Market

Bittensor Ranks 1st by Social Activity, and More

Decentralized Physical Infrastructure Networks (DePin) are transforming the tech by enabling decentralized projects in real-world infrastructure.

Here’s what happened recently in the DePIN sector: Bittensor led the list of projects with the highest social activity, decentralized weather tracking network WeatherXM installed its stations around the Olympic venues, Hivemapper

and DMM Crypto started demonstration experiment in Japan.

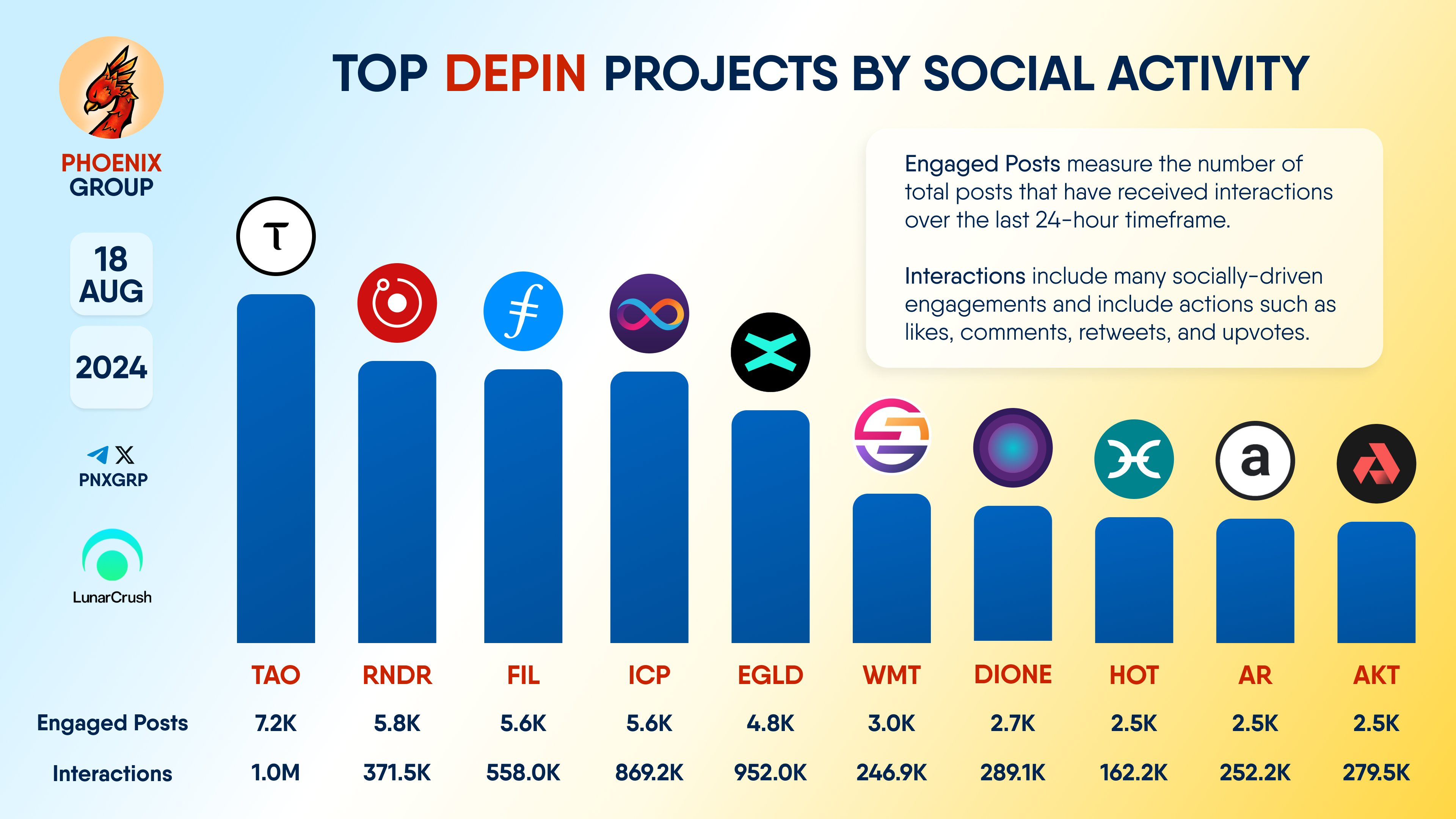

Phoenix Names Top DePin Projects by Social Activity

Analytics platform Phoenix Group recently released a list of prominent DePIN projects based on social activity. The list includes TAO, RNDR, FIL, ICP, EGLD, WMT, DIONE, HOT, AR, and AKT. The announcement was shared on the firm’s official X (formerly Twitter) account.

