Market

Bitcoin ETF Holdings Dip Below Satoshi As Outflows Continue

Bitcoin ETF outflows have nearly amounted to $750 million in the last two days as the crypto market consistently fell. BlackRock, the largest issuer, has offloaded around 2,000 BTC in the previous 24 hours.

Together, the ETF issuers sold off enough BTC that they collectively hold less than Satoshi. They surpassed him three months ago and continued buying huge amounts of Bitcoin, indicating truly massive sales.

Bitcoin ETF Outflows Continue

Since the Bitcoin ETFs first got SEC approval last year, they’ve had a transformative impact on the market. Lately, however, they’ve been turning bearish.

Towards the end of February, the market saw $2.7 billion in outflows, and this trend continued. The last four consecutive weeks had outflows, and the market already lost nearly $750 million this week alone.

This marks the seventh consecutive day of outflows for this ETF market. IBIT, BlackRock’s product, led these losses with $151 million in the last 24 hours.

In mid-February, some analysts began speculating that BlackRock would begin selling its Bitcoin, and ETF analyst Shaun Edmondson noticed how large of a trend it’s becoming:

“I know the markets are very ‘risk off’ at the moment with the Tariff uncertainty, but this is yet another outflow day from the US Spot ETFs, collectively now falling below Satoshi again. Given the bullish narrative from the SEC, Strategy raising 21 billion, State [Bitcoin Reserve] race and National [Bitcoin Reserve] bill, I find this a little surprising,” Edmondson claimed.

BlackRock alone has offloaded around 2,000 BTC since Edmondson posted yesterday’s daily tallies. It’s unclear how far the ETF issuers want to take this trend, but these Bitcoin sales are very concerning.

These issuers surpassed Satoshi’s Bitcoin holdings in December, so these outflows have already eaten up three months’ worth of vociferous purchasing.

Still, despite this ETF pessimism, Bitcoin’s actual price could be doing a lot worse. The entire crypto market has been hit with massive outflows, and BTC fell accordingly.

However, the US CPI report this morning was better than anticipated, which allowed Bitcoin a little breathing room. It’s anyone’s guess, however, how long this reprieve will actually last.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

XRP price started a fresh increase above the $2.20 resistance. The price is now correcting gains and might find bids near the $2.050 zone.

- XRP price started a downside correction from the $2.250 resistance zone.

- The price is now trading below $2.120 and the 100-hourly Simple Moving Average.

- There was a break below a connecting bullish trend line with support at $2.140 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if there is a close below the $2.050 support zone.

XRP Price Dips Again

XRP price started a fresh increase above the $1.980 resistance, like Bitcoin and Ethereum. The price climbed above the $2.020 and $2.050 resistance levels.

A high was formed at $2.244 and the price recently started a downside correction. There was a move below the $2.120 support zone. Besides, there was a break below a connecting bullish trend line with support at $2.140 on the hourly chart of the XRP/USD pair.

The price even spiked below the 50% Fib retracement level of the upward move from the $1.920 swing low to the $2.244 high. The price is now trading below $2.120 and the 100-hourly Simple Moving Average.

On the upside, the price might face resistance near the $2.120 level. The first major resistance is near the $2.180 level. The next resistance is $2.20. A clear move above the $2.20 resistance might send the price toward the $2.250 resistance. Any more gains might send the price toward the $2.320 resistance or even $2.350 in the near term. The next major hurdle for the bulls might be $2.50.

Another Decline?

If XRP fails to clear the $2.120 resistance zone, it could start another decline. Initial support on the downside is near the $2.050 level and the 61.8% Fib retracement level of the upward move from the $1.920 swing low to the $2.244 high. The next major support is near the $2.00 level.

If there is a downside break and a close below the $2.00 level, the price might continue to decline toward the $1.920 support. The next major support sits near the $1.840 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.050 and $2.00.

Major Resistance Levels – $2.120 and $2.180.

Market

Ethereum Leads Q1 2025 DApp Fees With $1.02 Billion

In Q1 2025, Ethereum solidified its leading position in the decentralized application (DApp) platform sector, generating $1.021 billion in fee revenue.

Other networks such as Base (Coinbase’s Layer-2), BNB Chain, Arbitrum, and Avalanche C-Chain also recorded significant revenue but lagged far behind Ethereum.

