Market

Brazil Announced Solana ETF Launch Date

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup covers the spot Solana ETF launch in Brazil, an investigation by Colombia’s Superintendence of Industry and Commerce into Worldcoin’s operations, and more.

Brazil Takes Lead in Solana ETF Race

While the prospect of a Solana ETF (SOL) in the US remains uncertain, Brazil is moving ahead confidently. QR Asset Management announced that its Solana ETF will be available for public offering starting Wednesday, August 21. The ETF is set to be listed on Brazil’s B3 stock exchange on August 28.

Earlier this month, the Brazilian Securities Commission (CVM) approved the ETF, named QSOL11. Managed by Vortx, the fund will track the CCME CF Solana Dollar Reference Rate. The index, developed by CF Benchmarks and the Chicago Mercantile Exchange (CME), ensures reliable Solana pricing.

This launch marks another milestone for QR Asset, which already offers crypto-related products like QBTC11 and QETH11. The company views the new ETF as a regulated option for both institutional and retail investors in Brazil.

“As a market player, it is reassuring to have Brazilian regulators so attentive and open to the evolution of the crypto ecosystem in a regulated environment. The new ETF represents yet another regulated option for institutional and retail investors to diversify their portfolios and choose the ideal composition of their investments in the sector,” QR Asset Management CIO Theodoro Fleury stated.

Read more: Solana ETF Explained: What It Is and How It Works

QR Asset isn’t the only firm working on a Solana ETF in Brazil. The CVM has also approved another Solana ETF, backed by Hashdex in partnership with BTG Pactual. Hashdex, which manages over $962 million in assets, has already launched several ETFs on B3.

Matter Labs Expands zkSync Operations into Latam

Matter Labs, the developer behind the Ethereum Layer-2 (L2) scaling solution zkSync, announced its expansion into Latin America, starting with a headquarter in Buenos Aires, Argentina. The new office aims to support local projects while driving zkSync’s growth in the region.

The protocol has seen increasing adoption in Argentina, highlighted by integrations with platforms like the Lemon exchange and QuarkID, a digital identification system built on zkSync. These partnerships are set to catalyze zkSync’s influence across Latin America in the coming months.

Matter Labs’ CEO Alex Gluchowski and President Nana Murugesan plan to visit Buenos Aires in August to meet with key leaders, decision-makers, policymakers, and crypto entrepreneurs. The goal is to explore collaboration opportunities and better understand the region’s financial state.

“Argentina has become the springboard for our regional expansion, and I’m excited for the next phase of Matter Labs’ journey to bring millions of developers and the next billion users to the blockchain,” Murugesan stated.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Matter Labs highlighted that zkSync partners like Lambda Class and OpenZeppelin are positioning L2 solutions in Latin America. They described Argentina’s crypto ecosystem as “vibrant” and a key launchpad for Web3 projects in the region.

Salvadoran FinTech DitoBanx Enters Mexico

El Salvador-based FinTech company DitoBanx is entering the Mexican market to offer financial services, including international transfers, digital credit cards, dollar accounts, cryptocurrency access, and tokenization. After obtaining its operating license in El Salvador in April 2023, the company has extended its reach to Guatemala, the US, Costa Rica, Panama, and now Mexico in 2024. The company highlighted a 50% growth in financial technology app usage in Mexico over the past four years.

DitoBanx’s offerings in Mexico will include DitoWallet and credit card services for everyday transactions. The company will also offer tokenization services to convert physical or digital assets into tokens.

“With a firm belief that financial well-being is the foundation of a prosperous society, DitoBanx enters Mexico offering personalized service available 24/7, 365 days a year,” said Guillermo Contreras, CEO and founder of DitoBanx.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

The company has reportedly invested $3 million in its Mexican operations, where mobile banking users have grown from 1.5 million in 2013 to 80 million by 2023.

Contreras highlighted the commitment to Mexico’s economic and technological growth. He also noted that they plan to integrate the digital Mexican peso and aim to operate under the legal framework of a Sociedad Financiera Popular (Sofipo) by 2025.

Peru Declares War on Cryptocurrency Crime

Peruvian authorities are ramping up efforts to combat cryptocurrency-related crime. While technological advancements and growing interest in cryptocurrencies have spurred their use, they have also brought concerns about potential criminal activities. Juan Carlos Villena Campana, Peru’s Public Prosecutor, has taken a firm stance on addressing these challenges.

Speaking at a workshop organized in collaboration with the US Department of Justice, Villena highlighted the importance of keeping pace with technological changes. He noted that while cryptocurrencies offer benefits like decentralization, they also pose risks due to the anonymity they afford, which can be exploited for illegal activities.

“The rapid evolution of technology and the growing adoption of cryptocurrencies have created new avenues for criminal activity, presenting fresh challenges to cybersecurity that threaten society,” Villena said in an interview with local media.

Read more: 15 Most Common Crypto Scams To Look Out For

The Peruvian Public Prosecutor’s Office has committed to leading efforts against these crimes, working in collaboration with other Latin American nations and international organizations like the Organization of American States (OAS).

