Market

Brazil Explores AI Regulation, and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories on Brazil’s efforts to regulate AI, a surge in interest in the Argentine Football Association fan token as the Copa América final approaches, and more.

BBVA: 9 out of 10 Argentines Use Digital Wallets

BBVA Bank recently reported that nine out of every ten Argentines under 40 now use digital wallets. This is a huge increase from 2020 when only 4% paid using QR codes. According to Argentina’s National Institute of Statistics and Census (Indec), 89% of Argentines use smartphones and 88% have internet access, helping modernize financial services.

“The outlook is for growth: the greater adoption of digital wallets among young people allows us to think that their use will be increasingly widespread,” said Joaquín Molina from the consulting firm Taquion.

Popular digital wallets in Argentina that are not crypto-based include Mercado Pago, Ualá, Brubank, MODO, Cuenta DNI, and Tarjeta Naranja. MODO is the only one that integrates services from several banks like BBVA, Santander, Macro, Galicia, Nación, ICBC, and Ciudad.

Read more: 16 Best Web3 Wallets In 2024

Data from Taquion also shows that 55% of Argentines use digital wallets for shopping at local stores, 38% for supermarket purchases, and 30% for buying shoes. Additionally, four out of ten users prefer this payment method for the rewards offered.

In March, Argentina drafted a law to regulate cryptocurrency exchanges and wallets, working closely with the private sector. This move follows the guidelines of the Financial Action Task Force (FATF).

The new set of rules requires Argentine lawyers, banks, and finance companies to report any client operations that seem illegal. This is part of President Javier Milei’s effort to regulate wallet use.

Venezuelan Authorities Warn of Alleged Cryptocurrency Ponzi Using PDVSA Name

In May and June, Venezuela faced controversies over alleged cryptocurrency Ponzi schemes. As July progresses, the issue persists with a new scheme reportedly using the name of Petroleos de Venezuela (PDVSA). The initial alert came from X (former Twitter) user RoamingVzla, known for exposing dubious operations of companies like BTR, HyperAI, and Solesbot.

“Since some major Ponzi schemes collapsed, new ones keep emerging weekly. Some last longer than others. The latest one, supposedly launched on July 2, is called PDVSA_Mall,” tweeted RoamingVzla.

The platform solicits investments in TRON (TRX) or USDT, promising benefits “valid for 40 days.” It also claims that forming a large team can significantly increase earnings.

“Whenever you top up through the registration link, you will receive additional USDT rewards. For instance, depositing 1000 USDT through the link grants an additional 160 USDT rebate,” stated the PDVSA-VIP team.

Read more: 15 Most Common Crypto Scams To Look Out For

The cryptocurrency ecosystem in Venezuela has seen multiple scams, causing significant losses. Previous schemes like Solesbot, HyperAI, and BTR have left Venezuelan investors wary.

The use of PDVSA’s name raises serious concerns, especially without official endorsement. The platform claims to operate under the Central Bank of Venezuela (BCV) and the Bank of Venezuela (BDV) regulations.

The PDVSA crypto scandal, marked by massive corruption within Petroleos de Venezuela, serves as a stark fraud warning. Former Petroleum Minister Tareck El Aissami was arrested for allegedly siphoning billions from oil sales through cryptocurrencies and Venezuela’s National Superintendence of Cryptoassets (SUNACRIP). Estimates suggest up to $23 billion was embezzled, severely impacting Venezuela’s economy.

Brazilian Senate Postpones Vote on AI Regulation Bill

The Brazilian Senate has delayed voting on Bill 2338/23, which aims to regulate artificial intelligence (AI) tools. The bill will undergo further debate, with a vote expected only after the municipal elections. Opposition senator Marcos Rogério proposed the postponement, citing concerns about the bill’s potential impact on the tech sector.

“The bill aims to regulate AI to prevent misuse in elections and establish privacy rules. However, it imposes excessive restrictions on a nascent sector,” he stated.

