Market

AI, RWA, and Meme Coins

Crypto narratives are undergoing major shifts this week, with AI tokens, Real-World Assets (RWA), and meme coins all seeing significant corrections. The AI sector, once a top-performing category, has seen its market cap drop 42% in the past month, with major tokens like FET and RENDER extending their losses.

Meanwhile, the RWA sector has fallen from $72 billion to $55.5 billion in just three days, though regulatory clarity in the US could provide long-term support. Meme coins have also taken a hit, with the top 10 largest tokens all down at least 22% in the last week.

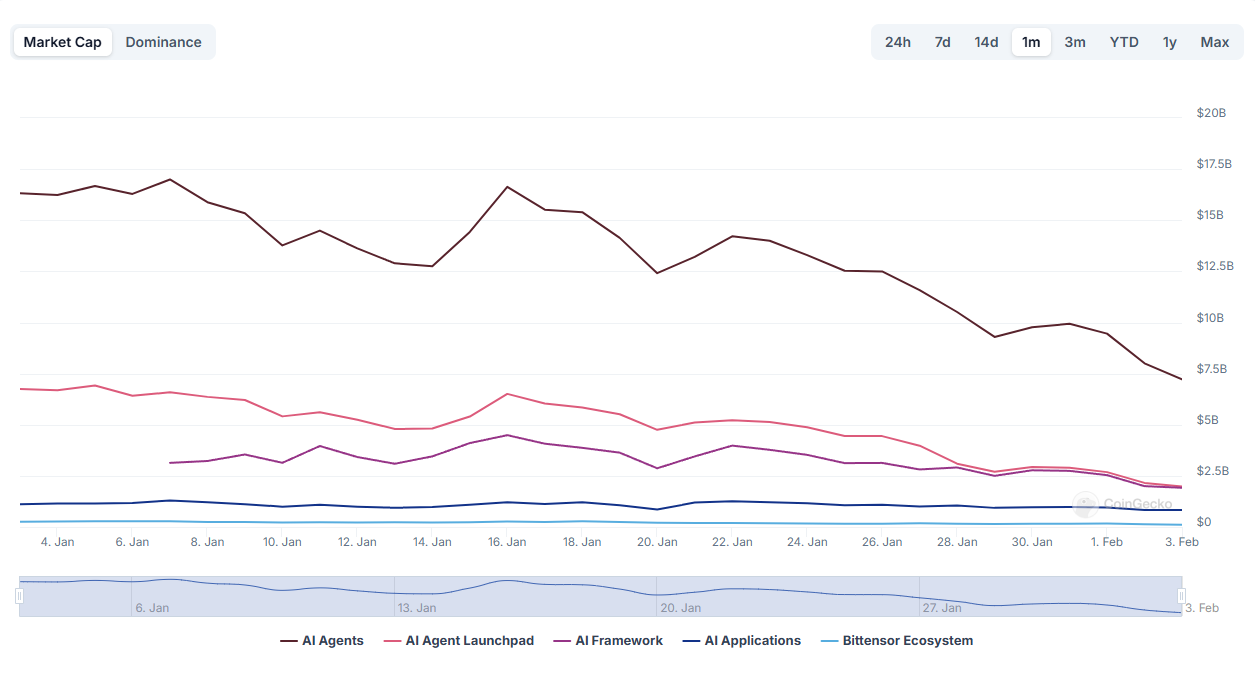

AI Tokens

The artificial intelligence sector has been one of the hardest-hit areas in the crypto market over the past month. After reaching a peak market cap of $60 billion on January 6, it has now fallen to $32.8 billion, reflecting a sharp decline.

Some of the biggest AI tokens have taken heavy losses in the past seven days, with FET down 32.2%, RENDER dropping 27.21%, and VIRTUAL losing 35%.

The correction, which began roughly two weeks ago with DeepSeek’s impact, has extended across the sector, pushing many AI tokens to multi-month lows.

With the AI crypto market cap down nearly 42% in 30 days, this week could be crucial in determining whether these assets stabilize and get ready for a rebound or face further downside.