Rodrigo Silva from the OAS echoed Villena’s concerns, stressing the need for law enforcement to stay updated on technological advancements to tackle the increasingly complex nature of cybercrime, even when it occurs on blockchain networks.

Colombia Investigates Worldcoin for Alleged Data Protection Violations

The Colombian Superintendence of Industry and Commerce (SIC) has launched an investigation into Worldcoin and Tools for Humanity Corporation, the platform behind WLD, for allegedly violating personal data protection laws. The investigation, initiated by resolution N. 46436, focuses on ensuring that Worldcoin’s data processing practices comply with Colombia’s regulations on sensitive personal data.

The SIC is specifically concerned with Worldcoin’s transparency in handling personal data, the implementation of security policies, and the existence of internal procedures for addressing complaints and queries from Colombian citizens. The regulator emphasized the importance of ensuring that the community remains cautious about sharing their personal data.

“The SIC del Cambio is committed to protecting the fundamental rights of citizens and advises the community to exercise caution with their personal data. This decision is in the process of being notified and will be signed once it is known by the involved parties. No appeal can be lodged against this decision,” the SIC stated.

Read more: What Is Worldcoin? A Guide to the Iris-Scanning Crypto Project

As of now, neither Worldcoin nor Tools for Humanity Corporation has commented on the investigation. However, if violations of data protection laws are confirmed, Worldcoin could face hefty fines or even be banned from operating in Colombia.

The Superintendency clarified that potential sanctions under Article 23 of Law 1581 of 2012 could include fines of up to 2,000 current legal monthly minimum wages, the suspension of activities for up to six months, the temporary closure of operations after the suspension, or the immediate and definitive closure of operations involving the processing of sensitive data.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Rises 13% But Fails to Break $136 Resistance

Solana (SOL) has climbed 13% over the past seven days, showcasing strong short-term performance. While momentum indicators like the RSI and EMA lines remain supportive, recent price action suggests that bullish strength may be stalling just below a key breakout point.

At the same time, the sharp drop in BBTrend indicates weakening trend strength and fading volatility, often a sign of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s next move will likely depend on whether buyers can regain control or if a broader pullback begins to unfold.

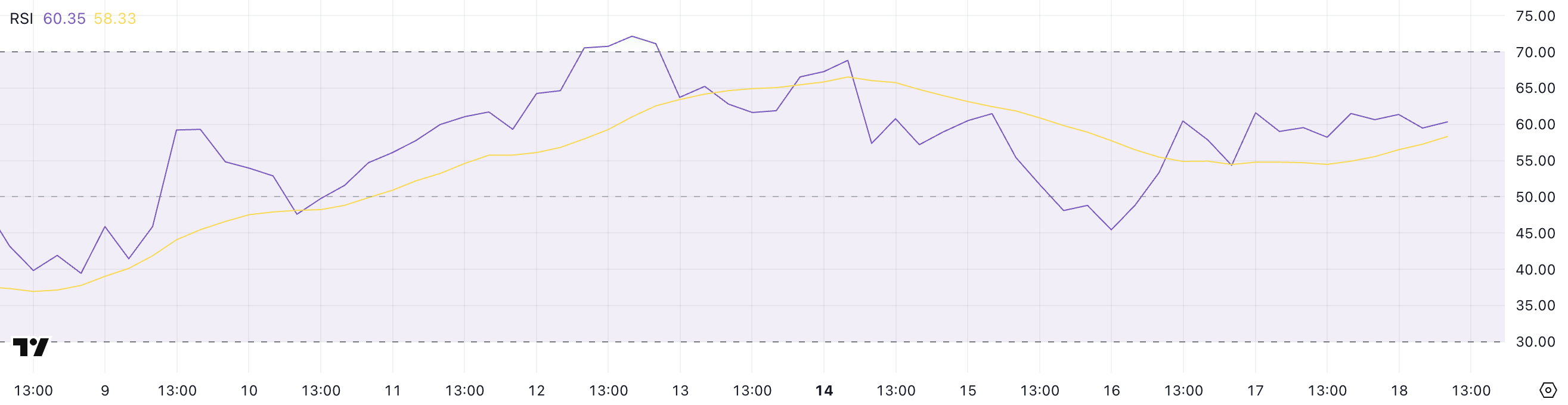

SOL RSI Rises Sharply, but Pause in Momentum Signals Caution

Solana’s Relative Strength Index (RSI) is currently at 60.35, marking a noticeable rise from 45 just two days ago.

This jump signals growing bullish momentum, although the RSI has remained stable since yesterday, suggesting that upward pressure may be easing for now.

The increase reflects renewed buying interest in recent sessions, pushing SOL closer to overbought territory but not quite there yet. This leveling off could indicate that the market is taking a breather before deciding its next move.

The RSI is a momentum oscillator that measures the speed and magnitude of price movements, ranging from 0 to 100. Values above 70 typically indicate that an asset is overbought and may be due for a pullback, while readings below 30 suggest oversold conditions, potentially signaling a buying opportunity.

With Solana’s RSI at 60.35, the asset is approaching bullish territory but hasn’t yet entered an extreme zone.