Rogério warned that the bill’s bureaucracy could hinder technological development, requiring rigorous documentation and state analysis for all systems. Alan Nicolas, founder of the Lendár.IA Community and an AI expert, echoed these concerns. He said the need for legislation to protect against AI misuse but cautioned against stifling innovation.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies

The push for AI regulation stems from its disruptive potential, especially in elections, where false information can spread rapidly. The Superior Electoral Court (TSE) has mandated AI-created content identification and banned deepfakes for the 2024 elections.

This concern extends beyond Brazil. Tech giants like Google and OpenAI have restricted their AI tools from discussing elections. OpenAI’s terms of service prohibit tools like ChatGPT from creating political content. With elections in Brazil and the US in 2024, it remains to be seen how AI will influence the outcomes, marking the first time elections will occur after AI tools have become widespread.

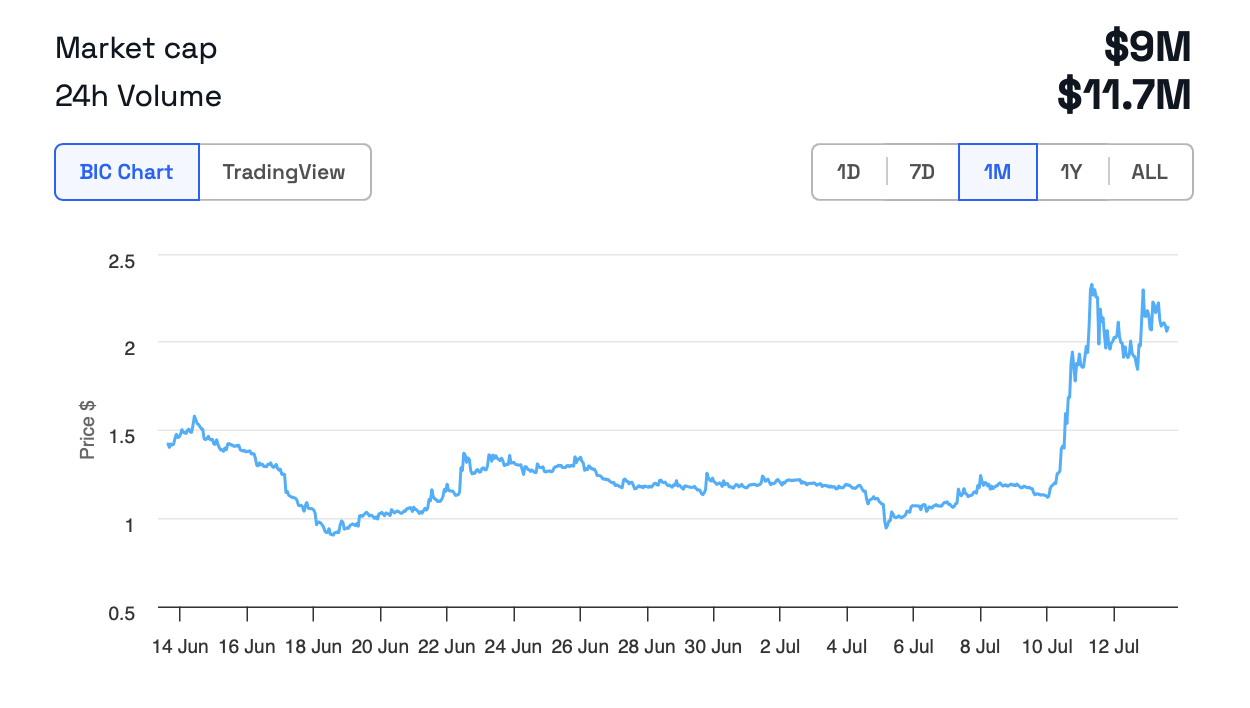

Copa América Final: Argentina Fan Token Surges

Argentina, the reigning world champions, will play Colombia in the Copa América final on July 14. Argentina is favored to win their 15th continental title.

Soccer fans have enjoyed this major event for a month, but cryptocurrencies have also taken the spotlight. Amid this excitement, the Argentine Football Association Fan Token (ARG) is surging, now trading at $2.09.

