Market

Bitcoin ETF investors hold strong despite a 25% BTC price drop: Here’s why

- US Bitcoin ETFs collectively manage $115 billion in assets

- Since mid-February, Bitcoin ETFs have witnessed total outflows of nearly $5 billion

- Bitcoin’s decline continues as selling pressure intensifies

Even as Bitcoin’s price has tumbled 25% since the start of 2025, a staggering 95% of investors in US spot Bitcoin ETFs have held firm, resisting the urge to sell.

Despite market volatility and macroeconomic uncertainties, Bloomberg data suggests that the overwhelming majority of ETF holders remain unfazed, showcasing strong conviction in Bitcoin’s long-term potential.

Bitcoin ETFs show resilience

Bloomberg ETF strategist James Seyffart reported that inflows into Bitcoin ETFs have slightly declined to $35 billion, down from their $40 billion peak.

However, this still represents over 95% of investor capital remaining in ETFs, even as Bitcoin’s price struggles.

Institutional investors, including Goldman Sachs, continue to maintain significant exposure, with more than $1.5 billion invested in Bitcoin ETFs.

As of now, US Bitcoin ETFs collectively manage $115 billion in assets, underscoring the staying power of both retail and institutional investors despite the crypto market downturn.

Bitcoin ETF outflows persist

Since mid-February, Bitcoin ETFs have witnessed total outflows of nearly $5 billion.

On March 13 alone, outflows reached $135 million, according to Farside Investors.

However, BlackRock’s iShares Bitcoin Trust (IBIT) remains an exception, attracting net inflows of $45.7 million amid the broader sell-off.

Bitcoin price faces pressure

Bitcoin’s decline continues as selling pressure intensifies due to macroeconomic concerns, including the Trump administration’s ongoing tariff battle.

While BTC briefly surged above $84,000 following the release of US CPI data on Wednesday, it failed to hold above key resistance levels.

At press time, Bitcoin is trading at $81,953, down 1.56% on the day, with daily trading volume dropping 22% to under $30 billion.

According to Coinglass data, 24-hour liquidations have spiked to $75 million, with $52 million in long positions being wiped out.

CryptoQuant CEO Ki Young Ju noted that Bitcoin demand appears “stuck” at current levels but emphasized that it is still “too early to call it a bear market.”

Long-term Bitcoin holders continue accumulating

Despite Bitcoin ETF outflows, on-chain data reveals that long-term holders are accumulating more BTC.

Crypto analyst Ali Martinez reported that these investors have added over 131,000 BTC to their wallets in the past month alone, signaling confidence in Bitcoin’s long-term trajectory.

With Bitcoin’s price volatility and ETF outflows persisting, the coming weeks could be crucial in determining whether investors’ diamond hands will hold firm or if selling pressure will intensify.

Market

Ripple and the SEC Receive 60-Day Pause to Reach Settlement

The SEC and Ripple’s joint motion to pause legal proceedings on their cross-appeal has been approved. Both parties will have 60 more days to agree on how to amicably end their legal battle.

The Ripple case has been moving toward a final resolution for over a month, but procedural hurdles keep the legal battle open. For example, the Commission cannot sign any agreement before Paul Atkins officially takes his seat as Chair.

When Will Ripple and The SEC Reach an Agreement?

The Ripple vs SEC case was one of the largest enforcement actions of the Gensler era, and it’s been wrapping up for over a month now. The Commission signaled that it would drop the case and then fully committed shortly afterward.

One remaining cross-appeal still stands between them and a final agreement, but they both proposed to settle. That proposal has made progress:

“The parties’ joint motion to hold the appeal in abeyance has been granted. The SEC is directed to file a status report within 60 days of this Order,” claimed James Filan, an observing attorney with no direct connection to either party.

Specifically, Ripple and the SEC filed a joint request last week to pause all courtroom appearances related to the cross-appeal. The two parties were making solid progress with an agreement and wished to save time and legal fees.

The SEC also made a similar joint request with Binance, claiming that the two parties had “productive talks” toward a settlement. That request differed slightly from the joint motion filed by Ripple and the SEC, as the Binance filing mentioned broader policy implications.

Still, today’s development shows that things can progress much faster than the 60-day deadlines.

