Market

Aptos Price Set for Breakout as Bitwise Registers for APT ETF

Aptos (APT) has spent the past month consolidating within a tight range, with its price bouncing between $5.63 and $6.53. This stagnation has been primarily driven by broader market volatility, leaving traders uncertain about the token’s direction.

However, recent developments, such as Bitwise’s filing for an APT ETF, could provide the spark necessary for a breakout, potentially sending Aptos’ price to new highs.

Aptos Could Find Institutional Interest

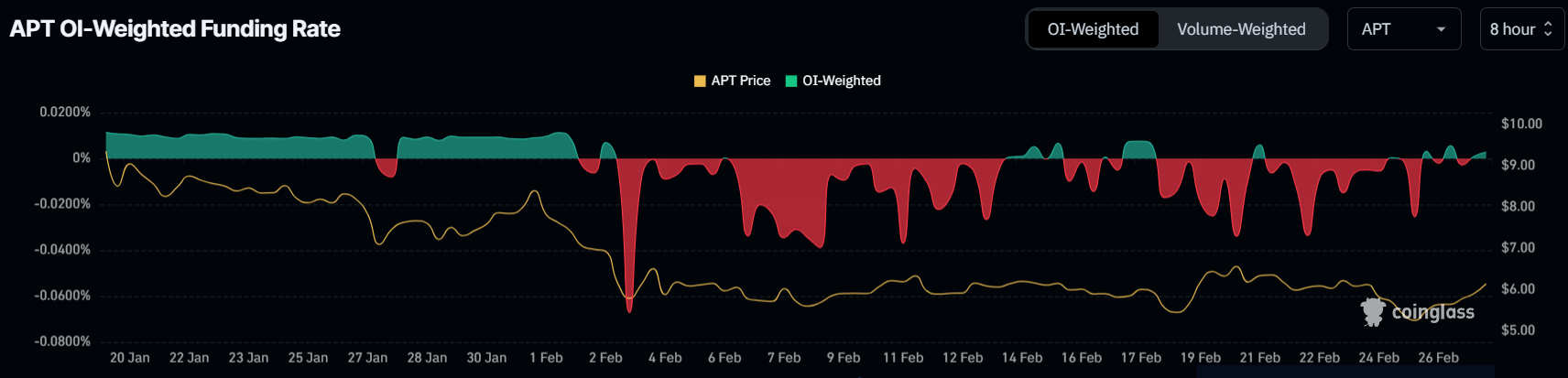

For most of the month, traders have expressed skepticism about Aptos’s price action. The prevailing sentiment has led to a dominance of short contracts over long ones, as evident in the funding rate, which reflects the overall bearish sentiment. As traders continued to place shorts, the pressure on APT to break free from its consolidation mounted. However, the recent filing for an APT ETF by Bitwise has shifted the market sentiment slightly, bringing new optimism and hinting at the potential for a price rise.

The shift in sentiment could help fuel a more bullish outlook for APT. With the ETF filing increasing institutional interest in the token, investors may start seeing more value in long positions, especially if Aptos can break free from its months-long consolidation pattern. This development could lead to increased confidence, further fueling buying activity and driving the price upwards.