Read more: What is Sorare? Where Blockchain Meets Fantasy Football

The rise in fan token prices correlates with the teams’ performances in the tournaments. However, other factors, like the overall volatility of the cryptocurrency market, also play a role. It’s important to note that fan tokens are a new and uncertain asset, involving several investment risks.

After the celebrity meme coin frenzy, hackers have shifted their focus to sports stars, using their accounts to push dubious projects. The latest victims are Lionel Messi and Ronaldinho Gaúcho.

Messi’s Instagram account was hacked on Monday, leading to a 193% surge in the WATER meme coin value. Hackers posted a story featuring an image of Messi with a link to promote WATER.

A similar incident occurred on Tuesday with Ronaldinho Gaúcho’s account. The post remained visible on his profile, with no explanation provided.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

The meme coin promotion reached a significant portion of the combined 577 million followers of the two soccer legends. This exposure created a spike in interest in WATER.

WATER was launched on June 24, 2024 on Solana, valued at approximately $0.00264353. It experienced a sharp decline, hitting a low of $0.00028329 by Monday morning.

The hack on Messi’s account caused WATER’s value to rise exponentially, reaching $0.00123181. However, the price fell again. Another slight surge occurred on Tuesday morning following the post on Ronaldinho’s account, but it failed to sustain the meme coin’s value, which has continued to decline.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

Larry Fink, CEO of BlackRock, claimed in a recent letter that Bitcoin and crypto could damage the dollar’s international standing. If investors treat Bitcoin as an inflation hedge to the dollar, it could precipitate serious trouble.

However, he was also adamant that the industry offers a lot of advantages, particularly through tokenization.

Larry Fink Sees Opportunity in Crypto

BlackRock is the leading Bitcoin ETF issuer in the US, and its CEO Larry Fink has long been bullish on Bitcoin. However, as Fink described in his most recent Annual Chairman’s Letter to investors, crypto’s best interest doesn’t always align with TradFi or the dollar.

“The US has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit. If the US doesn’t get its debt under control… America risks losing that position to digital assets like Bitcoin,” he said.

To be clear, Fink insisted that he supports crypto and listed some practical problems that he believes it can solve. He expressed a particular interest in asset tokenization, claiming that a digital-native infrastructure would improve and democratize the TradFi ecosystem.

Despite these advantages, Fink recognizes the danger that crypto can present to the US economy if not properly managed. He addressed the longstanding practice of using crypto to hedge against inflation, a wise practice for many assets.

However, if a wide swath of investors think Bitcoin is more stable than the dollar, it would threaten USD’s status as the world reserve currency. A scenario like that would be very dangerous to all of TradFi, and Fink has a particular interest in protecting BlackRock. Such an event would doubtlessly impact crypto as well.

“Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar,” Fink added.

He didn’t offer too many specific solutions to this growing problem, but Fink isn’t the only person concerned with the issue. President Trump recently suggested that stablecoins could promote dollar dominance worldwide. Even if the dollar is seen as unstable, its adoption within a rapidly growing global industry like stablecoins could help reinforce its strength and relevance.

Of course, there are also drawbacks to Trump’s plan. Larry Fink acknowledged a possible threat from crypto, but continues to espouse its utility. Its benefits are too good to ignore.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

