Market

Best Solana Airdrops for Early Crypto Access

As Bitcoin hauls altcoins further north in the wave of US election euphoria, crypto airdrops provide investors with low-bar entries into early-stage projects without any initial investment.

DeFi and airdrops researcher Jussy.Sol highlighted several crypto airdrops offering investment opportunities.

Switchboard: Plug into the On-Chain Economy

Switchboard airdrop is potentially confirmed, with orbs available for earning when participants supply liquidity to any partner project or complete quests. They have also recently announced a partnership program with Monad, which could culminate in a commendable airdrop.

“If you missed $1,500 — $3,000 drop from PYTH, you still have a chance to get SWITCH. To collect ORBs, use their partner protocols (RainFi, Save, Dumpyfun, Marginfi, All Domains, Drift), and stay active in Discord,” the researcher noted.

Read more: What are Crypto Airdrops?

Indeed, participation criteria include participating in community tasks and engaging with supported protocols to increase orbs, ultimately improving one’s chances in the airdrop. The Solana Guides website notes Flexlend, AllDomains, Solend, Marginfi, and Kamino as named protocols to engage. Of note, however, is that the Switchboard airdrop remains “severely underfarmed.”

Stabble: Revolutionizing Liquidity

Advertising as Solana’s first frictionless liquidity and trading layer, Stabble reserved a significant allocation for its STB airdrop. To be eligible to receive the airdrop, interested participants must be active users of the protocol, among other criteria.

Participants can earn points by executing swaps, depositing liquidity, or creating and managing pools. The more points one earns, the larger their airdrop, with the first season starting with the mainnet launch and ending with the TGE. Meanwhile, the project introduced methods to boost points earned.

“Users will need to spend significant time on the Stabble platform, have a strong understanding of DeFi, and be willing to provide in-depth feedback on features, UI, and UX — offering suggestions for improvements as engaged users. Feedback will be delivered in a structured manner, with feedback forms and accompanying loom/screen recordings where required,” Stabble detailed.

Kamino Finance: Concentrated Liquidity Layer

Another crypto airdrop on Solana is Kamino Finance. It offers lending and borrowing while providing access to a whole slew of vaults, effectively delivering multiple DeFi strategies.

Kamino has publicly confirmed its rumored airdrops and tokens. The simple premise is that users earn points by using Kamino products. As soon as season three of the airdrop goes live, the points will be converted into KMNO tokens.

“In Season 3, earn KMNO by using their platform — Multiply, Vaults, Lending, Borrowing, Long/Short,” said Jussy.Sol.

For reference, Season 2 distributed 3.5% of Kamino’s total token supply, 350 million KMNO tokens, which were worth around $13.5 million over four months. Season 3 started on August 1. The estimated total points at the end of Season 3 would be around 674 billion, representing a 36.1% increase compared to Season 2.

Dawn: Delivering Internet Service

Through the Dawn protocol and hardware, property owners or residents can buy and sell Internet capacity in the area around them. While the project empowers users to operate as their own Internet provider, Dawn Airdrop remains unconfirmed, according to airdrops.io.

Nevertheless, users receive free reward points by installing DAWN’s validator extension and participating as a validator node. Participants must also refer 30 to 40 users and follow DAWN on X, Discord, and Telegram. Earned points can later be converted to an airdrop.

“In such Airdrops, those who have referrals win that’s why Dawn reached 1M users, so fast,” Jussy.Sol added.

Cube: Providing Next-Gen Multi-Chain Experience

Cube is committed to actively participating in the development of decentralized cross-chain protocols and Web 3.0 infrastructure. According to Jussy.Sol, Cube plans to launch both its token and the mainnet of the intent network in the second quarter of 2025.

Nevertheless, the researcher observes that the testnet task will debut imminently. Based on this, they urge users to hold their deposits and get “Loot Boxes” every Sunday. Moreover, participants can earn points by opening these boxes, with the points being directly proportional to the rewards. Meanwhile, others like @Airdrop Guard on X say Cube is in line to win in the Solana ecosystem.

Solayer: Building Restaking Network Natively On Solana

Among the potential airdrops, Solayer is running a rewards system. While they do not have their own token yet, new registrations and deposits position users for the airdrop once the token debuts.

