Market

Bitcoin Price Rejects Key Resistance, Time For Another Drop In BTC?

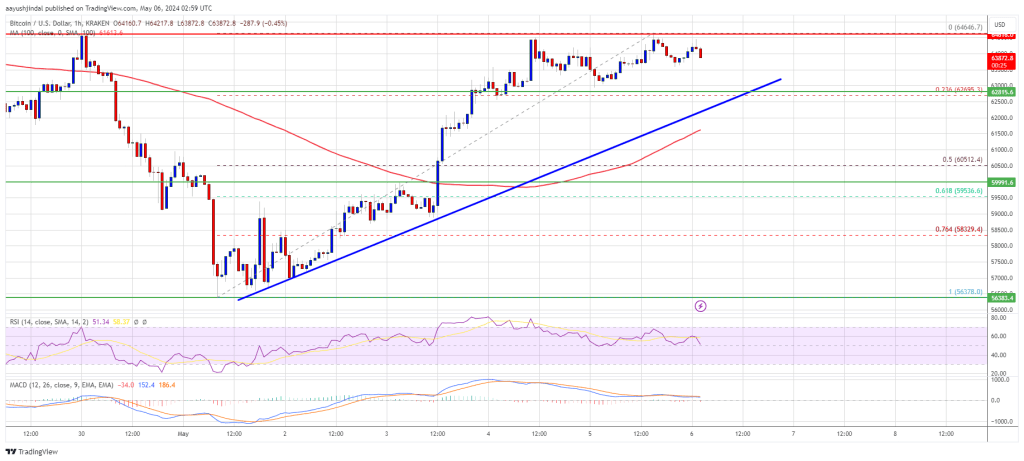

Bitcoin price started a steady increase above the $62,500 resistance. BTC is again struggling to clear the $64,500 and $65,000 resistance levels.

- Bitcoin is showing positive signs and facing hurdles near $64,500.

- The price is trading above $62,500 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $62,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could struggle to clear the $64,500 and $65,000 resistance levels.

Bitcoin Price Faces Resistance

Bitcoin price found support near the $56,500 zone and started a decent increase. There was a clear move above the $60,000 and $61,200 resistance levels.

The bulls pushed the price above the $63,500 level and the 100 hourly Simple moving average. However, the bears are again active near the $64,500 and $65,000 resistance levels. A high was formed at $64,646 and the price is now consolidating gains.

It is stable above the 23.6% Fib retracement level of the upward move from the $56,378 swing low to the $64,646 high. There is also a key bullish trend line forming with support at $62,800 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading above $62,500 and the 100 hourly Simple moving average. Immediate resistance is near the $64,500 level. The first major resistance could be $65,000. The next key resistance could be $65,500.

Source: BTCUSD on TradingView.com

A clear move above the $65,500 resistance might send the price higher. The next resistance now sits at $66,800. If there is a clear move above the $66,800 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $68,000.

Another Decline In BTC?

If Bitcoin fails to rise above the $64,500 resistance zone, it could start another decline. Immediate support on the downside is near the $62,800 level and the trend line.

The first major support is $61,500. If there is a close below $61,500, the price could start to drop toward the 61.8% Fib retracement level of the upward move from the $56,378 swing low to the $64,646 high at $59,500. Any more losses might send the price toward the $58,000 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $62,500, followed by $61,500.

Major Resistance Levels – $64,500, $65,000, and $65,500.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Market

Crypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

The European Central Bank (ECB) cut interest rates by another 25 basis points today, but the crypto market has hardly noticed. This highlights the European market’s declining influence over the crypto sector compared to the US.

Meanwhile, the crypto community is praying for rate cuts in the US, and false tariff rumors caused a massive pump. These policies still matter, but Europe is losing its macro influence.

The ECB Cuts Rates To Crypto Ambivalence

Global recession fears are circulating throughout the crypto market, and regulation plays a key role in them. US investors have been desperate for a rate cut in the hopes that it could provide a bullish narrative.

None has yet materialized. However, the ECB cut interest rates today for the sixth consecutive time, yet the crypto market barely reacted.

“The outlook for growth has deteriorated owing to rising trade tensions. Increased uncertainty is likely to reduce confidence among households and firms, and the adverse and volatile market response to the trade tensions is likely to have a tightening impact on financing conditions,” the ECB said in a public statement.

According to price data, the total crypto market cap has decreased by 0.2% since the ECB announced these rate cuts. Of the top 10 largest assets, all of them posted gains today except one.