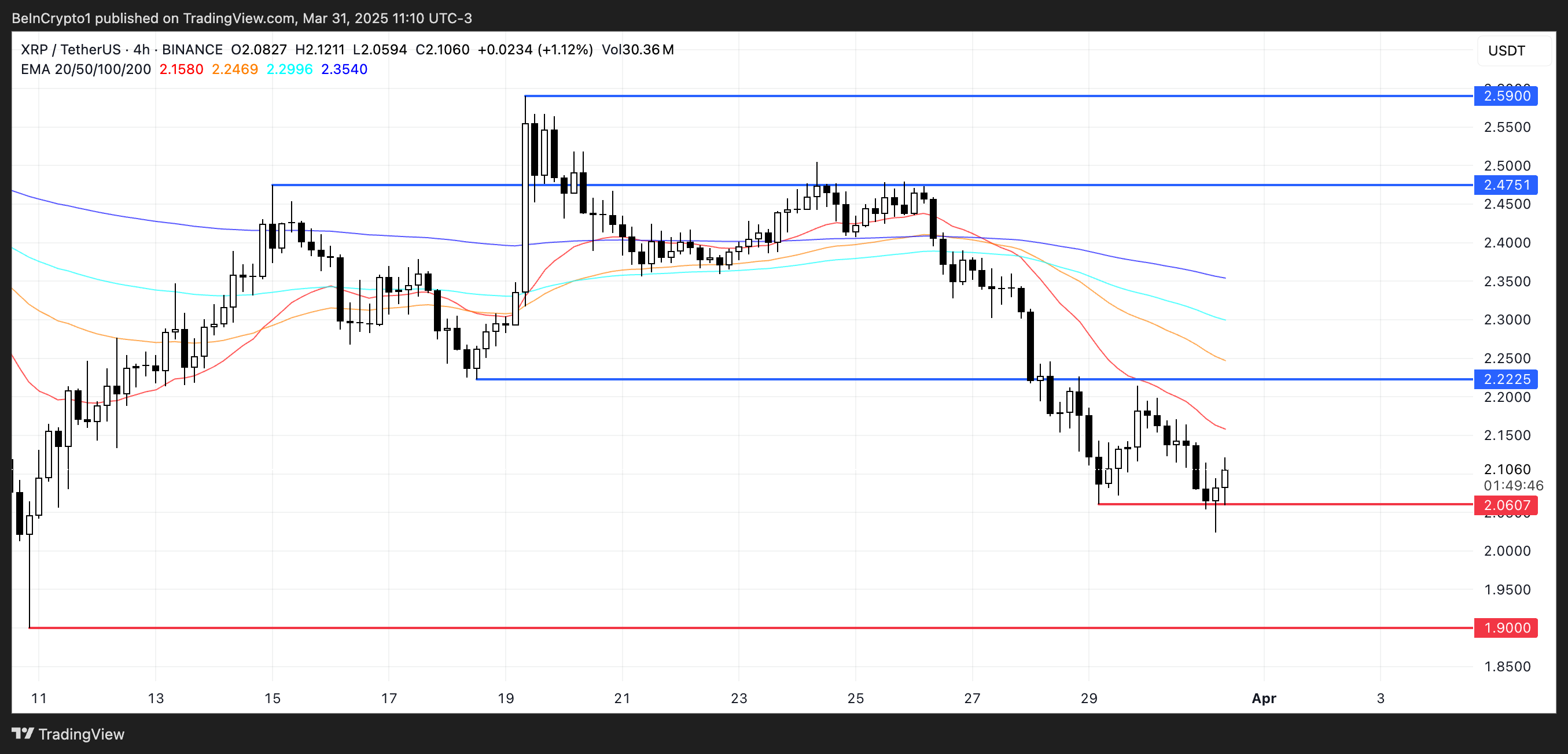

XRP Bears Lead, But Bulls Protect Key Price Zone

XRP has experienced a significant downturn in recent price action, with its value dropping nearly 15% over the past seven days as bears maintain control of the market. The coin’s technical indicators are showing mixed signals, with the RSI rebounding from oversold territory while Ichimoku Cloud patterns continue to paint a predominantly bearish picture.

Despite yesterday’s test of the critical $2.06 support level resulting in a temporary bounce, the momentum remains negative, with short-term EMAs positioned below long-term averages. The move from extreme oversold conditions suggests XRP might be entering a consolidation phase before its next significant price movement.

