Market

Binance to Launch EIGEN Spot Trading With Zero Fees

Binance, the largest crypto exchange by trading volume, announced plans to list EIGEN, opening trading for a select list of spot trading pairs.

EIGEN is the native token for the EigenLayer ecosystem, a leading restaking protocol on the Ethereum blockchain.

Binance Introduces EigenLayer Spot Trading

Users will be able to trade EIGEN against BTC, USDT, FDUSD, and TRY starting Tuesday, October 1, at 05:00 UTC. Before then, however, EIGEN holders can already deposit the token in preparation for trading, with withdrawals available starting Wednesday.

Notably, the new listing will feature zero fees, allowing users to trade the token without incurring costs — an approach often used by exchanges to attract more activity.

However, Binance has cautioned that EIGEN, as a relatively new token, carries higher-than-normal risk and may experience significant price volatility. To reflect this, Binance will apply a seed tag, a special identifier to distinguish EIGEN from other tokens.

Read more: Top 5 Spot Trading Crypto Exchanges

This listing highlights Binance’s interest in providing diverse trading options for its users and enhances Binance’s foray into the liquid staking space. Liquid staking tokens enable holders to earn yield against the underlying token while participating in decentralized finance (DeFi) activities like lending and borrowing. LSTs also help secure the blockchain through staking.

Meanwhile, EigenLayer remains dominant in Ethereum restaking. A recent report from CoinGecko noted that EigenLayer’s restaking contributed to the Ethereum ecosystem’s achievement in Q1 2024.

Since September 7, the total value locked (TVL) on EigenLayer has increased by over $1.5 million. This suggests users are depositing funds on the platform, which can lead to increased liquidity, popularity, and usability — key factors for a project’s success.

Currently, TVL on EigenLayer is $11.982 billion, signifying more capital locked in the DeFi protocol, offering participants greater benefits and returns.

Read more: What Is Liquid Staking in Crypto?

Other exchanges reportedly in the lineup to list EIGEN include Bybit, MEXC, Gate.io, and Kraken. The token is already available for pre-market trading in some of these platforms. Meanwhile, Tanaka, a contributor at Hashflow, said this listing could benefit related projects.

“EIGEN will be listed on centralized exchanges on 1/10. Maybe tomorrow, major exchanges like Binance, Kucoin, and OKX will announce it. I’m bidding on some LRT project,” Tanaka wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Altcoins to Watch in the Fourth Week of April 2025

The crypto market has shown consistent growth over the past few days, helping altcoins alongside Bitcoin to recover. However, relying solely on broader market cues or momentum will not sustain price growth.

BeInCrypto has analyzed three altcoins for investors to watch in April, as important developments are set to unfold this week.

Tutorial (TUT)

TUT price has remained stable throughout most of the month, currently hovering below the $0.027 resistance level. Successfully breaching this barrier is crucial for recovering the 53% losses incurred in March. A price rise above $0.027 could signal a positive trend and further upward movement in the coming weeks.

If this trend continues, TUT could push toward the next resistance level of $0.039, indicating strong momentum.

However, if TUT fails to break above the $0.027 resistance, the price could decline below $0.021. Such a drop would likely invalidate the bullish outlook and lead to further losses. In that scenario, the altcoin’s price might fall to $0.015, a significant setback for the token’s recovery.

Injective (INJ)

Injective’s price has surged by 17% in recent days, fueled by anticipation surrounding the upcoming Lyota Mainnet Upgrade. Set to go live on April 22, the upgrade is expected to enhance Injective’s infrastructure, performance, and transaction speeds. This has sparked optimism, driving the price higher in the short term.

Currently trading at $8.97, Injective is nearing the $9.11 resistance level. If it successfully breaches this barrier, the price could move beyond $10.00, potentially reaching $10.35. The positive sentiment surrounding the Lyota Mainnet Upgrade is likely to continue driving the token’s growth if it can surpass these levels.

However, if Injective fails to break through the $9.11 resistance, as seen earlier in April, the price could fall below $8.40. This would signal a retreat and could see the token dip to $7.64, invalidating the bullish outlook and erasing recent gains.

