Market

BlackRock’s IBIT Launch in Chile, and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about BlackRock’s IBIT launch in Chile, Nubank’s partnership with Lightspark, Bolivia’s cryptocurrency ban revoke, and more.

BlackRock Launches IBIT on Santiago Stock Exchange in Chile

BlackRock has introduced its iShares Bitcoin Trust (IBIT) to the Santiago Stock Exchange in Chile, managed by BCI Corredores de Bolsa. This launch allows Chilean investors to participate in Bitcoin investments at an institutional level.

Chile now follows Brazil in the region, where BlackRock launched the same ETF earlier in March. According to GTD, 74% of Chileans recognize Bitcoin as the leading cryptocurrency in the market. The ETF, which began trading on June 27, benefits from BlackRock’s technological expertise and its management of approximately 1,300 other ETFs.

This launch fills us with pride, as it is in line with the long history of innovation driven by BlackRock in the financial markets. Now, investors in Chile will have an accessible and efficient digital asset to include in their portfolios, backed by the extensive experience in risk management that our iShares ETFs have,” said Silvia Fernández, the Country Head of BlackRock Chile.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

IBIT has established itself as the world’s largest Bitcoin ETF, with over $20 billion in assets since it began trading in January 2024. It was also the fastest ETF to reach $10 billion in assets in history.

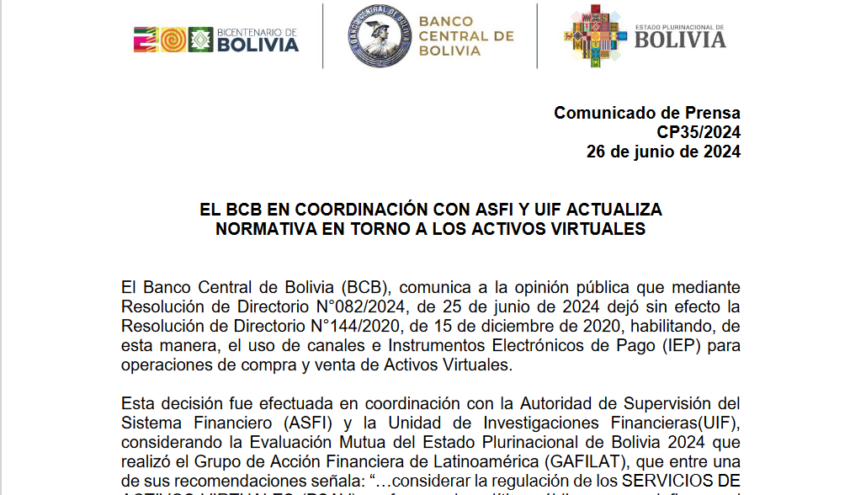

Bolivia Authorizes Cryptocurrency Use, Revoking Historic Ban

Bolivia has officially lifted its ban on cryptocurrencies, authorizing their use through Electronic Payment Instruments (IEP). Edwin Rojas, the president of the Central Bank of Bolivia, announced this decision, marking a massive shift in the country’s approach to digital commerce.

The reversal of the 2020 Resolution 144, which previously restricted cryptocurrency transactions, involved the Financial Investigations Unit and the Financial System Authority. Despite this change, the Boliviano remains the only legal tender.

The Central Bank stresses that all risks associated with virtual assets are the user’s responsibility. It highlights that these assets are not considered legal money and are not obligatory for payments. The Central Bank is committed to adapting existing regulations and launching educational campaigns.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This initiative aligns with recommendations from the Latin American Financial Action Task Force. They suggested regulating virtual asset services to meet new financial realities and the expanding use of blockchain technologies.

The recent move modernizes Bolivia’s financial system and opens doors to new digital commerce opportunities and financial inclusion, provided that public education manages the transition responsibly.

Santander Brazil Expands Crypto Trading to Retail Customers via Toro Platform

Santander, the multinational banking giant, has recently announced that it will start offering cryptocurrency trading services in Brazil. Starting this week, Santander’s Brazilian investment platform, Toro, will offer its retail customers access to Bitcoin and Ethereum.

Previously, these cryptoassets were available only to the bank’s private clients through ETFs. This move follows similar offerings by other Brazilian banks such as Itaú, Nubank, Inter, and BTG Pactual.

