Market

Bybit Registers as a VASP in Argentina

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes Bybit’s recent registration as a Virtual Asset Service Provider (VASP) in Argentina, Yilport Holdings’ strategic investment in El Salvador, and Paraguay’s Minister of Economy and Finance opposing punitive energy tariffs for cryptocurrency miners.

Bybit Registers as Virtual Asset Service Provider in Argentina

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has officially registered as a Virtual Asset Service Provider (VASP) in Argentina. The registration with the Financial Information Unit (UIF) marks a major step for the digital asset industry in the region.

This registration lets Bybit legally provide a full range of digital asset services in Argentina. The exchange views it as a strategic market, aiming to offer solutions tailored to meet local needs.

“This achievement marks an important step forward in our mission to provide accessible and secure digital asset services to users around the world and our commitment against financial crime,” said Ben Zhou, co-founder and CEO of Bybit. “Bybit is committed to supporting Argentina’s economic growth and empowering its citizens through the payment capabilities and potential of blockchain technology.”

Read more: Bybit Review 2024: Review of Its Security, Fees, and Features

Earlier this year, Argentina’s National Securities Commission (CNV) mandated that cryptocurrency operators register with the VASP Registry within 45 days of its creation. Bybit’s new license also extends beyond VASP operations to include card services. In July, the company launched the Bybit Card in Argentina, enabling users to easily bridge digital finance with everyday transactions.

El Salvador Secures $1.6 Billion Investment for Bitcoin City Port Development

El Salvador has obtained a strategic investment of $1.6 billion from Yilport Holdings, a leading Turkish global port logistics company, to develop the port of La Unión into the cornerstone of its ambitious Bitcoin City project. This port, located on the Pacific coast, is crucial to El Salvador’s goal of becoming a global cryptocurrency hub.

Yilport Holdings, known for port management across Europe, Asia, and the Americas, plans to make La Unión a world-class facility. The upgraded port will support Bitcoin City’s logistics and act as a strategic trade hub. It will connect El Salvador to major markets in Asia, North America, and Europe.

Max Keiser, Senior Bitcoin advisor to President Bukele, celebrated the announcement as an important milestone for Bitcoin City. He also highlighted that this investment solidifies the city’s foundations and enhances El Salvador’s role in the global crypto stage.

“Bukele’s Turkey trip paid off bigly! Qatar on deck,” Keiser hinted.

Read more: Who Owns the Most Bitcoin in 2024?

The port’s modernization, beyond Bitcoin City, is set to significantly boost the local economy. It will create thousands of jobs, driving growth and revitalizing the region. Yilport’s investment demonstrates confidence in El Salvador’s logistical potential and strengthens the country’s position on global trade routes.

The port of La Unión, completed in 2008 with a $200 million investment, remained underutilized due to private sector disinterest. Yilport’s involvement now aims to turn this dormant project into a catalyst for economic transformation in El Salvador. It positions the port as a crucial node in the international digital economy.

Retail Investors in Latin America Gain Access to Tokenized Real-World Assets

A recent alliance between Backed and eNor Securities is set to transform financial access for retail investors in Latin America. The partnership, announced on August 13, allows individual investors in the region to invest in tokenized real-world assets (RWA).

Backed, a firm specializing in RWA tokenization, joined forces with eNor Securities, a Salvadoran stock exchange, to present these assets to Latam’s retail market. This partnership brings Coinbase stocks, BlackRock’s S&P 500 ETF holdings, and corporate and government bond ETFs, to the eNor platform.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

Backed structures its offerings as bTokens, representing ownership of tokenized assets fully backed by underlying securities held by third-party custodians. These tokens comply with stringent European Union prospectus regulations, ensuring that holders maintain direct rights to the assets they represent. As of now, more than $52 million in bTokens have been issued across eight different blockchains.

Paraguay’s Minister of Economy Opposes Punitive Pricing for Crypto Mining

Carlos Fernández Valdovinos, Paraguay’s Minister of Economy and Finance, has voiced his opposition to imposing punitive energy prices on miners. Valdovinos recently stated that such measures could deter the growth of the mining industry in the country.