Fee Revenue Landscape Among Blockchains

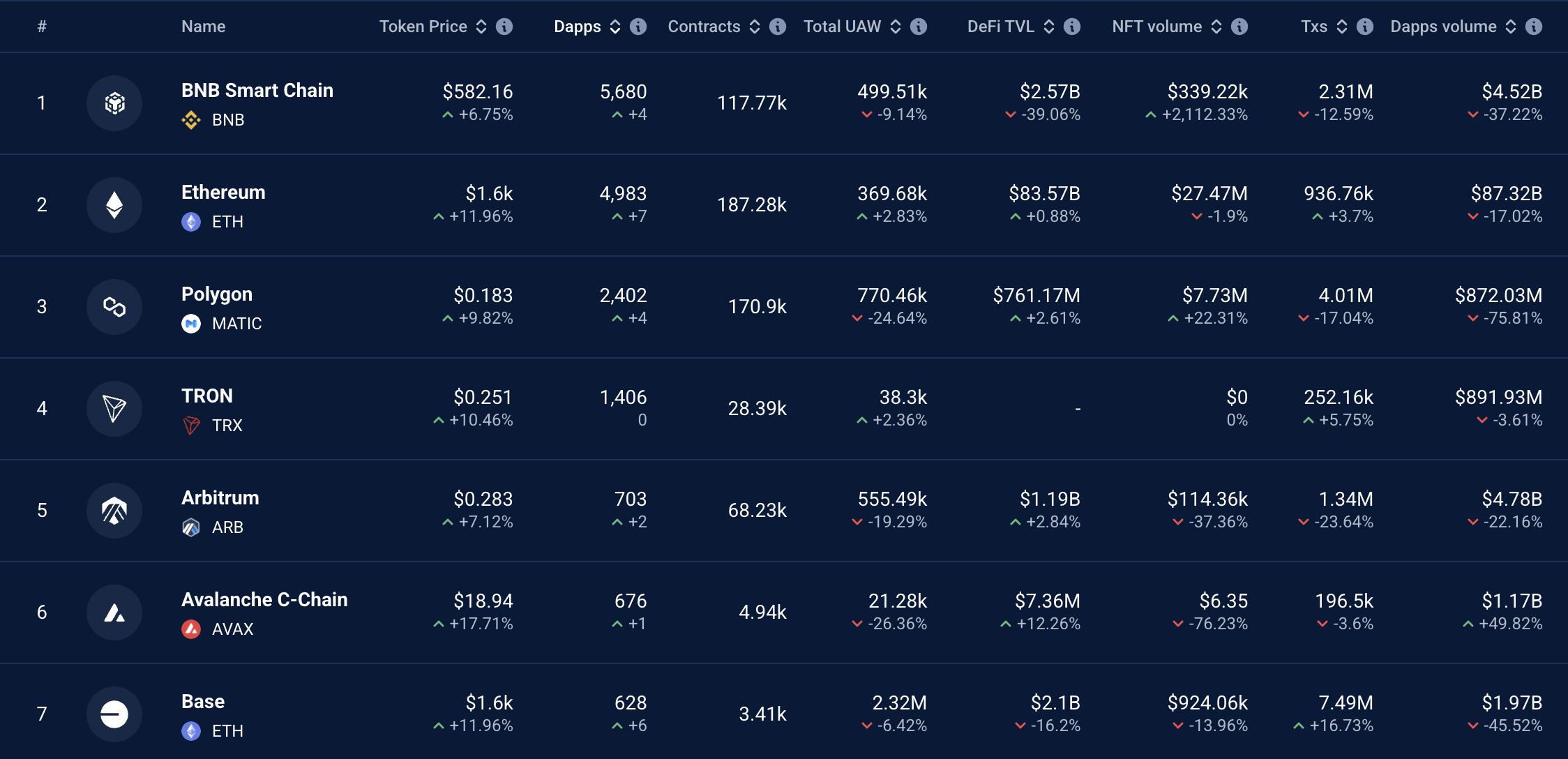

According to Token Terminal, Ethereum maintained its top position among DApp platforms, with DApp fee revenue reaching $1.021 billion in Q1 2025. This figure highlights Ethereum’s dominance and strong growth within the DApp ecosystem.

Base, a Coinbase Layer-2 network, ranked second with $193 million in DApp fee revenue, showing notable growth but still trailing Ethereum. BNB Chain followed in third with $170 million, Arbitrum with $73.8 million, and Avalanche C-Chain in fifth with $27.68 million.