BNB

BNB’s price currently stands at $604, experiencing a two-month downtrend. The altcoin is struggling to breach the resistance of $611. To push past this barrier, BNB needs strong support from the broader market or upcoming developments that could provide a catalyst for price movement and reversal.

One potential catalyst is the Lorentz opBNB mainnet hard fork, which is scheduled for today. The hard fork aims to enhance the chain’s speed and responsiveness. If successful, this could help BNB break the $611 resistance and push the price toward the next level of $647, spurring bullish sentiment.

However, if the hard fork’s impact fails to meet expectations, BNB could struggle to maintain upward momentum. In this case, the price may slip below the support of $576, potentially falling as low as $550. This would invalidate the current bullish outlook and likely continue the downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Will it Impact OM Price?

MANTRA CEO, JP Mullin, is burning 150 million OM tokens from his own allocation and engaging other ecosystem partners to burn an additional 150 million tokens. This 300 million OM token burn aims to restore investor trust in the project and stabilize the altcoin’s price dynamics.

OM is attempting to recover from one of the most dramatic crashes in recent crypto history. On April 13, it lost over 90% of its value in a single hour. The collapse, which erased more than $5.5 billion in market cap, triggered widespread accusations of insider activity and manipulation within the Real-World Assets (RWA) sector.

Understanding MANTRA’s Token Burn

Mantra, once one of the biggest players in the Real-World Assets (RWA) sector, suffered a dramatic collapse on April 13, with its token crashing over 90% in less than an hour and wiping out more than $5.5 billion in market capitalization.

The plunge followed a rapid surge earlier this year, when OM rose from $0.013 to over $6, pushing its fully diluted valuation to $11 billion. The crash was reportedly triggered by a $40 million token deposit into OKX by a wallet allegedly linked to the team, sparking fears of insider selling.

Panic spread quickly as rumors of undisclosed OTC deals, delayed airdrops, and excessive token supply concentration fueled mass liquidations across exchanges.

Despite co-founder John Patrick Mullin denying any wrongdoing and blaming centralized exchanges for forced closures, investors and analysts raised concerns about potential manipulation by market makers and CEXs, drawing comparisons to past collapses like Terra LUNA.

In an effort to rebuild trust, Mullin has announced the permanent burn of his 150 million OM team allocation. The tokens, originally staked at mainnet launch in October 2024, are now being unbonded and will be fully burned by April 29, reducing OM’s total supply from 1.82 billion to 1.67 billion.

This move also lowers the network’s staked amount by 150 million tokens, which could impact on-chain staking APR.

Additionally, MANTRA is in talks with partners to implement a second 150 million OM burn, potentially cutting the total supply by 300 million tokens.

OM Price Faces Critical Test as Token Burn Battles Lingering Market Doubt

Despite MANTRA’s ongoing token burn efforts, it’s still uncertain whether the move will be enough to fully restore investor confidence in OM.

From a technical standpoint, if momentum begins to recover, OM could test the immediate resistance at $0.59. A successful breakout at that level may pave the way for further gains toward $0.71, with additional key hurdles at $0.89 and $0.997 standing between the token and a return to the psychologically important $1 mark.

However, reclaiming these levels will likely require sustained buying interest and broader sentiment recovery across the Real-World Assets (RWA) sector.

On the downside, if the token burn fails to shift sentiment or if selling pressure continues, OM risks resuming its decline.

The first key support lies at $0.51, and a breakdown below that level could send the price further down to $0.469.

Given the scale of the recent crash and the lingering distrust among investors, the path to recovery remains fragile—OM now sits at a critical crossroads between a potential rebound and further erosion of its market value.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Strategy’s 12% YTD Yield and $555M Acquisition

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts say about Bitcoin’s (BTC) price amid recovery efforts. The status of Bitcoin as a hedge against inflation and economic uncertainty is progressively becoming questionable, with institutional influence adding to the concerns.

Can Strategy’s $555 Million BTC Purchase Send Bitcoin Past $90,000?

