Market

Base Reaches $2 Billion TVL, Sets Sights on Arbitrum’s Position

Base has breached the $2 billion threshold in total value locked (TVL) for the first time since its launch, as the Coinbase low-cost Layer-2 (L2) continues to record a significant rise in activity.

The L2 scaling solution, built on the Ethereum blockchain, could make Coinbase a decentralized finance (DeFi) powerhouse.

Base Breaks $2 Billion TVL Mark

With upwards of $156 million in deposits over the last 24 hours, Base TVL has gone past the $2 billion threshold to reach $2.131 billion as of this writing. A rise in TVL indicates more assets are being locked into smart contracts within the ecosystem, which is a measure of the platform’s success and stability.

It points to growth in Base’s user base and overall adoption of the L2 scaling solution within the DeFi space amid increased investor interest and confidence. Indeed, this interest is reflected in the TVL growth, a climb of almost 400% year-to-date. Since the mainnet launch in July, the TVL is up by $849 million.

Read More: What is Base Chain? Everything You Need to Know

Noteworthy, Base ascended the ranks rather quickly, dethroning OP Mainnet, according to data on L2Beat, to become the largest network on Superchain. It is also worth mentioning that Base is closing in on Arbitrum Layer-2, which has a TVL of $2.59 billion as of this writing.

The surge in Base’s Total Value Locked (TVL) is primarily driven by the ecosystem’s expansion. In addition to rising revenue and an increasing number of active addresses, Base continues to see a spike in transactions. On September 18, for instance, it set a new record with over 4.5 million transactions, largely due to the growing popularity of the Basenames domain name service.

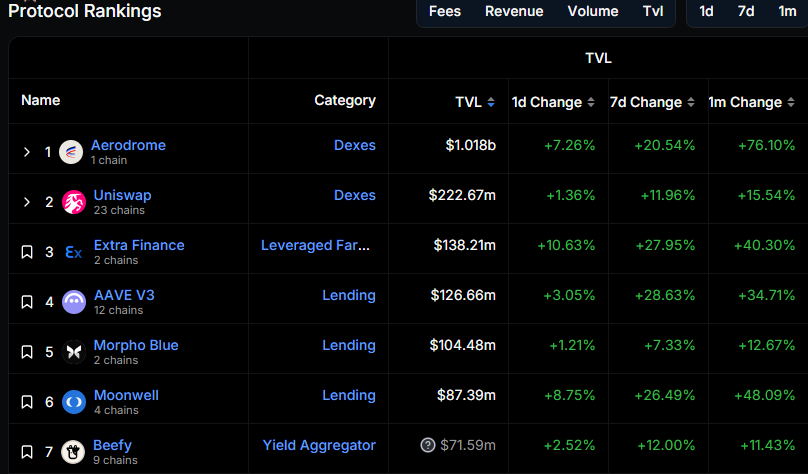

Moreover, the protocols within Base’s ecosystem play a critical role in its growth, particularly the Aerodrome decentralized exchange (DEX), which has been a key factor in its upward trajectory.

Aerodrome Helps Drive Base TVL Growth

Aerodrome is the leading protocol on Base L2, boasting a $1.018 billion TVL, which is up by 76% in the last month. Other protocols on Base include Uniswap and Aave V3, which could soon integrate Coinbase’s Bitcoin Wrapper, cbBTC.

Aerodrome accounts for nearly half of Base’s TVL, achieved as the DEX progressively launches liquidity pools for meme coins such as PEPE and WIF. These have attracted investors and could continue to do so as meme coins ride the new wave of market optimism towards Q4 2024.

Beyond that, Aerodrome’s Flight School program is also an enabler for growth because of its rewards. Specifically, for every veAERO a user deposits, they get up to 0.67 veAERO, which creates a great incentive to pump in more capital into the protocol.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Looking ahead, products such as cbBTC could continue to drive momentum for Base. Others include Coinbase’s collaboration with Morpho to launch a lending model with real-world assets (RWA).

Specifically, Morpho will leverage Coinbase’s authentication mechanism to establish two asset lending Vaults atop the Base L2 platform.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Dips To $1.97 – A Golden Opportunity Before The Next Rally?

XRP recent surge appears to be entering a cooling phase as the price edges lower to the $1.97 level, an area acting as a pivotal support. After a strong upward move fueled by improved market sentiment, the current pullback signals a potential pause rather than a full reversal.