Toro founder and CEO João Resende explains that negotiations begin with offering the two largest digital currencies to selected clients with an appropriate risk profile for the product.

“The product will be aimed at clients with an aggressive risk profile. Gradually, the new service will be rolled out to the broker’s entire base of more than one million active clients.” Resende says Toro is considering offering other digital currencies in addition to tokenized assets. “It’s a first step we are taking,” he noted.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

According to a report by Valor Econômico, the success of this initiative in Brazil might lead to its expansion across other Santander branches worldwide. Santander, also participating in the CBDC project known as Drex, recently conducted the first transaction using Anonymous Zether. The solution, developed by Consensys, allows users to conceal transaction amounts and the parties’ identities using cryptographic proofs.

Costa Rican Authorities Unveil Bitcoin Money Laundering Scheme

Costa Rican authorities have dismantled a sophisticated money laundering scheme involving cryptocurrencies, including Bitcoin. After a two-and-a-half-year investigation, police arrested 36 individuals on Tuesday. Among them were judges, lawyers, and two Spanish nationals identified as the ringleaders.

Randall Zúñiga, director of the Judicial Investigation Agency (OIJ), explained that the gang stole properties from Costa Rican residents. They then legitimized these assets through cryptocurrency purchases. In one instance, the organization moved $13 million in Bitcoin in a single day, highlighting the scale of its operations.

“There is a whole team dedicated to cryptocurrencies. In one day, they made a $13 million transaction in bitcoins. We have identified 25 properties, but over 100 have been stolen. Conversations suggest they have taken over 300 properties, with one valued at $30 million. This constitutes a multi-million dollar fraud,” Zúñiga stated.

Read more: Top 9 Safest Crypto Exchanges in 2024

The operation involved around 500 OIJ agents and conducted 47 raids nationwide. Lawyers, notaries, public officials, and five traffic officers were arrested. They face charges of registration fraud, ideological falsehood, and money laundering.

This case in Costa Rica mirrors a similar incident in Venezuela. The Scientific, Criminal, and Criminalistic Investigations Corps (CICPC) captured a criminal operating an illicit cryptocurrency exchange in Chacao, Miranda.

The detainee, Gabriel Bello, enticed victims with offers of currency exchange and cryptocurrencies at affordable prices. He then failed to deliver the promised returns. Bello, who was wanted for continuous swindling and other crimes, is now in the custody of the Public Prosecutor’s Office.

Colombia’s Usiacurí Municipality Adopts Bitcoin

The small Colombian town of Usiacurí, home to over 10,000 residents, has embraced cryptocurrencies like Bitcoin, USDT, and Tron for tourist transactions. This initiative mirrors El Salvador’s 2021 adoption of Bitcoin and aligns with Colombia’s high rate of Bitcoin utilization. President Gustavo Petro has even explored cryptocurrencies as potential solutions for governmental issues.

This adoption is part of the “Distrito Crypto” project, a collaboration between Usiacurí’s municipality, Universidad de la Costa (CUC), Certika, and Corporación CienTech, exclusive to Usiacurí in the Atlántico department. The program aims to facilitate cryptocurrency transactions for foreign tourists across local hotels, shops, and restaurants.

“The participation of the Universidad de la Costa was fundamental throughout the process, since through its teachers and researchers have been strengthening the research line of blockchain and its applications, as is this tool that allowed us to turn Usiacurí into the first municipality with Cryptocurrency District, generating more sales in its tourism and hotel sector,” explained CienTech.

Read more: Who Owns the Most Bitcoin in 2024?

Further enhancing Colombia’s appeal to crypto investors, the recent introduction of Worldcoin’s World ID verifications in Bogotá and Medellín positions the nation as a hub for digital identity solutions. This system serves as a “digital passport of humanity,” designed to verify unique individual identities securely, meeting growing demands for digital services verification.

Nubank Partners with Lightspark to Integrate Lightning Network in Brazil

Nubank has partnered with Lightspark to deploy the Bitcoin Lightning Network on its Brazilian platform. This alliance will explore potential synergies and development opportunities, with more specific details to be announced later.