Does this mean that macroeconomic factors are losing influence on crypto markets? That notion is demonstrably untrue. Less than two weeks ago, crypto had a huge rally after a false rumor that Trump would pause tariffs.

These gains came back when the pause actually happened. So, macro influence is still very strong in the current markets; it’s specifically that the ECB and Europe are losing influence.

The European Union isn’t the only economic bloc that’s losing its power in the space. Yesterday, the British government announced that inflation was lower than expected, potentially enabling another rate cut.

This, too, had a negligible impact on crypto. Macroeconomic concerns still impact the crypto market, but its strongest links are to the US and Asia.

A clear sign of this change in crypto happened months before the ECB cuts. Tether was forced to leave the EU due to MiCA regulations, but its business was minimally impacted.

It’s still the world’s largest stablecoin despite losing out on the entire European market. In fact, since then, it has taken steps to better integrate with US regulations.

Meanwhile, many large crypto businesses are reorienting towards Asia and the US and away from Europe. Earlier this year, a16z shut down its London office to focus on the US.

Tether relocated to El Salvador, giving it close proximity to the US and easier access to the Latin American market. This growth area is apparently more fruitful than trying again in Europe.

The ECB’s rate cuts barely impacted the crypto market, but that doesn’t mean that the industry will ignore the whole continent. Moving forward, however, EU operations will matter less and less to the largest companies.

This mirrors broader trends, as international capital is refocusing away from Europe. It’s only natural that crypto is part of that pattern.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Price Flat as Bulls Stay on Sidelines

Cardano (ADA) has been trading below the $0.70 mark since March 29, struggling to regain bullish momentum. Despite brief signs of strength, recent indicators now point to weakening trend conditions.

Both the BBTrend and ADX show fading buying pressure, while EMA alignment remains bearish. With price stuck between key support and resistance levels, ADA’s next move could define its short-term direction.

Cardano BBTrend Turns Negative, Signaling Momentum Reversal

Cardano’s BBTrend has flipped negative, currently sitting at -0.78 after spending the last five days in positive territory. The indicator reached a peak of 9.76 on April 14, signaling strong bullish momentum at the time.

BBTrend, short for Bollinger Band Trend, measures the strength and direction of a price move relative to its Bollinger Bands.

Positive values typically indicate bullish trends, while negative values point to bearish conditions or weakening momentum.

The shift to -0.78 suggests that Cardano’s recent uptrend has lost strength and may be reversing. A negative BBTrend reading means the price is now moving closer to the lower band, often a sign of rising selling pressure.

While it doesn’t confirm a strong downtrend yet, this reversal could indicate the beginning of a broader consolidation or bearish phase unless momentum quickly recovers.

Traders may want to watch closely for follow-through or a bounce to assess ADA’s short-term direction.

Cardano Momentum Fades as ADX Crashes and Selling Pressure Rises

Cardano’s DMI chart shows a sharp drop in trend strength, with its ADX falling to 15.12 from 28.34 just two days ago.

The ADX (Average Directional Index) measures trend intensity—readings above 25 suggest a strong trend, while values below 20 indicate a weak or consolidating market.

The steep decline in the ADX signals that the momentum behind Cardano’s recent move is quickly fading.

At the same time, the +DI (bullish directional indicator) has dropped from 22.61 to 17.39, showing weakening buying pressure. Meanwhile, the -DI (bearish indicator) has risen from 10.5 to 14.95, pointing to a gradual increase in selling strength.

With both the ADX and +DI falling, and -DI climbing, the setup hints at a potential shift in favor of the bears.

Unless bullish momentum returns quickly, Cardano could enter a period of sideways movement or even a short-term downtrend.

Bearish Structure Still Dominates Cardano

Cardano’s EMA lines remain bearish, with short-term averages still positioned below the long-term ones—indicating that downward momentum is intact.

Cardano price is holding above a key support zone near $0.594, but if this level fails, it could trigger a deeper drop toward $0.511. This would confirm a continuation of the downtrend and reflect growing selling pressure.

However, if ADA manages to reverse its current momentum, the first major resistance lies at $0.64. A breakout above that level could open the door to further gains, with potential targets at $0.66 and $0.70.

If the uptrend strengthens, ADA could even rally toward $0.77, marking a more decisive recovery and trend shift.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin (BTC) Stays Flat as Whales Reduce Market Exposure

Bitcoin (BTC) has been trading in a tight range between $83,000 and $86,000 over the past five days, showing signs of indecision in both price action and momentum indicators.

