Market

Arbitrum Buyback Plan Arrives Ahead of Major ARB Token Unlock

Arbitrum announced a strategic buyback plan to acquire ARB tokens amid a prolonged price decline. Its backing company, Offchain Labs, marks a significant move to reinforce its commitment to the ecosystem.

The buyback comes as ARB is down over 85% from its all-time high (ATH) and continues to lose ground.

Arbitrum Announces Buyback Program

In a post on X (Twitter), Offchain Labs emphasized that the initiative reflects the ongoing growth of Arbitrum’s ecosystem. According to the firm, technical advancements and strategic DAO initiatives are the primary drivers for the Arbitrum network.

“We’re reinforcing our commitment to the ecosystem and strengthening our alignment by adding ARB to our treasury through a strategic purchase plan,” the company stated.

The firm also assured the community that purchases would follow predetermined parameters to ensure sustainability.

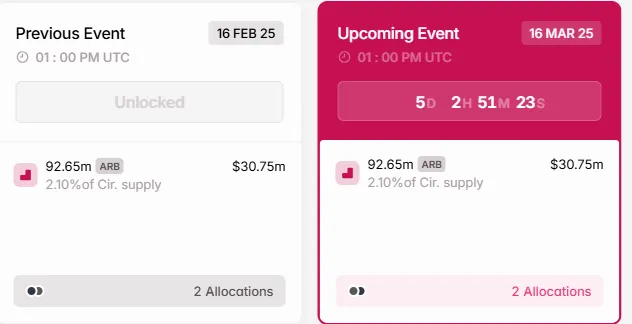

Meanwhile, this announcement comes only days before Arbitrum’s token unlock event. According to data on Tokenomist, the Arbitrum network will unlock 92.65 million ARB tokens worth $30.75 million based on current rates. These tokens constitute 2.1% of the ARB circulating supply.

Therefore, Offchain Labs’ buyback announcement aligns with this token unlocks event, with the plan to purchase ARB likely to absorb the expected supply shock. A recent report indicated that 90% of token unlocks drive prices down.

However, not everyone is convinced that buybacks alone are the right strategy. Yogi, a well-known wallet maxi, criticized the move, arguing that such a strategy lacks long-term vision. He compared it to traditional equity markets, where excessive buybacks often signal a slowdown in innovation.

“Pure buybacks alone feel unimaginative and short-sighted—they create scarcity without driving long-term growth or strategic value,” Yogi wrote.

He suggested a more diversified approach, proposing a framework where 30% of the treasury should be allocated to strategic buybacks and OTC (Over-the-Counter) deals. Further, 30% is directed toward liquidity provision to attract institutional players, and 20% is directed towards a yield-generating treasury for stable dividends.

Yogi also suggested 15% for ecosystem investments and 5% for a protocol insurance fund. In their opinion, this diversified strategy would better align incentives and enhance the protocol’s long-term sustainability.

Criticism Over Buybacks as ARB Price Struggles

Patryk, a researcher at Messari Crypto, echoed similar sentiments. He noted that while such structured plans are beneficial, they can be difficult to outline at the start of a buyback initiative. He suggested that Arbitrum remain flexible and deploy funds into strategic areas over time rather than committing to a rigid framework.

“I think projects will do this eventually. It’s just difficult to announce a concrete plan for the funds at the beginning of buybacks, like those that Arbitrum just announced. Remain flexible,” the researcher suggested.

Despite the ongoing debate, the buyback announcement and token unlocks come as Arbitrum is experiencing renewed market attention. The ARB token recently received a listing on the Robinhood platform.

While the move temporarily boosted the ARB price, it failed to sustain a lasting uptrend. Additionally, Arbitrum has gained significant community support for its BoLD proposal. As BeInCrypto reported, the governance initiative aims to decentralize decision-making further and enhance network security.

While Offchain Labs’ buyback plan signals confidence in the project, questions remain about whether it is enough to restore ARB’s market momentum. The broader sentiment around ARB remains cautious, with the massive token unlocks expected to have price implications.

