Market

Argentina to Protect Scam Victims

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup highlights Argentina’s efforts to protect cryptocurrency scam victims, Bancolombia’s integration of the Solana and Arbitrum networks, along with other key stories.

Bancolombia’s Wenia Expands with Solana and Arbitrum Integration

Bancolombia’s crypto platform, Wenia, has expanded its offerings by integrating the Solana and Arbitrum networks, allowing users to transfer Ethereum (ETH) via Arbitrum. This update aims to enhance user experience with lower transaction fees and faster processing times.

The inclusion of Solana and Arbitrum positions Wenia as a competitive force in the region, particularly with Arbitrum’s scalability advantages over Ethereum. Wenia noted that this move aligns the platform with a global trend favoring more efficient blockchain networks.

“We have an invitation you’re going to love! Arbitrum and Solana networks are now available on Wenia App, and our crypto specialist Rafael Santamaría will tell you everything in a takeover this Friday, September 13, on our Telegram channel. Don’t miss it!” the platform announced via its X account.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

Since its launch, Wenia has offered a variety of digital assets, including Bitcoin, Ethereum, USDC, MATIC, and the COPW stablecoin. The platform also allows users to view detailed reports on the reserves backing the COPW stablecoin through its Reserve Test feature.

Earlier this year, Wenia introduced Chainlink’s Proof-of-Reserve (PoR) services to enhance transparency in its holdings.

“On-chain Proof of Reserve data is a critical component for digital asset adoption and serves as a springboard toward increasing consumer confidence in the use of stablecoins and other tokenized assets. We chose Chainlink for its industry-leading platform,” said Pablo Arboleda, CEO of Wenia.

Enegix Global Taps Natural Gas for New Crypto Mining Data Center in Brazil

Enegix Global has announced plans to use isolated natural gas as the energy source for its upcoming cryptocurrency mining data center in Brazil. Set to launch this November, the facility will initially have a 25-megawatt (MW) capacity, with plans to expand to 80 MW.

The isolated natural gas, found in areas with limited infrastructure, offers a cleaner energy alternative for mining operations, particularly in regions rich in gas reserves. This move aligns with Brazil’s growing reputation for both cryptocurrency adoption and renewable energy innovation.

“In addition to being considered one of the largest cryptocurrency adoption markets in the world, Brazil has ideal conditions to attract the digital mining industry as well. With clean energy sources, such as isolated natural gas and hydroelectric power plants, the country favors the promotion of sustainability in the sector and at the same time presents favorable conditions for operating costs and electricity generation,” Enegix CEO Yerbolsyn Sarsenov stated.

Read more: Is Crypto Mining Profitable in 2024?

The project aims to support the mining of Bitcoin and altcoins while enhancing Enegix’s power management capabilities by over 30%.