While the number of whale wallets has started to decline, on-chain data still reflects elevated interest from large holders. Technically, BTC remains in a consolidation phase, with weak EMA signals and mixed Ichimoku readings.

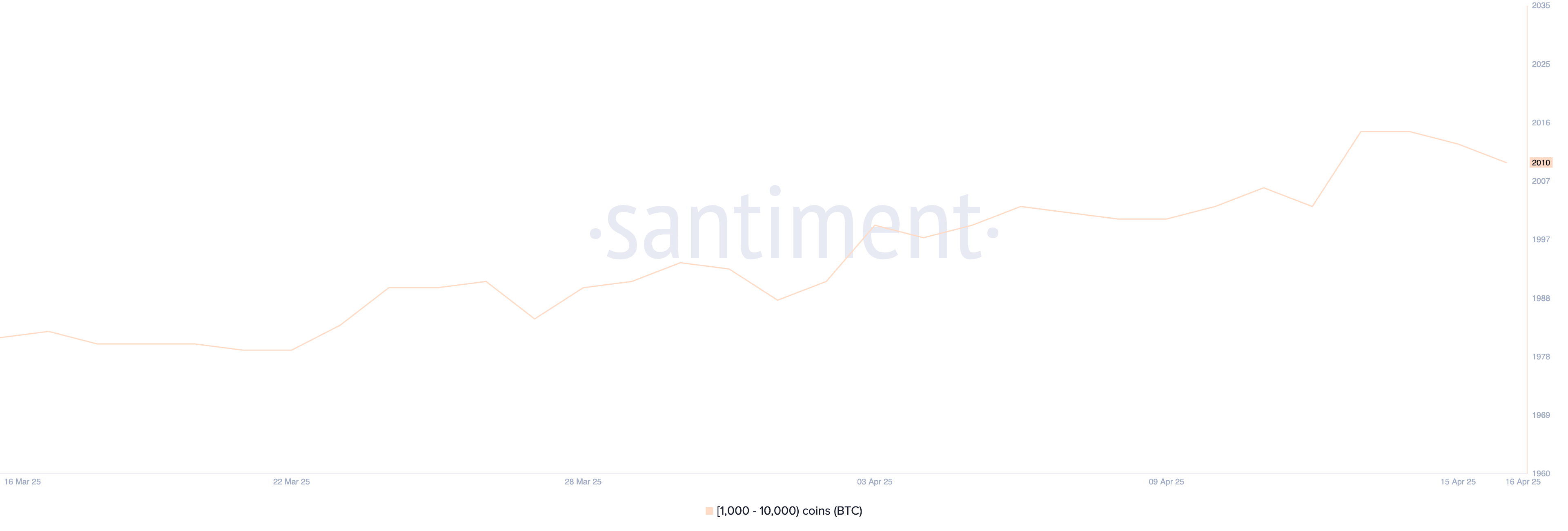

Bitcoin Whales Pull Back: Early Sign of Fading Confidence?

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—has declined slightly in recent days, dropping from 2,015 on April 14 to 2,010 by April 16.

This pullback comes just after the metric hit its highest level since May 2024, suggesting a potential shift in sentiment among large holders.

While the drop may seem small, movements in whale behavior often precede broader market trends, making even slight changes worth watching.

Whale activity is a key on-chain signal because these large holders can significantly influence market liquidity and price direction.

An increase in whale wallets often reflects accumulation and long-term confidence, while a decline may suggest strategic profit-taking or risk-off behavior.

The recent dip from the local peak could indicate that some whales are trimming exposure as market uncertainty rises. If the number continues to fall, it may signal weakening institutional conviction, potentially putting short-term pressure on Bitcoin’s price.