This positioning suggests that while recent momentum is positive, SOL could face some short-term consolidation or resistance before continuing higher—unless strong buying interest resumes and pushes the RSI closer to overbought levels.

SOL Trend Strength Weakens as BBTrend Falls Below 6

Solana’s BBTrend indicator is currently at 5.69, a significant drop from the 17.5 reading observed just four days ago.

This sharp decline suggests that volatility around SOL’s price has cooled notably, and the strength of the prior trend is weakening.

While BBTrend doesn’t signal direction on its own, the drop indicates that the strong movement, likely bullish, has lost momentum, and SOL may be entering a phase of consolidation or uncertainty.

BBTrend, short for Bollinger Band Trend, measures the strength of a price trend based on the expansion or contraction of Bollinger Bands.

Higher values suggest a strong, directional move (either up or down), while lower values point to weaker trends and reduced volatility. With BBTrend now at 5.69, Solana is in a much less volatile environment, which often precedes a breakout or a reversal.

For now, this reading signals that the recent momentum is fading. Unless volatility picks up again, SOL’s price may remain range-bound in the short term.

Golden Cross Looms for SOL, But $136 Barrier Still Holding Strong

Solana’s EMA lines continue to reflect a bullish structure, with the short-term average trending above the long-term one—suggesting that positive momentum remains intact.

A potential golden cross is also forming, which, if confirmed, would further reinforce the bullish outlook.

However, despite this favorable setup, Solana price has struggled to break through the $136 resistance level over the past few days, indicating that buyers may be losing steam at this key threshold.

Tracy Jin, COO of MEXC told BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with strong volume, it could open the path toward the next targets at $147 and potentially higher. But if the current momentum fades and the price reverses, a test of support at $124 becomes likely.

About Solana next moves, Jin told BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown below that could accelerate losses toward $112, and in the event of a deeper correction, SOL could even revisit the $95 region.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Roadmap Frustrates Users Over Missing Timeline

Pi Network released its Mainnet Migration Roadmap today. The roadmap lays out a three‑phase plan to move tens of millions of Pioneers who are still waiting to be moved to the open network. It also introduces new rewards, such as referral bonuses.

However, unlike most project roadmaps, Pi network didn’t provide any estimated date or timeline. This lack of clarification has frustrated early adopters who still await key rewards and clarity on rollout pacing.

Pi Network’s Three‑Phase Migration Plan

According to the roadmap, Pi Network will first complete initial migrations for Pioneers already in the queue. This batch covers verified base mining rewards, Security Circle contributions, lockup commitments, utility‑app usage rewards, and confirmed Node rewards for some operators.

After clearing the first wave, the team will tackle second migrations, adding all referral mining bonuses linked to KYC‑verified team members. Pi says these referral rewards will follow once the current queue finishes.

Finally, the network will move into ongoing periodic migrations—potentially monthly or quarterly—to process any remaining bonuses and rewards.

The cadence “is to be determined,” the roadmap notes.

Community Concerns and Critical Gaps

A thorough observation reveals several gaps and potential concerns in the roadmap.

For one, the plan never discloses how many Pioneers remain in the queue or the network’s daily migration capacity. Without those figures, users can’t predict when their own migration will occur.

Node operators report that some “confirmed Node rewards” have landed, but criteria for qualification remain opaque. Early node runners worry they may miss out without clear benchmarks.

Many Pioneers say they have tapped their claim buttons daily since migration opened yet still lack basic mining rewards. They question whether those base rewards and deferred referral bonuses will ever arrive in phase two.

Also, the roadmap admits the UI’s “Transferable Balance” underestimates actual migrated amounts to save resources. Users fear this pessimistic display could erode trust if their true balances remain hidden.

“I thought we were mining all of these PI coins this whole time? I thought the security circles were the Consensus Mechanism. It kinda seems to me like there isn’t a blockchain, and never was one. What kind of “Blockchain protocol” would “Require” all tokens to be minted at genesis?” one community member wrote.

Crucially, Pi offers no audit or error‑resolution process for users who spot mismatches in their historical mining data.

Given six years of complex records, occasional disputes seem inevitable, but the roadmap remains silent on redress.

All migrations hinge on KYC completion, yet the team omits any scaling targets or timelines for identity verification. A bottleneck here could stall every subsequent phase.

The schedule also ignores how major token unlock events—such as the roughly 108.9 million PI tokens due to release this month—will align with migration waves.

Finally, some Pioneers challenge the project’s foundational narrative. They note that Pi’s statement “all tokens were minted at genesis” contradicts six years of “mining.”

This raises doubts about whether Pi ever operated on a true blockchain protocol.

In the past month, PI price has dipped by over 45%. To sustain momentum and community trust, the team must now supply concrete timelines, transparent criteria, and clear audit paths for its Mainnet migration.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Market20 hours ago

Market20 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin23 hours ago

Altcoin23 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market18 hours ago

Market18 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Market22 hours ago

Market22 hours agoSui Meme Coins Surge With Rising DEX Volumes

-

Altcoin21 hours ago

Altcoin21 hours agoAnalysts Predict XRP Price to Hit $6 as Wave 2 Correction Nears End