Market

Bitcoin Price Rebounds, But Key Hurdles Could Stall Progress

Bitcoin price started a recovery wave from the $57,200 zone. BTC is rising, but it might struggle to surpass the $60,200 and $61,150 resistance levels.

- Bitcoin is attempting a recovery wave above the $58,000 support zone.

- The price is trading above $58,000 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $58,350 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could face heavy resistance at $60,200 or $61,150 in the near term.

Bitcoin Price Starts Recovery

Bitcoin price extended losses below the $58,500 support levels. BTC even spiked below $57,200. A low was formed at $57,124 and the price recently started a recovery wave.

There was a move above the $58,000 and $58,200 resistance levels. It cleared the 50% Fib retracement level of the downward move from the $61,143 swing high to the $57,124 low. There was also a break above a connecting bearish trend line with resistance at $58,350 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading above $58,000 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $60,200 level or the 76.4% Fib retracement level of the downward move from the $61,143 swing high to the $57,124 low.

The first key resistance is near the $61,150 level. A clear move above the $61,150 resistance might send the price further higher in the coming sessions. The next key resistance could be $62,000. A close above the $62,000 resistance might spark more upsides. In the stated case, the price could rise and test the $65,000 resistance.

Another Decline In BTC?

If Bitcoin fails to rise above the $60,200 resistance zone, it could start another decline. Immediate support on the downside is near the $58,750 level.

The first major support is $58,500. The next support is now near the $57,200 zone. Any more losses might send the price toward the $56,200 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $58,750, followed by $58,500.

Major Resistance Levels – $60,200, and $61,150.

Market

Are Ethereum Whales Threatening ETH Price Stability?

Ethereum (ETH) continues to struggle below the $2,000 mark, a level it hasn’t reclaimed since March 28, as bearish momentum lingers across both technical and on-chain indicators. Despite attempts to stabilize, recent data reveals rising concentration of ETH among whale wallets, alongside persistent weakness in trend indicators like EMA lines.

At the same time, retail and mid-sized holders are gradually losing share, further skewing ownership toward large players. This combination of declining retail participation and heavy whale dominance may leave ETH increasingly vulnerable to sharp corrections if sentiment turns.

ETH Whale Holdings Hit 9-Year High, Raising Centralization Concerns

The amount of ETH held by whale addresses—wallets controlling more than 1% of the total circulating supply—has reached its highest level since 2015, sitting at 46%.

This marks a significant shift in Ethereum’s ownership data, as whales surpassed the holdings of retail investors back on March 10 and have continued to grow their share since. In comparison, investor-level addresses, which hold between 0.1% and 1% of supply, and retail wallets, which hold less than 0.1%, have both seen declines in their share of ETH.

The jump from 43% to 46% in just a few months reflects a sharp accumulation trend among the largest holders, suggesting a growing concentration of ETH in fewer hands.

Whales typically represent institutional investors, funds, or early adopters, and their behavior can significantly impact price due to the volume they control. Investor-level addresses often reflect high-net-worth individuals or smaller institutions, while retail addresses include everyday traders and holders.

While some might see the rise in whale holdings as a vote of confidence, it also increases the risk of sudden volatility if large holders begin offloading.

With retail and investor participation shrinking, the market may become more fragile and vulnerable to sharp, unexpected price movements driven by a few dominant players.

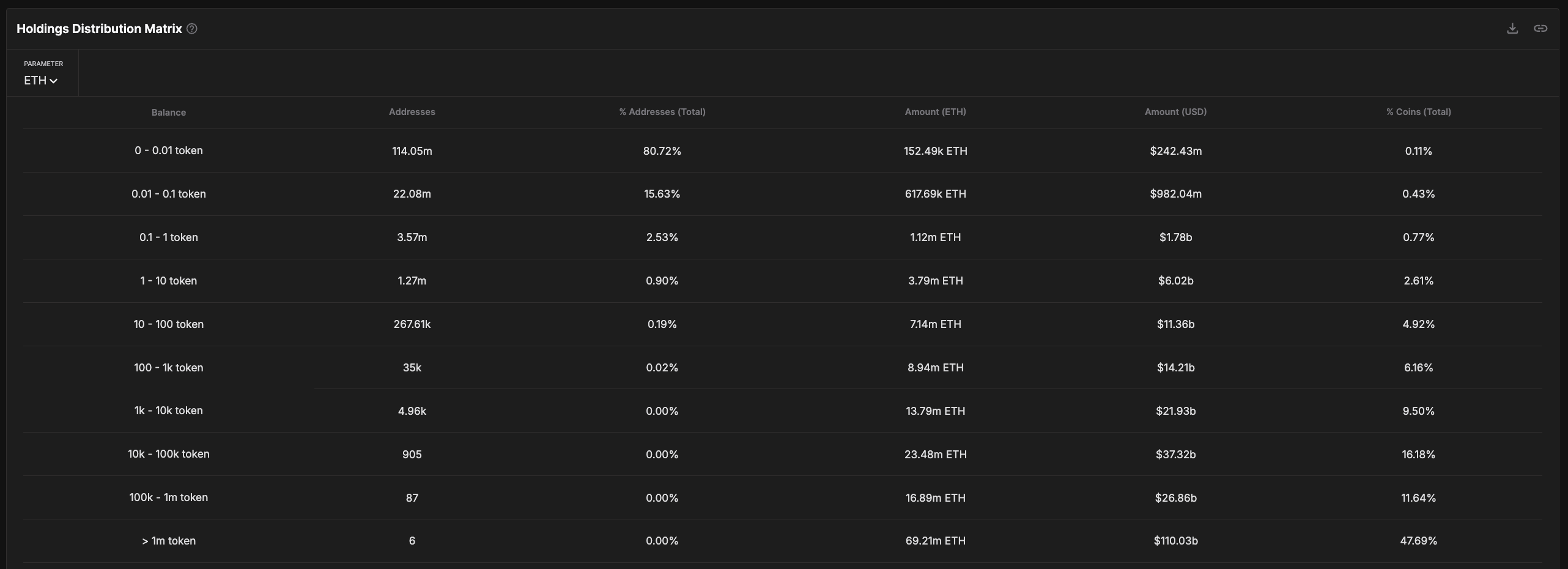

Whales Holding 1,000 to 100,000 ETH Now Control $59 Billion

Analyzing the ETH Holdings Distribution Matrix reveals concerning signs of deepening concentration.

When excluding addresses with over 100,000 ETH—typically linked to centralized exchanges—whale addresses holding between 1,000 and 100,000 ETH now control roughly $59 billion in ETH, representing around 25.5% of the circulating supply.

This group has steadily accumulated more of the network’s supply, reinforcing a power shift toward large entities operating outside of exchanges but still commanding immense influence over the market. Recently, Galaxy Digital moved $100 million in Ethereum, raising questions about whether it was a strategic shift or a sell-off signal.

While some might interpret this trend as strategic positioning by confident holders, it also exposes Ethereum to significant downside risk.

With over a quarter of supply concentrated in the hands of these whales, any coordinated or panic-driven selling could trigger sharp price drops, especially in an environment with weakening retail participation.

Rather than a sign of long-term stability, this level of concentration may make the ETH market increasingly fragile and prone to volatility if these holders start to rotate their capital to other assets.

Bearish EMA Structure Keeps ETH Under Pressure

Ethereum’s EMA lines continue to flash bearish signals, with short-term averages still positioned below the long-term ones—indicating downward momentum remains in play.

If a new correction happens, Ethereum could first test support at $1,535. A breakdown below that level opens the door to deeper declines toward $1,412 or even $1,385.

Should these supports also fail to hold, Ethereum would edge dangerously close to the $1,000 mark, a level some analysts have flagged as a potential downside target in the event of an extended market correction.

Still, a bullish reversal is not entirely out of the question. If buying pressure returns and Ethereum reclaims short-term momentum, it could test the resistance level at $1,669.

A breakout above that would be a significant technical signal, potentially pushing Ethereum price toward $1,749 and even $1,954.

However, with EMAs still tilted to the downside, the burden remains on bulls to prove that momentum has shifted decisively in their favor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CZ’s Plan to Streamline BNB Staking Could Boost DeFi

On Friday, Changpeng Zhao (CZ) sparked fresh momentum toward simplifying the BNB staking ecosystem.

The Binance founder proposed the unification of multiple liquid staking tokens into a single, streamlined structure.

CZ’s Bold Plan to Unify BNB’s Staking Maze

Changpeng Zhao’s comments come amid rising concerns over the fragmentation of BNB staking products. Their impact on user adoption and capital efficiency within the decentralized finance (DeFi) space has also been questioned.

“There are so many different versions of BNB rewards. asBNB, slisBNB, clisBNB… combine them?” CZ wrote on X (Twitter).

These tokens, each tied to a different platform or crypto staking strategy, represent staked BNB assets while allowing users to remain liquid.

However, the proliferation of variant tokens like asBNB, slisBNB, and clisBNB has created operational barriers for users, particularly newcomers. Each derivative often carries reward structures, lock-up conditions, and platform-specific limitations, making it harder to maneuver the ecosystem.

This highlights the growing problem in BNB’s liquid staking ecosystem. However, as more derivatives emerge, confusion has mounted. The call for consolidation follows recent activity in the BNB DeFi ecosystem. This week, Aster DEX (decentralized exchange) announced “back-to-back rewards” for asBNB holders.

While this added to the mix of incentives, it also highlighted the complexity of managing multiple tokens.

“INIT rewards are loading now and will be available for holders with previous rewards soon,” Aster posted.

The post demonstrates how derivative-specific reward systems may confuse users who are unfamiliar with each staking product’s nuances.

CZ shared a follow-up post, urging users to support projects in the ecosystem. The call to action reflects his commitment to nurturing BNB’s DeFi growth, albeit with a more coherent strategy.

As Binance aims to maintain its leadership in Web3 usability, Zhao’s suggestion to unify these staking derivatives could be a pivotal move to streamline BNB’s functionality across DeFi platforms.

BNB remains one of the most utilized assets in the DeFi ecosystem. The network underpins a wide array of liquidity pools, staking protocols, and yield-generating strategies.

CZ’s unification proposal aligns with a broader trend across DeFi to improve composability and standardization. Industry leaders increasingly recognize that overly complex or siloed token designs can deter participation and limit interoperability.

A standardized BNB staking token could help reduce fragmentation and boost liquidity. It could also encourage deeper integration across platforms using BNB Chain infrastructure.

While Binance has not yet issued an official roadmap for staking token consolidation, CZ’s comments may hint at a coming initiative to build a unified liquid staking standard.

Such a move could further solidify BNB’s position as a core DeFi asset, simplify staking for everyday users, and drive broader adoption of Binance’s on-chain ecosystem.

BeInCrypto data shows BNB was trading for $591.72 as of this writing, up by a modest 0.72% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Relying on TVL Could Mislead Your DeFi Strategy

Total value locked (TVL) is a widely used metric to track the popularity, adoption, and overall health of decentralized finance (DeFi) projects. However, is it the most accurate reflection of a chain’s true value? David Silverman, SVP of Strategic Product Initiatives at Polygon Labs, believes TVL is useful for grabbing headlines but doesn’t provide the full picture.

In an exclusive interview with BeInCrypto, Silverman explained why TVL has its limitations. He also revealed how the Chain-Aligned TVL (CAT) could provide a more meaningful measure for the crypto ecosystem.

Why TVL Falls Short as a Key DeFi Metric

Silverman acknowledged that TVL provides a general overview of the assets held within a protocol or chain. Yet, he argued that its importance and accuracy remain debatable.

“TVL mainly serves as a tool for crafting headlines and providing a general overview of the value held on a DeFi platform or a chain, and most people don’t really know what exactly this metric entails in particular. Saying that Ethereum has a TVL of $44.38 billion doesn’t really mean much until you dig deeper into the specifics,” Silverman told BeInCrypto.

According to DefiLlama data, in April 2025, Ethereum (ETH) ranks the highest among all chains in terms of TVL, dominating more than half of the market. Meanwhile, Polygon’s (POL) TVL stands at $760.9 million, making it the 13th largest chain.

Although there have been advancements in tracking the TVL over time, Silverman believes several issues persist. Thus, he advocated for what he calls a Chain-Aligned TVL.

According to Silverman, the name itself clearly differentiates it from traditional TVL. This metric focuses on the active use of assets rather than their mere presence on the chain.

“Knowing how much USDC or USDT is on a chain can make for good headlines, but if those tokens are just collecting dust in a wallet and don’t contribute to anything, do they really add any value to the ecosystem?” he questioned.

To illustrate his point, he emphasized that holding $1 million worth of USDT in Morpho is arguably far more beneficial for the chain, its users, and the ecosystem. Why? Because on the platform, it earns a yield and helps grow the chain’s TVL by extending credit.

“This is the main idea of Chain-Aligned TVL, which is the total value of assets that directly support and strengthen their underlying chain, whether held natively or within aligned protocols,” Silverman disclosed to BeInCrypto.

Furthermore, he said, the goal is to associate CAT with projects that truly add value to their communities.

Maximizing DeFi Potential: How Chain-Aligned TVL Benefits Users

The Polygon executive also outlined the benefits Chain-Aligned TVL brings to users. He explained that CAT’s nuanced way of gauging a chain’s value can help users find better yield opportunities.

“Chains will naturally want to promote projects that benefit them and their ecosystems, so they are more likely to promote projects with higher chain-aligned TVLs, making it easier for users to locate high-yielding opportunities,” he noted.

Silverman stressed that focusing on CAT can drive the development of more effective and user-friendly applications. The underlying chain will prioritize well-integrated projects beneficial to its ecosystem.

“Benefits to users include things like easier/cheaper/faster transitions and better DeFi opportunities,” he claimed.

Additionally, CAT-driven projects may offer better interest rates and provide more engaging experiences in areas like games and non-fungible tokens (NFTs), as developers are incentivized to enhance ecosystem engagement.

The benefits aren’t limited to users only. Rather, it can also have positive implications for entire blockchains.

“CAT is a metric that all chains can leverage and benefit from to get a better understanding of where their development efforts should be focused,” Silverman revealed to BeInCrypto.

He pointed out that transaction fees alone are not always a sustainable business model for chains. According to Silverman, the focus on CAT helps bring long-term value to a chain and its ecosystem beyond just short-term transaction revenue.

Meanwhile, to showcase Chain-Aligned TVL in action, Silverman cited Agora’s AUSD deployment on Polygon as an example.

“While other stables may have large amounts of idle TVL, the issuer and the issuer alone benefits from this not the chain and not the users. With AUSD, a portion of the yield generated from reserves is emitted on the chain as incentives helping grow protocols, rewarding active users and growing the chain’s economy even when the assets remain idle,” he highlighted.

While Silverman presents a strong case for Chain-Aligned TVL, widespread adoption of this metric remains a challenge. TVL has dominated the DeFi space for years, becoming the standard by which projects are measured.

Shifting to a more nuanced metric like CAT will require industry-wide education and a change in how both developers and users evaluate blockchain value.

However, as the ecosystem matures and the need for more accurate assessments of chain health grows, metrics like CAT could gradually gain traction, offering a more sustainable and meaningful way to measure a chain’s true impact.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoCoinbase Reveals Efforts To Make Its Solana Infrastructure Faster, Here’s All

-

Market22 hours ago

Market22 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin22 hours ago

Altcoin22 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Market23 hours ago

Market23 hours agoXRP Price Finds Stability Above $2 As Opposing Forces Collide

-

Market21 hours ago

Market21 hours agoCrypto Casino Founder Charged With Fraud in New York

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

-

Altcoin12 hours ago

Altcoin12 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market17 hours ago

Market17 hours agoBinance Leads One-Third of the CEX Market in Q1 2025