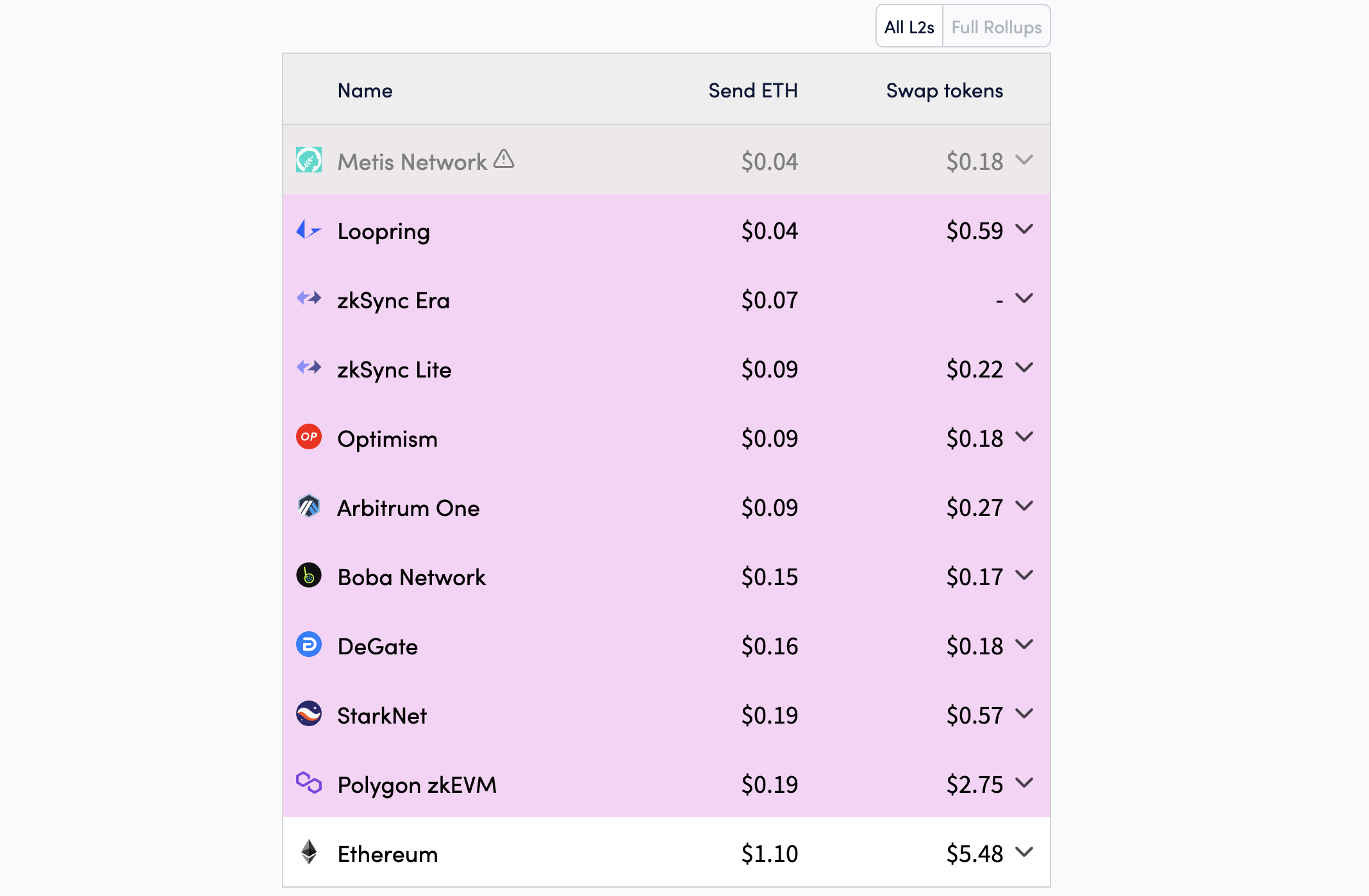

DApp fee revenue is a key metric for measuring a blockchain’s activity and user value. On Ethereum, popular DApps include DeFi protocols like Uniswap and Aave, NFT platforms like OpenSea, blockchain games, and social applications. The growth in Ethereum’s DApp fee revenue indicates sustained high demand for these applications despite competition from other networks and often high transaction costs (gas fees) on the mainnet.