Lightspark will provide Nubank with an enterprise-grade gateway to the Lightning Network, facilitating reliable, near real-time transactions for Bitcoin and fiat currencies at reduced costs.

“The partnership with Lightspark, which has developed an excellent technical solution for Bitcoin’s Lightning network, is another step in Nubank’s mission to provide the best solutions for our customers and strengthen our long-term relationship with them. The future integration of Lightning underscores Nubank’s ongoing mission to deliver more efficient services faster and at lower costs through blockchain technology,” stated Thomaz Fortes, CEO of Nubank Crypto.

Read more: The Best Bitcoin Lightning Network Wallets In 2024

The collaboration will allow Nubank’s teams to enhance the end-to-end customer experience by focusing on product innovation without the burden of managing a large-scale Lightning deployment. This integration represents a significant advancement in the adoption and efficiency of digital financial transactions, promising a faster, more affordable, and secure service for Nubank’s customers. It’s a significant milestone for the Lightning Network, expected to greatly increase its overall network utilization.

Argentina and Venezuela Face Hyper AI Platform Controversy

The Hyper AI platform, renowned for integrating advanced technologies like AI and blockchain into a metaverse, has recently suspended user withdrawals, alleging a system update. This action has alarmed its investors in Venezuela and caused uncertainty in Argentina. The platform is now accused of operating like a Ponzi scheme, leading many users to organize a protest to file formal complaints with the public prosecutor’s office in Venezuela.

Social media and cryptocurrency forums are buzzing with reactions as users in Venezuela express their frustration over the lack of transparency, accusing Hyper AI of employing common Ponzi scheme tactics. Approximately 20,000 users in Los Teques, El Jarillo, and La Colonia Tovar are reportedly affected. On Wednesday, June 26, a group will officially approach the Superior Prosecutor’s Office of Miranda to denounce the platform.

“I entered in the month of February, I started with the minimum investment of 50 dollars. For a while I recovered something, but for example my son borrowed money, he entered with $5,000 and of course he lost all of that. I know many people who sold houses, cars, who were excited because this platform was supposed to last until next year”, Carlos Chavez told the local Venezuelan media Diario Avance.

Read more: 15 Most Common Crypto Scams To Look Out For

The controversy is not confined to Venezuela; it has also touched Argentina. Users have voiced their dissatisfaction and are seeking answers to the ongoing crisis.

“My experience was awful, I entered through my nephew who was also scammed. I invested almost 900 dollars and I could not withdraw anything and it was horrible to know that they played with us like that”, Gabriela Romando told Argentinean media El Diario del Sur.

The situation that all Hyper AI users are going through has exacerbated the distrust in investments related to emerging technologies in the region. This saga is reminiscent of other recent financial collapses of digital platforms such as FTX, BTR, Solesbot, and CowCoin.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. From BlackRock’s Bitcoin ETF launch in Chile to Brazilian Nubank’s partnership with Lightspark, Latin America is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will XRP Break Support and Drop Below $2?