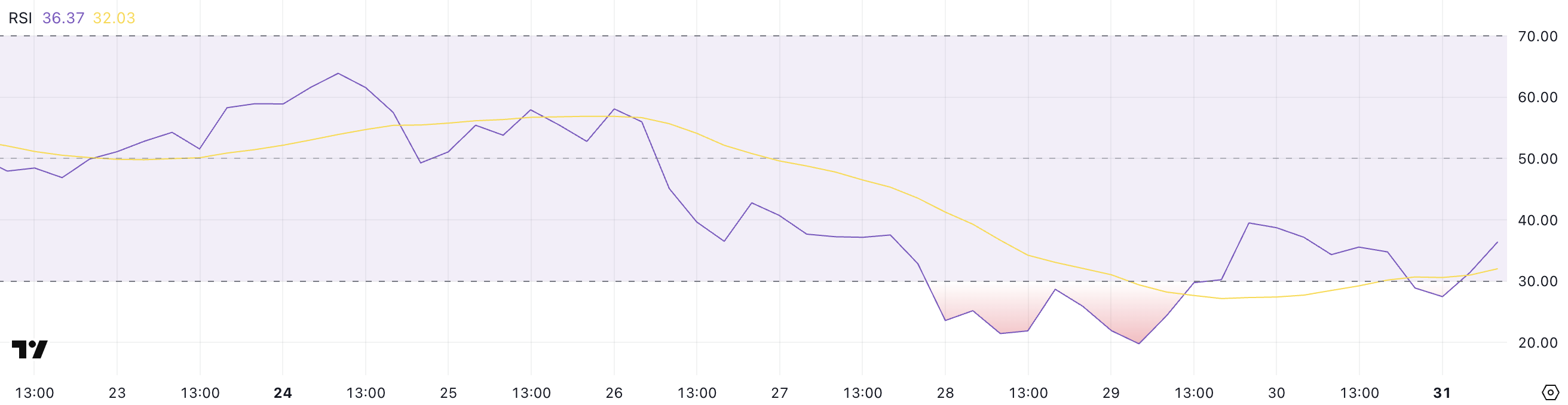

XRP RSI Is Up From Oversold Levels

XRP’s Relative Strength Index (RSI) is currently at 36.37, showing a notable rebound from a low of 27.49 just a few hours ago. This upward shift indicates a shift in momentum, as buying interest has started to pick up after a period of heavy selling pressure.

Although still in the lower range, this recovery suggests that traders may be stepping back in. That could mean they are potentially viewing the recent dip as an opportunity.

RSI is a widely used momentum indicator that measures the speed and change of price movements on a scale from 0 to 100. Readings below 30 typically indicate that an asset is oversold and may be undervalued, while readings above 70 suggest it is overbought and could be due for a correction.

XRP’s bounce from 27.49 to 36.37 signals that it may have just exited oversold conditions. This could mean that the recent selling phase is easing. If the buying momentum continues to build, XRP might be entering the early stages of a potential recovery.