Meanwhile, Solayer has also rolled out its mainnet, allowing users to earn additional rewards. Participation requires meeting specific criteria, including depositing 10 native SOL tokens, joining epoch, referring depositors, and using all invite codes, among other requirements.

“Deposit amount, deposit duration, higher multipliers for native SOL deposits,” the researcher noted.

Flash Trade: Trading and Earning

Flash Trade presented its FAF token, which is expected to debut in the fourth quarter (Q4). Meanwhile, the Flash Trade airdrop is confirmed for Flash Trade NFT holders, although it remains unclear how much they will receive. Meanwhile, experts urge airdrop farmers to continue trading, open several positions, and deposit in Liquidity Pools.

The Vault: Aligning Financial Stakes with Social Stakes

Featuring among the confirmed airdrops, The Vault does not have its own token, but one could launch soon, offering an airdrop to users who collect points. This means users who collect points will be able to redeem their governance token once the token launches.

Read more: Best Upcoming Airdrops in 2024

The Vault airdrop was moved to 2025, extending the runway for interested airdrop farmers. Participation requirements include staking SOL or providing liquidity to the Saber SOL-vSOL pool and staking the LP tokens in the quarry to earn points.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

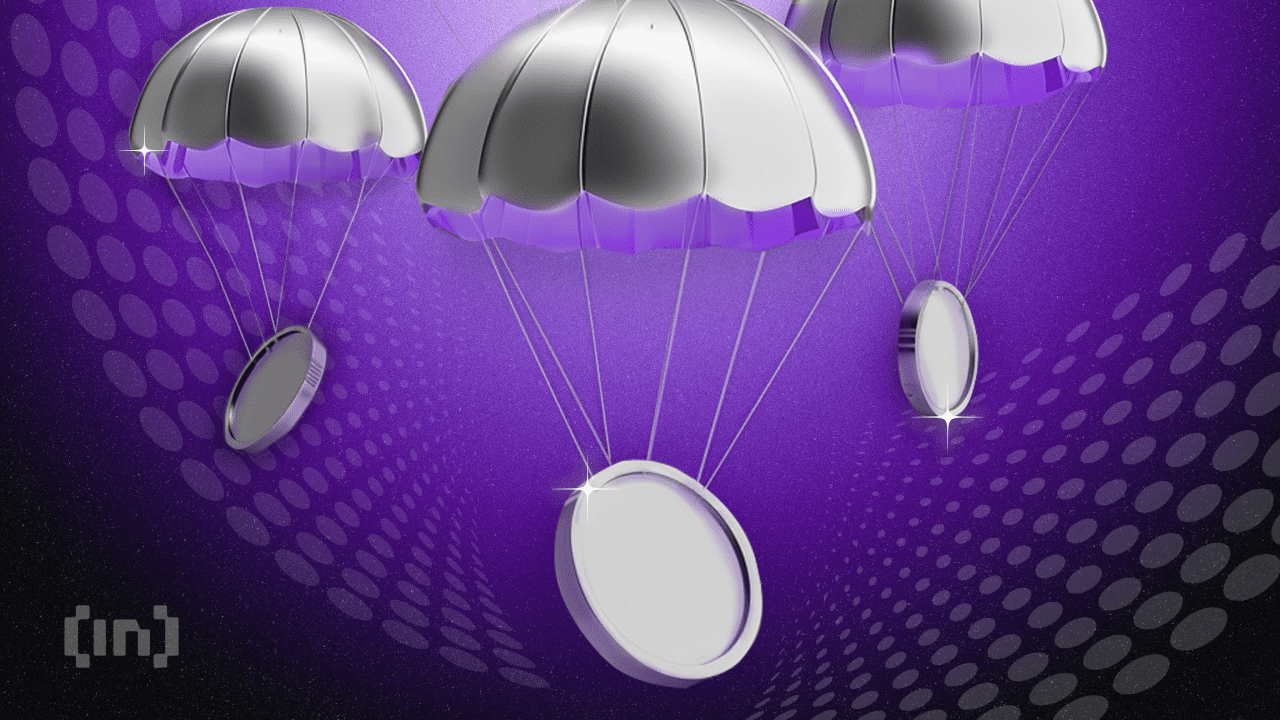

Binance Leads One-Third of the CEX Market in Q1 2025

Despite regulatory hurdles and listing concerns, a new report from TokenInsight shows that Binance is comfortably leading the CEX market. Increasing competition from MEXC and Bitget saw Binance’s market share drop 1%, but it still dominates more than one-third of the CEX trades.