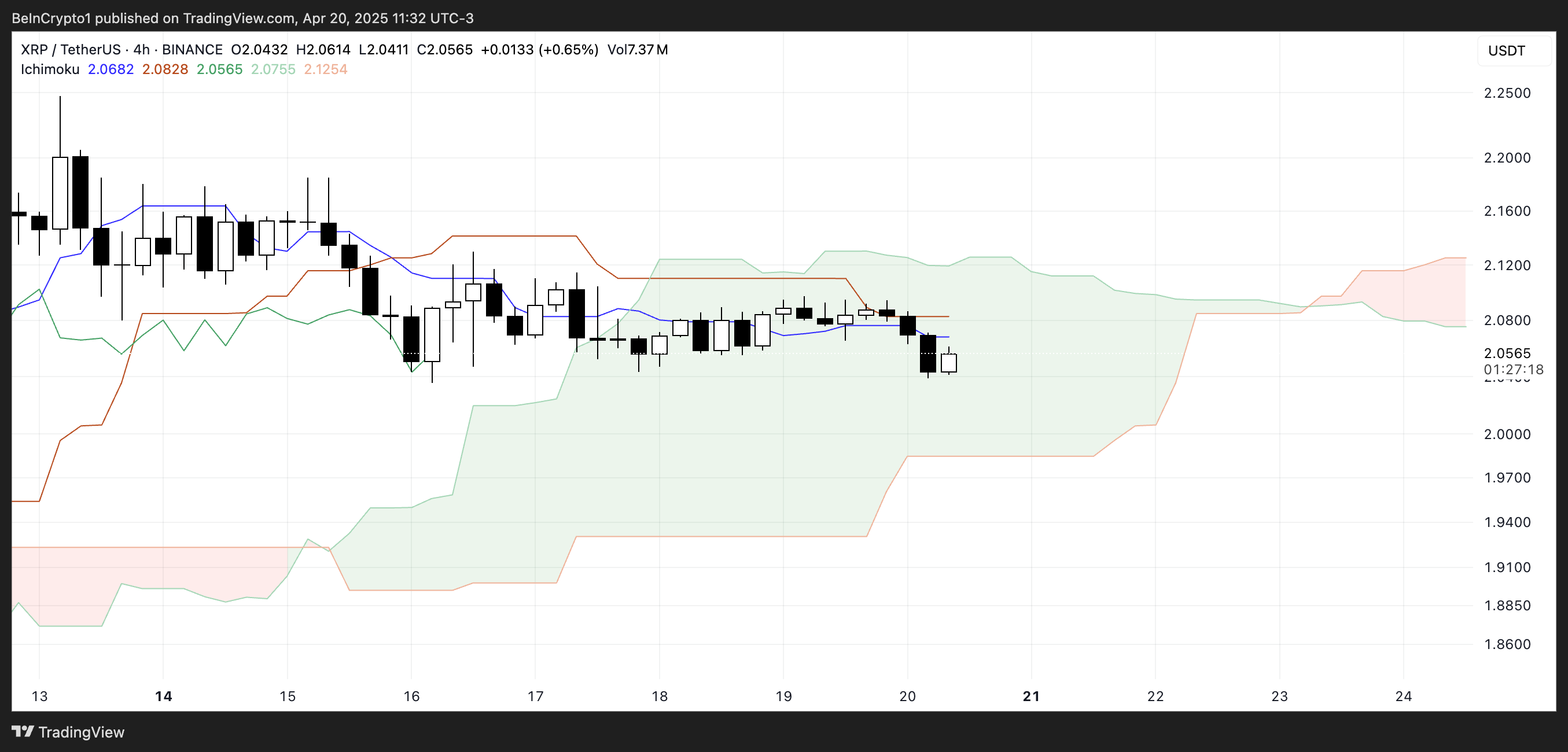

XRP is down 5% over the past week, struggling to regain momentum as technical indicators flash mixed signals. Its Relative Strength Index (RSI) has dropped below 50, and the price remains stuck within a tight range between key support and resistance levels.

At the same time, the Ichimoku Cloud has shifted from green to red, with a thickening cloud ahead suggesting growing bearish pressure. With volatility compressing and momentum fading, XRP is nearing a critical point where a breakout—or breakdown—seems increasingly likely.

XRP Struggles to Regain Momentum as RSI Drops Below 50

XRP’s Relative Strength Index (RSI) is currently sitting at 44.54, after recovering from an intraday low of 40.67. Just yesterday, it was at 51.30, highlighting increased short-term volatility.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Readings above 70 typically suggest an asset is overbought, while readings below 30 indicate it may be oversold.

With XRP’s RSI at 44.54, it’s currently in neutral territory, showing neither strong buying nor selling pressure.

However, the fact that it hasn’t crossed the overbought threshold of 70 since March 19—over a month ago—signals a lack of sustained bullish momentum. This could mean XRP is still in a consolidation phase, with the market waiting for a clearer direction.

If RSI continues to climb toward 50 and beyond, it may hint at building momentum, but without a breakout above 70, upside could remain limited.

XRP Faces Uncertainty as Bearish Trend Begins to Expand

XRP is currently trading inside the Ichimoku Cloud, signaling market indecision and a neutral trend.

The Tenkan-sen (blue line) has crossed below the Kijun-sen (red line), which is a bearish signal, but with the price still within the cloud, it lacks full confirmation.