Latam Countries Rank Among Top 20 With Highest Crypto Adoption

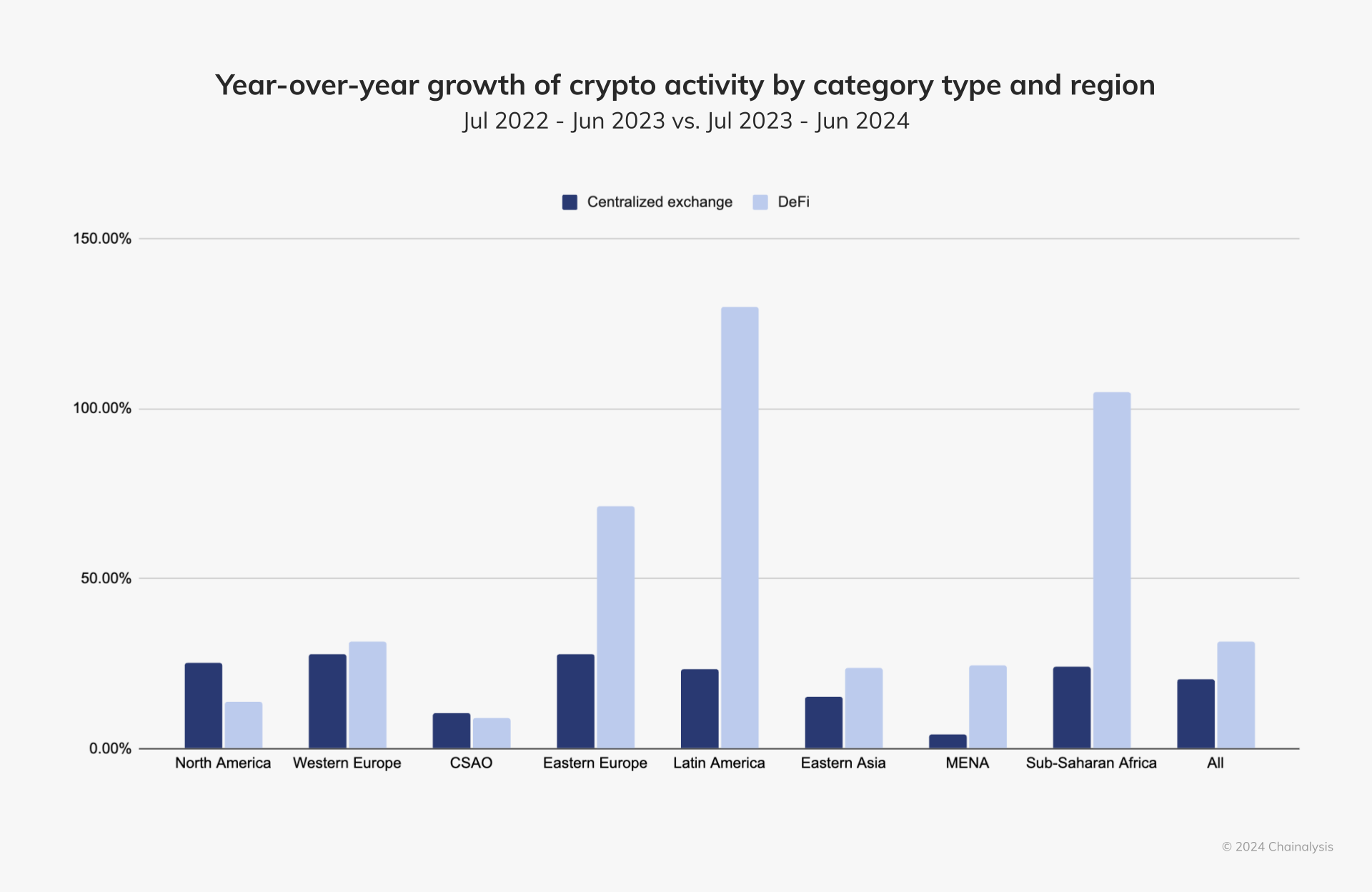

According to the latest report from blockchain analytics firm Chainalysis, Brazil, Venezuela, Mexico, and Argentina are among the top 20 countries globally with the highest cryptocurrency adoption rates. These Latin American nations join others like India, Nigeria, and the United States in leading the world in crypto usage and transfers.

Chainalysis’ global adoption index highlights the role of Bitcoin spot exchange-traded funds (ETFs) in driving BTC activity in North America and Western Europe. In contrast, stablecoins have had a more significant impact in regions such as Africa and Latin America.

“Between Q4 2023 and Q1 2024, the total value of global crypto activity increased substantially, reaching higher levels than 2021 during the cryptocurrency bull market. This year, cryptocurrency activity increased in countries at all income levels, with a pullback in high-income countries from early 2024,” the report noted.

Read more: Top 9 Crypto Friendly Countries For Digital Assets Investors

In Latin America, Brazil, Venezuela, Mexico, and Argentina are leading the charge. The report also notes a significant increase in global cryptocurrency activity between Q4 2023 and Q1 2024, surpassing the levels seen during the 2021 bull market. Cryptocurrency usage grew across all income levels, although high-income countries saw a slight decline in early 2024.

Fundación Blockchain Argentina to Offer Legal Support to Cryptocurrency Scam Victims

Fundación Blockchain Argentina has launched a new initiative aimed at protecting cryptocurrency users by offering free legal advice to victims of scams. Led by Dr. Sabrina Scavone, the program aims to provide guidance to individuals who have fallen prey to cryptocurrency-related fraud. As investments in digital assets, such as Bitcoin, continue to rise, so too have incidents of scams, creating concern within the crypto community.

The service focuses on offering specialized legal advice to those who have suffered financial losses from Ponzi schemes, fraudulent investments, or phishing attacks. The Foundation’s move follows a significant increase in such crimes, with reports indicating millions of dollars lost to hacks and scams. The service will provide victims with a thorough analysis of their legal options and clear steps for pursuing their cases.

Guido Zatloukal, president of Fundación Blockchain Argentina, highlighted that this initiative reflects the organization’s commitment to the safety and well-being of the country’s crypto community.

