Market

Can Cardano’s ADA Price Rally Above $0.60?

Cardano’s ADA price rallied by over 35% to a multi-month high of $0.63. This surge occurred after Charles Hoskinson announced plans to influence US crypto policy under the Donald Trump administration.

ADA briefly traded above the $0.60 mark, marking the first time this had happened since April. However, while the market’s enthusiasm is evident, Cardano’s ADA price rally may struggle to continue. This analysis delves into why.

Cardano’s Charles Hoskinson is Fueling the Current Rally

Cardano’s price has risen to a seven-month high. During Sunday’s trading session, the altcoin rallied by over 30%, outperforming Bitcoin and other leading crypto assets. This price surge was fueled by Charles Hoskinson’s declaration that he could be part of the Trump administration in 2025.

In a November 9 X podcast, Cardano founder Charles Hoskinson announced his commitment to supporting US crypto policy initiatives under the Trump administration.

“I’m going to be spending quite a bit of time working with lawmakers in Washington DC to help foster and facilitate with other key leaders in the industry with the crypto policy,” Hoskinson noted.

Cardano’s Market Overheats

Cardano currently trades at $0.56, an 11% decline from the $0.63 multi-month peak. Although buying activity is still underway, the Cardano market appears overheated, and the coin’s price may soon experience a pullback.