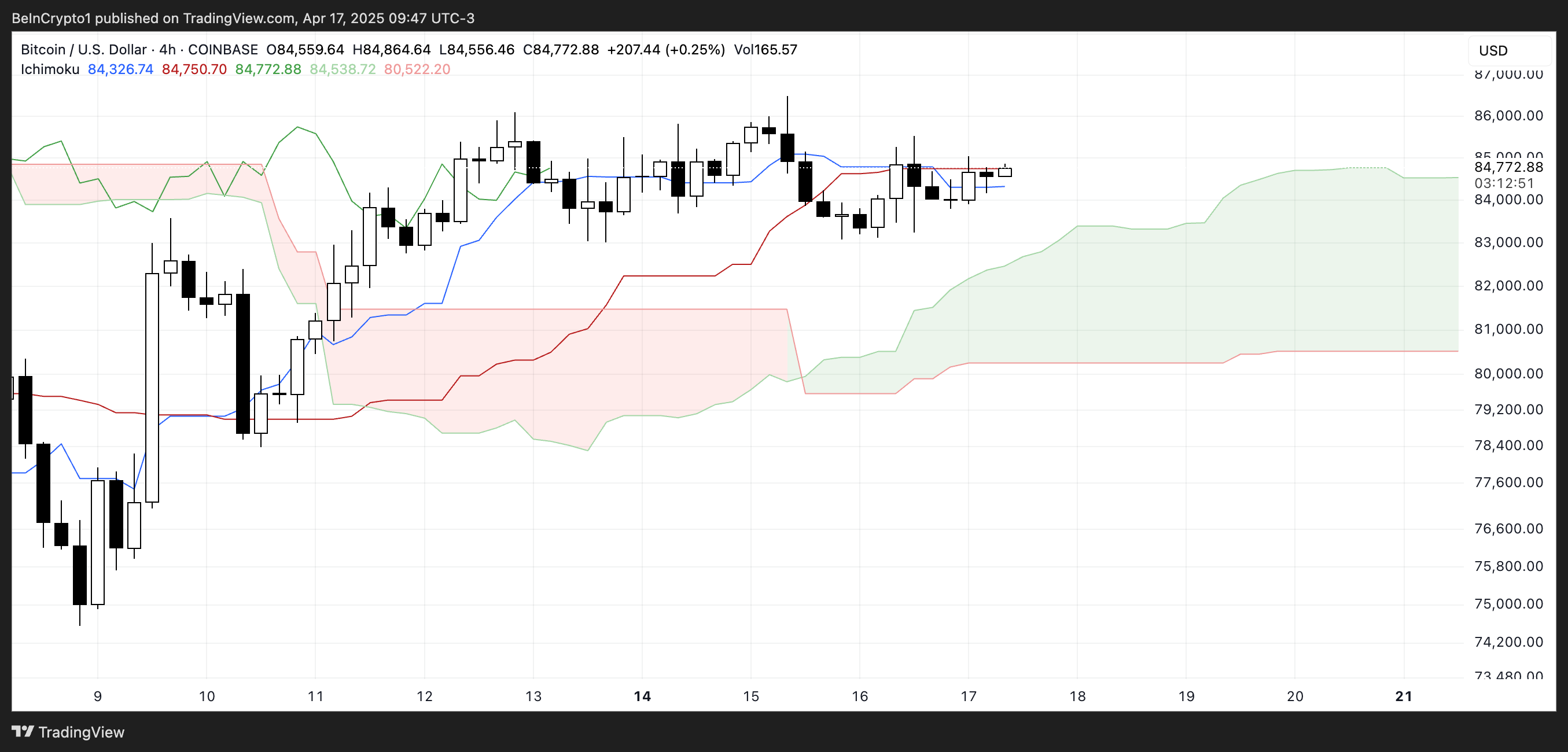

Bitcoin Stalls Near Ichimoku Pivot as Momentum Fades

The Ichimoku Cloud chart for Bitcoin shows a period of consolidation, with the price currently trading near the flat Tenkan-sen (blue line) and Kijun-sen (red line).

This alignment suggests a lack of short-term momentum, as both lines are moving sideways, indicating equilibrium between buyers and sellers.

The Kumo (cloud) ahead is bullish, with the Senkou Span A (green cloud boundary) above the Senkou Span B (red cloud boundary), but the distance between them is relatively narrow.

This hints at weak bullish momentum for now. The price is sitting just above the cloud, which is a positive sign, but without a clear breakout above the Tenkan-sen and recent highs, the trend remains indecisive.

Chikou Span (lagging line) is overlapping with recent candles, reinforcing the sideways movement.

Overall, Bitcoin is hovering in a neutral-to-slightly-bullish zone, but it needs a stronger push to confirm a clear trend direction.