The $1.97 zone now stands as a critical support level, previously acting as resistance during XRP’s recent climb. If buyers step in with strength and volume begins to rise, this dip could prove to be a strategic entry point for those eyeing the next breakout.

Key Support Holds At $1.97 – Is XRP Building A Base?

XRP’s pullback to the $1.97 level has brought attention to the critical support zone that may serve as a foundation for the next leg up. Despite broader market fluctuations, price action has shown resilience around this area, with buyers stepping in to defend the level. Historically, $1.97 has acted as a pivotal point during previous rallies and corrections, increasing its significance as a potential accumulation zone.

The Moving Average Convergence Divergence (MACD) indicator is beginning to flash early signs of a potential bullish reversal for XRP. After the recent dip to $1.97, the MACD line is showing signs of converging toward the signal line, hinting that bearish momentum may be losing steam. This subtle shift often precedes a reversal and suggests that buyers are gradually regaining control.

Should the MACD complete a bullish crossover, where the MACD line crosses above the signal line, it will reinforce the argument for a rebound. When paired with XRP’s position above key support, such a signal could confirm that market sentiment is tilting in favor of the bulls. A strengthening MACD histogram, reflecting diminishing downside pressure, would further validate this shift and add weight to the case for an upward move in the coming sessions.

Bulls On Standby: What Needs To Happen For A Breakout

Several key conditions must be met before momentum shifts decisively in the bulls’ favor as XRP’s price action nears the $1.97 support zone. First, XRP needs to firmly establish $1.97 as a solid base, with multiple successful defenses of this level reinforcing buyer confidence. A rebound from this zone would signal underlying strength and provide the first step toward an upside breakout.

Secondly, volume needs to step in. A breakout without a noticeable increase in trading volume risks being a false move. Sustained buying pressure would confirm that market participants are positioned for a trend reversal. Additionally, a decisive break above nearby resistance levels such as $2.25 or higher would invalidate the current consolidation phase and open the door for further gains.

Lastly, indicators like the RSI and MACD must align with the bullish narrative. A rising RSI, without entering overbought territory, and a bullish MACD crossover would solidify the technical foundation for an upward move.

Market

XRP Slides Into Bearish Zone Amid Weak Trading Signals

XRP gained only 2% in the past week, signaling weak momentum and fading interest from buyers in the short term.Technical indicators like the RSI, Ichimoku Cloud, and EMA lines are all starting to reflect increased bearish pressure. Here’s a breakdown of what the charts are saying and what could come next for XRP.

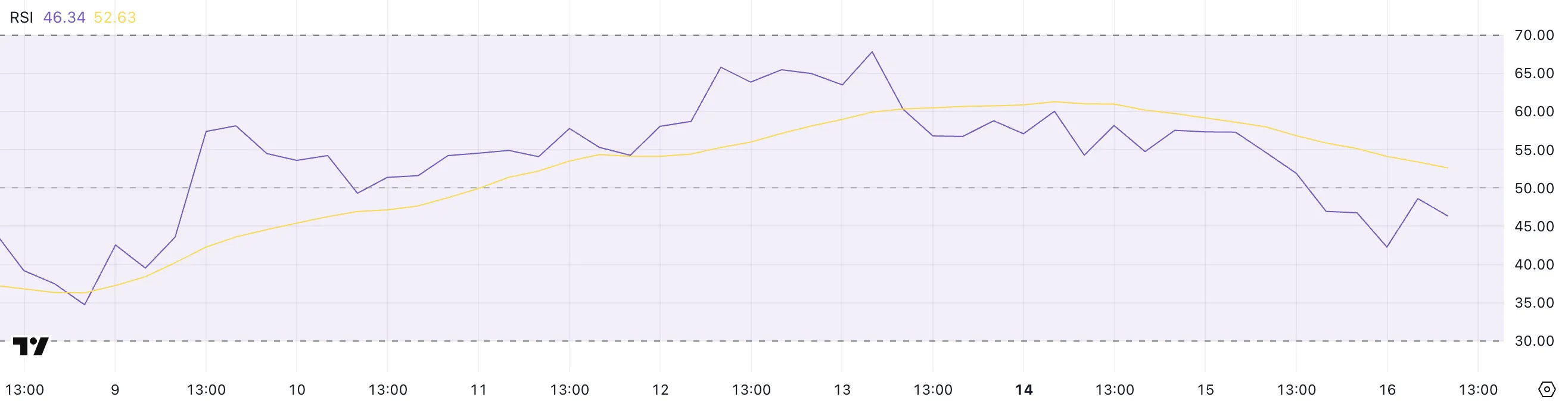

XRP RSI Shows Buyers Are Losing Control

XRP’s Relative Strength Index (RSI) has declined to 46.34, a noticeable drop from 57.30 just one day ago. This sharp move suggests a clear shift in momentum, with buying pressure cooling off significantly in the short term.