Michael Saylor, the chairman of Strategy (formerly MicroStrategy), revealed the firm’s latest Bitcoin purchase, comprising 6,556 BTC tokens worth approximately $555.8 million. With this, the firm has attained a Bitcoin yield of 12.1% year-to-date (YTD) in 2025.

“MSTR has acquired 6,556 BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved BTC Yield of 12.1% YTD 2025. As of 4/20/2025, Strategy holds 538,200 BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin,” Saylor shared.

Strategy uses the Bitcoin Yield YTD to measure the BTC holdings per share increase. This model has been a key part of their financial strategy firm since their first Bitcoin purchase in August 2020.

This acquisition aligns with a bullish market sentiment for Bitcoin, which is steadily nearing the $90,000 milestone, as the recent US Crypto News indicated.

Despite a mild recovery in Bitcoin prices this week, up by over 3% in the last 24 hours, it is worth noting that Bitcoin is highly sensitive to economic indicators.

Similarly, the global market is highly sensitive to monetary policies set by major economies, particularly the US. BeInCrypto contacted Paybis founder and CEO Innokenty Isers for insights on the current market outlook, particularly for Bitcoin.

“Given the strong concentration of investors in technology stocks, shifts in trade policies and government interventions that influence key indices like the Nasdaq Composite create ripple effects across financial markets,” Isers told BeInCrypto.

According to the Pybis executive, since the US Presidential inauguration, the outlook of Bitcoin has changed from a trusted hedge against inflation to a more risk-on asset.

“With its relatively higher volatility, risk-averse investors may favor alternative inflation hedges instead of Bitcoin,” he added.

Iners expressed cognizance of the longer stretch of the trade war and the potential inflation that will emerge. Based on this, he noted that capital allocation to Bitcoin as a hedge against economic instability might be reduced.

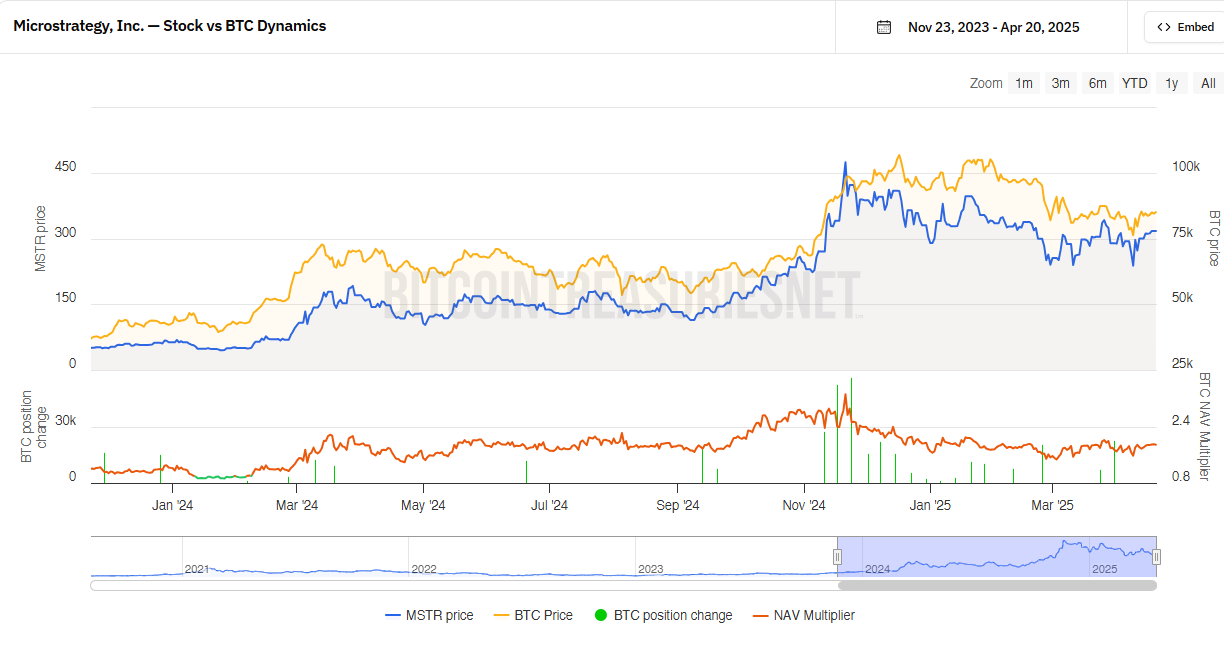

Strategy’s Stock Premium Narrows as Bitcoin Hype Cools

Meanwhile, Strategy has seen a significant shift in its stock valuation dynamics over the past year. Saylor recently revealed that as of Q1 2025, over 13,000 institutions and 814,000 retail accounts held MSTR directly.