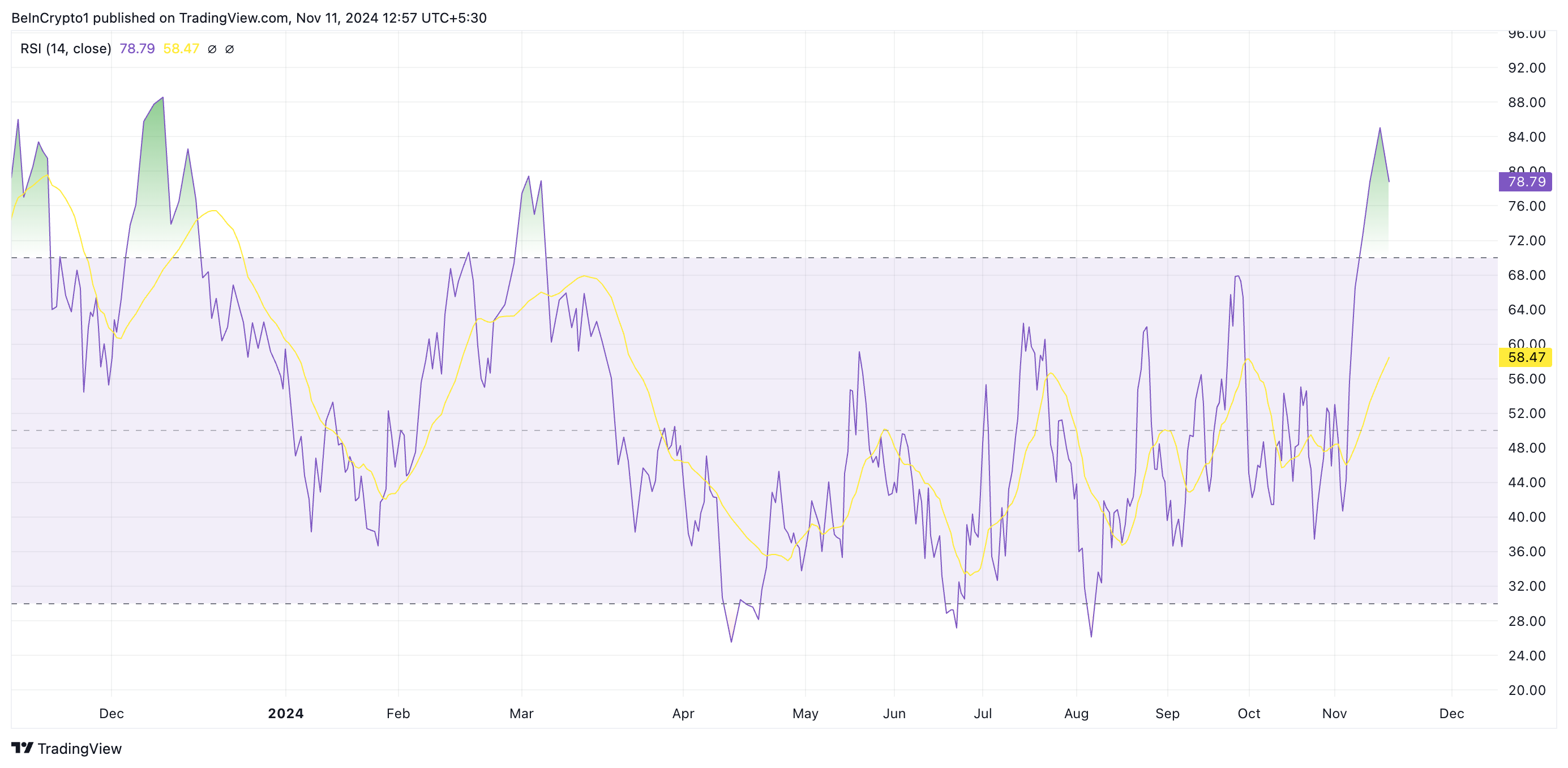

The coin’s high Relative Strength Index (RSI) is a notable indicator of this. ADA’s RSI is at 78.79 at press time, its highest since December 2023.

This indicator measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a decline, while values under 30 indicate that the asset is oversold and may soon witness a rebound.

ADA’s RSI reading of 78.79 indicates it is significantly overbought, suggesting buyers may soon start to witness exhaustion. This elevated RSI increases the likelihood of ADA facing selling pressure, as investors could begin taking profits, potentially leading to a price pullback.

Moreover, as of this writing, ADA’s price is above the upper band of its Bollinger Bands indicator, confirming its overbought status. The Bollinger Bands indicator measures market volatility and identifies potential buy and sell signals. It has three main components: the middle band, the upper band, and the lower band.

When an asset’s price trades above the upper band of this indicator, it suggests that the asset may be overbought and potentially overextended. Traders often interpret this as a signal to anticipate possible downward pressure; hence, they may sell once they have realized sizable gains.

ADA Price Prediction: Key Levels To Watch

As of this writing, ADA trades at $0.56, just below the $0.60 resistance level. Should the Cardano market become significantly overheated and buyers experience exhaustion, the price may correct, potentially dropping toward $0.54 to test it as a support floor. If this level fails to hold, ADA’s decline could extend to $0.40.

Alternatively, if trading activity remains strong and the coin maintains its upward momentum, a successful breach of the $0.60 resistance could pave the way for Cardano’s ADA price rally toward its year-to-date high of $0.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

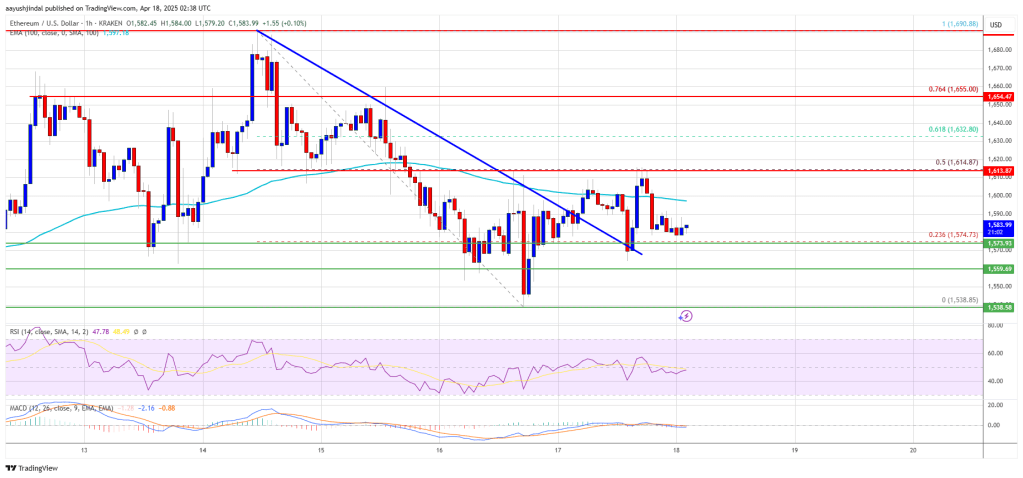

Ethereum price started a fresh decline below the $1,620 zone. ETH is now consolidating and might attempt to recover above the $1,620 resistance.

- Ethereum started a fresh decline below the $1,620 and $1,600 levels.

- The price is trading below $1,620 and the 100-hourly Simple Moving Average.

- There was a break above a connecting bearish trend line with resistance at $1,590 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,615 resistance zone.

