Market

Bitcoin Pepe maintains its shine as Bitcoin price bleeds further

Bitcoin season remains in play at an index of 14, as highlighted on CoinMarketCap. Even with heightened market volatility and revolutionary technologies like AI and Telegram gaming, BTC remains the most steady and reliable network. While it has dropped by about 20% since hitting its all-time high in late January, it is still 30% higher than it was a year ago.

Even so, savvy investors are increasingly looking for opportunities in the altcoins. More specifically, the meme culture has birthed numerous crypto millionaires. This is one of the reasons why revolutionary meme projects like Bitcoin Pepe are raising hefty figures in their first weeks of presale. Its adoption of the meme culture, coupled with the PEP-20 standard and layer-2 solution on the Bitcoin network places it on the list of crypto ICOs to watch in 2025.

Bitcoin ETFs record massive outflows as BTC price remains in the red

Bitcoin price is in the red for the second week in a row as the bulls strive to defend the support zone of $85,000. Since hitting its all-time high in late January 2025, it has dropped by over 20%; momentarily plunging below the crucial level of $80,000 a week ago.

Amid the selling pressure, Bitcoin ETFs recorded total net outflows of $409.21 million on 7th March as stated on SoSoValue. ARK 21Shares Bitcoin ETF and Fidelity Wise Origin Bitcoin Fund topped the list with daily net outflows of $160.03 million and $154.89 million respectively.

A look at its daily chart points to the continuation of the downtrend, atleast in the short term. More specifically, it will likely trade within the range of between $85,083 and the 25-day EMA of $91,054 for a while longer. Failure to attract enough buyers to defend the current support zone will give the bears an opportunity to retest the week’s low at $82,223.

Bitcoin Pepe surpasses $4 million in less than 4 weeks as momentum heightens

Less than 4 weeks since the launch of its presale, Bitcoin Pepe has already raised over $4 million. Indeed, it is more than a typical meme coin; it is a revolutionary project.

Through the new PEP-20 standard, anyone can launch a meme coin directly on the highly stable Bitcoin network. This has bridged the gap between the Bitcoin maximalists who view meme coins as an unserious venture and meme coin enthusiasts who saw BTC as being beyond their reach.

Besides, the Layer 2 solution is aimed at building “Solana on Bitcoin”. This means that investors are assured of Bitcoin’s top-notch security while enjoying lower fees and speedier transactions.

At stage 6 of its presale, the early adopters have already locked in 27.6% in gains. By the time it hits the public shelves in Q2, their capital investment will have earned cumulative returns of 311.4%. Read more on how to buy Bitcoin Pepe here.

Crypto downturn pushes Solana on range-bound trading

Solana price has experienced intense swings in recent weeks; plunging by about 53% since hitting its all-time high in late January 2025. During this timeframe, it has been in the red for six out of the past seven weeks.

A look at its daily chart shows the altcoin trading below the 25 and 50-day EMAs, indicating that it is not out of the woods yet. In the short term, the range between the steady support zone of $125.28 and the resistance level of $146.33 will be worth watching. Further rebounding will have the bulls eyeing the next target at $160.10.

Market

Solana Futures Market Turn Bearish as SOL Might Dip Below $130

Solana’s price has faced significant volatility over the past week due to recent market troubles. This has led to a sharp decline in its futures market sentiment as leveraged traders appear reluctant to take bullish positions.

This lack of confidence increases the risk of a further price drop, with SOL eyeing a dip below the $130 level in the near term.