“An estimated 55 million beneficiaries have indirect exposure through ETFs, mutual funds, pensions, and insurance portfolios,” Saylor added.

According to data on Bitcointreasuries.net, the premium investors once paid for exposure to its Bitcoin holdings has notably narrowed.

Specifically, the NAV multiplier, a measure of how much the stock trades above the value of Strategy’s Bitcoin assets, has decreased compared to last year. This indicates that MSTR is now trading closer to the actual value of its Bitcoin reserves.

In 2024, investors were willing to pay a substantial premium for MSTR shares, driven by Bitcoin’s hype and MicroStrategy’s aggressive accumulation strategy.

“I don’t know if buying strategy equity is a good idea for the government. The stock would just pump, and it’s likely trading at a premium over NAV with a higher risk profile. Also, I believe the gov will find it difficult to find institutions that would be willing to sell their BTC in large quantities,” an analyst said recently.

The shrinking NAV multiplier suggests a more cautious market sentiment. Analysts believe this reflects a shift toward valuing MicroStrategy based on its fundamentals rather than speculative Bitcoin enthusiasm.

This suggests a maturing market approach to the company’s unique investment strategy.

Chart of the Day

This chart shows how Strategy’s stock price (blue) moves with Bitcoin price (orange). When Bitcoin goes up, MicroStrategy usually follows, but it swings even more.

However, the NAV multiplier has narrowed compared to last year, meaning MicroStrategy’s stock is now trading closer to the actual value of its Bitcoin holdings.

Last year, investors paid a bigger premium for exposure to MSTR, but that gap has shrunk. This suggests a more cautious sentiment or a shift toward valuing the company based on fundamentals rather than just Bitcoin hype.

Byte-Sized Alpha

- Bitcoin ETFs saw modest $15 million inflows, a shift from the previous $713 million outflows, but the smallest influx of 2025, signaling cautious investor sentiment.

- XRP’s futures market shows a bullish shift with long positions exceeding short bets, signaling potential price increases.

- Accumulation signals from whale activity and consolidation at $0.60 indicate a possible rally for Pi Network, despite concerns about the lack of exchange listings and use cases.

- Solana surpasses Ethereum in staking market cap with $53.15 billion, driven by higher staking yield and 65% of supply staked.

- Bitcoin whales accumulated 53,652 BTC worth $4.7 billion in a month, pushing the price to $87,463, but long-term holder profits hit a two-year low.

- PlanB criticizes Ethereum as centralized and pre-mined, citing PoS, tokenomics, and a flexible supply as key red flags.

- Decentraland’s (MANA) price has surged over 10% in 24 hours, hitting a two-month high of $0.31.

Crypto Equities Pre-Market Overview

| Company | At the Close of April 17 | Pre-Market Overview |

| Strategy (MSTR) | $317.20 | $323.49 (+1.98%) |

| Coinbase Global (COIN) | $175.03 | $175.85 (+0.46%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.41%) |

| MARA Holdings (MARA) | $12.66 | $12.83 (+1.34%) |

| Riot Platforms (RIOT) | $6.49 | $6.52 (+0.54%) |

| Core Scientific (CORZ) | $6.61 | $6.59 (-0.27%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoWill XRP Break Support and Drop Below $2?

-

Bitcoin14 hours ago

Bitcoin14 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

-

Bitcoin20 hours ago

Bitcoin20 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Market16 hours ago

Market16 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Says Solana Price To $2,000 Is Within Reach, Here’s How

-

Market14 hours ago

Market14 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Market13 hours ago

Market13 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V