The firm dominates in every metric that the report examined, from market share to public notoriety. It leads both in spot and derivatives trading volume and maintains the most stable ratio between the two of any CEX.

Binance is Winning the CEX Race By a Mile

Binance suffered a few setbacks in this period, but it still comfortably leads the CEX market in a few key areas. Its token listings are not performing like they used to, prompting community backlash, and its potential ties with the Trump family are also raising concerns.

However, the exchange had a strong Q1 2025, as its trading volume continued to dominate one-third of the CEX market.

“Binance maintained its market-leading position in both quarters, with a trading volume of $9.95 trillion in Q4 2024. Due to market volatility, its trading volume in Q1 2025 was approximately $8.39 trillion. Binance continued to lead in market share, holding 36.5% in Q1 2025,” the report claimed.

In terms of total market share, Binance isn’t completely surpassing the CEX market. In fact, its control actually decreased by 1.38%.

No other exchange saw this level of decline, as Bybit only lost 0.89% after the infamous hack. Nonetheless, most of the biggest CEXs also declined slightly, and none of the growing exchanges managed to compete with its head start.

Binance accounts for nearly 36% of the CEX market share, but this isn’t its only advantage. It also leads in both spot trading and derivatives volumes, controlling 45% of the former and maintaining a 17% lead with the latter.

Additionally, TokenInsight determined that it had the most stable platform structure, keeping its ratio of spot to derivatives trading very consistent.

The firm also ranked number one in open interest market share, but this was its least comfortable lead. However, TokenInsight identified a few intangibles that significantly impacted Binance’s CEX performance.

In its list of noteworthy industry events for Q1 2025, Binance was mentioned more than any other exchange. In one such mention, Forbes listed it as one of the world’s most trusted crypto exchanges.

Overall, despite ongoing regulatory scrutiny in several different regions, the exchange seemingly holds a firm grip on the market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

The European Central Bank (ECB) cut interest rates by another 25 basis points today, but the crypto market has hardly noticed. This highlights the European market’s declining influence over the crypto sector compared to the US.

Meanwhile, the crypto community is praying for rate cuts in the US, and false tariff rumors caused a massive pump. These policies still matter, but Europe is losing its macro influence.

The ECB Cuts Rates To Crypto Ambivalence

Global recession fears are circulating throughout the crypto market, and regulation plays a key role in them. US investors have been desperate for a rate cut in the hopes that it could provide a bullish narrative.

None has yet materialized. However, the ECB cut interest rates today for the sixth consecutive time, yet the crypto market barely reacted.

“The outlook for growth has deteriorated owing to rising trade tensions. Increased uncertainty is likely to reduce confidence among households and firms, and the adverse and volatile market response to the trade tensions is likely to have a tightening impact on financing conditions,” the ECB said in a public statement.

According to price data, the total crypto market cap has decreased by 0.2% since the ECB announced these rate cuts. Of the top 10 largest assets, all of them posted gains today except one.

Does this mean that macroeconomic factors are losing influence on crypto markets? That notion is demonstrably untrue. Less than two weeks ago, crypto had a huge rally after a false rumor that Trump would pause tariffs.

These gains came back when the pause actually happened. So, macro influence is still very strong in the current markets; it’s specifically that the ECB and Europe are losing influence.

The European Union isn’t the only economic bloc that’s losing its power in the space. Yesterday, the British government announced that inflation was lower than expected, potentially enabling another rate cut.

This, too, had a negligible impact on crypto. Macroeconomic concerns still impact the crypto market, but its strongest links are to the US and Asia.

A clear sign of this change in crypto happened months before the ECB cuts. Tether was forced to leave the EU due to MiCA regulations, but its business was minimally impacted.

It’s still the world’s largest stablecoin despite losing out on the entire European market. In fact, since then, it has taken steps to better integrate with US regulations.

