early signs of a potential reversal are emerging as short-term averages begin to slope downward. The coming days will be key in determining whether Onyxcoin can stabilize and resume its climb—or if a deeper correction is on the horizon.

Onyxcoin Shows Early Signs of Stabilization, but Momentum Remains Uncertain

Onyxcoin’s Relative Strength Index (RSI) is currently sitting at 43. Readings above 70 typically indicate that an asset is overbought and could be due for a pullback, while readings below 30 suggest it may be oversold and poised for a potential rebound.

Levels between 30 and 70 are considered neutral, often reflecting consolidation or indecision in the market.

XCN’s RSI signals a neutral state but shows signs of gradual recovery. While not yet a clear bullish signal, yesterday’s upward move suggests that bearish momentum may be easing.

However, the fact that RSI failed to hit above 50 reflects lingering uncertainty and a lack of sustained buying pressure.

For now, XCN appears to be in a wait-and-see phase, where a continued climb in RSI could signal a shift toward renewed upside, but any further weakness might keep the price trapped in a consolidation range.

XCN Uptrend Weakens as ADX Signals Fading Momentum

Onyxcoin’s Average Directional Index (ADX) has declined to 11, down from 13.92 yesterday and 15.26 two days ago. This decline reflects a consistent weakening in trend strength.

The ADX is a key component of the Directional Movement Index (DMI) and is used to measure the strength—not the direction—of a trend on a scale from 0 to 100.

Values below 20 typically suggest that the market is trending weakly or not at all, while readings above 25 confirm a strong and established trend.

With the ADX now at 11, Onyxcoin’s trend is losing momentum, even though it technically remains in an uptrend. This low reading suggests the current bullish phase is fragile and may lack the conviction needed for sustained upward movement.

Combined with EMA lines that are beginning to flatten, the weakening ADX adds weight to the possibility that the trend could soon shift or stall.

If no surge in buying pressure emerges to reinforce the uptrend, XCN may enter a period of sideways movement or even a reversal in the short term.

Onyxcoin at a Crossroads as EMA Lines Hint at Possible Trend Reversal

XCN EMA lines remain bullish for now, with short-term averages still positioned above long-term ones.

However, the short-term EMAs have started to slope downward, raising the possibility of a looming death cross—a bearish crossover in which the short-term average falls below the long-term average.

If this crossover materializes, it would signal a shift in trend direction and could trigger a deeper pullback, after a 200% rally between April 9 and April 11, making it one of the best-performing altcoins of the previous weeks.

Key support levels to watch are $0.016, followed by $0.0139 and $0.0123. If bearish momentum accelerates, XCN could drop as low as $0.0109, marking a potential 38% correction from current levels.

On the flip side, if bulls manage to regain control and reinforce the existing uptrend, XCN could challenge the resistance at $0.020.

A breakout above that level would open the door for a potential rally toward $0.027, representing a 55% upside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch in the Fourth Week of April 2025

The crypto market has shown consistent growth over the past few days, helping altcoins alongside Bitcoin to recover. However, relying solely on broader market cues or momentum will not sustain price growth.

BeInCrypto has analyzed three altcoins for investors to watch in April, as important developments are set to unfold this week.

Tutorial (TUT)

TUT price has remained stable throughout most of the month, currently hovering below the $0.027 resistance level. Successfully breaching this barrier is crucial for recovering the 53% losses incurred in March. A price rise above $0.027 could signal a positive trend and further upward movement in the coming weeks.

If this trend continues, TUT could push toward the next resistance level of $0.039, indicating strong momentum.

However, if TUT fails to break above the $0.027 resistance, the price could decline below $0.021. Such a drop would likely invalidate the bullish outlook and lead to further losses. In that scenario, the altcoin’s price might fall to $0.015, a significant setback for the token’s recovery.

Injective (INJ)

Injective’s price has surged by 17% in recent days, fueled by anticipation surrounding the upcoming Lyota Mainnet Upgrade. Set to go live on April 22, the upgrade is expected to enhance Injective’s infrastructure, performance, and transaction speeds. This has sparked optimism, driving the price higher in the short term.

Currently trading at $8.97, Injective is nearing the $9.11 resistance level. If it successfully breaches this barrier, the price could move beyond $10.00, potentially reaching $10.35. The positive sentiment surrounding the Lyota Mainnet Upgrade is likely to continue driving the token’s growth if it can surpass these levels.