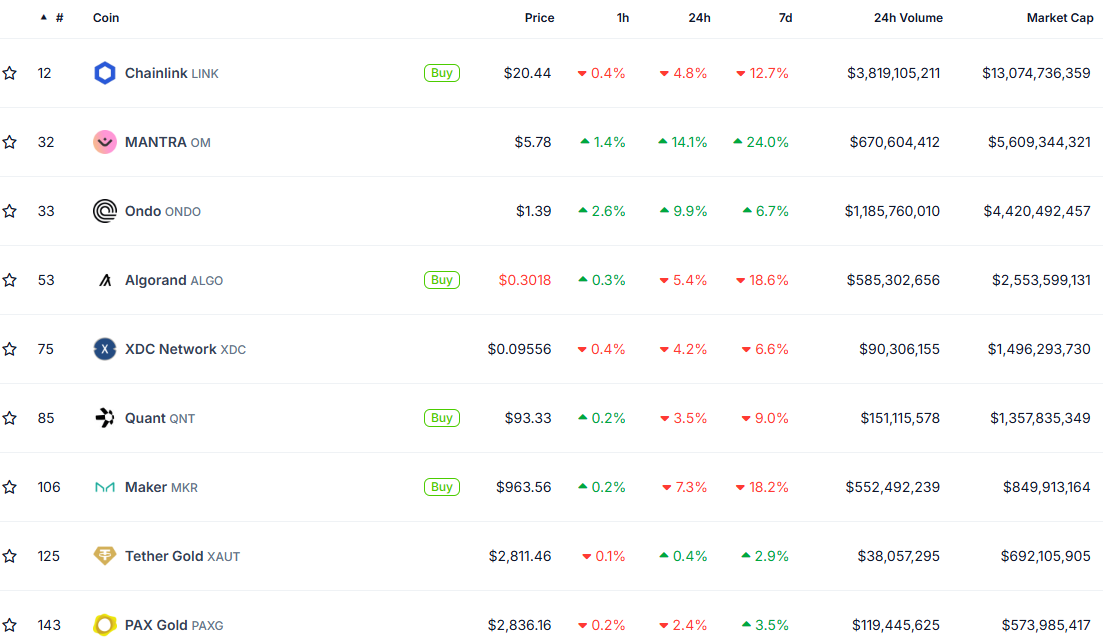

Real-World Assets (RWA)

The Real-World Assets (RWA) sector has experienced a sharp decline, with its market cap dropping from $72 billion on January 31 to $55.5 billion in just three days.

Despite this downturn, RWA remains a significant asset class within crypto, currently comprising nine projects with market caps above $1 billion. Key players such as Chainlink, Avalanche, Hedera, Mantra, and Ondo continue to drive the sector’s development.

Although the recent correction has impacted RWA valuations, the sector continues to be one of the most interesting crypto narratives. It stands to gain from potential regulatory advancements in the US, a strong promise made by Donald Trump.

A clearer and more favorable regulatory framework could unlock new opportunities for RWA applications. With institutional giants like BlackRock and Morgan Stanley showing interest, the sector is already drawing mainstream attention, further strengthening its long-term growth prospects.

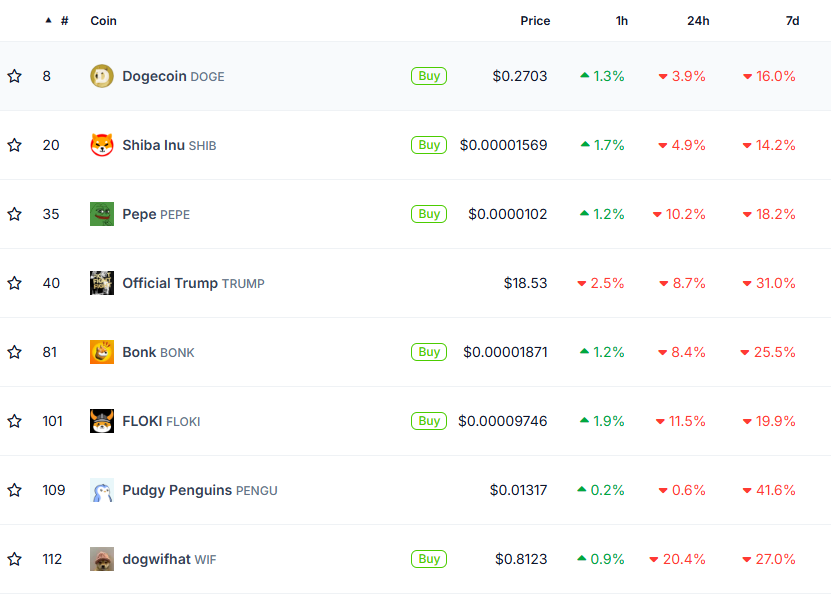

Meme Coins

The meme coin sector, one of the biggest crypto narratives in the market, has taken a major hit in today’s liquidation chaos. The top 10 largest meme coins are all down at least 22% in the past week. PENGU has led the losses, dropping 46%, while only five meme coins now maintain a market cap above $1 billion.

Over the last 30 days, the entire meme coins market has shrunk by 37%, bringing its total valuation down to $68 billion. This sharp correction highlights a shift in sentiment, with meme coins losing the momentum they had in previous months.

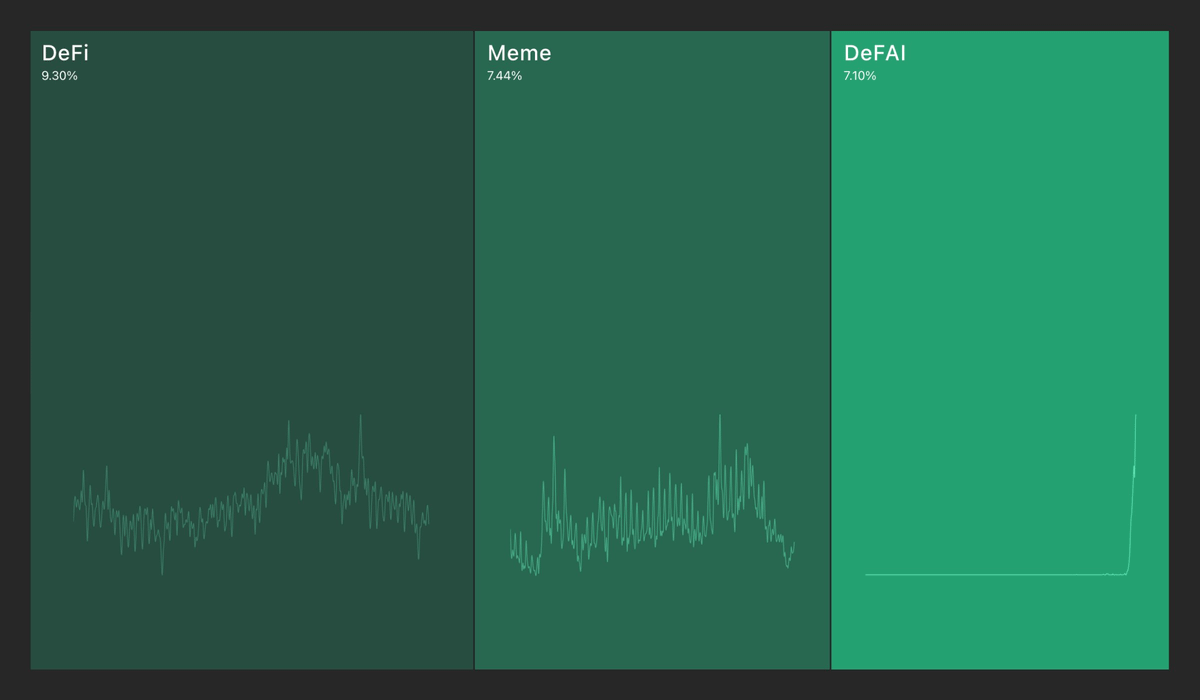

Recent data from Kaito suggests that meme coin mindshare has now fallen below that of DeFi, a trend that hasn’t occurred in months.

This shift implies that investors may be rotating funds away from meme coins and into more traditional DeFi assets or stablecoins.

With lower engagement and declining prices, meme coins are facing increased selling pressure. Unless a new catalyst emerges, their market dominance could continue to fade.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Vietnam Partners with Bybit to Launch Legal Crypto Exchange

Vietnam’s Finance Minister Nguyen Van Thang met with Bybit CEO Ben Zhou on April 17 at the Ministry’s headquarters to discuss potential cooperation in the digital asset space.

The meeting marked a significant step forward in fostering cooperation to build a legal framework for digital assets. It also advanced the plan to establish Vietnam’s first virtual asset exchange.

Bybit and Vietnam Explore Crypto Opportunities

According to the official portal of the Ministry of Finance, Ben Zhou, co-founder of Bybit, and his delegation met with leaders from various departments of the Ministry on the morning of April 17.

The Ministry reported that Zhou is currently exploring Vietnam’s digital asset market and expressed his desire to cooperate with and invest in the country.

During the meeting, Zhou also addressed a recent security breach, in which Bybit lost approximately $1.5 billion due to a hack. However, he emphasized that all investors on the platform were fully reimbursed.

The CEO said the incident did not affect users or cause any major disruption. This outcome, according to Zhou, was possible due to Bybit’s transparency and uninterrupted withdrawal services. He noted that user assets on Bybit are backed on a 1:1 basis.

Meanwhile, Minister Nguyen Van Thang appreciated Bybit’s cooperative intentions. He acknowledged the rapid global growth of blockchain technology and digital assets, including in Vietnam, where the market is expanding quickly and shows great potential.

The Minister also highlighted Vietnam’s efforts to submit a pilot resolution to the government. This resolution aims to establish a regulated exchange for digital assets in Vietnam. The Ministry welcomed Bybit’s proposal to support training, operational process development, risk control, and legal framework design in the country.

“The Ministry of Finance highly appreciates Bybit’s goodwill in proposing cooperation and support in areas such as training, developing risk control systems, building operational procedures for exchanges, and establishing a legal framework. These are all critical issues that require serious attention and thorough implementation,” Minister Thang stated during the meeting.

In addition to his meeting with the Ministry of Finance, Ben Zhou met privately with Nguyen Duy Hung, CEO of SSI Securities Corporation. They discussed the future of finance and digital assets. SSI is one of the oldest securities firms operating in Vietnam’s stock market.

Recently, SSI partnered with Tether and KuCoin to promote blockchain startups in Vietnam. The company also announced the launch of SSI Digital Ventures, an investment arm with an initial capital of $200 million. This fund may grow to $500 million as SSI continues collaborating with more partners to support blockchain startups in Vietnam.

“Different generations, different journeys — I’ve spent my life in traditional finance, while Ben is one of the pioneers shaping the world of crypto. Tonight, we sat down at my home and shared stories about the future of finance — where tradition and innovation meet to create lasting value,” Nguyen Duy Hung said.

Vietnam Races to Build Legal Framework for Crypto

The Vietnamese government is currently accelerating efforts to regulate digital assets.

In January 2025, the Prime Minister instructed officials to classify different types of digital assets. The government also proposed piloting digital asset exchanges in Ho Chi Minh City and Da Nang. The goal is to create a transparent trading environment, reduce investor risk, and prevent illegal activities such as money laundering.

Additionally, General Secretary To Lam officially assigned One Mount Group to develop a Layer 1 blockchain network, “Make in Vietnam,” with an investment of up to $500 million.

The meetings between Bybit, the Ministry of Finance, and SSI represent a rare moment of engagement between the Vietnamese government and a major crypto company. This comes at a time when crypto trading still operates in a legal gray area.

According to Chainalysis, Vietnam ranked 5th globally in the 2024 Global Crypto Adoption Index. The country now has over 17 million crypto asset holders, and blockchain-related capital flows reached more than $105 billion between 2023 and 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Gears Up for Next Leg Higher—Upside Potential Builds

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price is slowly moving higher above the $83,500 zone. BTC must clear the $85,200 resistance zone to continue higher in the near term.

- Bitcoin found support at $83,200 and started a recovery wave.

- The price is trading above $84,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $84,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,200 zone.

Bitcoin Price Eyes Fresh Upside

Bitcoin price started a fresh decline below the $86,200 and $85,500 levels. BTC even declined below the $84,00 level before the bulls appeared.

The price tested the $83,200 support. A low was formed at $83,171 and the price recently started a recovery wave. The price climbed above the $84,500 resistance zone. There was a break above the 50% Fib retracement level of the downward move from the $86,400 swing high to the $83,171 low.

Besides, there was a break above a connecting bearish trend line with resistance at $84,650 on the hourly chart of the BTC/USD pair. Bitcoin price is now trading above $84,500 and the 100 hourly Simple moving average.

On the upside, immediate resistance is near the $85,200 level. It is near the 61.8% Fib retracement level of the downward move from the $86,400 swing high to the $83,171 low. The first key resistance is near the $85,500 level. The next key resistance could be $86,500.

A close above the $86,500 resistance might send the price further higher. In the stated case, the price could rise and test the $87,200 resistance level. Any more gains might send the price toward the $88,800 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,200 resistance zone, it could start another decline. Immediate support on the downside is near the $84,500 level. The first major support is near the $84,000 level.

The next support is now near the $83,200 zone. Any more losses might send the price toward the $82,500 support in the near term. The main support sits at $81,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,200.

Major Resistance Levels – $85,200 and $85,500.

Market

Circle Introduces On-Chain Refund Protocol to Strengthen USDC Payments

Circle, the issuer behind the USDC stablecoin, has officially introduced the Refund Protocol—an advanced smart contract framework developed by Circle Research.

This innovation marks a turning point for decentralized stablecoin payments by directly embedding on-chain dispute resolution mechanisms into the blockchain, ensuring digital commerce transparency, security, and trust.

Role of Refund Protocol in the Circle Ecosystem

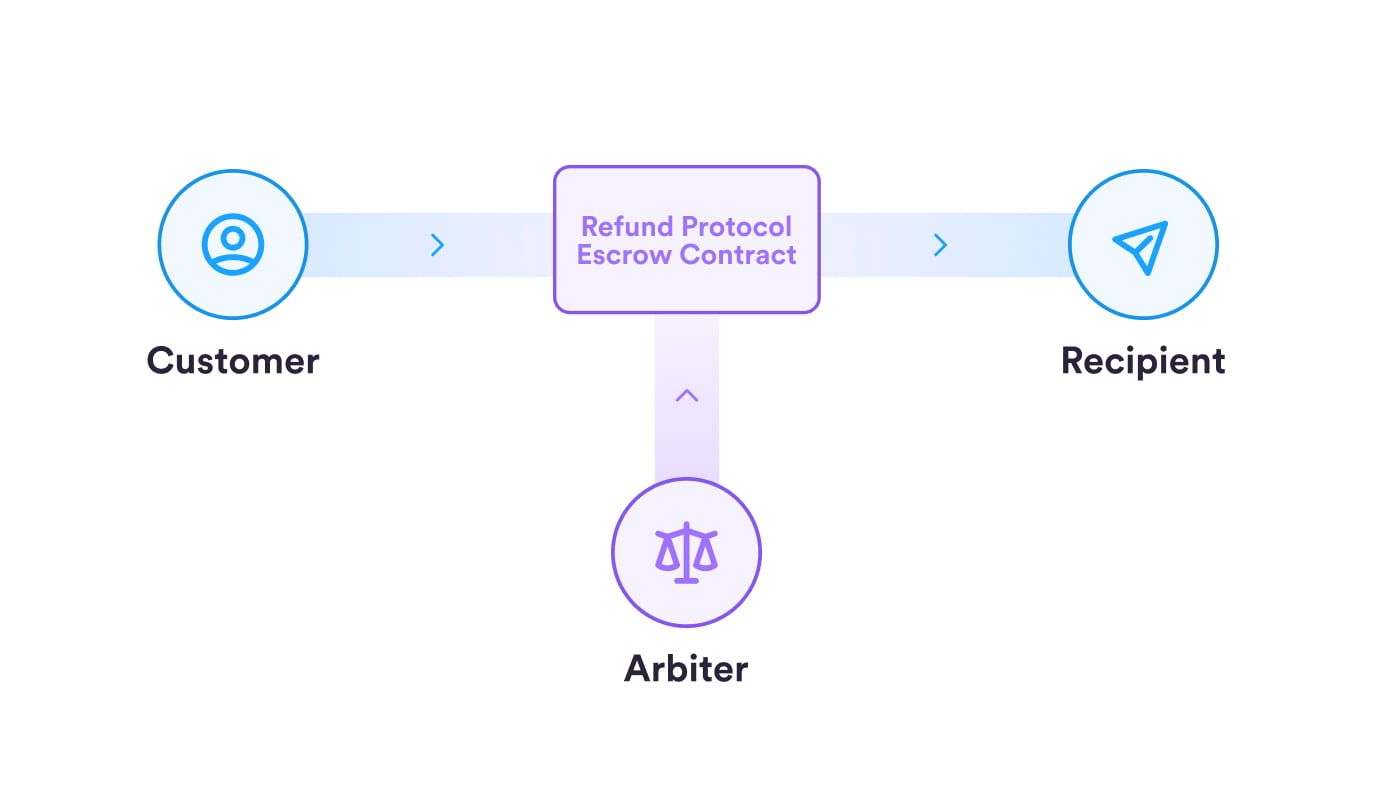

Traditional stablecoin payment models often lack on-chain refund or dispute resolution mechanisms. Typically, the sender’s stablecoins are held in escrow for a period before being released to the recipient.

An external party, known as an arbiter, oversees this escrow account. However, resolution usually happens off-chain when disputes arise, leading to two major concerns: centralized control by the arbiter and lack of transparency in the dispute process.

To solve this, Circle has designed the Refund Protocol to enhance the overall stablecoin payment experience, especially for USDC. The protocol acts as a smart contract, enabling non-custodial escrow and on-chain dispute resolution.

“Today, Circle’s R&D team released a new Refund Protocol for stablecoin payments. This builds on our earlier open source releases for confidential payments as well as reversible payments. Progress in mainstreaming stablecoin payments,” said Circle CEO Jeremy Allaire.

Rather than controlling the escrow account, the Refund Protocol can only do two things: release funds to the recipient or refund them to the customer. This removes reliance on third-party intermediaries, increases transparency, and boosts efficiency and user trust.

Refund Protocol to Help USDC Gain Market Share?

According to data from DefiLlama, USDT from Tether currently dominates the stablecoin market with over 61% market share. Although USDC holds the second position, its market capitalization is still less than half that of USDT.

The launch of Refund Protocol provides Circle with a strategic edge. By offering developers and businesses an easy way to integrate USDC payments into e-commerce platforms, NFT marketplaces, and DeFi applications, the protocol strengthens USDC’s position as a flexible and reliable medium of exchange.

Additionally, Refund Protocol gives Circle an advantage by providing a decentralized, low-cost, and transparent solution. This will help USDC stand out in real-world applications.

Refund Protocol may face regulatory hurdles despite its innovation, especially in jurisdictions with strict blockchain laws. The legal recognition of on-chain dispute resolution remains uncertain in many regions, potentially posing one of the biggest obstacles to widespread adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Market17 hours ago

Market17 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin17 hours ago

Altcoin17 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Continues To Outpace ETH For 5 Months; What Lies Ahead?

-

Altcoin24 hours ago

Altcoin24 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Market23 hours ago

Market23 hours agoBitcoin Price Range-Bound—But a Move Higher May Be Brewing?

-

Market22 hours ago

Market22 hours agoExpanding Blockspace and Enhancing Privacy

-

Market21 hours ago

Market21 hours agoWhy XRP Could Beat Dogecoin, Solana In ETF Race And Trigger A Price Surge