Phoenix Group’s DePIN social activity list considers key indicators like engaged posts and interactions. Engaged posts track the number of posts receiving interactions within 24 hours, while interactions cover socially-driven actions such as upvotes, retweets, comments, and likes.

According to Phoenix Group, TAO tops the list with 7,200 engaged posts and 1 million interactions. RNDR ranks second with 5,800 posts and 371,500 interactions, followed by FIL in third with 5,600 posts and 558,000 interactions. ICP and EGLD complete the top five, showcasing strong community engagement.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

While social activity isn’t the only metric to gauge a project’s success, it offers valuable insight into community engagement and interest. High interaction levels, like those seen in TAO, RNDR, and FIL, often reflect strong user involvement, which can drive adoption and momentum. However, other factors like technology, real-world utility, and market conditions also play crucial roles in determining long-term success.

WeatherXM Stations Appeared at Olympic Games

A decentralized weather tracking network called WeatherXM installed 40 Pulse weather stations around Olympic venues. These $900 devices reward operators with tokens while tracking crucial weather data, including precise temperatures, solar radiation, and air pressure near the competition areas.

The installation came together when Yannis Pitsiladis, a professor and member of the International Olympic Committee’s Medical and Scientific Commission, struck a partnership deal between WeatherXM and his research company Humantelemetrics. Humantelemetrics purchased 40 of the weather stations and now will receive token rewards for taking part in the network.

“A major objective of this mainly R&D partnership is to create and make universally available more innovative environmental monitoring solutions to allow the microclimate of competing athletes, officials, and even spectators to be determined in real-time and anywhere in the world where there is connectivity, with particular focus on keeping all these important stakeholders safe when operating in extreme environmental conditions,” Pitsiladis commented.

The sensors were used to track the “microclimate” to keep athletes and observers safe during “extreme environmental conditions.” So, perhaps WeatherXM stations could offer more precise monitoring on lightning storms or excessive heat.

WeatherXM is a growing player in the DePIN space. While some WeatherXM stations connect to Helium’s IoT network, the Pulse stations purchased by Pitsiladis and his company do not, according to the WeatherXM explorer. WeatherXM’s native WXM token is based on Ethereum, differentiating it from Helium’s Solana-based system.

Hivemapper Enters Japanese Market

DMM Crypto, a Japanese blockchain company founded in 2023, has partnered with Hivemapper, a decentralized mapping project, to launch a new initiative in Japan. Hivemapper uses AI-powered dashcams to crowdsource real-time map data, rewarding drivers with tokens for their contributions.

This initiative aims to improve map accuracy and support industries like cab and logistics. The project has been selected by JETRO as part of a “Web3 technology x incentive grant demonstration” aimed at addressing the shortage of drivers in the cab and logistics sectors. Under JETRO’s “Subsidy Project for Inward Direct Investment Promotion,” the collaboration seeks to drive innovation and resolve key challenges in these industries.

“DMM Crypto is an exceptional organization with a proven track record in areas essential to Hivemapper’s growth. Through our partnership, we aim to highlight the transformative power of DePIN and set the gold standard for Web3 projects in the region,” Hivemapper CEO Ariel Seidman said.

Read more: Top 10 Web3 Projects That Are Revolutionizing the Industry

Hivemapper’s decentralized physical infrastructure network has already mapped over 15 million kilometers in just 20 months, surpassing conventional mapping services. Its data is available to support navigation services, home delivery, the real estate industry, and the safe operation of self-driving vehicles.

While DePIN is still in its early stages and has some flaws, it allows for the exchange of tokens between synthetic and real-world assets. This supports traditional infrastructure by providing last-mile coverage in areas where conventional models are not economically feasible.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MELANIA Crashes to All-Time Low Amid Insiders Continued Sales

A wave of heavy sell-offs linked to the team behind the Melania meme coin (MELANIA) has raised fresh concerns about insider activity within the project.

These activities have contributed to the token’s value dropping to an all-time low, a staggering 97% down from its all-time high on Trump’s inauguration day back in January.