The cloud itself acts as a zone of support and resistance, and XRP is now moving sideways within that zone.

Looking ahead, the cloud has shifted from green to red—a sign that bearish momentum may be building. Even more concerning is that the red cloud is widening, which suggests increasing downward pressure in the near future.

A thickening red Kumo often signals stronger resistance overhead and a potential continuation of a bearish trend if the price breaks below the cloud.

Until XRP breaks out decisively in either direction, the market remains in a wait-and-see phase, but the growing red cloud tilts the bias toward caution.

XRP Compression Zone: A Breakout Could Send Price to $2.50 — Or Much Lower

XRP price is currently trading within a tight range, caught between a key support level at $2.05 and resistance at $2.09. This narrow channel reflects short-term uncertainty, but a decisive move in either direction could set the tone for what’s next.

If the $2.05 support fails, the next level to watch is $1.96. A break below that could trigger a steep drop toward $1.61, which would mark the first close below $1.70 since November 2024—a bearish signal that could accelerate selling pressure.

Recently, veteran analyst Peter Brandt warned that a major correction could hit XRP soon.

On the flip side, if bulls regain control and push XRP above the $2.09 resistance, the next target lies at $2.17. A breakout beyond that could open the door to a move toward $2.50, a price level not seen since March 19.

For that to happen, XRP would need a clear resurgence in momentum and buying volume.

Until then, the price remains trapped in a narrow zone, with both upside and downside potential on the table.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin Defies Bullish Bets During Dogeday Celebration

On April 20, Dogecoin enthusiasts worldwide united to mark Dogeday, a community-driven holiday celebrating the world’s most recognizable meme coin.

While the festivities showcased the coin’s loyal fanbase and cultural relevance, the celebration failed to spark any meaningful market movement.

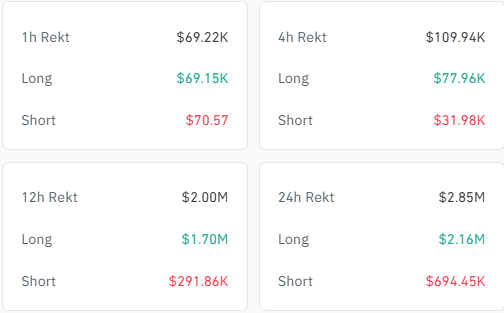

Dogeday Fails to Lift Dogecoin Price as Traders Face $2.8 Million in Liquidations

Instead of riding a wave of positive sentiment, Dogecoin was the worst-performing asset among the top 20 cryptocurrencies during the past day.

According to data from BeInCrypto, the token dropped over 2.5% during the reporting period compared to the muted performance of the general market.

This disappointing performance led to roughly $2.8 million in liquidations, with traders betting on an upward price movement losing more than $2 million, per Coinglass figures.

However, even with the lackluster price action, Dogecoin’s relevance in the crypto ecosystem remains undeniable. Launched in 2013 as a parody of Bitcoin, DOGE has grown far beyond its meme origins.

The digital asset is now the ninth-largest cryptocurrency by market capitalization, currently valued at approximately $22.9 billion, according to CoinMarketCap.

Much of its growth can be attributed to high-profile endorsements. Tesla CEO and presidential advisor Elon Musk has repeatedly voiced support for Dogecoin, as has billionaire entrepreneur Mark Cuban. Their backing helped shift public perception of DOGE from a joke to a legitimate digital asset and payment option.