Solana Struggles as Traders Exit

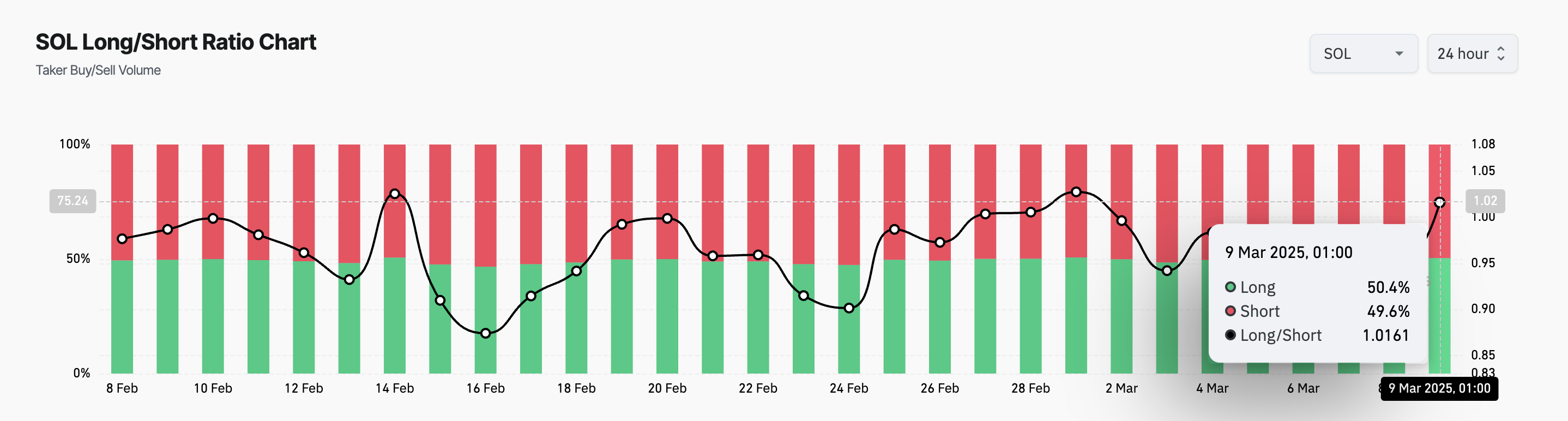

SOL’s negative funding rate is an indicator of the waning bullish bias among its futures traders.

According to Coinglass data, SOL perpetual futures have maintained a negative funding rate for the past three days, indicating that short sellers are paying to hold their positions. At press time, this stands at -0.0060%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot market.

As with SOL, when this rate is negative, it means that short sellers (those betting on a price decline) are paying fees to long traders, indicating a bearish sentiment in the market.

Therefore, more traders are positioned for a price drop, reinforcing the downward pressure on the coin’s price.

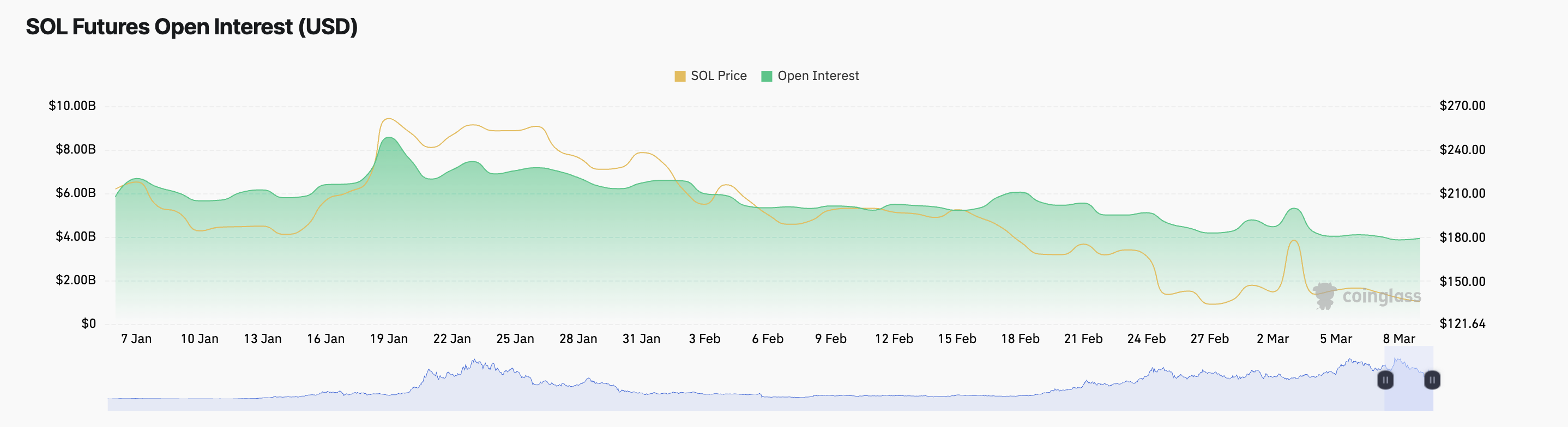

Moreover, the lack of confidence among SOL futures traders is reflected by its plummeting open interest. At press time, this is at $3.94 billion, falling 19% since the beginning of March.