Ethereum Price Faces Hurdles

Ethereum price struggled to continue higher above $1,690 and started a fresh decline, like Bitcoin. ETH declined below the $1,600 and $1,580 support levels. It even spiked below $1,550.

A low was formed at $1,538 and the price is now attempting a recovery wave. There was a move above the $1,580 level. The price climbed above the 23.6% Fib retracement level of the downward move from the $1,690 swing high to the $1,538 low.

Besides, there was a break above a connecting bearish trend line with resistance at $1,590 on the hourly chart of ETH/USD. Ethereum price is now trading below $1,620 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $1,600 level. The next key resistance is near the $1,615 level or the 50% Fib retracement level of the downward move from the $1,690 swing high to the $1,538 low. The first major resistance is near the $1,655 level.

A clear move above the $1,655 resistance might send the price toward the $1,700 resistance. An upside break above the $1,700 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

Another Drop In ETH?

If Ethereum fails to clear the $1,615 resistance, it could start another decline. Initial support on the downside is near the $1,5750 level. The first major support sits near the $1,540 zone.

A clear move below the $1,540 support might push the price toward the $1,480 support. Any more losses might send the price toward the $1,420 support level in the near term. The next key support sits at $1,400.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,540

Major Resistance Level – $1,655

Market

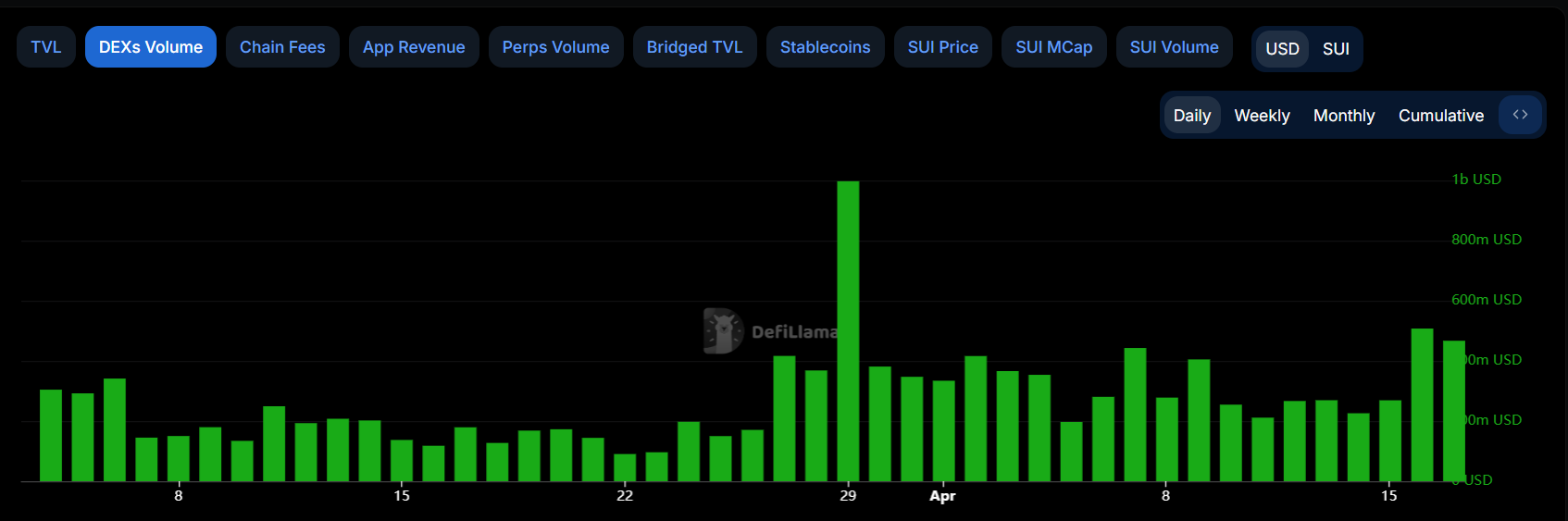

Sui Meme Coins Surge With Rising DEX Volumes

Sui meme coins, not typically seen at the forefront of the sector, are surging in volume recently. Their market cap is far smaller than Solana meme coins, but it’s also growing fast.

LOFI, a meme coin deployed on the blockchain, surged by over 186% in a week. If fresh DEX trading volumes start flowing into these assets, Sui could be the next emerging ecosystem for meme coins.

Are Sui Meme Coins About to Explode?