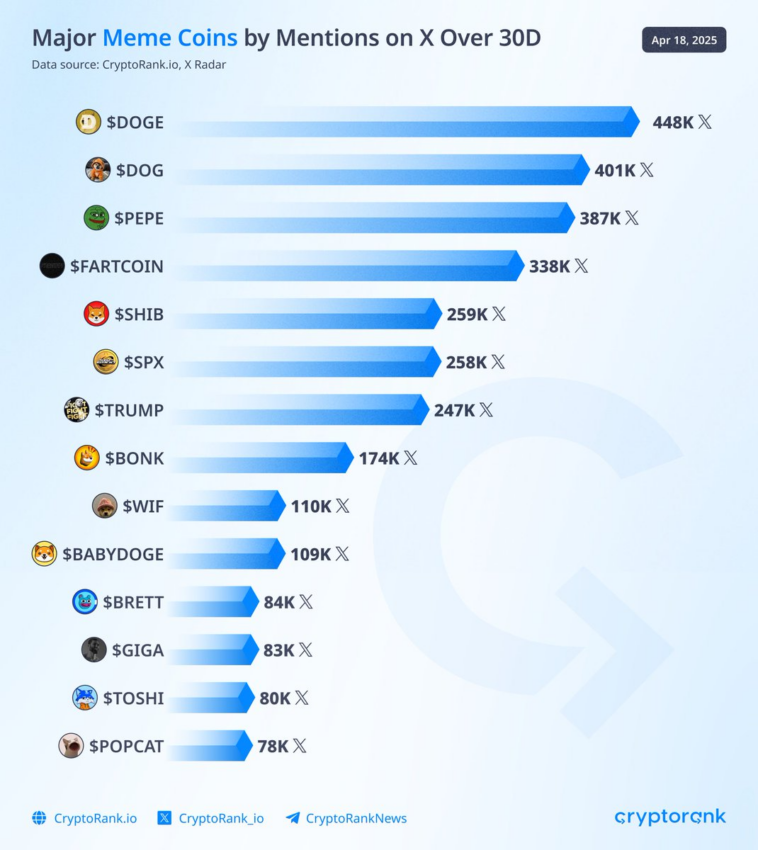

On social media, Dogecoin continues to lead the memecoin narrative. According to CryptoRank, it was the most mentioned memecoin ticker on X (formerly Twitter) in the past month. This visibility continues to fuel both community engagement and investor interest.

Moreover, institutional interest in Dogecoin is also on the rise. Major asset managers, including Bitwise, Grayscale, 21Shares, and Osprey, have submitted filings to the US Securities and Exchange Commission (SEC) seeking to launch spot Dogecoin ETFs.

If granted, these financial investment vehicles could become the first exchange-traded funds centered entirely on a meme coin.

Considering this, crypto bettors on Polymarket put the odds of these products’ approval above 55% this year. This optimism reflects a growing belief that Dogecoin could soon secure a place in mainstream financial markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tokens Big Players Are Buying

Crypto whales are making bold moves heading into May 2025, and three tokens are standing out: Ethereum (ETH), Artificial Superintelligence Alliance (FET), and Onyxcoin (XCN). All three have seen a noticeable uptick in large-holder accumulation over the last week, signaling growing interest from big players despite recent volatility.

While ETH and XCN are both coming off sharp corrections, whale buying suggests confidence in a potential rebound. Meanwhile, FET is riding renewed momentum in the AI sector, with whale activity accelerating alongside rising prices.

Ethereum (ETH)

The number of Ethereum crypto whales—wallets holding between 1,000 and 10,000 ETH—has been steadily climbing since April 15. Back then, there were 5,432 such addresses.

That number has now risen to 5,460, the highest count since August 2023. At the same time, the concentration of ETH held by these whales is also hitting new highs, signaling growing accumulation by large holders.

While this can be interpreted as confidence in Ethereum’s long-term value, it also raises concerns about centralization and potential selling pressure if whales decide to take profits.

Ethereum price is currently down more than 19% over the last 30 days. If the correction continues, the price could retest support at $1,535. Losing that level might send ETH toward deeper support at $1,412 or even $1,385.

However, if the trend reverses, key resistance zones lie at $1,669 and $1,749—with a potential push toward $1,954 if bullish momentum builds.

In this context, the growing dominance of whales could act as either a stabilizing force or a looming risk, depending on how they respond to market shifts.