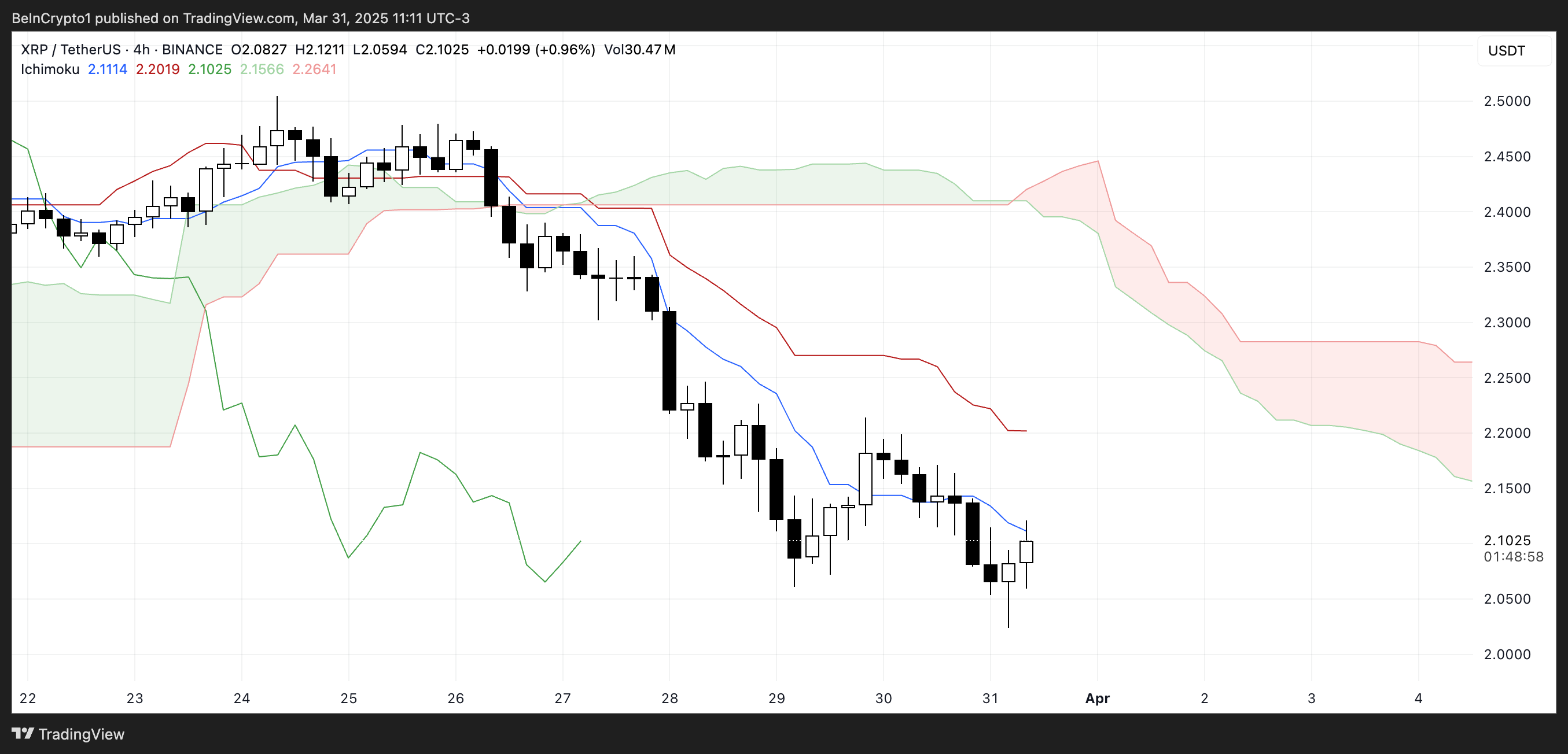

XRP Ichimoku Cloud Shows A Bearish Scenario

XRP’s Ichimoku Cloud chart shows that the price action remains below both the red baseline (Kijun-sen) and the blue conversion line (Tenkan-sen). That indicates the prevailing momentum is still bearish.

The candles are also forming well beneath the cloud, which reflects a broader downtrend.

When the price is under all major Ichimoku components like this, it typically signals continued downward pressure unless a strong reversal breaks those resistance levels.

Additionally, the cloud ahead is red and spans horizontally with a downward slope, reinforcing the bearish outlook in the near term. The thickness of the cloud suggests moderate resistance if the price attempts to move upward.

However, some consolidation is evident in the recent candles, showing that sellers may be losing some control.

For any potential trend reversal, XRP would need to break above the Tenkan-sen and Kijun-sen, and eventually challenge the cloud itself — a move that would require a clear uptick in momentum.

XRP Could Rise After Testing An Important Support Yesterday

XRP’s EMA lines are clearly aligned in a bearish formation, with the short-term averages sitting well below the long-term ones and a noticeable gap between them—highlighting strong downward momentum.

Yesterday, XRP price tested the support level at $2.06 and rebounded, showing that buyers are still active at that zone. However, this support remains critical. If it is tested again and fails to hold, XRP could fall further. Its next major support sitting around $1.90.

If the trend begins to shift and XRP breaks above the short-term EMAs, the first key resistance to watch is at $2.22. A successful move above this level could trigger a stronger recovery, potentially pushing the price toward $2.47.