Read more: 15 Most Common Crypto Scams To Look Out For

Sabrina Scavone also stressed the importance of creating a more secure and transparent cryptocurrency ecosystem, noting that legal tools can be crucial for those affected by such crimes. With the rise of fraud, Fundación Blockchain Argentina strengthens its role in promoting blockchain education and development, now extending its efforts to include legal support.

Venezuelan Authorities Seize 35 Bitcoin Mining Machines Amid Regulatory Uncertainty

On September 6, 2024, Venezuelan authorities, led by the Bolivarian National Armed Forces (FANB) and the Public Prosecutor’s Office, seized 35 Bitcoin mining machines in the state of Guárico. The operation, sanctioned by the 3rd Control Court of San Juan de los Morros, also resulted in the confiscation of 30 extractors, several industrial fans, and two vehicles. The raid occurred due to the lack of necessary permits for operating the mining farm.

In Venezuela, cryptocurrency mining is heavily regulated, requiring authorization from the National Superintendence of Cryptoassets (Sunacrip). However, since Sunacrip was suspended in 2023 amid a corruption scandal involving state oil company PDVSA, the crypto industry has been left without a clear regulatory framework.

This regulatory void has created challenges for miners. Many argue that they lack the guidance to operate legally, resulting in interventions like the one in Guárico. High energy consumption from Bitcoin mining, particularly from ASIC machines, has been a key issue, exacerbating Venezuela’s ongoing energy crisis. Frequent blackouts have prompted the government to disconnect mining farms from the National Electric System (SEN), aiming to stabilize power for citizens.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

President Nicolás Maduro recently stated that cryptocurrencies would become a priority on his political agenda, but details on restoring Sunacrip or clarifying regulations remain vague. Until then, the uncertainty surrounding Bitcoin mining in Venezuela continues, with miners left exposed to legal action and sanctions. Similar crackdowns have been reported in Paraguay, where protecting the electricity grid is also cited as the primary reason for such interventions.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Weakens—Can Bulls Prevent a Major Breakdown?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started another decline and traded below the $1,880 level. ETH is now consolidating and remains at risk of more losses.

- Ethereum struggled to continue higher above the $2,000 resistance level.

- The price is trading below $1,880 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $1,820 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,820 and $1,880 resistance levels to start a decent increase.

Ethereum Price Dips Again

Ethereum price failed to continue higher above $2,100 and started another decline, like Bitcoin. ETH declined below the $1,920 and $1,880 support levels.

It tested the $1,765 zone. A low was formed at $1,767 and the price recently attempted a fresh upward move. There was a move above the $1,800 level but the price is still below the 23.6% Fib retracement level of the recent decline from the $2,033 swing high to the $1,767 low.

Ethereum price is now trading below $1,880 and the 100-hourly Simple Moving Average. There is also a connecting bearish trend line forming with resistance at $1,820 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,820 level. The next key resistance is near the $1,880 level and the 50% Fib retracement level of the recent decline from the $2,033 swing high to the $1,767 low. The first major resistance is near the $1,920 level.

A clear move above the $1,920 resistance might send the price toward the $2,000 resistance. An upside break above the $2,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,880 resistance, it could start another decline. Initial support on the downside is near the $1,780 level. The first major support sits near the $1,765 zone.

A clear move below the $1,765 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,680 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,765

Major Resistance Level – $1,880

Market

Bitcoin Bears Tighten Grip—Where’s the Next Support?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

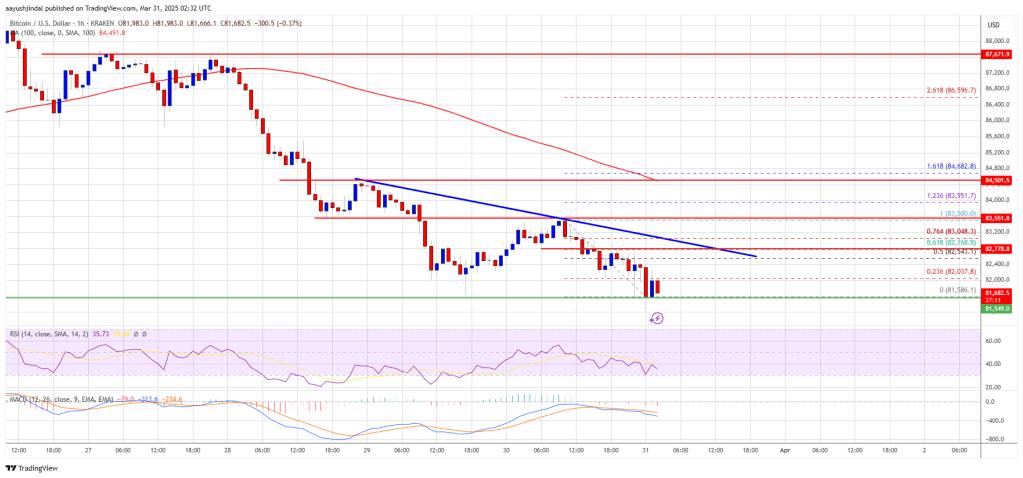

Bitcoin price started another decline below the $85,000 zone. BTC is now consolidating and might struggle to recover above the $83,500 zone.