Meanwhile, many large crypto businesses are reorienting towards Asia and the US and away from Europe. Earlier this year, a16z shut down its London office to focus on the US.

Tether relocated to El Salvador, giving it close proximity to the US and easier access to the Latin American market. This growth area is apparently more fruitful than trying again in Europe.

The ECB’s rate cuts barely impacted the crypto market, but that doesn’t mean that the industry will ignore the whole continent. Moving forward, however, EU operations will matter less and less to the largest companies.

This mirrors broader trends, as international capital is refocusing away from Europe. It’s only natural that crypto is part of that pattern.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Price Flat as Bulls Stay on Sidelines

Cardano (ADA) has been trading below the $0.70 mark since March 29, struggling to regain bullish momentum. Despite brief signs of strength, recent indicators now point to weakening trend conditions.

Both the BBTrend and ADX show fading buying pressure, while EMA alignment remains bearish. With price stuck between key support and resistance levels, ADA’s next move could define its short-term direction.

Cardano BBTrend Turns Negative, Signaling Momentum Reversal

Cardano’s BBTrend has flipped negative, currently sitting at -0.78 after spending the last five days in positive territory. The indicator reached a peak of 9.76 on April 14, signaling strong bullish momentum at the time.

BBTrend, short for Bollinger Band Trend, measures the strength and direction of a price move relative to its Bollinger Bands.

Positive values typically indicate bullish trends, while negative values point to bearish conditions or weakening momentum.

The shift to -0.78 suggests that Cardano’s recent uptrend has lost strength and may be reversing. A negative BBTrend reading means the price is now moving closer to the lower band, often a sign of rising selling pressure.

While it doesn’t confirm a strong downtrend yet, this reversal could indicate the beginning of a broader consolidation or bearish phase unless momentum quickly recovers.

Traders may want to watch closely for follow-through or a bounce to assess ADA’s short-term direction.

Cardano Momentum Fades as ADX Crashes and Selling Pressure Rises

Cardano’s DMI chart shows a sharp drop in trend strength, with its ADX falling to 15.12 from 28.34 just two days ago.

The ADX (Average Directional Index) measures trend intensity—readings above 25 suggest a strong trend, while values below 20 indicate a weak or consolidating market.

The steep decline in the ADX signals that the momentum behind Cardano’s recent move is quickly fading.

At the same time, the +DI (bullish directional indicator) has dropped from 22.61 to 17.39, showing weakening buying pressure. Meanwhile, the -DI (bearish indicator) has risen from 10.5 to 14.95, pointing to a gradual increase in selling strength.

With both the ADX and +DI falling, and -DI climbing, the setup hints at a potential shift in favor of the bears.

Unless bullish momentum returns quickly, Cardano could enter a period of sideways movement or even a short-term downtrend.

Bearish Structure Still Dominates Cardano

Cardano’s EMA lines remain bearish, with short-term averages still positioned below the long-term ones—indicating that downward momentum is intact.

Cardano price is holding above a key support zone near $0.594, but if this level fails, it could trigger a deeper drop toward $0.511. This would confirm a continuation of the downtrend and reflect growing selling pressure.

However, if ADA manages to reverse its current momentum, the first major resistance lies at $0.64. A breakout above that level could open the door to further gains, with potential targets at $0.66 and $0.70.

If the uptrend strengthens, ADA could even rally toward $0.77, marking a more decisive recovery and trend shift.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Market22 hours ago

Market22 hours agoPEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

-

Bitcoin24 hours ago

Bitcoin24 hours agoETF Issuers Bring Stability to Bitcoin Despite Tariff Chaos

-

Market24 hours ago

Market24 hours agoBase Meme Coin Wipes $15 Million After Official Promotion

-

Market18 hours ago

Market18 hours agoNo Rate Cut Soon, Crypto Banking Rules to Ease

-

Market17 hours ago

Market17 hours agoEthereum Price Struggles to Rebound—Key Hurdles In The Way

-

Ethereum17 hours ago

Ethereum17 hours ago77K Ethereum Moved to Derivatives—Is Another Price Crash Looming?

-

Market16 hours ago

Market16 hours agoBitcoin and Global M2 Money Supply: A Misleading Connection?