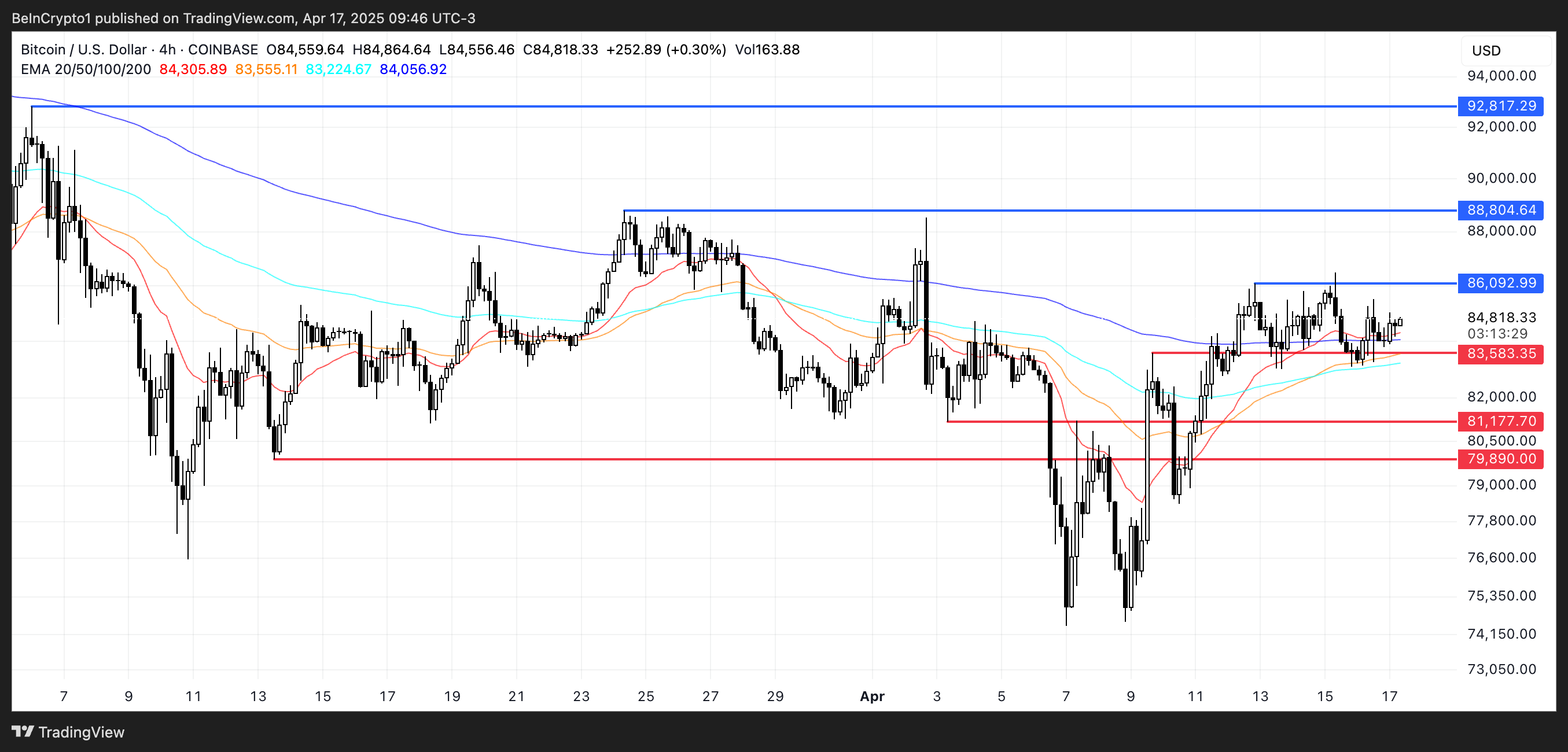

Bitcoin Struggles for Direction as Key Levels Loom

Bitcoin’s EMA lines are currently flat, indicating a weak and uncertain trend. The price action shows hesitation, with bulls and bears lacking conviction.

If the support level at $83,583 is tested and fails to hold, the market could enter a sharper correction, targeting the next support at $81,177.

A break below that could push Bitcoin price under the psychological $80,000 level once again, with $79,890 as the next possible downside target.

However, if bulls manage to regain control, Bitcoin could shift toward recovery. The first key resistance lies at $86,092—breaking this level would suggest renewed upward momentum.

From there, the next upside targets would be $88,804 and, if the trend strengthens further, $92,817.

Reaching this level would mean breaking above the $90,000 mark for the first time since March 7, potentially sparking renewed interest from both retail and institutional investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Market21 hours ago

Market21 hours agoPEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

-

Bitcoin24 hours ago

Bitcoin24 hours agoETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

-

Market23 hours ago

Market23 hours agoBase Meme Coin Wipes $15 Million After Official Promotion

-

Market18 hours ago

Market18 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market17 hours ago

Market17 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Ethereum17 hours ago

Ethereum17 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Market16 hours ago

Market16 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?