- Bitcoin started a fresh decline below the $83,500 support zone.

- The price is trading below $83,200 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $82,750 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another decline if it stays below the $83,500 resistance zone.

Bitcoin Price Dips Further

Bitcoin price failed to remain above the $85,500 level. BTC started another decline and traded below the support area at $85,000. The bears gained strength for a move below the $83,500 support zone.

The price even declined below the $82,000 level. A low was formed at $81,586 and the price is now consolidating losses below the 23.6% Fib retracement level of the downward move from the $83,500 swing high to the $81,586 swing low.

Bitcoin price is now trading below $82,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,000 level. The first key resistance is near the $82,750 level. There is also a connecting bearish trend line forming with resistance at $82,750 on the hourly chart of the BTC/USD pair.

The trend line is near the 61.8% Fib retracement level of the downward move from the $83,500 swing high to the $81,586 swing low. The next key resistance could be $83,500. A close above the $83,500 resistance might send the price further higher. In the stated case, the price could rise and test the $84,200 resistance level. Any more gains might send the price toward the $84,800 level or even $85,000.

Another Decline In BTC?

If Bitcoin fails to rise above the $83,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $81,800 level. The first major support is near the $81,500 level.

The next support is now near the $80,650 zone. Any more losses might send the price toward the $80,000 support in the near term. The main support sits at $78,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $81,500, followed by $80,650.

Major Resistance Levels – $82,750 and $83,500.

Market

Solana (SOL) Price Risks Dip Below $110 as Bears Gain Control

Solana (SOL) has dropped over 6% in the past seven days and has been trading below $150 since March 6. The current trend shows clear bearish signals across multiple indicators.

From a death cross to a rising ADX and a red Ichimoku Cloud, technicals suggest growing downside pressure. With SOL nearing key support, the next few days could be critical for its price direction.

SOL Ichimoku Cloud Paints A Bearish Picture

The Ichimoku Cloud chart for Solana shows a clear bearish structure, with price action trading below both the Kijun-sen (red line) and Tenkan-sen (blue line).

The Lagging Span (green line) is also positioned below the price candles and the cloud, reinforcing the negative outlook. The Kumo ahead is red and descending, suggesting that resistance remains strong in the near term.

Solana has struggled to break above short-term resistance levels and remains stuck in a downward channel. The thin nature of the current cloud suggests weak support, making the price vulnerable to further downside if bearish momentum continues.

For a reversal, Solana would need to break above the Kijun-sen and push decisively toward the cloud, but for now, the trend remains tilted to the downside.

Solana DMI Shows Sellers Are In Control

Solana’s DMI chart shows a sharp rise in the ADX, now at 40.87—up from 19.74 just three days ago.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and values above 40 signaling a very strong one.

This surge confirms that the current downtrend in SOL is gaining momentum.

At the same time, the +DI has dropped from 17.32 to 8.82, while the -DI has climbed to 31.09, where it has held steady for the past two days.

This setup suggests that the sellers are firmly in control, and the downtrend is strong and also strengthening.

As long as the -DI remains dominant and ADX stays elevated, SOL is likely to remain under pressure in the short term.

Can Solana Drop Below $110 Soon?

Solana recently formed a death cross, a bearish signal where short-term moving averages cross below long-term ones.

It’s now approaching key support at $120—if that level breaks, Solana price could drop to $112, and possibly below $110 for the first time since February 2024.

If bulls step in and buying pressure returns, SOL could rebound toward resistance at $136.

A breakout above that level may lead to a push toward $147, which acted as strong resistance just five days ago.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Market19 hours ago

Market19 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Bitcoin16 hours ago

Bitcoin16 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

-

Regulation24 hours ago

Regulation24 hours agoKentucky Governor Signs Off On ‘Bitcoin Rights’ Bill, Strengthening Crypto Protections

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

-

Bitcoin22 hours ago

Bitcoin22 hours agoWhy Bitcoin Seasoned Investors Are Accumulating — Analyst Evaluates BTC’s Current Phase

-

Ethereum15 hours ago

Ethereum15 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?