Unfortunately, there are still a few obstacles to a speedy resolution. President Trump nominated Paul Atkins to be the next SEC Chair, and he successfully passed his confirmation hearings. The formal swearing-in ceremony hasn’t actually happened, though.

It’s a formality that could happen at any time, but procedural issues can still hold up the process.

That is to say, Atkins will need to Chair the SEC to approve a settlement with Ripple. The crypto industry is used to a chaotic and fast-paced business environment, but legal proceedings can take a very long time.

Ideally, Atkins could sign a settlement agreement as soon as he takes office. For all we know, however, more minor delays could continue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

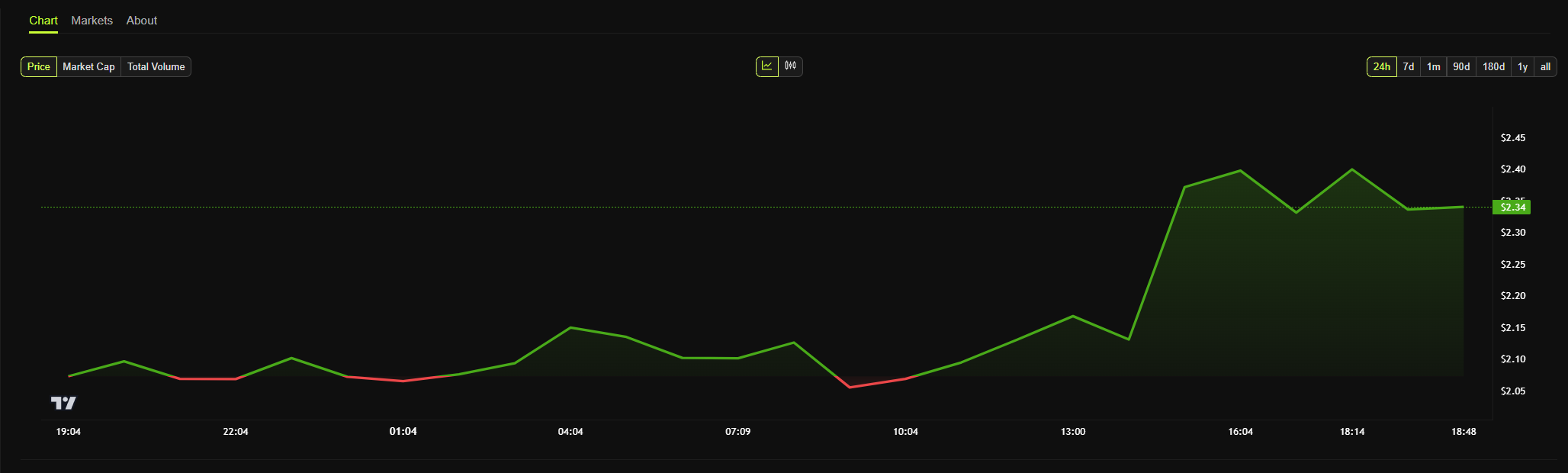

Pi Network Drops10% as Outflows Surge, Death Cross Looms

Pi Network (PI) is down nearly 10% in the last 24 hours, as multiple indicators point to growing bearish momentum. The DMI shows a clear shift from an uptrend to a downtrend, while CMF data confirms increasing outflows.

EMA lines are also warning of a potential death cross, which could trigger further losses. Here’s a breakdown of what the charts are signaling for PI in the near term.

Bearish Momentum Builds as PI Network’s DMI Flips to Downtrend

Pi Network’s (PI) DMI chart reveals a clear shift in momentum, with the ADX dropping from 43.68 to 39.17 over the past two days.

The ADX, or Average Directional Index, measures the strength of a trend, with values above 25 generally indicating a strong trend.

Although the current reading still suggests solid momentum, the recent decline in ADX combined with the trend reversal from uptrend to downtrend signals that bullish strength is fading and bearish pressure is taking control.

Supporting this shift, the +DI (Directional Indicator) has dropped sharply from 22.11 to 13.29, while the -DI has surged from 11.32 to 30.95.

The +DI represents bullish strength, and the -DI represents bearish strength—so this crossover and widening gap confirm that sellers are now in control. This setup typically points to continued downside, especially if the -DI remains dominant and the ADX stabilizes or rises again, signaling a strengthening bearish trend.