Why Ethereum Leads

Several factors explain Ethereum’s continued leadership in DApp fee revenue. Firstly, Ethereum was the first blockchain to support smart contracts, laying the foundation for its DApp ecosystem. According to DappRadar data, Ethereum remains the blockchain with the largest DApps, hosting over 4,983 active DApps, below the BNB Chain.

Second, Ethereum’s high security and reliability make it the preferred choice for developers and users. Despite high mainnet transaction costs, Ethereum has improved performance through upgrades like Dencun (implemented in 2024), which reduced costs on Layer-2 networks and enhanced scalability.

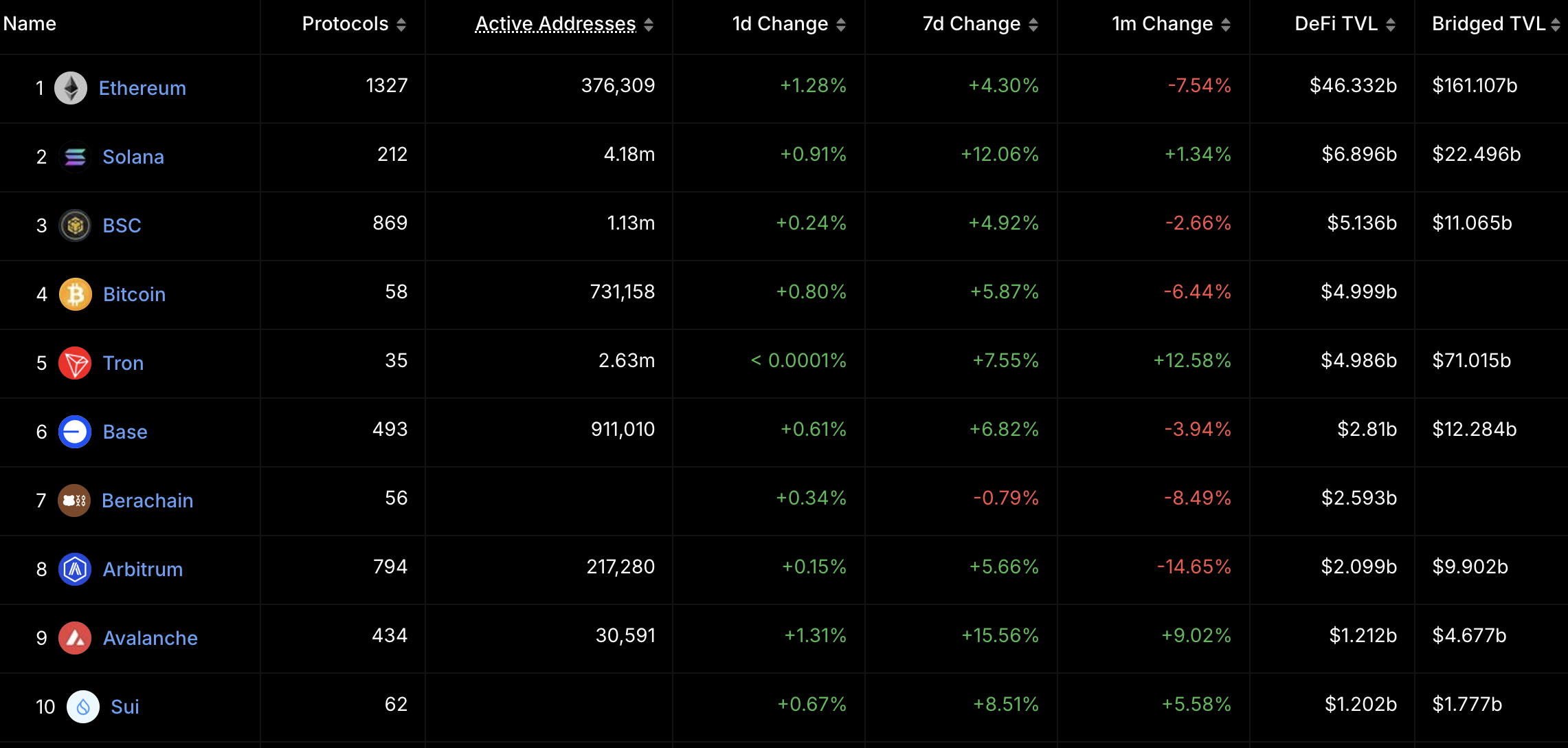

Third, Ethereum’s DeFi ecosystem remains a primary driver of fee revenue. According to DefiLlama, the Total Value Locked (TVL) in Ethereum’s DeFi protocols reached $46 billion, representing 51% of the total TVL in the DeFi market.