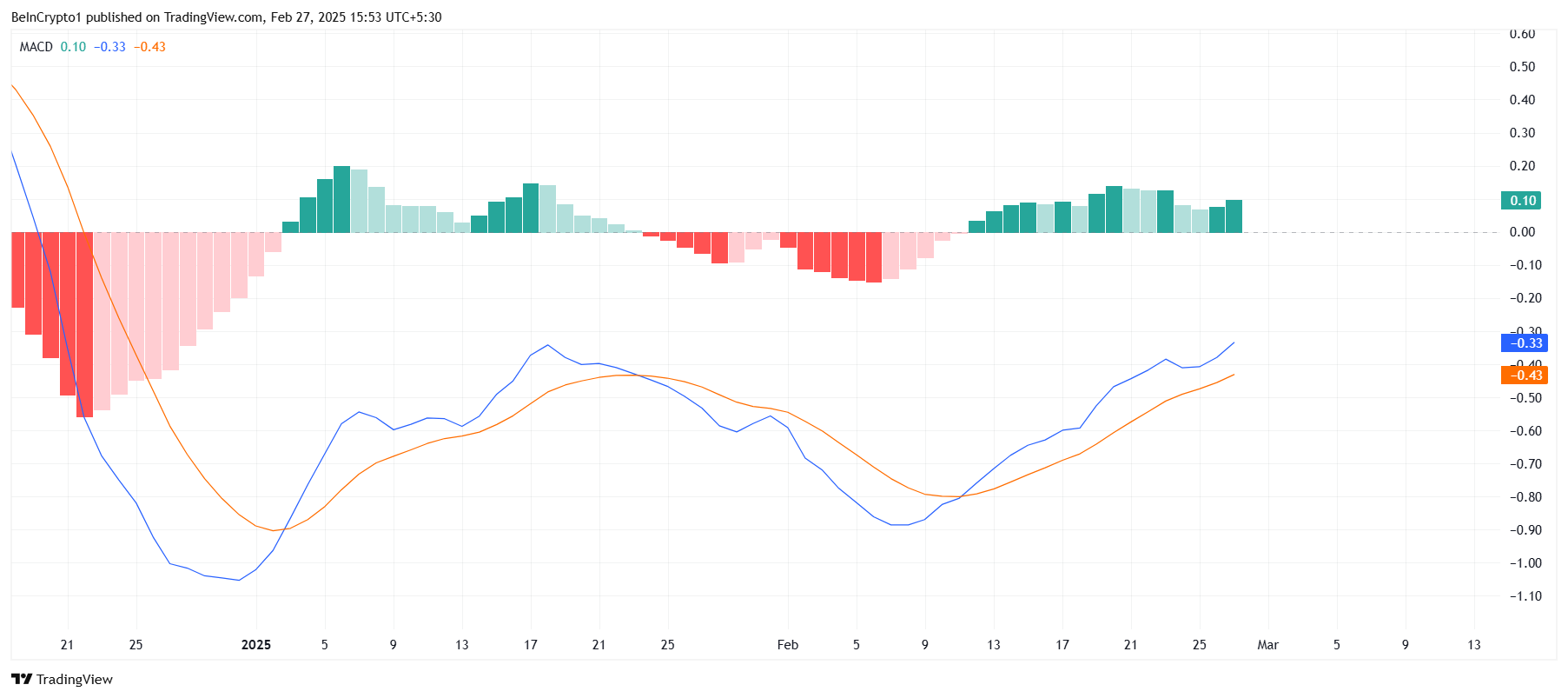

Aptos’ macro momentum is beginning to show signs of improvement, driven in part by the rising bullish momentum observed in the MACD indicator. After experiencing a slight dip last week, the MACD is now showing a resurgence in upward momentum, which could provide the catalyst needed for a breakout. If the MACD continues to trend higher, it will likely support the potential for Aptos to break through resistance levels and push toward a rally.

Technical indicators suggest that the shift in sentiment and momentum could set the stage for a significant price movement. The combination of improved market sentiment and growing investor interest, alongside a positive MACD trend, provides the conditions for a potential price surge. Aptos may be poised to make its move if this momentum continues.

APT Price Primed For Breakout

Aptos has already experienced a 9% rise over the past day, signaling that a rally could be underway. The altcoin has been stuck in consolidation for over a month, with prices bouncing between $5.63 and $6.53. However, the new developments in the market could be what pushes APT beyond its previous limits.

The positive factors at play suggest that Aptos could break the $6.53 barrier, signaling the end of its consolidation phase. This would likely pave the way for a rise toward $7.20, bringing a fresh wave of optimism and trading volume. If APT manages to breach this level, it could spark a full-scale rally.

If the breakout fails to materialize, however, Aptos might remain trapped within its consolidation range. A drop below the $5.63 support could indicate further weakness, with a potential decline toward $4.96. Such a scenario would invalidate the bullish outlook, stalling any potential rally for the altcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Act Could Ban TRUMP And Political Token Launches