Unless there’s a sharp reversal in these indicators, PI could remain under pressure in the near term.

Selling Pressure Intensifies as Outflows Accelerate on PI Network

Pi Network’s Chaikin Money Flow (CMF) has dropped sharply to -0.13, down from 0.07 just a day ago. The CMF is a volume-based indicator that measures the flow of money in and out of an asset over a set period.

It ranges from -1 to +1, with positive values indicating buying pressure and negative values suggesting selling pressure.

A sudden shift from positive to negative typically signals a change in sentiment and potential weakness ahead.

With the CMF now at -0.13, it suggests that outflows are picking up and sellers are becoming more active.

This kind of drop often reflects reduced demand and a lack of confidence from buyers, especially if it comes alongside declining prices or weakening momentum indicators.

If the CMF remains in negative territory, it could point to sustained bearish pressure and a risk of further downside for PI unless strong inflows return soon.

Will PI Fall Below $0.50?

Pi Network’s EMA lines are signaling a potential death cross, where the short-term moving average crosses below the long-term moving average.

This is typically seen as a bearish sign, often preceding further downside. If confirmed, it could lead PI to retest the support level at $0.54.

A break below that level may open the door for a move under $0.50, especially if overall momentum continues to weaken, as analysts warn about Pi Network transparency after Mantra’s OM token collapse.

However, if the trend reverses and buyers step back in, PI price could regain strength and push toward the resistance at $0.66.

A breakout above that level would be an early sign of renewed bullish momentum.

If that move holds and gains traction, the next key target would be $0.789, which could be a major test of the strength of the recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Raydium’s New Token Launchpad Competes with Pump.fun

Raydium is releasing LaunchLab, a new token launchpad to compete with Pump.fun. The exchange announced this platform last month, and its full release has sparked community enthusiasm.

Pump.fun and Raydium have been locked in an intense competition in the Solana ecosystem. Last month, Pump.fun launched its own decentralized exchange, and now Raydium has introduced its own launchpad.

Raydium Increases Solana Dominance with new Launchpad

Raydium, Solana’s largest decentralized exchange, has the opportunity to make some serious gains in the near future. Solana meme coins are eyeing a comeback with heightened trade volumes and rising token prices, and the firm is releasing a long-awaited project.

Although it will compete with Pump.fun, Raydium’s launchpad services look more extensive. They will allow all kinds of tokens to be launched, not just meme coins, and these tokens can be directly traded on the exchange.

“Introducing LaunchLab, Raydium’s all-in-one token launchpad. Built for creators, developers, and the community. Get started with JustSendIt mode: launch a token, hit 85 SOL, [and] liquidity migrates to Raydium’s AMM INSTANTLY. Seamless, on-chain token creation. No migration fee. No gatekeepers,” the firm claimed in its launch announcement.

Pump.fun is the most popular meme coin launchpad on Solana, and its business has been intertwined with Raydium in a few ways. Since it launched Pumpswap, its own DEX, both exchanges have fueled a meme coin frenzy.

A month and a half ago, rumors that it was testing an AMM made Raydium’s RAY token drop significantly.

Last month, however, this same asset soared when Raydium first announced Launchpad. Pump.fun entered the DEX sector, and Raydium is enabling users to launch their own meme coins.

Since this launch announcement took place, RAY spiked around 10%, signifying the community’s enthusiasm.

There may be another explanation for this token rally in addition to community hype. Raydium also mentioned that all of Launchpad’s trading fees will go towards ecosystem development.

More specifically, 25% of these fees will directly fund buybacks of RAY tokens, while the other 75% go towards a Community Pool and Program fee.

These other funds can enable a few generous user incentives. Raydium claimed that Launchpad token creators can earn up to 10% of trading fees from the AMM pool post-graduation, and users can also receive SOL tokens from referring new clients. Token creators will also enjoy several other quality-of-life features.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market21 hours ago

Market21 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market20 hours ago

Market20 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market18 hours ago

Market18 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market17 hours ago

Market17 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market19 hours ago

Market19 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market15 hours ago

Market15 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Market24 hours ago

Market24 hours agoNew USDi Stablecoin Pegged to US Inflation Metrics