While Ethereum leads, other networks are also showing significant growth. According to Token Terminal, Base, Coinbase’s Layer-2, generated $193 million in DApp fee revenue, a 45% increase from Q4 2024.

BNB Chain, with $170 million, remains a strong competitor due to low costs and a diverse DApp ecosystem, including platforms like PancakeSwap. Arbitrum, another Ethereum Layer-2, recorded $73.8 million, driven by the expansion of DeFi and blockchain gaming DApps. With $27.68 million, Avalanche C-Chain excels in finance and NFTs but cannot match Ethereum’s scale.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price on The Brink? Signs Point to Renewed Decline

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

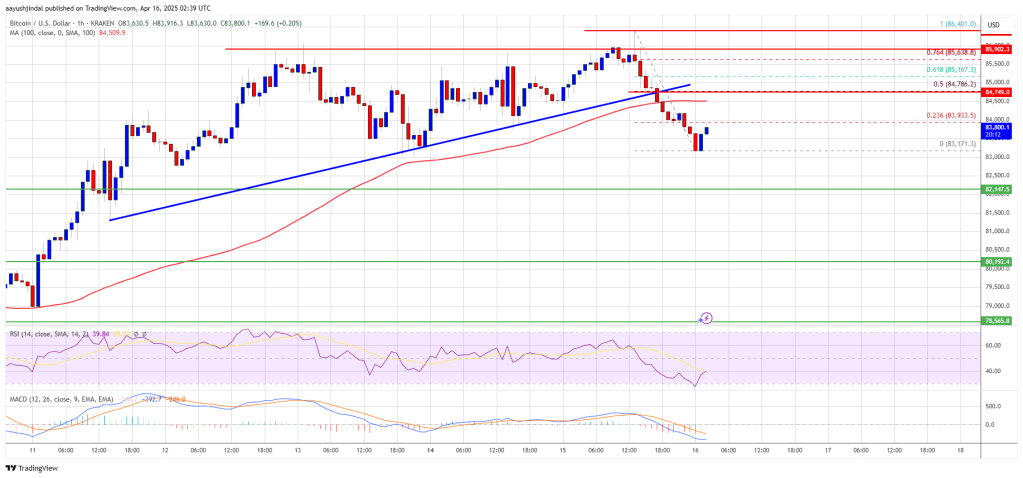

Bitcoin price started a fresh decline from the $86,500 zone. BTC is now consolidating and might continue to decline below the $83,200 support.

- Bitcoin started a fresh decline from the $86,500 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There was a break below a connecting bullish trend line with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $84,500 zone.

Bitcoin Price Faces Rejection

Bitcoin price started a fresh increase above the $83,500 zone. BTC formed a base and gained pace for a move above the $84,000 and $85,500 resistance levels.

The bulls pumped the price above the $86,000 resistance. A high was formed at $86,401 and the price recently corrected some gains. There was a move below the $85,000 support. Besides, there was a break below a connecting bullish trend line with support at $84,500 on the hourly chart of the BTC/USD pair.

The price tested the $83,200 support. Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $84,000 level and the 23.6% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

The first key resistance is near the $84,500 level. The next key resistance could be $84,750 and the 50% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

A close above the $84,750 resistance might send the price further higher. In the stated case, the price could rise and test the $85,500 resistance level. Any more gains might send the price toward the $86,400 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,000 resistance zone, it could start another decline. Immediate support on the downside is near the $83,500 level. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $83,200, followed by $82,200.

Major Resistance Levels – $84,750 and $85,500.

-

Market20 hours ago

Market20 hours agoCan Pi Network Avoid a Similar Fate?

-

Market23 hours ago

Market23 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Ethereum24 hours ago

Ethereum24 hours agoSEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

-

Market22 hours ago

Market22 hours agoCardano Buyers Eye $0.70 as ADA Rallies 10%

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market19 hours ago

Market19 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Altcoin15 hours ago

Altcoin15 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance