Market

Bitcoin Price Dives Once More—Is a Deeper Correction Underway?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

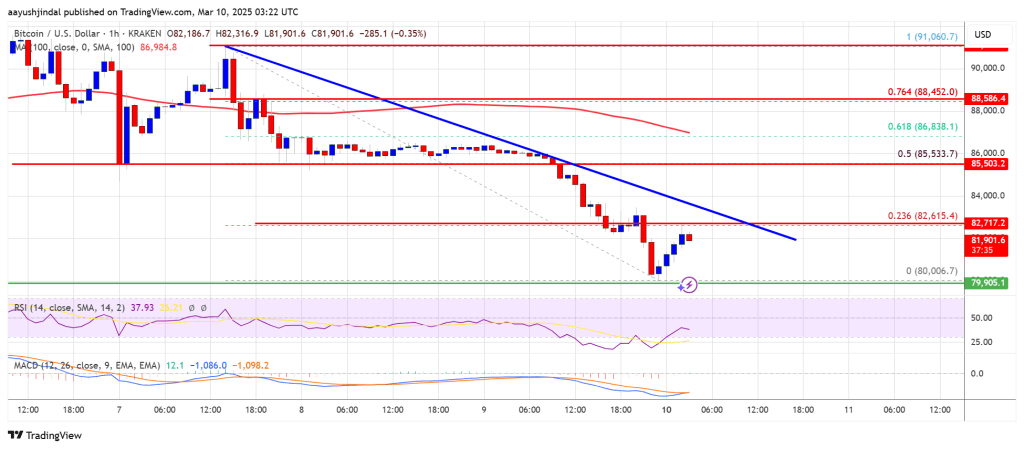

Bitcoin price started a fresh decline from the $92,000 zone. BTC is back below $85,500 and might continue to move down below $80,000.

- Bitcoin started a fresh decline below the $85,000 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There is a short-term bearish trend line forming with resistance at $83,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it fails to clear the $80,000 resistance zone.

Bitcoin Price Faces Resistance

Bitcoin price started a fresh decline below the $88,000 level. BTC traded below the $86,000 and $85,000 support levels. Finally, the price tested the $80,000 support zone.

A low was formed at $80,006 and the price recently started a recovery wave. There was a move above the $80,500 and $81,200 resistance levels. The bulls pushed the price toward the 23.6% Fib retracement level of the downward move from the $91,060 swing high to the $80,006 low.

Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,700 level. The first key resistance is near the $83,000 level.

There is also a short-term bearish trend line forming with resistance at $83,200 on the hourly chart of the BTC/USD pair. The next key resistance could be $85,000. It is near the 50% Fib retracement level of the downward move from the $91,060 swing high to the $80,006 low.

A close above the $85,000 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $90,000 level or even $96,200.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $81,000 level. The first major support is near the $80,200 level.

The next support is now near the $80,000 zone. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $80,000, followed by $78,000.

Major Resistance Levels – $83,000 and $85,000.

Market

XRP Price Eyes $2.0 Breakout—Can It Hold and Ignite a Bullish Surge?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Onyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

Onyxcoin has surged by nearly 30% in the past 24 hours, riding the wave of a broader crypto market rally.

But beyond the market-wide momentum, on-chain data suggests that XCN’s spike, its strongest in over a month, is driven by genuine demand for the altcoin.

Onyxcoin Rallies, But There Is a Catch

XCN’s double-digit rally has been accompanied by a surge in its daily trading volume. This totals $128 million at press time, rocketing 480% over the past day.

When an asset’s price and trading volume spike simultaneously, it signals strong market interest and momentum. This means more participants are actively trading XCN and validating its price movement.

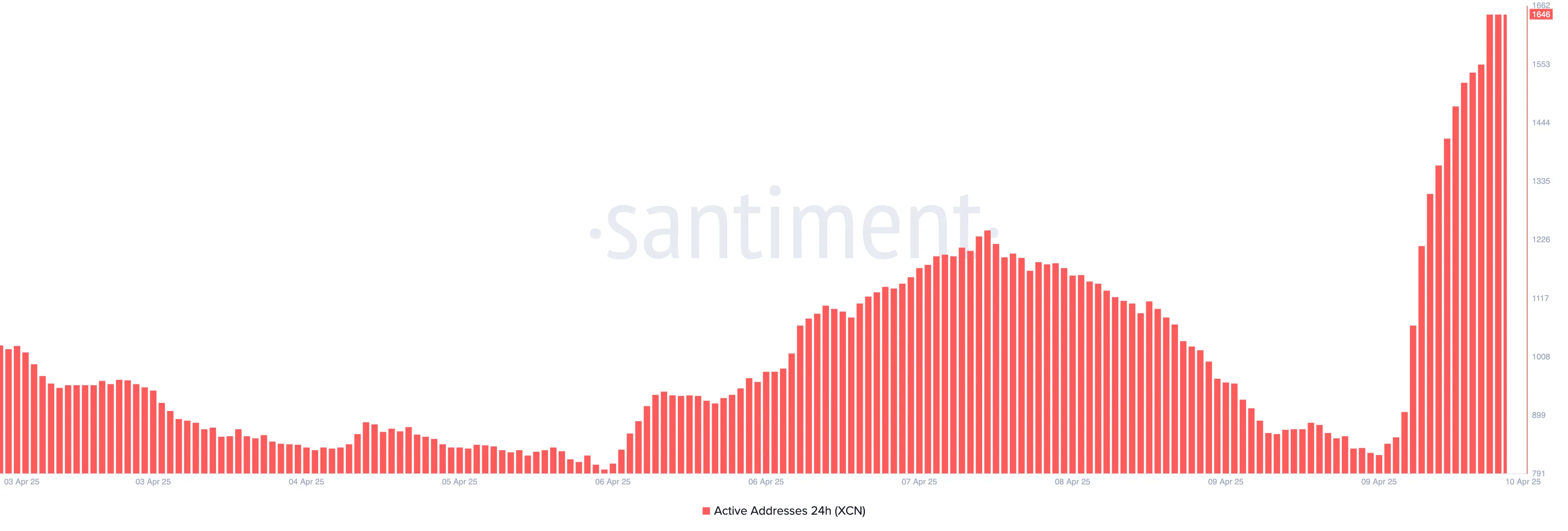

Moreover, the daily count of active addresses that have traded XCN today has climbed to a 60-day high of 1,646.

This spike in active addresses reflects growing retail and possibly institutional interest in XCN. More wallets transacting the token typically suggests broader network participation and confidence, which can serve as a strong bullish signal for the asset.

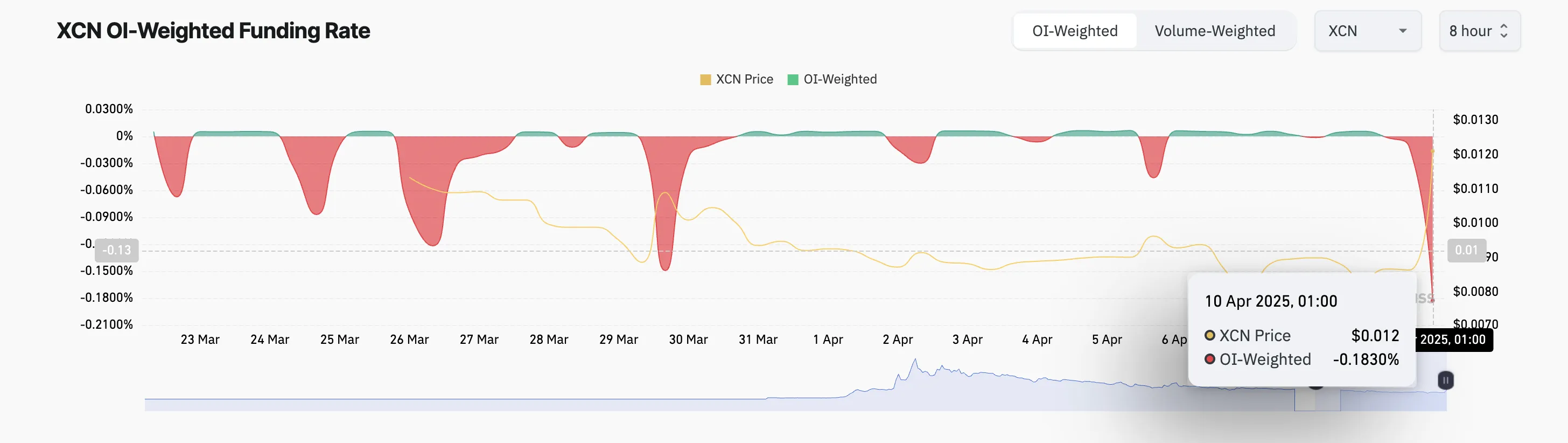

However, not all traders share this bullish sentiment. In the XCN futures market, the outlook is persistently bearish, as reflected by the token’s negative funding rate. This is at a two-month low of -0.18% at press time.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures to keep the contract price in line with the spot price.

When an asset’s funding rate is negative like this, short traders pay long traders. This indicates bearish sentiment and that more XCN traders are betting on the price to fall.

XCN Clears Key Barrier as Accumulation Grows — Is $0.015 Next?

Apart from the broader market recovery, the price rally is also supported by a visible uptick in on-chain user engagement, signaling that XCN traders are not just following hype but are actively accumulating.

On the daily chart, XCN has broken above the crucial $0.01 resistance level—a price point it struggled to break for two weeks. If the rally persists, XCN’s price could climb to $0.015, a high it last reached on March 5.

However, if market participants begin profit-taking, XCN could shed its recent gains and fall below the $0.011 support toward $0.0075.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Bitcoin15 hours ago

Bitcoin15 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Altcoin19 hours ago

Altcoin19 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Altcoin18 hours ago

Altcoin18 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Market15 hours ago

Market15 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market16 hours ago

Market16 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Market21 hours ago

Market21 hours agoCrypto Market Rallies After Trump’s 90-Day Pause on Tariffs

-

Regulation14 hours ago

Regulation14 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market19 hours ago

Market19 hours agoFARTCOIN Jumps 160% in 30 Days but Momentum Fades