However, if Injective fails to break through the $9.11 resistance, as seen earlier in April, the price could fall below $8.40. This would signal a retreat and could see the token dip to $7.64, invalidating the bullish outlook and erasing recent gains.

BNB

BNB’s price currently stands at $604, experiencing a two-month downtrend. The altcoin is struggling to breach the resistance of $611. To push past this barrier, BNB needs strong support from the broader market or upcoming developments that could provide a catalyst for price movement and reversal.

One potential catalyst is the Lorentz opBNB mainnet hard fork, which is scheduled for today. The hard fork aims to enhance the chain’s speed and responsiveness. If successful, this could help BNB break the $611 resistance and push the price toward the next level of $647, spurring bullish sentiment.

However, if the hard fork’s impact fails to meet expectations, BNB could struggle to maintain upward momentum. In this case, the price may slip below the support of $576, potentially falling as low as $550. This would invalidate the current bullish outlook and likely continue the downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Will it Impact OM Price?

MANTRA CEO, JP Mullin, is burning 150 million OM tokens from his own allocation and engaging other ecosystem partners to burn an additional 150 million tokens. This 300 million OM token burn aims to restore investor trust in the project and stabilize the altcoin’s price dynamics.

OM is attempting to recover from one of the most dramatic crashes in recent crypto history. On April 13, it lost over 90% of its value in a single hour. The collapse, which erased more than $5.5 billion in market cap, triggered widespread accusations of insider activity and manipulation within the Real-World Assets (RWA) sector.

Understanding MANTRA’s Token Burn

Mantra, once one of the biggest players in the Real-World Assets (RWA) sector, suffered a dramatic collapse on April 13, with its token crashing over 90% in less than an hour and wiping out more than $5.5 billion in market capitalization.

The plunge followed a rapid surge earlier this year, when OM rose from $0.013 to over $6, pushing its fully diluted valuation to $11 billion. The crash was reportedly triggered by a $40 million token deposit into OKX by a wallet allegedly linked to the team, sparking fears of insider selling.

Panic spread quickly as rumors of undisclosed OTC deals, delayed airdrops, and excessive token supply concentration fueled mass liquidations across exchanges.

Despite co-founder John Patrick Mullin denying any wrongdoing and blaming centralized exchanges for forced closures, investors and analysts raised concerns about potential manipulation by market makers and CEXs, drawing comparisons to past collapses like Terra LUNA.

In an effort to rebuild trust, Mullin has announced the permanent burn of his 150 million OM team allocation. The tokens, originally staked at mainnet launch in October 2024, are now being unbonded and will be fully burned by April 29, reducing OM’s total supply from 1.82 billion to 1.67 billion.

This move also lowers the network’s staked amount by 150 million tokens, which could impact on-chain staking APR.

Additionally, MANTRA is in talks with partners to implement a second 150 million OM burn, potentially cutting the total supply by 300 million tokens.

OM Price Faces Critical Test as Token Burn Battles Lingering Market Doubt

Despite MANTRA’s ongoing token burn efforts, it’s still uncertain whether the move will be enough to fully restore investor confidence in OM.

From a technical standpoint, if momentum begins to recover, OM could test the immediate resistance at $0.59. A successful breakout at that level may pave the way for further gains toward $0.71, with additional key hurdles at $0.89 and $0.997 standing between the token and a return to the psychologically important $1 mark.

However, reclaiming these levels will likely require sustained buying interest and broader sentiment recovery across the Real-World Assets (RWA) sector.

On the downside, if the token burn fails to shift sentiment or if selling pressure continues, OM risks resuming its decline.

The first key support lies at $0.51, and a breakdown below that level could send the price further down to $0.469.

Given the scale of the recent crash and the lingering distrust among investors, the path to recovery remains fragile—OM now sits at a critical crossroads between a potential rebound and further erosion of its market value.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoWill XRP Break Support and Drop Below $2?

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

-

Bitcoin14 hours ago

Bitcoin14 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Market16 hours ago

Market16 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Bitcoin20 hours ago

Bitcoin20 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Says Solana Price To $2,000 Is Within Reach, Here’s How

-

Market14 hours ago

Market14 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Market13 hours ago

Market13 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V