Heavy Insider Selling Sends MELANIA to Historic Low

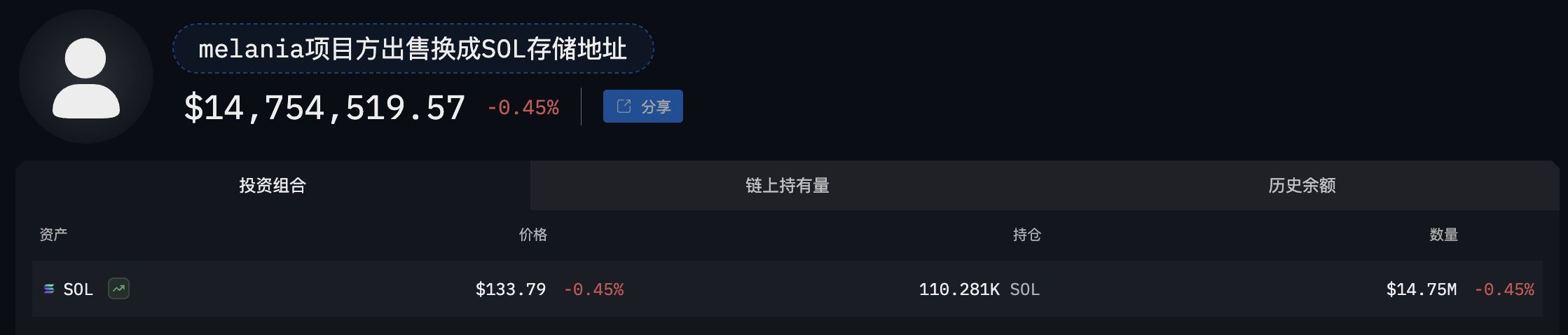

On April 19, on-chain analyst EmberCN reported that wallets tied to the project offloaded nearly 3 million MELANIA tokens.

In return, the team received approximately 9,009 SOL, valued at around $1.2 million. The tokens were sold through unilateral liquidity provisions added to the MELANIA/SOL trading pair on Meteora.

This transaction is part of a broader pattern. In the past three days, the MELANIA team reportedly moved 7.64 million tokens, worth about $3.21 million, from both liquidity and community wallets.

The team systematically added these tokens to the same liquidity pool and sold them for SOL within a pre-defined price range. Out of the total, they sold 2.95 million tokens just hours before EmberCN’s disclosure.

“In the past 3 days, the $MELANIA project team has continued to transfer out 7.643 million $MELANIA tokens ($3.21M) from liquidity and community addresses, then added them to MELANIA/SOL one-sided liquidity on Meteora, selling $MELANIA within a set range for SOL. Of which, 2.95 million $MELANIA tokens were sold 7 hours ago for 9,009 SOL,” EmberCN stated.

EmberCN further pointed out that the project’s team has sold over 23 million MELANIA tokens in the past month. The tokens were worth approximately $14.75 million.

These repeated sell-offs have added weight to concerns over internal dumping—suspicions that first emerged in March.

At the time, blockchain analytics firm Bubblemaps reported unusual movements of over $30 million in MELANIA tokens. Originally part of the community allocation, the tokens appeared to be gradually transferred to exchanges without explanation.

The firm linked these transactions to Hayden Davis, a co-founder of the meme coin. Davis previously worked on another controversial token, LIBRA, which briefly surged after Argentine President Javier Milei endorsed it, then quickly collapsed.

Bubblemaps also revealed that wallets tied to the MELANIA team control roughly 92% of the token’s total supply. Critics argue that this level of centralization raises red flags over potential market manipulation.

As a result of these concerns, MELANIA has seen its price collapse. After reaching a high of over $13 earlier this year, the token has dropped by over 96% to an all-time low of $0.38, according to data from BeInCrypto.

However, the steep decline reflects both internal turmoil and broader weakness in the meme coin sector. Investor appetite for high-risk tokens appears to be fading amid global uncertainty and a more cautious market sentiment

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Charles Schwab Plans Spot Crypto Trading Rollout in 2026

Charles Schwab, one of the largest brokerage firms in the United States, is preparing to launch a spot cryptocurrency trading platform within the next year.

This marks a major move by one of the most trusted names in traditional finance and shows that demand for crypto investment options continues to climb.

Charles Schwab Eyes Crypto Expansion

During a recent earnings call, Schwab CEO Rick Wurster said the firm is optimistic about upcoming regulatory changes that could allow it to fully enter crypto trading.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto and our goal is to do that in the next 12 months and we’re on a great path to be able to do that,” Wurster explained.

This move would allow the company to offer direct access to spot crypto trading and place it in direct competition with major players like Coinbase and Binance.

While the company already offers crypto-related products such as Bitcoin futures and crypto ETFs, the addition of direct trading would significantly expand its crypto portfolio. According to the CEO, engagement on these products has grown rapidly in recent months.