When the RSI drops this quickly, it can often indicate that traders are taking profits or beginning to rotate out of a position, especially after a period of modest gains.

While XRP hasn’t entered oversold territory yet, the drop below the 50 mark is typically viewed as a bearish signal, pointing to a potential shift in sentiment from bullish to neutral or bearish.

The RSI, or Relative Strength Index, is a widely used technical indicator that helps traders gauge the strength of a price trend. It ranges from 0 to 100, with readings above 70 considered overbought and readings below 30 considered oversold.

When the RSI is above 50, momentum is typically bullish, while levels below 50 reflect increasing bearishness. With XRP now sitting at 46.34, it suggests the asset is losing upward momentum and may be at risk of further downside unless buying interest returns soon.

If selling pressure continues and RSI trends lower, XRP could test key support levels in the near future.

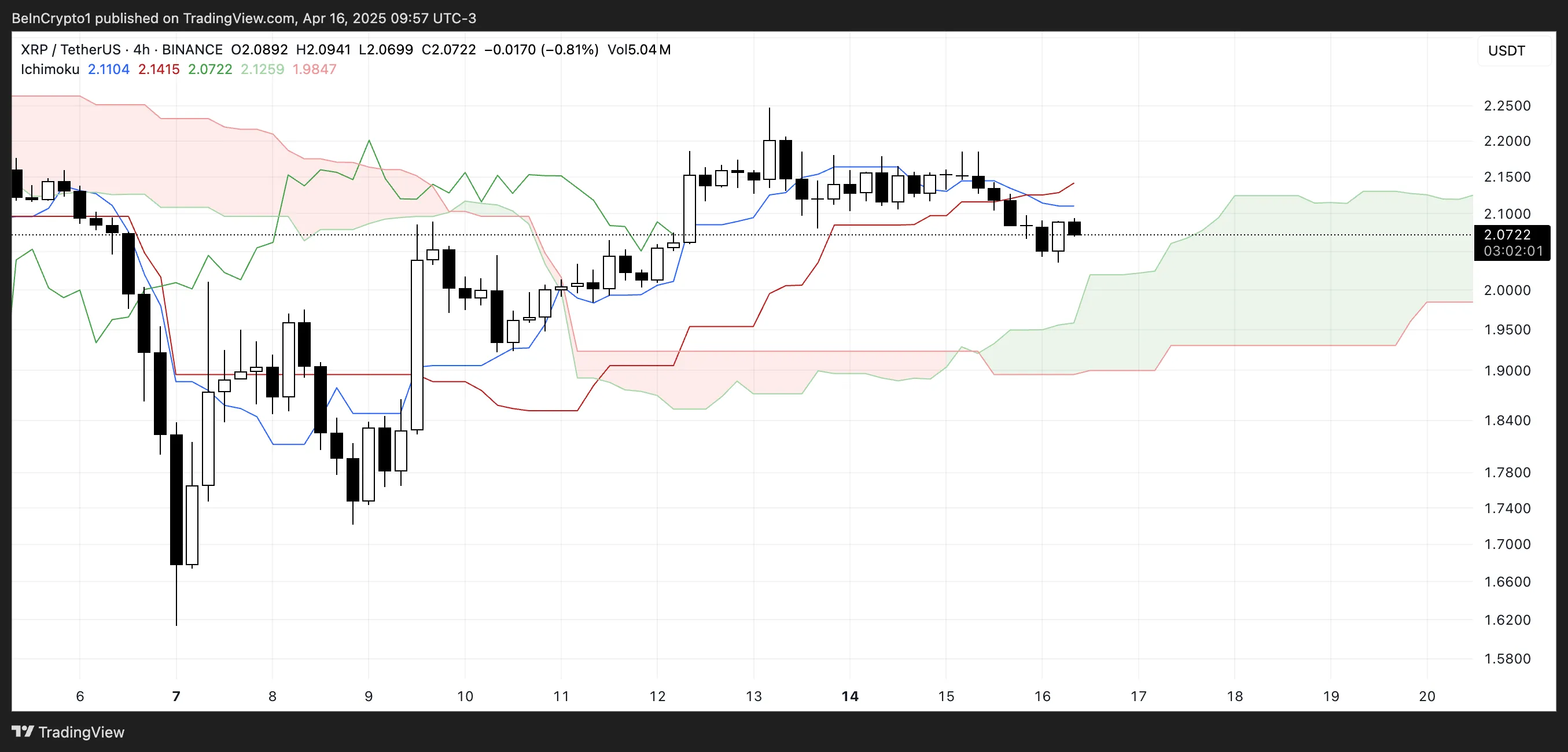

XRP Ichimoku Cloud Shows Momentum Is Shifting

XRP’s Ichimoku Cloud chart currently shows a shift toward short-term bearish momentum.

The price has fallen below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline), which is typically viewed as a bearish signal.

When the price trades beneath these two lines, it often suggests weakening momentum and increasing downside risk unless a quick recovery follows.

Additionally, the price is now entering the green cloud (Kumo), which represents a zone of uncertainty or consolidation. The cloud ahead is relatively flat and wide, indicating potential support but also a lack of strong upward momentum.

The green Senkou Span A (leading span A) remains above the red Senkou Span B (leading span B), signaling that the broader trend is still slightly bullish—but if price action stays inside or breaks below the cloud, that trend may begin to reverse.

Overall, the Ichimoku setup points to caution for bulls unless XRP reclaims the Tenkan and Kijun lines convincingly.