Meme coins based on Solana have been getting a lot of attention lately, with surging trade volumes and token prices. This has fueled speculation that Solana’s poised to lead a new meme coin boom, especially as the sector is exposed to new risks.

However, Sui meme coins are gaining some unexpected traction, and DEX volumes are noticeably soaring.

Sui is a high-performance Layer-1 blockchain that shares many similarities with Solana but several key differences.

Its design focuses on scalability, using parallel transaction processing and an object-centric transaction model to achieve this aim. Sui’s ecosystem is much less mature than Solana’s, but this could present opportunities for meme coins.

Sui’s developers are constantly working on upgrades to encourage new projects, some of which are explicitly geared towards meme coins. Solana’s 6.3 billion meme coin market cap grew by 2.4% in the previous 24 hours, while Sui’s increased by 4.6%.

LOFI grew 184.5% in the last week, highlighting its dedicated community.

LOFI’s impressive rise stands out, but several other projects on the layer-1 network have also attracted speculative interest. Meme coins thrive on community hype, and the blockchain’s DEX volumes are soaring.

If this high performance and committed enthusiasm connect with fresh investors, it could present an explosive opportunity.

For now, Sui’s meme coin ecosystem has a ways to go, with a total market cap of $123 million. However, this sector moves fast, and the Sui ecosystem could be poised to make some major growth soon, if meme coin enthusiasts continue to trade.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 AI Coins To Watch: RENDER, IP, and CLANKER

AI coins continue to draw attention as April nears its end, with Render (RENDER), Story Protocol (IP), and CLANKER standing out. RENDER has led the pack, surging nearly 17% this week and reclaiming a $2 billion market cap.

In contrast, Story (IP) is down 6.5%, the worst performer among the top 10 AI tokens, while CLANKER dropped over 7% in the last 24 hours. With momentum shifting across the sector, all three tokens are positioned at key technical levels that could define their next move.

RENDER

Render Network provides decentralized GPU computing power for creators, developers, and artificial intelligence applications. Its infrastructure supports rendering for 3D graphics, visual effects, and artificial intelligence model training.

RENDER, the network’s native token, has surged nearly 17% over the past week, pushing its market cap back above $2 billion. It was the top performer among the ten largest AI coins in the market.

If the bullish momentum holds, RENDER could test resistance levels at $4.065 and $4.21, and a breakout could open the path to $4.63.

However, if the trend reverses, key support lies at $3.82 and $3.68—losing these could trigger a deeper decline toward $3.47 or even $3.14 in a stronger correction.

Story (IP)

Story Protocol is a decentralized infrastructure designed to manage and monetize intellectual property (IP) on-chain, with a strong focus on artificial intelligence.

It allows creators to register stories, characters, and other digital assets, enabling collaborative development, licensing, and programmable royalties—all while integrating AI into the creation and distribution process.

Despite its explosive 477% rally between February 16 and 26, Story’s native token, IP, is down 6.5% over the last seven days—the largest drop among the top 10 AI coins.

If the current correction continues, IP could test support at $3.82, and a break below that may push the price under $3. However, if bullish momentum returns, IP could retest resistance at $4.49 and then aim for $5.04.

A strong rebound could eventually lift the token back toward the $6.61 zone, reclaiming some of its earlier hype.

tokenbot (CLANKER)

Tokenbot is a coin launchpad built on the Base chain. Its native token, CLANKE, has been down over 7% in the last 24 hours.

Notably, Base has climbed to the fourth spot in weekly DEX volume, reaching $4.7 billion—just behind BNB, Ethereum, and Solana—although its volume is down 7.73% in the last week.

Interest remains around Base’s recent push into “Content Coins,” with the community watching closely to see how the narrative evolves.

If CLANKER’s current downtrend deepens, it could test support at $27.97 and potentially fall to $22.84, dropping below $25 for the first time since April 6.

On the upside, a recovery could lead to a test of the $36 resistance, followed by $40. If sentiment around Base tokens strengthens, CLANKER could rally toward $47 as momentum builds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?

-

Market24 hours ago

Market24 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market17 hours ago

Market17 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Market23 hours ago

Market23 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Ethereum22 hours ago

Ethereum22 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Altcoin18 hours ago

Altcoin18 hours agoHow Rising Solana Network Inflows Could Drive SOL Price to $150?

-

Bitcoin18 hours ago

Bitcoin18 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Altcoin17 hours ago

Altcoin17 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?