If bullish momentum continues, the next upside target would be $2.59. For now, though, the EMA structure still leans bearish. XRP would need sustained buying pressure to flip the trend and aim for those higher resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Market Cap Now Approaching $300 Million

SAFE has emerged as the best-performing altcoin of the day, with its price surging 5% in the last 24 hours and its market capitalization now close to $300 million. The coin is showing strong technical indicators despite some mixed signals from momentum oscillators that suggest consolidation may be on the horizon.

Technical analysis of the EMA lines remains bullish, with short-term averages positioned favorably above long-term ones, pointing to continued strength in the immediate term. However, recent RSI and BBTrend readings indicate a potential cooling-off period could be approaching as the asset digests its recent gains.

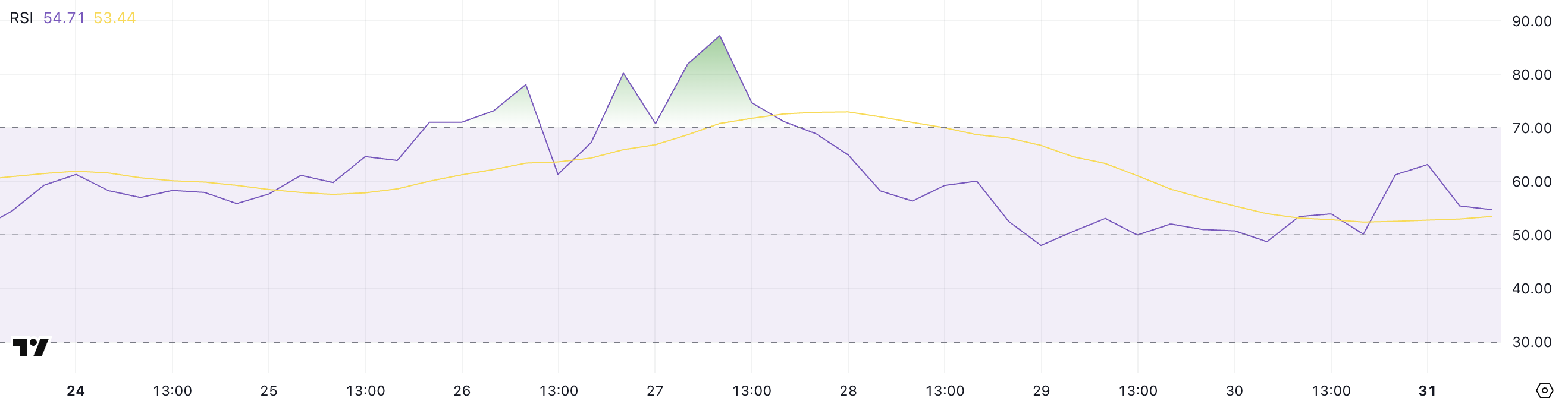

SAFE RSI Is Back To Neutral Levels After Reaching Overbought Levels

The SAFE RSI is currently at 54.71, maintaining a neutral position for the past three days after experiencing significant momentum earlier in the week.

This moderation in the indicator suggests that the previous buying pressure has subsided somewhat, allowing the asset to consolidate following recent price movements.

The current neutral reading indicates a balanced market where neither buyers nor sellers have a decisive advantage.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100. Generally, an RSI reading above 70 is considered overbought, suggesting a potential reversal or pullback, while readings below 30 indicate oversold conditions that might precede a bounce.

With SAFE’s RSI recently peaking at 87 just four days ago, the asset was in strongly overbought territory, signaling excessive buying enthusiasm. The current value of 54.71 represents a significant cooling off from those extreme levels, suggesting that SAFE’s price could be entering a period of stabilization.

This moderation may provide a healthier foundation for sustainable price action moving forward, as the previous overbought conditions have been worked through without dropping into oversold territory. This potentially indicates underlying strength in the asset despite the retreat from recent highs.