Wurster revealed that visits to the firm’s crypto-focused content have surged 400%. Of that traffic, 70% came from users who are not yet customers, showing a growing appetite for digital asset investments.

Wurster’s confidence in crypto aligns with the Trump administration’s efforts to introduce a clearer regulatory framework for digital assets. Compared to past years, progress on crypto legislation and oversight has accelerated, especially among key regulatory bodies like the SEC.

If these improvements continue, Schwab could debut its spot crypto trading platform before mid-2026. The firm believes its reputation in traditional finance gives it a strategic advantage in expanding into the crypto space.

Meanwhile, Schwab is already dipping its toes into the sector through its role as custodian for Truth.Fi, an upcoming digital investment platform launched by Trump Media and Technology Group. Truth.Fi plans to offer a mix of Bitcoin, separately managed accounts, and other crypto-linked products.

Indeed, Schwab’s potential entry into the sector has drawn attention from other industry leaders. Asset management firm Bitwise CEO Hunter Horsley described the brokerage firm’s move as a milestone in crypto’s transition to mainstream finance.

Rachael Horwitz, Chief Marketing Officer at Haun Ventures, echoed that sentiment and encouraged Schwab to consider crypto-collateralized lending as a future offering.

“Schwab should implement crypto-collateralized lending as part of its banking services next,” Horwitz said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Today’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

A long-time supporter of XRP who is not afraid to speak his mind has issued stunning predictions concerning the future value of the cryptocurrency. His assertions have both interested and confused investors.

Investor Forecasts 50-Fold Return On XRP

As per the Alpha Lions Academy founder Edoardo Farina, an investment of $1,000 in XRP today can increase to more than $50,000 in the future. The estimate is based on the altcoin crossing Farina’s desired price target of $100 per token, from its current value of around $2.

“Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+”, Farina tweeted recently.

Farina previously revealed he will not sell any of his XRP holdings until the price reaches at least $100 per token. He terms the coin as sitting at the hub of what he refers to as a “multi-generational pump” and points out its potential function within the international finance system.

XRP @ $2

Buying $1,000 worth right now is really buying over $50,000 in the future when $XRP hits $100+

50x return

— EDO FARINA 🅧 XRP (@edward_farina) April 18, 2025

Minimum Holdings Suggestion Sparks Skepticism

According to reports, Farina urges retail investors to own a minimum of 1,000 XRP tokens. He asserts that such an amount is the minimum one needs in order to take advantage of the use and greater adoption of XRP in the future.

Such opinions regarding the issue have been unequivocal. Farina has reportedly said that individuals who have fewer than 1,000 XRP tokens “don’t care enough about their financial success” and called possessing less than that amount “insanity.”

Though these comments represent Farina’s individual investment strategy, they echo a developing perception among XRP enthusiasts that the asset is undervalued and poised for strong growth if regulatory clarity increases and more businesses embrace it.

Doubters Challenge The Life-Changing Assertions

Not everyone shares Farina’s positive perspective. Doubters have raised issues with his assertion that $1,000 in XRP today may be worth $50,000 someday.

One critic pointed out that even if XRP hits $100 and converts $1,000 into $50,000, this may not be sufficient for early retirement. The remark points out that what appears to be a good return may not necessarily be the life-altering wealth many investors expect.

Questions also arise regarding if XRP will ever hit the $100 level, and if so, how long it would take to arrive there.

Price Target Timeline Indicates Long Way To Go

The journey to $100 looks long for XRP, which is currently trading at about $2. It would need a nearly 5,000% rise from where it is now to reach $100.

Featured image from Pexels, chart from TradingView

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveals Dogecoin Price Can Reach New ATH In 55 Days If This Happens

-

Market20 hours ago

Market20 hours agoBinance Mandates KYC Re-Verification For India Users

-

Altcoin23 hours ago

Altcoin23 hours agoPi Coin Price Soars As Pi Network Reveals Massive Community Reward Plans.

-

Market22 hours ago

Market22 hours agoSCR, PLUME, ALT Tokens Unlocking This Week

-

Altcoin15 hours ago

Altcoin15 hours agoCardano Bulls Secure Most Important Signal To Drive Price Rally

-

Market23 hours ago

Market23 hours agoRipple Takes Asia By Storm With New XRP Product, Here Are The Recent Developments

-

Bitcoin17 hours ago

Bitcoin17 hours agoSwiss Supermarket Chain Welcomes Crypto Payments

-

Market21 hours ago

Market21 hours agoAptos Seeks to Cut Staking Yield by 50% to Spur Network Growth