An asset’s open interest tracks the total number of active futures contracts that have not been settled.

When this falls, especially during a period of price decline, it suggests that traders are closing positions without opening new ones. This confirms the reduced conviction in a short-term SOL price recovery among its futures traders.

Solana Bulls Weaken—Can They Prevent a Drop Below $130?

At press time, SOL trades at $137.70, resting just above the support floor of $136.62. As bullish sentiment tapers, this level risks being flipped into a resistance zone.

Should this happen, SOL’s price could slip below $130 to exchange hands at $120.72.

On the other hand, if bullish momentum returns to the SOL market, this bearish projection will be invalidated. In that scenario, new demand could drive the coin’s price to $182.31.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

1inch Hacker Returns $5 Million Stolen Funds After Bug Bounty

Decentralized exchange (DEX) aggregator 1inch experienced a critical breach of its smart contracts last week. However, following negotiations with the hacker, the exchange successfully recovered most of the $5 million stolen.

Despite the recovery, the attack highlights the ongoing security challenges within the DeFi ecosystem.

1inch Recovers Most of Its Stolen Funds

1inch experienced this particular breach on March 5. Investigators attributed it to a vulnerability in an outdated version of the platform’s smart contract. After discussions and a generous bug bounty, the attacker returned the funds.

“After negotiations with the hacker, most of the $5 million stolen from 1inch has been returned, with the hacker keeping a portion as a bug bounty,” WuBlockchain reported, citing Decurity’s postmortem report.

1inch explained in the March 7 blog that the breach was caused by a flaw in the Fusion v1 resolver smart contract, an obsolete platform component. The team detected the incident at approximately 6 PM UTC on March 5.

Attackers exploited outdated logic within Fusion v1 to execute unintended transactions.

Notably, no end users were directly affected, as the attack targeted a third-party market maker, TrustedVolumes. Upon discovering the breach, 1inch swiftly redeployed its resolver contracts as a precautionary security measure, preventing further exploits.

According to Decurity’s postmortem report, the hacker initiated an on-chain message following the attack. They requested a bug bounty in exchange for returning the stolen funds.

TrustedVolumes, the affected market maker, entered negotiations with the attacker, leading to a successful resolution.

This resolution marks a rare instance in which a DeFi exploit resulted in the voluntary return of stolen assets. It reflects the growing trend of ethical hacking and white hat negotiations in the DeFi industry.

Security Remains a Major Challenge for 1inch

This incident marks the second time in six months that 1inch has faced a security breach. In October 2024, the platform suffered a front-end compromise due to a supply chain attack.

Also, it highlights the persistent risks DeFi protocols encounter. The latest hack is another reminder of the necessity for continuous monitoring and rapid response mechanisms to safeguard users and assets.

Despite the recovery, the 1INCH price has only gone up by a modest 1.12% since Sunday’s session opened and was trading for $0.23 as of this writing.

This incident highlights the importance of continuous smart contract audits and proactive vulnerability detection. It also indicates the need for stronger validation mechanisms to prevent similar incidents in the future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Bear Market Ahead? Analyst Warns of 33% Price Drop

According to Timothy Peterson, author of Metcalfe’s Law as a Model for Bitcoin Value, the crypto industry could be on the brink of another bear market.

This analysis comes as the Federal Reserve (Fed) maintains its cautious stance on interest rates despite persisting economic uncertainties.

Analyst Explains How a Bear Market Could Unfold

In his recent analysis, shared on X (Twitter), Peterson warned that the market is currently overvalued. This, he says, makes it vulnerable to a downturn. While such a decline needs a trigger, he suggests that the Fed’s decision to keep interest rates steady could be enough to set it off.

“It’s time to talk about the next bear market. There’s no reason to think it couldn’t happen now. The valuation justifies it. What it needs is a trigger. I think that trigger may be as simple as the Fed not cutting rates at all this year,” wrote Peterson.