“I do not agree with putting a punitive price that will scare away cryptocurrency mining,” the minister said in an interview with ABC media. However, he stressed the need to strike a fair balance, noting that the National Electricity Administration (ANDE) requires resources for infrastructure investments.

Recent reports by BeInCrypto indicate that Paraguay is considering the legalization and regulation of cryptocurrency mining. Javier Giménez, another senior government official, mentioned plans to sell energy directly to mining companies, aiming to position Paraguay as a regional hub for this activity.

Read more: Is Crypto Mining Profitable in 2024?

As the country works to formalize the sector, ANDE has dismissed rumors that mining companies are leaving Paraguay. According to ANDE President Felix Sosa, the country currently hosts 72 contracted mining companies, which could generate up to $100 million in revenue.

The ongoing dialogue highlights Paraguay’s balancing act between promoting economic growth through cryptocurrency mining and ensuring sustainable energy management.

Ecuador’s Central Bank Reaffirms Cryptocurrency Ban

Ecuador’s Central Bank (BCE) has reiterated that cryptocurrencies are banned and do not hold legal tender status in the country. The statement comes amid growing discussions around Worldcoin (WLD), a project sparking debate for offering cryptocurrency in exchange for iris scans.

The BCE highlighted that, according to Articles 94 and 99 of national law, the US dollar is the only legal currency in Ecuador. Cryptoassets are neither legal tender nor an authorized means of electronic payment. Despite this, Ecuador ranked eighth in Latin America, receiving $7 billion in cryptocurrency transactions between 2022 and 2023.

The Central Bank stated that the only recognized payment methods include physical currency, electronic transfers, e-wallets, credit and debit cards, and prepaid cards. Digital assets are not recognized by Ecuadorian law.

“The BCE reminds individuals and businesses that cryptoassets are not legal tender nor an authorized means of payment in Ecuador. The use of unauthorized payment methods is prohibited under Article 98 of the COMF. If identified, the BCE will report such activities to the Attorney General’s Office for investigation and possible sanctions,” the statement clarified.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The statement follows the rising presence of Worldcoin in Ecuador, where its rapid growth has attracted attention. Without proper licensing, the project drew crowds in Guayaquil, where people lined up to scan their irises in exchange for $30 in cryptocurrency, convertible to $20 in US dollars.

The BCE clarified that the reported $7 billion in cryptocurrency transactions, according to Chainalysis, did not affect the national financial system, indicating that most transactions occur digitally on exchanges without influencing cash flow or reserves. The bank warned citizens of the inherent risks and volatility in cryptocurrency investments.

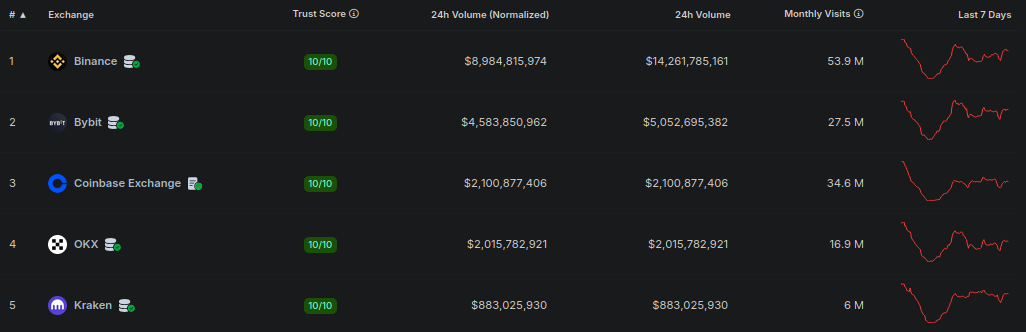

Binance Faces Web Restrictions in Venezuela

Venezuelan users are now grappling with restricted access to Binance, the world’s largest cryptocurrency exchange by trading volume, as the government tightens its internet control. Binance confirmed these challenges in a recent statement shared on X (formerly Twitter), acknowledging difficulties in maintaining access for Venezuelan users.

“Like several websites of companies from different segments in Venezuela, including social networks, Binance pages have been facing access restrictions,” the statement read.