“I think now may be a good time to short. Or sell. Or both,” Yogi remarked.

With Arbitrum at a crossroads, the effectiveness of this buyback strategy in revitalizing investor confidence and driving long-term growth will be closely watched. The debate between pure buybacks and strategic reinvestment continues to shape the discourse around Arbitrum’s future.

BeInCrypto data shows ARB was trading for 0.33, down almost 9% since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Gold Price Hits New All-Time High Above $3,300 Amid Tariff Turmoil

Gold prices have surpassed $3,300 per ounce, setting a historic high as global markets face heightened volatility.

This surge reflects investor anxiety over economic uncertainty and highlights the significant impact of controversial tariff policies under President Trump. Consequently, experts have issued conflicting forecasts on how this may influence Bitcoin.

What’s Driving Gold to Keep Breaking Records?

At the time of writing, gold has surged past $3,000, reaching a peak of $3,317. That marks a 25% increase since the beginning of the year.

According to a report in The New York Times, the global trade war is the primary force behind gold’s continued rise. Retaliatory tariffs among major economies are clouding the global economic outlook.

The US imposed new tariffs, quickly triggering countermeasures from China, the European Union, and Canada. In response, the White House escalated the situation further.

“While general uncertainty and deteriorating economic vibes are improving interest in gold, most of gold’s price action is around the uncertainty related to tariffs,” Helima Croft, head of global commodity strategy at RBC Capital Markets, said.

In addition, there are growing concerns that tariffs could directly target imported gold. This fear has led to gold stockpiling within the United States.

Business Standard reported that major banks like JPMorgan Chase and HSBC have been moving large quantities of gold from London to New York. JPMorgan alone plans to transport $4 billion worth of gold this month.

Besides the tariff war, macro analyst Zerohedge pointed to another factor—the Senate Budget Resolution for FY2025. This resolution allows the US to increase its budget deficit by up to $5.8 trillion over the next ten years. Zerohedge suggested that Gold is responding to this news.

The price spike reflects fears of currency devaluation due to ballooning deficits.

Goldman Sachs has also raised its year-end gold forecast to $3,700. The bank cited stronger-than-expected central bank demand and rising recession risks.

What Are Analysts Saying About Bitcoin as Gold Hits a New Peak?

While gold shines, Bitcoin, often called “digital gold,” has drawn mixed opinions.

Anthony Papillano, CEO of Professional Capital Management, told CNBC on April 15 that Bitcoin has dropped around 10% since the start of the year, while gold has gained 20%. However, both assets have risen approximately 35% over the past year.

He also outlined reasons why Bitcoin might soon rally like gold. These include the US government’s strategic Bitcoin reserve plans and the younger generation’s growing view of Bitcoin as part of a long-term investment strategy.

“History tells us Bitcoin’s returns will skyrocket past Gold in the coming months,” Papillano predicted.

Supporting this view, several analysts noted that Bitcoin often follows gold’s upward momentum with a lag of about 100 days, especially during increased global liquidity. Additionally, companies purchased more than 95,400 BTC in the first quarter of 2025, showing strong institutional demand.

However, not everyone agrees. Economist Peter Schiff, a long-time Bitcoin critic, offered a contrasting view. He claimed the best trade right now is to sell all Bitcoin and other cryptocurrencies and invest entirely in gold and silver mining stocks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh decline from the $1,690 zone. ETH is now consolidating and might decline further below the $1,580 support zone.

- Ethereum started a fresh decline after it failed to clear $1,700 and $1,720.

- The price is trading below $1,620 and the 100-hourly Simple Moving Average.

- There was a break below a new connecting bullish trend line with support at $1,625 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,640 resistance zone.

Ethereum Price Faces Rejection

Ethereum price formed a base above $1,550 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,600 and $1,620 resistance levels.

The bulls even pumped the price above the $1,650 zone. A high was formed at $1,690 and the price recently corrected gains. There was a move below the $1,640 support zone. Besides, there was a break below a new connecting bullish trend line with support at $1,625 on the hourly chart of ETH/USD.