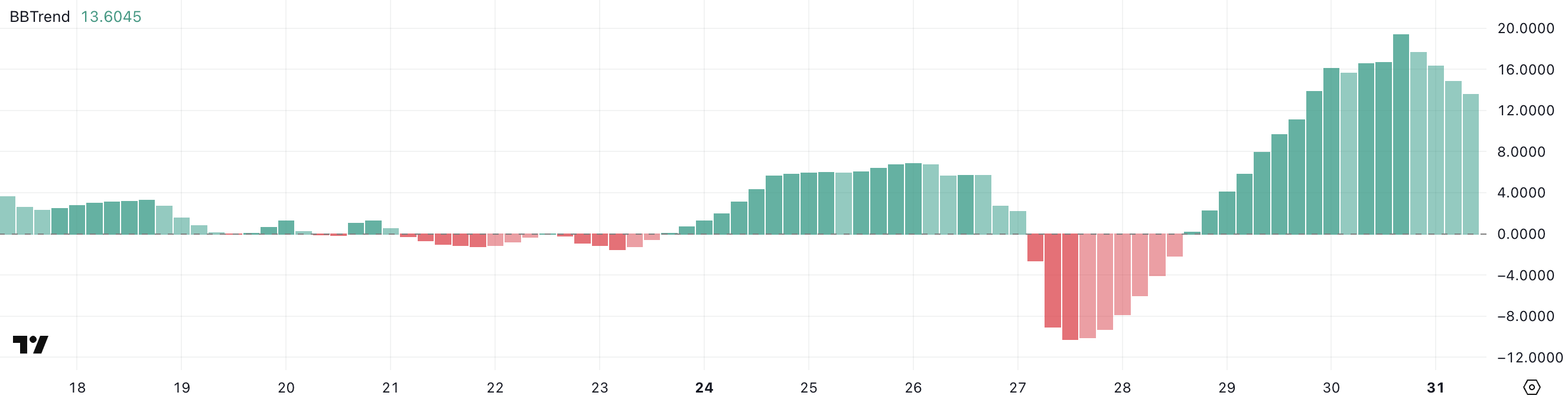

SAFE BBTrend Is Still High, But Down From Yesterday

The SAFE BBTrend is currently at 13.6, maintaining a positive position for the last two days after reaching a peak of 19.39 yesterday.

This recent positive trend suggests that the price movement has been gaining momentum, though there appears to be some moderation from yesterday’s higher reading.

The continued positive BBTrend indicates that the asset is still showing strength, despite the slight pullback from yesterday’s peak value.

BBTrend (Bollinger Bands Trend) is a technical indicator that measures the strength and direction of a trend by analyzing the relationship between price and Bollinger Bands.

The indicator typically ranges from negative to positive values, with readings above 0 indicating a bullish trend and readings below 0 suggesting a bearish trend. With SAFE’s BBTrend at 13.6, this suggests a moderately strong bullish trend that could indicate potential for continued upward price movement in the near term for the altcoin.

However, the decrease from yesterday’s 19.39 peak might signal some slowing in momentum, potentially leading to consolidation before the next significant move higher.

Will SAFE Uptrend Revert Soon?

SAFE EMA lines are still bullish, with short-term lines positioned above long-term ones. This positive alignment of exponential moving averages indicates continued upward momentum in the price action.

If this uptrend momentum maintains its strength, SAFE could potentially climb to test the resistance level at $0.72.

Should this resistance be successfully broken, the next target would be $0.879. The altcoin could exceed $0.90 for the first time since January 19, sustaining its momentum as one of the most trending altcoins.

On the other hand, as indicated by the RSI and BBTrend indicators, the uptrend appears to be losing some momentum. This could signal a potential reversal in the near future.

If the trend does reverse, SAFE might test the nearby support level at $0.54, which sits precariously close to the current price.

Should this support level fail to hold, further downside could see SAFE decline to test subsequent support levels at $0.48 and $0.40. In a worst-case scenario, a drop all the way to $0.35 could potentially occur.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.