In response, many users have turned to virtual private networks (VPNs) to bypass the restrictions. Reports show that the issue affects only Binance’s web platform, while the mobile app continues to operate normally. Ernesto Contreras, a prominent figure in Venezuela’s crypto scene, advised users not to panic, recommending the use of non-US VPN locations and urging self-custody of funds.

“Also, if you are an expert, it is time to start self-custody! Download your wallet and try to store your funds yourself (Make sure to protect your seed phrase) […] Take advantage of learning, and everything will be fine!” Contreras suggested.

Read more: 7 Best Binance Alternatives in 2024

The restrictions come at a critical time, as Venezuelans increasingly rely on digital currencies to counter the country’s economic crisis. Cryptocurrency adoption in Venezuela has surged, offering a refuge from hyperinflation and economic instability.

This development follows the recent ban on X in Venezuela after a public clash between President Nicolás Maduro and X owner Elon Musk. Amid escalating tensions after a disputed election, Maduro ordered the telecommunications regulator to block X for ten days, accusing Musk of inciting division and unrest.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Notcoin Price Break This Key Resistance?

Like other altcoins in the market, Notcoin (NOT) has seen a price increase in the last 24 hours. Within the period mentioned, NOT has jumped by 8% while its volume has surged 85%, indicating growing interest in the Telegram coin.

With market volatility at a high level, Notcoin faces a crucial momentum that could determine its short-term movement. If NOT fails to break through this key resistance, it risks facing a significant correction that may send its price tumbling.

Notcoin Encounters Challenges

Notcoin is currently trading at $0.0078, still 73% below its all-time high. Despite recent gains in price and volume, which suggest a potential rally, the 4-hour analysis indicates the token could face challenges as it targets $0.011.

The 4-hour chart shows that Notcoin is working its way toward $0.0080, but this level has previously acted as resistance, where the coin faced rejection. If Notcoin fails to break above this price level, it could see a 10% correction. In this case, its value might drop to $0.0072.

Read more: 5 Top Notcoin Wallets in 2024

An evaluation of Notcoin on the daily timeframe shows its Relative Strength Index (RSI) remains below the neutral 50.00 mark. The RSI is a momentum indicator that tracks the speed and size of price changes.

If the RSI moves above the midpoint, it signals bullish momentum and a potential price increase. Conversely, a decline in the RSI suggests weakening momentum.

For Notcoin, the RSI is rising but still below the signal line, indicating the uptrend is uncertain. The token’s upward movement will likely remain shaky unless bulls apply more pressure to push the price higher.

NOT Price Prediction: Rally Could Stop

Furthermore, the Fibonacci retracement indicator provides insights into NOT’s next movement. From a short-term perspective, bulls might try to break above $0.0085. However, around the same region, Notcoin began a decline that pulled it down to $0.0072 on September 6.

As such, that region is a supply zone that requires notable buying pressure to surpass. Currently, it does not appear that Notcoin has the notable capital flow to keep the upswing going.

Read more: Notcoin (NOT) Price Prediction 2024/2025/2030

In a highly bearish scenario, Notcoin’s price could drop to $0.0072 and possibly as low as $0.0069. On the other hand, if the token manages to break above the $0.0080 and $0.0085 resistance levels, it could potentially surge to $0.011.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why 2024 Altcoin Season Could Fuel a Rally in These 6 Tokens

Crypto investors and analysts support that the 2024 altcoin season may have just started, drawing signals from multiple fundamentals, including Bitcoin’s (BTC) sustained foray above $63,000.

The optimism comes after the Federal Open Market Committee (FOMC) decided a 50 basis points interest rate cut in September, suggesting the US economy is in a good place.

Crypto Banter Founder Highlights Tokens Primed for Altcoins

Crypto Banter, a popular YouTube channel with over 1.08 million subscribers, says the 2024 altcoin season is beginning. Its founder, Ran Neuner, cites the Federal Reserve’s (Fed) interest cut on Wednesday, increasing global liquidity and the all-time high seen in the money market funds. With this, he lists six tokens that are best positioned to rally if the altcoin season takes off.

SUI

The analyst starts by highlighting Sui (SUI) as a standout token, noting its rising prominence in the market, even posing a threat to Solana (SOL). SUI has been making headlines with major partnerships, including Circle’s USDC integration. Grayscale also recently launched a Sui Trust, which has driven a significant increase in both price and trading volume.