The price tested the 50% Fib retracement level of the upward move from the $1,472 swing low to the $1,690 high. Ethereum price is now trading below $1,625 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $1,620 level. The next key resistance is near the $1,640 level. The first major resistance is near the $1,650 level. A clear move above the $1,650 resistance might send the price toward the $1,690 resistance.

An upside break above the $1,690 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,640 resistance, it could start another decline. Initial support on the downside is near the $1,580 level. The first major support sits near the $1,555 zone and the 61.8% Fib retracement level of the upward move from the $1,472 swing low to the $1,690 high.

A clear move below the $1,555 support might push the price toward the $1,525 support. Any more losses might send the price toward the $1,450 support level in the near term. The next key support sits at $1,420.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,580

Major Resistance Level – $1,640

Market

Semler Doubles Down on Bitcoin Investments Despite Losses

Semler Scientific (SMLR), a US-based medical technology company, has revealed plans to acquire more Bitcoin (BTC) despite facing a 5.0% unrealized loss on its previous BTC investments.

The firm has filed a Form S-3 registration with the US Securities and Exchange Commission (SEC) to raise up to $500 million through a securities offering. The proceeds would be allocated for general corporate purposes, including expanding its Bitcoin portfolio.

Semler Scientific Files S-3 to Fund Bitcoin Investments

According to the official filing, the firm plans to issue common stock, preferred stock, debt securities, and warrants as part of the securities offering. The SEC filing does not specify the exact amount allocated for Bitcoin purchases. Nonetheless, Semler’s recent activity suggests a strong focus on cryptocurrency.

“We have not determined the amount of net proceeds to be used specifically for such purposes. As a result, management will retain broad discretion over the allocation of the net proceeds of any offering,” the filing read.

This move follows Semler’s previous acquisition of 871 BTC for $88.5 million at an average price of $101,616 per Bitcoin. The purchases were made between January 11 and February 3.

The acquisition increased Semler’s total Bitcoin holdings to 3,192 BTC. The holdings worth $266.1 million represent 80.6% of the company’s total market capitalization of 330.1 million. This indicates that a significant portion of its value is tied to its Bitcoin investments.

“From January 1, 2025, to February 3, 2025, Semler Scientific’s BTC Yield was 21.9%. From July 1, 2024 (the first full quarter after Semler Scientific adopted its bitcoin treasury strategy) to February 3, 2025, Semler Scientific’s BTC Yield was 152.2%,” the firm revealed.

However, the tides have shifted since then. According to Bitcoin Treasuries, Semler’s average BTC acquisition cost is $87,850 per coin. As of the latest data from BeInCrypto, Bitcoin’s market price stood at $83,397, placing Semler at a 5.0% loss on its investment.

Previously, BeInCrypto noted that the losses surged to 14.7% as BTC fell below the $80,000 mark. Despite this, Semler’s leadership appears committed to its Bitcoin strategy, viewing the cryptocurrency as a long-term store of value.

Semler’s strategic push into Bitcoin mirrors those of other firms, such as Strategy (formerly MicroStrategy) and Metaplanet. Earlier this week, the firms acquired BTC worth $285 million and $26.3 million, respectively.

However, Semler’s decision to double down on Bitcoin comes amid financial and legal challenges. On April 15, the company announced a preliminary $29.75 million settlement with the US Department of Justice (DOJ) to resolve allegations of violating federal anti-fraud laws related to marketing its QuantaFlo product.

The settlement is pending final approval. Yet, it adds pressure to Semler’s balance sheet as it navigates its ambitious fundraising and Bitcoin investment plans.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin

-

Altcoin20 hours ago

Altcoin20 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Market19 hours ago

Market19 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Market24 hours ago

Market24 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Market16 hours ago

Market16 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Altcoin23 hours ago

Altcoin23 hours agoHas XRP Price Already Bottomed? Analyst On How Ripple Coin Can Hit $15

-

Market20 hours ago

Market20 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

-

Market18 hours ago

Market18 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows