Market

Bitcoin (BTC) Resilience Driven by Whale Accumulation and Key Support

Last Friday, Bitcoin’s price fell from $72,000 to $69,000, causing a 10% average drop across many cryptocurrencies.

This sharp decline has caused the market to be concerned, leading to questions about what’s driving these changes and how investors are reacting. To better understand what might happen next, we’re looking at on-chain data for clearer insights.

Bitcoin’s Whale Activity: Insights Into the Market’s Silent Movers

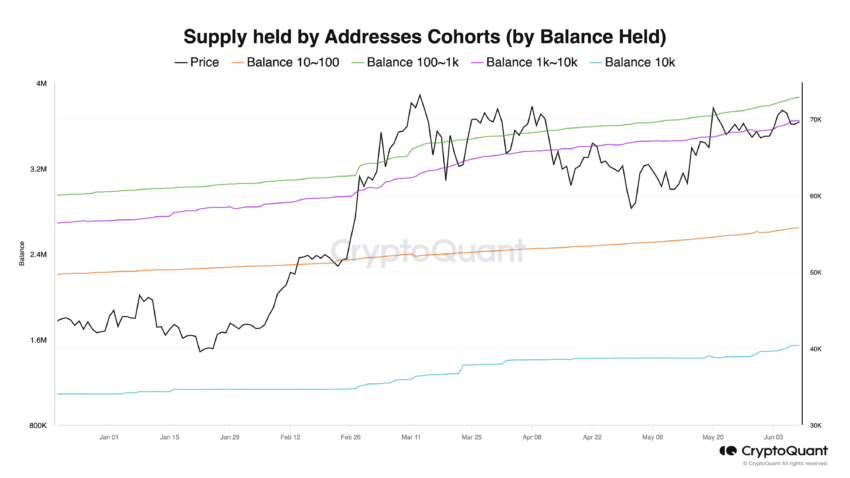

The on-chain data indicates that whales, the large holders of Bitcoin, are not only retaining their holdings but are also increasing their supply. This strategic accumulation during price dips suggests that these influential market players view the current lower prices as favorable buying opportunities.

Their actions can significantly impact market sentiment and price stabilization, hinting that they may foresee a potential rebound or at least do not expect further significant declines in the short term.

The changes in Bitcoin balance across different cohorts show notable increases.

Specifically, addresses holding 100 to 1,000 BTC saw an increase of 30,601 BTC, those with 1,000 to 10,000 BTC increased by 34,834 BTC, and the largest holders, those with over 10,000 BTC, increased their balances by 24,176 BTC.

These significant increases suggest that larger Bitcoin holders are accumulating more BTC during the recent market correction.

BTC Current Price: Watching the Critical Support Level

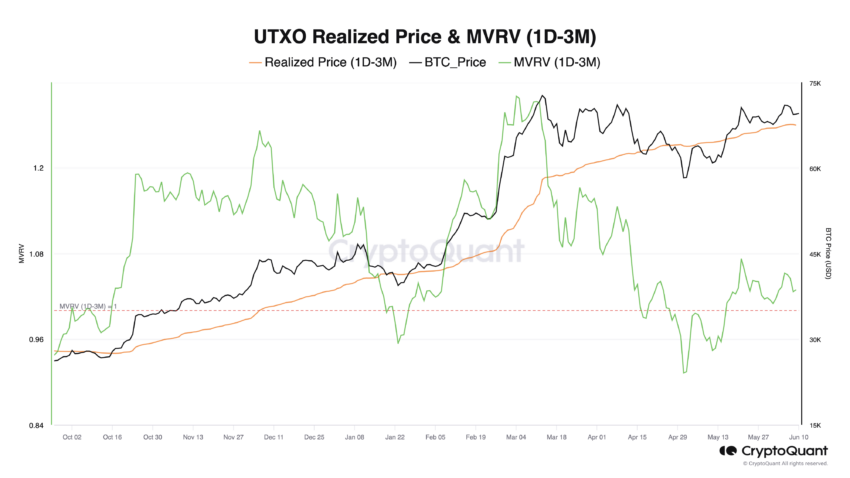

The average acquisition price for Bitcoin bought between one day and three months ago is $67,500. Bitcoins bought within this timeframe account for 17% of the total circulating supply.

Should the price fall below this level, it could potentially initiate a cascade of sell-offs as investors rush to minimize losses.

If the price falls below the $67,500 level, it may find support in the $61,000 – $62,000 range, which aligns with the realized price of significant wallet cohorts.

The “realized price” is a financial metric that estimates the average cost at which all Bitcoins in circulation were last moved or transacted. Unlike the “market price,” which fluctuates based on trading activity, the realized price provides insight into what investors paid for their holdings, aggregating this data across all Bitcoins.

If the market price falls below the realized price, it could indicate that, on average, 17% of the circulating Bitcoin supply is held at a loss. This situation might prompt selling pressure as investors attempt to minimize their losses.

On the other hand, if the market price remains above this realized price, 17% of the Bitcoin supply will be in profit. This incentivizes holders to retain their positions for extended periods, potentially signaling a positive trend for the market.

A price surge toward the $72,000 level could be decisive this time, potentially leading to an all-time high breakout in the mid-term.

As detailed in the analysis, this scenario is plausible if Bitcoin can hold its position above the $67,500 support level.

The post Bitcoin (BTC) Resilience Driven by Whale Accumulation and Key Support appeared first on BeInCrypto.

Market

XRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

Renowned market analyst Egrag Crypto has shared another puzzling XRP price prediction stating the altcoin is at a major technical crossroads. This development follows a resilient price performance in the past week during which XRP gained by 2.07% as the broader crypto market stands bullish despite the announcement of new US trade tariffs.

Ascending Wedge Signals Incoming Volatility — Which Way Will XRP Break?

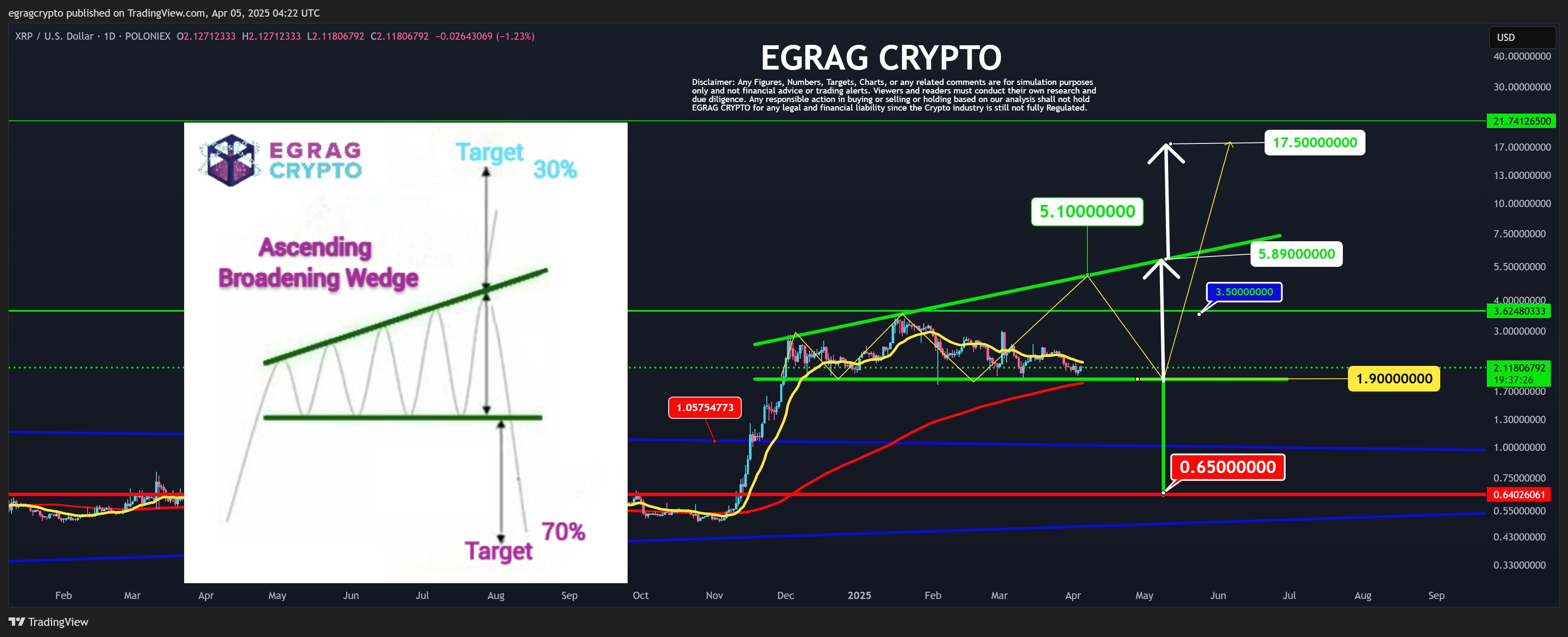

In an X post on April 5, Egrag Crypto issued a dual price forecast on the XRP market based on the potential implications of a forming Ascending Broadening Wedge pattern. Also known as the megaphone pattern, the chart formation signals increasing volatility and investor indecisions. It looks like a widening triangle with two diverging trendlines, as seen in the chart below.

The Ascending Broadening Wedge presents high unpredictability and offers a 70% chance of a downside breakout and a 30% probability of an upside breakout. However, despite this statistical bias, the analyst postulates the chances of an upside remain valid if certain conditions are met.

According to the analyst, XRP must first close above $3.50 for a bullish scenario to start taking shape. In doing so, the altcoin would surpass the local peak of the current bull cycle and confirm intentions of an upward momentum. Following this move, XRP bulls should then aim for the $5 range—another key resistance level that could determine the asset’s next major move.

Interestingly, Egrag explains that a failure to convincingly close above $5 would only be a critical development that completes the formation of the Ascending Wedge Pattern and increases the likelihood of a breakout. If this rejection occurs, XRP is expected to retest the $1.90 area and make a second push toward the $5, this time breaking through and closing above $6.

Egrag states the breakout above $6 would validate the bullish run and likely spark a surge toward double-digit territory with a potential target at $17.50 based on the Ascending Wedge Pattern. However, should XRP bulls fail to meet these conditions or follow this sequence, the historical 70% chance of a breakdown points to a downside target of around $0.65.

XRP Price Overview

At the time of writing, XRP trades at $2.14 reflecting a price gain of 0.60% in the past day. Meanwhile, the token’s trading volume is down by 62.92% in the past day indicating a fall in market engagement and a declining buying pressure following the recent market gain. In making any significant uptrend, XRP bulls must first reclaim the following resistances at $2.47 and $2.61 while avoiding any slip below the $2 support zone.

Market

Solana Altcoin Saros Rallies 1000% Since March, Hits New High

Saros, the Solana-based altcoin, has been on an impressive uptrend over the past month. The token’s price has formed new all-time highs (ATHs) nearly every day throughout March.

However, with the momentum showing signs of slowing, investors are wondering if this rally is nearing its end.

SAROS Refrains From Following Bitcoin

The correlation between Saros and Bitcoin (BTC) is currently negative, sitting at -0.43. This negative correlation has worked in Saros’ favor, as it allowed the altcoin to perform well during Bitcoin’s struggles throughout March. While Bitcoin faced significant declines, Saros was able to rally largely due to this inverse relationship.

The shifting dynamics between Bitcoin and Saros will be key to the future price movement of the altcoin. Should Bitcoin regain its upward momentum, Saros may face increased selling pressure. This is because the negative correlation that has benefited Saros may reverse, impacting the altcoin’s ability to maintain its upward trajectory.

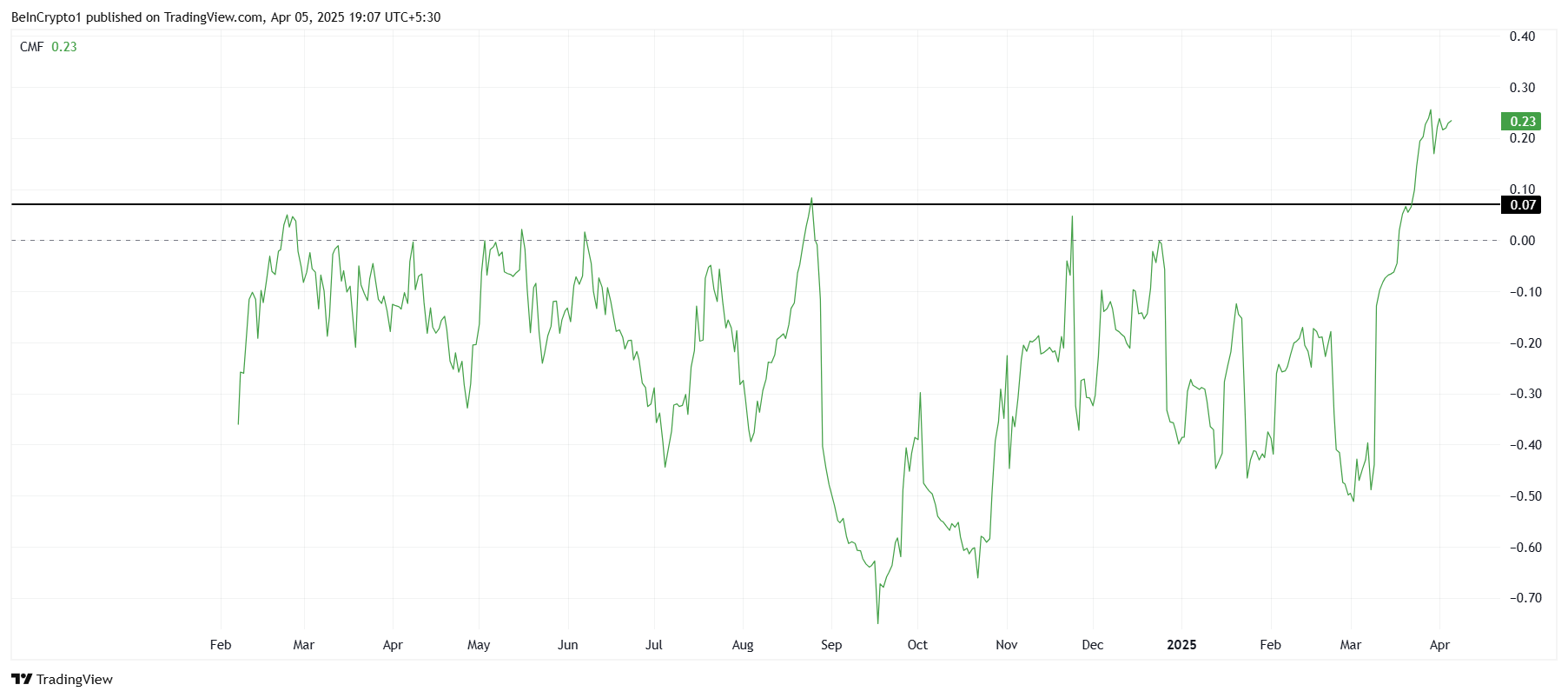

The overall macro momentum of Saros shows that investor interest has remained strong. The Chaikin Money Flow (CMF) indicator has been increasing steadily over the past month, signaling consistent inflows.

Recently, it crossed the saturation threshold of 0.7, a level that has historically led to price corrections. This suggests that while Saros has experienced significant gains, the market may be nearing an overbought condition. If profit-taking begins, a price pullback is highly probable for the altcoin.

SAROS Price Rise Continues

Saros has surged by an astounding 1,024% since the beginning of March, trading at $0.153 as of now. Throughout March, the altcoin has formed new ATHs almost daily, reflecting strong investor sentiment and demand.

The current ATH stands at $0.163, and the momentum could continue pushing the price upwards, potentially reaching $0.200 if the uptrend remains intact. However, as the price continues to rise, the risk of profit-taking increases.

If Saros faces such a pullback, it could fall back towards the $0.100 support level. If the altcoin loses this key support, the price could drop further to $0.055, invalidating the bullish outlook. Investors should keep an eye on these levels as they will help determine whether the current rally is sustainable.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Key Levels To Watch For Potential Breakout

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

-

Market18 hours ago

Market18 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Risks 15% Drop If It Doesn’t Reclaim Key Resistance

-

Market23 hours ago

Market23 hours agoPi Network Hits New Low, Then Rallies 36%—What’s Next?

-

Market22 hours ago

Market22 hours agoEthereum Transaction Fees Hit Lowest Level Since 2020

-

Market19 hours ago

Market19 hours agoSEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

-

Bitcoin18 hours ago

Bitcoin18 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Ethereum17 hours ago

Ethereum17 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?