Ran Neuner believes these strong fundamentals position SUI for success in the short term, especially if an altcoin season unfolds.

FTM

The analyst also highlights Fantom (FTM) as a promising altcoin, noting its strong price performance. FTM has gained attention after recent internal developments, including the rebrand to Sonic Labs in August.

The rebrand has sparked renewed investor interest, positioning Fantom for further growth. Sonic Labs is building on this momentum with the launch of Sonic Gateway, a decentralized bridge that enables secure ERC-20 token transfers between Ethereum and Sonic.

This development has provided a boost for FTM, which has risen by 10% since the Thursday session began, trading at $0.33, according to BeInCrypto data.

IMX

ImmutableX (IMX) is also on Crypto Banter’s list of altcoins poised to rally on a possible alt season. The gaming token has broken above a falling wedge pattern, effectively confirming a reversal. Based on this breakout, analysts expect a bullish wave.

Read more: What Is Altcoin Season? A Comprehensive Guide

AERO

The portfolio rebalancing also considers Aerodrome (AERO), as the central trading and liquidity marketplace continues to thrive on Base L2. The underlying fundamental for AERO is Aerodrome’s MetaDEX model, which combines the best aspects of previous decentralized exchange market leaders.

“When we assess Aerodrome’s implied outcomes through a model, it’s evident that token inflation, in itself, is not inherently bad. Instead, emissions are just one input into an economic model—a cost that can be managed and overcome,” a DeFi researcher echoed.

SOL

If the assumption proves accurate, Solana (SOL) may be gearing up for a strong rally, given its history of delivering impressive gains during altcoin market surges. Solana has often outperformed when broader altcoin momentum picks up, making it a key player to watch.

Currently, SOL is trading at $141.53, marking a 10% increase in the last 24 hours, according to BeInCrypto data.

OM

MANTRA (OM) earns a spot on the analyst’s list due to the upcoming launch of its mainnet in October. This event is expected to be a major milestone for the project, as it will bring real-world assets (RWA) on-chain. The mainnet launch will be a crucial step in integrating traditional finance (TradFi) into the blockchain ecosystem, creating new opportunities for MANTRA’s growth.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

Ran Neuner also highlighted several other tokens that could see strong rallies, including Arweave (ARV), THORChain (RUNE), Render (RNDR), Crown by Third Time Games (CROWN), and SuperVerse (SUPER). These tokens have posted steady, conservative gains despite recent market uncertainty, positioning them for larger increases if an altcoin season takes off.

However, Neuner advises investors to keep an eye on the Bank of Japan’s (BOJ) CPI and interest rate decision on Friday. He warns that if the BOJ raises rates, it could disrupt the current rally, potentially leading to a market reversal. On the other hand, if the BOJ cuts interest rates, it could reinforce the ongoing upward momentum.

“Don’t get overconfident. We need good CPI out of Japan tomorrow and for BOJ not to raise rates on Friday. September still has some potential liquidity drains so don’t lever up to the gills, just 8 more days until it is really up only,” GamesMasterFlex wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will NEIRO Price hit $0.17 soon?

After a brutal 45% plunge triggered by Binance’s actions, Neiro Ethereum (NEIRO) is making a remarkable comeback. The meme coin has surged by an impressive 51% in the past 24 hours, outpacing the broader meme market.

With a resurgence in demand for NEIRO, the meme coin looks poised to extend its gains.

Neiro Ethereum Makes Its Comeback

BeinCrypto reported that NEIRO saw a sharp 45% price drop on Monday after Binance listed a different token with the same NEIRO ticker on its spot and futures markets.

However, the broader market’s positive sentiment over the past 24 hours, fueled by the US Federal Reserve’s rate cut, sparked a strong recovery for NEIRO. At press time, the altcoin is trading at $0.11, up 51%, with trading volume surging 53% to $93 million.

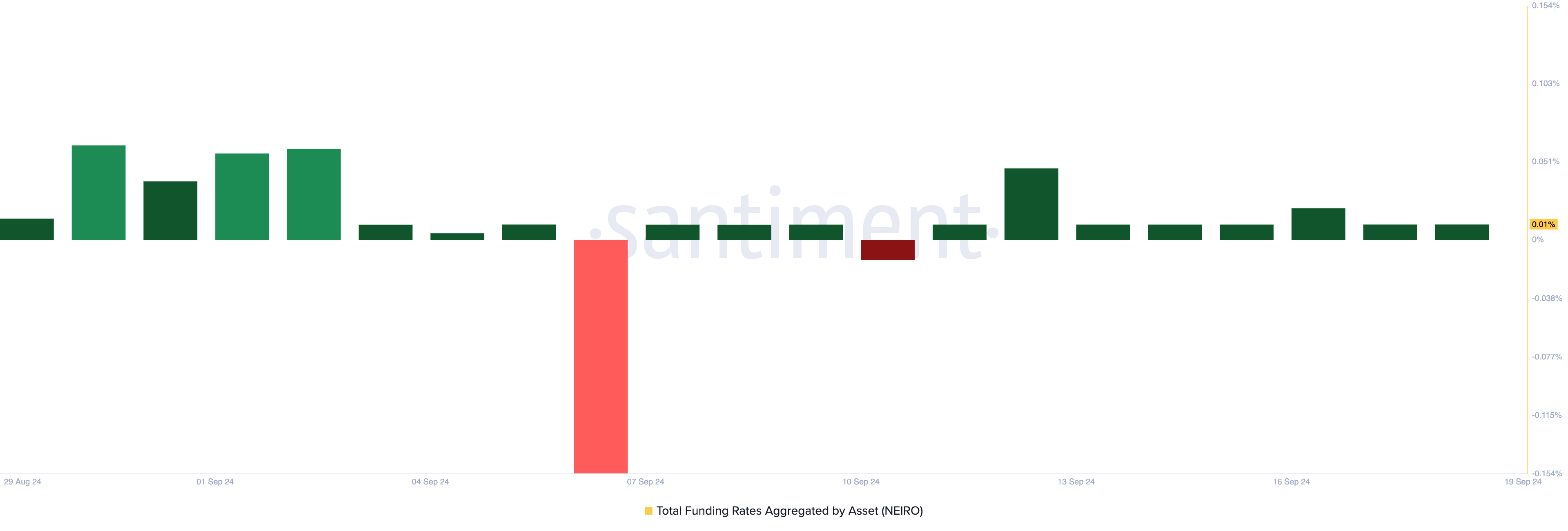

This rally has significantly boosted the number of profitable NEIRO transactions. Santiment data shows the ratio of transaction volume in profit to loss is now 3.66, its highest since the token’s July launch. This means that for every transaction at a loss today, 3.66 have turned a profit.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in September 2024

NEIRO traders remain bullish, with the altcoin’s funding rate at 0.01%, indicating higher demand for long positions among futures market participants.

NEIRO Price Prediction: Higher Demand May Push Token To $0.17

NEIRO’s Relative Strength Index (RSI) on the four-hour chart confirms the growing accumulation of the altcoin. At 59.07, this momentum indicator suggests market conditions are leaning toward buying rather than selling.

If buying pressure continues, NEIRO’s uptrend could persist, with the potential to rise another 46% and reach $0.17.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, if selloffs gain momentum, this bullish projection will be invalidated as NEIRO’s price may drop to $0.06.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market3 months ago

Market3 months agoTON Foundation’s Plan to Onboard 500 Million Users

-

Altcoin3 months ago

Altcoin3 months agoAre Solana, Cardano, Polygon Commodities As US SEC Ends Ethereum Investigation?

-

Regulation5 months ago

Regulation5 months agoCFTC Appoints Dr. Ted Kaouk as First Chief AI Officer

-

NFT3 months ago

NFT3 months agoNew And Upcoming NFT Projects

-

Altcoin3 months ago

Altcoin3 months ago2.52 Million Altcoins Are Ruining Crypto’s Future

-

NFT3 months ago

NFT3 months agoBLUR Is Down 30%, And Whales Are To Blame–Here’s Why

-

Blockchain5 months ago

Blockchain5 months agoHong Kong’s Securities Association Tips Authorities On Crypto Self-Regulation

-

Market3 months ago

Market3 months agoEthena (ENA) Whale Faces $13M Loss With 30% Token Drop