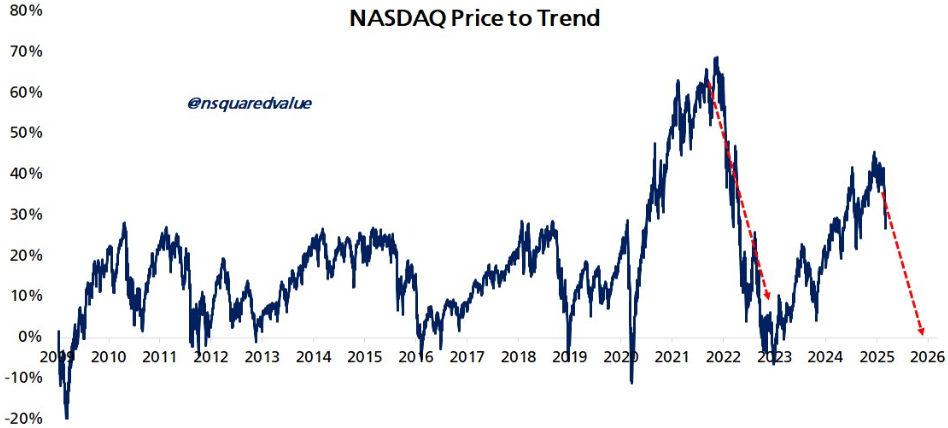

Peterson’s analysis draws parallels between past market downturns and current conditions. Using the NASDAQ as a reference point, he estimates that a bear market could last anywhere from 7 to 14 months.

Given that the NASDAQ is currently 28% overvalued, he anticipates a decline of about 17%, bringing the index down to 15,000.

Applying these projections to Bitcoin, Peterson expects a roughly 33% drop, pushing Bitcoin’s price down to around $57,000.

“Multiply by 1.9. 17% drop in NASDAQ = 33% drop in BTC -> $57k,” Peterson added.

However, he notes that opportunistic investors could step in early. Such an intervention could prevent the Bitcoin price from falling that low, potentially finding support around $71,000.

This aligns with a recent analysis from Arthur Hayes. As BeInCrypto reported, the BitMex founder claimed Bitcoin could slump to $70,000 before a potential rebound.

Analysts also highlighted Bitcoin’s air gap below $93,198, with little to no significant support until around the $70,000 range.

Fed’s Role in the Market Downturn

Meanwhile, about a month ago, Fed Chair Jerome Powell said that the central bank is in no rush to cut interest rates. He reiterated these remarks during his speech last week. speaking at a policy forum in New York, Powell emphasized the need for patience.

“We do not need to be in a hurry, and are well positioned to wait for greater clarity,” Powell stated.

Powell’s remarks come amid economic uncertainty fueled by President Donald Trump’s policy changes in trade, immigration, fiscal policy, and regulation. With inflation hovering around 2.5%, the Fed is focused on addressing these challenges cautiously.

Despite market expectations for rate cuts this year, Powell has made it clear that the Fed will wait and see before adjusting monetary policy.

Adding to concerns about an impending Fed-inspired downturn, Bitcoin recently dropped following the Fed’s warning of a possible recession. The Fed projected a 2.8% decline in GDP for the first quarter (Q1) of 2025, triggering fears of economic instability. This had influenced investor sentiment negatively.

Despite these warnings, Peterson remains unconvinced that a full-fledged bear market is imminent. He argues that current market conditions are not as euphoric as those of previous bubbles. The analyst also explains that bearish sentiment among investors could indicate a long-term buying opportunity rather than a sell signal.

BeInCrypto data shows Bitcoin was trading for $86,026 as of this writing, down 0.1% since Sunday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoPEPE Price Hits 6-Month Low; Recovery Delayed Further

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Eyes Key Support at $2,350 — Price Surge To Follow?

-

Altcoin20 hours ago

Altcoin20 hours agoCan XRP Become The Cornerstone OF US Global Financial Policy?

-

Market23 hours ago

Market23 hours agoCZ agrees with the idea of merging Broccoli Meme Coins

-

Regulation23 hours ago

Regulation23 hours agoCoinbase Blames FDIC for Refusal to Cooperate in Operation Choke Point 2.0

-

Ethereum13 hours ago

Ethereum13 hours ago330,000 Ethereum Withdrawn From Exchanges In 72 Hours – Supply Squeeze Incoming?

-

Altcoin21 hours ago

Altcoin21 hours agoPi Network Enters This Trillion-Dollar Industry, Pi Coin To Hit $10?

-

Altcoin17 hours ago

Altcoin17 hours agoWhat’s Next for Cardano Price as Bears Take Control Below Key Support?