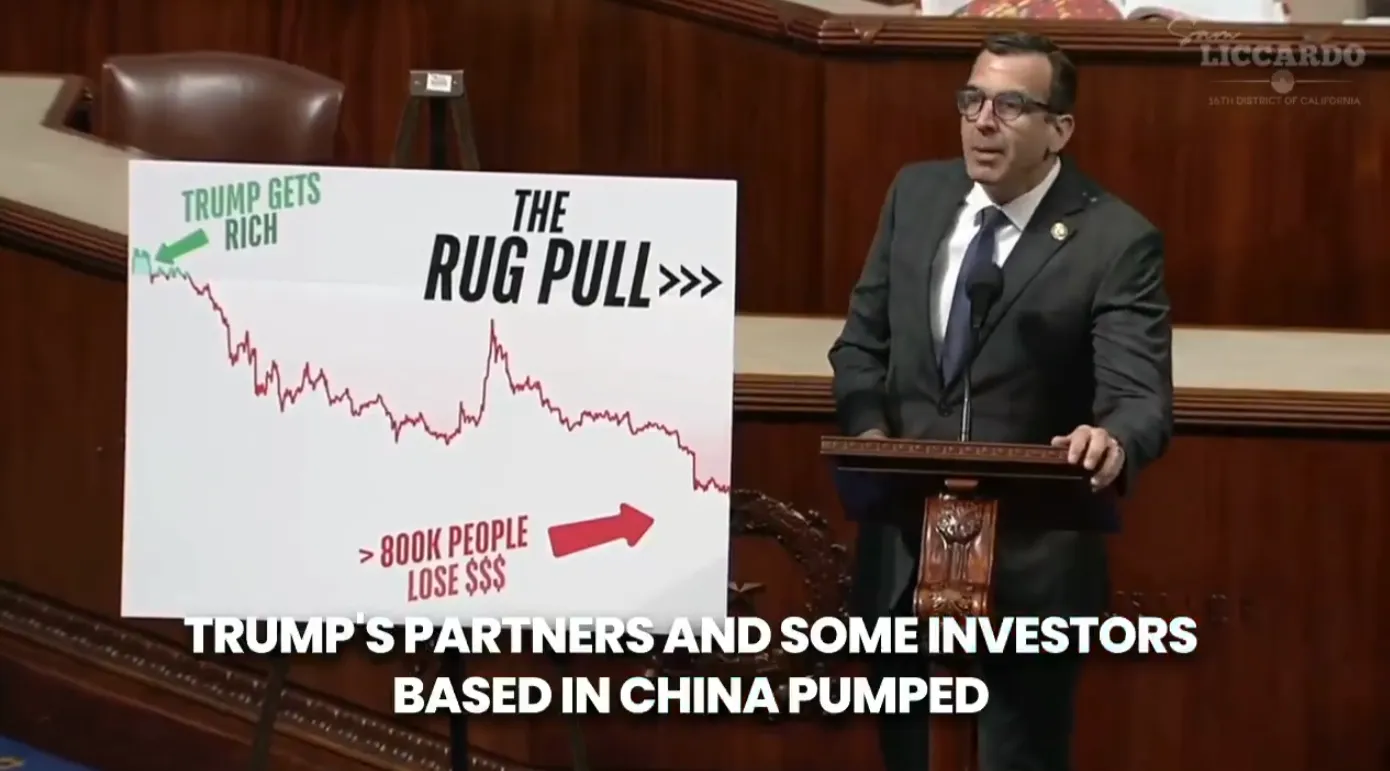

Sam Liccardo, a Silicon Valley congressman, proposed the MEME Act to stop TRUMP and other political tokens. The bill has practically no chance of passing, but it might be an important milestone.

Although the crypto industry is theoretically enjoying real political power, there are some cracks in the Republican coalition. If these cracks widen, a vital legislation like this could have a chance at success.

Can the MEME Act Stop TRUMP?

When President Trump launched his own meme coin, it crossed worrying new boundaries for the crypto space. Nearly half of its investors were complete novices to the crypto space, and scammers exploited the hype to steal $857 million in the first few days.

Now, freshman Congressman Sam Liccardo is trying to stop the trend by sponsoring his first piece of legislation:

“That wasn’t my plan when I ran for office, I can assure you. [Trump’s] behavior is so self-evidently unethical that it raises the question why isn’t there a clear enough prohibition [on political meme coins]. You need to have some enforcement mechanism and a private right of action helps to keep everybody honest,” Liccardo claimed in an interview.

Liccardo is the Representative for Silicon Valley, the US’ biggest tech hub, and he’s been in office since January. So far, it is unclear how many of the Valley’s tech firms support his first big Congressional effort.

Today, he proposed the Modern Emoluments and Malfeasance Enforcement (MEME) Act, which targets TRUMP and other political meme coins.

This act would block the President, members of Congress, other senior officials, and their family members from launching or endorsing any tokens under threat of civil and criminal penalties. It would also impose similar restrictions on commodities and securities.

If approved, the MEME Act would also demand that Trump disgorge all profits from his token launch.

The rise of TRUMP and other political meme coins is causing prominent figures like Vitalik Buterin to worry about the industry’s direction. Blatant scams are impacting crypto’s credibility, and multiple foreign governments have launched or considered launching their own meme coins and rug pulls.

Several crypto community members believe these tokens are a stupendous mechanism for enabling political corruption.

Liccardo was very open about his intent to use this bill as an act of protest. He got 12 other Democrats to co-sponsor the bill, but it doesn’t have bipartisan support.

The Republican Party has shown clear signs that it’s very pro-crypto as advertised, but it’s important not to overstate the fact. Yet, even the GOP’s crypto skeptics would have no reason to oppose their President publicly.

In short, the MEME Act may not end up doing anything to stop TRUMP or the political meme coin craze. Still, Liccardo’s effort may be an important building block. It may help build future legislation or gauge the feasibility of GOP crypto skepticism.

Ostensibly, the industry has more political power than ever, but this power hasn’t faced a real test.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Shiba Inu Investors Increase Holding Times—Bullish for SHIB?

The general crypto market has faced significant headwinds this week, with top meme coins among the hardest hit.

However, leading meme asset Shiba Inu is witnessing a notable shift in investor behavior. The Shiba Inu holders are increasing their average holding time, signaling confidence in the asset’s long-term potential.

Selling Pressure Eases as Shiba Inu Holders Take Control

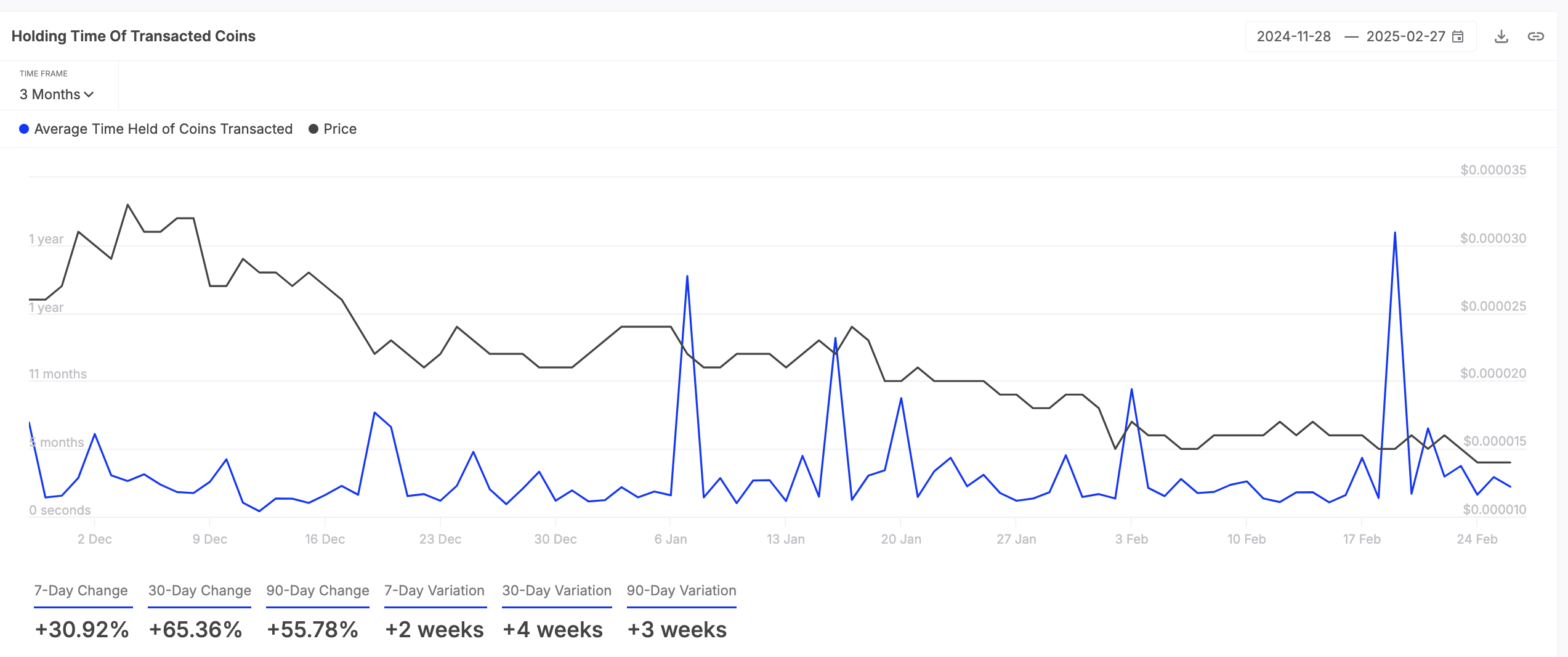

On-chain data has revealed a spike in the holding time of all SHIB coins transacted in the past seven days. According to IntoTheBlock, the metric has soared by 31% during that period.

The holding time of an asset’s transacted coins measures the average duration its tokens are held before being sold or transferred. When holding time spikes, it indicates that investors are choosing to hold their coins rather than sell, suggesting confidence in the asset’s future value.

This is happening amid the steady decline in SHIB’s value over the past few days. Trading at $0.0000146 at press time, the meme coin’s price has fallen by 7% since the beginning of the week. If SHIB holders remain resilient and increase their holding times, it can help reduce the selling pressure in the SHIB market, driving up its value in the short term.

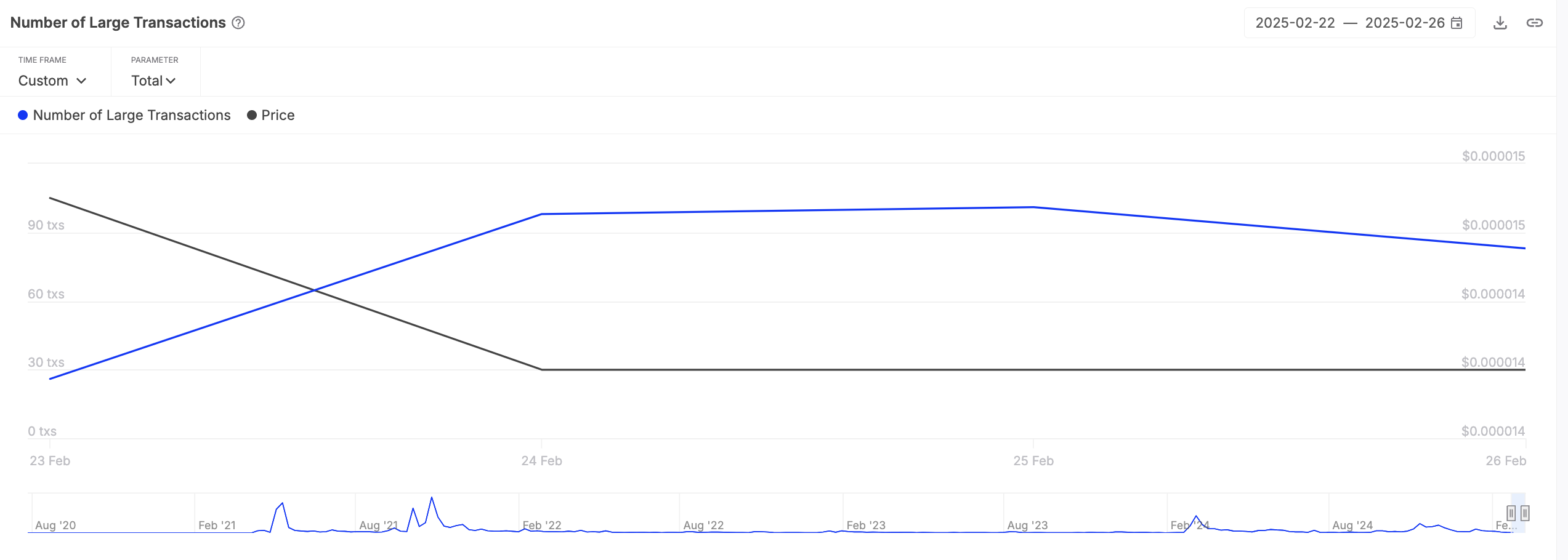

Additionally, during the period in review, the number of large transactions involving SHIB has surged, signaling increased activity from institutional players and whales. According to IntoTheBlock’s data, large transactions—those exceeding $100,000—have spiked significantly. Over the past week, the daily count of such transactions has risen by more than 200%, highlighting renewed interest from major investors.

SHIB at a Crossroads: Breakout Ahead or Further Decline?

With both a rise in holding time and an uptick in daily large transactions, SHIB’s recent losses could be short-lived.

According to readings from its Fibonacci Retracement tool, if these bullish signals persist, the meme coin could break above the descending trendline that has kept its price in decline since early December. A breach of this long-term resistance level could propel SHIB’s price to $0.0000166.

Conversely, if the decline persists, SHIB’s price could break below support at $0.0000140 and trade at $0.000010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Fear And Greed Index at Lowest Level Since 2022

The Crypto Fear and Greed Index reached “Extreme Fear” today, its lowest level since the FTX collapse in 2022. Between ETF outflows, Trump tariffs, and more, bearish sentiment is everywhere.

In less than one month, Bitcoin went from over $100,000 to under $85,000, and this has sparked a lot of fear. However, even if a crash is imminent, analysts predict the market to rebound stronger by mid-2025.

Fear And Greed Index on Red Alert

For the crypto community, there’s a lot of anxiety in the air right now. The price of Bitcoin has been an important bellwether for bearish sentiment, as high ETF outflows Monday turned into all-time record losses.

Now, the Crypto Fear and Greed Index has turned towards fear at an alarming rate, completely outpacing mild anxieties from earlier in the month.

The Crypto Fear and Greed Index is an important barometer for market sentiment, tracking investor behavior patterns in the aggregate. It is now in a state of “Extreme Fear,” and its lowest level since the 2022 FTX collapse.

As crypto liquidations are on the rise, experts are beginning to openly state that a major correction is imminent. How did we get here?

Several key factors have contributed to this panic. For one thing, blatant scams are saturating the meme coin space right now, scaring hordes of potential investors and diminishing crypto’s credibility.

Additionally, many major institutions bet heavily on crypto and aren’t getting the best returns. Strategy recently spent $2 billion on BTC, but its stock price only suffered for it.

Additionally, Donald Trump’s proposed 25% EU tariffs are adding huge amounts of fear to the Index. He postponed tariffs on Canada and Mexico in early February, causing crypto to breathe easy.

However, today the US president confirmed that the tariffs are coming back stronger than before. Other businesses that have heavily invested in Bitcoin, like Tesla, are cratering alongside the US Dollar.

Despite all these signs and portents, community leaders are urging calm. The Crypto Fear and Greed Index is swinging heavily towards bearishness. So what? These assets are very volatile, and we’ve seen plenty of major crashes before.

As financial expert Robert Kiyosaki put it, there are still solid reasons to believe in Bitcoin’s fundamentals:

“Bitcoin crashing, bitcoin is on sale, I am buying. The problem is not Bitcoin, the problem is our Monetary System and our criminal bankers. When Bitcoin crashes, I smile and buy more. Bitcoin is money with integrity,” he claimed on social media.

In short, the Index may be reporting extreme levels of fear in the crypto community, but statistically, there is no better investment option on the table.

“Massive Bitcoin outflows from Coinbase Advanced—two days in a row. This kind of aggressive accumulation screams institutions or ETF buyers stacking hard. Since Coinbase is the go-to for US institutions, this looks like long-term holding. If spot demand keeps rising, we could be looking at a serious supply squeeze,” wrote analyst Kyle Doops.

Crypto is highly connected to macroeconomic factors, and these tariffs and chaotic political developments are impacting the current market sentiment.

Yet, any impending pro-crypto development, such as more ETF approvals and regulatory clarity, can usher in a fresh bullish cycle.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoSEC Drops Gemini Probe, But Winklevoss Wants Penalties

-

Market19 hours ago

Market19 hours ago5 RWA Altcoins to Watch In March 2025

-

Market18 hours ago

Market18 hours agoPi Network Hits All-Time High as Trading Volume Surges

-

Regulation24 hours ago

Regulation24 hours agoGotbit Founder Extradited to US Over Crypto Market Manipulation Fraud

-

Market16 hours ago

Market16 hours agoPump.fun Social Media Hacked to Promote Fake PUMP Token

-

Market23 hours ago

Market23 hours agoHedera (HBAR) Slips Below $0.20 Amid Ongoing Downtrend

-

Altcoin22 hours ago

Altcoin22 hours agoShiba Inu Price Eyes 450% As It Holds Above Critical Level

-

Market21 hours ago

Market21 hours agoTrump Announces EU Tariffs and Bitcoin Falls Below $85,000