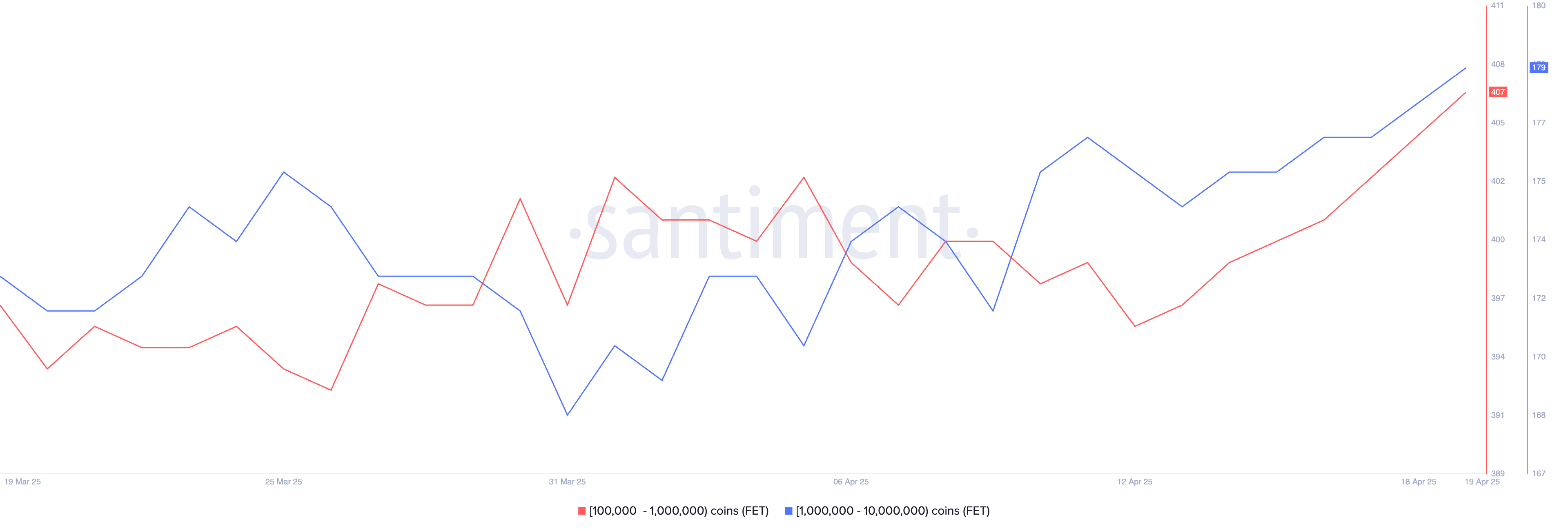

Artificial Superintelligence Alliance (FET)

The number of FET whales—wallets holding between 10,000 and 1,000,000 tokens—increased from 572 on April 13 to 586 by April 19.

This steady growth in large holders points to rising confidence among bigger players. It comes at a time when the broader AI crypto narrative is showing signs of a rebound.

Key AI coins like FET, TAO, and RENDER have all increased over 9% in the last seven days, with FET itself gaining more than 8% in the past 24 hours and 13.5% over the week. This suggests a possible comeback for the artificial intelligence narrative in crypto.

If this momentum continues, FET could push toward resistance at $0.659. A clean breakout from that level could open the door to further gains, with $0.77 and $0.82 as the next potential targets.

On the flip side, if the rally stalls, FET might drop back to test support at $0.54. A breakdown below that could send it as low as $0.44.

With whale activity heating up and the AI sector showing renewed strength, FET’s next move could be a key signal for where the narrative heads next.

Onyxcoin (XCN)

Onyxcoin was one of the standout performers in January, but its momentum has faded in recent months. After a strong bounce—up of over 57% in the last 30 days, the token is now correcting, down 19% in the past seven days.

Despite this pullback, accumulation continues. The number of crypto whales holding between 1 million and 10 million XCN has grown from 528 on April 16 to 541, suggesting some large holders may be buying the dip.

If the correction deepens, XCN could lose support at $0.0165. A drop below that may open the door to further declines toward $0.0139 and $0.0123.

But if the trend flips back upward, the token could first test resistance at $0.020. A strong breakout from there might lead to a move toward $0.027. With whale activity on the rise and volatility returning, XCN’s next move could be decisive.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Bitcoin24 hours ago

Bitcoin24 hours agoAnalyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

-

Altcoin19 hours ago

Altcoin19 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market16 hours ago

Market16 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Market14 hours ago

Market14 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Reveals Why Consensus 2025 Will Be Pivotal For Pi Network

-

Market10 hours ago

Market10 hours ago1 Year After Bitcoin Halving: What’s Different This Time?