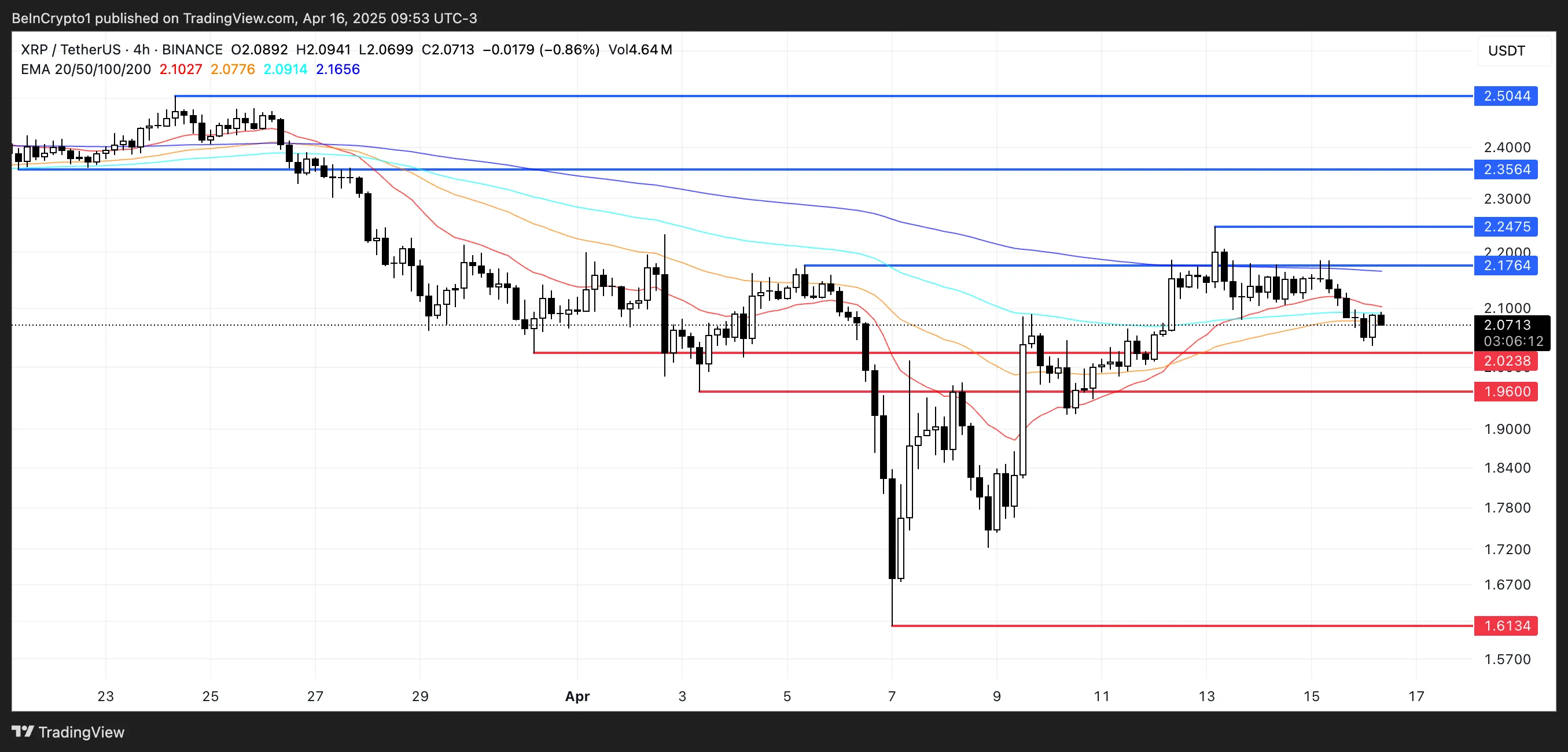

EMA Lines Suggest XRP Could Fall Below $2

XRP’s EMA lines are showing signs of weakness, with XRP price repeatedly failing to break through the resistance near $2.17—even amid speculation about a potential partnership with Swift.

This repeated rejection at the same level indicates strong selling pressure. The EMAs suggest momentum is fading as the shorter-term average is beginning to bend downward.

A potential death cross, where the short-term EMA crosses below the long-term EMA, appears to be forming. If confirmed, it could signal a deeper correction ahead, with XRP possibly retesting support levels at $2.02 and $1.96.

A breakdown below these levels could lead to a drop toward $1.61. However, if bulls manage to reclaim $2.17, the next resistance at $2.24 becomes the key target.

A clean break above that could trigger a stronger rally, potentially pushing XRP to $2.35 or even $2.50 if momentum accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

PEPE’s price action has been relatively quiet in the past few weeks. The meme coin has been quietly going through a continued wave of selloffs amidst the volatility in the wider crypto market.

However, an interesting technical analysis shows that the chart structure of PEPEUSDT is pointing to a massive move to the upside, one that could send the token soaring by as much as 796% before the end of 2025. As the broader crypto market continues to move sideways, crypto analyst MasterAnanda identified a short-term higher low forming around support levels, which could act as the launchpad for a major PEPE price breakout.

Short-Term Higher Low Points To Strong Accumulation Zone

The bullish outlook on PEPE is based on the repeat of a similar price formation that played out in 2024 before its run to new price highs and eventually its current all-time high of $0.00002803. According to the price chart shared by the analyst on the TradingView platform, PEPE initially traded in a descending channel between May to September 2024 before eventually breaking out of the channel. After breaking out of the channel, PEPE went on a brief uptrend and another downside which led to the creation of a lower low, before eventually going on an extended rally that peaked in December 2024.

Related Reading

Notably, it seems the same structure is showing up again on the PEPE price chart, specifically on the daily candlestick timeframe. In the analysis, MasterAnanda marks April as the period where PEPE bottomed out within a descending channel. Since then, two distinct highs and two clear lows have shaped what appears to be a reversal structure.

Most notably, a new higher low is beginning to form a pattern that, according to previous price action, could precede a bullish wave. The analyst labels this as a important stage, especially for spot traders who are positioning for long-term growth. Although there could be weakness in the short term, which could result in one last shakeout or another downside wick, the analyst noted that this shouldn’t worry spot investors.

It may offer a final opportunity to accumulate before momentum builds toward a new cycle high. On the other hand, leveraged traders are advised to proceed with caution and risk management, given the potential volatility during the build-up to the breakout.

Fibonacci Levels Show 480% To 796% Rally Target

The chart highlights a significant confluence around Fibonacci extension levels, with the 1.618 Fib level suggesting a possible 480% move and the more ambitious 2.618 extension pointing to a 796% upside. Interestingly, MasterAnanda noted that the numbers are huge.

Related Reading

Although these targets are just projections, they align with the previous rally seen in late 2024. If this prediction structure holds, the next rally could push PEPE beyond the 1.618 Fib level at $0.0004264, surpassing all prior highs and printing a new all-time high in 2025.

At the time of writing, PEPE is trading at $0.00000708, down by 4.7% in the past 24 hours.

Featured image from Shutterstock, chart from Tradingview.com

-

Market23 hours ago

Market23 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin22 hours ago

Altcoin22 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market22 hours ago

Market22 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin21 hours ago

Bitcoin21 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Market24 hours ago

Market24 hours agoEthereum Leads Q1 2025 DApp Fees With $1.02 Billion

-

Market21 hours ago

Market21 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Current Status Of 9 Ripple ETFs

-

Market18 hours ago

Market18 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?